Fecal Occult Testing Market Report

Published Date: 31 January 2026 | Report Code: fecal-occult-testing

Fecal Occult Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the fecal occult testing market, encompassing market size, growth trends, regional insights, and segmentation from 2023 to 2033.

| Metric | Value |

|---|---|

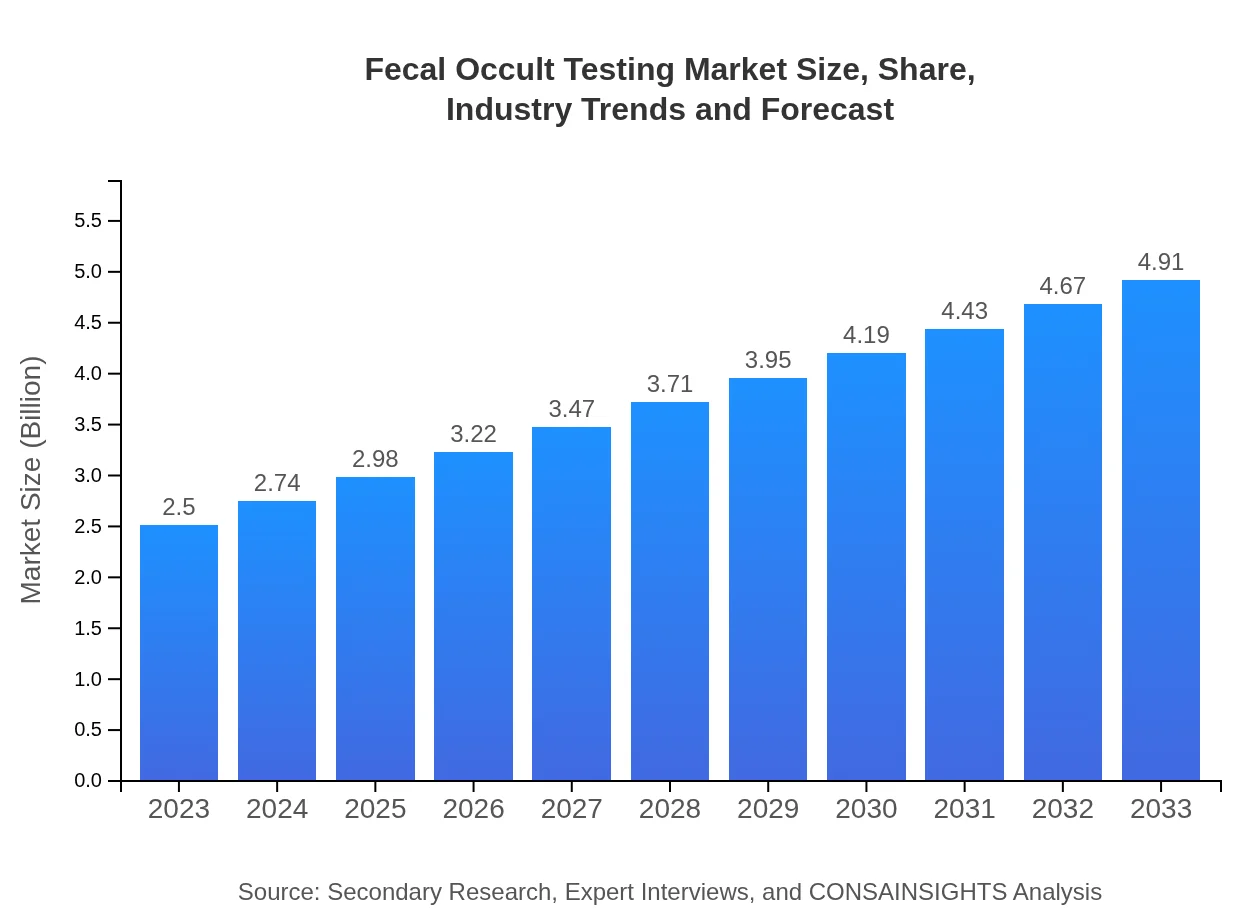

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Beckman Coulter, Inc., Siemens Healthineers, Cardinal Health, Inc. |

| Last Modified Date | 31 January 2026 |

Fecal Occult Testing Market Overview

Customize Fecal Occult Testing Market Report market research report

- ✔ Get in-depth analysis of Fecal Occult Testing market size, growth, and forecasts.

- ✔ Understand Fecal Occult Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fecal Occult Testing

What is the Market Size & CAGR of Fecal Occult Testing market in 2023?

Fecal Occult Testing Industry Analysis

Fecal Occult Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fecal Occult Testing Market Analysis Report by Region

Europe Fecal Occult Testing Market Report:

The European market for fecal occult testing is projected to grow from USD 0.67 billion in 2023 to USD 1.31 billion by 2033. Aging demographics and a strong emphasis on preventive healthcare lead to an increased uptake of screening tests.Asia Pacific Fecal Occult Testing Market Report:

The Asia Pacific region is poised for significant growth, with the market size projected to increase from USD 0.49 billion in 2023 to USD 0.97 billion by 2033. The expanding patient population, rising awareness about colorectal cancer, and increased healthcare expenditure contribute to this expansion.North America Fecal Occult Testing Market Report:

North America remains the dominant market for fecal occult testing, expected to grow from USD 0.90 billion in 2023 to USD 1.77 billion by 2033. The presence of advanced healthcare infrastructure, high prevalence of colorectal cancer, and favorable reimbursement policies drive the market.South America Fecal Occult Testing Market Report:

In South America, the fecal occult testing market is forecasted to grow from USD 0.16 billion in 2023 to USD 0.31 billion by 2033. Rising healthcare access, along with initiatives to promote cancer screening, underlines growth prospects in this region.Middle East & Africa Fecal Occult Testing Market Report:

The Middle East and Africa market is anticipated to increase from USD 0.28 billion in 2023 to USD 0.55 billion by 2033. Emerging healthcare systems and an increasing awareness around gastrointestinal conditions are pivotal for market growth.Tell us your focus area and get a customized research report.

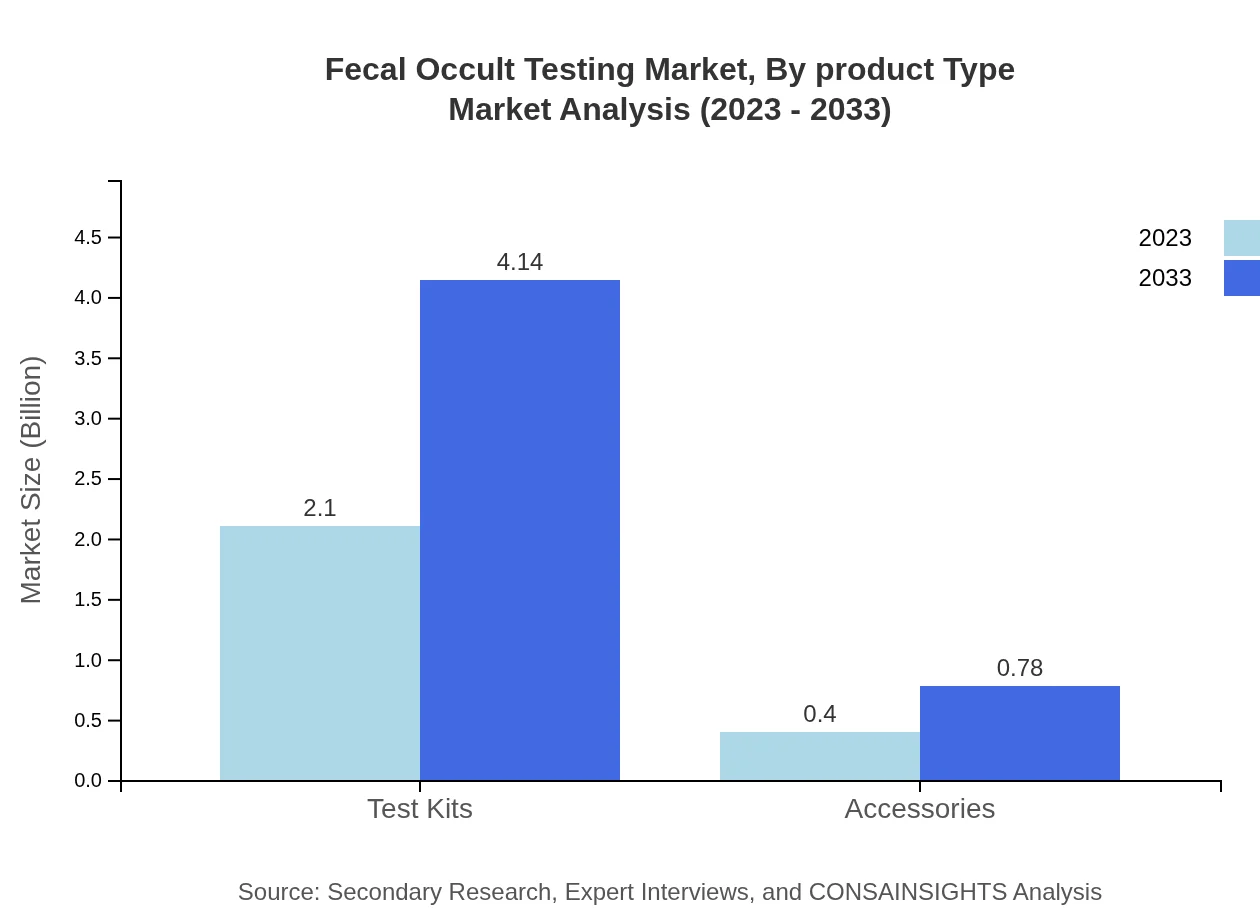

Fecal Occult Testing Market Analysis By Product Type

For 2023, test kits dominate this market segment with a size of USD 2.10 billion, constituting 84.19% market share. This is anticipated to increase to USD 4.14 billion by 2033, maintaining the same share. Accessories generate a modest revenue stream, projected to grow from USD 0.40 billion to USD 0.78 billion, balancing a 15.81% share throughout the decade.

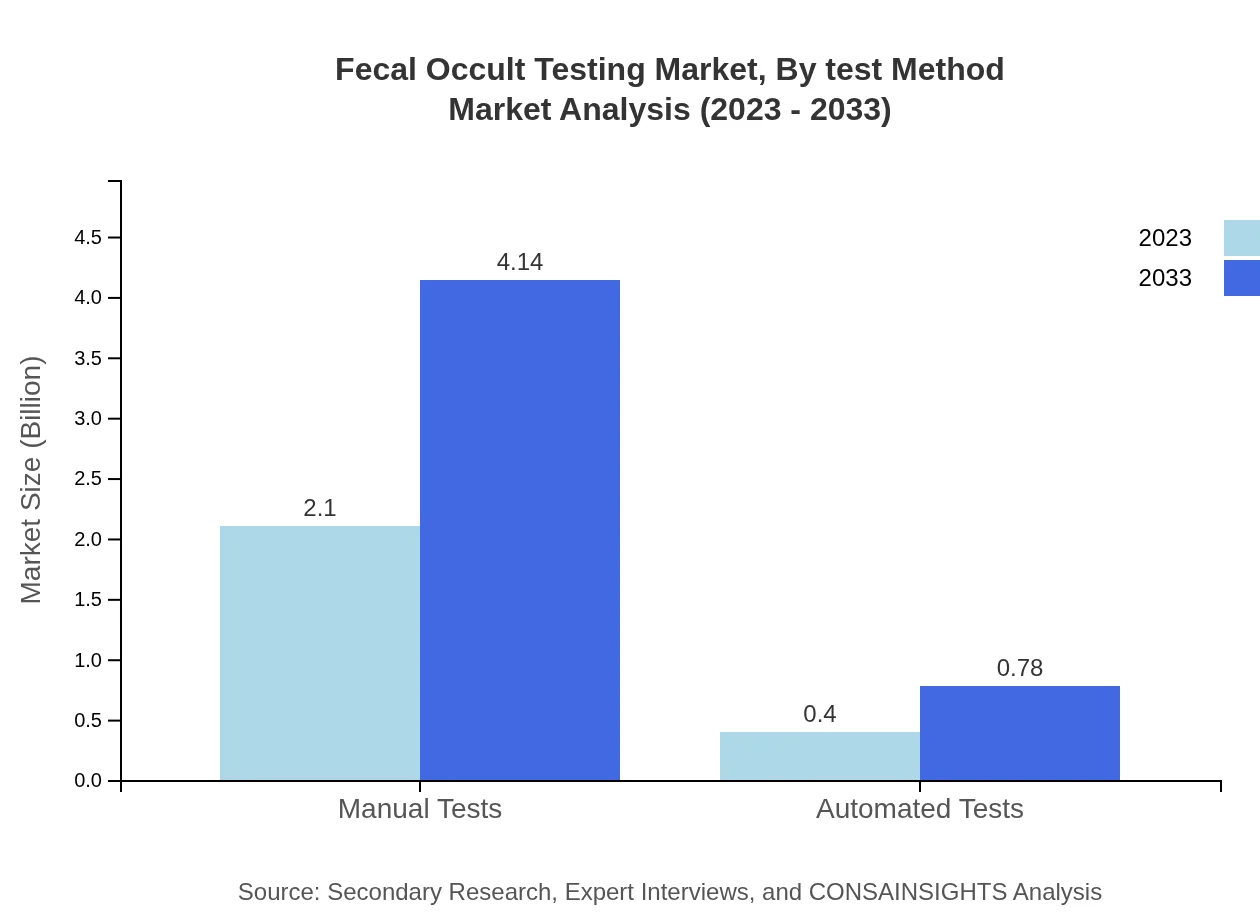

Fecal Occult Testing Market Analysis By Test Method

Manual tests account for 84.19% market share, with revenues surging from USD 2.10 billion in 2023 to USD 4.14 billion in 2033, reflective of their established protocols in clinical settings. Automated tests, while currently smaller at USD 0.40 billion and a share of 15.81%, demonstrate rapid growth potential as innovation drives the convenience and efficacy of fecal testing.

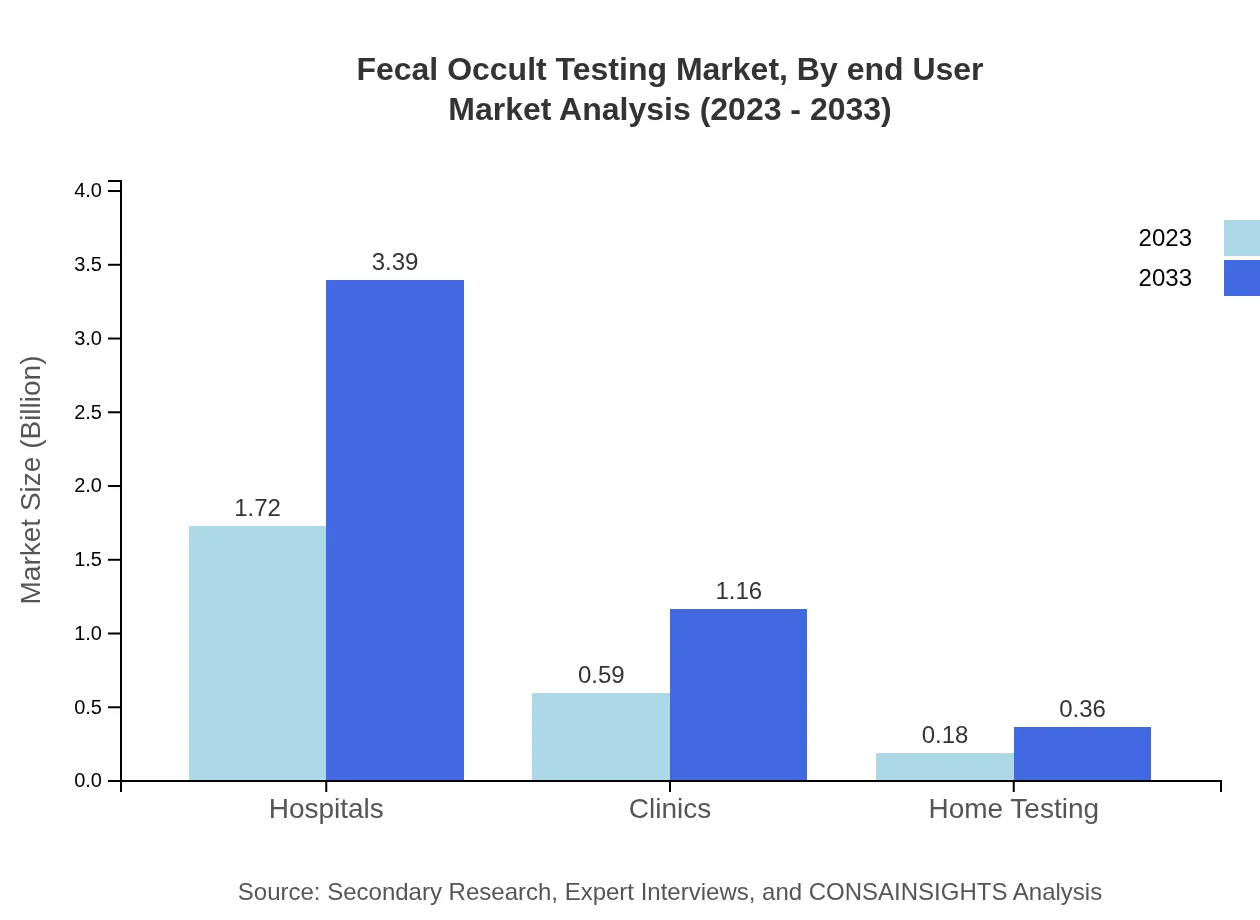

Fecal Occult Testing Market Analysis By End User

Hospitals lead as key end-users, commanding USD 1.72 billion in 2023 (68.98% share) and expanding to USD 3.39 billion by 2033. Clinics and home testing exhibit notable growth too, with clinics rising from USD 0.59 billion to USD 1.16 billion and home testing from USD 0.18 billion to USD 0.36 billion, showcasing the broadening scope of fecal testing.

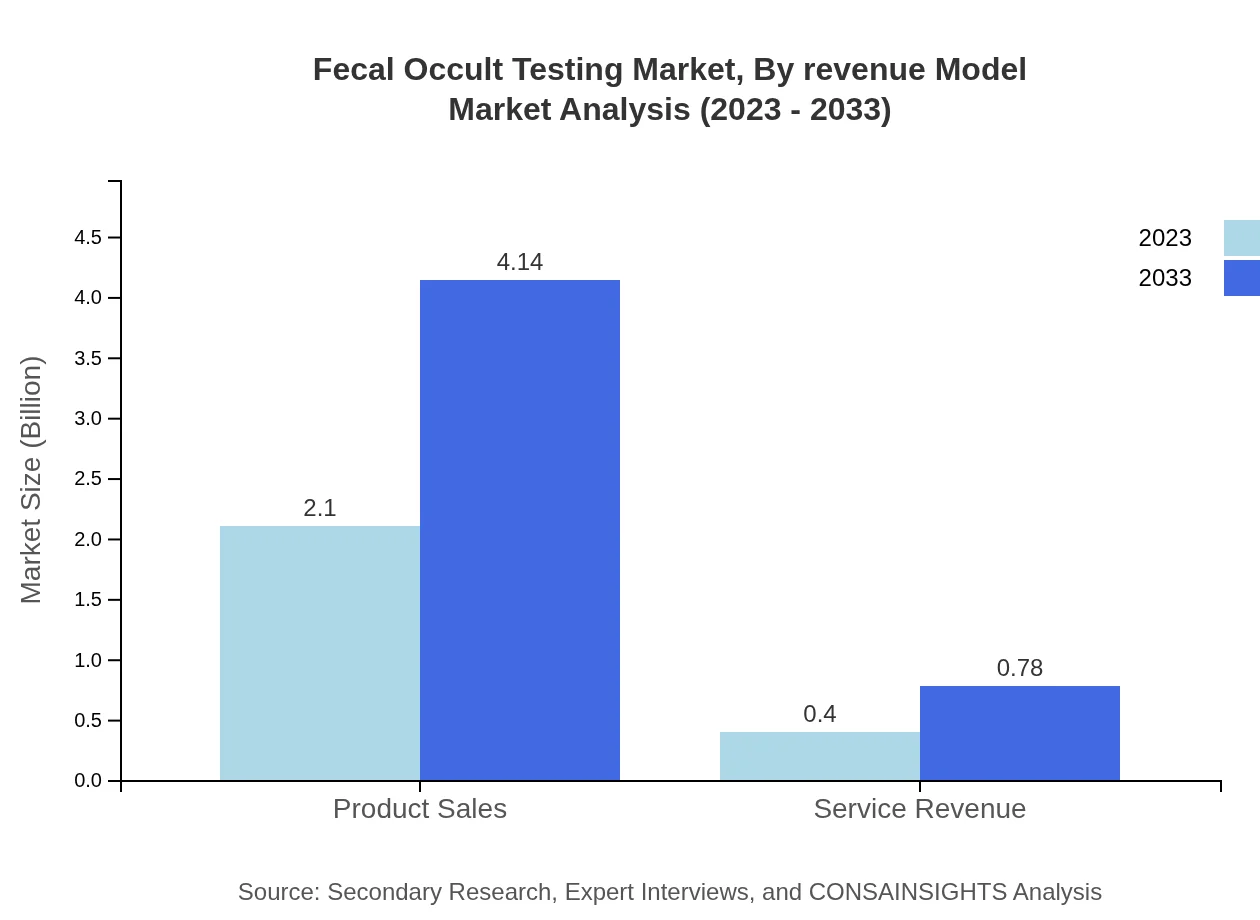

Fecal Occult Testing Market Analysis By Revenue Model

As of 2023, product sales dominate with USD 2.10 billion and a consistent 84.19% market share, expected to rise to USD 4.14 billion by 2033. Service revenue follows with a smaller yet important contribution, growing from USD 0.40 billion to USD 0.78 billion, reflecting costs associated with additional diagnostic services.

Fecal Occult Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fecal Occult Testing Industry

Abbott Laboratories:

A leading global healthcare company known for its diagnostic solutions in fecal occult blood testing, focusing on innovation and precision in patient care.F. Hoffmann-La Roche Ltd.:

Prominent for its investments in advanced testing methodologies and a comprehensive approach to colorectal screening solutions.Beckman Coulter, Inc.:

Specializes in diagnostic instruments and tests, making significant contributions to lab automation and efficiency in fecal occult testing.Siemens Healthineers:

Provides innovative diagnostic solutions and significantly invests in research to improve patient diagnostic methodologies.Cardinal Health, Inc.:

Offers a wide range of medical products and services, including key diagnostics resources for fecal occult testing, contributing to improved healthcare outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of fecal Occult Testing?

The global market size for fecal occult testing is projected to reach $2.5 billion by 2033, expanding at a CAGR of 6.8%. This growth reflects increasing awareness regarding colorectal cancer and advancements in testing technologies.

What are the key market players or companies in this fecal Occult Testing industry?

Key players in the fecal occult testing industry include major diagnostics companies and healthcare providers, but specifics can be obtained in comprehensive market reports detailing specific company strategies and market share.

What are the primary factors driving the growth in the fecal Occult Testing industry?

Growth drivers in the fecal occult testing industry include rising incidences of colorectal cancer, advancements in technology, increasing awareness about preventive healthcare, and favorable government initiatives encouraging early diagnosis.

Which region is the fastest Growing in the fecal Occult Testing?

The fastest-growing region in the fecal occult testing market is North America, projected to grow from $0.90 billion in 2023 to $1.77 billion by 2033, reflecting increased healthcare expenditure and awareness.

Does ConsaInsights provide customized market report data for the fecal Occult Testing industry?

Yes, ConsaInsights specializes in delivering customized market reports tailored to specific needs, including detailed analyses of market trends, segments, and competitive landscapes in the fecal occult testing industry.

What deliverables can I expect from this fecal Occult Testing market research project?

Deliverables typically include comprehensive market analysis reports, segment data, trend forecasts, competitive landscape evaluations, and tailored insights to help stakeholders make informed decisions in the fecal occult testing market.

What are the market trends of fecal Occult Testing?

Current market trends in fecal occult testing include a shift towards home testing solutions, technological innovation in testing methods, and an increasing focus on patient-centered care, which all contribute to market expansion.