Fatty Acid Ester Market Report

Published Date: 02 February 2026 | Report Code: fatty-acid-ester

Fatty Acid Ester Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Fatty Acid Ester market, covering market size, industry analysis, segmentation, regional insights, and forecasts from 2023 to 2033.

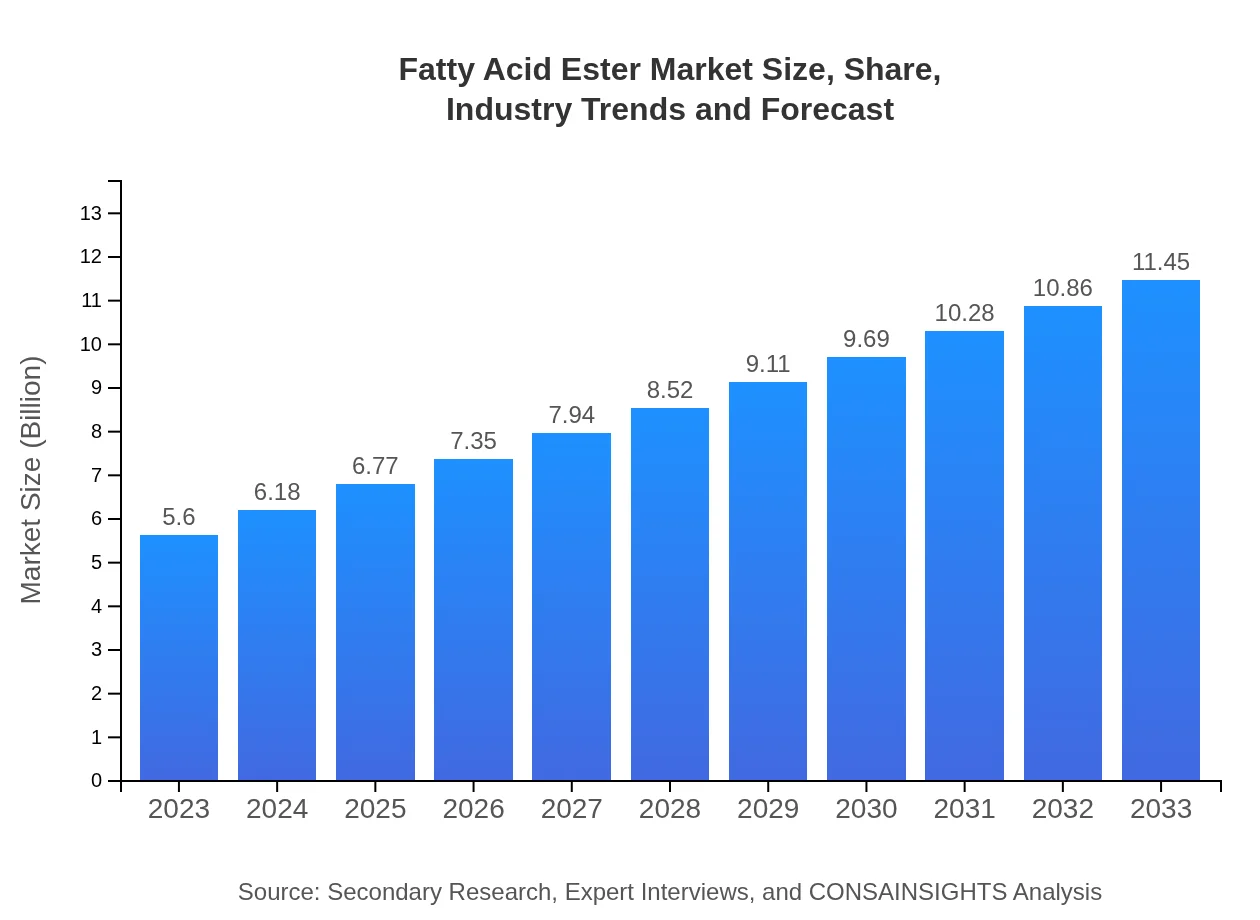

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | BASF SE, Cargill, Incorporated, Croda International Plc, Wilmar International Ltd., Evonik Industries AG |

| Last Modified Date | 02 February 2026 |

Fatty Acid Ester Market Overview

Customize Fatty Acid Ester Market Report market research report

- ✔ Get in-depth analysis of Fatty Acid Ester market size, growth, and forecasts.

- ✔ Understand Fatty Acid Ester's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fatty Acid Ester

What is the Market Size & CAGR of Fatty Acid Ester market in 2023?

Fatty Acid Ester Industry Analysis

Fatty Acid Ester Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fatty Acid Ester Market Analysis Report by Region

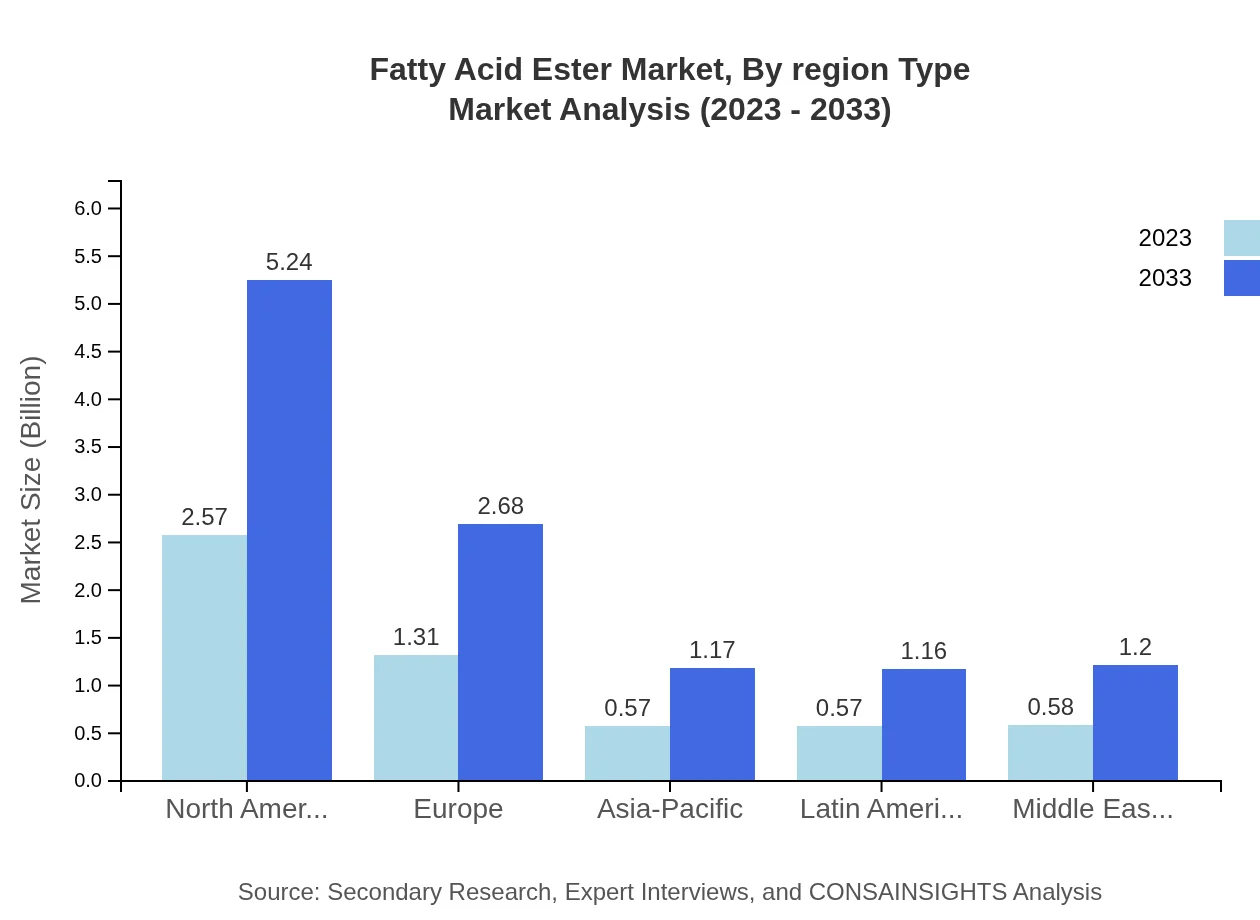

Europe Fatty Acid Ester Market Report:

Europe is projected to see substantial growth, with market size expanding from $1.51 billion in 2023 to $3.09 billion by 2033. The region is characterized by stringent regulations promoting environmentally safe products, leading to increased adoption of Fatty Acid Esters in various applications, including cosmetics and food.Asia Pacific Fatty Acid Ester Market Report:

The Asia Pacific region is anticipated to exhibit remarkable growth, with the market size estimated at $1.14 billion in 2023 and projected to reach $2.32 billion by 2033. Increasing industrial production, coupled with rising consumer demand for personal care products, supports this growth trajectory. Additionally, the push for sustainable alternatives is likely to enhance the adoption of Fatty Acid Esters across various applications.North America Fatty Acid Ester Market Report:

North America represents a significant portion of the market, forecasted to grow from $2.11 billion in 2023 to $4.31 billion by 2033. The demand in this region is driven primarily by robust food, pharmaceutical, and personal care industries, with an increasing shift towards bio-based formulations and sustainable practices.South America Fatty Acid Ester Market Report:

In South America, the market is expected to grow from $0.54 billion in 2023 to $1.11 billion by 2033. The growth is attributed to the region's growing focus on sustainable agricultural practices and the increasing use of environmentally friendly products across sectors such as food processing and cosmetics.Middle East & Africa Fatty Acid Ester Market Report:

The Middle East and Africa market is smaller but poised for growth, increasing from $0.30 billion in 2023 to $0.61 billion by 2033. Growth drivers in this region include a growing consumer base looking for eco-friendly personal care products and industries focusing on sustainable manufacturing practices.Tell us your focus area and get a customized research report.

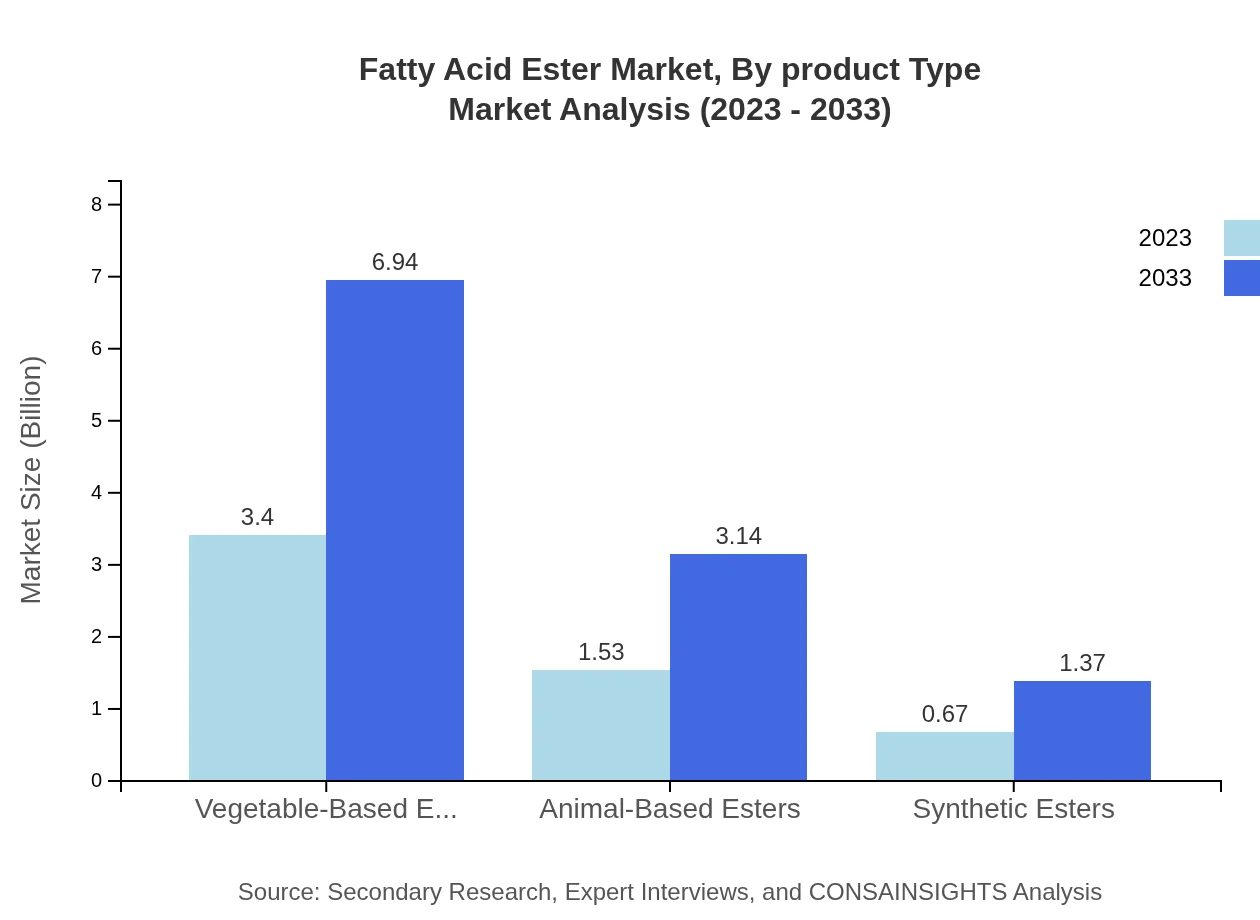

Fatty Acid Ester Market Analysis By Product Type

The segmentation by product type reflects a significant market distribution. In 2023, vegetable-based esters take the lead with a market size of $3.40 billion (60.64% share), followed by animal-based esters at $1.53 billion (27.41% share), and synthetic esters at $0.67 billion (11.95% share). By 2033, this trend continues as vegetable-based esters are anticipated to reach $6.94 billion, maintaining leadership due to consumer preference for natural ingredients.

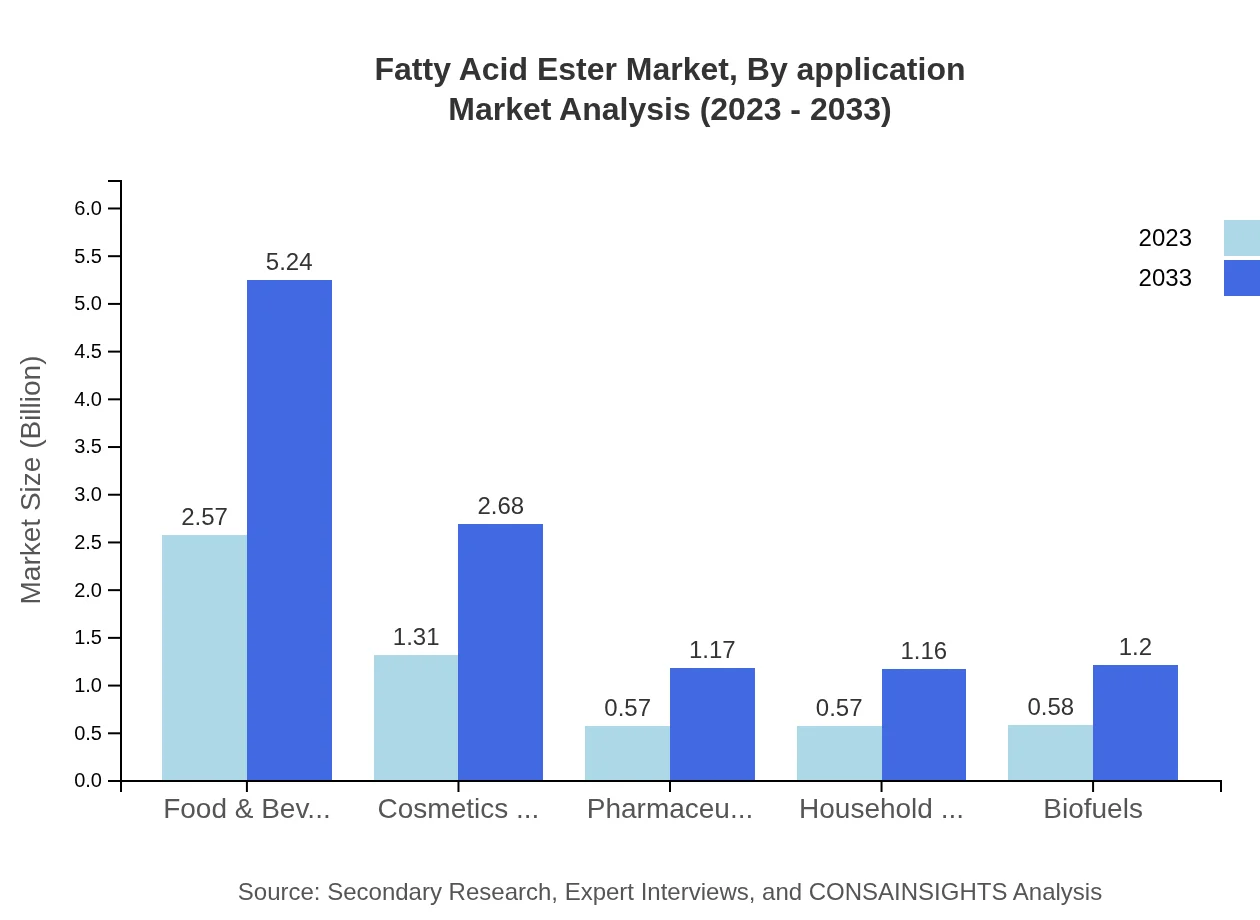

Fatty Acid Ester Market Analysis By Application

Applications of fatty acid esters vary significantly, with industrial applications commanding a substantial share. The food and beverage industry mirrors this trend, showing a size of $2.57 billion in 2023 and expected to grow to $5.24 billion by 2033. Concurrently, sectors such as cosmetics (from $0.57 billion to $1.17 billion) and pharmaceuticals illustrate notable growth due to heightened demand for multifunctional product capabilities.

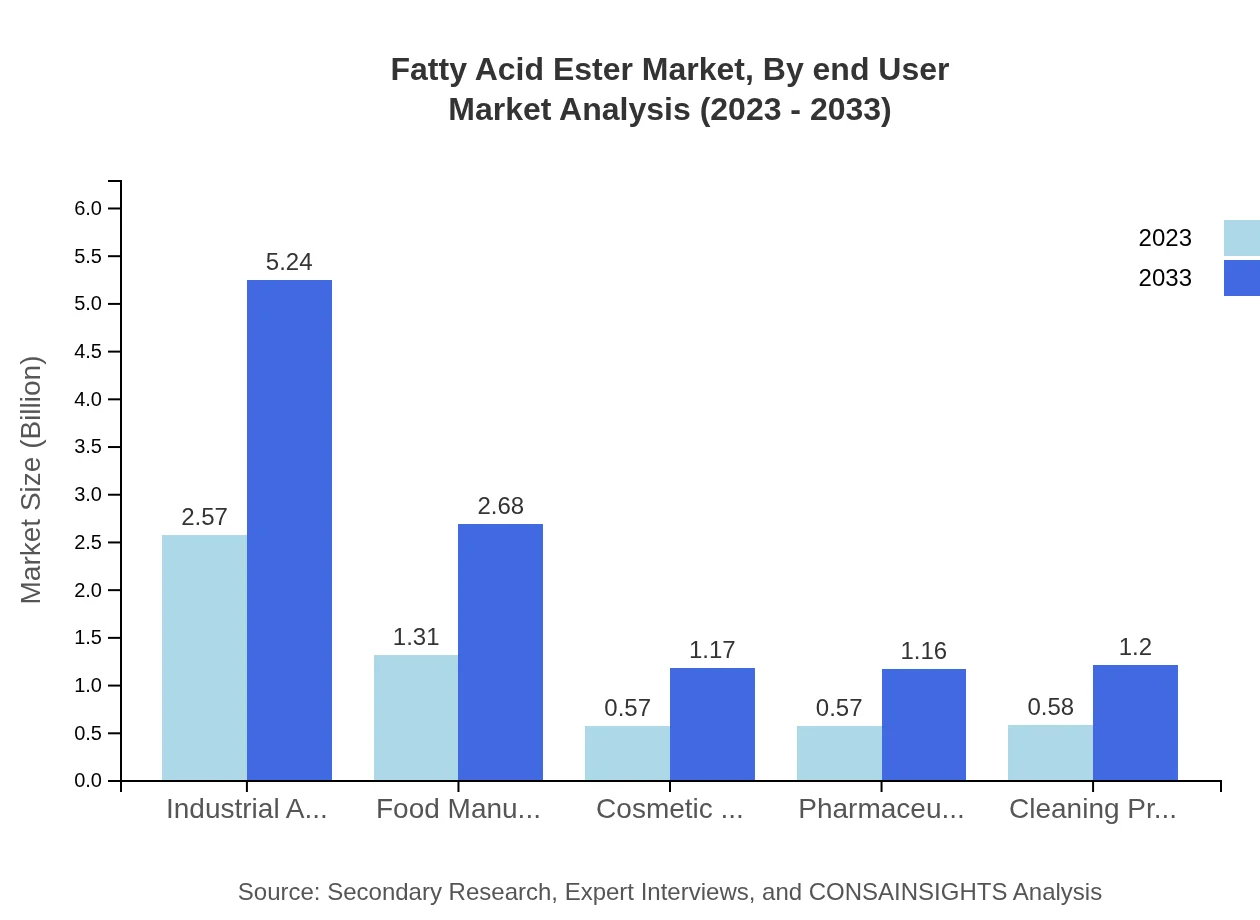

Fatty Acid Ester Market Analysis By End User

End-user industries highlight diverse applications. The food industry accounts for about 45.81% of the market share in 2023, with growth forecasted accordingly. Similarly, the cosmetics sector represents around 23.44%, showcasing steady demand as consumers lean towards natural products. The pharmaceutical industry accounts for 10.21%, reflecting the increasing integration of fatty acid esters in developing formulations.

Fatty Acid Ester Market Analysis By Region Type

Regional analysis reveals varying growth dynamics. North America and Europe emerge as key markets due to established regulatory frameworks favoring bio-based products. Asia Pacific is gaining momentum through rapid industrialization and increased consumer awareness regarding eco-friendly products. The growth in South America and the Middle East and Africa is relatively slow but expected to pick up as market awareness increases.

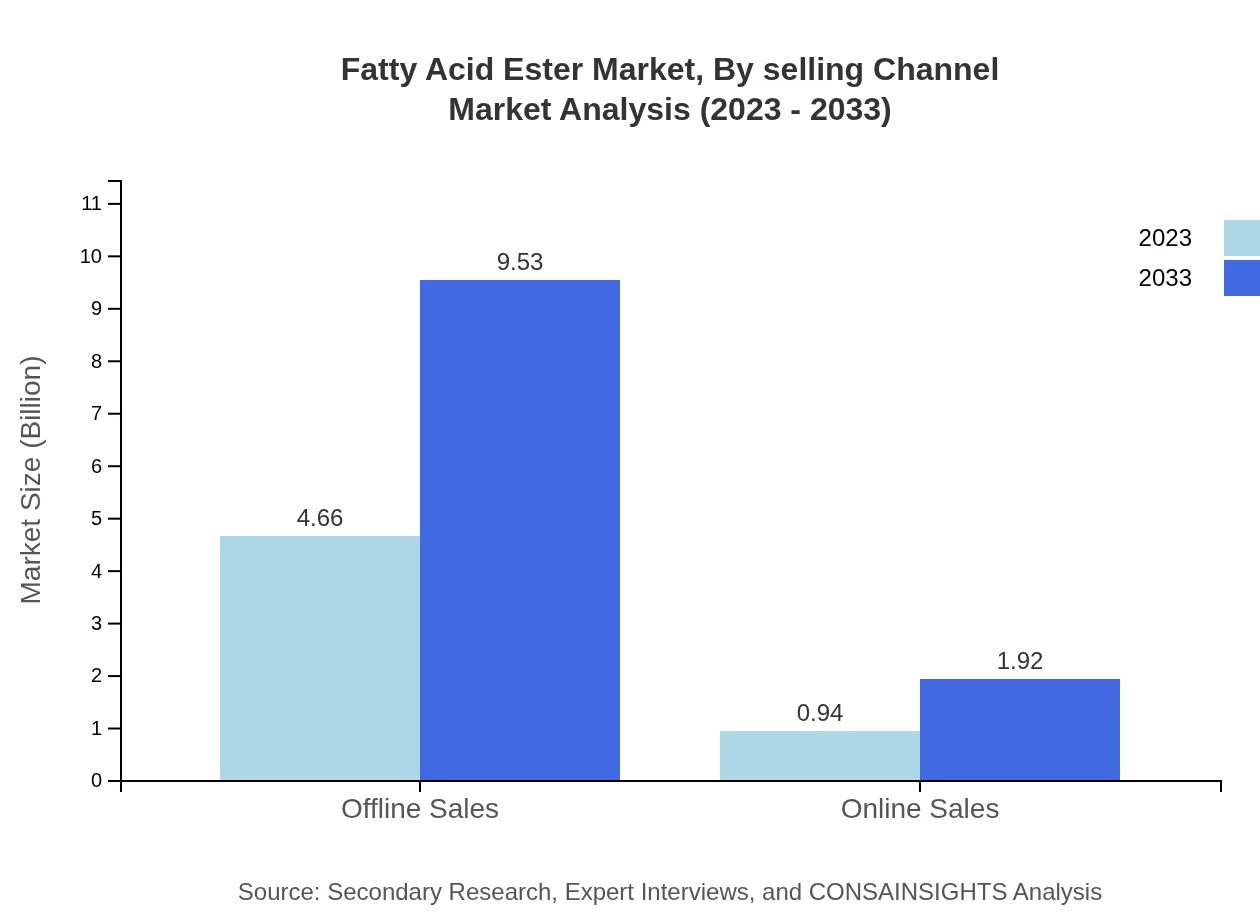

Fatty Acid Ester Market Analysis By Selling Channel

The market presents a dichotomy between offline and online sales. Offline sales dominate the market with an 83.22% share in 2023, given traditional purchasing habits. However, online sales are gradually increasing, with a share of 16.78%, highlighting a shift in consumer purchasing patterns driven by convenience and broader product accessibility.

Fatty Acid Ester Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fatty Acid Ester Industry

BASF SE:

BASF SE operates as a leading chemical company, offering varied product lines including Fatty Acid Esters for personal care and industrial applications, providing sustainable and innovative solutions.Cargill, Incorporated:

Cargill is a major player in the production of vegetable-based oils and esters used in various applications, emphasizing sustainability in their supply chain and product manufacturing.Croda International Plc:

Croda specializes in manufacturing specialty chemicals, including Fatty Acid Esters that cater to personal care and healthcare sectors, focusing on high-performance solutions.Wilmar International Ltd.:

Wilmar International is a leading agribusiness company in Asia, producing a range of fatty acid esters used in food and personal care applications, championing sustainability in the industry.Evonik Industries AG:

Evonik is a global leader in specialty chemicals, providing Fatty Acid Esters for dynamic applications in various sectors, constantly innovating to meet consumer demands.We're grateful to work with incredible clients.

FAQs

What is the market size of fatty Acid Ester?

The fatty-acid-ester market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 7.2%, indicating strong growth potential through to 2033.

What are the key market players or companies in this fatty Acid Ester industry?

Key players in the fatty-acid-ester market include major chemical manufacturers, food and beverage companies, as well as cosmetic and pharmaceutical firms that rely on fatty-acid-esters for various applications.

What are the primary factors driving the growth in the fatty Acid Ester industry?

Growth in the fatty-acid-ester market is driven by increasing demand from food manufacturers, rising health and wellness trends, and the expanding applications in personal care, pharmaceuticals, and biofuels sectors.

Which region is the fastest Growing in the fatty Acid Ester market?

The fastest-growing region in the fatty-acid-ester market is expected to be Asia-Pacific, with market values increasing from $1.14 billion in 2023 to $2.32 billion by 2033, reflecting a robust growth trajectory.

Does ConsaInsights provide customized market report data for the fatty Acid Ester industry?

Yes, ConsaInsights offers customized market reports tailored to specific research needs, providing in-depth insights and data on the fatty-acid-ester industry.

What deliverables can I expect from this fatty Acid Ester market research project?

Deliverables from this market research project will include detailed reports containing market size data, growth projections, competitive analysis, and insights into regional and segment performances.

What are the market trends of fatty Acid Ester?

Current trends in the fatty-acid-ester market include increased utilization of vegetable-based esters, growing sustainability concerns, and a shift towards online sales channels in response to consumer preferences.