Facility Management Market Report

Published Date: 02 February 2026 | Report Code: facility-management

Facility Management Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Facility Management market, covering trends, segmentation, regional insights, and forecasts from 2023 to 2033. It aims to provide actionable data for stakeholders and industry participants.

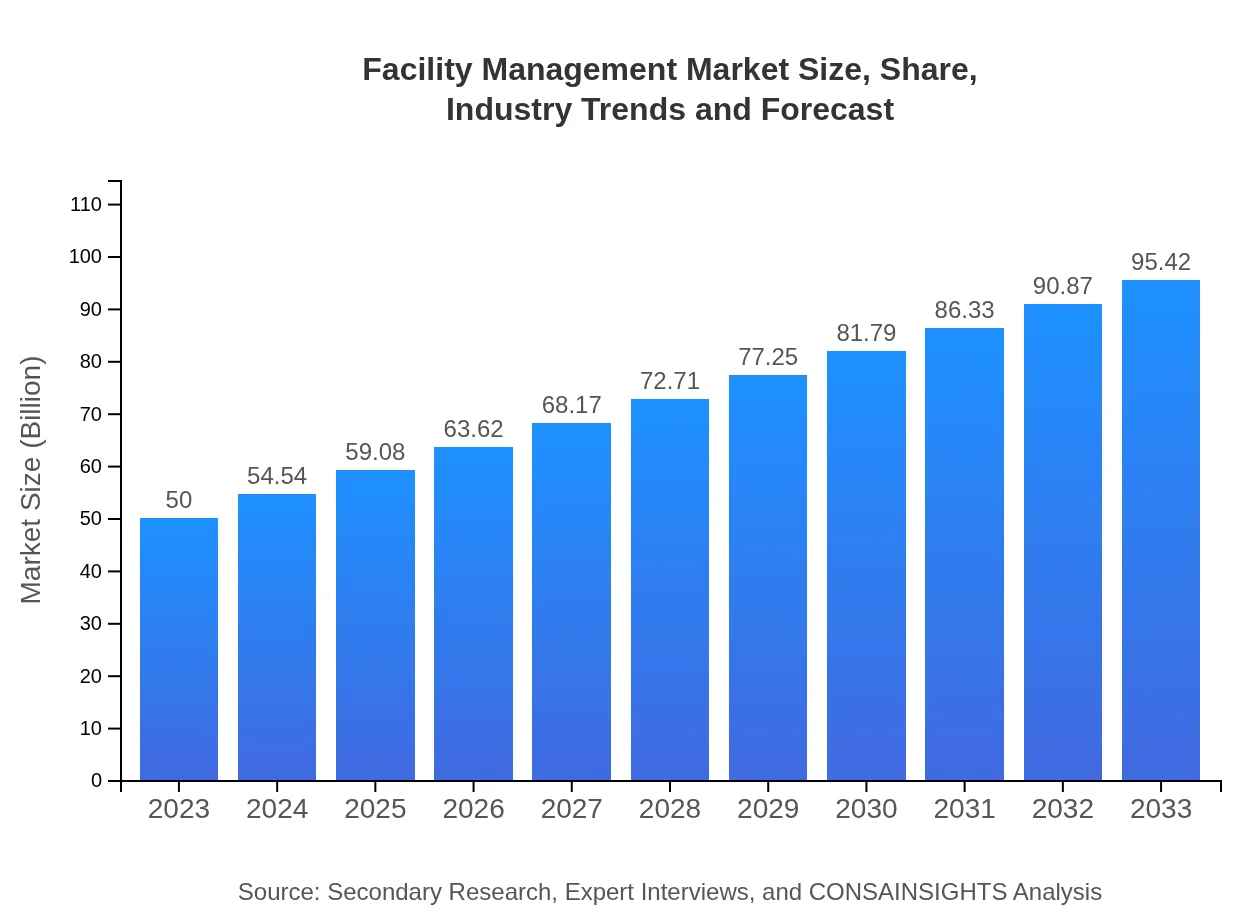

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $95.42 Billion |

| Top Companies | ISS A/S, CBRE Group, Inc., Aramark Corporation, Sodexo |

| Last Modified Date | 02 February 2026 |

Facility Management Market Overview

Customize Facility Management Market Report market research report

- ✔ Get in-depth analysis of Facility Management market size, growth, and forecasts.

- ✔ Understand Facility Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Facility Management

What is the Market Size & CAGR of Facility Management market in 2023?

Facility Management Industry Analysis

Facility Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Facility Management Market Analysis Report by Region

Europe Facility Management Market Report:

Europe's market size is anticipated to grow from $13.72 billion in 2023 to $26.18 billion by 2033. The growth is attributed to stringent regulations on energy efficiency and sustainability, alongside the need for highly specialized services tailored to diverse facilities.Asia Pacific Facility Management Market Report:

In 2023, the Asia Pacific Facility Management market is estimated at $9.70 billion and expected to grow to $18.50 billion by 2033. The region's growth is driven by rapid urbanization, increasing construction activities, and rising demand for integrated facility management services in both commercial and residential sectors.North America Facility Management Market Report:

North America holds a significant portion of the market, with 2023 valuation at $18.02 billion, projected to rise to $34.38 billion by 2033. The push towards automation, energy efficiencies, and sustainability practices bolsters growth in this region, along with high demand for sophisticated IT services.South America Facility Management Market Report:

The South American market is valued at $3.69 billion in 2023, projecting growth to $7.04 billion by 2033. Economic improvements and trends towards outsourcing facility management are the key drivers, as businesses seek to optimize resources and costs.Middle East & Africa Facility Management Market Report:

In the Middle East and Africa, the market's value is $4.88 billion in 2023 and is projected to increase to $9.31 billion by 2033. Significant investments in infrastructure and the hospitality sector, coupled with a growing awareness of facility management benefits, are fueling this growth.Tell us your focus area and get a customized research report.

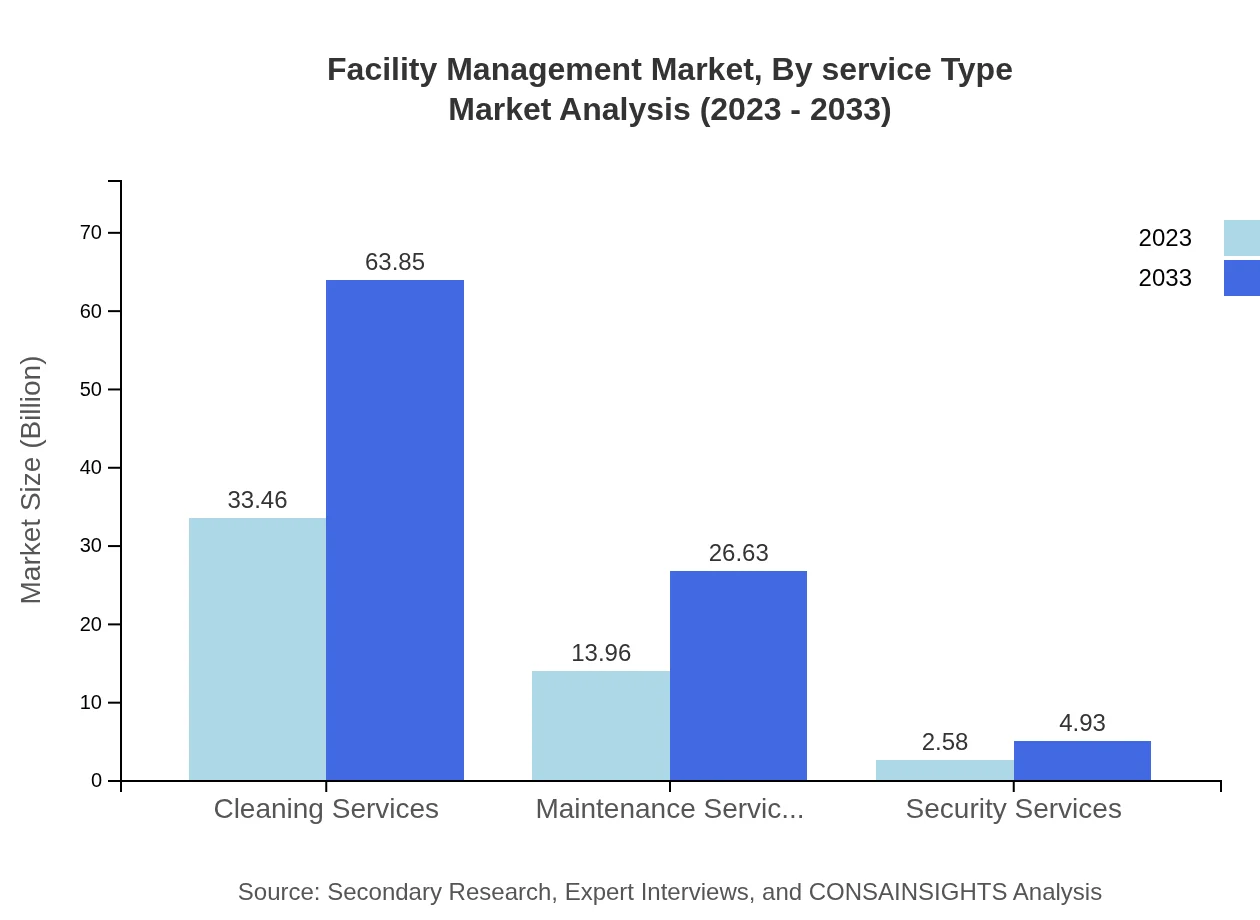

Facility Management Market Analysis By Service Type

The Facility Management market, classified by service type, includes Commercial and Residential sectors. The commercial sector has a robust market size of $33.46 billion in 2023, with expectations to grow to $63.85 billion by 2033. The residential segment is also significant, with a current market size of $13.96 billion, projected to increase to $26.63 billion. Other notable services include maintenance and cleaning, each contributing substantially to market revenue.

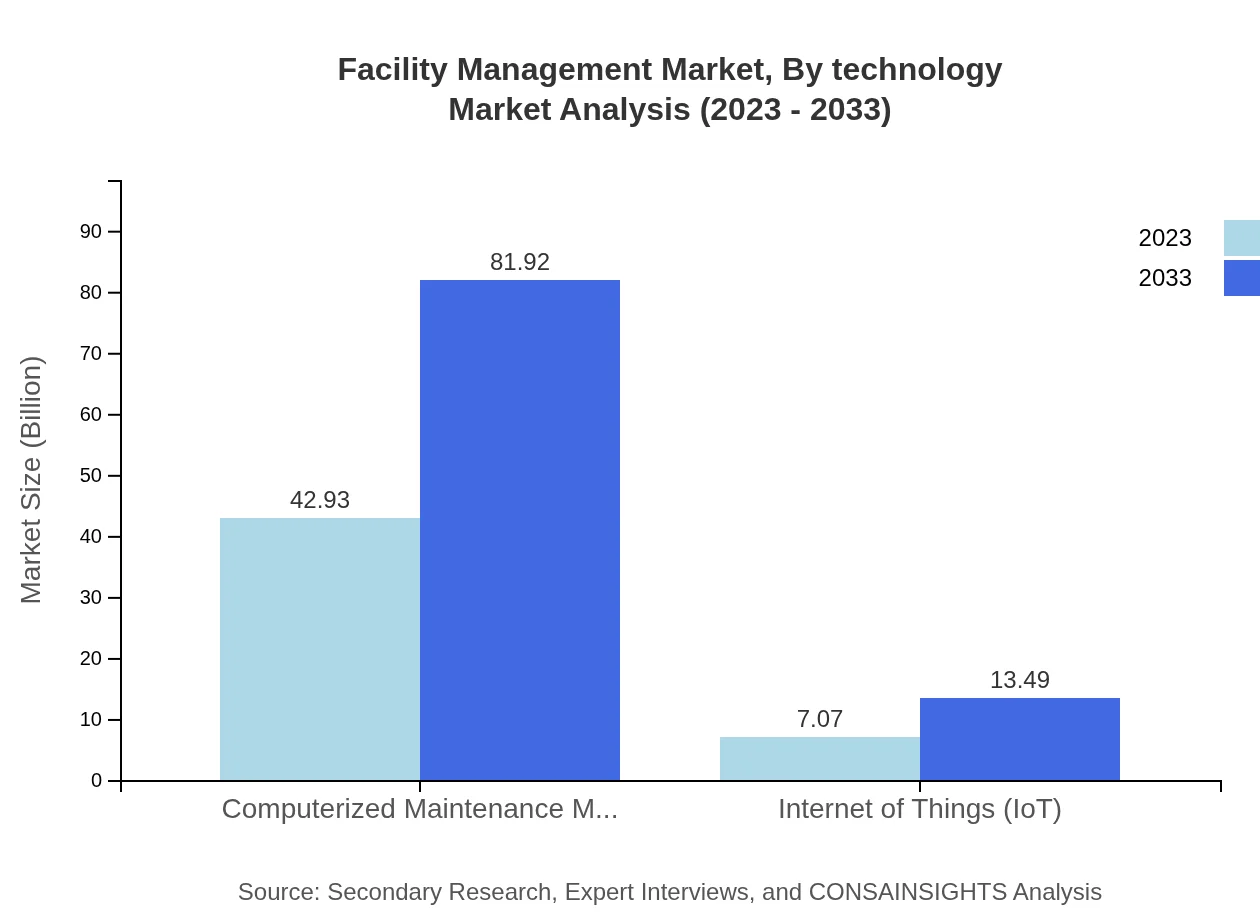

Facility Management Market Analysis By Technology

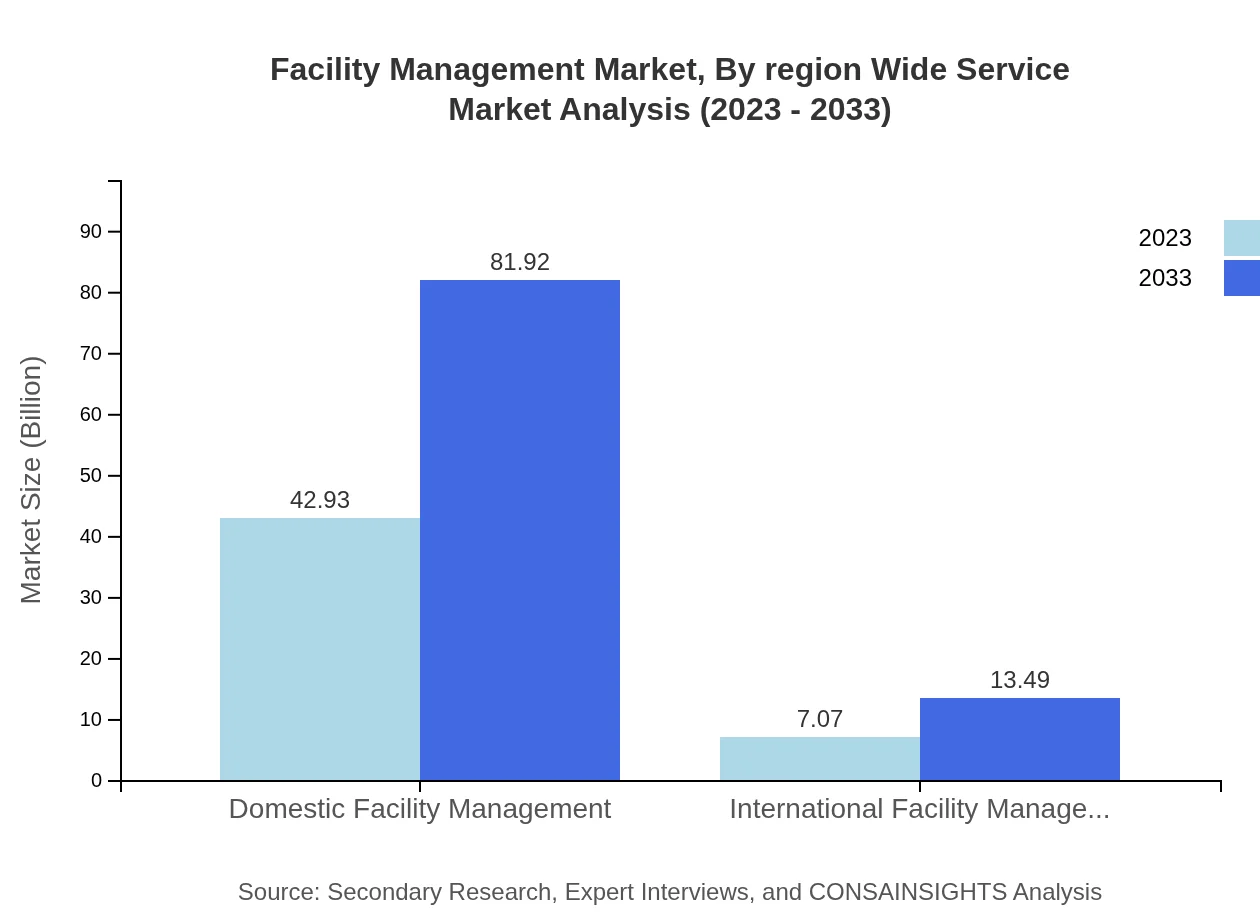

The growing reliance on technology in facility management is evident, particularly with Computerized Maintenance Management Systems (CMMS) which showcase performance growth from $42.93 billion in 2023 to $81.92 billion by 2033. The Internet of Things (IoT) segment is also notable, with values moving from $7.07 billion to $13.49 billion over the same period, indicating an increasing shift towards smart technology and connectivity in facilities.

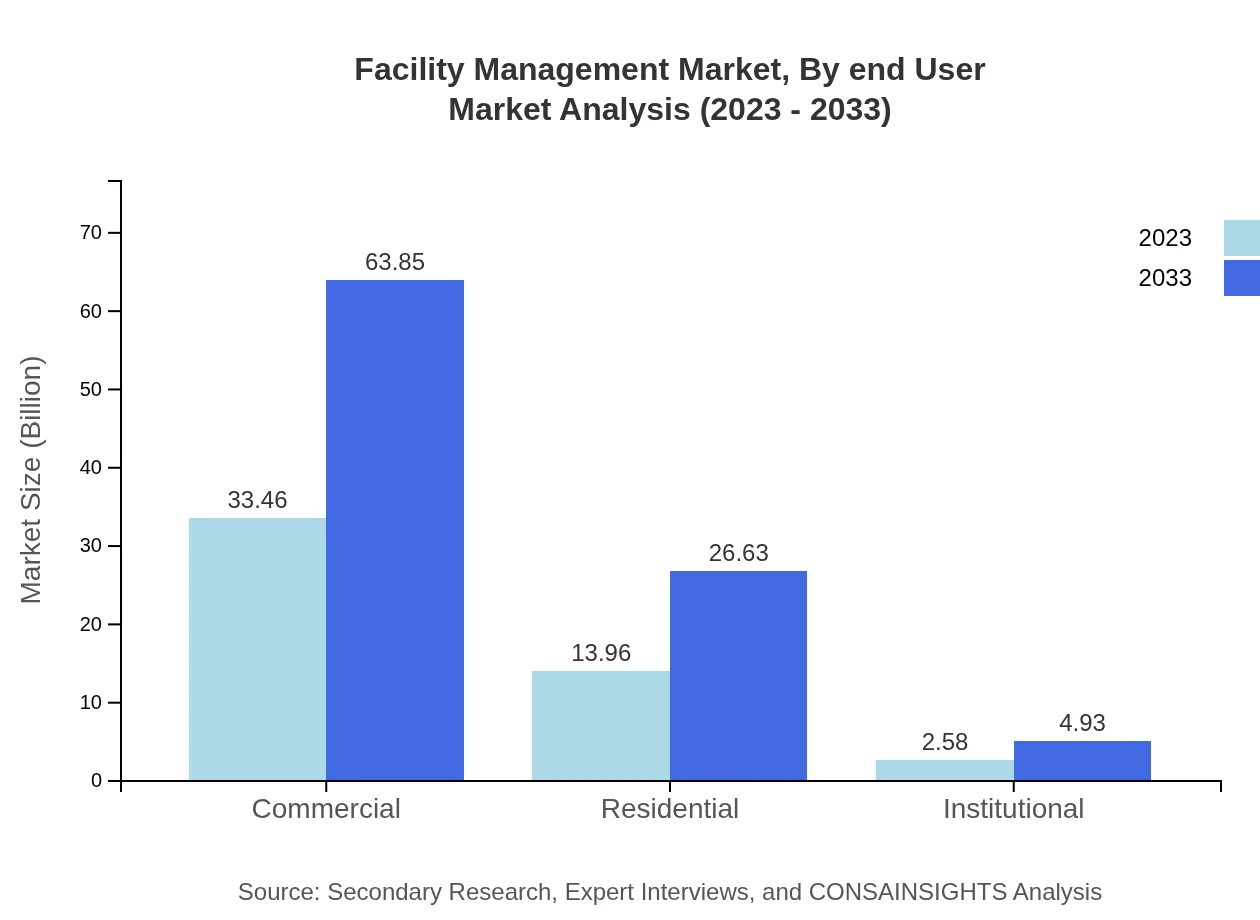

Facility Management Market Analysis By End User

Different end-user segments exhibit varying market dynamics. The commercial sector dominates the market share at 66.92% in 2023, maintaining the same share through to 2033, while the residential segment follows with a 27.91% share. The institutional segment remains a smaller contributor, reflecting 5.17% of the market. As businesses evolve, the commercial sector is increasingly driving investments in facility management services to enhance operational efficiency.

Facility Management Market Analysis By Region Wide Service

Regional performance shows distinct characteristics, with North America leading in terms of market size, followed by Europe and Asia Pacific. The increasing adoption of technology across regions influences service delivery strategies, with rising demand for comprehensive solutions in both residential and commercial sectors, ensuring a competitive landscape for service providers.

Facility Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Facility Management Industry

ISS A/S:

A global leader in facility services, ISS manages services tailored to client needs with a focus on creating efficient workplaces through innovative management solutions.CBRE Group, Inc.:

CBRE is a prominent player offering integrated real estate and facility management services, emphasizing technology integration and sustainability in operations.Aramark Corporation:

Aramark delivers professional services in food, facilities, and uniform services while prioritizing health and safety, notably in various education and healthcare institutions.Sodexo:

Sodexo is recognized for its diverse facility management services, eagerly investing in advanced technologies to streamline operations and enhance customer satisfaction.We're grateful to work with incredible clients.

FAQs

What is the market size of facility management?

The facility management market is projected to reach approximately $50 billion by 2033, growing from $50 billion in 2023 with a CAGR of 6.5%. This robust growth signifies increasing investments and innovations within the sector.

What are the key market players or companies in this facility management industry?

Key players in the facility management industry include multinational corporations and specialized vendors. Companies like CBRE Group, ISS A/S, and JLL dominate the space, maintaining significant market shares through innovative service offerings and technology integration.

What are the primary factors driving the growth in the facility management industry?

Growth in facility management is driven by technological advancements, increasing demand for efficiency, sustainability concerns, and urbanization. The integration of IoT and automated solutions significantly enhances operational efficiency, contributing to market expansion.

Which region is the fastest Growing in the facility management?

The fastest-growing region for facility management is North America, where the market size is expected to expand from $18.02 billion in 2023 to $34.38 billion in 2033. Europe and Asia Pacific also show considerable growth, driven by regional investments.

Does ConsaInsights provide customized market report data for the facility management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the facility management industry. Clients can request in-depth analyses focusing on particular segments, regions, or trends for more informed decision-making.

What deliverables can I expect from this facility management market research project?

Expect comprehensive deliverables that include market size estimates, trend analysis, competitive landscape, segmentation breakdown, and regional assessments. Detailed reports and executive summaries will also be provided for strategic insights into market dynamics.

What are the market trends of facility management?

Current trends in facility management include increased adoption of smart technologies, a focus on sustainability, and the integration of data analytics. Emphasis on IoT and CMMS systems highlights the industry's transition towards more efficient, tech-driven solutions.