Fats And Oils Market Report

Published Date: 31 January 2026 | Report Code: fats-and-oils

Fats And Oils Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the global Fats And Oils market, including market size, growth trends, and competitive landscape from 2023 to 2033, providing key insights for industry stakeholders and investors.

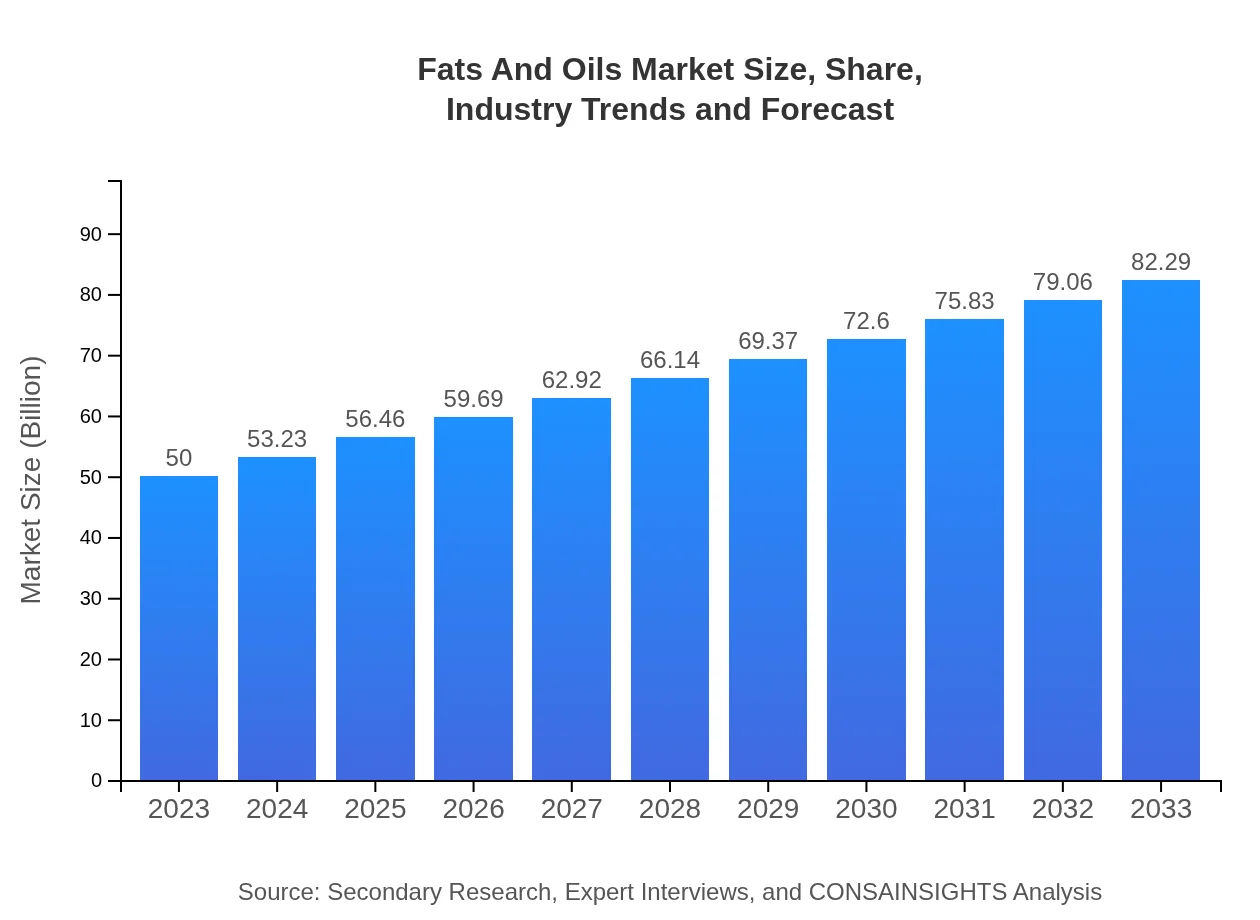

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $82.29 Billion |

| Top Companies | Archer Daniels Midland Company (ADM), Bunge Limited, Cargill, Incorporated, Kerry Group |

| Last Modified Date | 31 January 2026 |

Fats And Oils Market Overview

Customize Fats And Oils Market Report market research report

- ✔ Get in-depth analysis of Fats And Oils market size, growth, and forecasts.

- ✔ Understand Fats And Oils's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fats And Oils

What is the Market Size & CAGR of Fats And Oils market in 2023?

Fats And Oils Industry Analysis

Fats And Oils Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fats And Oils Market Analysis Report by Region

Europe Fats And Oils Market Report:

In Europe, the market size is projected to grow from USD 12.42 billion in 2023 to USD 20.44 billion by 2033. The European market is experiencing a shift towards organic oils and sustainably produced fats, spurred by consumer demand for cleaner labels.Asia Pacific Fats And Oils Market Report:

In the Asia Pacific region, the Fats and Oils market is anticipated to grow from USD 9.56 billion in 2023 to USD 15.73 billion by 2033. This growth is attributed to rising population levels, increasing food demand, and growing disposable incomes allowing consumers to spend more on quality products.North America Fats And Oils Market Report:

The North American market for Fats and Oils is projected to rise from USD 18.73 billion in 2023 to USD 30.83 billion by 2033. The region's thriving food processing industry and innovations in healthy oil alternatives are propelling this growth.South America Fats And Oils Market Report:

South America is expected to see its Fats and Oils market expand from USD 2.33 billion in 2023 to USD 3.83 billion by 2033. The growth is driven by the strong agricultural base for oilseeds, coupled with regional trends towards health-conscious food consumption.Middle East & Africa Fats And Oils Market Report:

The Middle East and Africa are expected to witness growth in the Fats and Oils market from USD 6.97 billion in 2023 to USD 11.46 billion by 2033. Increasing urbanization and shifts in dietary habits towards fats derived from plant sources are enhancing market potential.Tell us your focus area and get a customized research report.

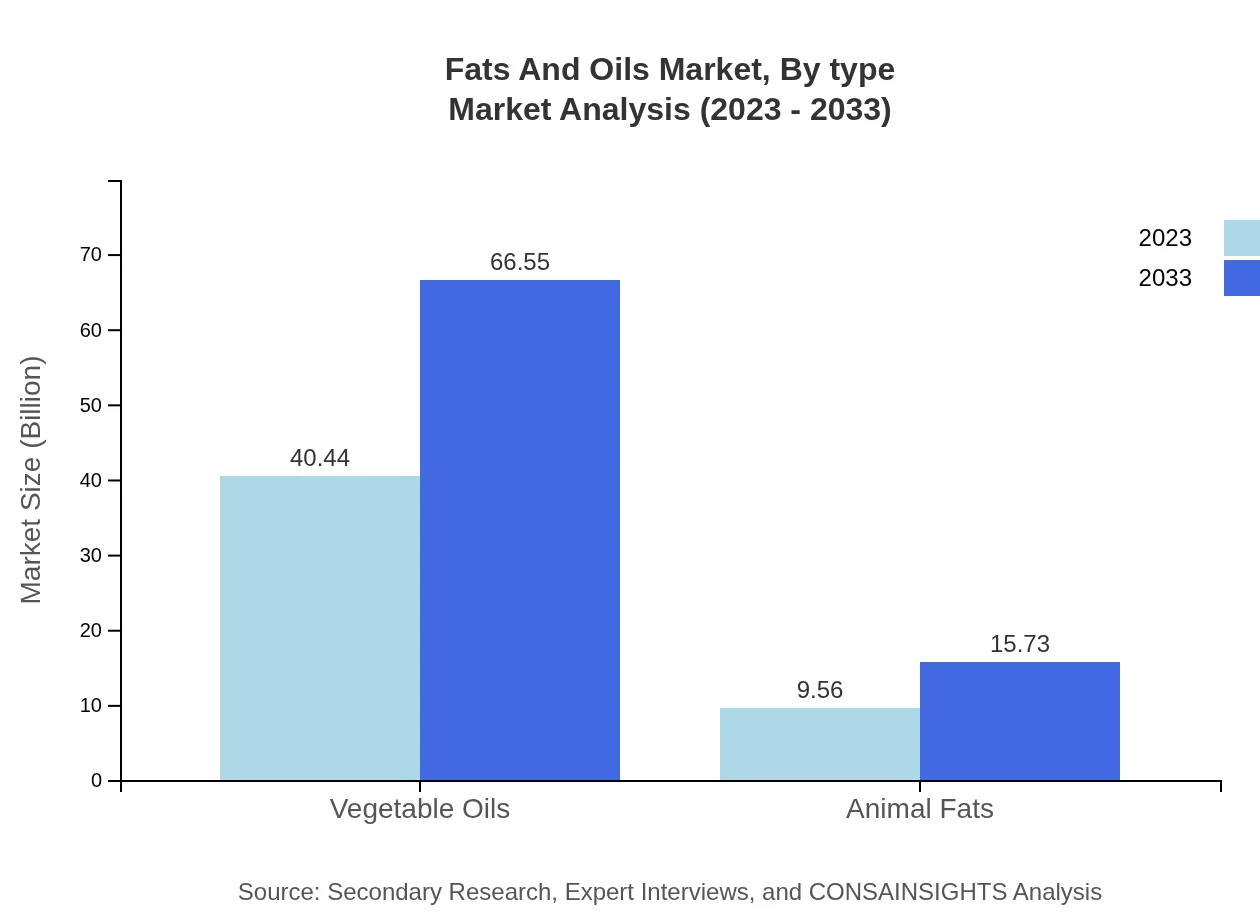

Fats And Oils Market Analysis By Type

The Vegetable Oils segment is leading in market size, anticipated to grow from USD 40.44 billion in 2023 to USD 66.55 billion by 2033, capturing an 80.88% share of the market. The Animal Fats segment is expected to increase from USD 9.56 billion in 2023 to USD 15.73 billion, holding a share of 19.12%.

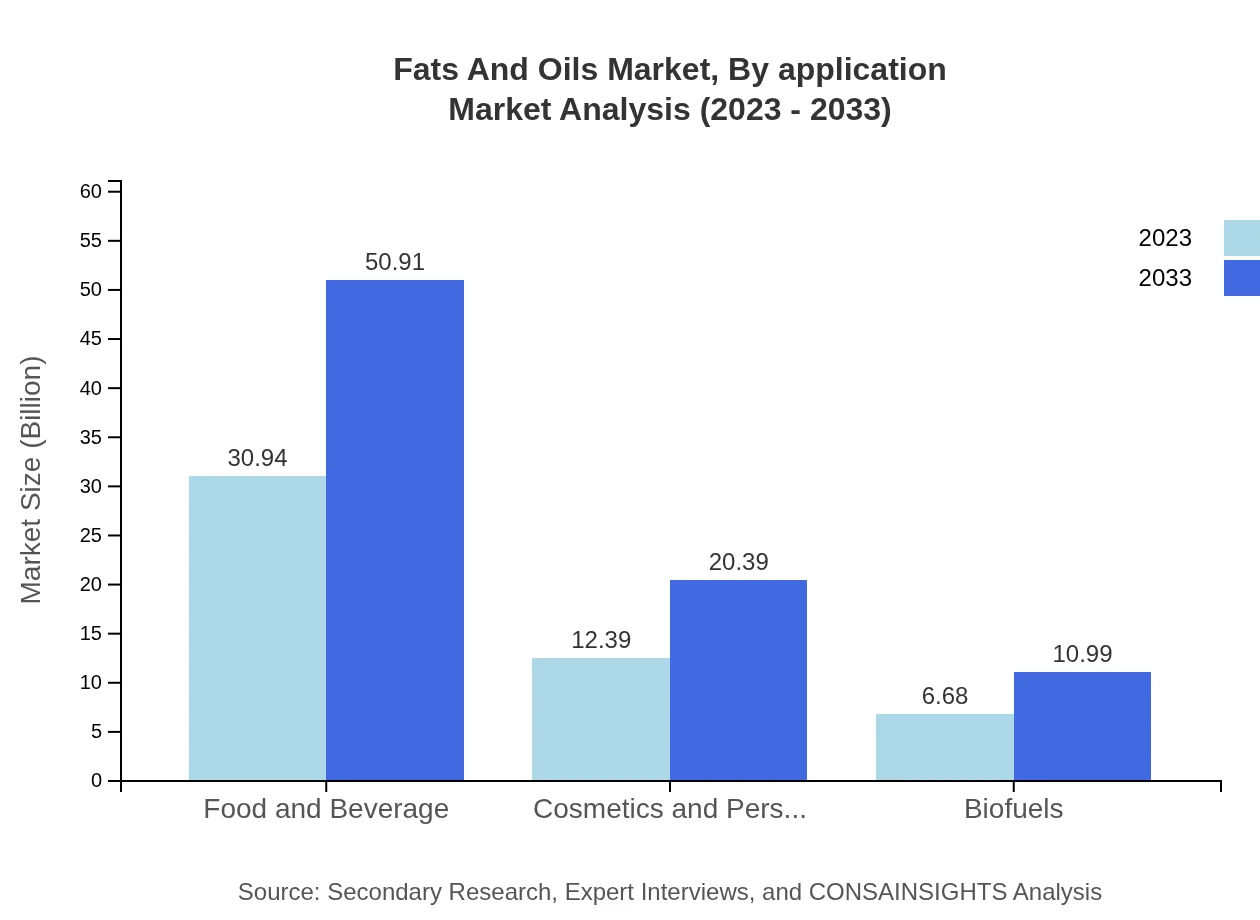

Fats And Oils Market Analysis By Application

The Food and Beverage industry dominates, expected to increase from USD 30.94 billion in 2023 to USD 50.91 billion by 2033, representing a 61.87% share. Cosmetics and Personal Care products are also significant, with a projected increase from USD 12.39 billion to USD 20.39 billion, maintaining a segment share of 24.78%.

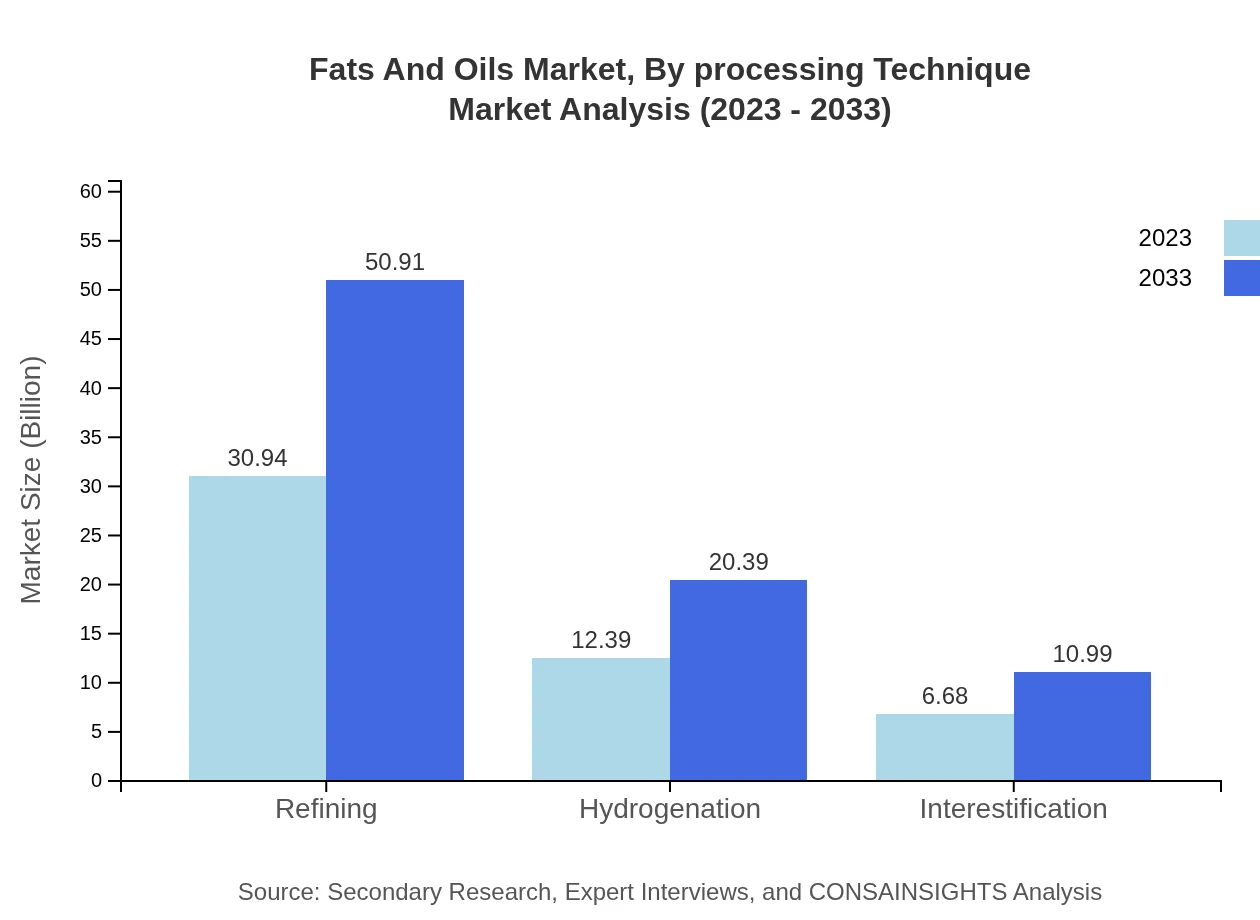

Fats And Oils Market Analysis By Processing Technique

Refining processes dominate with an anticipated growth from USD 30.94 billion to USD 50.91 billion by 2033, representing a significant share in the market at 61.87%. Hydrogenation will also see growth from USD 12.39 billion to USD 20.39 billion, with a share of 24.78%.

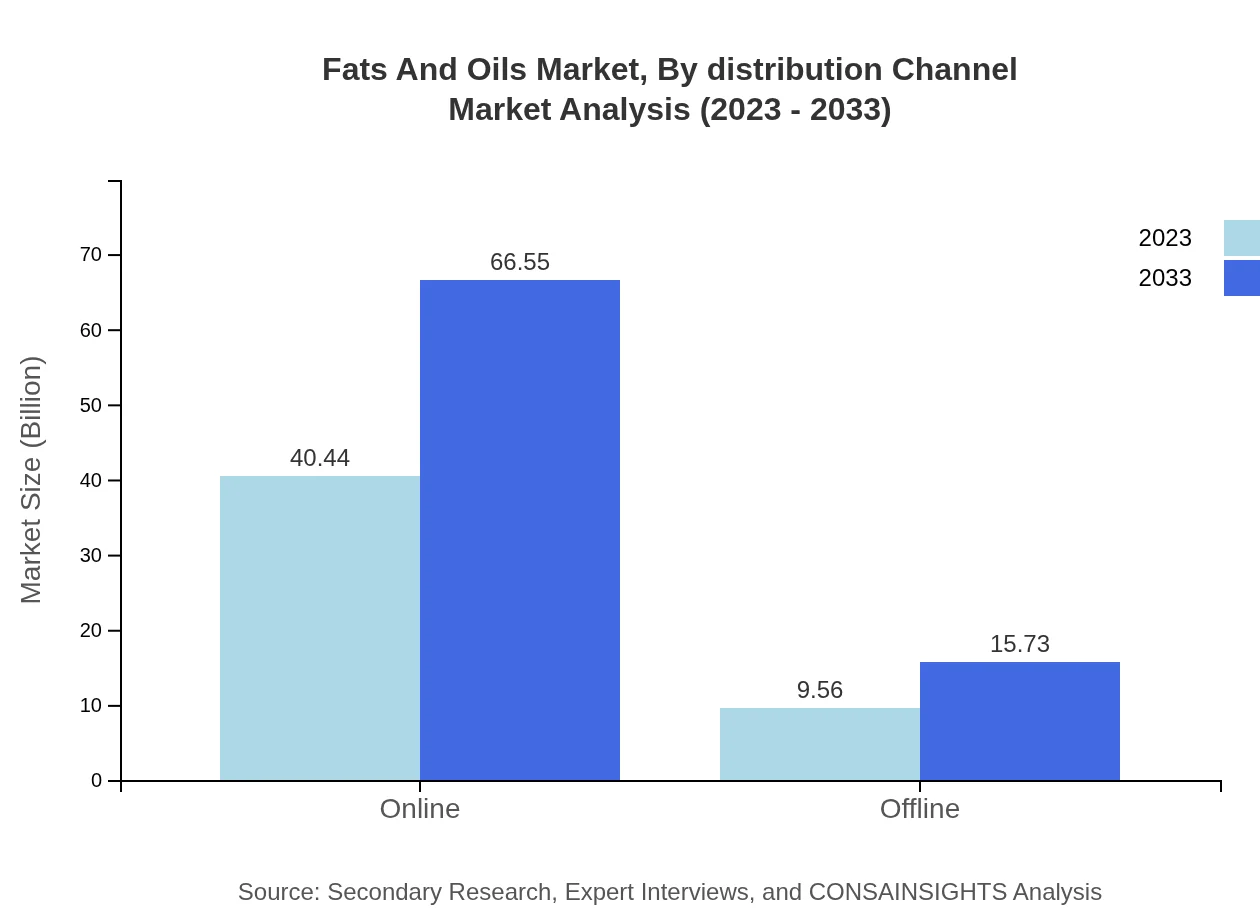

Fats And Oils Market Analysis By Distribution Channel

The Online segment is projected to lead the market from USD 40.44 billion in 2023 to USD 66.55 billion by 2033, capturing 80.88% of the market, as consumer preference shifts towards online grocery shopping. The Offline segment is expected to grow from USD 9.56 billion to USD 15.73 billion, maintaining 19.12% market share.

Fats And Oils Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fats And Oils Industry

Archer Daniels Midland Company (ADM):

A global leader in agricultural processing and food ingredient manufacturing, ADM provides a range of oils and fats for food and industrial uses.Bunge Limited:

Bunge operates as an agribusiness and food company involved in the processing of oilseeds, offering diverse edible oils, margarine, and shortenings.Cargill, Incorporated:

Cargill is a multinational corporation that focuses on nutrition and food production, supplying a variety of fats and oils to different sectors.Kerry Group:

Kerry Group is a leader in taste and nutrition, providing innovative food solutions including specialty oils and fats.We're grateful to work with incredible clients.

FAQs

What is the market size of fats And Oils?

The global fats and oils market is currently valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of 5% from 2023 to 2033, indicating steady growth in demand across various sectors.

What are the key market players or companies in the fats And Oils industry?

Key players in the fats and oils industry include major corporations such as Archer Daniels Midland Company, Cargill, Bunge Limited, and Wilmar International, which dominate the market through extensive production and distribution networks.

What are the primary factors driving the growth in the fats And Oils industry?

The growth in the fats and oils market is driven by increasing demand for vegetable oils due to health trends, rising consumption in the food industry, and the expanding cosmetics and biofuels sectors, along with innovations in product refinement.

Which region is the fastest Growing in the fats And Oils market?

The Asia Pacific region is the fastest-growing area in the fats and oils market, expected to rise from $9.56 billion in 2023 to $15.73 billion by 2033, reflecting a growing population and increasing urbanization.

Does ConsaInsights provide customized market report data for the fats And Oils industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the fats and oils industry, addressing unique questions and perspectives to help businesses make informed strategic decisions.

What deliverables can I expect from this fats And Oils market research project?

From the fats and oils market research project, you can expect comprehensive reports including market size, trends, regional insights, competitive analysis, and actionable recommendations tailored to your business objectives.

What are the market trends of fats And Oils?

Current trends in the fats and oils market include a shift towards healthier, plant-based oils, increasing demand for sustainable sourcing practices, and innovation in processing techniques to enhance product quality and sustainability.