Feed Betaine Market Report

Published Date: 31 January 2026 | Report Code: feed-betaine

Feed Betaine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Feed Betaine market, including market size, growth trends, segmentation, regional insights, and industry forecasts from 2023 to 2033.

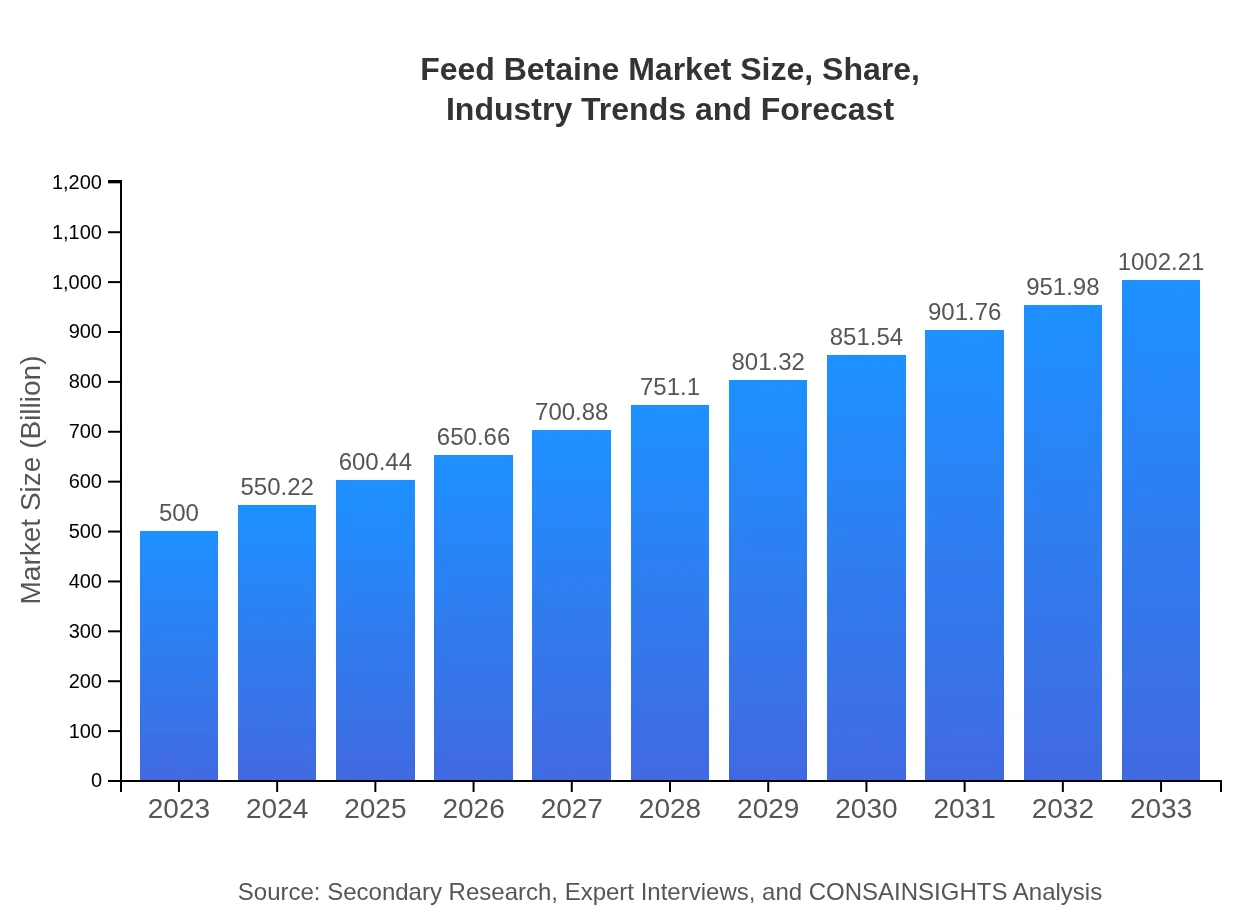

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $1002.21 Million |

| Top Companies | DuPont de Nemours, Inc., Evonik Industries AG, BASF SE, Nutreco N.V., Kemin Industries, Inc. |

| Last Modified Date | 31 January 2026 |

Feed Betaine Market Overview

Customize Feed Betaine Market Report market research report

- ✔ Get in-depth analysis of Feed Betaine market size, growth, and forecasts.

- ✔ Understand Feed Betaine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Betaine

What is the Market Size & CAGR of Feed Betaine market in 2023?

Feed Betaine Industry Analysis

Feed Betaine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Betaine Market Analysis Report by Region

Europe Feed Betaine Market Report:

Europe’s Feed Betaine market is set to grow from $166.70 million in 2023 to $334.14 million by 2033, with a strong emphasis on sustainability and organic farming practices enhancing the demand for natural products.Asia Pacific Feed Betaine Market Report:

In 2023, the Feed Betaine market in Asia Pacific is estimated at $90.15 million, projected to grow to $180.70 million by 2033. The growth is driven by the increasing demand for livestock and aquaculture production, particularly in countries like China and India.North America Feed Betaine Market Report:

In North America, the market size is anticipated to grow from $173.10 million in 2023 to $346.96 million by 2033. This growth is fueled by advancements in farming technology and strict regulations requiring improved feed quality.South America Feed Betaine Market Report:

South America’s Feed Betaine market, valued at $34.70 million in 2023, is expected to reach $69.55 million by 2033. The region shows strong growth potential due to expanding agriculture and livestock industries.Middle East & Africa Feed Betaine Market Report:

The Middle East and Africa market is projected to increase from $35.35 million in 2023 to $70.86 million by 2033, driven by rising meat consumption and aquaculture activities.Tell us your focus area and get a customized research report.

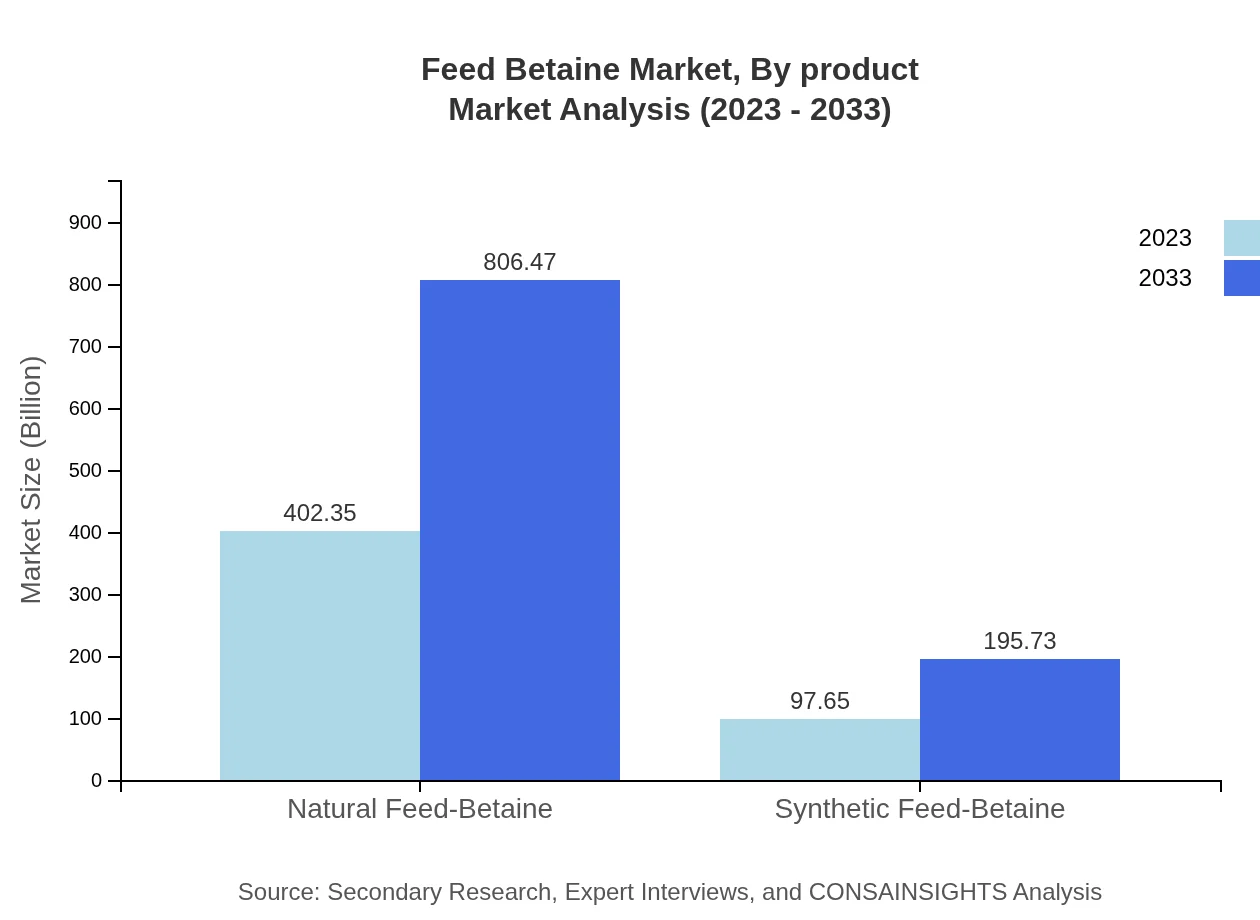

Feed Betaine Market Analysis By Product

The Feed Betaine market is segmented into Natural and Synthetic types. The Natural Feed Betaine market is projected to grow significantly, reaching $806.47 million by 2033 from $402.35 million in 2023. Conversely, the Synthetic Feed Betaine segment is expected to grow from $97.65 million in 2023 to $195.73 million by 2033.

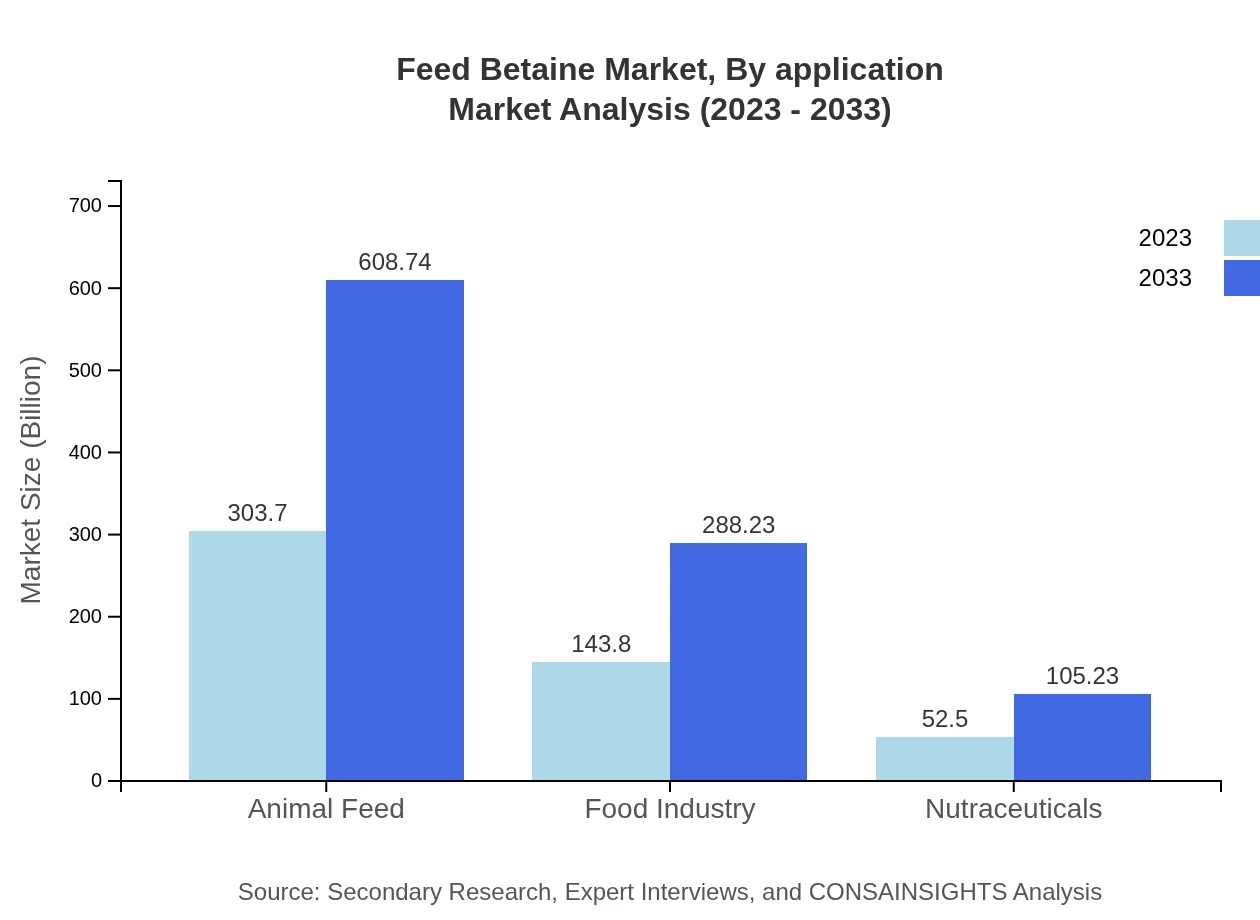

Feed Betaine Market Analysis By Application

In terms of applications, the Livestock sector dominates the Feed Betaine market, with estimated values of $303.70 million in 2023 and $608.74 million by 2033. Other significant application segments include the Pet industry and Aquaculture, reflecting diverse utilization across different animal categories.

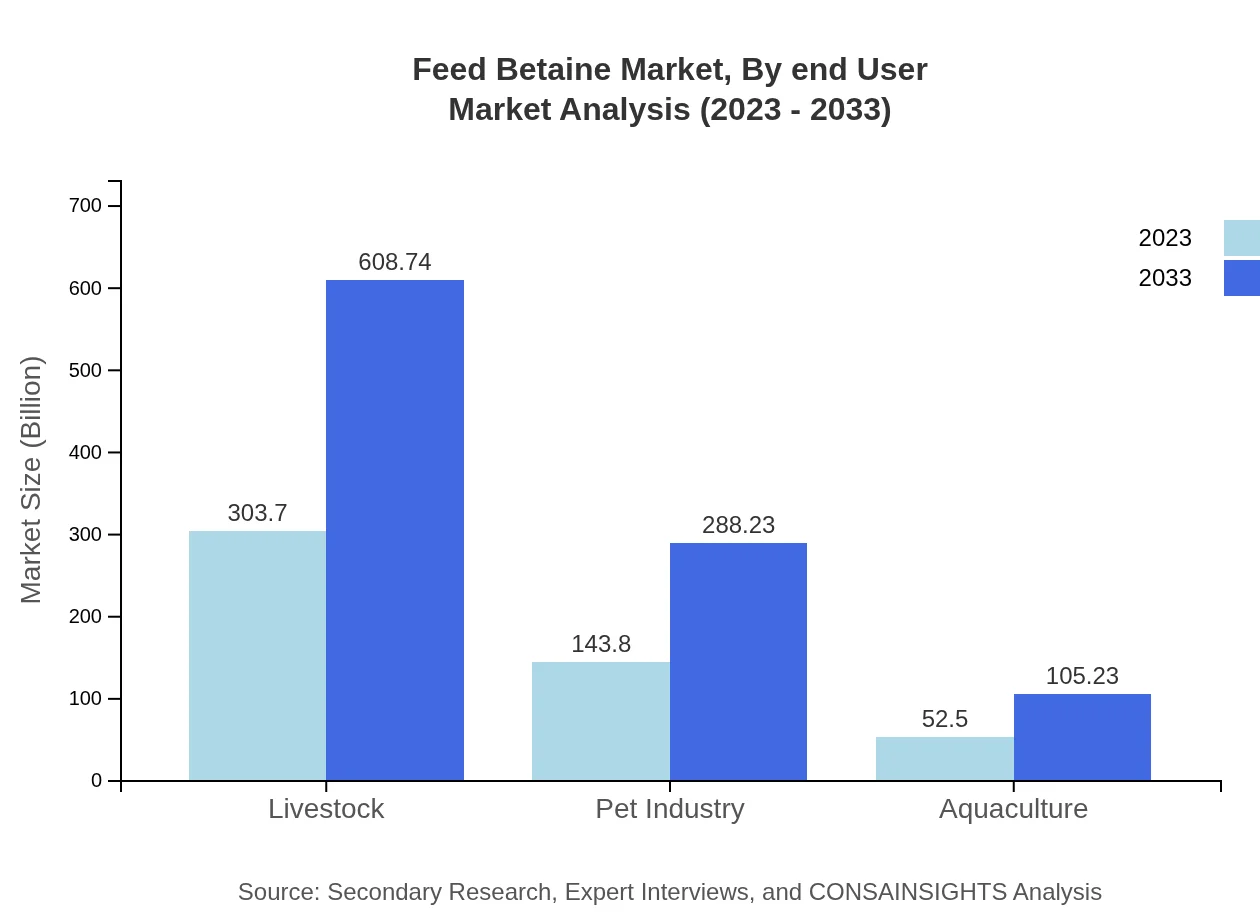

Feed Betaine Market Analysis By End User

The major end-users of Feed Betaine include various segments within the agricultural and feed industries, primarily focusing on improving the health and productivity of livestock and pets.

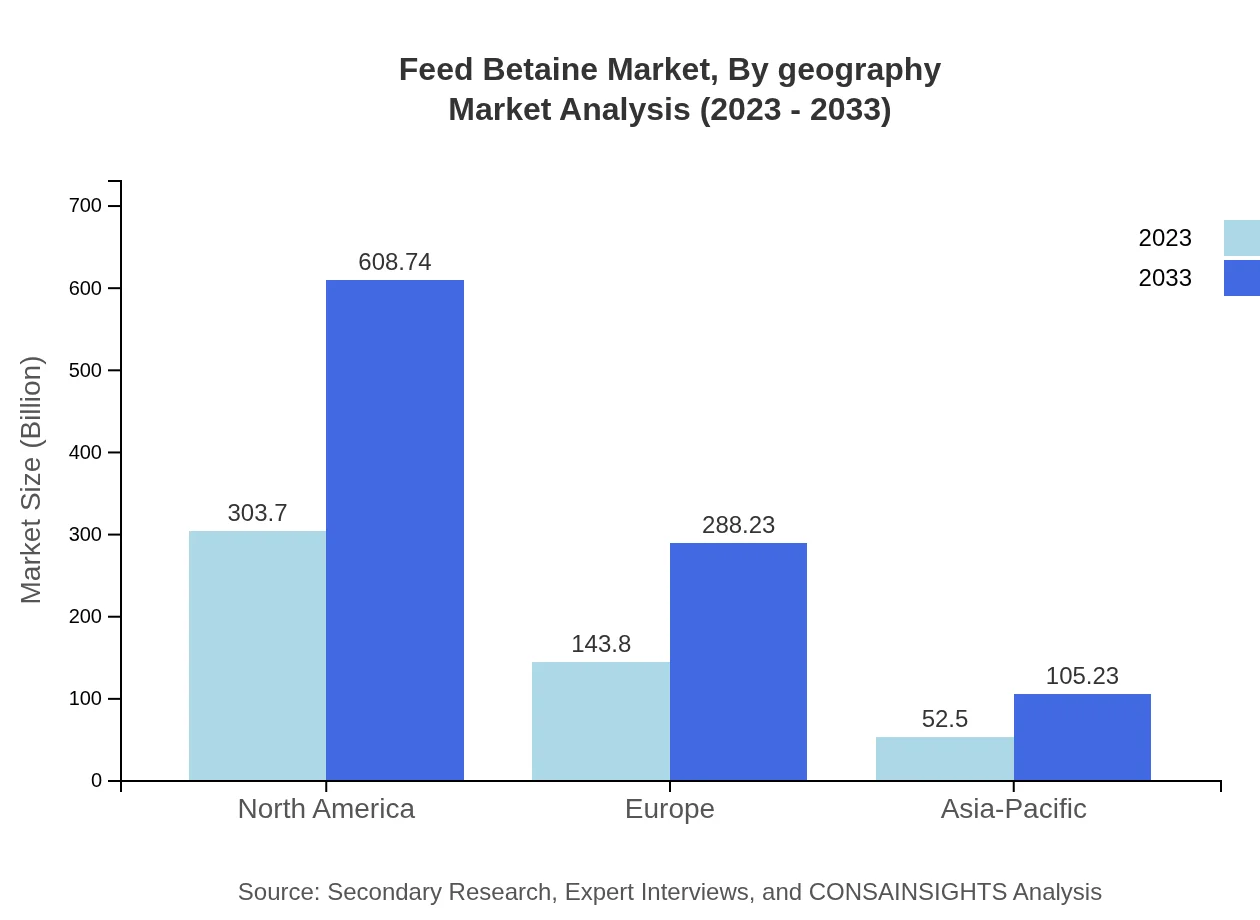

Feed Betaine Market Analysis By Geography

Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa, with each region exhibiting unique growth drivers and challenges, influencing product adoption and market dynamics.

Feed Betaine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Betaine Industry

DuPont de Nemours, Inc.:

A leading producer of natural and synthetic Betaines, DuPont offers innovative animal nutrition solutions globally and invests significantly in R&D to enhance product offerings.Evonik Industries AG:

Known for its high-quality Feed Betaine products, Evonik focuses on sustainable production practices and has a strong presence in the aquaculture and livestock feed sectors.BASF SE:

BASF is a significant player in the Feed Betaine market, emphasizing innovation and responsible sourcing, catering to various global regions.Nutreco N.V.:

Specializing in animal nutrition, Nutreco offers a broad portfolio of Feed Betaine products designed to improve feed efficiency and well-being in livestock.Kemin Industries, Inc.:

Kemin focuses on high-performance Feed Betaine solutions, investing in cutting-edge technology to meet evolving market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Betaine?

The global feed-betaine market is valued at approximately $500 million in 2023, with a projected compound annual growth rate (CAGR) of 7% through 2033, indicating significant growth in demand and application across various industries.

What are the key market players or companies in this feed Betaine industry?

Key players in the feed-betaine market include major companies specializing in feed additives, such as BASF, DuPont, and Kemin Industries. These companies dominate the market by providing innovative products to enhance animal health and performance.

What are the primary factors driving the growth in the feed Betaine industry?

The growth in the feed-betaine industry is driven by the increasing demand for high-quality animal feed, a focus on improving livestock health, and the rising awareness about feed efficiency. Furthermore, the expansion of the aquaculture sector significantly contributes to market growth.

Which region is the fastest Growing in the feed Betaine?

Europe is the fastest-growing region in the feed-betaine market, projected to grow from $166.70 million in 2023 to $334.14 million by 2033. North America also shows significant growth potential, reflecting increasing investments in innovative feed solutions.

Does ConsaInsights provide customized market report data for the feed Betaine industry?

Yes, ConsaInsights offers customized market report data for the feed-betaine industry, allowing clients to gain tailored insights based on specific requirements, market segments, or regional trends for more focused strategic planning.

What deliverables can I expect from this feed Betaine market research project?

From the feed-betaine market research project, you can expect detailed market analysis, competitive landscape evaluation, segmentation breakdown, regional insights, and growth forecasts, providing a comprehensive understanding of the current and future market conditions.

What are the market trends of feed Betaine?

Key trends in the feed-betaine market include increased adoption of natural feed ingredients, a shift towards sustainable aquaculture practices, and advancements in technology for feed formulation, indicating a robust future for this sector.