Fatty Acids Market Report

Published Date: 31 January 2026 | Report Code: fatty-acids

Fatty Acids Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the global Fatty Acids market, providing insights into its current state, segmentation, and growth forecasts from 2023 to 2033, alongside trends, key players, and regional analyses.

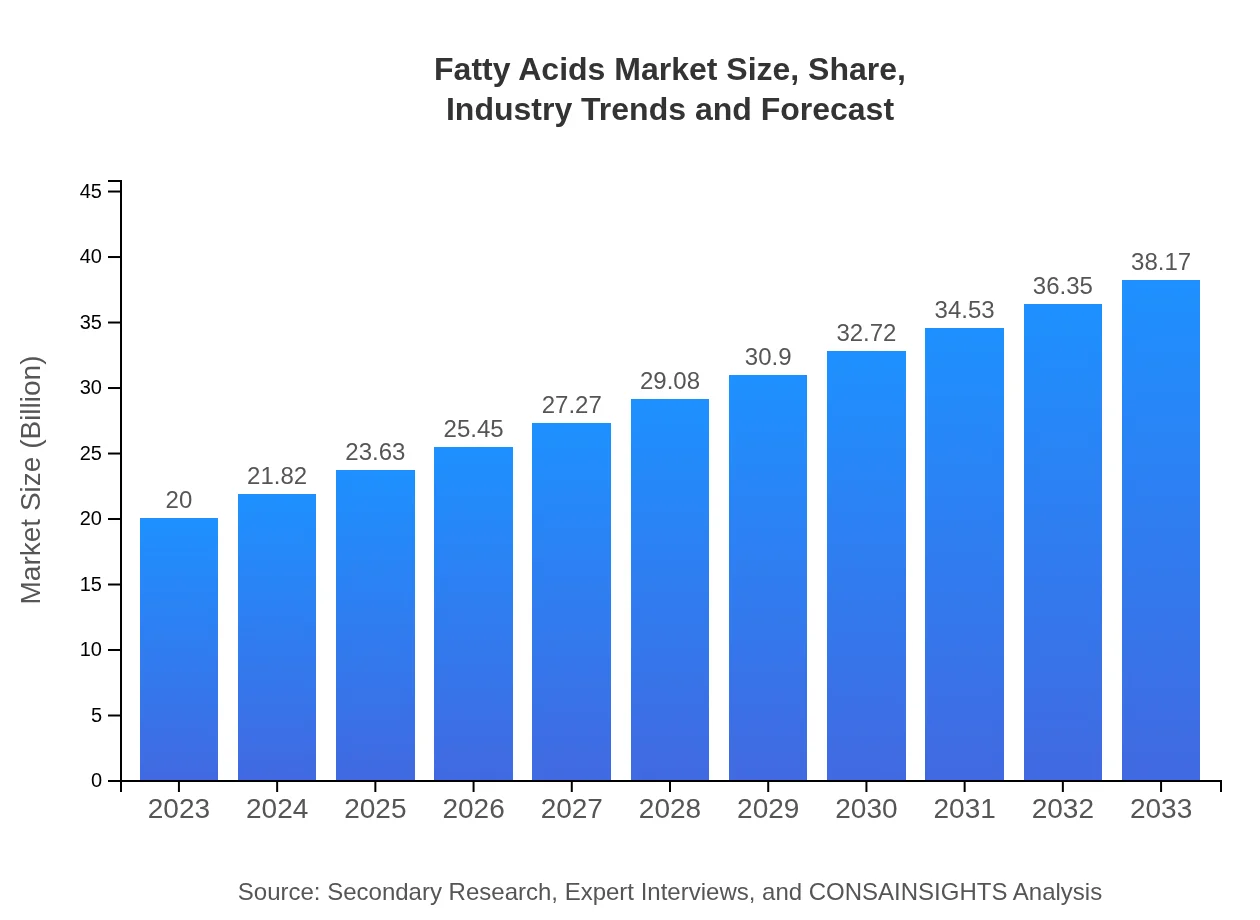

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $38.17 Billion |

| Top Companies | BASF SE, Cargill, Incorporated, Dow Chemical Company, Wilmar International Limited |

| Last Modified Date | 31 January 2026 |

Fatty Acids Market Overview

Customize Fatty Acids Market Report market research report

- ✔ Get in-depth analysis of Fatty Acids market size, growth, and forecasts.

- ✔ Understand Fatty Acids's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fatty Acids

What is the Market Size & CAGR of Fatty Acids market in 2023 and 2033?

Fatty Acids Industry Analysis

Fatty Acids Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fatty Acids Market Analysis Report by Region

Europe Fatty Acids Market Report:

Europe's market for Fatty Acids is projected to expand from 5.23 billion USD in 2023 to 9.99 billion USD by 2033. The region is witnessing a shift towards organic and sustainably-sourced products, favoring innovation in fatty acid applications.Asia Pacific Fatty Acids Market Report:

In the Asia Pacific region, the Fatty Acids market is projected to grow from 3.93 billion USD in 2023 to 7.51 billion USD by 2033, driven by rising industrial activities and the expanding food sector. The region’s focus on sustainable production practices is also contributing to this growth.North America Fatty Acids Market Report:

In North America, market size is expected to rise significantly from 7.76 billion USD in 2023 to 14.82 billion USD by 2033. The growth is propelled by strong demand from the food and beverage industry and increasing consumer awareness surrounding health and wellness.South America Fatty Acids Market Report:

The South American Fatty Acids market is expected to maintain a steady growth, increasing from 0.34 billion USD in 2023 to 0.64 billion USD by 2033. The region's agricultural base enables ample raw material availability, supporting market expansion.Middle East & Africa Fatty Acids Market Report:

The Middle East and Africa market is anticipated to grow from 2.73 billion USD in 2023 to 5.21 billion USD by 2033, primarily driven by advancements in manufacturing capabilities and demand from personal care industries.Tell us your focus area and get a customized research report.

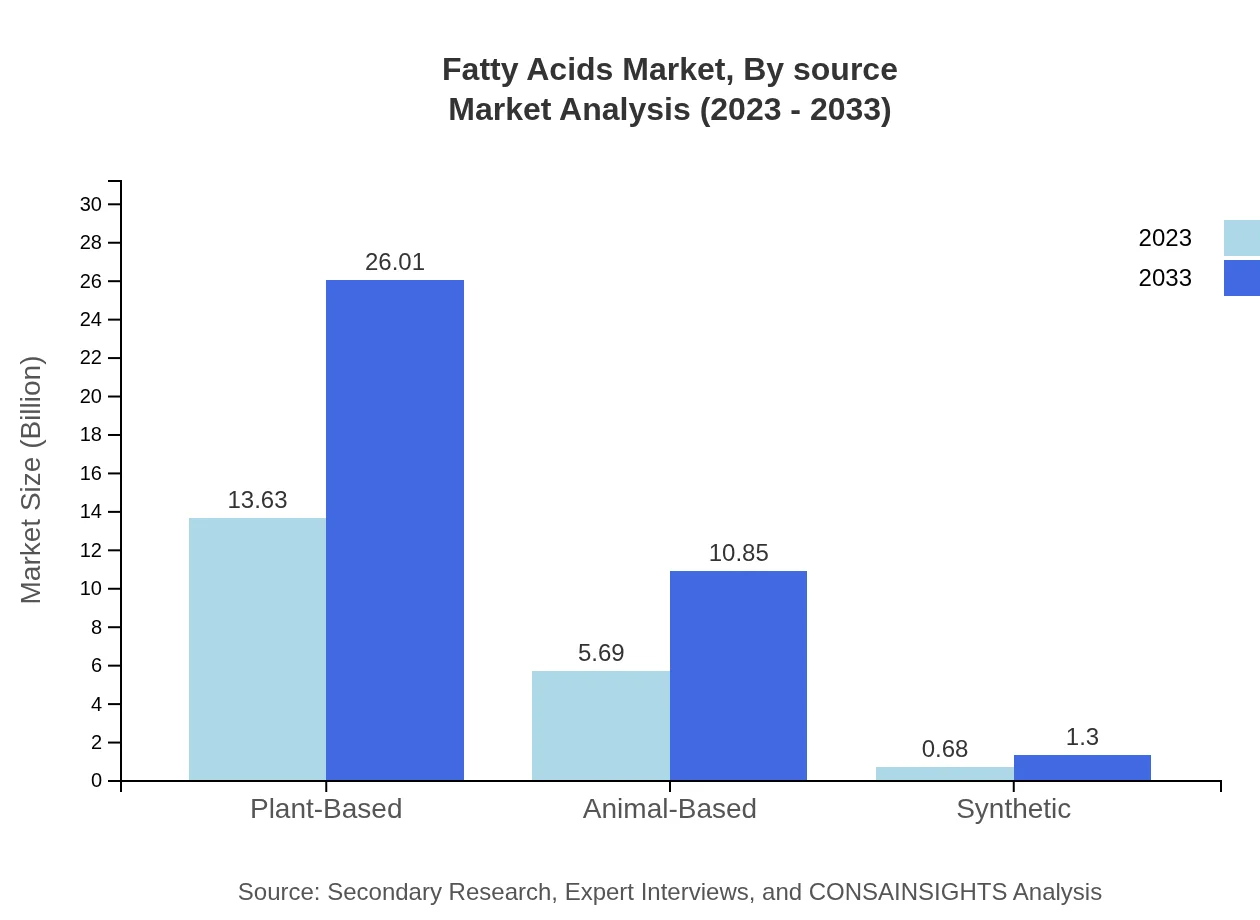

Fatty Acids Market Analysis By Source

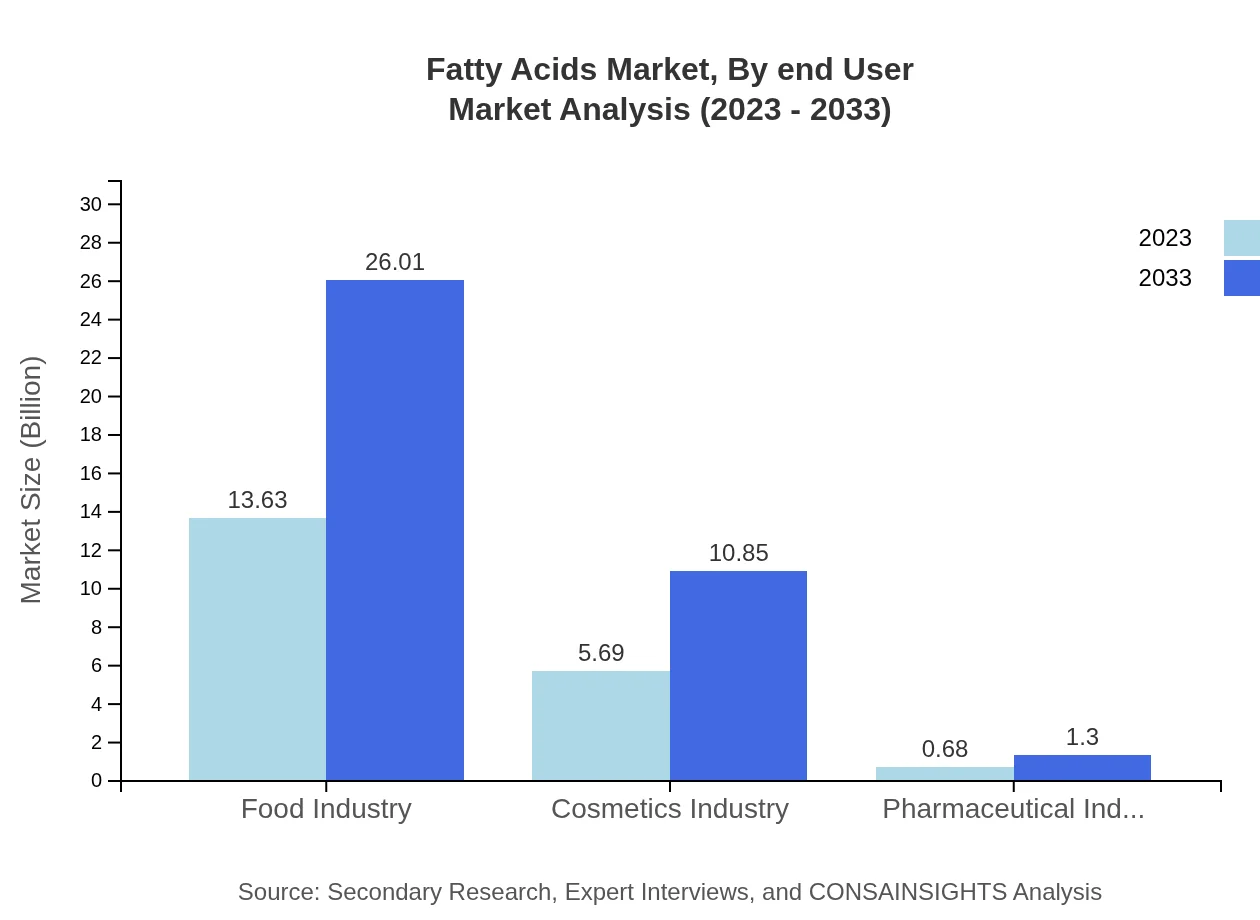

The Fatty Acids market is segmented by source into plant-based, animal-based, and synthetic fatty acids. In 2023, plant-based fatty acids hold a market size of 13.63 billion USD, demonstrating a robust trend towards natural ingredients across applications. By 2033, this segment is expected to grow significantly to 26.01 billion USD. Animal-based fatty acids currently represent a market size of 5.69 billion USD, projected to reach 10.85 billion USD by 2033. Meanwhile, synthetic fatty acids, although smaller currently at 0.68 billion USD, are also anticipated to see growth reaching 1.30 billion USD by 2033.

Fatty Acids Market Analysis By Product Type

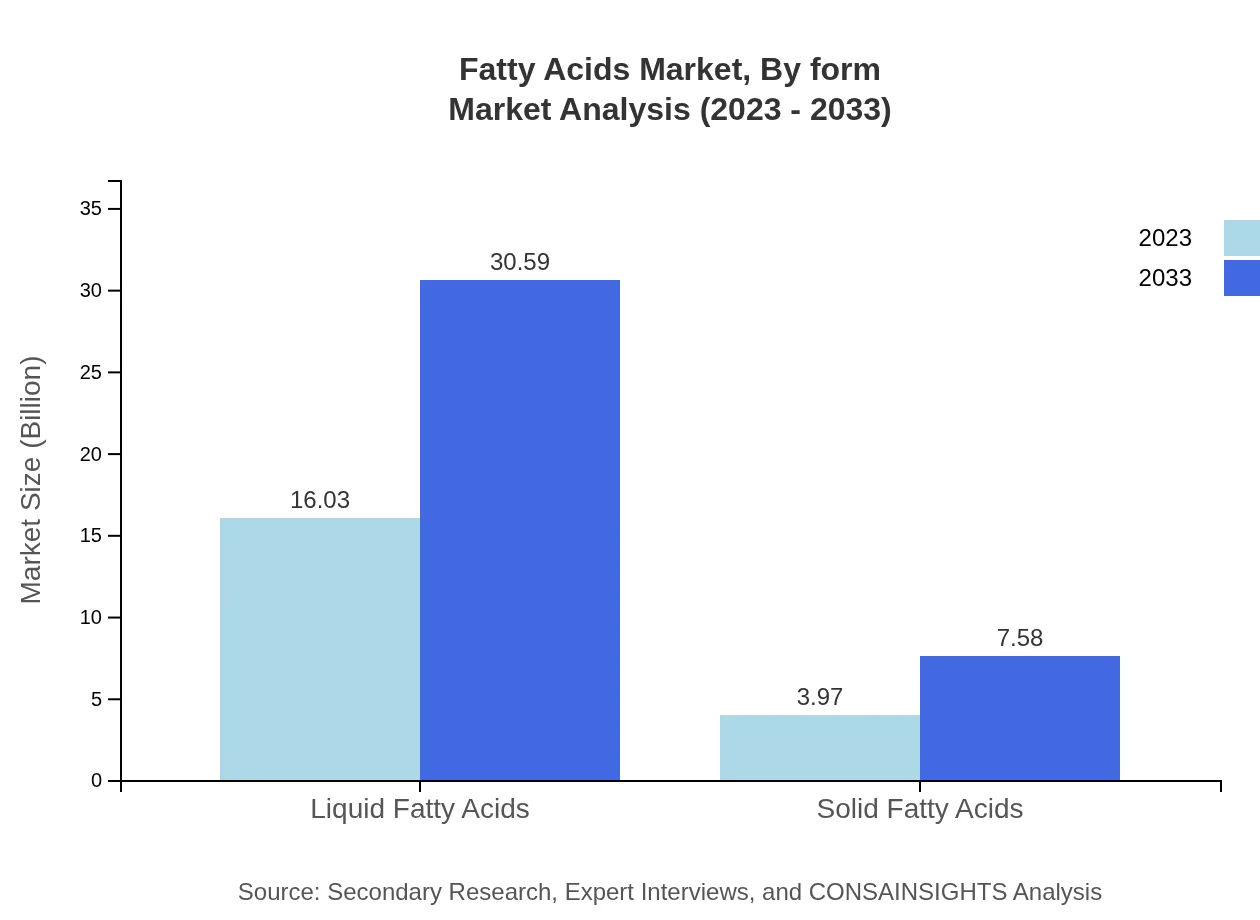

In terms of product type, liquid fatty acids dominate the market, valued at 16.03 billion USD in 2023 and projected to grow to 30.59 billion USD by 2033, maintaining an 80.14% share of the market. Solid fatty acids currently hold a market size of 3.97 billion USD, forecasted to reach 7.58 billion USD by 2033, with a share of 19.86%.

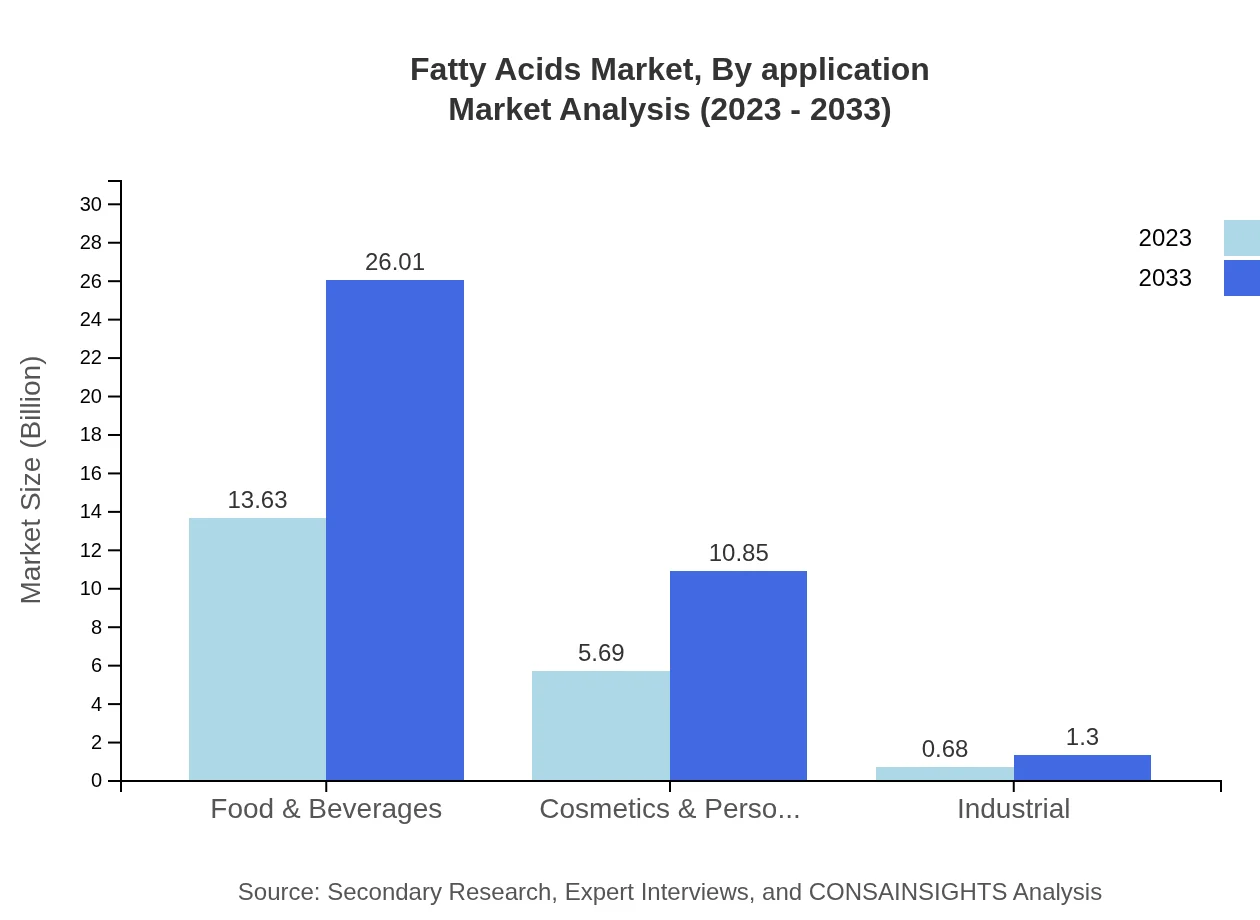

Fatty Acids Market Analysis By Application

The application segment of the Fatty Acids market includes food & beverages, cosmetics, and industrial applications. Currently, the food industry represents the largest application segment with a size of 13.63 billion USD, expected to double to 26.01 billion USD by 2033. Cosmetics account for 5.69 billion USD in 2023 with a projected growth to 10.85 billion USD by 2033. Industrial applications also exhibit potential growth from 0.68 billion USD to 1.30 billion USD.

Fatty Acids Market Analysis By End User

Key end-users of fatty acids are primarily in the food, cosmetic, and industrial sectors. The food industry’s growing demand for natural flavorings and health-conscious ingredients is propelling its market size to significant heights. The cosmetics sector is leveraging fatty acids for moisturizers and other personal care products, with a current size of 5.69 billion USD expected to rise. The industrial sector is also seeing growth due to diverse applications in lubricants and surfactants.

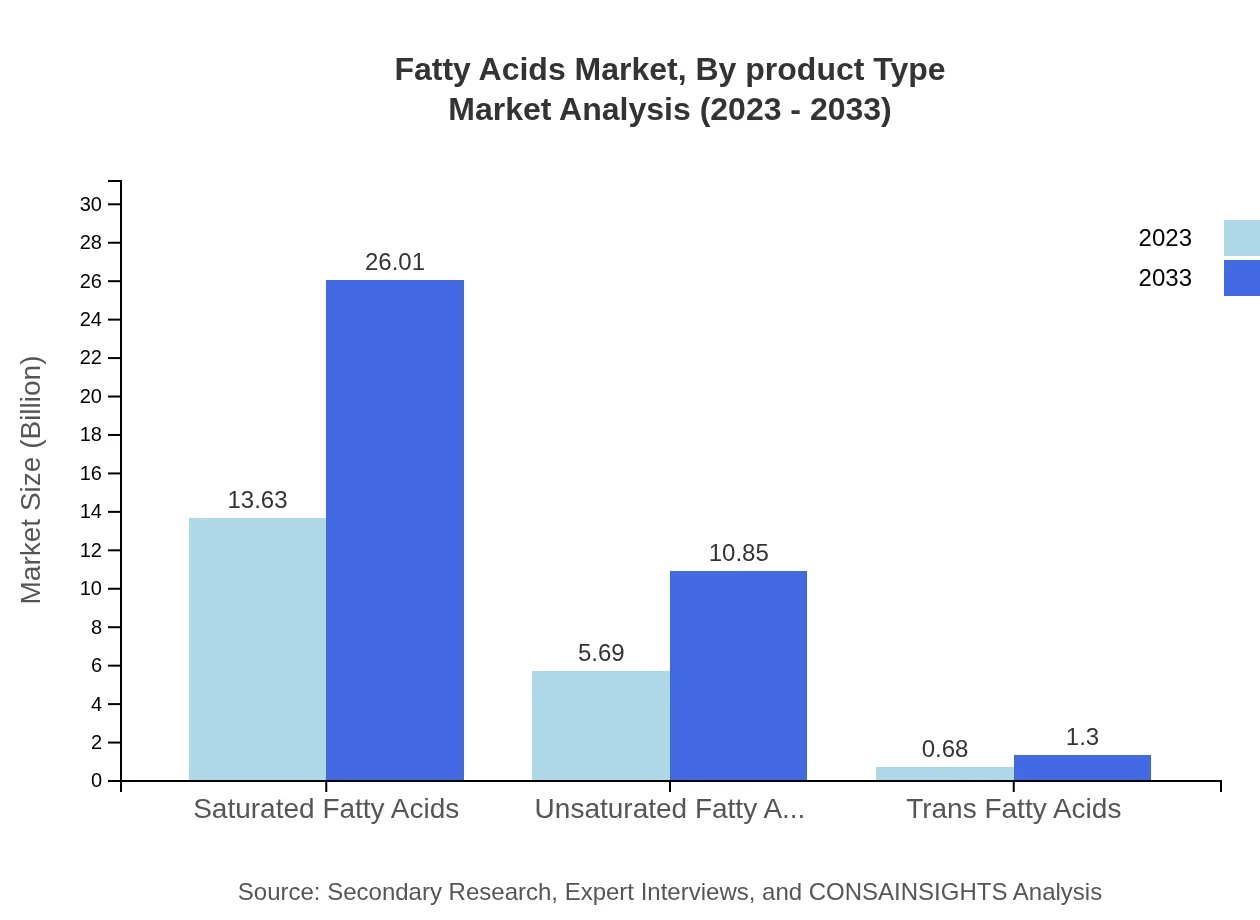

Fatty Acids Market Analysis By Form

Fatty acids can be categorized into saturated, unsaturated, and trans fatty acids. Saturated fatty acids are currently valued at 13.63 billion USD and expected to reach 26.01 billion USD by 2033, maintaining a share of 68.16%. Unsaturated fatty acids hold a size of 5.69 billion USD, likely growing to 10.85 billion USD by 2033, while synthetic fatty acids, though smaller, will grow at their own pace.

Fatty Acids Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fatty Acids Industry

BASF SE:

A leading global chemical company, BASF produces a wide range of fatty acids and their derivatives for various applications spanning across multiple sectors including personal care and food.Cargill, Incorporated:

Cargill is a major player in the agricultural sector and a prominent producer of vegetable oils and fatty acids, focusing on sustainable and innovative solutions.Dow Chemical Company:

Dow's portfolio includes numerous fatty acid products utilized in industrial applications, emphasizing sustainability and technological advancements.Wilmar International Limited:

As one of the largest agricultural commodity companies, Wilmar develops a variety of fatty acids derived from palm oil and other vegetable sources.We're grateful to work with incredible clients.

FAQs

What is the market size of fatty acids?

The global fatty acids market is projected to reach approximately $20 billion by 2033, growing at a CAGR of 6.5% from its current valuation. This growth reflects increasing demand across various sectors, including food, cosmetics, and pharmaceuticals.

What are the key market players or companies in the fatty acids industry?

Key market players in the fatty acids industry include major manufacturers like BASF SE, KLK Oleo, and Dow Chemical. These companies lead the market due to their extensive product portfolios and innovations in fatty acid applications.

What are the primary factors driving the growth in the fatty acids industry?

Growth in the fatty acids industry is driven by rising consumer demand for natural ingredients in food, cosmetics, and pharmaceuticals, alongside a growing trend of adopting plant-based alternatives. Increased awareness of health and wellness also fuels market expansion.

Which region is the fastest Growing in the fatty acids market?

The Asia Pacific region is expected to be the fastest-growing market for fatty acids, projected to grow from $3.93 billion in 2023 to $7.51 billion by 2033. This is driven by increasing industrial applications and consumer trends favoring health-oriented products.

Does ConsaInsights provide customized market report data for the fatty acids industry?

Yes, ConsaInsights provides tailored market reports for the fatty acids industry. Clients can obtain specific data, trends, and insights to assist in strategic planning and informed decision-making based on their unique business needs.

What deliverables can I expect from this fatty acids market research project?

Deliverables from the fatty acids market research project include comprehensive reports, trend analyses, segmented market insights by region and product type, and strategic recommendations based on current market dynamics.

What are the market trends of fatty acids?

Current market trends in fatty acids include a shift towards plant-based sources, heightened interest in sustainable production methods, and increasing use in cosmetics and nutritional supplements. These trends reflect a broader health and environmental consciousness among consumers.