Feed Amino Acids Market Report

Published Date: 02 February 2026 | Report Code: feed-amino-acids

Feed Amino Acids Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Feed Amino Acids market between 2023 and 2033, covering market dynamics, size, trends, and forecasts. Insights into regional markets and competitive landscape are included to inform strategic decisions.

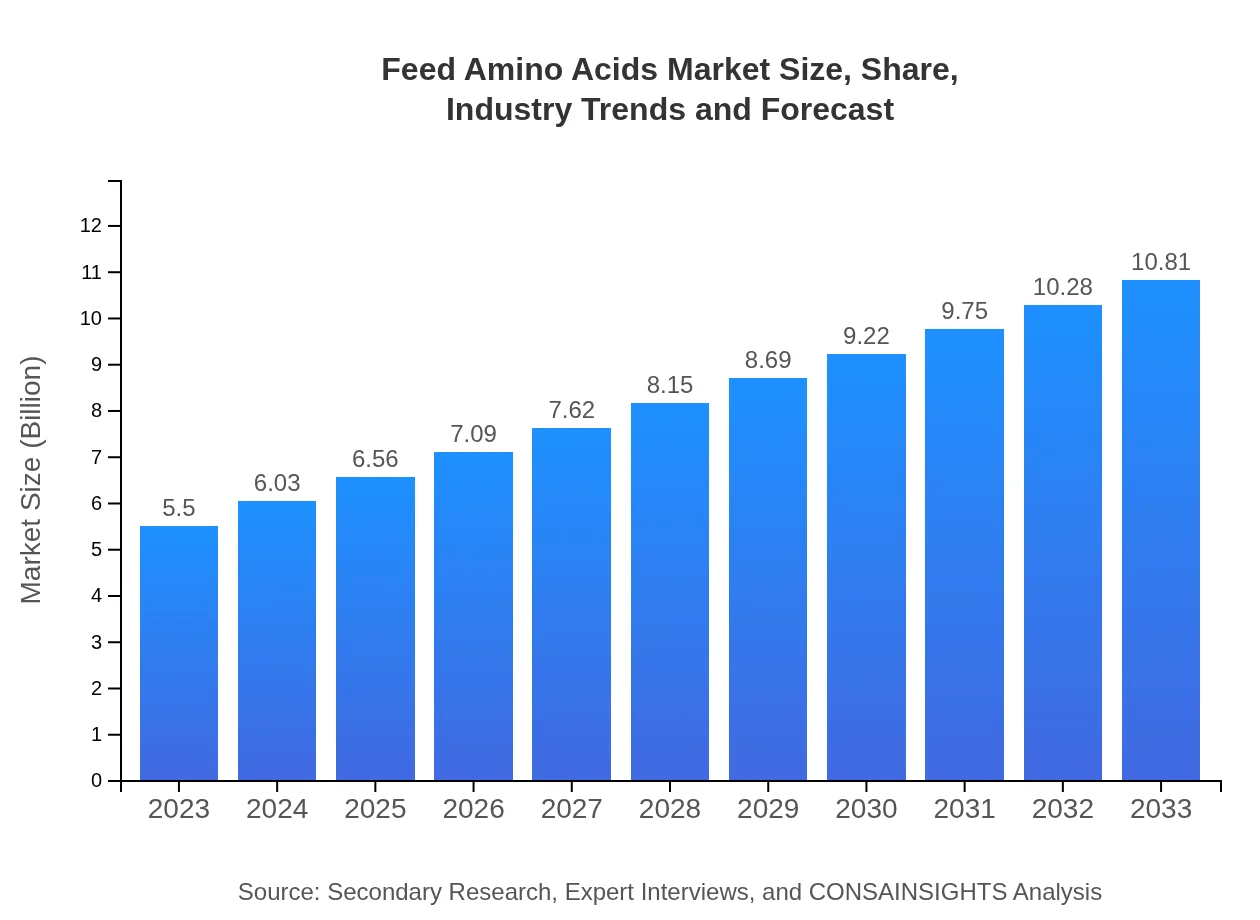

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.81 Billion |

| Top Companies | Ajinomoto Co., Inc., Cargill, Incorporated, Evonik Industries AG, Archer Daniels Midland Company (ADM), Nutreco N.V. |

| Last Modified Date | 02 February 2026 |

Feed Amino Acids Market Overview

Customize Feed Amino Acids Market Report market research report

- ✔ Get in-depth analysis of Feed Amino Acids market size, growth, and forecasts.

- ✔ Understand Feed Amino Acids's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Amino Acids

What is the Market Size & CAGR of Feed Amino Acids market in 2023 and 2033?

Feed Amino Acids Industry Analysis

Feed Amino Acids Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Amino Acids Market Analysis Report by Region

Europe Feed Amino Acids Market Report:

The European Feed Amino Acids market is set to expand from $1.65 billion in 2023 to $3.24 billion by 2033. A growing preference for natural feed additives, alongside strict regulations on animal feed, is shaping market dynamics. Countries such as Germany, the UK, and France are investing in R&D for innovative feed solutions.Asia Pacific Feed Amino Acids Market Report:

The Asia Pacific region is expected to showcase substantial growth, with the market size anticipated to increase from $1.07 billion in 2023 to $2.10 billion by 2033. Rising meat consumption, expansion of aquaculture, and the growing livestock sector are several factors contributing to this growth. Countries like China and India are at the forefront of this expansion, supported by government initiatives aimed at enhancing livestock productivity.North America Feed Amino Acids Market Report:

North America is a significant market for Feed Amino Acids, with market size growing from $1.96 billion in 2023 to $3.85 billion by 2033. Strong investment in animal agriculture and advancements in feed technologies are key growth drivers. The U.S. leads this market, focusing on high-quality feed formulations to maximize animal health and production.South America Feed Amino Acids Market Report:

In South America, the Feed Amino Acids market is projected to grow from $0.4 billion in 2023 to $0.78 billion by 2033. The increasing demand for meat in both local and export markets, along with the rise in feed efficiency practices, is driving this growth. Brazil is a major player, leveraging its agricultural capabilities to boost amino acid production.Middle East & Africa Feed Amino Acids Market Report:

In the Middle East and Africa, the Feed Amino Acids market is expected to witness growth from $0.43 billion in 2023 to $0.85 billion by 2033. Factors driving this market include increasing meat consumption, expanding livestock farming, and a focus on improving feed quality to enhance livestock performance.Tell us your focus area and get a customized research report.

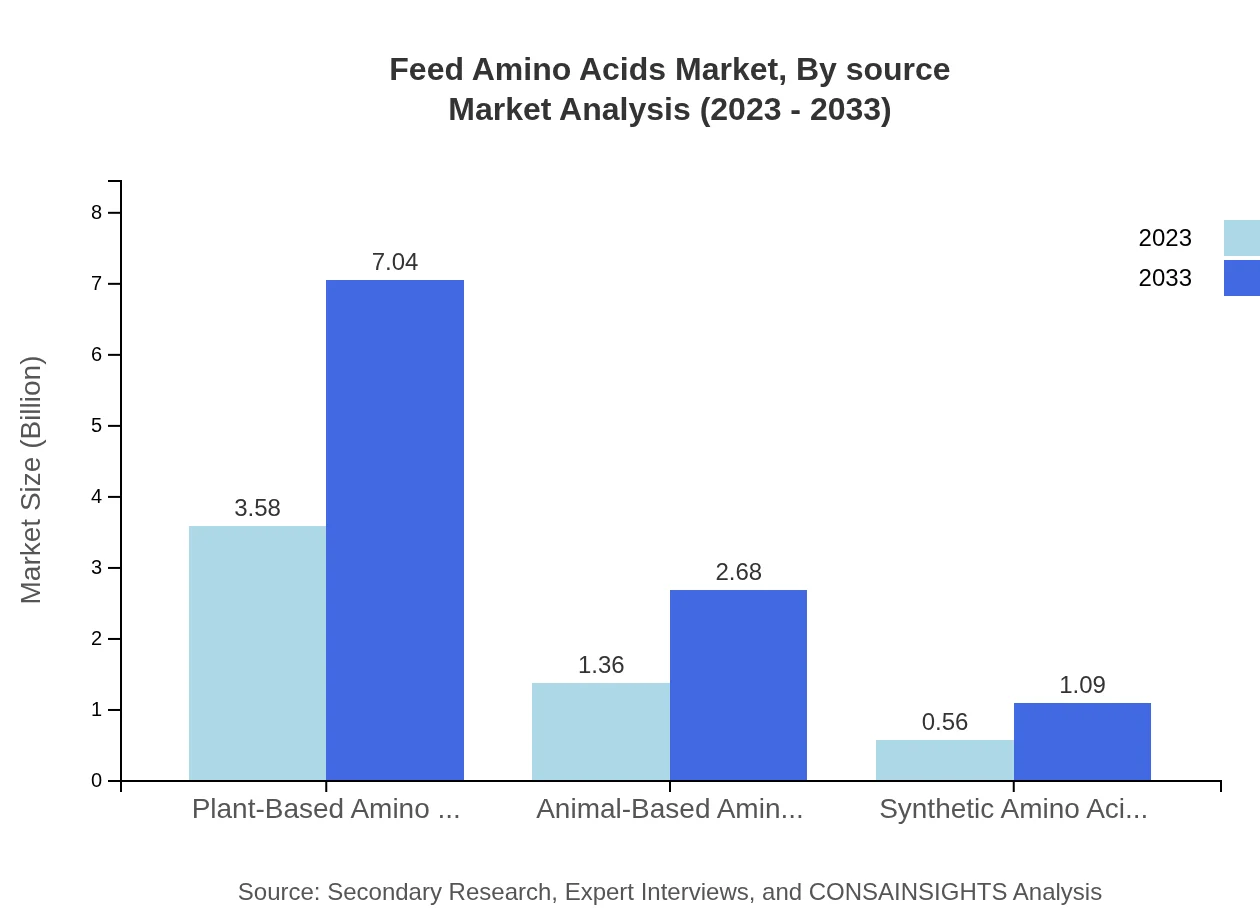

Feed Amino Acids Market Analysis By Source

The market is segmented by source into plant-based, animal-based, and synthetic amino acids. In 2023, plant-based amino acids dominate the market size at approximately $3.58 billion, expected to grow to $7.04 billion by 2033, with a share of 65.09%. Animal-based amino acids are forecasted to increase from $1.36 billion to $2.68 billion with a share of 24.81%. Synthetic amino acids, while smaller, are also projected to grow from $0.56 billion to $1.09 billion.

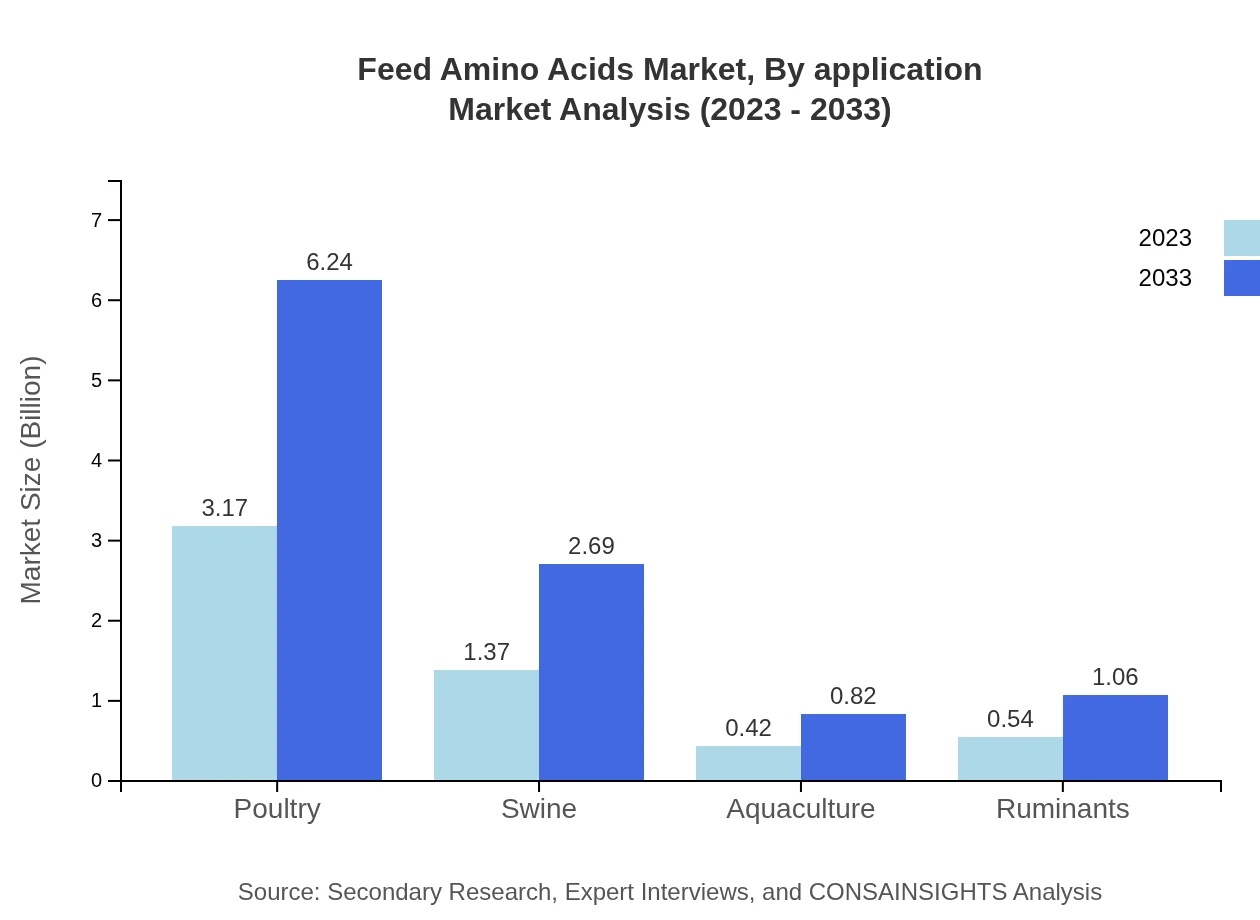

Feed Amino Acids Market Analysis By Application

The Feed Amino Acids market is applied across various livestock sectors including poultry, swine, aquaculture, and ruminants. The poultry segment leads, accounting for $3.17 billion in 2023 and expected to reach $6.24 billion by 2033, reflecting a 57.7% market share. The swine segment is also significant, growing from $1.37 billion to $2.69 billion, while aquaculture represents a smaller, yet growing segment.

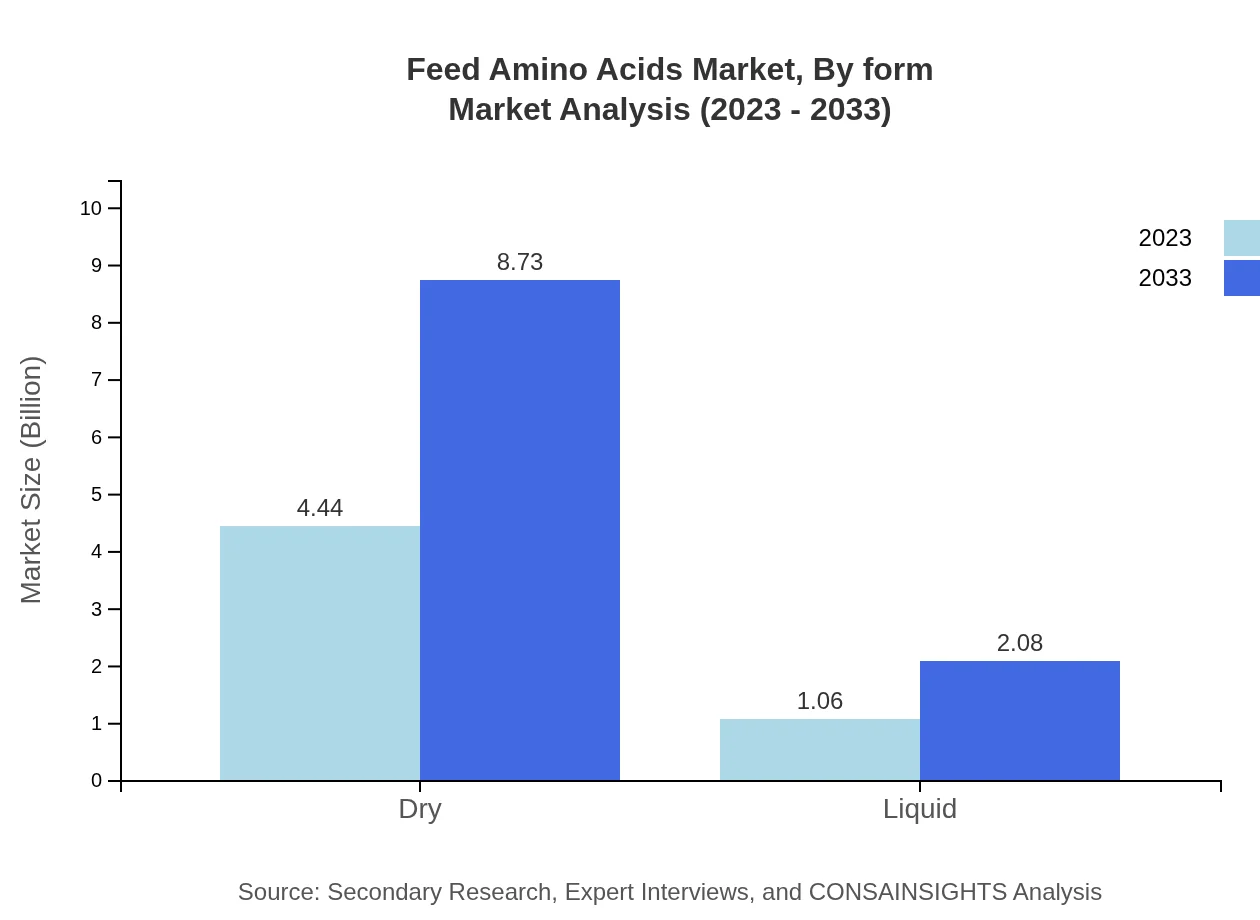

Feed Amino Acids Market Analysis By Form

Feed Amino Acids are available in dry and liquid forms. Dry forms dominate with a market size of $4.44 billion in 2023, anticipated to grow to $8.73 billion by 2033, maintaining an 80.74% market share. Liquid forms, while less prevalent, are projected to grow from $1.06 billion to $2.08 billion, representing a 19.26% share.

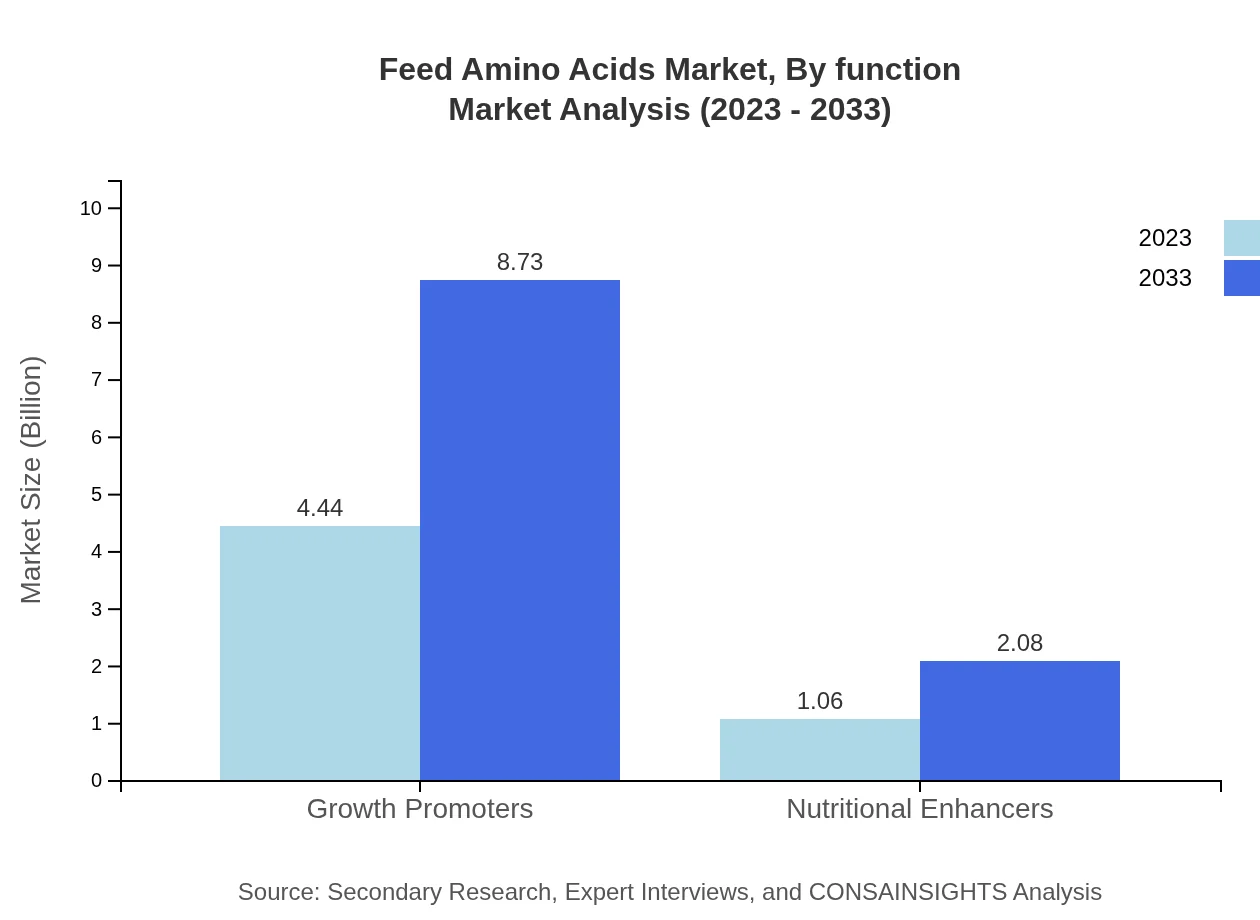

Feed Amino Acids Market Analysis By Function

The main functions of amino acids in livestock feed include growth promoters and nutritional enhancers. Growth promoters currently capture $4.44 billion of the market, forecasted to rise to $8.73 billion by 2033. Nutritional enhancers are predicted to grow from $1.06 billion to $2.08 billion, offering significant support to animal health and productivity as well.

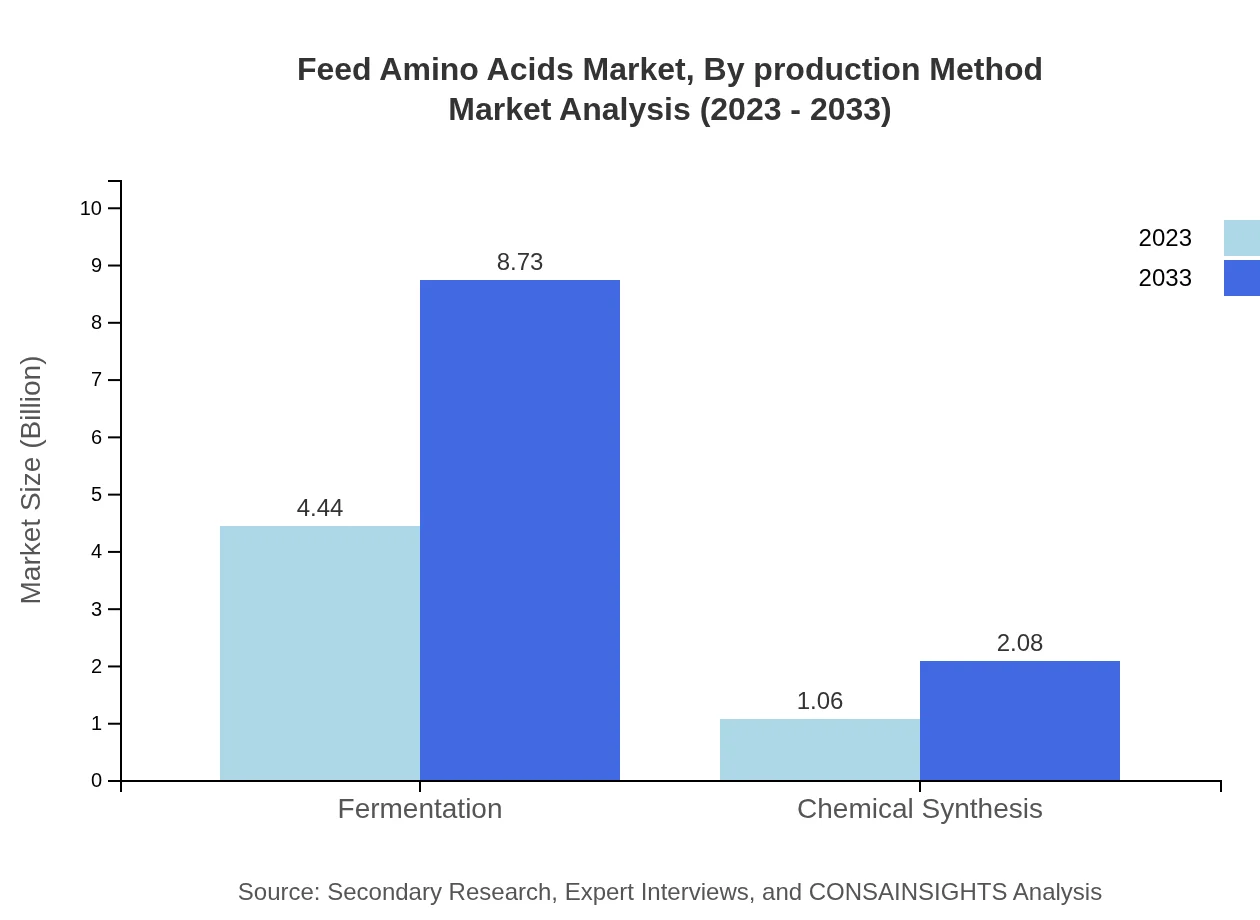

Feed Amino Acids Market Analysis By Production Method

Feed Amino Acids are produced through fermentation and chemical synthesis. Fermentation methods are leading in market share, valued at approximately $4.44 billion in 2023 with consistent growth projected to $8.73 billion. Chemical synthesis forms the alternative segment, expanding from $1.06 billion to $2.08 billion, highlighting diverse production avenues.

Feed Amino Acids Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Amino Acids Industry

Ajinomoto Co., Inc.:

Ajinomoto is a global leader in amino acid production, offering a wide range of feed amino acids and focusing on sustainable practices and innovation.Cargill, Incorporated:

Cargill provides high-quality animal nutrition products, including amino acids, and focuses on enhancing livestock performance through improved feed formulations.Evonik Industries AG:

Evonik is a prominent player specializing in amino acids and nutritional products, emphasizing research and development to drive market innovations.Archer Daniels Midland Company (ADM):

ADM is a leading agricultural processor, producing amino acids and other nutrients, and plays a significant role in the supply chain of animal nutrition.Nutreco N.V.:

Nutreco specializes in animal nutrition and aquafeed, leveraging its research capabilities to enhance the efficiency of feed amino acids.We're grateful to work with incredible clients.

FAQs

What is the market size of Feed Amino Acids?

The global feed amino acids market is projected to grow from USD 5.5 billion in 2023 to significant values by 2033, maintaining a CAGR of 6.8%. This growth highlights the increasing demand for amino acids in animal nutrition.

What are the key market players or companies in the Feed Amino Acids industry?

Key players in the feed amino acids market include prominent companies like ADM, BASF SE, and Evonik Industries. These companies are known for their innovative solutions in amino acid production and contribute significantly to the market dynamics.

What are the primary factors driving the growth in the Feed Amino Acids industry?

Growth in the feed amino acids industry is driven by increasing livestock population, rising demand for high-quality animal protein, and a growing focus on efficient animal nutrition. Innovations in product formulations and technologies also play a crucial role.

Which region is the fastest Growing in the Feed Amino Acids?

The Asia Pacific region is expected to witness rapid growth in the feed amino acids market, with projections rising from USD 1.07 billion in 2023 to USD 2.1 billion by 2033, driven by rapidly increasing livestock production and consumption.

Does ConsaInsights provide customized market report data for the Feed Amino Acids industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the feed amino acids industry. Clients can request reports that focus on particular segments, geographies, or competitive analyses.

What deliverables can I expect from this Feed Amino Acids market research project?

Deliverables from the feed amino acids market research include comprehensive reports detailing market size, segment analysis, competitor profiles, and growth trends, alongside actionable insights to help inform strategic decisions.

What are the market trends of Feed Amino Acids?

Key trends in the feed amino acids market include a shift towards plant-based alternatives, increasing use of synthetic amino acids, and growing preferences for natural and sustainable additives to enhance animal nutrition.