Feed Carotenoids Market Report

Published Date: 31 January 2026 | Report Code: feed-carotenoids

Feed Carotenoids Market Size, Share, Industry Trends and Forecast to 2033

This report provides insights into the Feed Carotenoids market, analyzing its growth trajectory from 2023 to 2033. It covers market size, CAGR, regional analysis, product performance, and the competitive landscape to equip stakeholders with vital information for strategic decision-making.

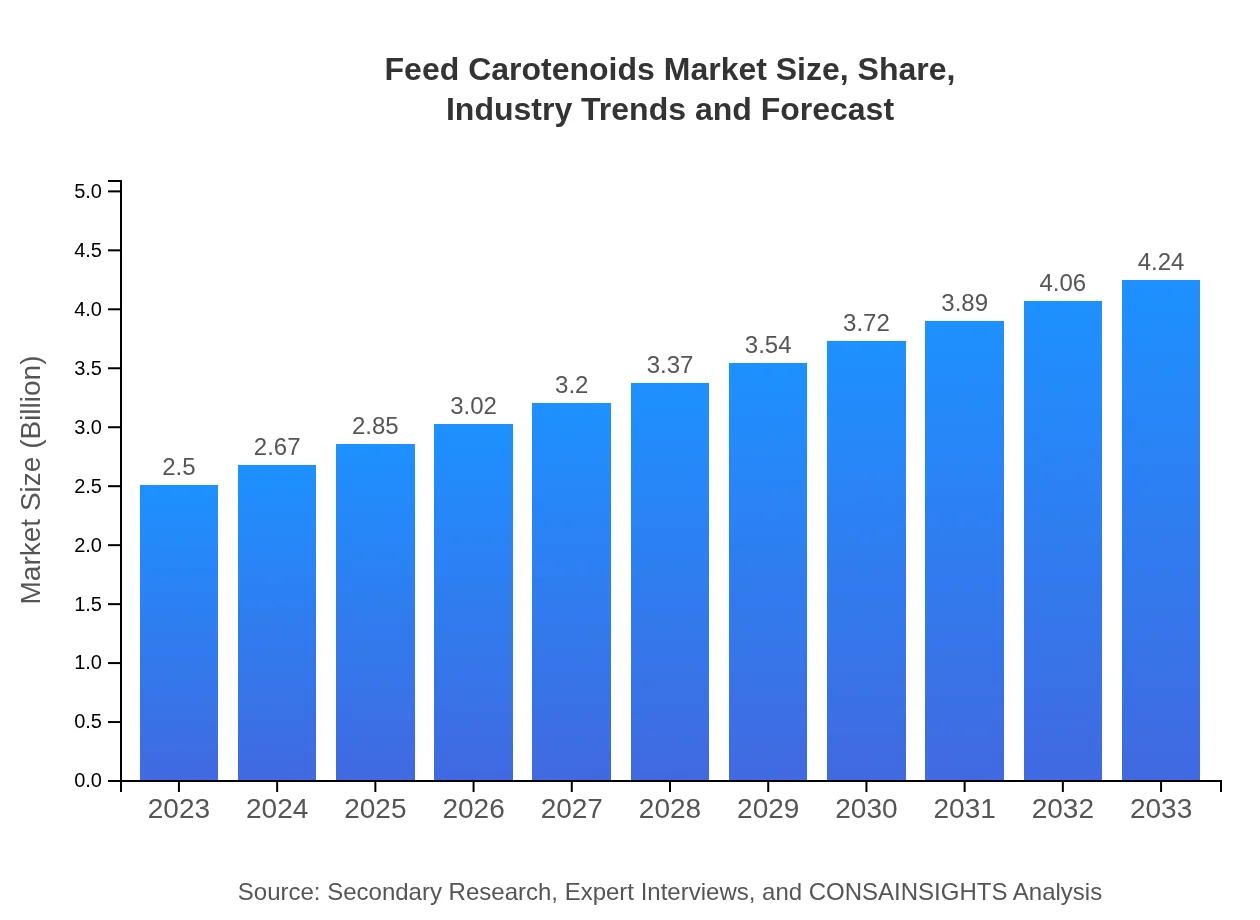

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $4.24 Billion |

| Top Companies | BASF SE, DSM Nutritional Products, Kemin Industries, Inc., Alltech, Nutreco N.V. |

| Last Modified Date | 31 January 2026 |

Feed Carotenoids Market Overview

Customize Feed Carotenoids Market Report market research report

- ✔ Get in-depth analysis of Feed Carotenoids market size, growth, and forecasts.

- ✔ Understand Feed Carotenoids's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Carotenoids

What is the Market Size & CAGR of Feed Carotenoids market in 2023?

Feed Carotenoids Industry Analysis

Feed Carotenoids Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Carotenoids Market Analysis Report by Region

Europe Feed Carotenoids Market Report:

Europe’s feed carotenoids market size is projected to increase from $0.69 billion in 2023 to $1.16 billion by 2033. The market growth is fueled by stringent regulations promoting the use of natural additives and increasing consumer awareness regarding sustainable farming practices.Asia Pacific Feed Carotenoids Market Report:

The Asia Pacific region is poised for notable growth in the feed carotenoids market, projected to reach $0.82 billion by 2033, up from $0.49 billion in 2023. Factors driving growth include an expanding aquaculture sector, increasing consumer demand for animal protein, and rising disposable incomes. Countries such as China and India are significant contributors to this growth.North America Feed Carotenoids Market Report:

North America is the largest market for feed carotenoids, expected to grow from $0.95 billion in 2023 to $1.61 billion by 2033. The presence of major livestock industries, advancements in agricultural technologies, and a strong regulatory framework supporting natural feed additives contribute to this growth.South America Feed Carotenoids Market Report:

In South America, the market is expected to grow from $0.20 billion in 2023 to $0.34 billion by 2033. Brazil's advanced agricultural sector and the increasing demand for sustainable livestock practices are key drivers of this growth, encouraging the adoption of feed carotenoids.Middle East & Africa Feed Carotenoids Market Report:

In the Middle East and Africa, the market is anticipated to escalate from $0.18 billion in 2023 to $0.30 billion by 2033. Demand for high-quality livestock products driven by population growth and urbanization is likely to boost the adoption of feed carotenoids in this region.Tell us your focus area and get a customized research report.

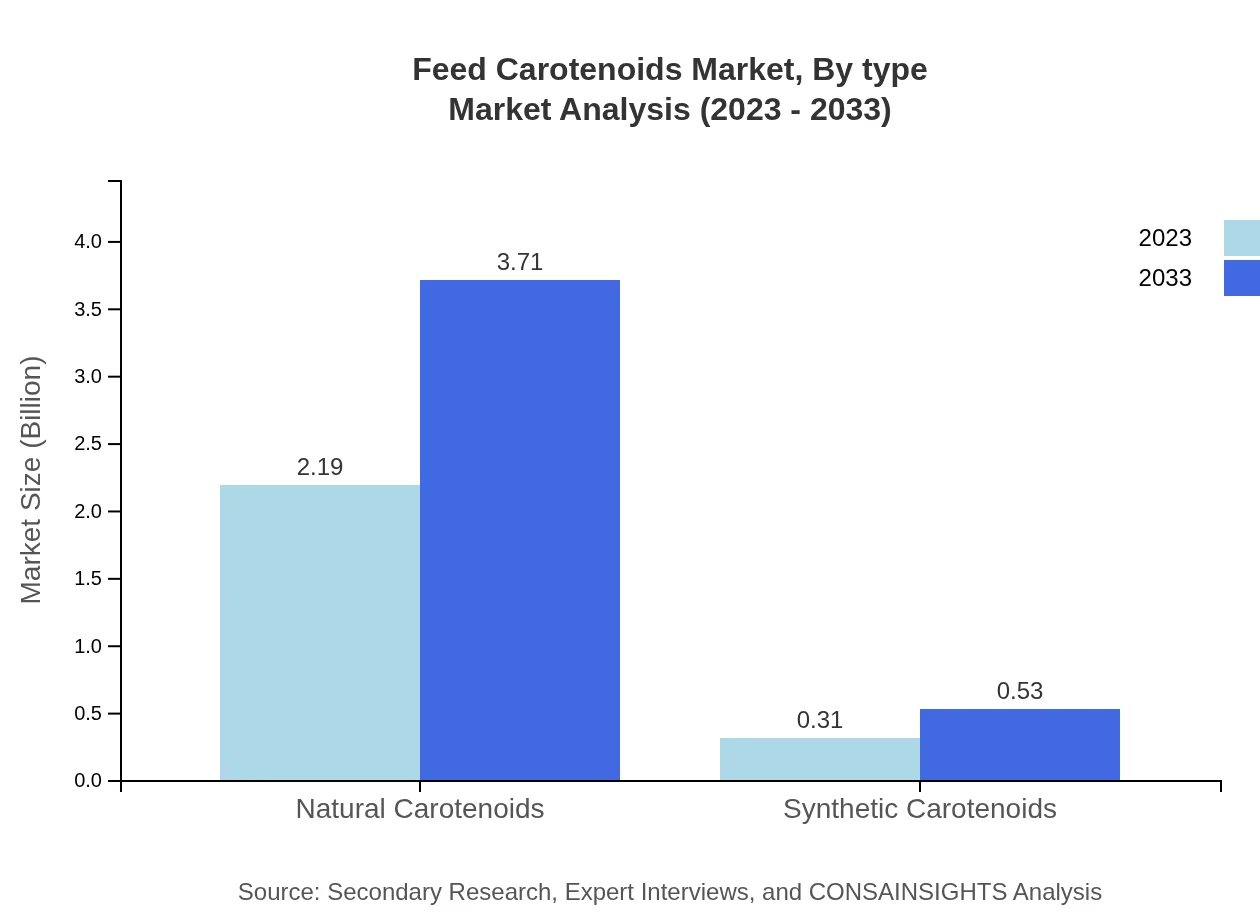

Feed Carotenoids Market Analysis By Type

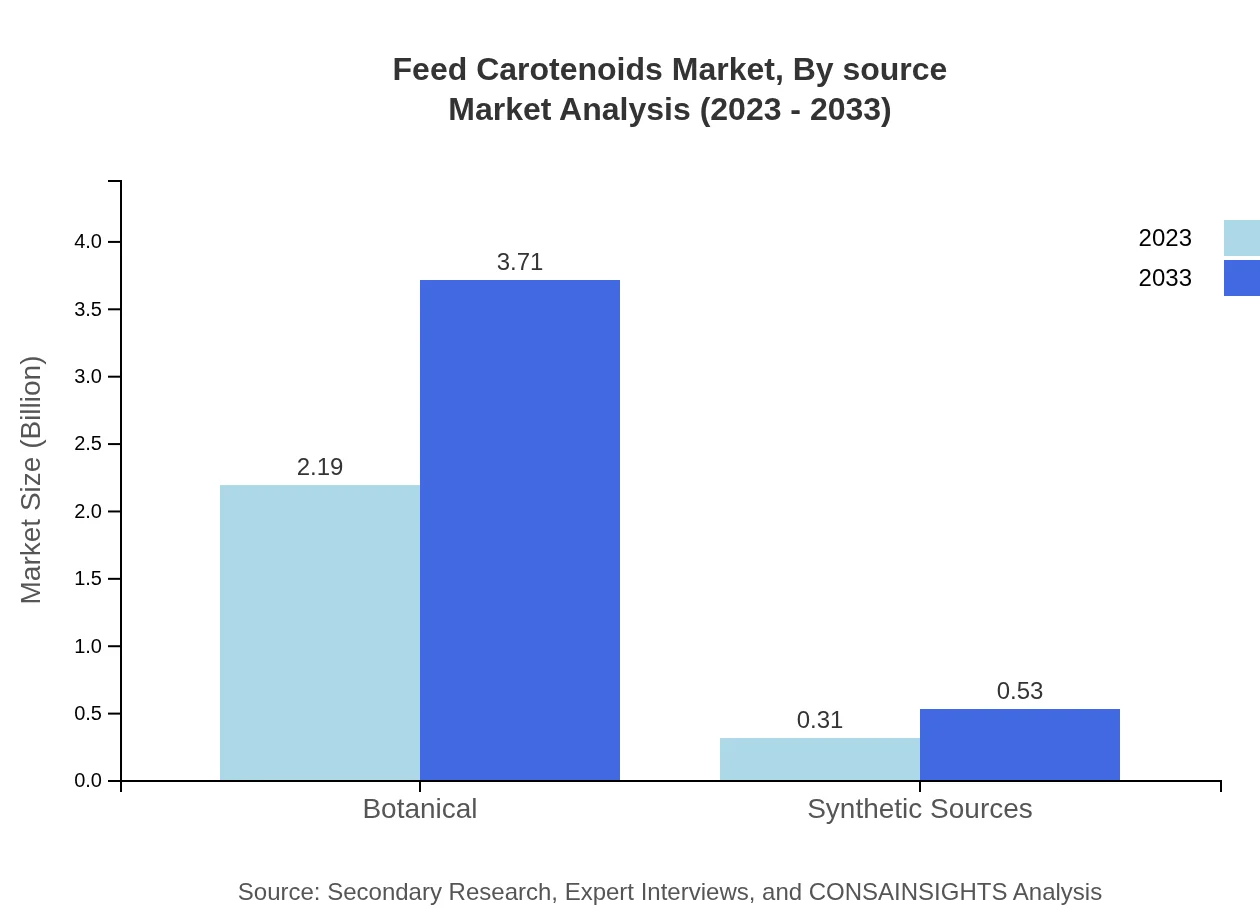

Natural carotenoids accounted for a dominant market share of 87.54% in 2023, with a market size of $2.19 billion. This segment is projected to reach $3.71 billion by 2033 due to the growing preference for natural ingredients in feed formulations. Synthetic carotenoids, however, represent a smaller segment, contributing 12.46% to the market in 2023, valued at $0.31 billion, expected to grow to $0.53 billion by 2033.

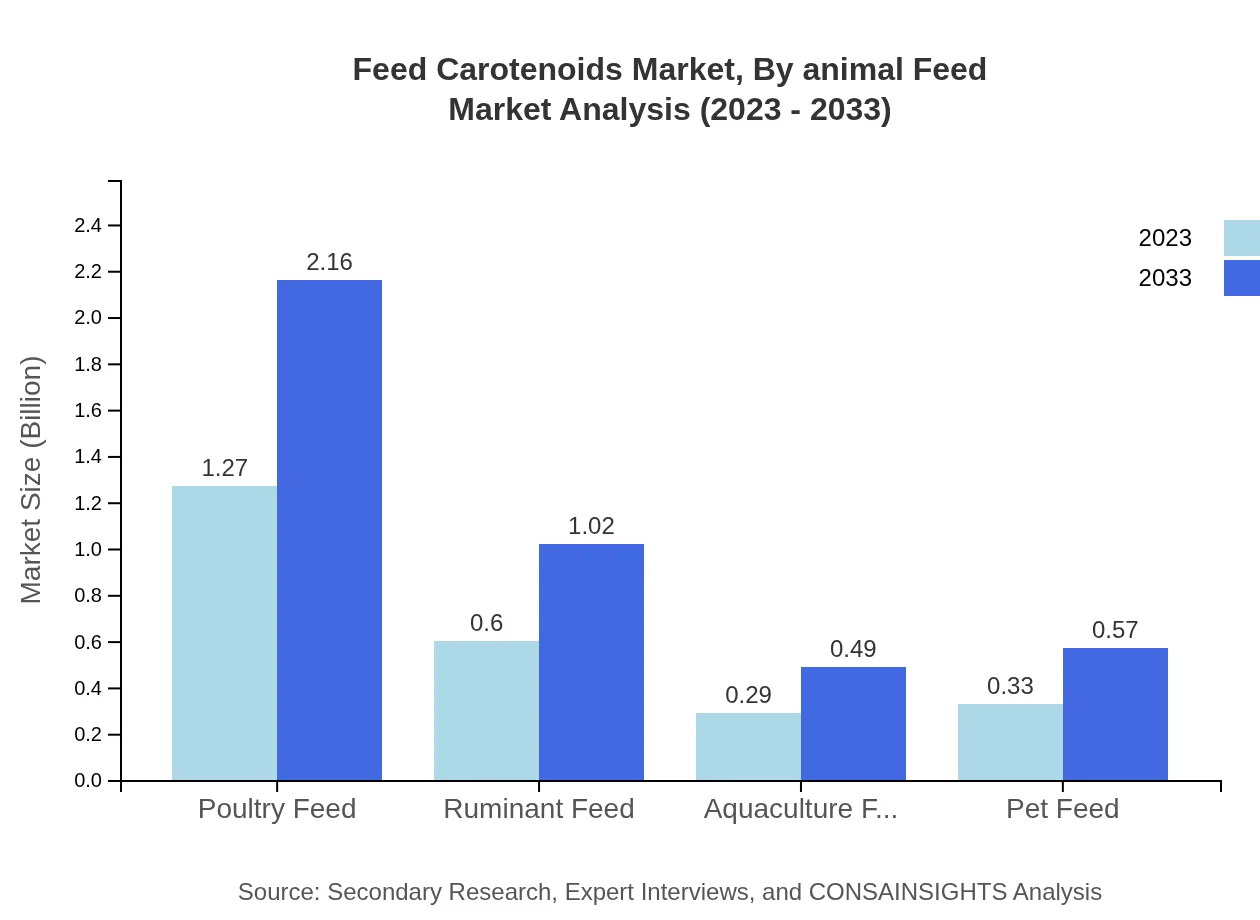

Feed Carotenoids Market Analysis By Animal Feed

The poultry feed segment is the largest within the market, valued at $1.27 billion in 2023 and projected to reach $2.16 billion by 2033. This segment's growth is driven by the increasing demand for high-quality poultry products. Ruminant feed is also significant, growing from $0.60 billion in 2023 to $1.02 billion by 2033, while aquaculture and pet feed are anticipated to grow steadily as well.

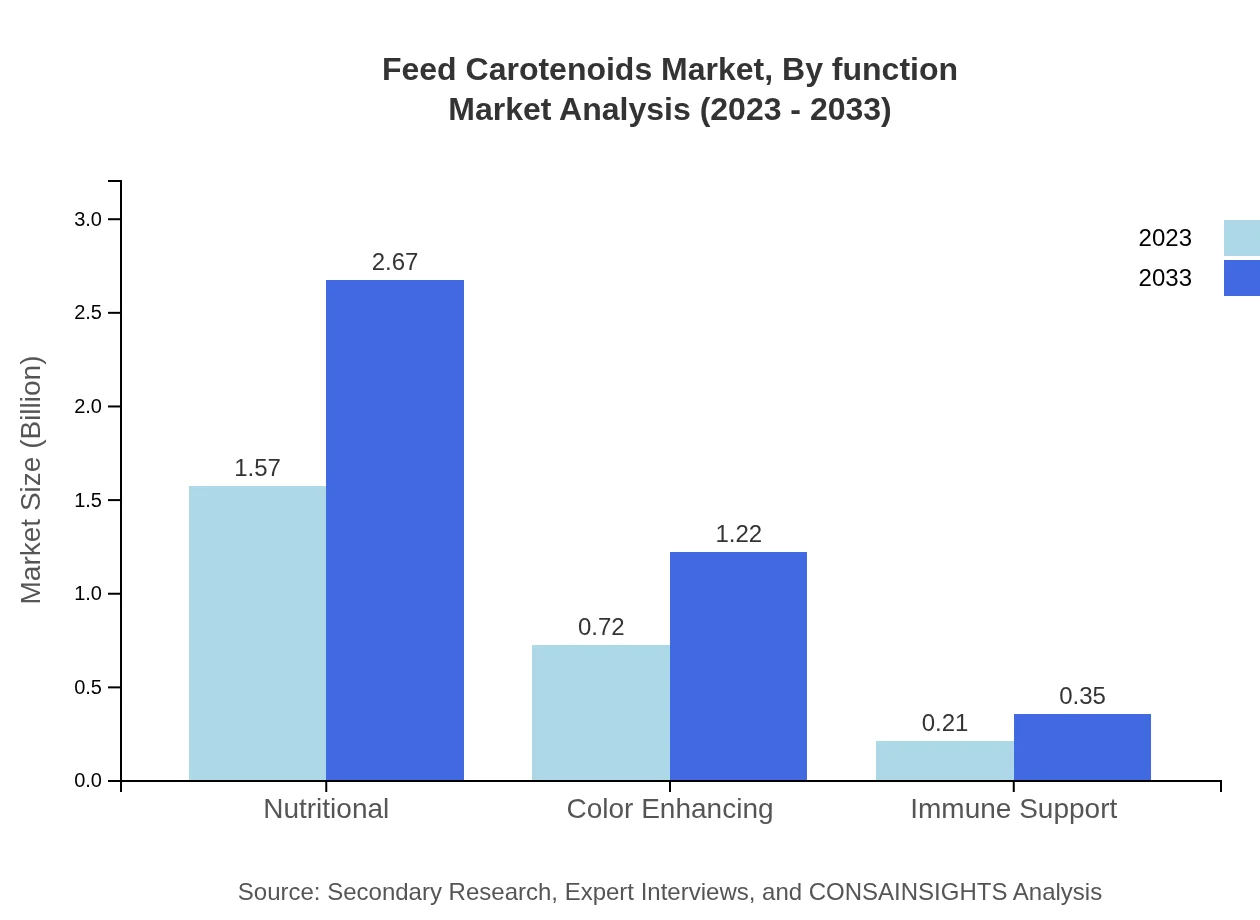

Feed Carotenoids Market Analysis By Function

Nutritional functions dominate the market, accounting for 62.94% market share valued at $1.57 billion in 2023, reaching $2.67 billion by 2033. Color-enhancing and immune-supporting functions also contribute, with respective market shares of 28.8% and 8.26%, valued at $0.72 billion and $0.21 billion in 2023.

Feed Carotenoids Market Analysis By Source

Natural carotenoids from botanical sources dominate the market due to consumer preference for natural ingredients, holding a market size of $2.19 billion in 2023. Synthetic sources comprise the remaining segment, valued at $0.31 billion in 2023, with a gradual increase expected in both segments by 2033.

Feed Carotenoids Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Carotenoids Industry

BASF SE:

A leading chemical company that offers a range of feed additives, including carotenoids, enhancing animal nutrition and health.DSM Nutritional Products:

A global player in nutritional science, DSM focuses on developing innovative feed additives, particularly in the area of carotenoids.Kemin Industries, Inc.:

Kemin enhances the nutritional value of animal feed with advanced carotenoid formulations, contributing to improved animal performance.Alltech:

A global leader in animal nutrition, Alltech offers innovative solutions, including carotenoid-rich feed additives for livestock.Nutreco N.V.:

Nutreco specializes in animal nutrition and aquafeed, developing sustainable carotenoid products to enrich feed.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Carotenoids?

The global feed-carotenoids market is valued at approximately $2.5 billion in 2023, with an expected CAGR of 5.3% from 2023 to 2033, indicating significant growth potential driven by rising demand in the animal feed sector.

What are the key market players or companies in the feed Carotenoids industry?

Key players in the feed-carotenoids market include major companies such as BASF SE, DSM Nutritional Products, and Ingredion Incorporated. These firms are pivotal in driving innovation and expanding product offerings within the industry.

What are the primary factors driving the growth in the feed Carotenoids industry?

The growth of the feed-carotenoids market is primarily driven by increasing consumer demand for natural feed additives, greater awareness of animal health, and the growing aquaculture and poultry industries, supported by advancements in nutritional science.

Which region is the fastest Growing in the feed Carotenoids market?

The fastest-growing region in the feed-carotenoids market is North America, with market size projected to increase from $0.95 billion in 2023 to $1.61 billion by 2033, reflecting a robust demand for nutrition-enhancing products in livestock.

Does ConsaInsights provide customized market report data for the feed Carotenoids industry?

Yes, ConsaInsights offers customized market report data tailored to the feed-carotenoids industry, ensuring businesses can obtain specific insights, trends, and projections that align with their research needs.

What deliverables can I expect from this feed Carotenoids market research project?

From the feed-carotenoids market research project, expect comprehensive deliverables including detailed market analysis, regional insights, competitive landscape reviews, and forecasts that facilitate informed strategic decision-making.

What are the market trends of feed Carotenoids?

Current trends in the feed-carotenoids market include a shift towards natural sources, increased demand for functional feeds, and significant growth in alternative aquaculture practices, enhancing nutritional profiles of animal feed.