Factoring Service Market Report

Published Date: 31 January 2026 | Report Code: factoring-service

Factoring Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Factoring Service market, focusing on market trends, insights into size and growth forecasts from 2023 to 2033, and key regional dynamics affecting the industry.

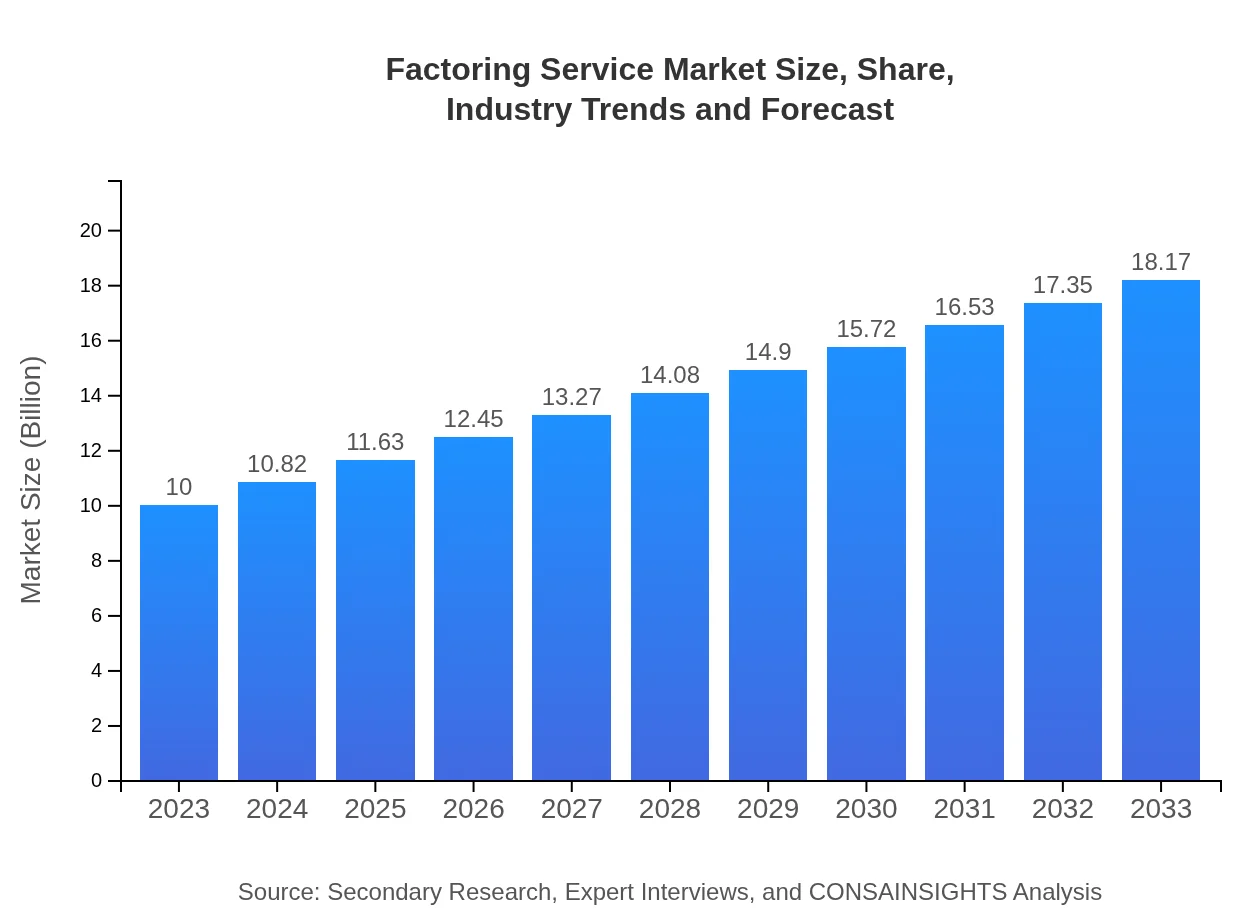

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | Bibby Financial Services, BlueVine, Funding Circle, Bank of America, CMB Financial |

| Last Modified Date | 31 January 2026 |

Factoring Service Market Overview

Customize Factoring Service Market Report market research report

- ✔ Get in-depth analysis of Factoring Service market size, growth, and forecasts.

- ✔ Understand Factoring Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Factoring Service

What is the Market Size & CAGR of Factoring Service market in 2023?

Factoring Service Industry Analysis

Factoring Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Factoring Service Market Analysis Report by Region

Europe Factoring Service Market Report:

Europe’s Factoring Service market is valued at $2.73 billion in 2023 and is forecasted to reach $4.96 billion by 2033. It is characterized by a mature market structure with widespread adoption of factoring as a financing tool across various sectors.Asia Pacific Factoring Service Market Report:

The Asia Pacific region presented a market size of approximately $1.95 billion in 2023, projected to grow to $3.54 billion by 2033. The growth is propelled by expanding small and medium-sized enterprises and increasing international trade. Technological advancements have also enhanced service delivery in this region.North America Factoring Service Market Report:

The North American market stands at $3.65 billion in 2023 with a forecasted growth to $6.63 billion by 2033, driven by strong demand from SMEs, technological integration, and the established presence of numerous factoring firms.South America Factoring Service Market Report:

In South America, the market size reached $0.46 billion in 2023 and is expected to expand to $0.84 billion by 2033. Economic recovery post-pandemic and the increasing need for liquidity among businesses contribute to this growth trend.Middle East & Africa Factoring Service Market Report:

The Middle East and Africa market is anticipated to grow from $1.21 billion in 2023 to $2.20 billion by 2033. Factors enhancing growth include increased awareness of factoring services and evolving financial regulations in several countries.Tell us your focus area and get a customized research report.

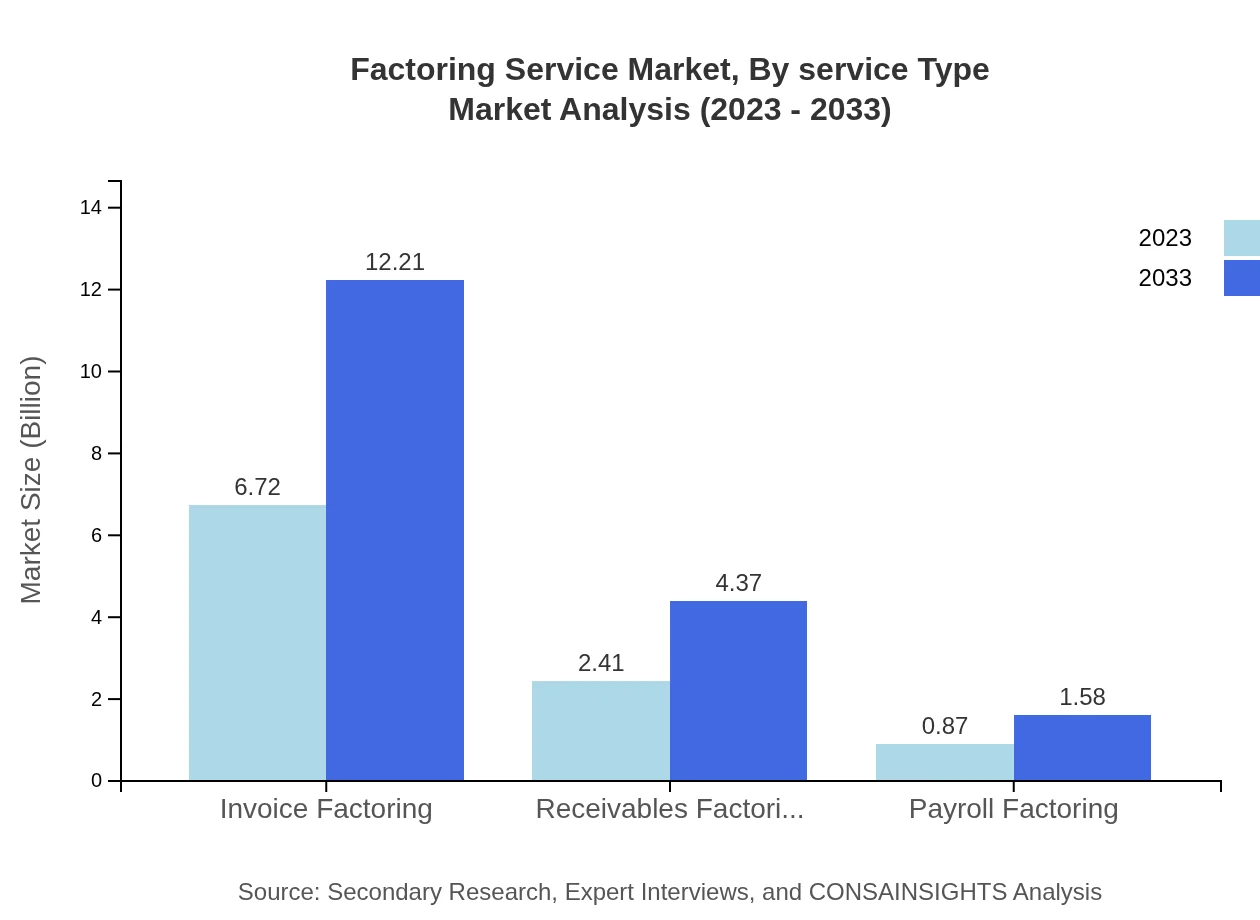

Factoring Service Market Analysis By Service Type

In the service type segment, Invoice Factoring leads with a market size of $6.72 billion in 2023, expected to reach $12.21 billion by 2033, captured 67.22% market share. Receivables Factoring follows at $2.41 billion, growing to $4.37 billion, representing 24.08% share. Payroll Factoring and Non-Recourse Factoring are also notable segments, demonstrating significant growth potential.

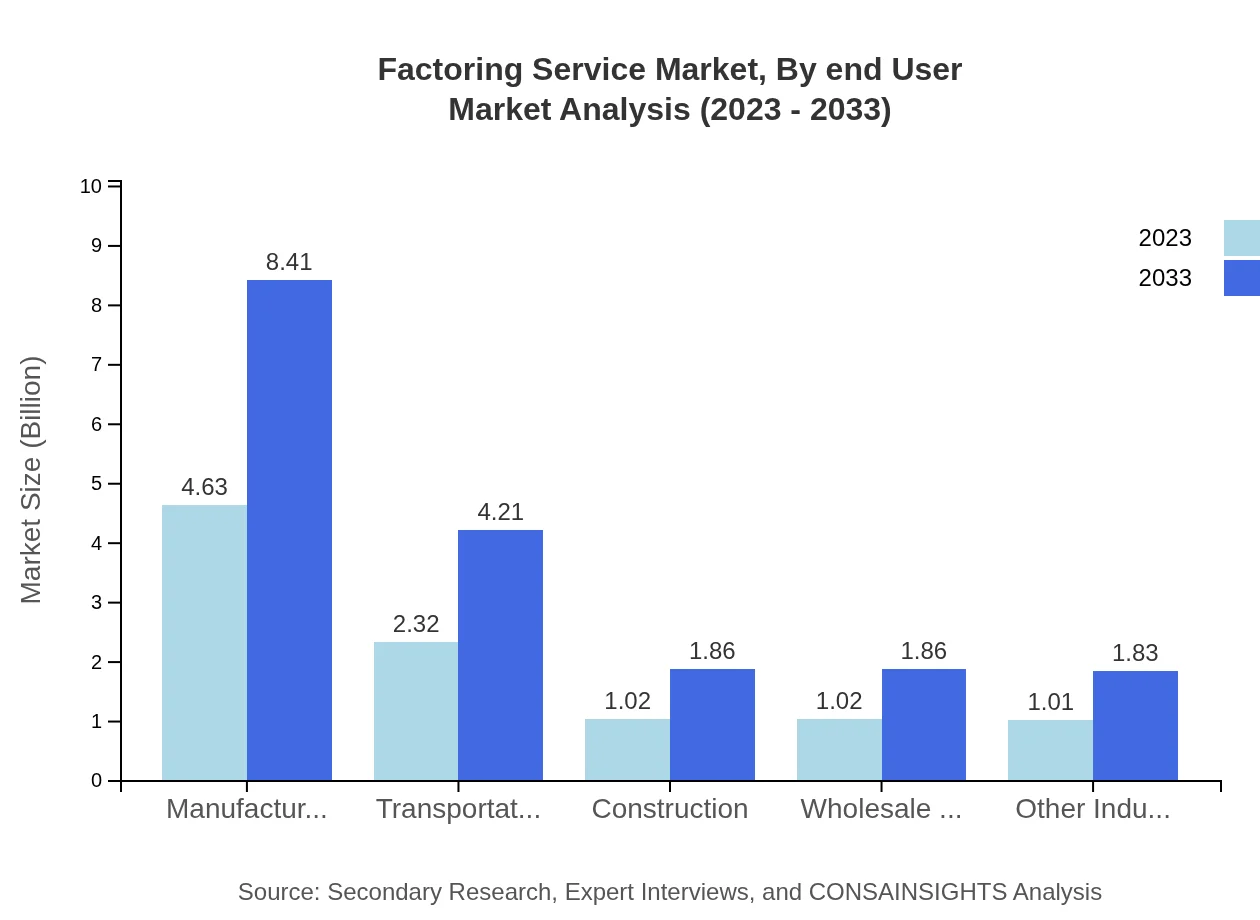

Factoring Service Market Analysis By End User

The manufacturing sector dominates the end-user industry with a market size of $4.63 billion in 2023, expected to increase to $8.41 billion. The transportation and wholesale & retail sectors exhibit comparable share levels at approximately 23%, emphasizing their importance. Other industries, including construction and others, continue to show promising growth as businesses seek effective cash flow solutions.

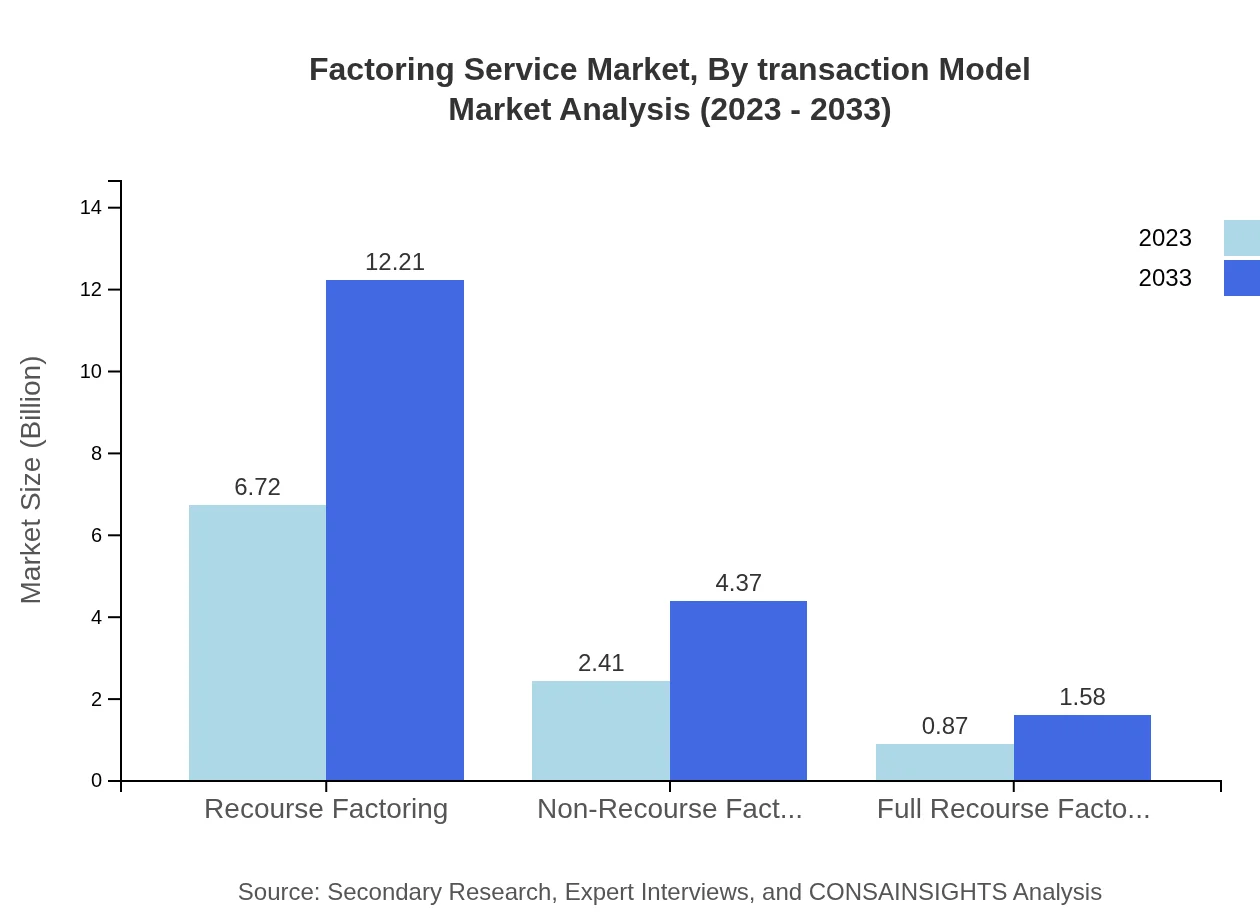

Factoring Service Market Analysis By Transaction Model

Recourse Factoring and Non-Recourse Factoring are significant transaction models within the market. Recourse Factoring commands a major market segment with revenues of $6.72 billion in 2023, forecast to reach $12.21 billion by 2033. Non-Recourse Factoring, holding a 24.08% market share, shows a stable growth trajectory, reflecting businesses' preference for reduced risk.

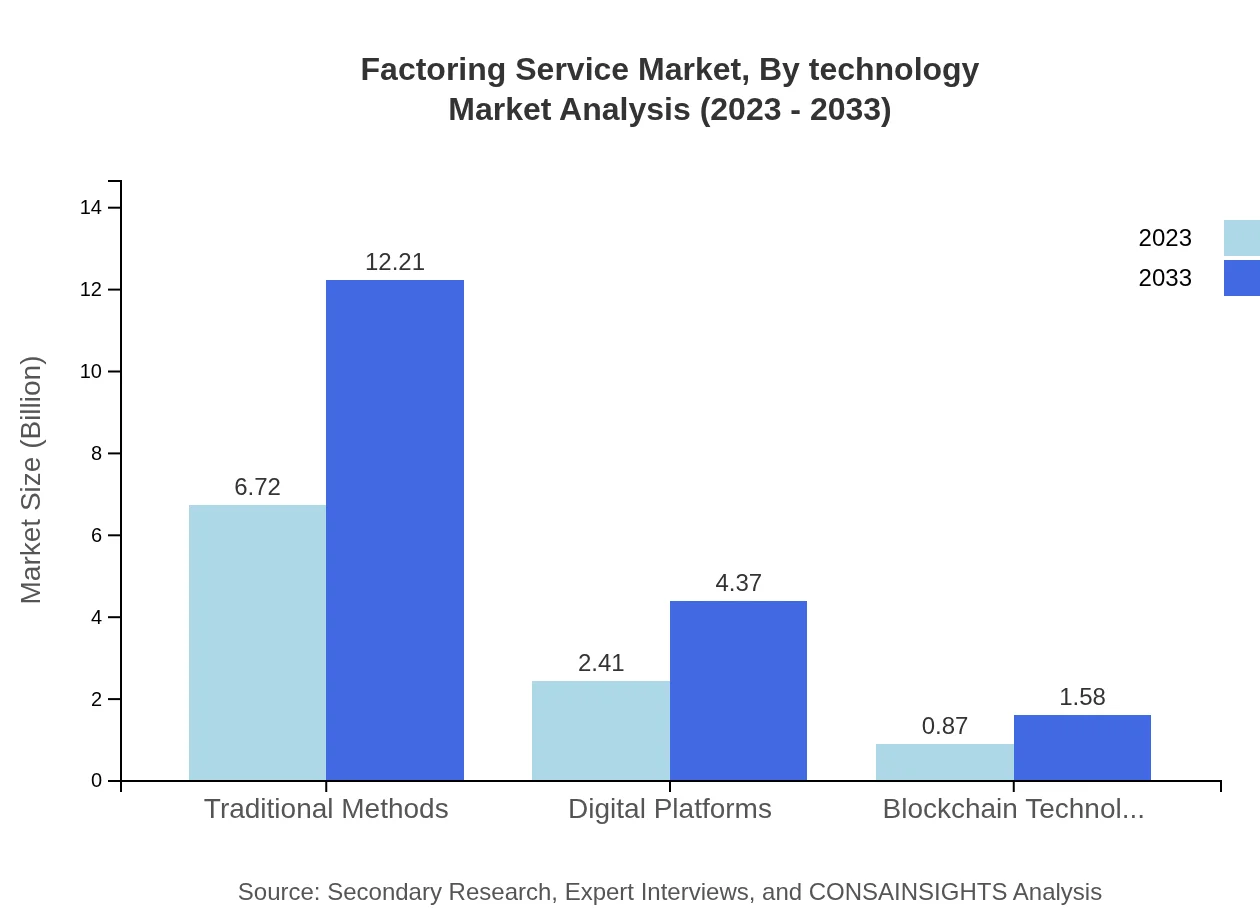

Factoring Service Market Analysis By Technology

The market is increasingly influenced by emerging technologies such as Blockchain, which is expected to see growth from $0.87 billion to $1.58 billion from 2023 to 2033. Digital Platforms also show growth, reflecting the evolving landscape where technology streamlines factoring processes and customer interactions.

Factoring Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Factoring Service Industry

Bibby Financial Services:

Bibby is one of the UK's largest independent providers of financial services, specializing in factoring and invoice financing.BlueVine:

BlueVine offers online invoice factoring and financing solutions, focusing on technology-driven services for small businesses.Funding Circle:

Funding Circle provides fast and flexible financing for SMEs, leveraging a unique blend of data and technology.Bank of America:

A key player in the factoring industry, providing a variety of financial services, including factoring and receivables financing.CMB Financial:

CMB focuses on small business financing solutions, including non-recourse factoring services to improve cash flow management.We're grateful to work with incredible clients.

FAQs

What is the market size of factoring Service?

The global factoring service market size was valued at approximately $10 billion in 2023 and is projected to grow at a CAGR of 6% from 2023 to 2033, indicating a robust growth trajectory for the industry.

What are the key market players or companies in this factoring Service industry?

Key market players in the factoring service industry typically include established financial institutions, specialized factoring companies, and fintech startups that focus on providing innovative factoring solutions to businesses, enhancing liquidity and cash flow.

What are the primary factors driving the growth in the factoring service industry?

The growth in the factoring service industry is primarily driven by increasing demand for alternative financing solutions, rising trade activities, and businesses' need to manage cash flow effectively, especially amid economic uncertainties.

Which region is the fastest Growing in the factoring service market?

North America is currently the fastest-growing region in the factoring service market, with expected growth from $3.65 billion in 2023 to $6.63 billion by 2033, indicating strong demand across various sectors.

Does ConsaInsights provide customized market report data for the factoring service industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the factoring service industry, enabling businesses to gain insights aligned with their strategic objectives.

What deliverables can I expect from this factoring Service market research project?

Clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, segment breakdown, competitive landscape, and actionable insights to guide strategic decision-making within the factoring service market.

What are the market trends of factoring service?

Current market trends in the factoring service industry include a shift towards digital platforms, increased adoption of blockchain technology for secure transactions, and a growing focus on receivables factoring as businesses seek efficient financing options.