Feed Flavors And Sweeteners Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in‐depth analysis of the Feed Flavors And Sweeteners market, offering valuable insights into market trends, technology advancements, segmentation, regional dynamics, and key players. Covering forecast data from 2024 to 2033, the report details the market size, growth drivers, and challenges, enabling strategic decision-making for industry stakeholders.

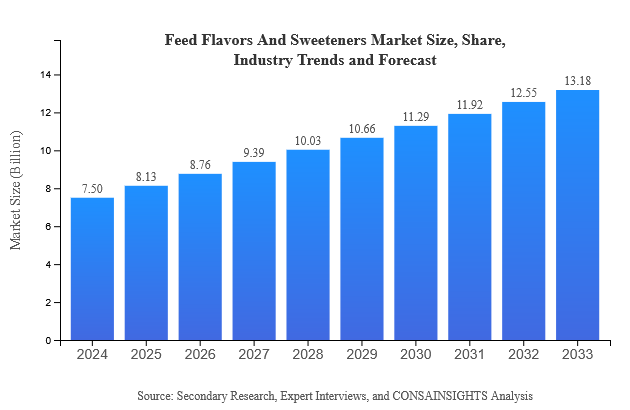

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $7.50 Billion |

| CAGR (2024-2033) | 6.3% |

| 2033 Market Size | $13.18 Billion |

| Top Companies | Global FeedTech Industries, NutriFlavor Solutions, AgriTaste Corporation |

| Last Modified Date | 25 February 2025 |

Feed Flavors And Sweeteners Market Overview

What is the Market Size & CAGR of Feed Flavors And Sweeteners market in 2024?

Feed Flavors And Sweeteners Industry Analysis

Feed Flavors And Sweeteners Market Segmentation and Scope

Request a custom research report for industry.

Feed Flavors And Sweeteners Market Analysis Report by Region

Europe Feed Flavors And Sweeteners:

Europe’s market is evolving steadily, with growth figures rising from 2.03 in 2024 to 3.56 in 2033. The region is witnessing a shift towards cleaner labels and natural ingredients, which in turn supports the integration of advanced feed formulations aimed at improving animal health and product performance.Asia Pacific Feed Flavors And Sweeteners:

In Asia Pacific, the market is witnessing significant growth as feed manufacturers adopt advanced technologies to improve production quality and meet rising demand. The region’s market size is projected to rise from 1.57 in 2024 to 2.75 in 2033, driven by expanding agricultural activities, increased livestock production, and investment in sustainable technologies.North America Feed Flavors And Sweeteners:

North America continues to be an influential market with a projected increase from 2.45 in 2024 to 4.30 in 2033. Advanced research, high adoption of innovative technologies, and a focus on quality standards are driving the growth, alongside supportive regulatory frameworks that foster industry expansion.South America Feed Flavors And Sweeteners:

South America remains a vital market due to its strong agricultural base and growing livestock sector. With market sizes growing from 0.70 in 2024 to 1.24 in 2033, this region is capitalizing on modern feed production techniques and an increasing focus on nutrition and productivity.Middle East & Africa Feed Flavors And Sweeteners:

In the Middle East and Africa, the market is anticipated to grow from 0.75 in 2024 to 1.33 in 2033. Factors such as population growth, urbanization, and initiatives to boost food security are prompting investments in advanced feed technologies, thereby enhancing overall market viability.Request a custom research report for industry.

Feed Flavors And Sweeteners Market Analysis By Type

Global Feed Flavors and Sweeteners Market, By Type Market Analysis (2024 - 2033)

The by-type segmentation divides the market into natural and synthetic flavors and sweeteners. Natural flavors and sweeteners, which held a dominant share of 82.26% in 2024 and are expected to maintain their prominence through 2033, are favored for their perceived health benefits and natural sourcing. In contrast, synthetic flavors, accounting for 17.74% of the market, cater to specific formulation requirements and cost considerations. This segmentation reflects the consumer shift towards high-quality, naturally derived products. Companies are focusing on innovative extraction and production techniques to enhance the performance and appeal of both natural and synthetic offerings, ensuring customized solutions that meet final product specifications and regulatory guidelines.

Feed Flavors And Sweeteners Market Analysis By Application

Global Feed Flavors and Sweeteners Market, By Application Market Analysis (2024 - 2033)

Application-based segmentation is crucial for understanding the diverse needs within the feed industry. Key applications include categories such as feed manufacturers, livestock farmers, and pet owners. Feed manufacturers, who represent 65.03% of the market share, leverage advanced formulations to improve both efficiency and product consistency. Livestock farmers, constituting 21.99%, benefit from improved animal nutrition and performance outcomes, while the pet owners segment, with 12.98%, drives innovation in pet-specific feed formulations. Each application segment requires tailored solutions that address unique production challenges, regulatory requirements, and consumer expectations relating to quality and nutritional benefits.

Feed Flavors And Sweeteners Market Analysis By Functionality

Global Feed Flavors and Sweeteners Market, By Functionality Market Analysis (2024 - 2033)

Functionality in feed additives is typically segmented into palatability enhancers, nutritional improvement agents, and shelf-life extenders. Palatability enhancers lead the functionality segment with a dominant share of 65.03%, reflecting the critical need to improve feed acceptance among animals. Nutritional improvement additives, accounting for 21.99%, are designed to augment the health benefits of feed, ensuring enhanced performance and growth. Shelf-life extenders, making up 12.98% of the share, are vital in preserving product integrity during storage and transportation. Each functionality segment is continuously evolving, with companies investing in research to develop solutions that maximize feed efficiency and meet evolving market demands.

Feed Flavors And Sweeteners Market Analysis By Form

Global Feed Flavors and Sweeteners Market, By Form Market Analysis (2024 - 2033)

The market by form is categorized into liquid, powder, and granular forms. Liquid formulations, which are forecast to grow from a size of 4.88 in 2024 to 8.57 in 2033 while maintaining a share of 65.03%, are popular due to their ease of blending and quick integration into feed mixes. Powder forms, representing 21.99% of the market share, are valued for their stability and convenience in storage. Granular forms, though smaller with a share of 12.98%, offer benefits in terms of controlled release of flavor and sweetness. Continuous improvements in formulation technology are enabling producers to address specific application requirements and optimize overall performance.

Feed Flavors And Sweeteners Market Analysis By End User

Global Feed Flavors and Sweeteners Market, By End-User Market Analysis (2024 - 2033)

End-user segmentation breaks down the market into feed manufacturers, livestock farmers, and other categories such as poultry, swine, aquaculture, and pet food sectors. Feed manufacturers lead significantly, reflecting a concentration of industrial demand. Livestock farmers and specialized segments such as poultry and swine are driving innovation through the adoption of advanced, nutritional formulations. The diverse range of end-users necessitates a tailored approach to product development and marketing strategies. As consumer awareness regarding animal feed quality increases, end-users are demanding products with consistent quality, improved nutritional profiles, and enhanced safety standards, prompting manufacturers to continuously innovate and adapt.

Feed Flavors And Sweeteners Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Feed Flavors And Sweeteners Industry

Global FeedTech Industries:

A pioneer in integrated feed solutions, Global FeedTech Industries leads the market by providing innovative flavor and sweetener formulations that enhance animal feed performance and sustainability.NutriFlavor Solutions:

NutriFlavor Solutions focuses on research-driven innovations, delivering high-quality natural and synthetic flavor additives. Their cutting-edge solutions help optimize feed efficiency and ensure consistent product quality globally.AgriTaste Corporation:

AgriTaste Corporation is renowned for its balanced portfolio in both natural and synthetic feed additives, offering customized solutions designed to boost palatability and nutritional performance across diverse animal segments.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of feed Flavors And Sweeteners?

The global Feed Flavors and Sweeteners market is projected to reach approximately $7.5 billion by 2024, with a CAGR of 6.3% anticipated through 2033. This growth reflects increasing demand across various segments of the feed industry.

What are the key market players or companies in this feed Flavors And Sweeteners industry?

Key market players in the Feed Flavors and Sweeteners sector include prominent manufacturers focused on developing innovative flavoring solutions to enhance livestock and pet feed, fostering competitive innovation and market growth.

What are the primary factors driving the growth in the feed Flavors And Sweeteners industry?

Driving factors include increasing demand for quality livestock products, trends towards enhancing feed palatability, and the rise in aquaculture and pet food markets. These elements are propelling market expansion.

Which region is the fastest Growing in the feed Flavors And Sweeteners?

North America is the fastest-growing region for feed flavors and sweeteners, projected to grow from $2.45 billion in 2024 to $4.30 billion by 2033, influenced by its advanced livestock industry and feed production techniques.

Does ConsaInsights provide customized market report data for the feed Flavors And Sweeteners industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the Feed Flavors and Sweeteners industry, enabling businesses to make informed decisions based on specific market needs.

What deliverables can I expect from this feed Flavors And Sweeteners market research project?

Deliverables from this research project will include comprehensive market analysis, segment insights, trend forecasts, and strategic recommendations, equipping stakeholders with actionable intelligence in the Feed Flavors and Sweeteners market.

What are the market trends of feed Flavors And Sweeteners?

Emerging trends include an increasing emphasis on natural flavors, sustainability in sourcing and production, and innovative formulations aimed at improving animal nutrition and product appeal in the feed and pet food sectors.