Fan Out Packaging Market Report

Published Date: 31 January 2026 | Report Code: fan-out-packaging

Fan Out Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fan Out Packaging market, detailing market size, segmentation, industry analysis, and regional insights from 2023 to 2033, alongside forecasts and market trends.

| Metric | Value |

|---|---|

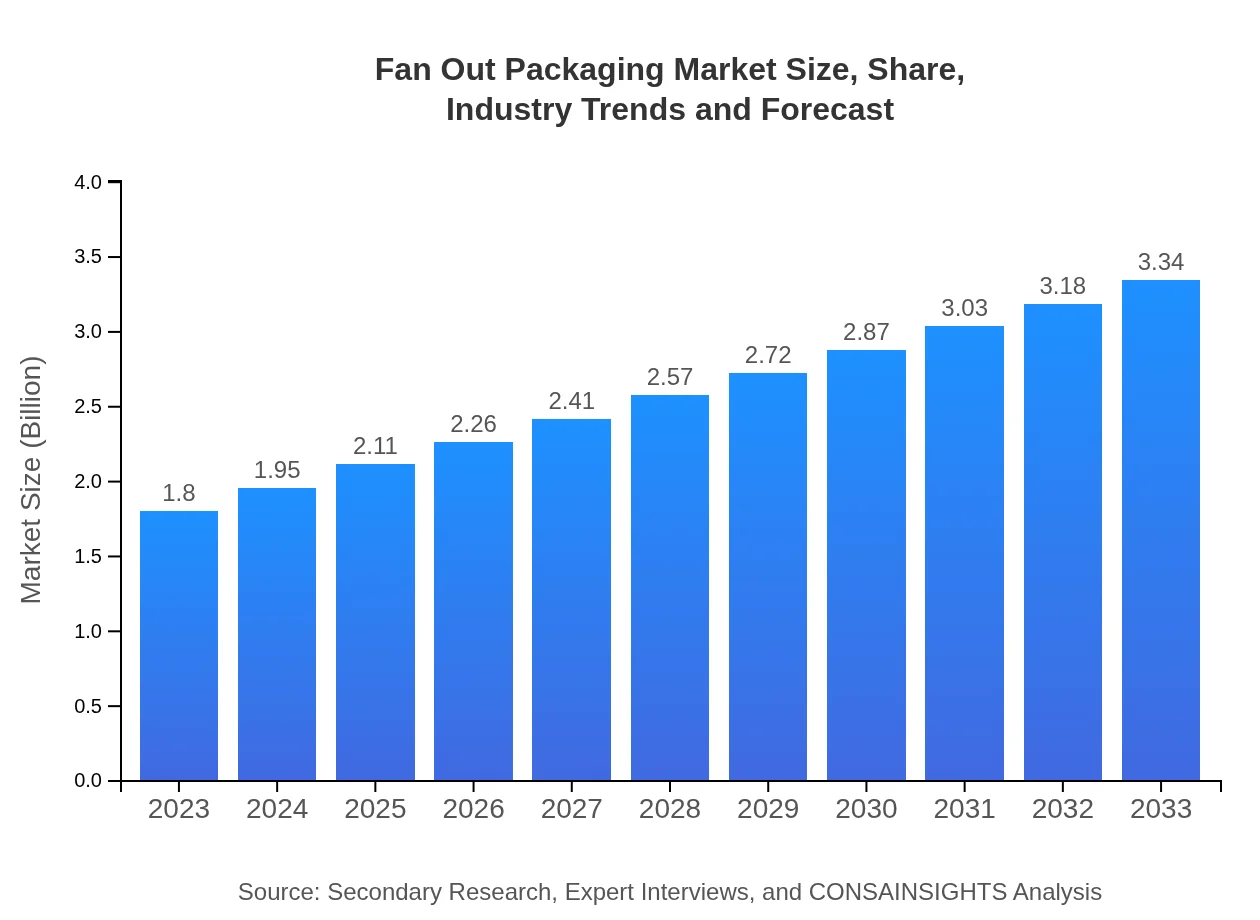

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | ASE Group, Amkor Technology, Inc., Siemens AG, Intel Corporation |

| Last Modified Date | 31 January 2026 |

Fan Out Packaging Market Overview

Customize Fan Out Packaging Market Report market research report

- ✔ Get in-depth analysis of Fan Out Packaging market size, growth, and forecasts.

- ✔ Understand Fan Out Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fan Out Packaging

What is the Market Size & CAGR of Fan Out Packaging market in 2023?

Fan Out Packaging Industry Analysis

Fan Out Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fan Out Packaging Market Analysis Report by Region

Europe Fan Out Packaging Market Report:

Europe's Fan Out Packaging market is forecasted to advance from $0.48 billion in 2023 to $0.89 billion by 2033. The focus on sustainable manufacturing and stringent regulatory requirements regarding electronic waste management are expected to fuel innovations in packaging techniques.Asia Pacific Fan Out Packaging Market Report:

In the Asia Pacific region, the Fan Out Packaging market is projected to grow from $0.35 billion in 2023 to $0.65 billion by 2033. The region is a hub for electronics manufacturing, with countries like China, Japan, and South Korea leading the charge in the adoption of advanced packaging technologies.North America Fan Out Packaging Market Report:

North America holds a substantial market share, increasing from $0.63 billion in 2023 to $1.17 billion by 2033. The United States remains at the forefront due to its advanced technology hubs and a strong demand for innovative packaging solutions across various industries.South America Fan Out Packaging Market Report:

The South American market, though smaller, is expected to show significant growth from $0.12 billion in 2023 to $0.23 billion by 2033. This growth is driven by increasing investments in the electronics sector and the rise of local manufacturers tapping into global supply chains.Middle East & Africa Fan Out Packaging Market Report:

The Middle East and Africa region is expected to grow from $0.21 billion in 2023 to $0.39 billion by 2033. The region's growth is supported by emerging electronics markets and increasing adoption of modern technology.Tell us your focus area and get a customized research report.

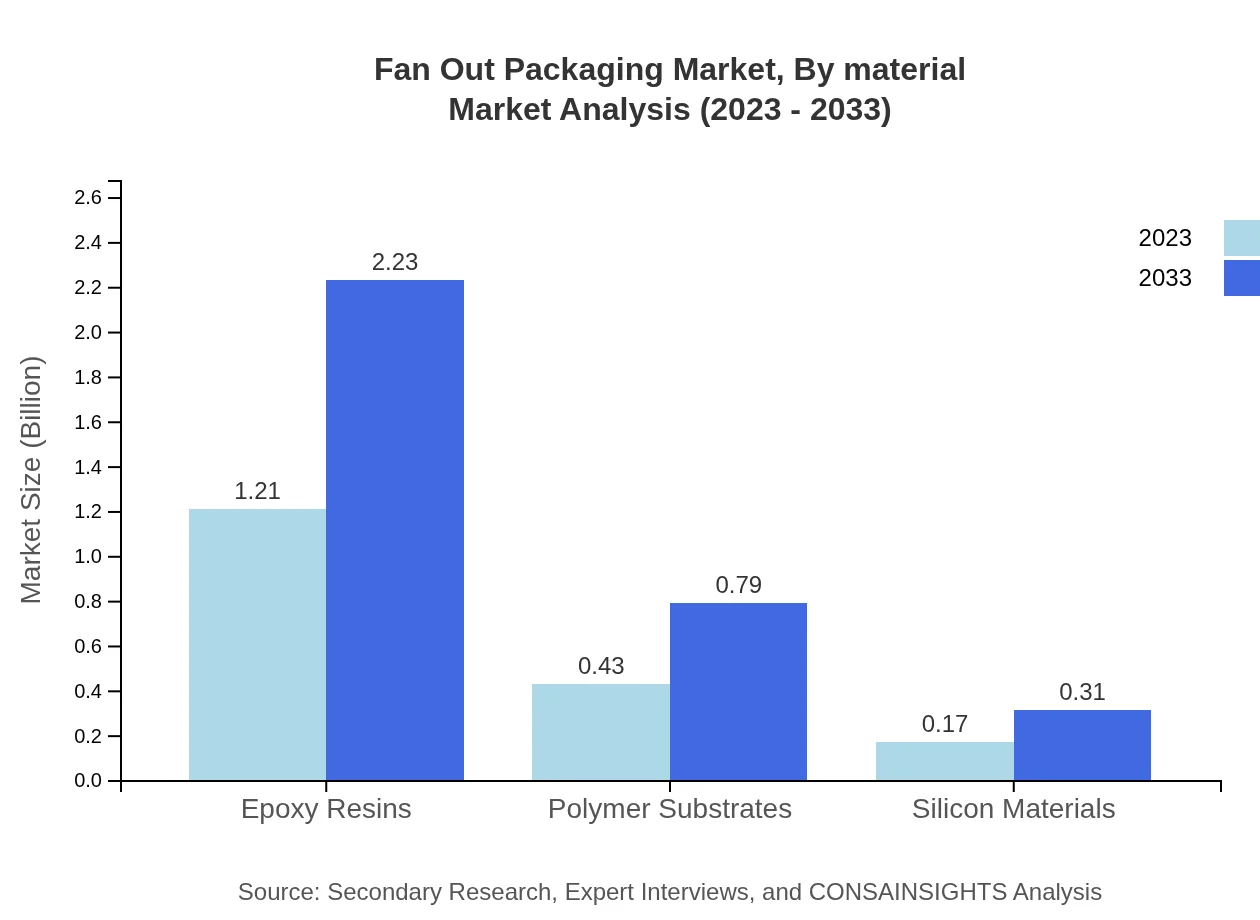

Fan Out Packaging Market Analysis By Material

The material segment of the Fan-Out Packaging market is dominated by epoxy resins and polymer substrates, which together account for approximately 90% of the market share. In 2023, epoxy resins held a market size of $1.21 billion, growing to $2.23 billion by 2033. This segment's growth is supplemented by innovation focused on improving material properties for better thermal performance and reliability.

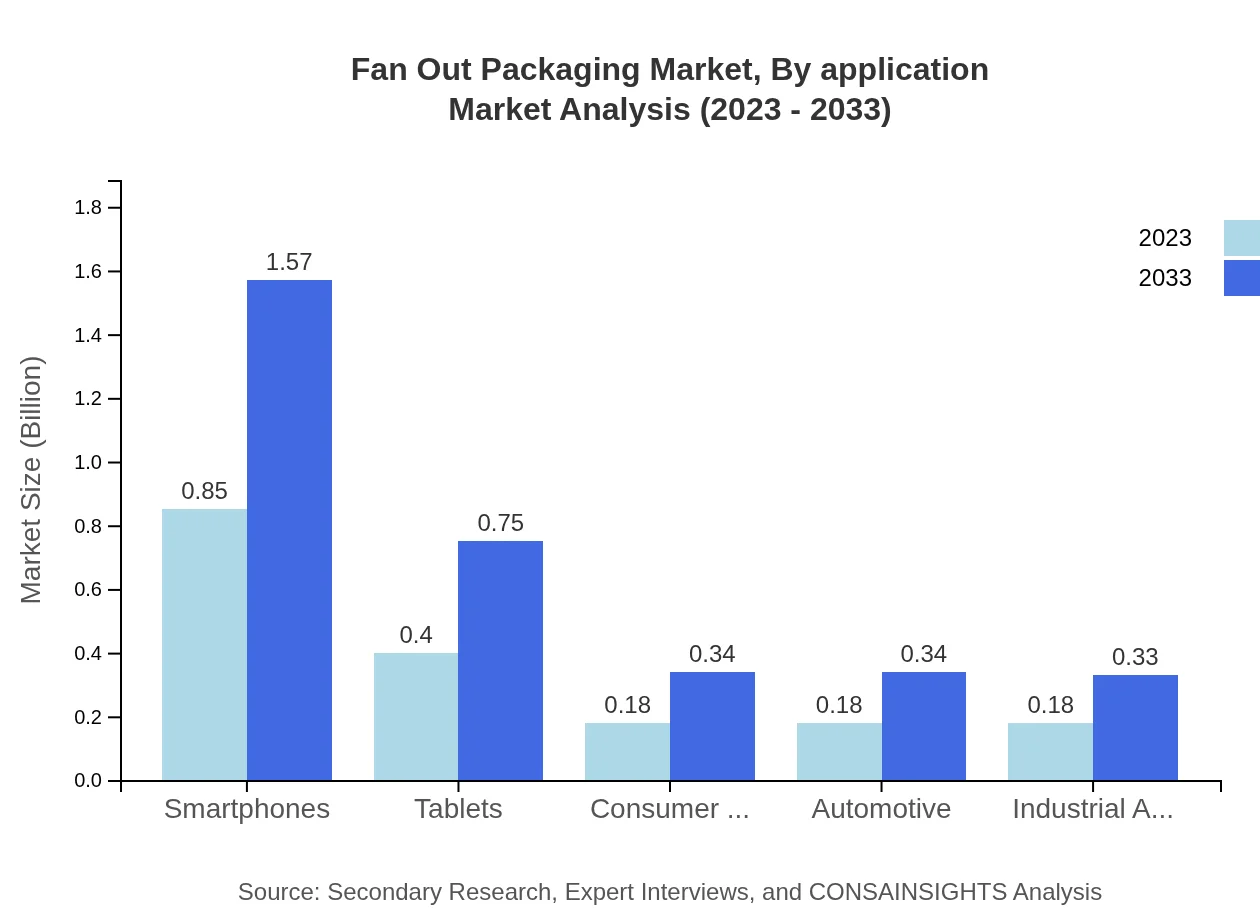

Fan Out Packaging Market Analysis By Application

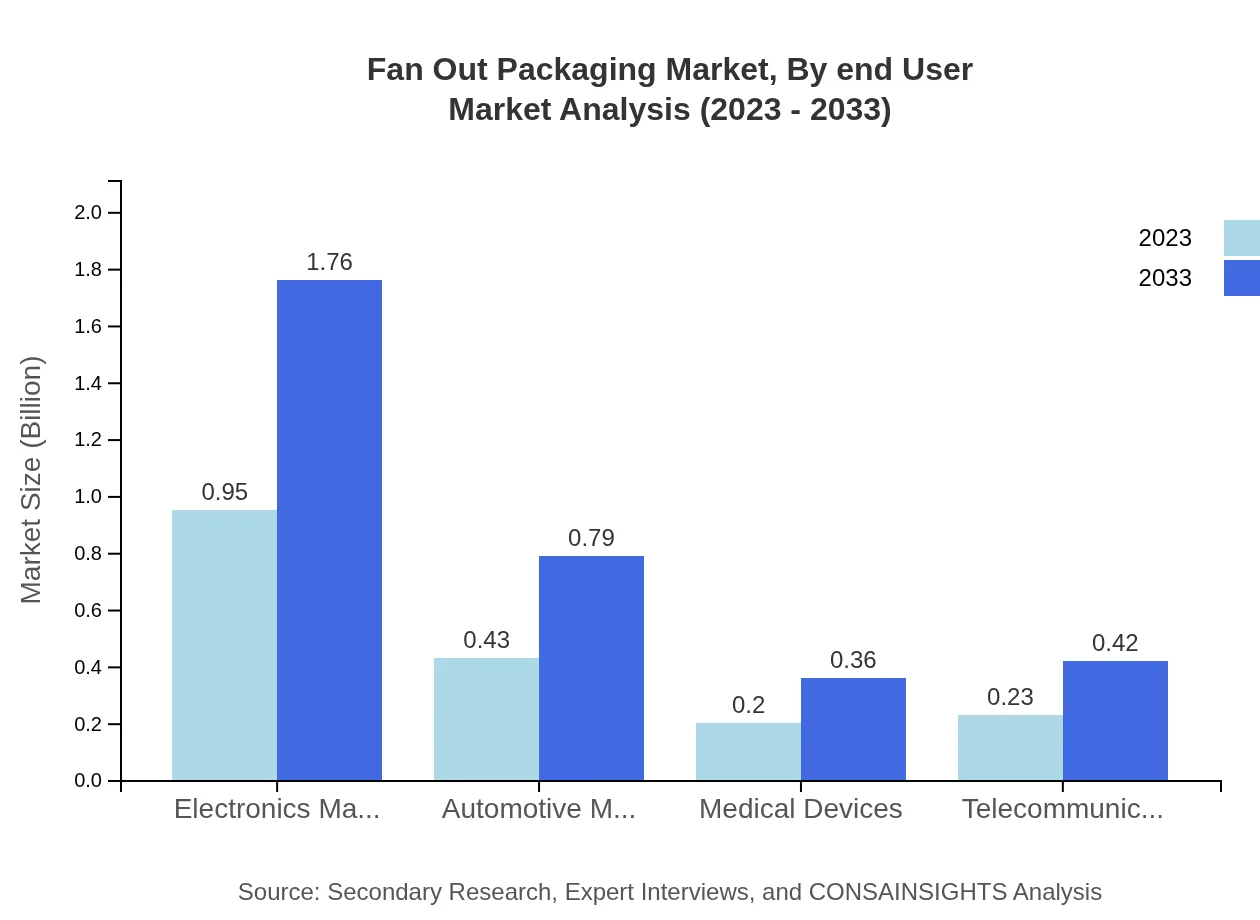

The application segment consists of various industries, with electronics manufacturers leading the market. In 2023, the electronics application segment was valued at $0.95 billion and is projected to reach $1.76 billion by 2033, showcasing the segment's critical role in the demand for Fan Out Packaging.

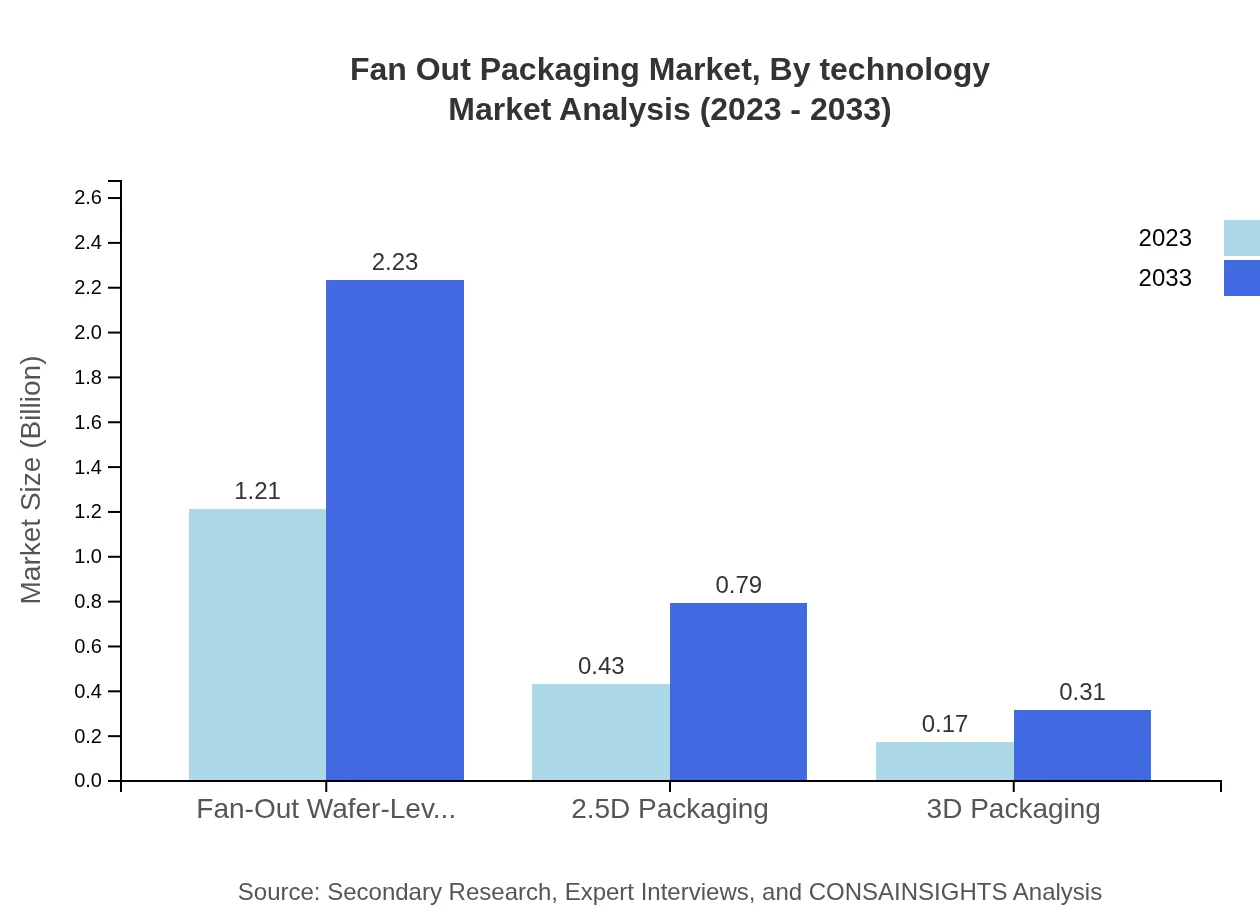

Fan Out Packaging Market Analysis By Technology

Within the technology segment, Fan-Out Wafer-Level Packaging is the most significant driver, capturing a share of 66.98% in 2023 and extending to the same percentage by 2033. This indicates a stable demand for this technology, driven by its advantages in performance and space efficiency.

Fan Out Packaging Market Analysis By End User

End-user industries including consumer electronics, automotive, and telecommunications are major contributors to market growth. In 2023, consumer electronics represented 47.19% of the market share, with a projected rise to 50% by 2033, underscoring continued reliance on advanced packaging solutions in this sector.

Fan Out Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fan Out Packaging Industry

ASE Group:

A leading provider of advanced semiconductor packaging and testing services, ASE Group is at the forefront of Fan Out technologies, offering innovative solutions that enhance performance and efficiency.Amkor Technology, Inc.:

Amkor Technology is known for its advanced packaging technologies, including Fan Out Packaging solutions which cater to various high-tech applications across consumer and automotive electronics.Siemens AG:

Siemens AG is focused on integrating technology and engineering to develop efficient semiconductor packaging solutions that drive market demand for Fan Out technologies.Intel Corporation:

A significant player in the semiconductor market, Intel is continually advancing its packaging technologies, positioned prominently within the Fan Out Packaging market.We're grateful to work with incredible clients.

FAQs

What is the market size of fan Out Packaging?

The global fan-out packaging market is valued at approximately $1.8 billion in 2023, with an expected CAGR of 6.2% over the next decade. This growth reflects advancements in packaging technologies and increasing demand across various sectors.

What are the key market players or companies in this fan Out Packaging industry?

Major players in the fan-out packaging industry include ASE Group, Amkor Technology, STMicroelectronics, and Siliconware Precision Industries. These companies are pivotal in driving innovation and growth, focusing on high-performance packaging solutions.

What are the primary factors driving the growth in the fan Out Packaging industry?

Key drivers of growth in the fan-out packaging market include rising demand for compact electronic devices, advancements in semiconductor technologies, and increasing adoption of IoT and AI applications that require efficient packaging solutions.

Which region is the fastest Growing in the fan Out Packaging?

North America is the fastest-growing region for fan-out packaging, expected to grow from $0.63 billion in 2023 to $1.17 billion by 2033. This growth is driven by a robust electronics and automotive sector seeking advanced packaging technologies.

Does ConslaInsights provide customized market report data for the fan Out Packaging industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the fan-out packaging industry. Clients can request insights based on particular segments, regions, or trends to support strategic decision-making.

What deliverables can I expect from this fan Out Packaging market research project?

Deliverables for the fan-out packaging market research project include detailed market analysis, forecasts, competitive landscape insights, regional data, and segmentation analysis, all aimed at providing comprehensive market understanding.

What are the market trends of fan Out Packaging?

Current trends in the fan-out packaging market include the shift towards advanced packaging technologies, increasing integration of heterogeneous materials, and rising demand for miniaturization in consumer electronics, highlighting the market's dynamic nature.