Feed Fats And Proteins Market Report

Published Date: 02 February 2026 | Report Code: feed-fats-and-proteins

Feed Fats And Proteins Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Feed Fats and Proteins market, including market size, segmentation, and growth forecasts from 2023 to 2033. Key insights into regional markets, industry leaders, and emerging trends are also covered to furnish stakeholders with critical data for strategic decision-making.

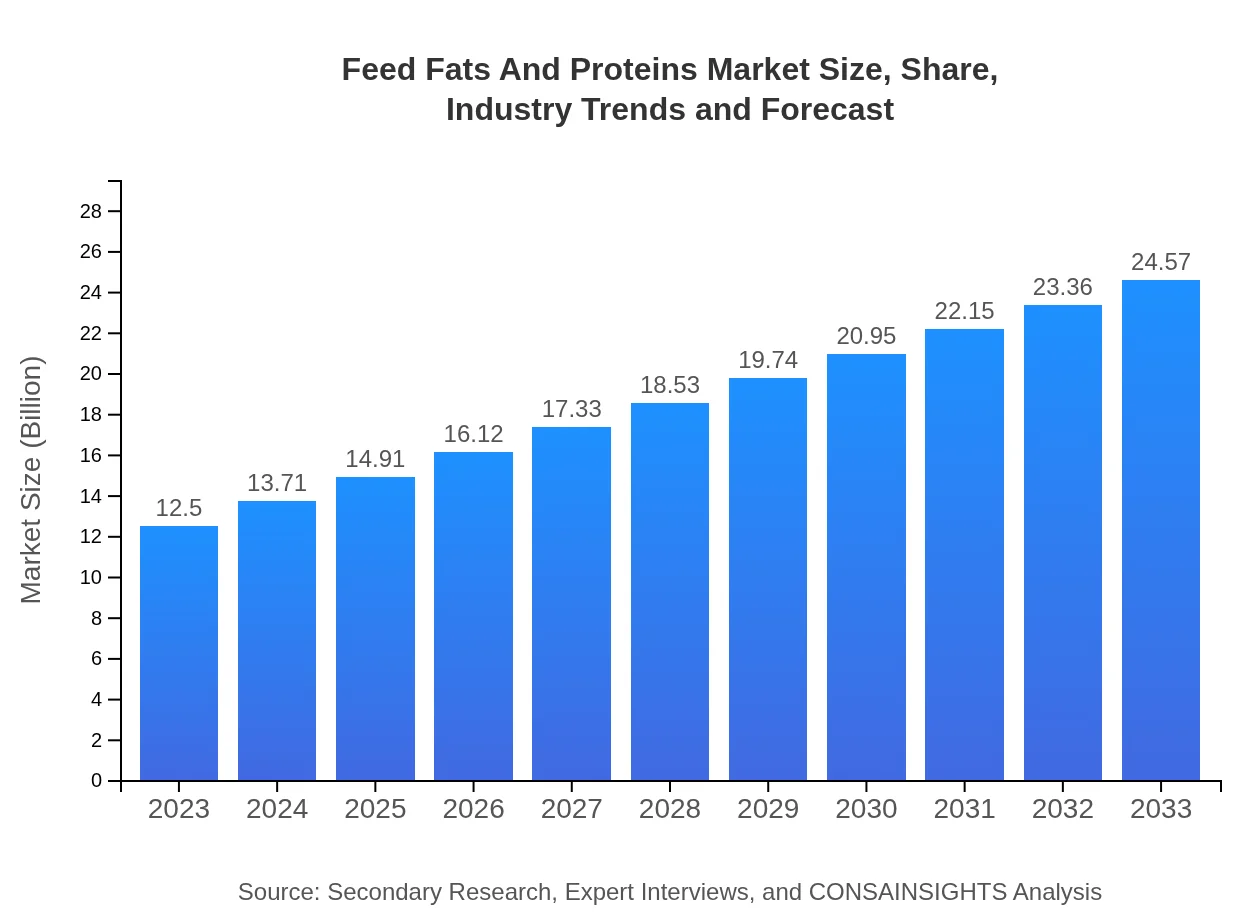

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Alltech, BASF SE, Nutreco N.V. |

| Last Modified Date | 02 February 2026 |

Feed Fats And Proteins Market Overview

Customize Feed Fats And Proteins Market Report market research report

- ✔ Get in-depth analysis of Feed Fats And Proteins market size, growth, and forecasts.

- ✔ Understand Feed Fats And Proteins's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Fats And Proteins

What is the Market Size & CAGR of Feed Fats And Proteins market in 2023?

Feed Fats And Proteins Industry Analysis

Feed Fats And Proteins Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Fats And Proteins Market Analysis Report by Region

Europe Feed Fats And Proteins Market Report:

Europe is set to experience considerable growth, with projections estimating the market will grow from 4.39 billion USD in 2023 to 8.63 billion USD by 2033. The shift towards organic farming and the stringent regulations surrounding animal feed quality drive this trend.Asia Pacific Feed Fats And Proteins Market Report:

The Asia Pacific region is anticipated to show a strong market presence, with an expected market size of 4.07 billion USD by 2033, up from 2.07 billion USD in 2023. This region's growth is largely attributed to population growth, increased meat consumption, and rising preferences for nutritionally-balanced feed solutions in countries like China and India.North America Feed Fats And Proteins Market Report:

North America holds a significant portion of the market, with sizes estimated at 4.24 billion USD in 2023 and 8.33 billion USD by 2033. The region's advanced agricultural infrastructure and high demand for premium meat products contribute to its robust growth forecast.South America Feed Fats And Proteins Market Report:

South America is projected to expand its market from 0.77 billion USD in 2023 to 1.51 billion USD by 2033. The rising adoption of advanced farming techniques and animal nutrition awareness are key drivers behind this growth in countries like Brazil and Argentina.Middle East & Africa Feed Fats And Proteins Market Report:

The Middle East and Africa market is expected to rise from 1.03 billion USD in 2023 to approximately 2.03 billion USD by 2033. Growth factors include the increasing livestock population and the adoption of modern livestock rearing practices.Tell us your focus area and get a customized research report.

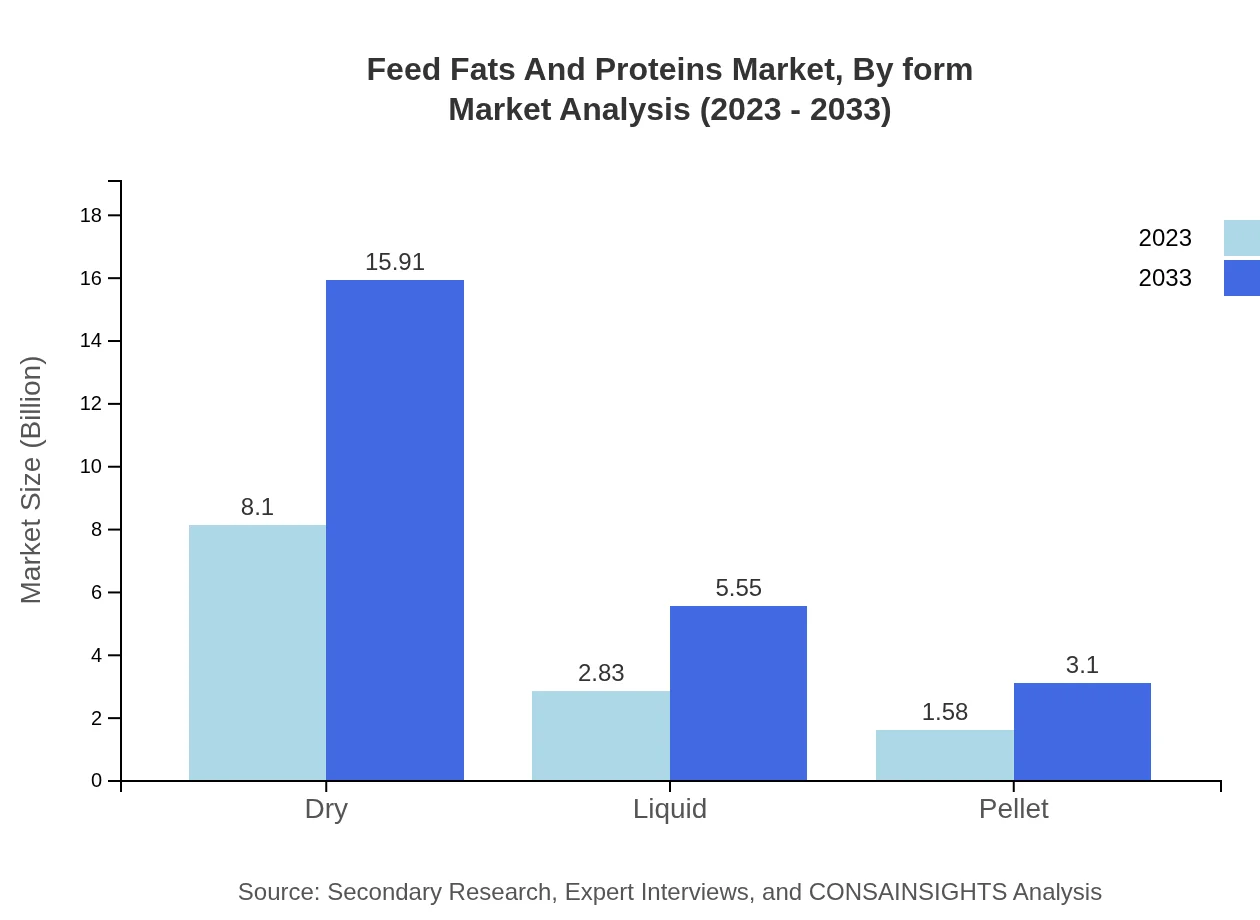

Feed Fats And Proteins Market Analysis By Type

The market is segmented by type into Dry, Liquid, and Pellet forms. The Dry category is projected to significantly dominate the market, growing from 8.10 billion USD in 2023 to 15.91 billion USD by 2033, maintaining a share of approximately 64.77%. Liquid forms are expected to grow from 2.83 billion USD to 5.55 billion USD during the same period, holding around 22.6% of the market share. Pellet forms are anticipated to increase from 1.58 billion USD to 3.10 billion USD, representing 12.63% of the market.

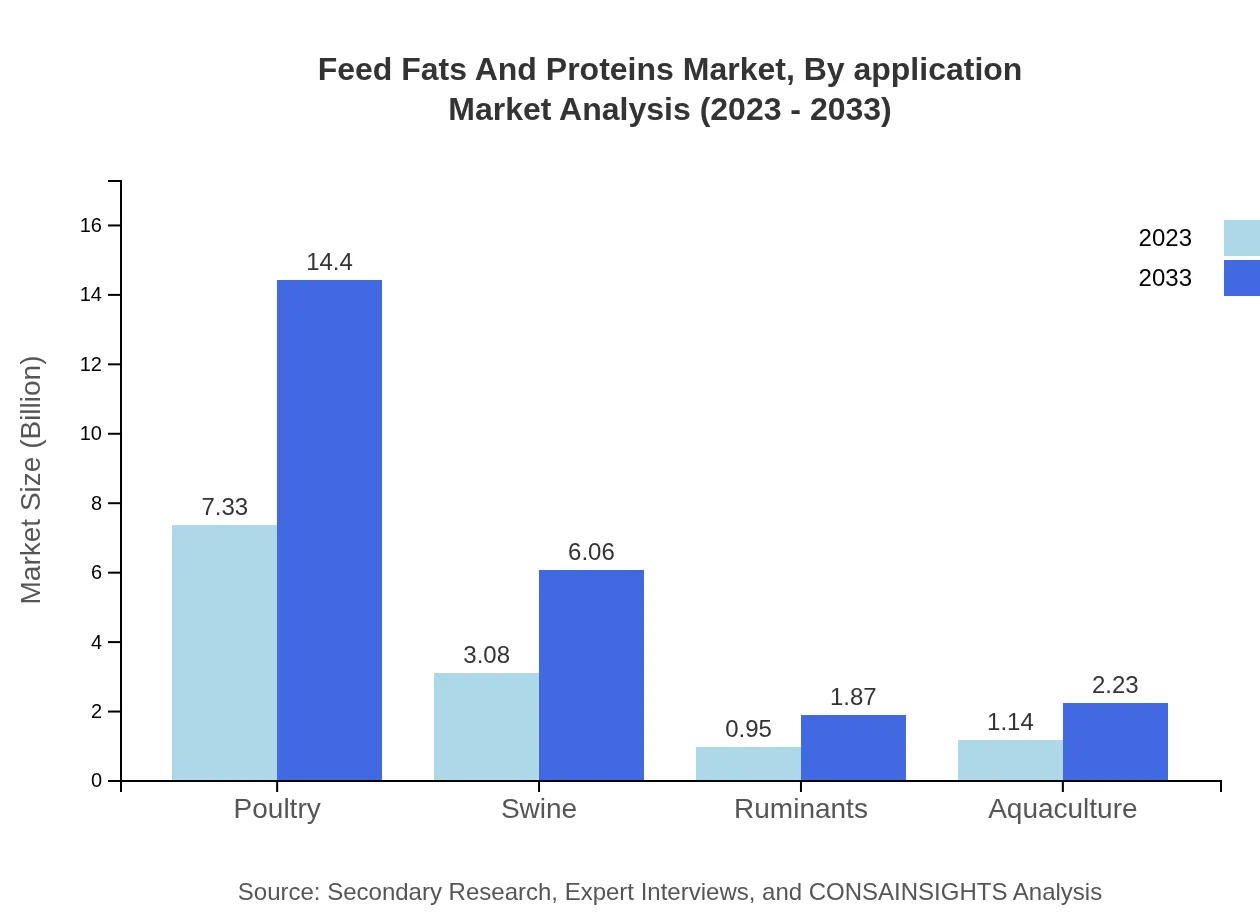

Feed Fats And Proteins Market Analysis By Application

Application segmentation includes Poultry, Swine, Ruminants, and Aquaculture. Poultry is likely to stay the largest segment, expanding from 7.33 billion USD in 2023 to 14.40 billion USD by 2033. Significant growth is also expected in the Swine sector, which will rise from 3.08 billion USD to 6.06 billion USD, while Ruminants and Aquaculture will also experience growth, albeit at a slower pace.

Feed Fats And Proteins Market Analysis By Form

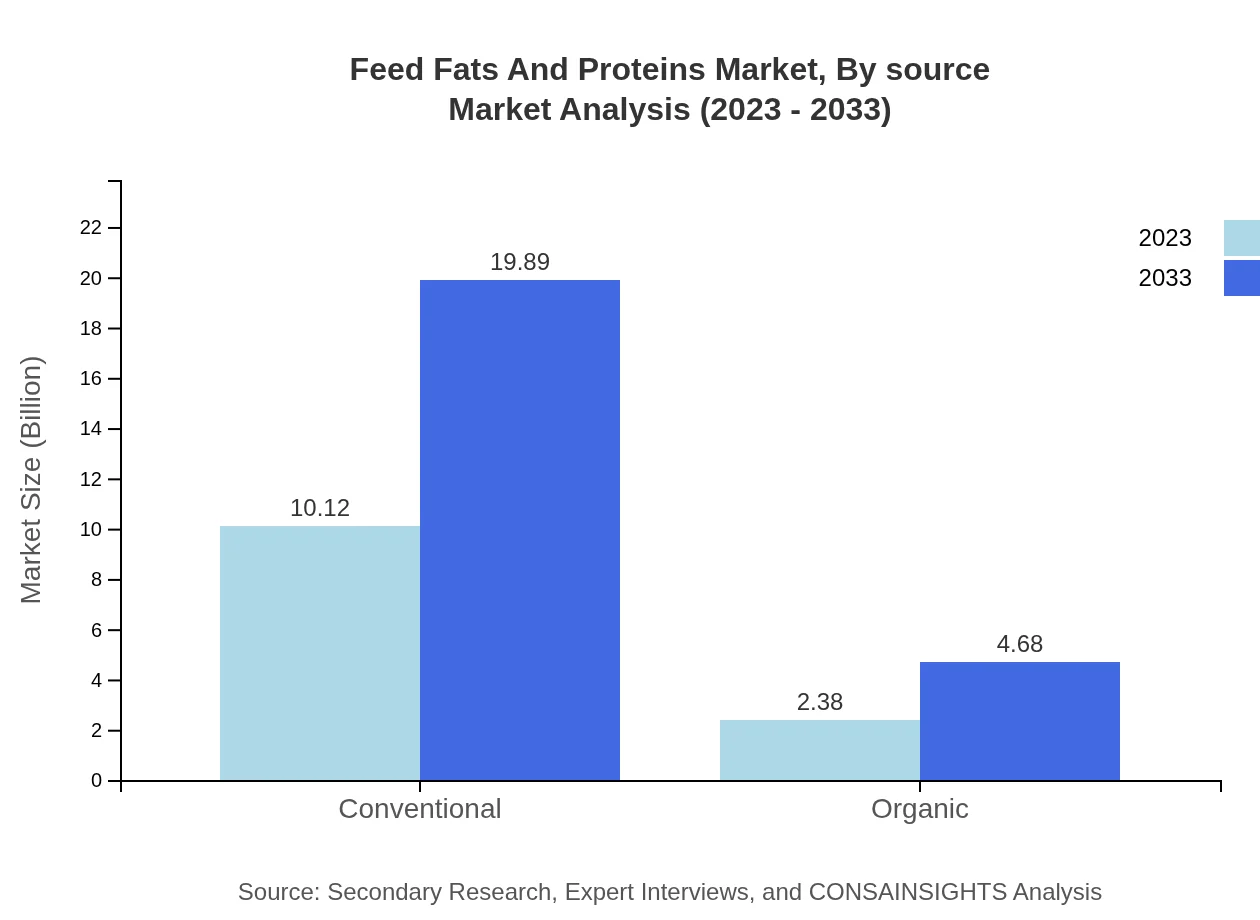

Feed Fats and Proteins are available in various forms, including conventional and organic. The conventional segment currently leads the market size, estimated at 10.12 billion USD in 2023, and is expected to grow to 19.89 billion USD by 2033, holding a share of 80.94%. Organic products, while smaller, are growing significantly from 2.38 billion USD to 4.68 billion USD (19.06% share).

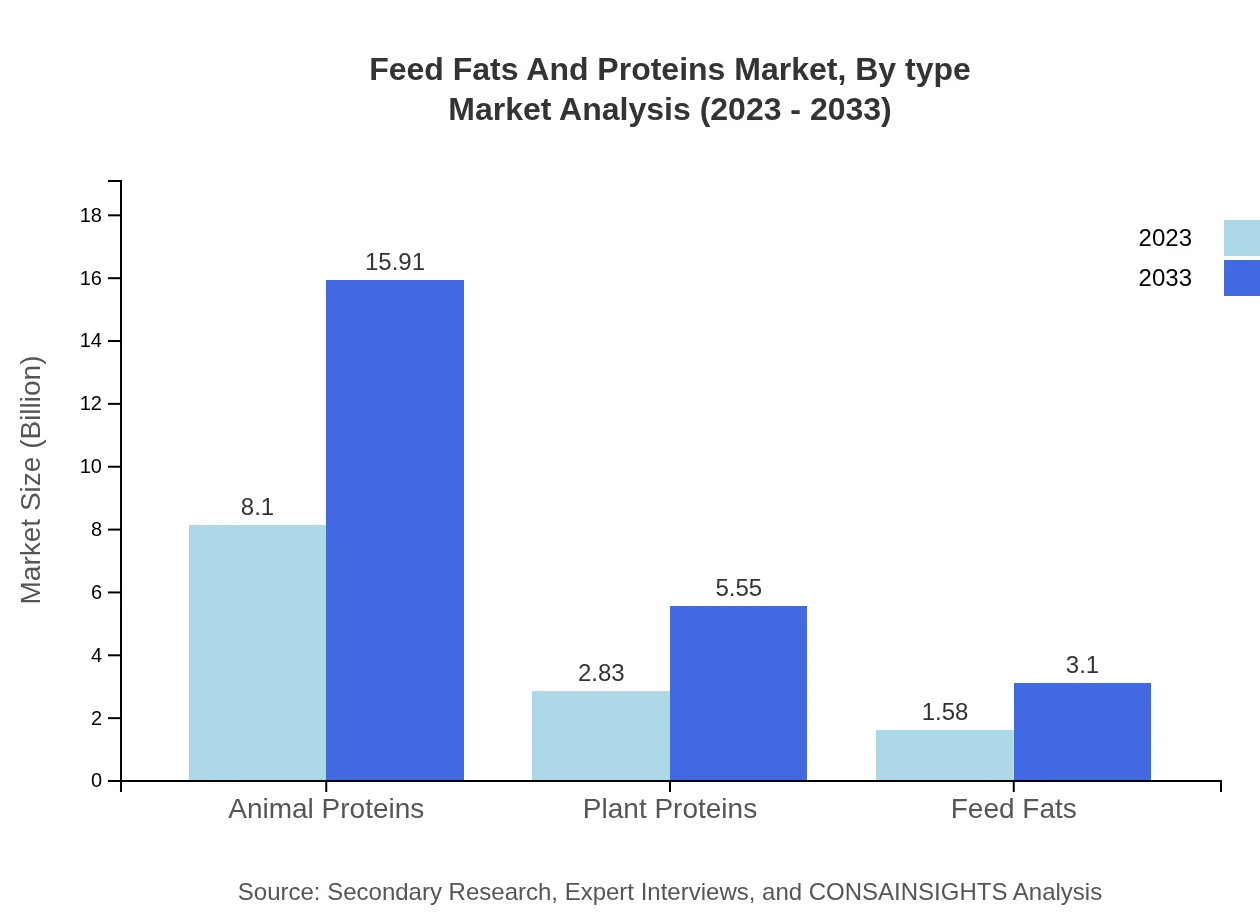

Feed Fats And Proteins Market Analysis By Source

The source segmentation reveals the top contributors as Animal Proteins and Plant Proteins. The Animal Proteins segment is expected to maintain its dominance, estimated to capture 64.77% of the market share, with a projected size of 8.10 billion USD in 2023, reaching 15.91 billion USD in 2033. Plant Proteins are also predicted to increase from 2.83 billion USD to 5.55 billion USD, marking significant growth within the industry.

Feed Fats And Proteins Market Analysis By Nutrient Content

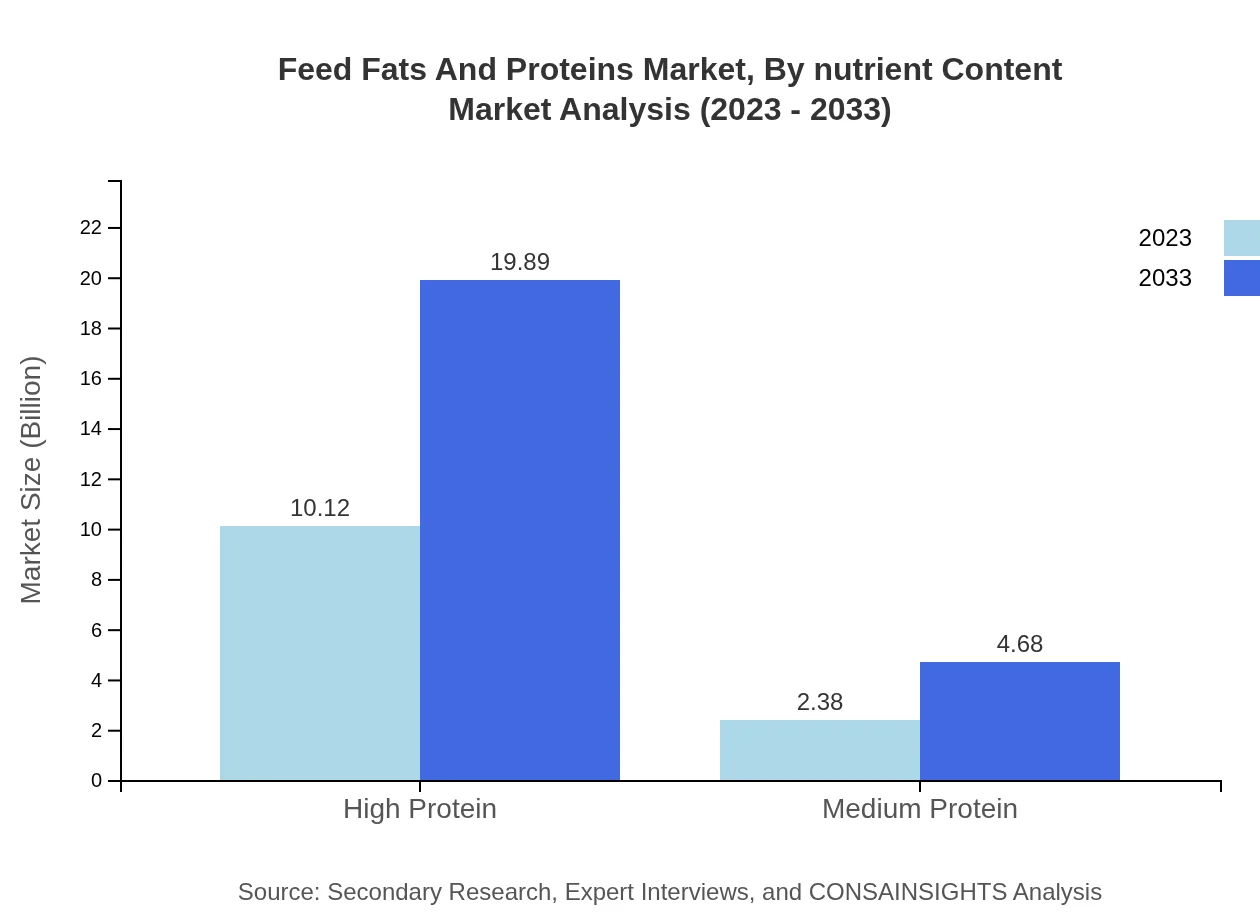

High Protein content products currently account for about 80.94% of the Feed Fats and Proteins market. This segment, valued at approximately 10.12 billion USD in 2023, is expected to show the greatest growth potential, reaching 19.89 billion USD by 2033. Conversely, Medium Protein content is projected to experience steady growth from 2.38 billion USD to 4.68 billion USD, capturing a relevant share of 19.06%.

Feed Fats And Proteins Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Fats And Proteins Industry

Cargill, Incorporated:

Cargill is a global leader in animal nutrition, providing high-quality feed ingredients and supplements. The company's innovative nutrient solutions significantly enhance livestock health and growth performance.Archer Daniels Midland Company (ADM):

ADM is a prominent player in the feed fats and proteins market, delivering a range of products designed to optimize animal nutrition. Their extensive R&D efforts focus on sustainable practices and nutritional efficacy.Alltech:

Alltech specializes in developing nutritional solutions for the livestock industry, focusing on innovation and natural alternatives. Their products are recognized for improving feed quality and animal health.BASF SE:

BASF's Animal Nutrition division offers a wide array of feed additives and nutritional supplements, aimed at enhancing feed efficiency and animal growth rates.Nutreco N.V.:

Nutreco provides innovative feed solutions tailored to the specific needs of various animal species, focusing extensively on sustainability and nutrition.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Fats And Proteins?

The global feed fats and proteins market is valued at approximately $12.5 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6.8%, reaching significant growth by 2033.

What are the key market players or companies in the feed Fats And Proteins industry?

Key players in the feed fats and proteins industry include prominent companies specializing in animal nutrition and feed production, striving to enhance feed efficiency and sustainability.

What are the primary factors driving the growth in the feed Fats And Proteins industry?

The growth in the feed fats and proteins market is driven by rising demand for high-quality animal feed, the expansion of aquaculture, and increasing livestock production to meet global protein consumption.

Which region is the fastest Growing in the feed Fats And Proteins?

The fastest-growing region is Europe, where the market is expected to grow from $4.39 billion in 2023 to $8.63 billion by 2033, reflecting substantial investment in feed technologies.

Does ConsaInsights provide customized market report data for the feed Fats And Proteins industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the feed fats and proteins industry, providing detailed insights and analyses.

What deliverables can I expect from this feed Fats And Proteins market research project?

Deliverables include comprehensive market analysis reports, segment data, regional insights, and forecasts to support strategic decision-making in the feed fats and proteins sector.

What are the market trends of feed Fats And Proteins?

Trends include increasing adoption of organic feed options, rising demand for high-protein formulations, and a shift towards sustainable sourcing of raw materials in feed production.