Farm Equipment Rental Market Report

Published Date: 22 January 2026 | Report Code: farm-equipment-rental

Farm Equipment Rental Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the global Farm Equipment Rental market, offering insights into market dynamics, segmentation, regional performance, and future trends. Covering the forecast from 2023 to 2033, it provides a comprehensive analysis of size, growth potential, and competitive landscapes.

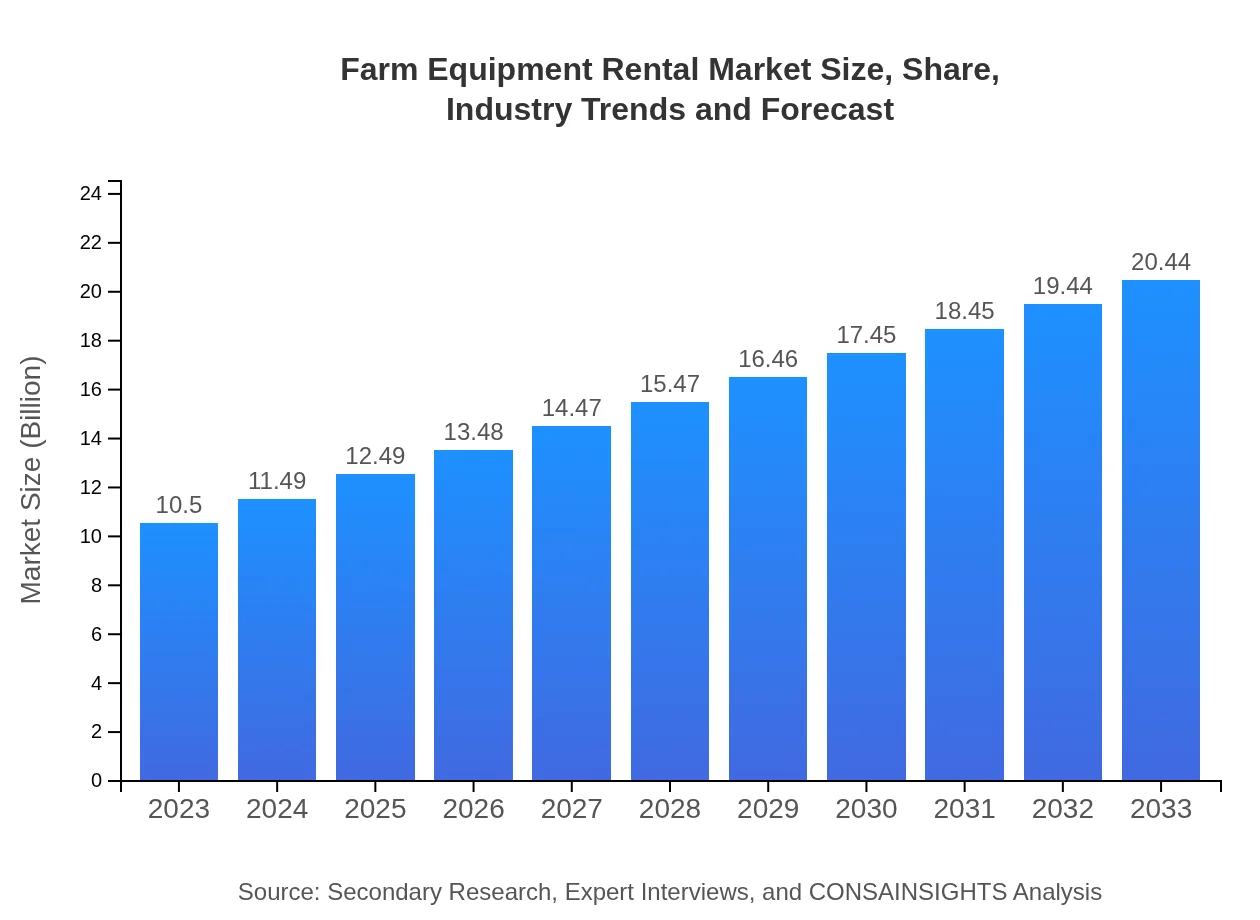

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $20.44 Billion |

| Top Companies | John Deere, Caterpillar Inc., AGCO Corporation, Kubota Corporation, CLAAS |

| Last Modified Date | 22 January 2026 |

Farm Equipment Rental Market Overview

Customize Farm Equipment Rental Market Report market research report

- ✔ Get in-depth analysis of Farm Equipment Rental market size, growth, and forecasts.

- ✔ Understand Farm Equipment Rental's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Farm Equipment Rental

What is the Market Size & CAGR of Farm Equipment Rental market in 2023 and 2033?

Farm Equipment Rental Industry Analysis

Farm Equipment Rental Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Farm Equipment Rental Market Analysis Report by Region

Europe Farm Equipment Rental Market Report:

Currently valued at $3.29 billion, Europe's market is projected to reach $6.40 billion by 2033. Factors supporting this growth include the EU legislation promoting sustainable farming practices and investment in digital agriculture.Asia Pacific Farm Equipment Rental Market Report:

In 2023, the Farm Equipment Rental market in the Asia Pacific region is valued at $2.04 billion, projected to grow to $3.96 billion by 2033. The rapid adoption of mechanization among emerging economies and rising agricultural productivity drives growth in this region.North America Farm Equipment Rental Market Report:

The North American market stands at $3.40 billion in 2023, with forecasts indicating an increase to $6.61 billion by 2033, propelled by high demand for rental services among commercial farmers who seek to optimize costs.South America Farm Equipment Rental Market Report:

The South American market is currently valued at $0.56 billion and is expected to reach $1.08 billion by 2033. The demand here is influenced by the booming agriculture sector and strong imports of rental equipment.Middle East & Africa Farm Equipment Rental Market Report:

In the Middle East and Africa, the market is valued at $1.22 billion in 2023, expected to rise to $2.38 billion by 2033. This growth is driven by agricultural investments and modernization efforts across the region.Tell us your focus area and get a customized research report.

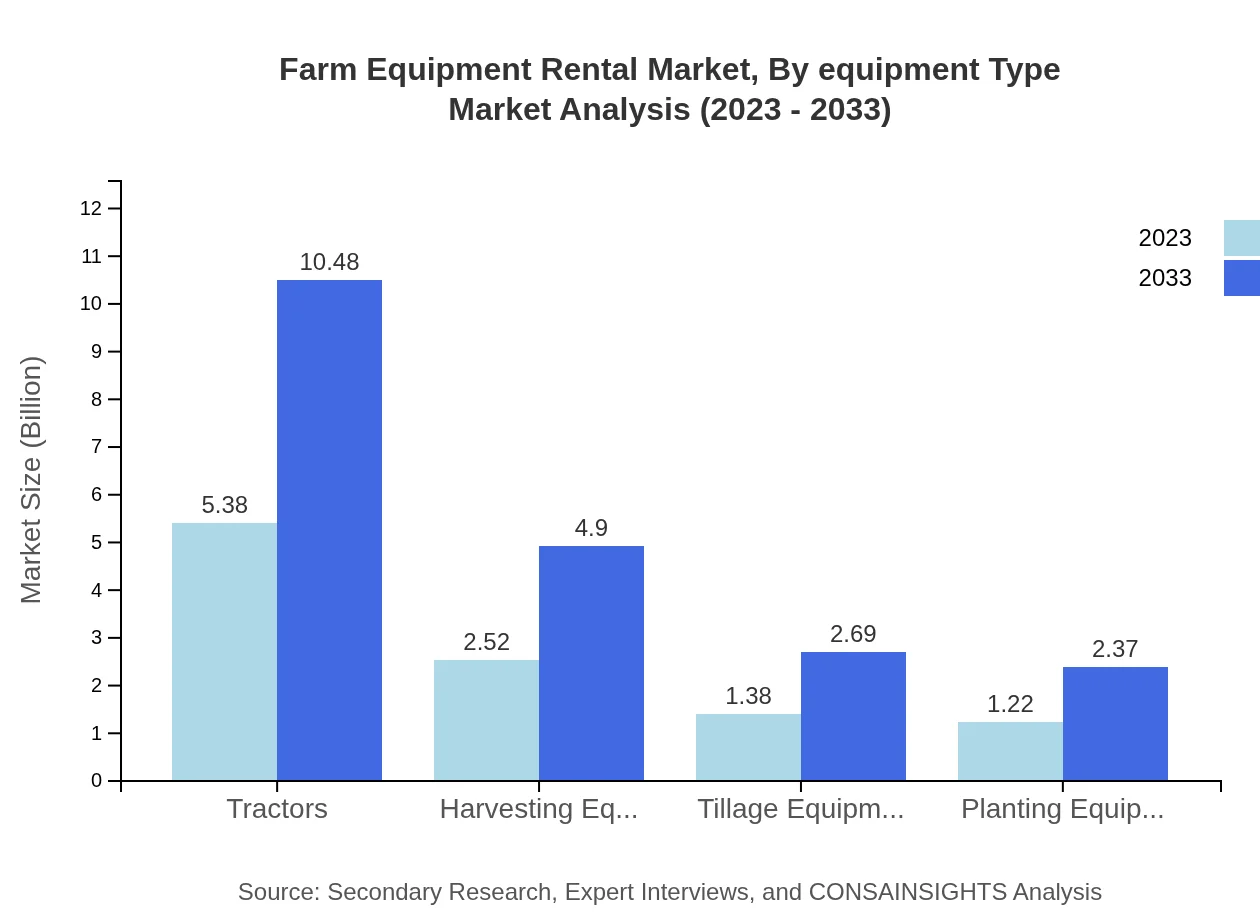

Farm Equipment Rental Market Analysis By Equipment Type

The equipment rental market primarily includes categories like Tractors, Harvesting Equipment, Tillage Equipment, and Planting Equipment. Tractors lead the market share at 51.28% in 2023, growing to a projected 51.28% by 2033. Harvesting Equipment, representing 23.97%, is expected to follow suit, with a growth from $2.52 billion to $4.90 billion by 2033.

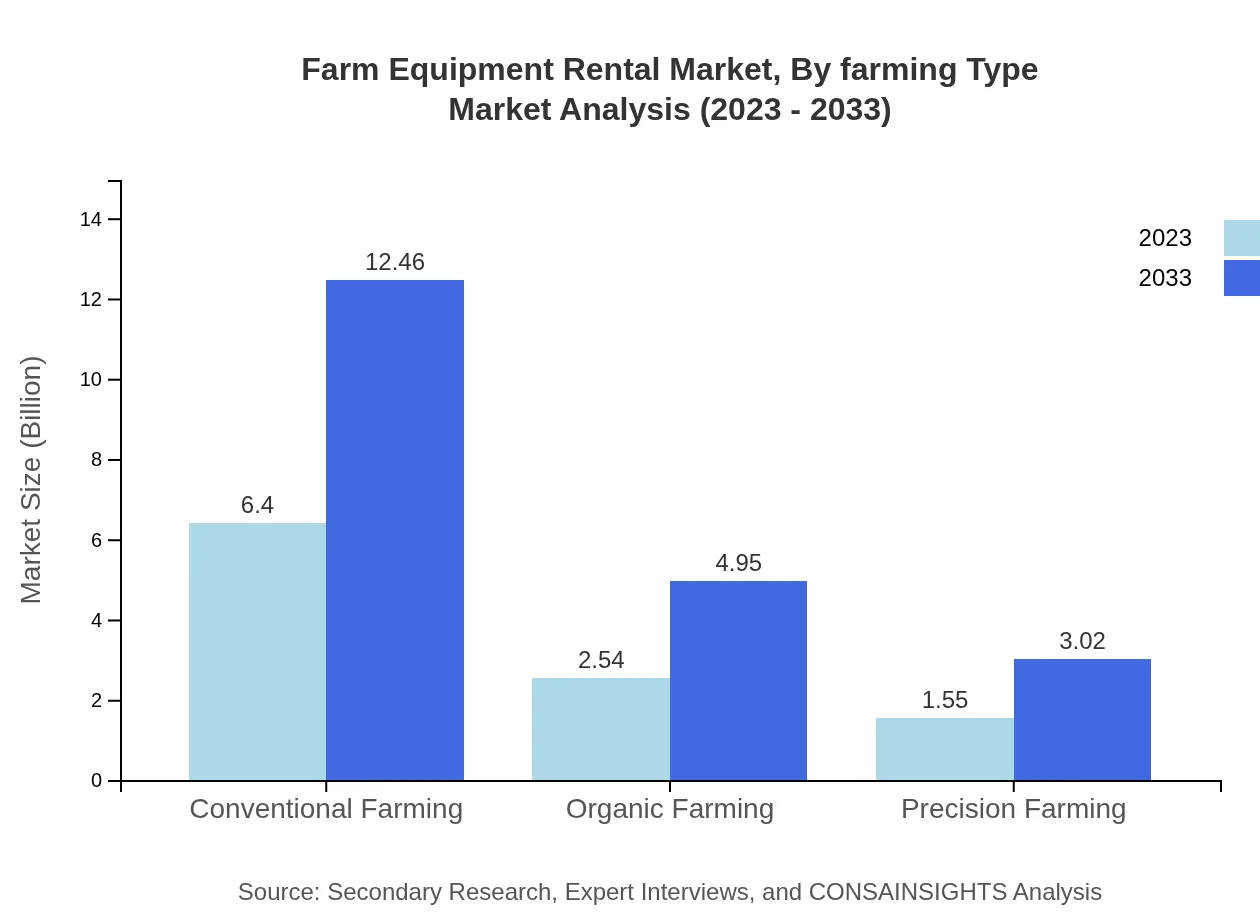

Farm Equipment Rental Market Analysis By Farming Type

The market is segmented into Conventional Farming, Organic Farming, and Precision Farming methods. Conventional Farming commands a robust size of $6.40 billion in 2023 and is set to grow to $12.46 billion by 2033, reflecting its dominant position and consistent demand. Organic Farming and Precision Farming also exhibit promising growth potential, with projected sizes reaching $4.95 billion and $3.02 billion respectively by 2033.

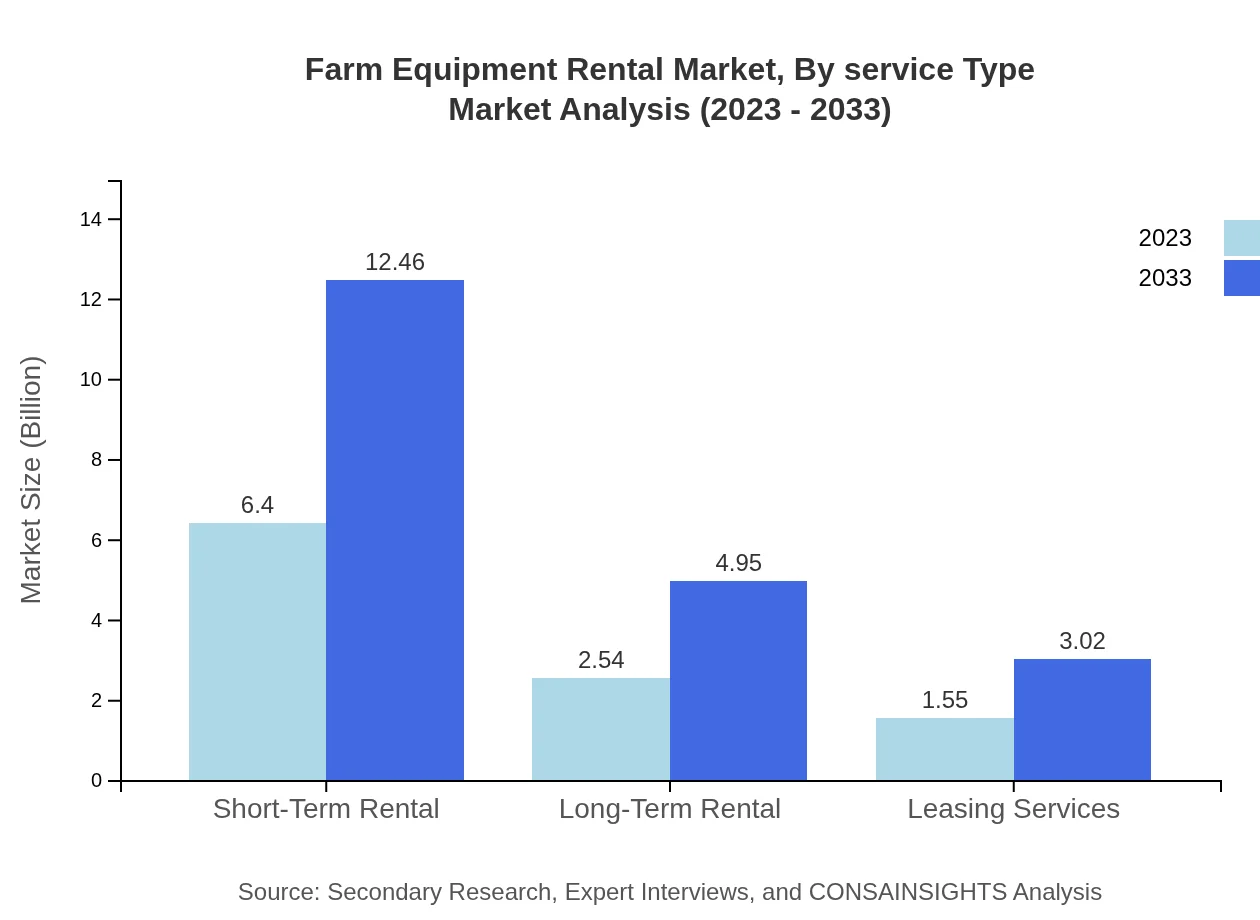

Farm Equipment Rental Market Analysis By Service Type

The market is categorized into Short-Term and Long-Term Rental services, with Short-Term rental leading at a size of $6.40 billion in 2023, refining member operational ability and cost efficiency. Both segments are anticipated to experience growth, with Long-Term Rentals expanding to approximately $4.95 billion by 2033.

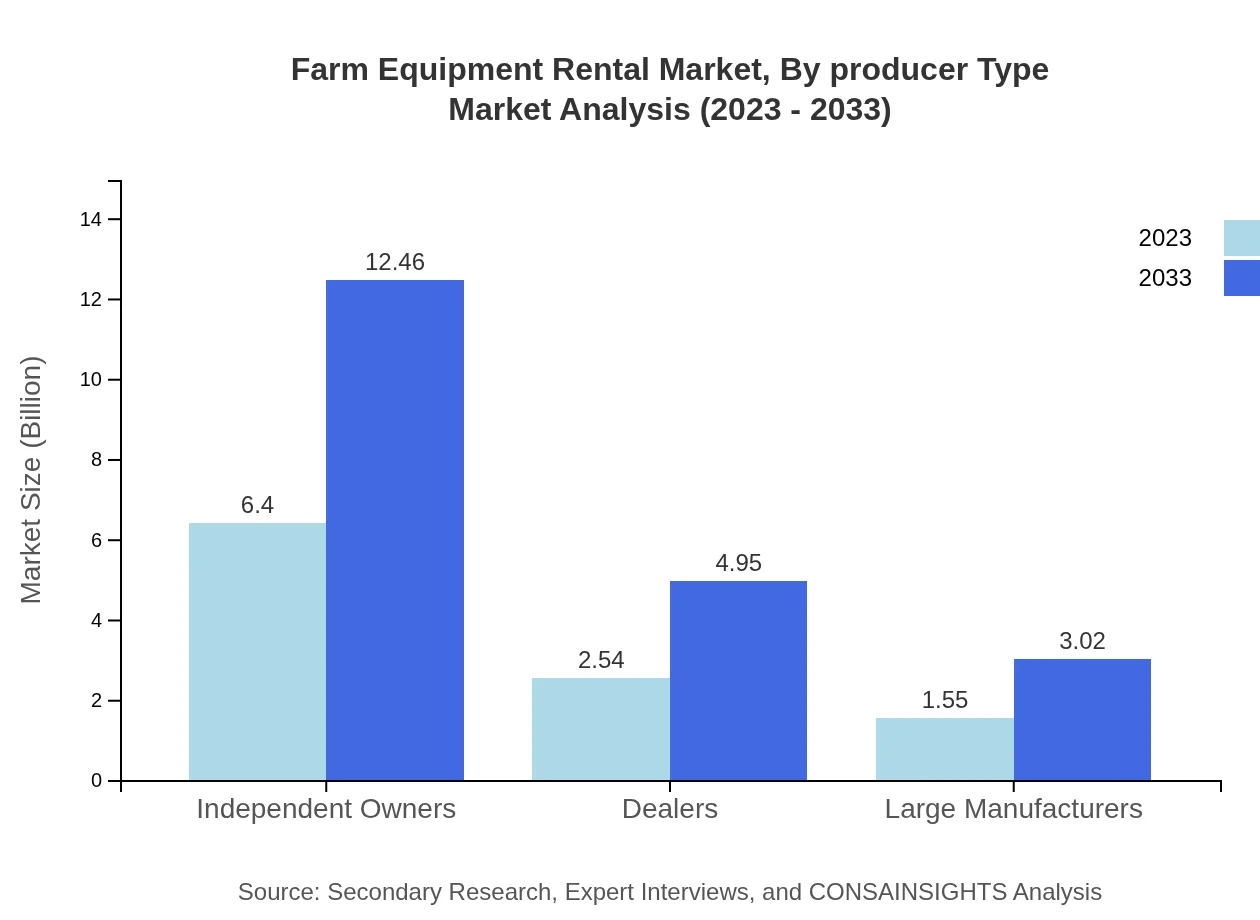

Farm Equipment Rental Market Analysis By Producer Type

The producer type segment includes Independent Owners, Dealers, and Large Manufacturers. Independent Owners hold a market share of 60.99%, translating to $6.40 billion in 2023, growing to $12.46 billion by 2033. Dealers and Large Manufacturers showcase a steady increase as well, with specific strategies driving their presence in the rental landscape.

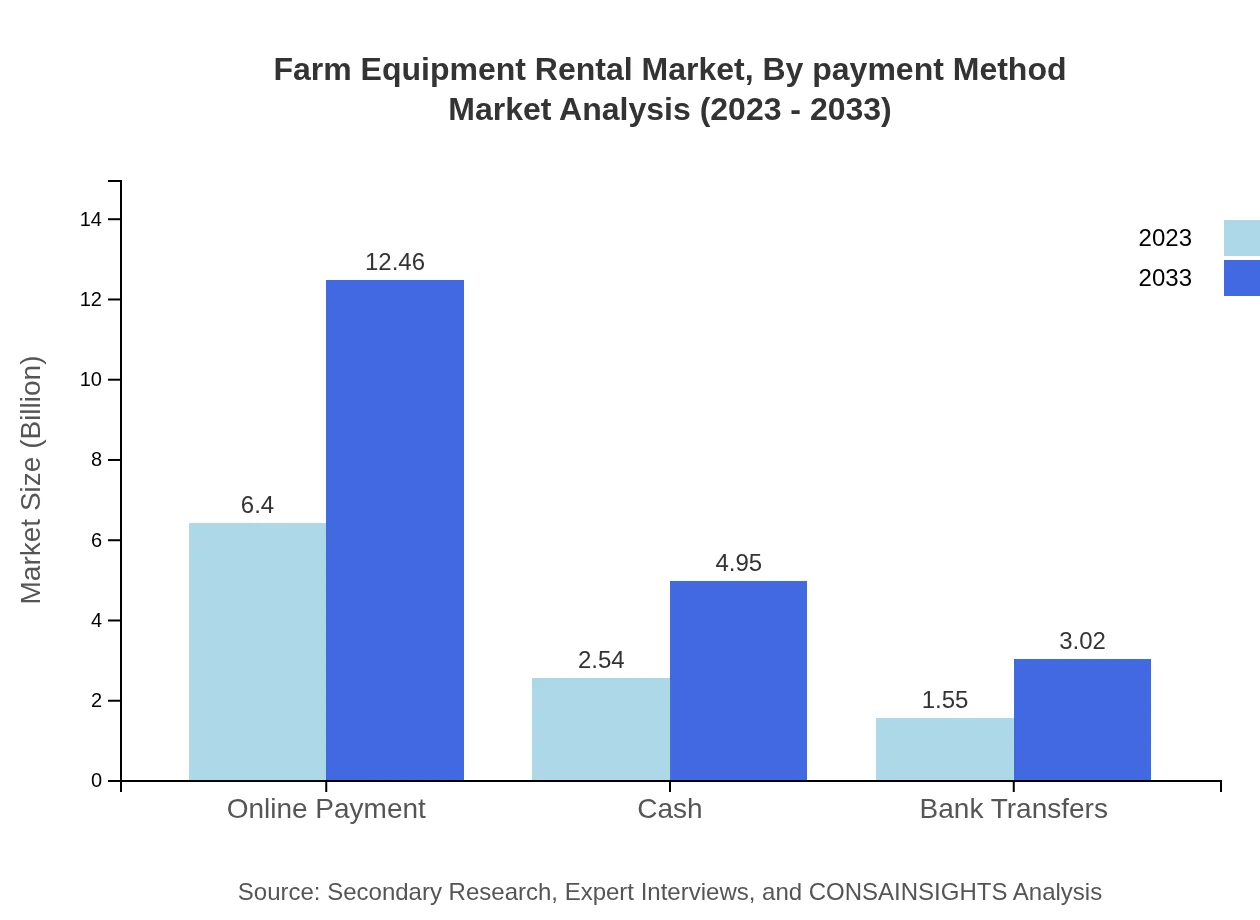

Farm Equipment Rental Market Analysis By Payment Method

Payment methods in the rental market have evolved with options like Online Payment, Cash, and Bank Transfers. Online Payments dominate the segment at $6.40 billion in 2023, expected to rise significantly through 2033, reflecting the shift towards digital solutions in ensuring seamless transactions in the rental process.

Farm Equipment Rental Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Farm Equipment Rental Industry

John Deere:

A global leader in agricultural equipment, John Deere offers robust rental services across various equipment lines, providing farmers with the latest technology.Caterpillar Inc.:

Caterpillar provides a diverse portfolio of agricultural machinery and rental services, significantly impacting the farming efficiency and productivity.AGCO Corporation:

AGCO specializes in farming equipment solutions, including rental services that cater to both conventional and organic farming sectors.Kubota Corporation:

Kubota is recognized for its high-quality machinery rental options that are widely used by farmers looking for reliable equipment in the farming sector.CLAAS:

A prominent player in the agriculture sector, specializing in harvesting solutions and providing effective rental programs suitable for farmers.We're grateful to work with incredible clients.

FAQs

What is the market size of farm Equipment Rental?

The farm equipment rental market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 6.7% leading to significant growth by 2033.

What are the key market players or companies in this farm Equipment Rental industry?

Key players in the farm equipment rental market include independent owners, large manufacturers, and dealers, all of which contribute to the availability and variety of rental equipment.

What are the primary factors driving the growth in the farm Equipment Rental industry?

Growth in the farm equipment rental industry is driven by rising demand for precision farming, cost-effective rental solutions, and advancements in agricultural technology.

Which region is the fastest Growing in the farm Equipment Rental?

The North America region is the fastest-growing segment in the farm equipment rental market, with growth from $3.40 billion in 2023 to $6.61 billion in 2033.

Does ConsaInsights provide customized market report data for the farm Equipment Rental industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the farm equipment rental industry, enabling targeted insights.

What deliverables can I expect from this farm Equipment Rental market research project?

Deliverables include comprehensive market analysis reports, segmented data, growth forecasts, and key player insights tailored to the farm equipment rental market.

What are the market trends of farm Equipment Rental?

Current trends include rising demand for online payment options, the shift towards precision farming, and an increase in short-term rentals over long-term commitments.