Factory Automation And Industrial Controls Market Report

Published Date: 22 January 2026 | Report Code: factory-automation-and-industrial-controls

Factory Automation And Industrial Controls Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Factory Automation and Industrial Controls market, encompassing market trends, regional insights, key players, and forecasts for the years 2023 to 2033. The report highlights growth opportunities and challenges influencing the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

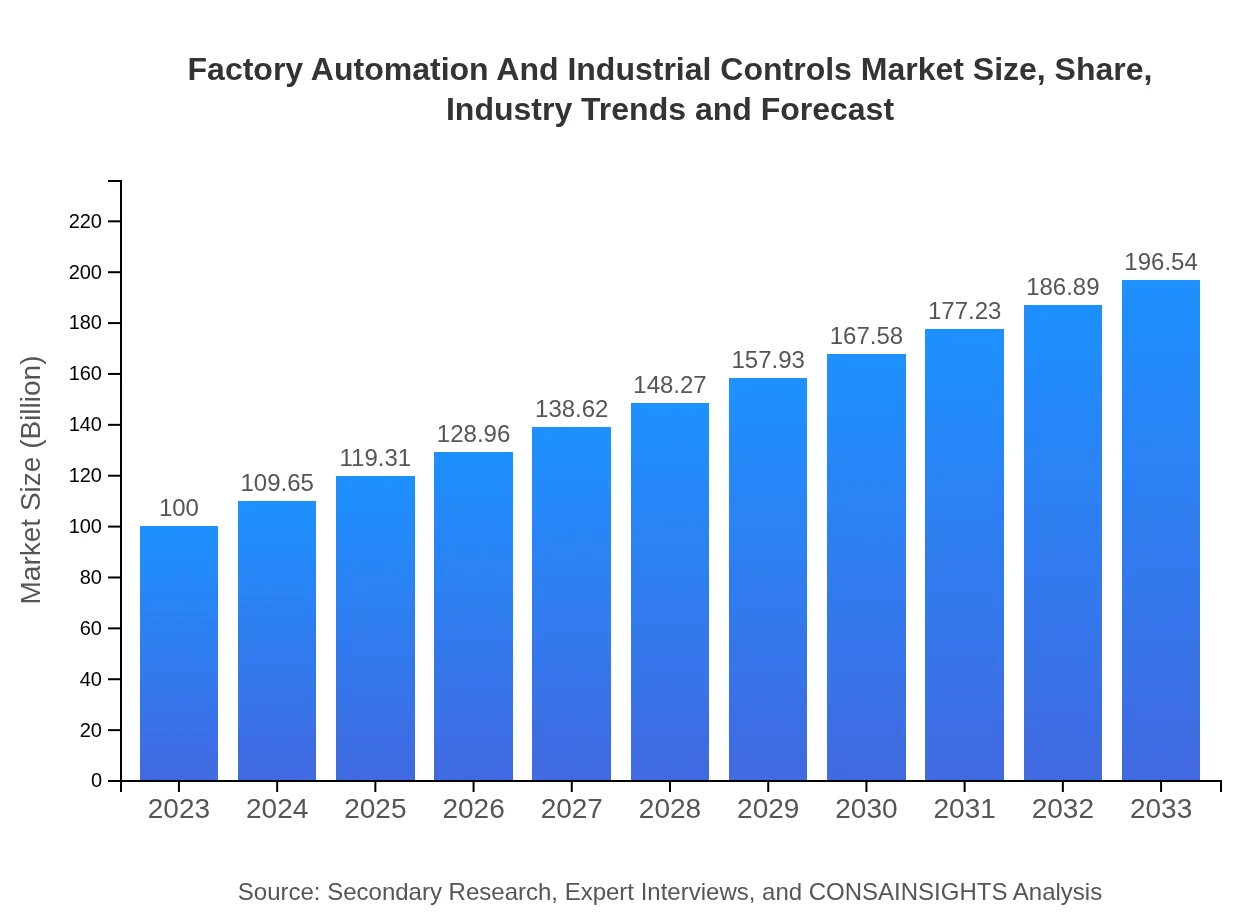

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $196.54 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Inc., ABB Ltd., Honeywell International Inc., Schneider Electric SE |

| Last Modified Date | 22 January 2026 |

Factory Automation And Industrial Controls Market Overview

Customize Factory Automation And Industrial Controls Market Report market research report

- ✔ Get in-depth analysis of Factory Automation And Industrial Controls market size, growth, and forecasts.

- ✔ Understand Factory Automation And Industrial Controls's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Factory Automation And Industrial Controls

What is the Market Size & CAGR of Factory Automation And Industrial Controls market in 2023?

Factory Automation And Industrial Controls Industry Analysis

Factory Automation And Industrial Controls Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Factory Automation And Industrial Controls Market Analysis Report by Region

Europe Factory Automation And Industrial Controls Market Report:

The European market is anticipated to grow from $31.41 billion in 2023 to $61.73 billion by 2033. Strategic initiatives by the EU to enhance competitiveness in manufacturing and investment in digital technologies contribute to this growth.Asia Pacific Factory Automation And Industrial Controls Market Report:

The Asia Pacific market is forecasted to grow from $18.03 billion in 2023 to $35.44 billion by 2033, driven by rapid industrialization, strong manufacturing base, and government initiatives towards automation in key economies such as China and India.North America Factory Automation And Industrial Controls Market Report:

North America holds a substantial market share, projected to rise from $36.41 billion in 2023 to $71.56 billion by 2033. The region benefits from advanced industrial sectors, high implementation of automation technologies, and continuous research and development initiatives.South America Factory Automation And Industrial Controls Market Report:

In South America, the market is expected to increase from $3.45 billion in 2023 to $6.78 billion by 2033. Growth is stimulated by investments in manufacturing industries and increasing foreign investments, particularly in Brazil and Argentina.Middle East & Africa Factory Automation And Industrial Controls Market Report:

The Middle East and Africa market is expected to grow from $10.70 billion in 2023 to $21.03 billion by 2033, driven by an increase in automation projects in oil & gas and manufacturing sectors as nations diversify their economies.Tell us your focus area and get a customized research report.

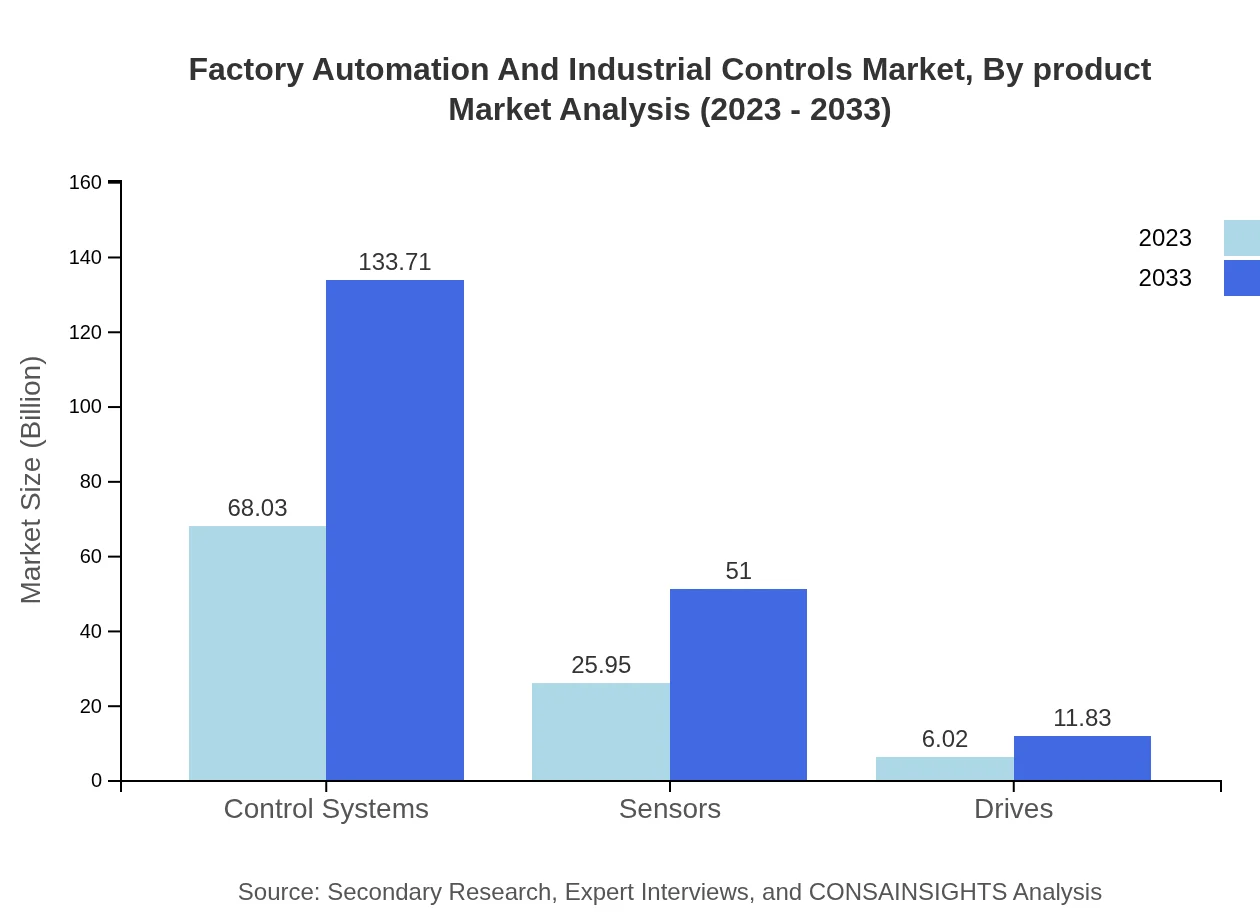

Factory Automation And Industrial Controls Market Analysis By Product

The product segmentation includes control systems, sensors, drives, and industrial robots. Control systems dominate the market in terms of revenue and growth, expected to increase from $68.03 billion in 2023 to $133.71 billion by 2033. Other categories like sensors and industrial robots are also gaining market share with increasing application scopes in diverse industries.

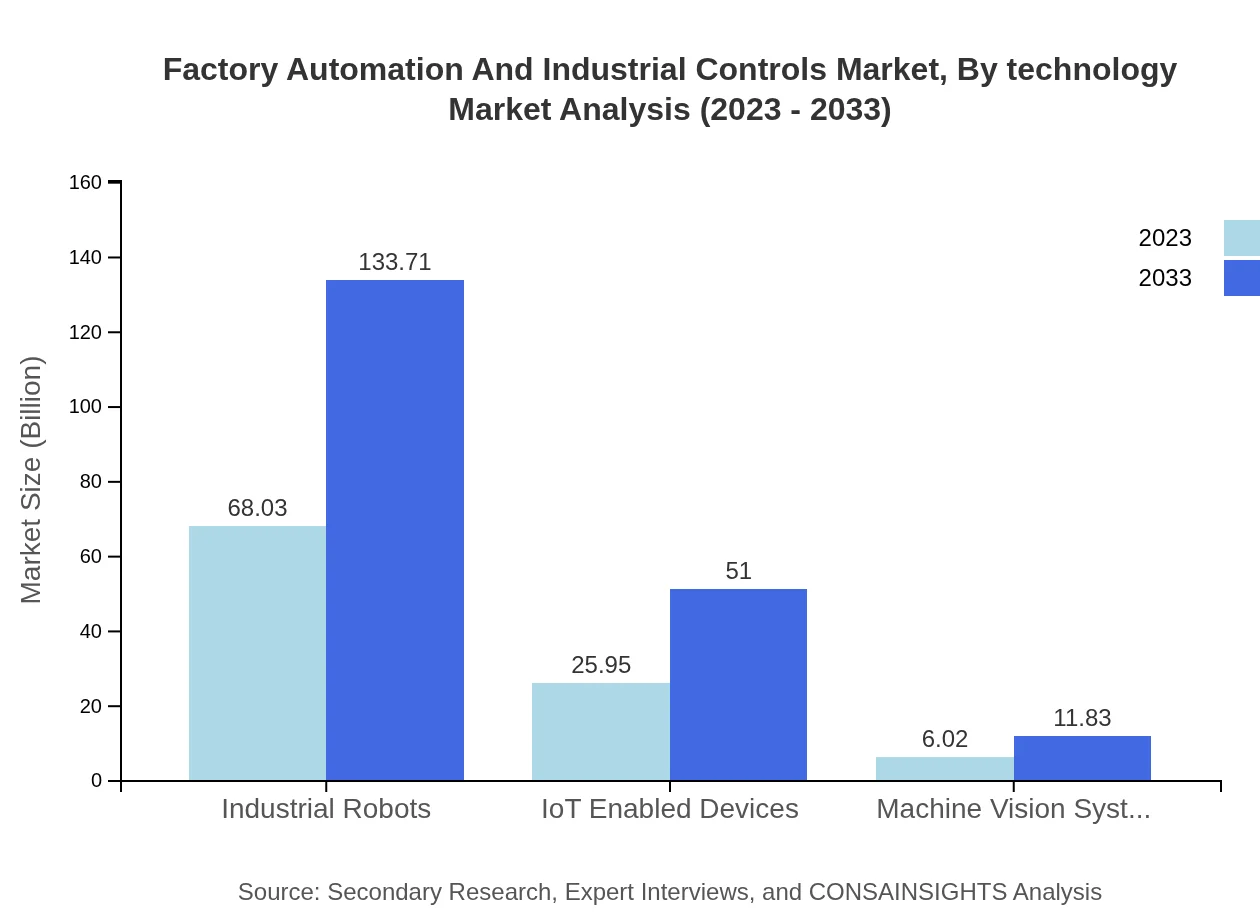

Factory Automation And Industrial Controls Market Analysis By Technology

In the technology segment, IoT-enabled devices and automation software are emerging as crucial components. The market for IoT-enabled devices is projected to grow significantly, with values moving from $25.95 billion in 2023 to $51.00 billion by 2033, reflecting rising interest in smart factory solutions.

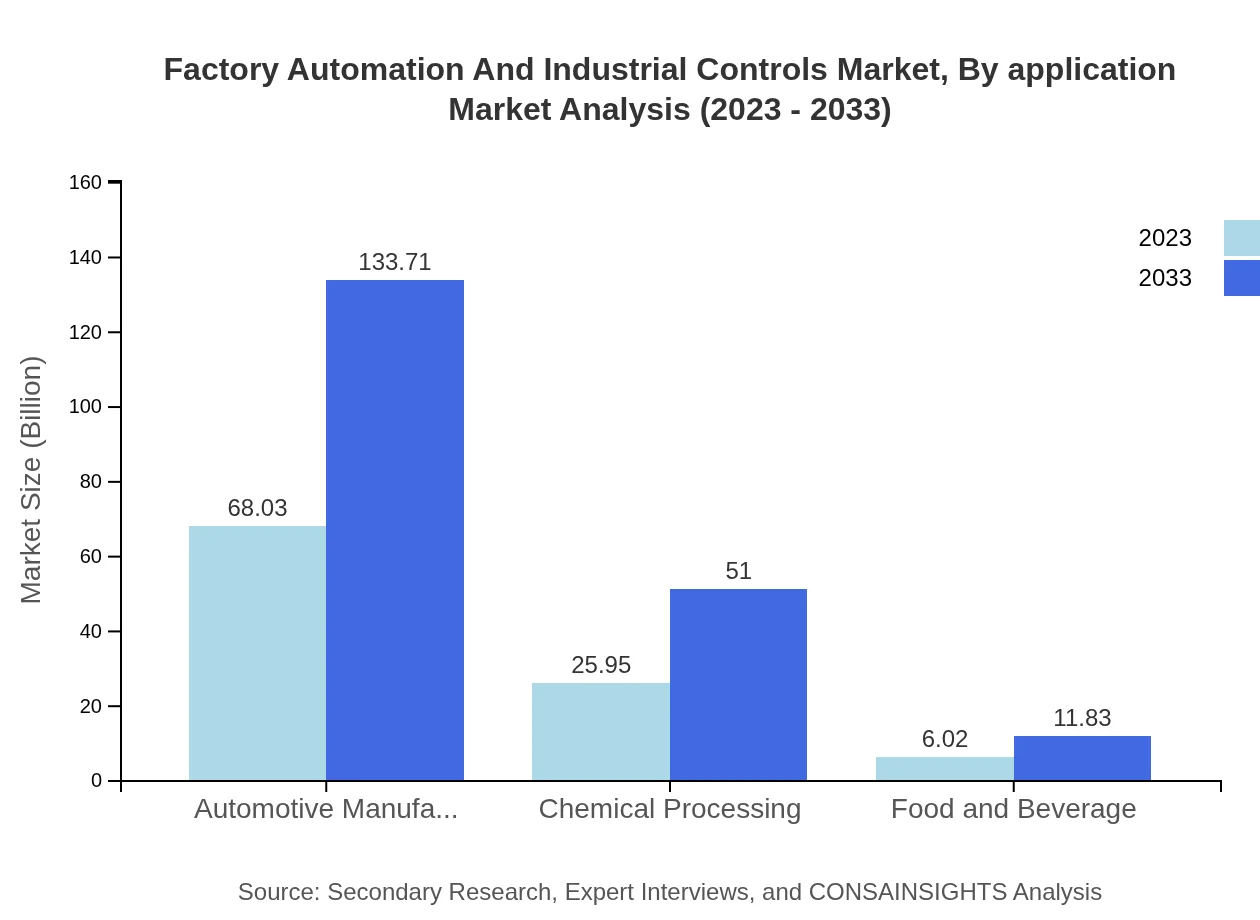

Factory Automation And Industrial Controls Market Analysis By Application

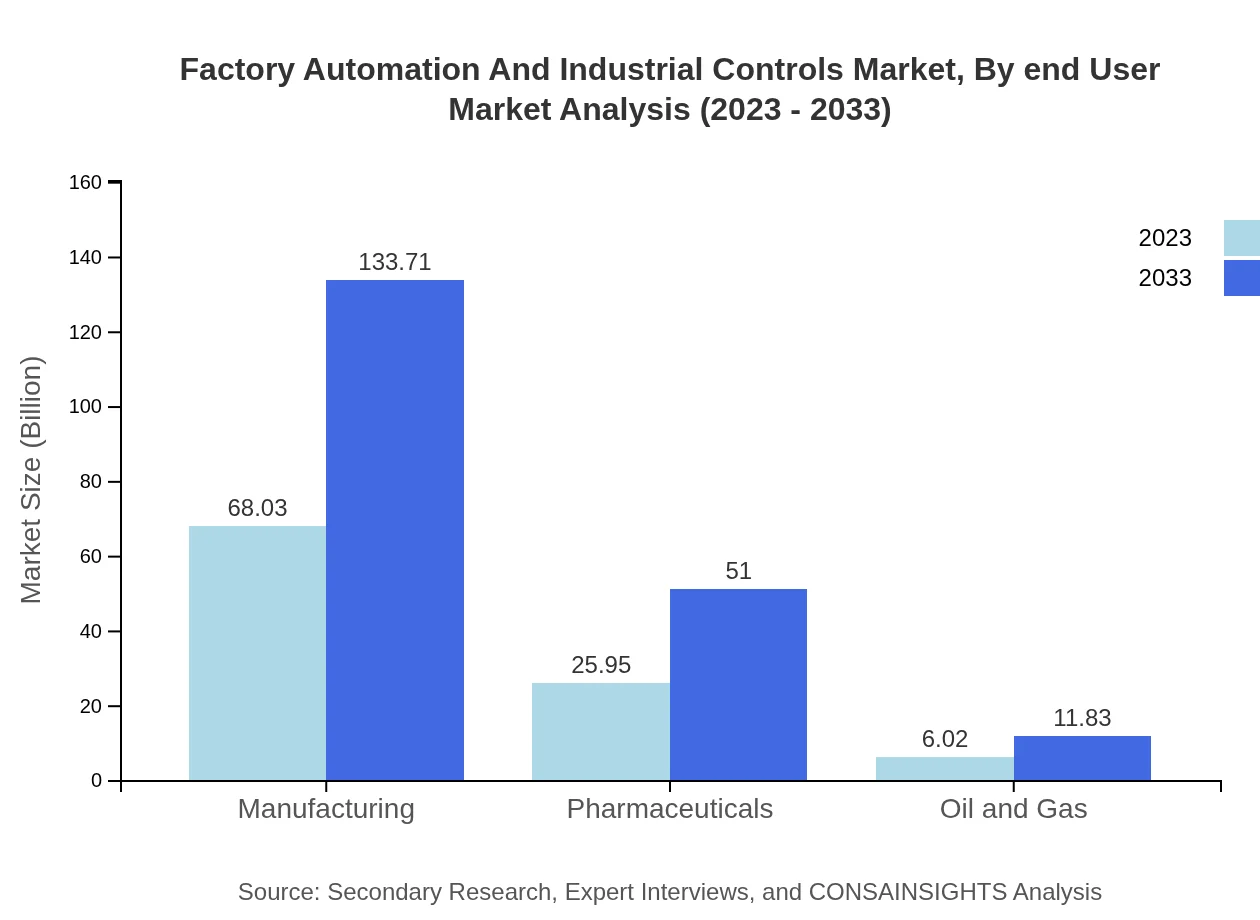

Applications in manufacturing, pharmaceuticals, and food and beverages drive demand for automation solutions, with manufacturing projected to grow from $68.03 billion in 2023 to $133.71 billion by 2033. Each application continues to optimize production efficiencies.

Factory Automation And Industrial Controls Market Analysis By End User

End-users include sectors such as automotive, pharmaceuticals, and chemical processing. The automotive industry remains one of the largest consumers of automation technologies, projected to grow rapidly alongside expanded manufacturing capabilities.

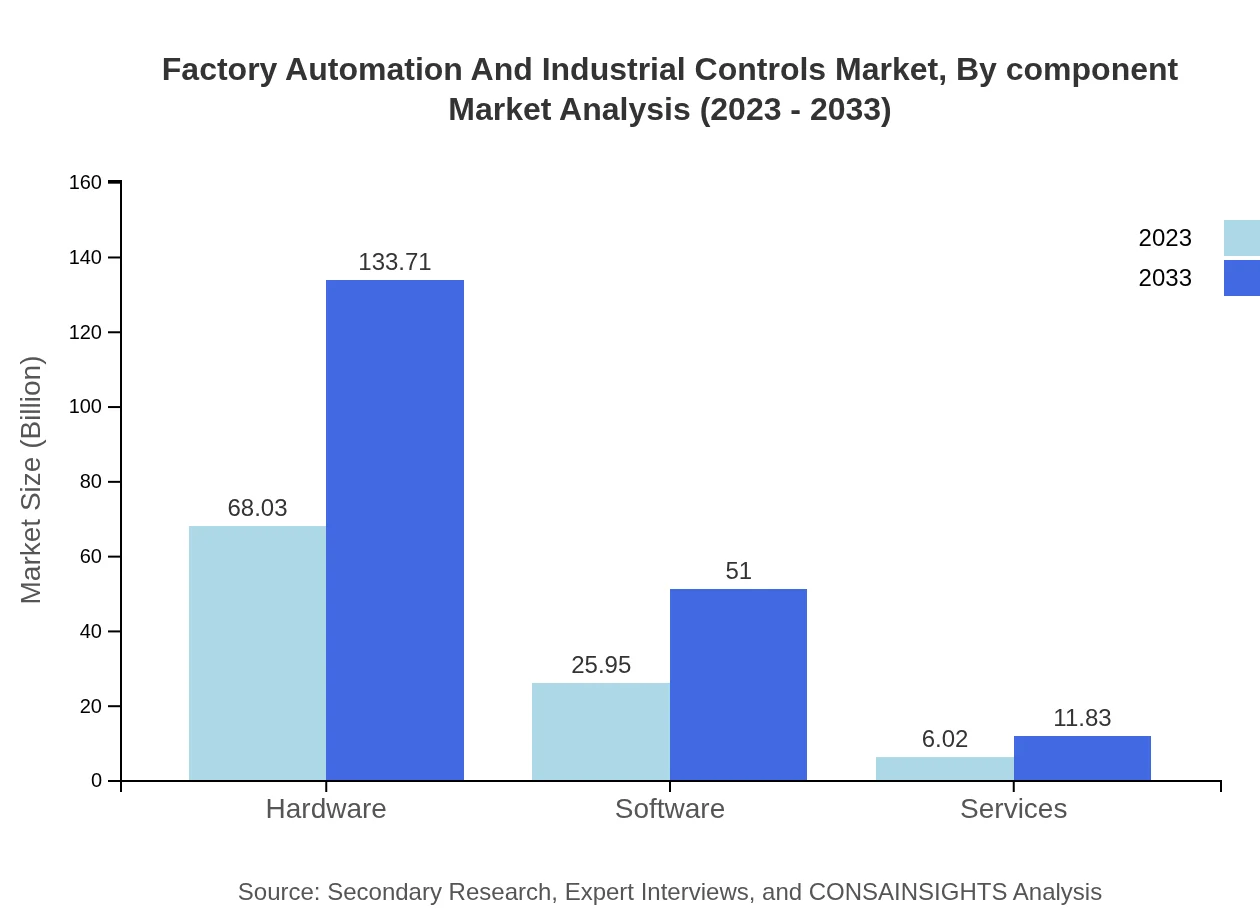

Factory Automation And Industrial Controls Market Analysis By Component

The components include hardware, software, and services. Hardware leads the market with significant growth, from $68.03 billion in 2023 to $133.71 billion by 2033, reflecting a growing trend of integrating automated machinery within factories.

Factory Automation And Industrial Controls Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Factory Automation And Industrial Controls Industry

Siemens AG:

A leader in industrial automation technologies, Siemens provides a comprehensive portfolio of products and solutions ranging from sensors to advanced robotics.Rockwell Automation, Inc.:

This company specializes in industrial automation equipment and software, promoting manufacturing efficiency through digital transformation.ABB Ltd.:

Known for its innovations in robotics and automation, ABB offers seamless integration of technology across various sectors.Honeywell International Inc.:

Honeywell's automation solutions enhance operational efficiency across numerous industries, facilitating growth through smart technology.Schneider Electric SE:

A pioneer in energy management and automation solutions, Schneider Electric focuses on sustainable and efficient manufacturing processes.We're grateful to work with incredible clients.

FAQs

What is the market size of Factory Automation and Industrial Controls?

The Factory Automation and Industrial Controls market is projected to grow from $100 billion in 2023 to a significant size by 2033, with a CAGR of 6.8%, indicating robust growth in this sector.

What are the key market players or companies in the Factory Automation and Industrial Controls industry?

Key players include Siemens, Schneider Electric, Rockwell Automation, ABB, and Honeywell, all of which contribute significantly to the innovation and market share within the Factory Automation and Industrial Controls industry.

What are the primary factors driving the growth in the Factory Automation and Industrial Controls industry?

Key factors include the increasing demand for automation in manufacturing, advancements in IoT technologies, investments in smart factories, and the need for enhanced operational efficiency across various sectors.

Which region is the fastest Growing in the Factory Automation and Industrial Controls?

The fastest-growing region is North America, escalating from $36.41 billion in 2023 to an anticipated $71.56 billion by 2033, driven by technological advancements and higher adoption rates of automated solutions.

Does ConsaInsights provide customized market report data for the Factory Automation and Industrial Controls industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the Factory Automation and Industrial Controls industry, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this Factory Automation and Industrial Controls market research project?

Deliverables include comprehensive market analysis, growth forecasts, industry trends, competitive landscape, segment breakdowns, and actionable insights tailored to your business needs.

What are the market trends of Factory Automation and Industrial Controls?

Current trends include the rise of Industry 4.0, increasing use of AI and machine learning in manufacturing processes, heightened focus on sustainability, and the integration of advanced robotics and automation solutions.