Family Offices Market Report

Published Date: 24 January 2026 | Report Code: family-offices

Family Offices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Family Offices market, covering key insights on market size, growth trends, segmentation, regional dynamics, and competitive landscape from 2023 to 2033.

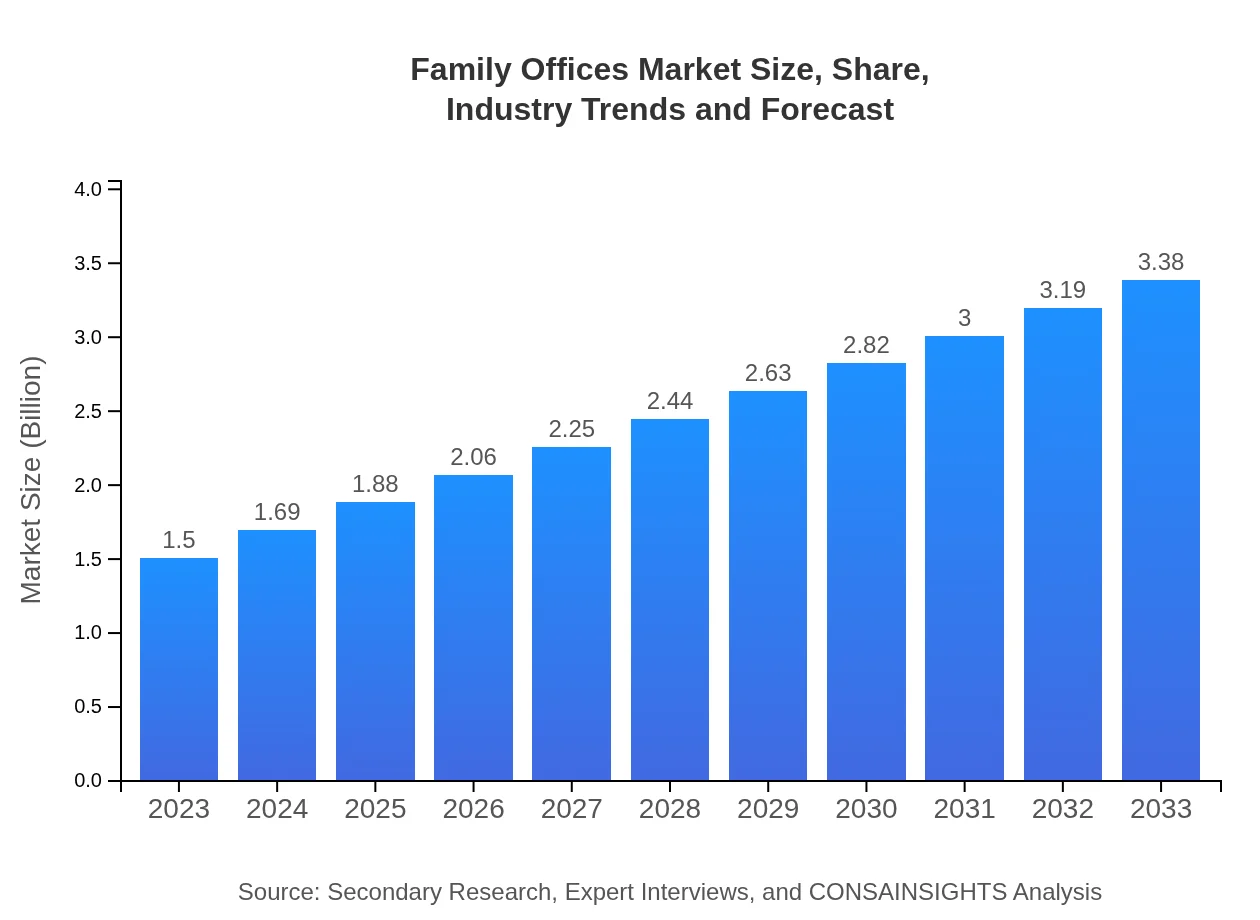

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Trillion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $3.38 Trillion |

| Top Companies | Bessemer Trust, Northern Trust, Citi Private Client, J.P. Morgan Private Bank |

| Last Modified Date | 24 January 2026 |

Family Offices Market Overview

Customize Family Offices Market Report market research report

- ✔ Get in-depth analysis of Family Offices market size, growth, and forecasts.

- ✔ Understand Family Offices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Family Offices

What is the Market Size & CAGR of Family Offices market in 2023?

Family Offices Industry Analysis

Family Offices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Family Offices Market Analysis Report by Region

Europe Family Offices Market Report:

Europe's Family Offices market is valued at $0.37 trillion in 2023, with projections to reach $0.84 trillion by 2033. This market is characterized by a blend of traditional and modern investment practices. The presence of established family offices focused on legacy preservation and sustainability investing is pertinent in countries like Switzerland and the UK.Asia Pacific Family Offices Market Report:

In the Asia-Pacific region, the Family Offices market was valued at $0.31 trillion in 2023 and is expected to reach $0.70 trillion by 2033. The growing number of wealthy individuals and families, driven by economic growth in countries like China and India, significantly contributes to this expansion. Family businesses are increasingly investing in local and global opportunities, requiring sophisticated wealth management solutions.North America Family Offices Market Report:

In North America, the Family Offices market size stands at $0.53 trillion in 2023 and is anticipated to grow to $1.19 trillion by 2033. The region is home to a significant number of ultra-high-net-worth individuals, making it a leader in the family office model. High demand for wealth preservation and investment diversification is shaping service offerings in this region.South America Family Offices Market Report:

The South American Family Offices market is projected to grow from $0.11 trillion in 2023 to $0.24 trillion by 2033. Factors driving this growth include rising wealth among individuals and the need for comprehensive financial planning amid economic fluctuations in countries like Brazil and Argentina. Family offices here are often focused on natural resources and emerging markets.Middle East & Africa Family Offices Market Report:

The Middle East and Africa market shows potential, growing from $0.18 trillion in 2023 to $0.41 trillion by 2033. Economic diversification efforts in several Middle Eastern countries are driving the establishment of family offices. Investment strategies often focus on real estate and infrastructure investments, influenced by regional governmental initiatives.Tell us your focus area and get a customized research report.

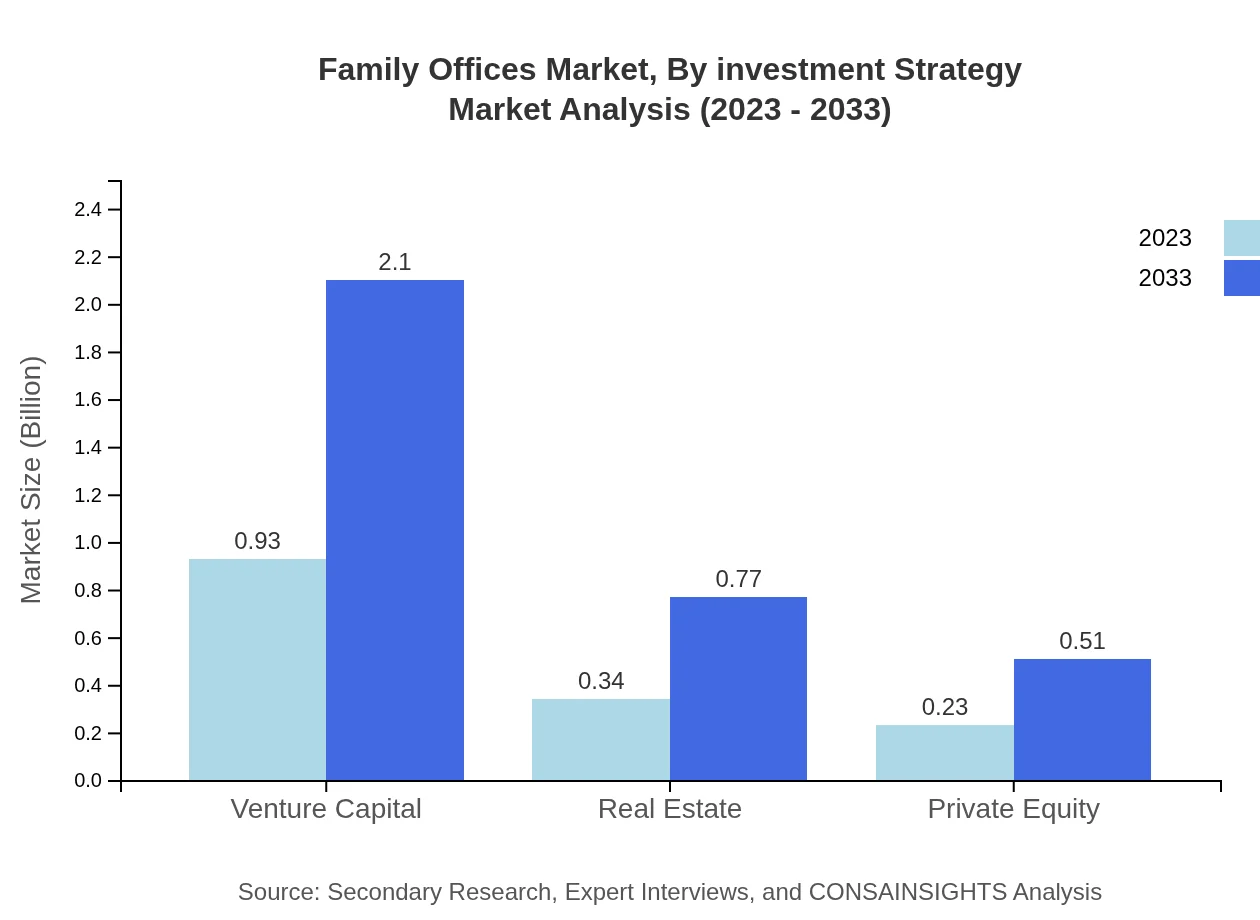

Family Offices Market Analysis By Investment Strategy

The investment strategy segment is critical in understanding the preferences of family offices. In 2023, Equities dominate with a market size of $0.93 trillion, expected to reach $2.10 trillion by 2033, holding a share of 62.07%. Fixed Income is another significant segment, with a projected growth from $0.34 trillion to $0.77 trillion, maintaining a share of 22.71%. Alternative Investments also reflect growth from $0.23 trillion to $0.51 trillion, exhibiting a share of 15.22%.

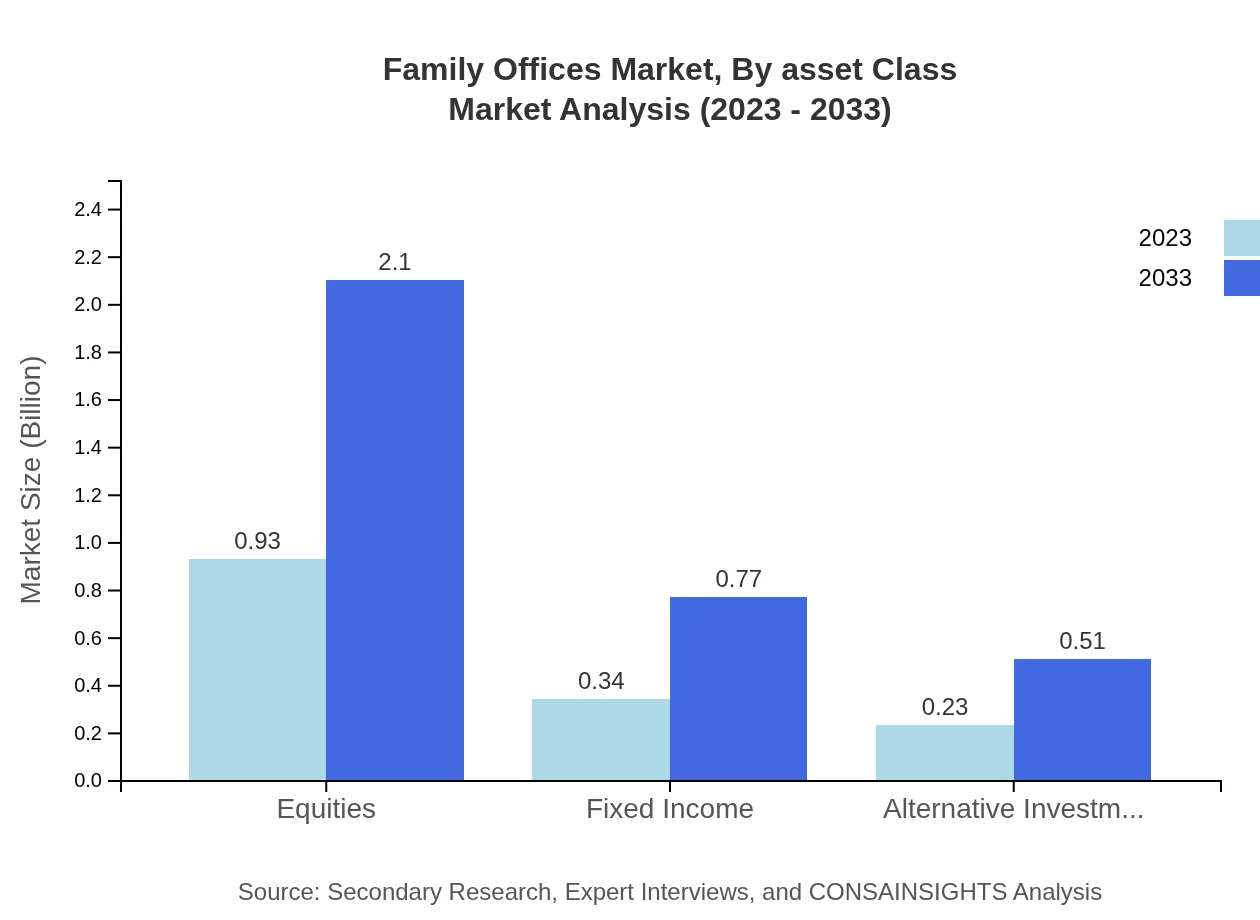

Family Offices Market Analysis By Asset Class

The asset class segmentation shows equities leading the market, with a size increase from $0.93 trillion in 2023 to $2.10 trillion by 2033. Fixed Income increases from $0.34 trillion to $0.77 trillion, and real estate follows with growth from $0.34 trillion to $0.77 trillion in the same period. The continued interest in venture capital, projected to grow to $2.10 trillion by 2033 from $0.93 trillion, illustrates a desire for high-risk, high-reward investment avenues.

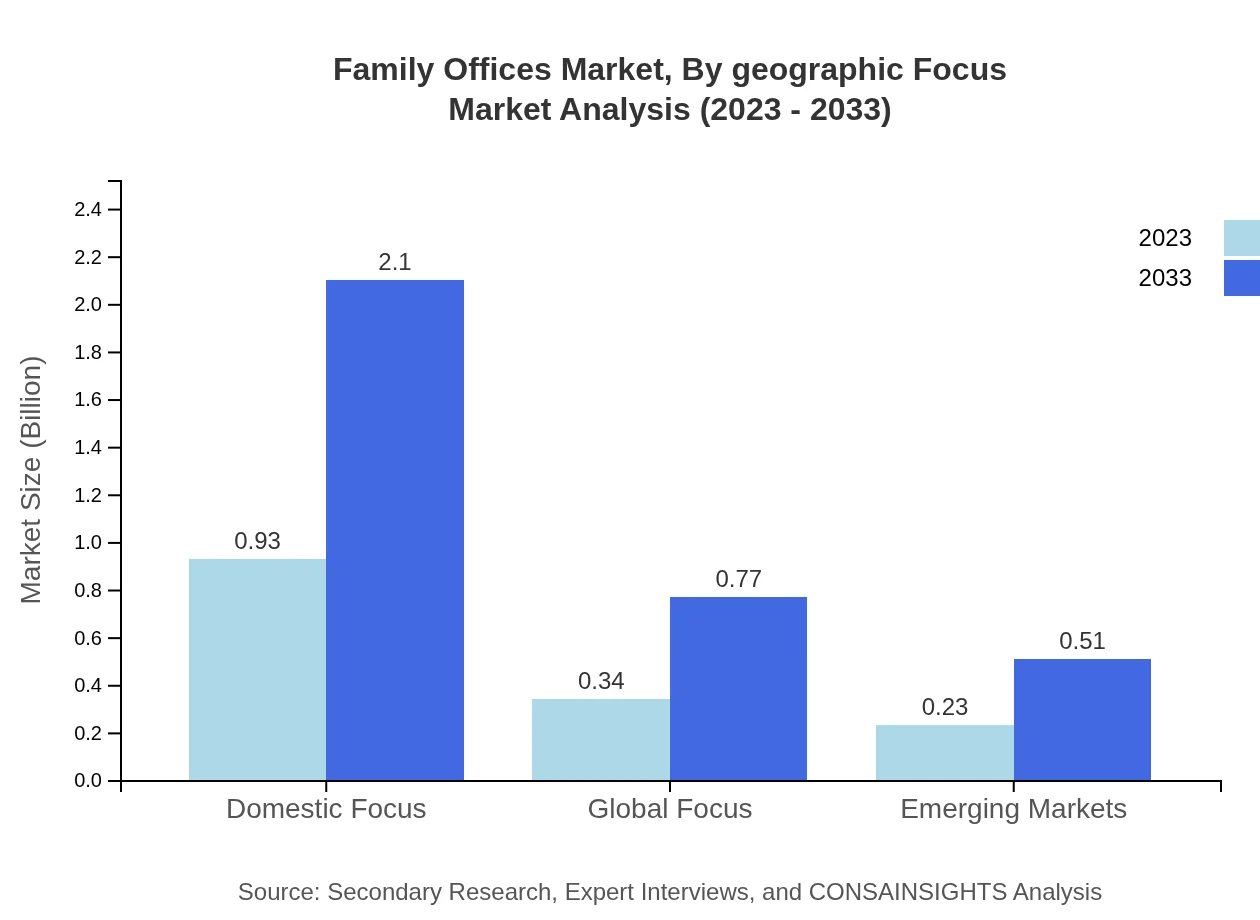

Family Offices Market Analysis By Geographic Focus

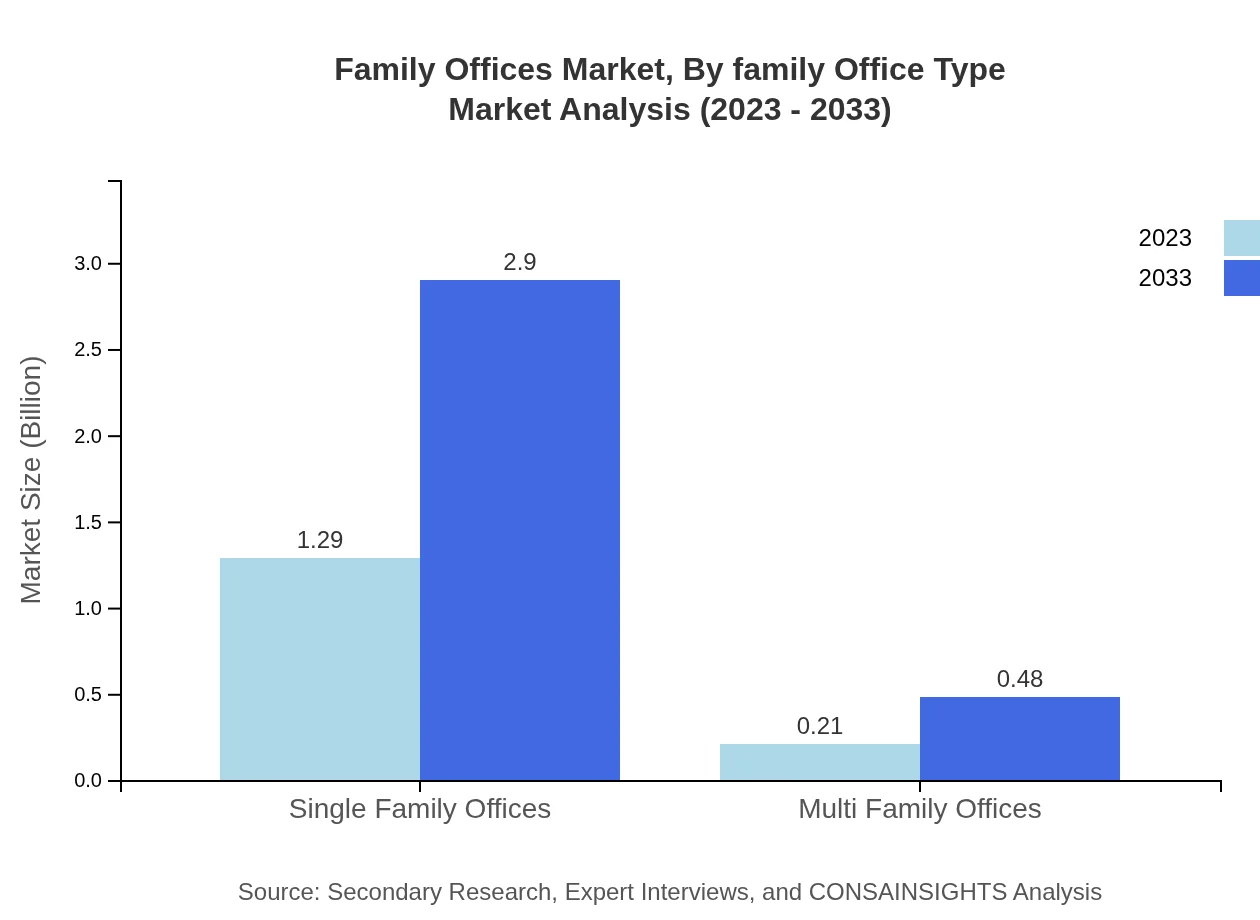

The geographic focus of family offices indicates an inclination towards domestic investments, with both single-multi family offices having significant market size. In 2023, single family offices represented approximately $1.29 trillion, expected to reach $2.90 trillion by 2033. Meanwhile, multi-family offices show growth from $0.21 trillion to $0.48 trillion. This emphasizes a trend toward consolidated wealth management strategies.

Family Offices Market Analysis By Family Office Type

Single family offices are predominant, holding a market share of 85.89% in 2023 while multi-family offices account for 14.11%. The growth in both categories highlights a trend of the wealthy seeking more personalized services, with single family offices expected to continue leading the segment due to their tailored service approach.

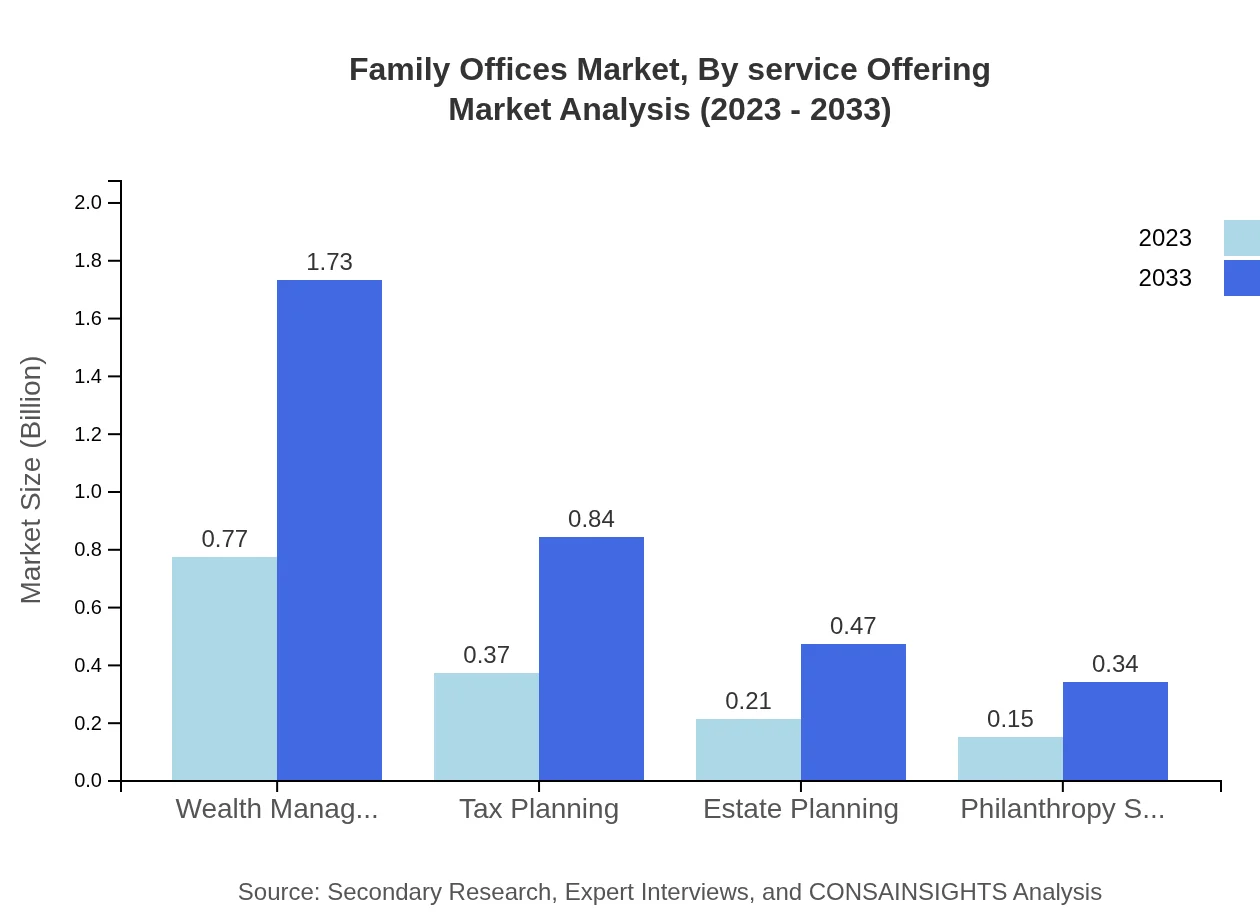

Family Offices Market Analysis By Service Offering

Wealth management remains the core offering, with a size of $0.77 trillion in 2023, anticipated to reach $1.73 trillion by 2033. Tax planning and estate planning follow suit, indicative of the need for efficient asset distribution and wealth preservation strategies. Philanthropy services, while smaller, show promise for growth as more families focus on responsible investing.

Family Offices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Family Offices Industry

Bessemer Trust:

Bessemer Trust is a leading wealth management firm specializing in family office investment services, focusing on personalized investment strategies and estate planning.Northern Trust:

Northern Trust offers innovative family office solutions, integrating investment management with estate and tax planning services for high-net-worth families.Citi Private Client:

Citi Private Client provides comprehensive family office services, supporting families with bespoke financial strategies and a global network of investment opportunities.J.P. Morgan Private Bank:

J.P. Morgan Private Bank serves ultra-high-net-worth individuals and families with a range of wealth management and family office services, including philanthropy advisory.We're grateful to work with incredible clients.

FAQs

What is the market size of family Offices?

The global market size for family offices is currently valued at approximately $1.5 trillion, with an expected compound annual growth rate (CAGR) of 8.2% through 2033. This significant growth reflects the increasing number of families opting for personalized wealth management solutions.

What are the key market players or companies in this family Office industry?

Key players in the family offices industry include wealth management firms, investment advisors, and specialized family office service providers. Notable companies often engage in tailored financial strategies and asset management services tailored for affluent families.

What are the primary factors driving the growth in the family Office industry?

Primary factors for growth in the family office sector include increasing high-net-worth individuals, a rising desire for personalized wealth management, complex family dynamics demanding tailored solutions, and growing focus on sustainable investing practices.

Which region is the fastest Growing in the family Office market?

The fastest-growing region in the family office market is North America, projected to increase from $0.53 trillion in 2023 to $1.19 trillion by 2033. This growth is driven by high-net-worth individuals seeking specialized and dedicated wealth management services.

Does ConsaInsights provide customized market report data for the family Office industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the family-office industry, ensuring clients receive relevant data and analysis that support their strategic decision-making and investment planning.

What deliverables can I expect from this family Office market research project?

Expected deliverables from a family office market research project include detailed market analysis reports, competitive landscape assessments, regional insights, segment data, and actionable recommendations to inform investment strategies and operational decisions.

What are the market trends of family Offices?

Current market trends in family offices include a shift towards integration of technology and digital solutions, increased focus on alternative investments, and heightened interest in philanthropic strategies as families align their investments with personal values.