Farm Management Software Market Report

Published Date: 02 February 2026 | Report Code: farm-management-software

Farm Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the dynamics of the Farm Management Software market, offering insights on market size, segmentation, regional analysis, and industry trends. The forecast period spans from 2023 to 2033, presenting detailed projections and challenges facing the sector.

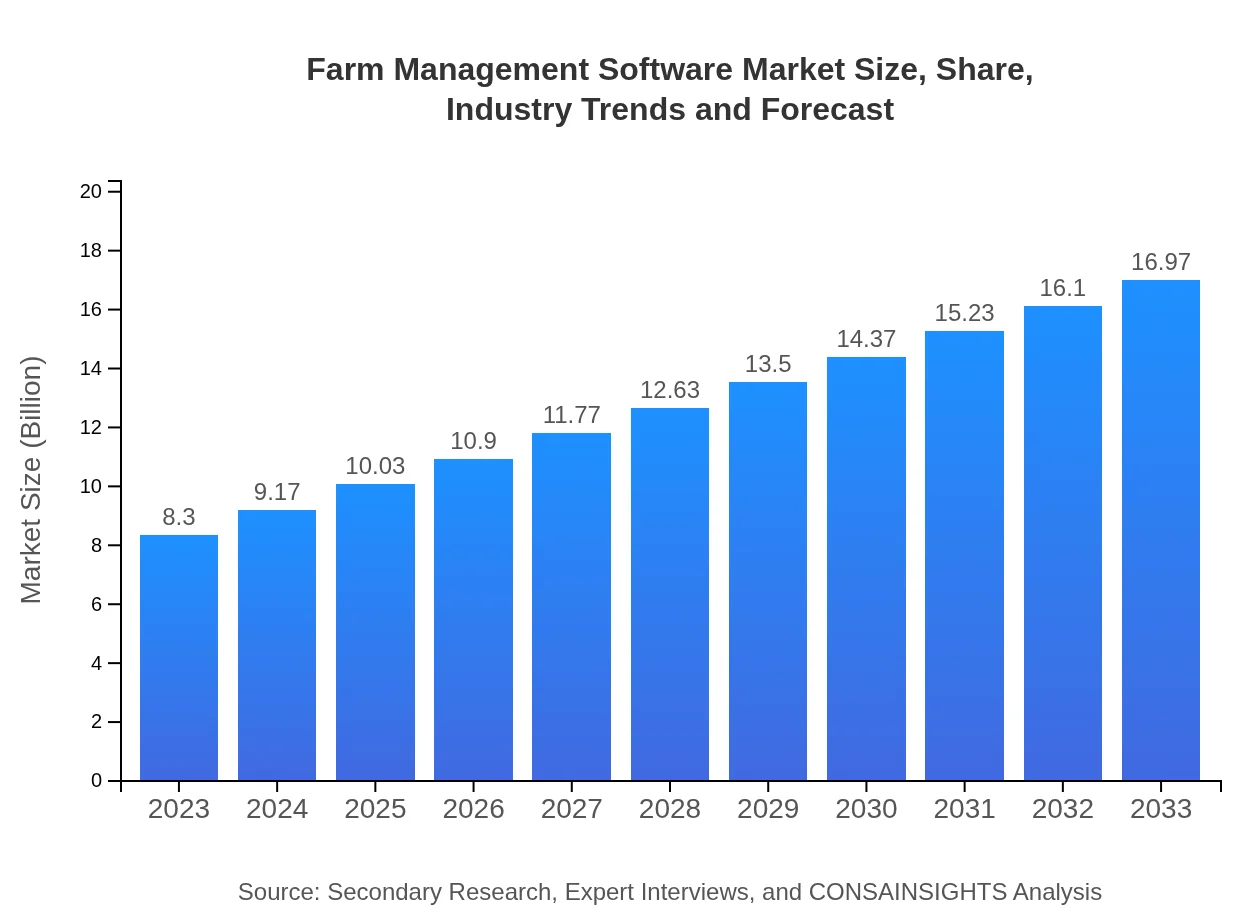

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $16.97 Billion |

| Top Companies | Trimble Ag Software, Farms.com, Ag Leader Technology, AgriWebb |

| Last Modified Date | 02 February 2026 |

Farm Management Software Market Overview

Customize Farm Management Software Market Report market research report

- ✔ Get in-depth analysis of Farm Management Software market size, growth, and forecasts.

- ✔ Understand Farm Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Farm Management Software

What is the Market Size & CAGR of Farm Management Software market in 2023?

Farm Management Software Industry Analysis

Farm Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Farm Management Software Market Analysis Report by Region

Europe Farm Management Software Market Report:

Europe's FMS market is anticipated to grow from $2.43 billion in 2023 to $4.97 billion by 2033, as countries push for more sustainable farming practices and regulatory compliance, prompting farmers to implement efficient management solutions.Asia Pacific Farm Management Software Market Report:

In the Asia Pacific region, the Farm Management Software market is projected to grow from $1.82 billion in 2023 to $3.72 billion by 2033, driven by rapid urbanization, increasing population, and the need for efficient agricultural practices to feed growing communities. The adoption of mobile-based solutions is also contributing to this growth.North America Farm Management Software Market Report:

North America leads with a market size of approximately $2.66 billion in 2023, expected to reach $5.44 billion by 2033. High adoption rates of advanced agriculture technologies and the rising trend of precision farming are significant growth factors in this region.South America Farm Management Software Market Report:

South America’s Farm Management Software market is set to expand from $0.76 billion in 2023 to $1.56 billion by 2033. The agricultural sector's integration of technology is transforming traditional farming methods, positively impacting yield and efficiency.Middle East & Africa Farm Management Software Market Report:

The Middle East and Africa region is forecasted to grow from $0.62 billion in 2023 to $1.27 billion by 2033. Increased investment in smart agriculture technologies amid challenges like water scarcity is driving the adoption of management software.Tell us your focus area and get a customized research report.

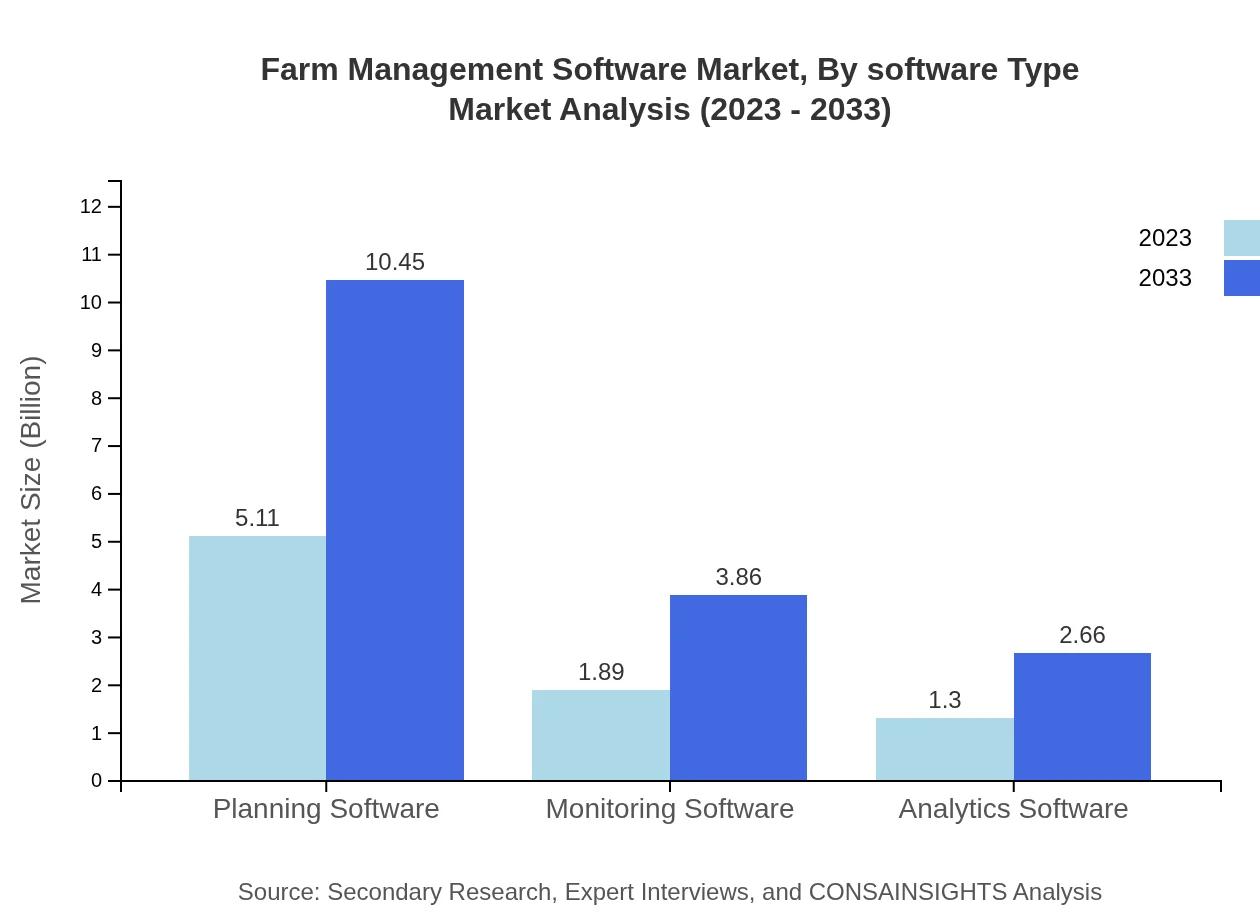

Farm Management Software Market Analysis By Software Type

In 2023, the planning software market is valued at $5.11 billion, anticipated to rise to $10.45 billion by 2033, capturing a significant share due to its critical role in operational efficiency. Monitoring software and analytics software are also gaining traction, reflecting the industry's shift towards data-centric solutions.

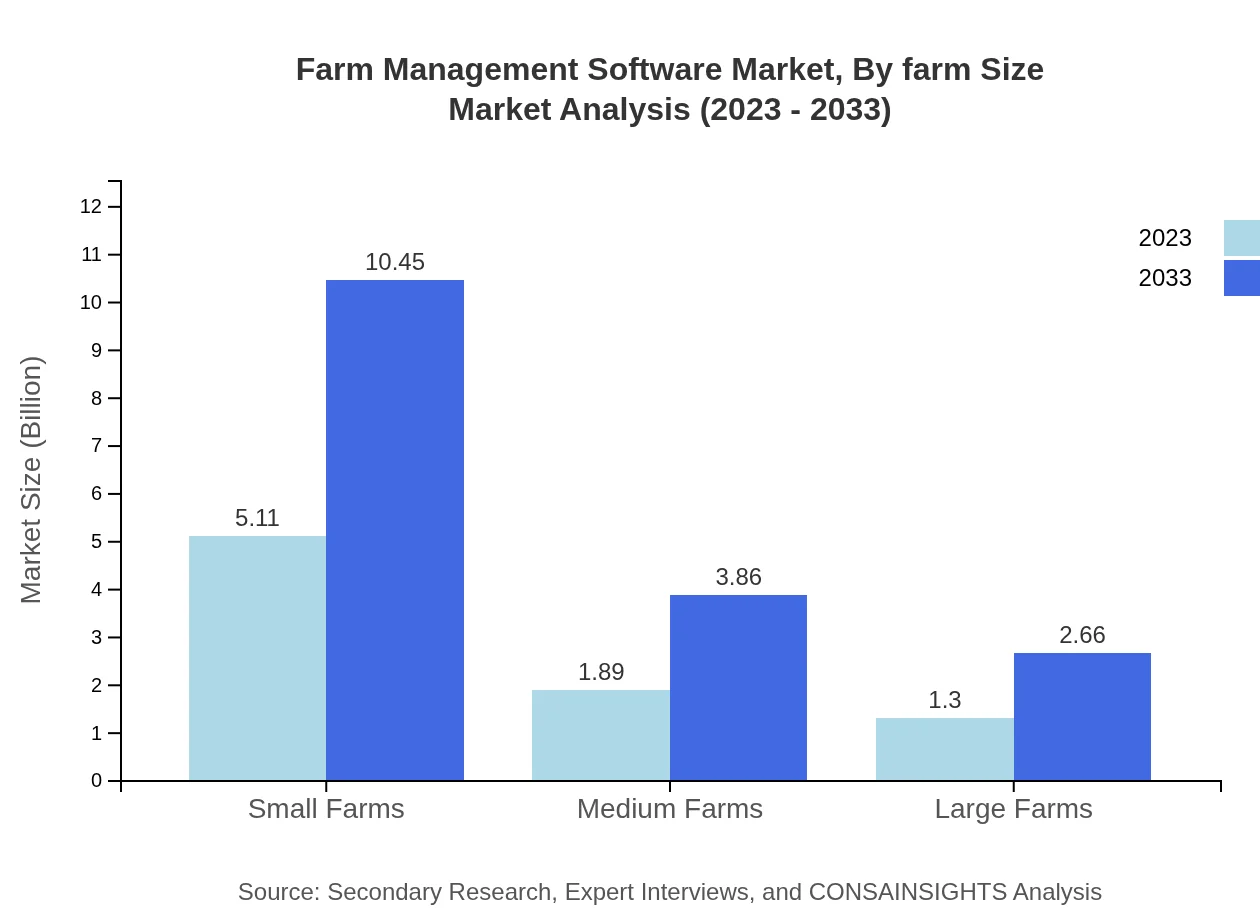

Farm Management Software Market Analysis By Farm Size

Small farms represent the largest segment, with a market size of $5.11 billion in 2023 expected to grow to $10.45 billion by 2033. Medium and large farms are equally increasing their investment in software solutions to enhance productivity and manage resources efficiently.

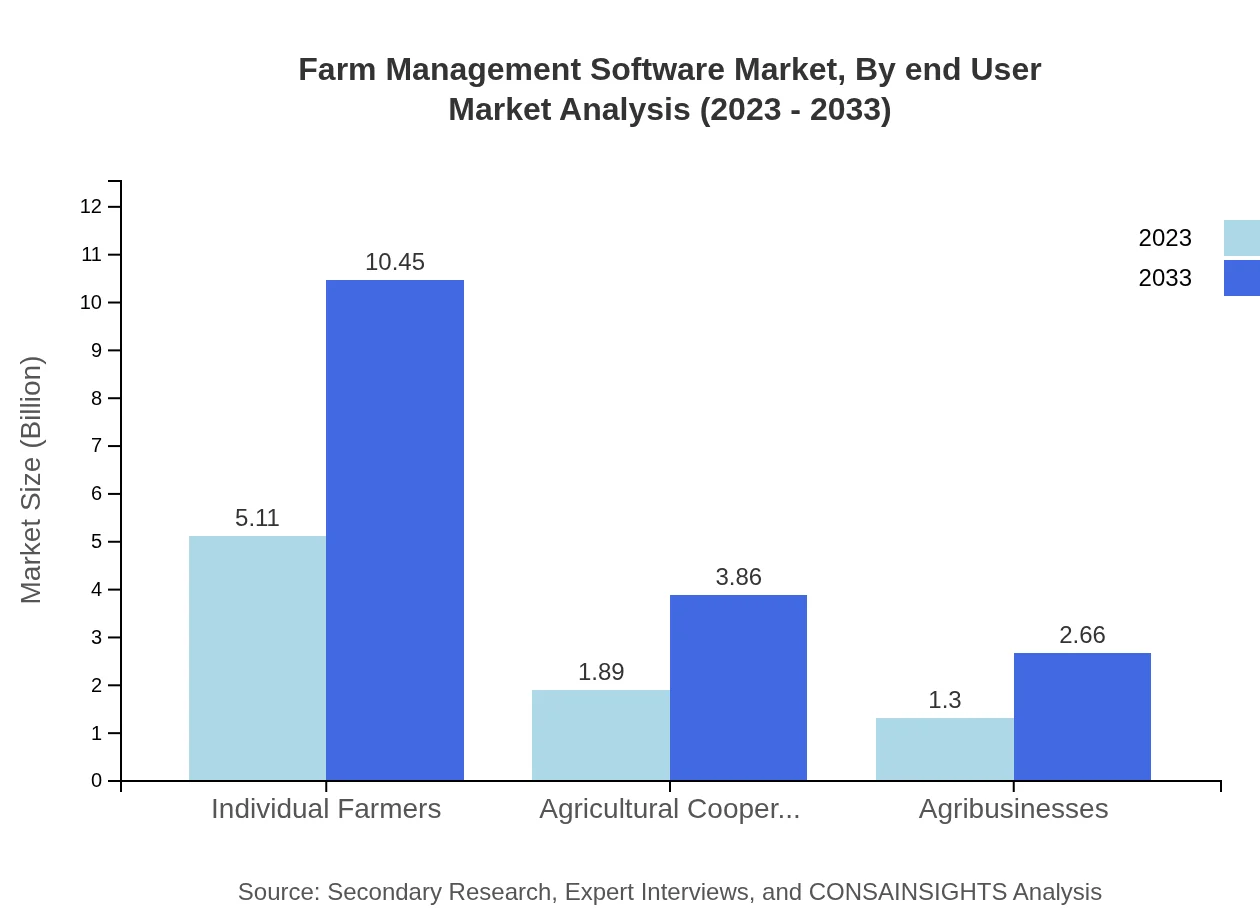

Farm Management Software Market Analysis By End User

Individual farmers dominate the end-user segment, accounting for $5.11 billion in 2023, with expectations to reach $10.45 billion by 2033. Agricultural cooperatives and agribusinesses follow, emphasizing the software's importance in collaborative farming efforts and large-scale operations.

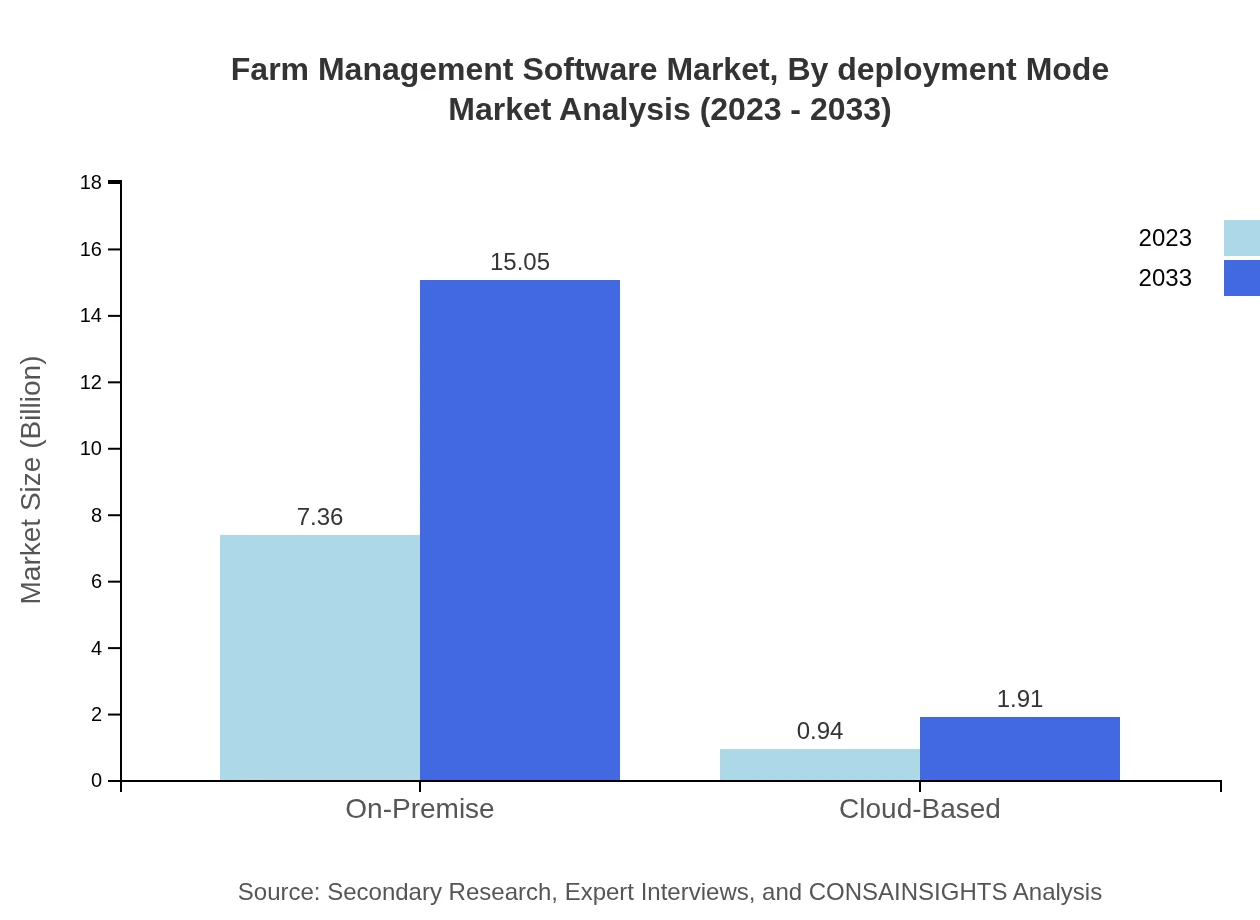

Farm Management Software Market Analysis By Deployment Mode

On-premise solutions are currently preferred, holding a market size of $7.36 billion in 2023, attributed to their security. However, the cloud-based segment, starting at $0.94 billion, is projected to grow as farmers seek flexibility and accessibility in managing their operations.

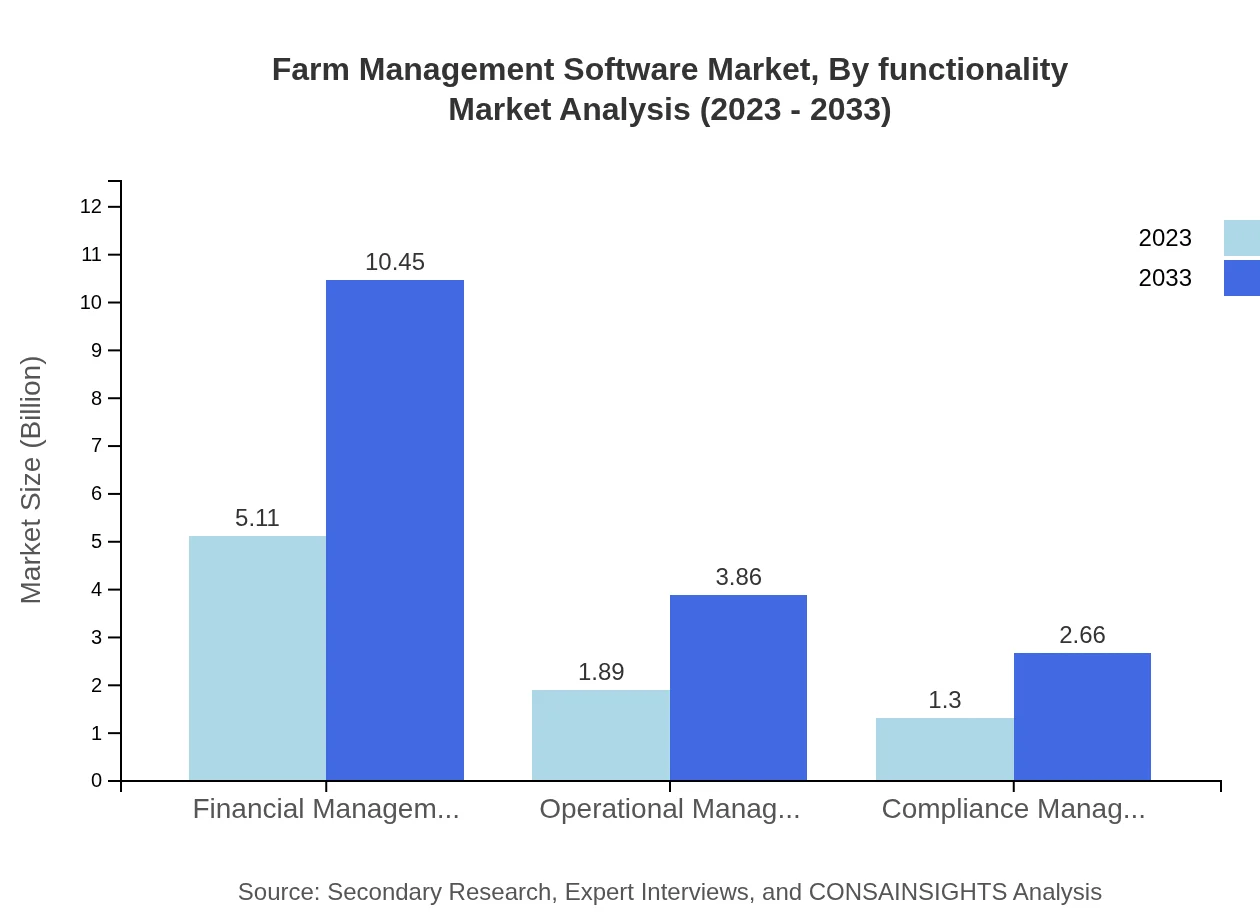

Farm Management Software Market Analysis By Functionality

Functionalities like financial management lead, with a market size of $5.11 billion in 2023, expected increase to $10.45 billion by 2033. Operational management follows, with its importance in streamlining day-to-day operations further indicating the software's integral role in modern farming.

Farm Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Farm Management Software Industry

Trimble Ag Software:

A leader in precision agriculture solutions, Trimble Ag Software provides innovative software solutions that help farmers enhance productivity and manage their operations efficiently.Farms.com:

Farms.com offers a comprehensive suite of tools and resources for farm management, playing a significant role in connecting farmers with essential data and trends.Ag Leader Technology:

Known for its advanced technology and innovative approaches, Ag Leader Technology delivers software solutions that promote efficient farming and smarter decision-making.AgriWebb:

AgriWebb specializes in farm management software that focuses on simplifying record-keeping to help farmers optimize operations and achieve sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of Farm Management Software?

The Farm Management Software market is valued at approximately $8.3 billion in 2023, with an expected CAGR of 7.2% through 2033, indicating a strong growth trajectory in this key industry sector.

What are the key market players or companies in the Farm Management Software industry?

Key players in the Farm Management Software market include established software companies and emerging tech innovators. These entities drive technological advancement, enhancing data analytics, and farm efficiency, essential for boosting productivity and profitability in agriculture.

What are the primary factors driving the growth in the Farm Management Software industry?

Several factors contribute to the growth of the Farm Management Software industry, including increasing global food demand, the need for efficient farm management, advancements in IoT technologies, and the adoption of precision agriculture techniques to optimize resource use.

Which region is the fastest Growing in the Farm Management Software market?

The North American region is the fastest-growing in the Farm Management Software market, projected to grow from $2.66 billion in 2023 to $5.44 billion by 2033, reflecting significant market potential driven by technological adoption and investment.

Does ConsaInsights provide customized market report data for the Farm Management Software industry?

Yes, ConsaInsights offers customized market report data. Their tailored insights are designed to meet the specific needs of clients, helping businesses to navigate market complexities and leverage opportunities in the Farm Management Software sector.

What deliverables can I expect from this Farm Management Software market research project?

Clients can expect comprehensive market assessments, segment analysis, regional insights, competitive landscape evaluations, and forecasts, providing a well-rounded understanding of the Farm Management Software market's dynamics and future opportunities.

What are the market trends of the Farm Management Software industry?

Current trends in the Farm Management Software industry include an increased focus on cloud-based solutions, the integration of AI and machine learning for data analysis, and a shift towards sustainable farming practices, all aimed at enhancing efficiency and productivity.