Feed Grade Vitamin A Market Report

Published Date: 02 February 2026 | Report Code: feed-grade-vitamin-a

Feed Grade Vitamin A Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers the Feed Grade Vitamin A industry, offering insights and data from 2023 to 2033, including market size, trends, segment analysis, and regional growth patterns.

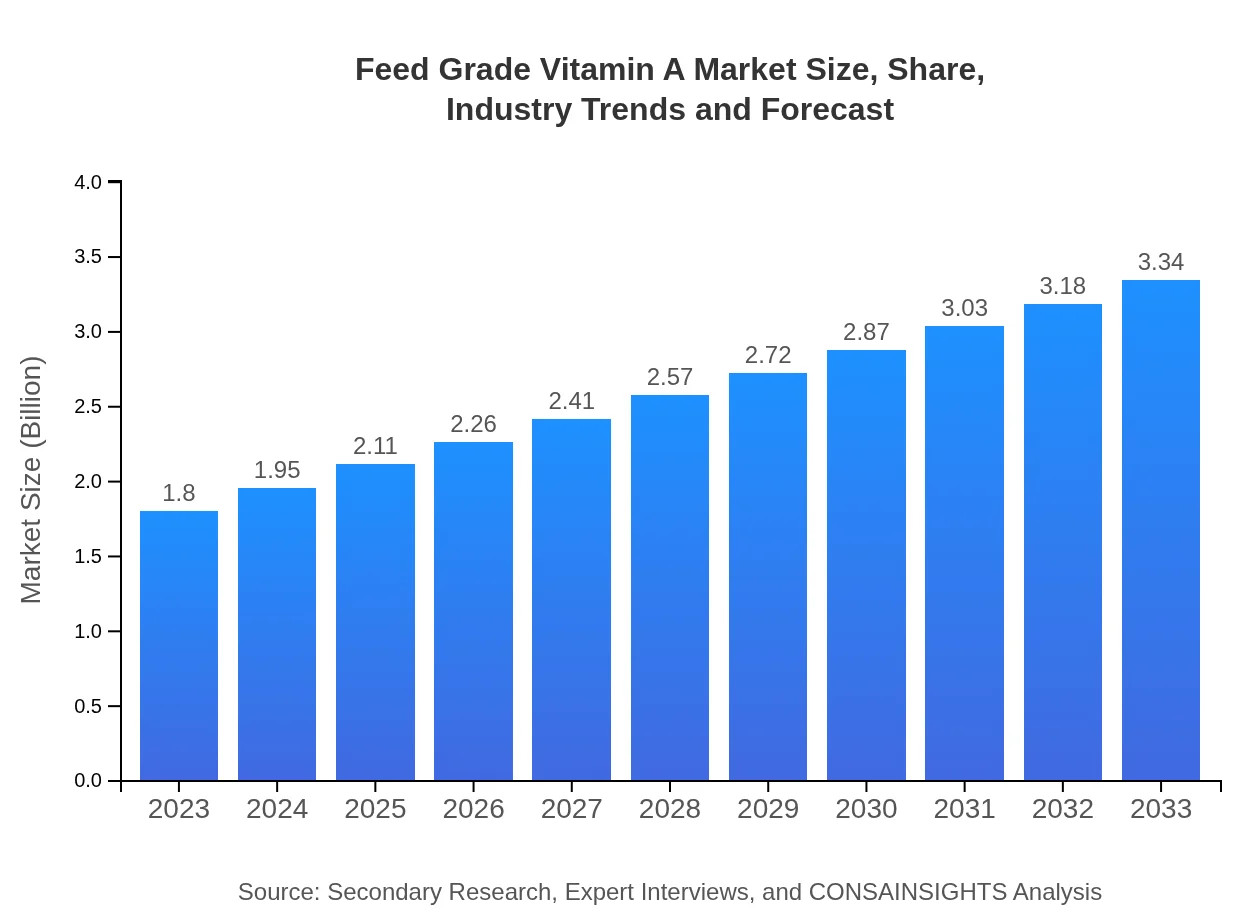

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | BASF SE, DSM Nutritional Products, Adisseo |

| Last Modified Date | 02 February 2026 |

Feed Grade Vitamin A Market Overview

Customize Feed Grade Vitamin A Market Report market research report

- ✔ Get in-depth analysis of Feed Grade Vitamin A market size, growth, and forecasts.

- ✔ Understand Feed Grade Vitamin A's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Grade Vitamin A

What is the Market Size & CAGR of Feed Grade Vitamin A market in 2023?

Feed Grade Vitamin A Industry Analysis

Feed Grade Vitamin A Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Grade Vitamin A Market Analysis Report by Region

Europe Feed Grade Vitamin A Market Report:

The European market for Feed Grade Vitamin A will grow from USD 0.50 billion in 2023 to USD 0.93 billion by 2033. Increasing governmental regulations related to animal welfare and nutrition are influencing the market, alongside a growing trend towards organic farming.Asia Pacific Feed Grade Vitamin A Market Report:

The Asia Pacific region is projected to grow from USD 0.35 billion in 2023 to USD 0.66 billion by 2033, driven by rapid growth in livestock production and increasing demand for high-quality meat products. Countries like China and India lead in consumption, supported by rising disposable incomes and changing dietary patterns.North America Feed Grade Vitamin A Market Report:

In North America, the market is anticipated to increase from USD 0.65 billion in 2023 to USD 1.20 billion by 2033. The region benefits from advanced agricultural practices, significant investment in aquaculture, and a high demand for efficient feed products for livestock.South America Feed Grade Vitamin A Market Report:

The South American market is expected to grow from USD 0.05 billion in 2023 to USD 0.09 billion by 2033. Brazil, being a major player in the global meat industry, is focusing on integrating advanced nutritional additives into animal feed, which will stimulate growth in the region.Middle East & Africa Feed Grade Vitamin A Market Report:

The Middle East and Africa market is set to grow from USD 0.24 billion in 2023 to USD 0.45 billion by 2033 as the demand for feed additives rises in developing countries, driven by the need for enhanced production efficiency in both livestock and aquaculture sectors.Tell us your focus area and get a customized research report.

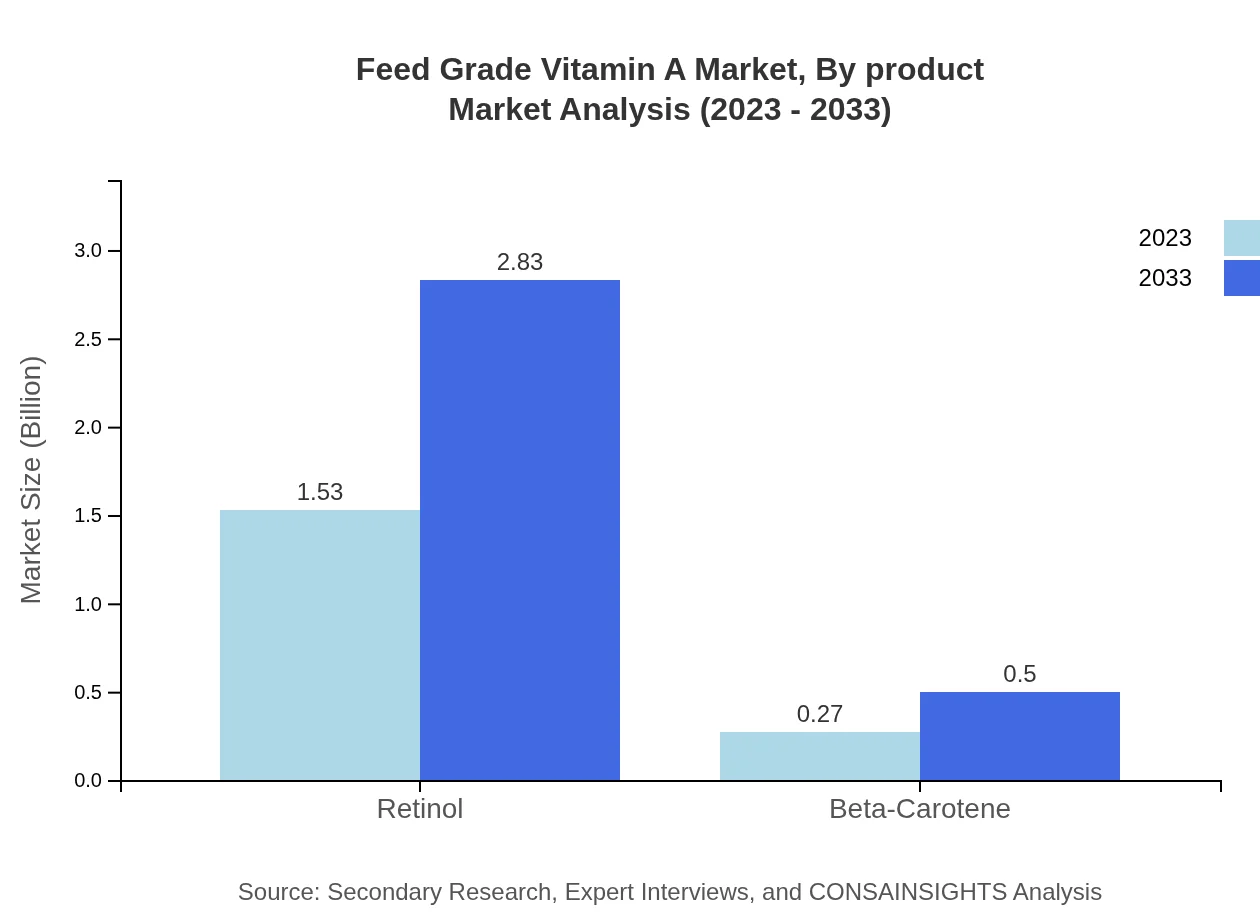

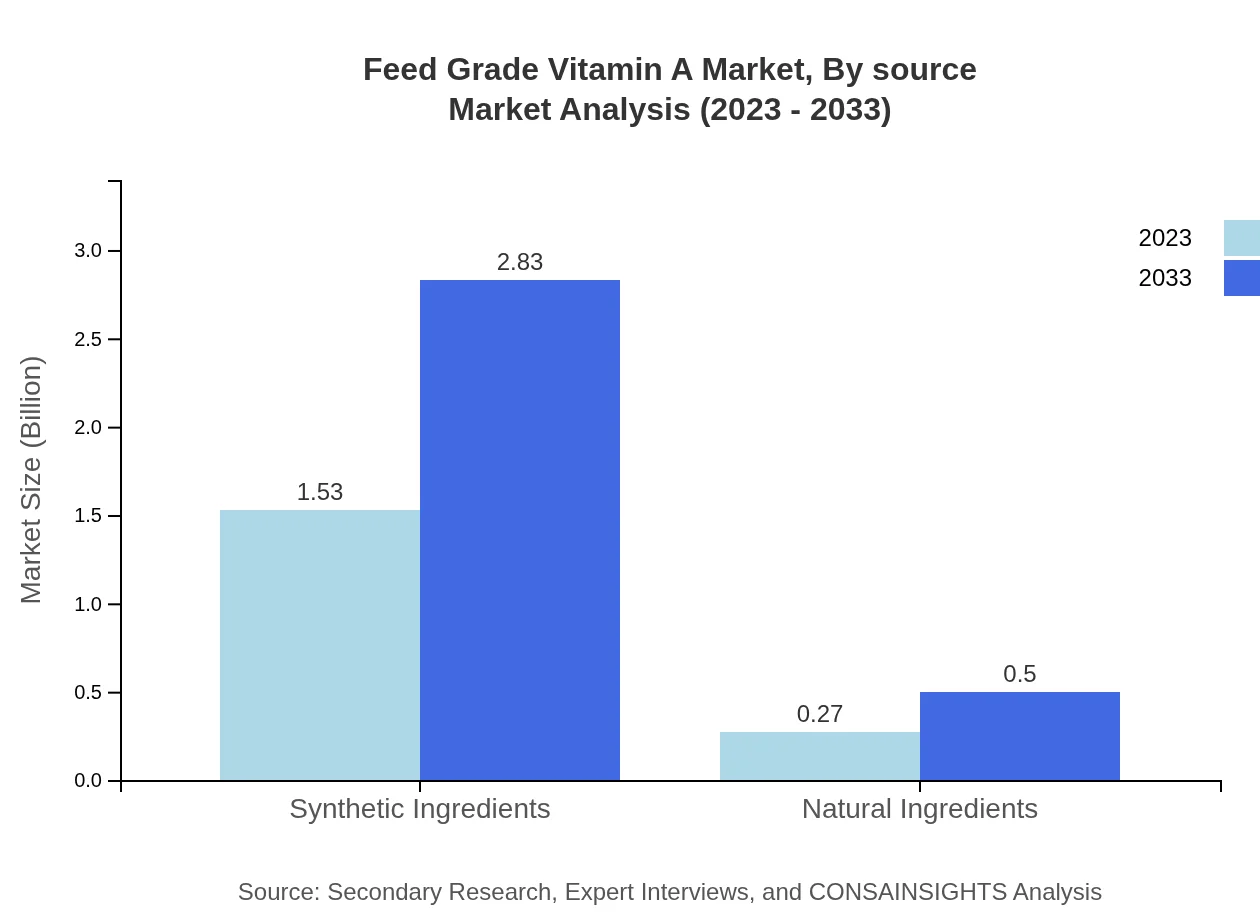

Feed Grade Vitamin A Market Analysis By Product

The market distribution by product type indicates a dominant presence of synthetic ingredients, anticipated to grow from USD 1.53 billion in 2023 to USD 2.83 billion by 2033. Synthetic ingredients hold a significant market share of 84.87% in 2023, remaining stable through 2033. Natural ingredients are emerging, growing from USD 0.27 billion to USD 0.50 billion, gradually increasing their share to 15.13%.

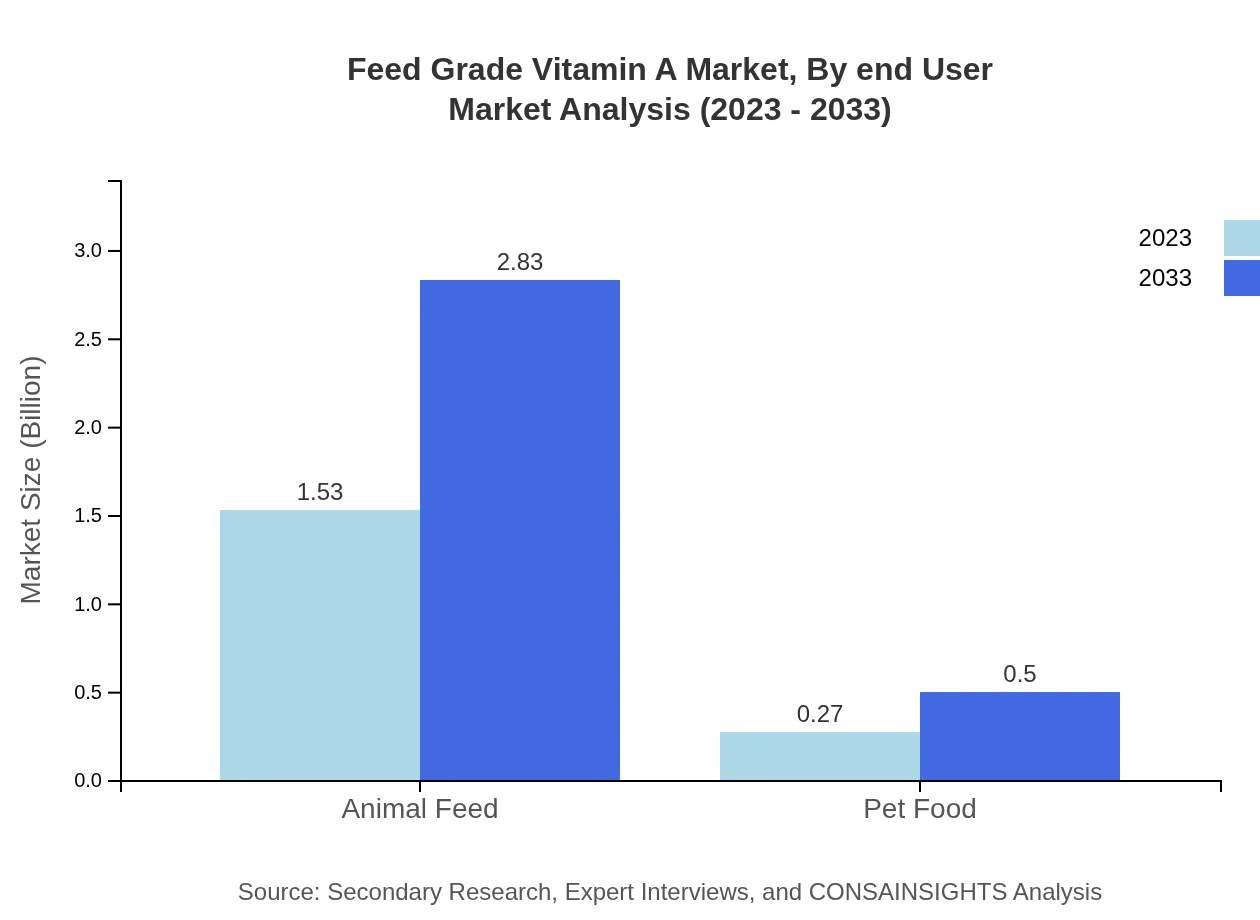

Feed Grade Vitamin A Market Analysis By Application

In terms of application, animal feed is the leading segment, projected to dominate the market from USD 1.53 billion in 2023 to USD 2.83 billion by 2033, capturing 84.87% of the market share. Pet food represents a smaller but growing segment, increasing from USD 0.27 billion to USD 0.50 billion, with a steady share at 15.13%.

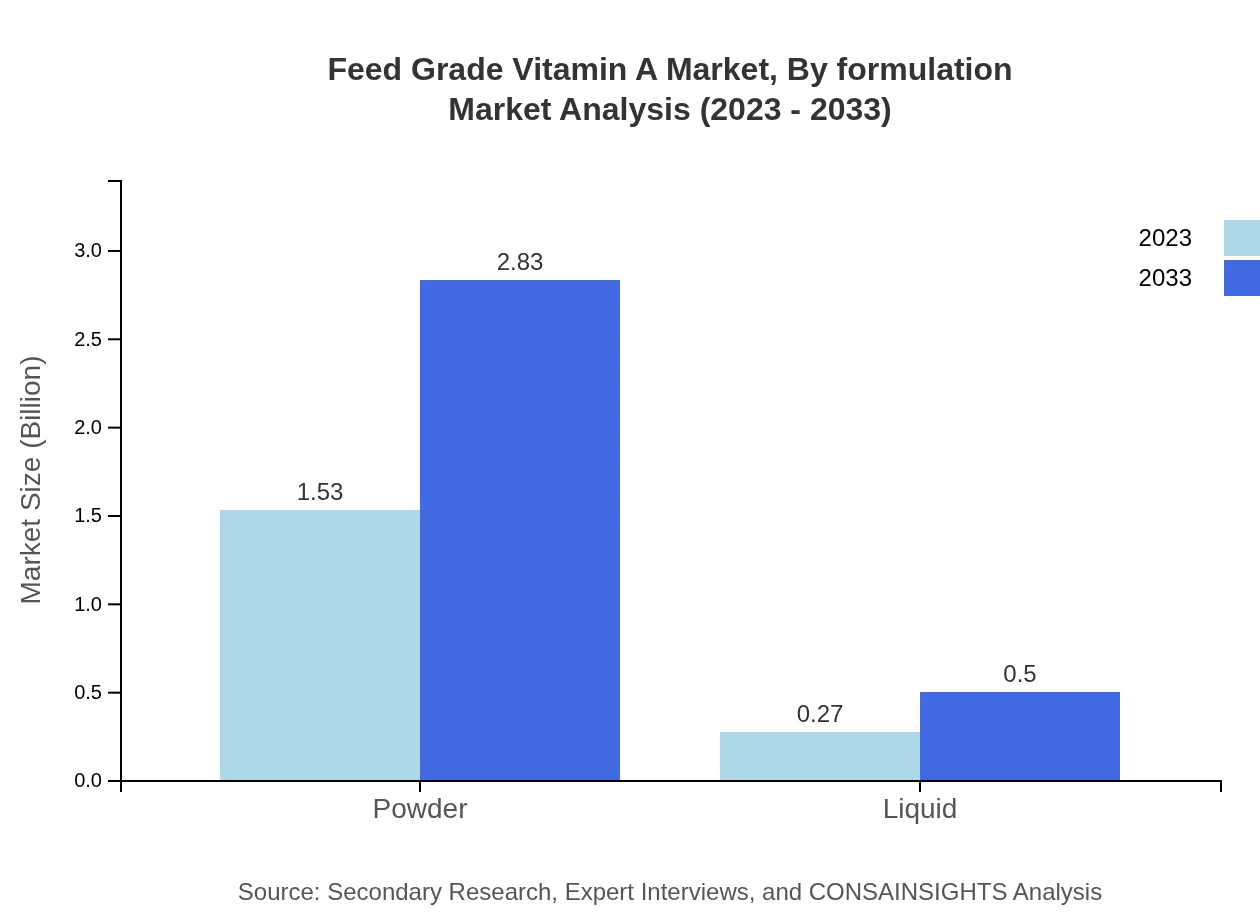

Feed Grade Vitamin A Market Analysis By Formulation

The formulation analysis reveals a significant preference for powder formulations, which dominate the market size from USD 1.53 billion in 2023 to USD 2.83 billion by 2033, maintaining 84.87% market share. Liquid formulations are also gaining traction, expected to rise from USD 0.27 billion to USD 0.50 billion, making up 15.13% of the market.

Feed Grade Vitamin A Market Analysis By Source

Sources of Feed Grade Vitamin A are primarily synthetic, reflecting a steady demand in the industry. While the synthetic source dominates with an extensive market reach, natural sources are slowly making their presence felt as consumers gravitate towards more natural and organic feed solutions.

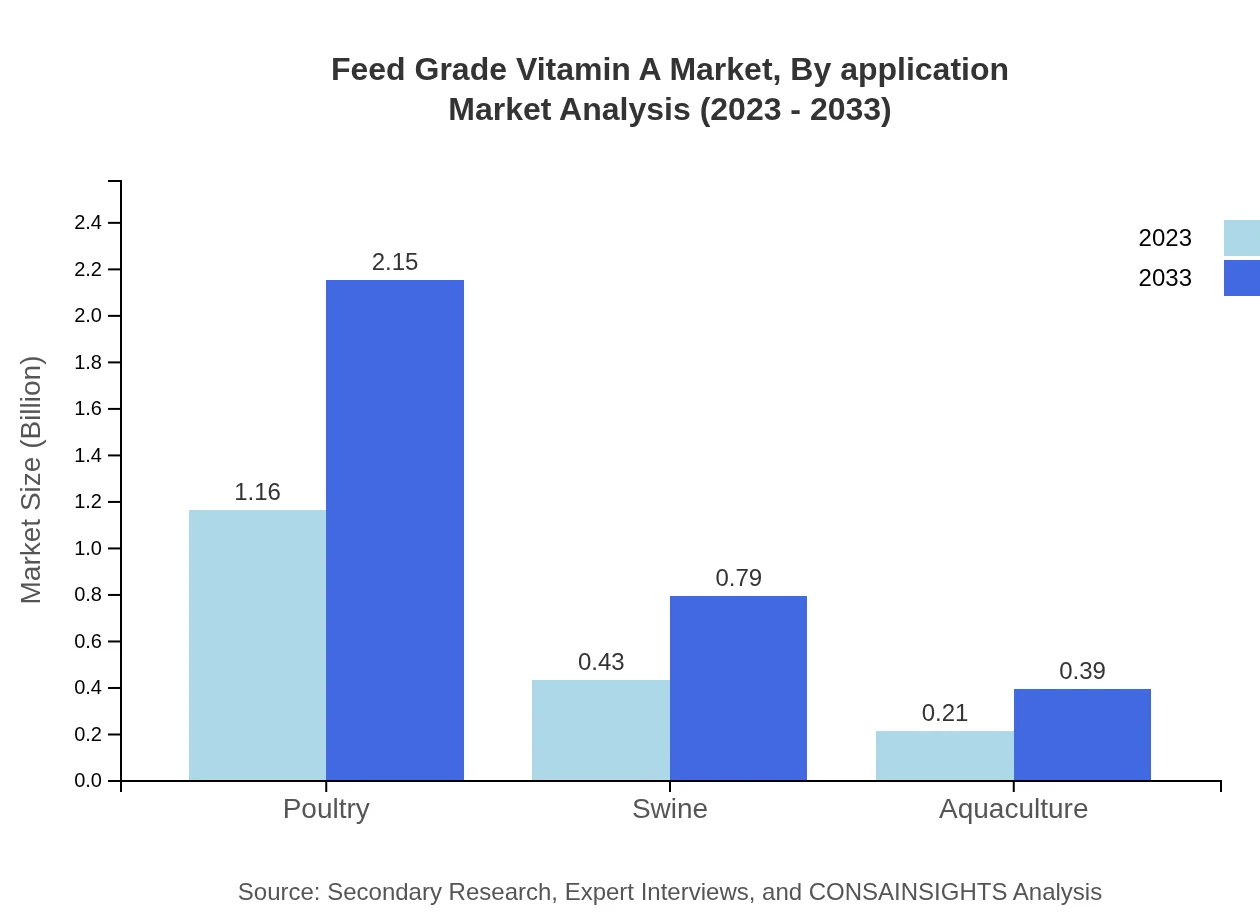

Feed Grade Vitamin A Market Analysis By End User

The end-user analysis shows that poultry remains the key end-user category, with market size increasing from USD 1.16 billion in 2023 to USD 2.15 billion by 2033, capturing 64.53% of the share. Swine and aquaculture are also significant, with shares of 23.76% and 11.71%, respectively.

Feed Grade Vitamin A Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Grade Vitamin A Industry

BASF SE:

A global leader in the chemical industry, BASF produces a wide range of feed additives, including Feed Grade Vitamin A, emphasizing sustainability and innovation in animal nutrition.DSM Nutritional Products:

Part of the Dutch multinational DSM, this company specializes in nutritional solutions and has a strong focus on developing advanced vitamin solutions for the animal feed sector.Adisseo:

A leading company in the animal nutrition industry, Adisseo develops high-quality feed additives and solutions, including Vitamin A, aiming to optimize feed efficiency and animal health.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Grade Vitamin A?

The global market size for feed-grade vitamin A is projected to reach approximately $1.8 billion by 2033, with a compound annual growth rate (CAGR) of 6.2% from 2023 to 2033.

What are the key market players or companies in the feed Grade Vitamin A industry?

Key players in the feed-grade vitamin A market include prominent companies such as DSM Nutritional Products, BASF SE, and Adisseo, which drive innovation and maintain significant market shares.

What are the primary factors driving the growth in the feed Grade Vitamin A industry?

Growth in the feed-grade vitamin A industry is driven by increasing livestock production, rising demand for quality animal nutrition, and greater awareness of vitamin A's role in enhancing feed efficiency and animal health.

Which region is the fastest Growing in the feed Grade Vitamin A?

The Asia Pacific region is anticipated to be the fastest-growing market for feed-grade vitamin A, with market size expected to grow from $0.35 billion in 2023 to $0.66 billion by 2033.

Does ConsaInsights provide customized market report data for the feed Grade Vitamin A industry?

Yes, ConsaInsights offers customized market report data for the feed-grade vitamin A industry, providing tailored insights to meet specific client requirements.

What deliverables can I expect from this feed Grade Vitamin A market research project?

Deliverables from the feed-grade vitamin A market research project include detailed market analysis reports, segmentation data, growth forecasts, and strategic recommendations.

What are the market trends of feed Grade Vitamin A?

Market trends for feed-grade vitamin A include increasing utilization of synthetic ingredients, a shift towards natural sources, and an emphasis on product innovation aimed at enhancing animal health and productivity.