Feed Ingredients Market Report

Published Date: 02 February 2026 | Report Code: feed-ingredients

Feed Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Feed Ingredients market, providing insights into market size, forecasts from 2023 to 2033, key trends, regional analysis, and an overview of industry leaders. It aims to equip stakeholders with data-driven insights to facilitate strategic decision-making.

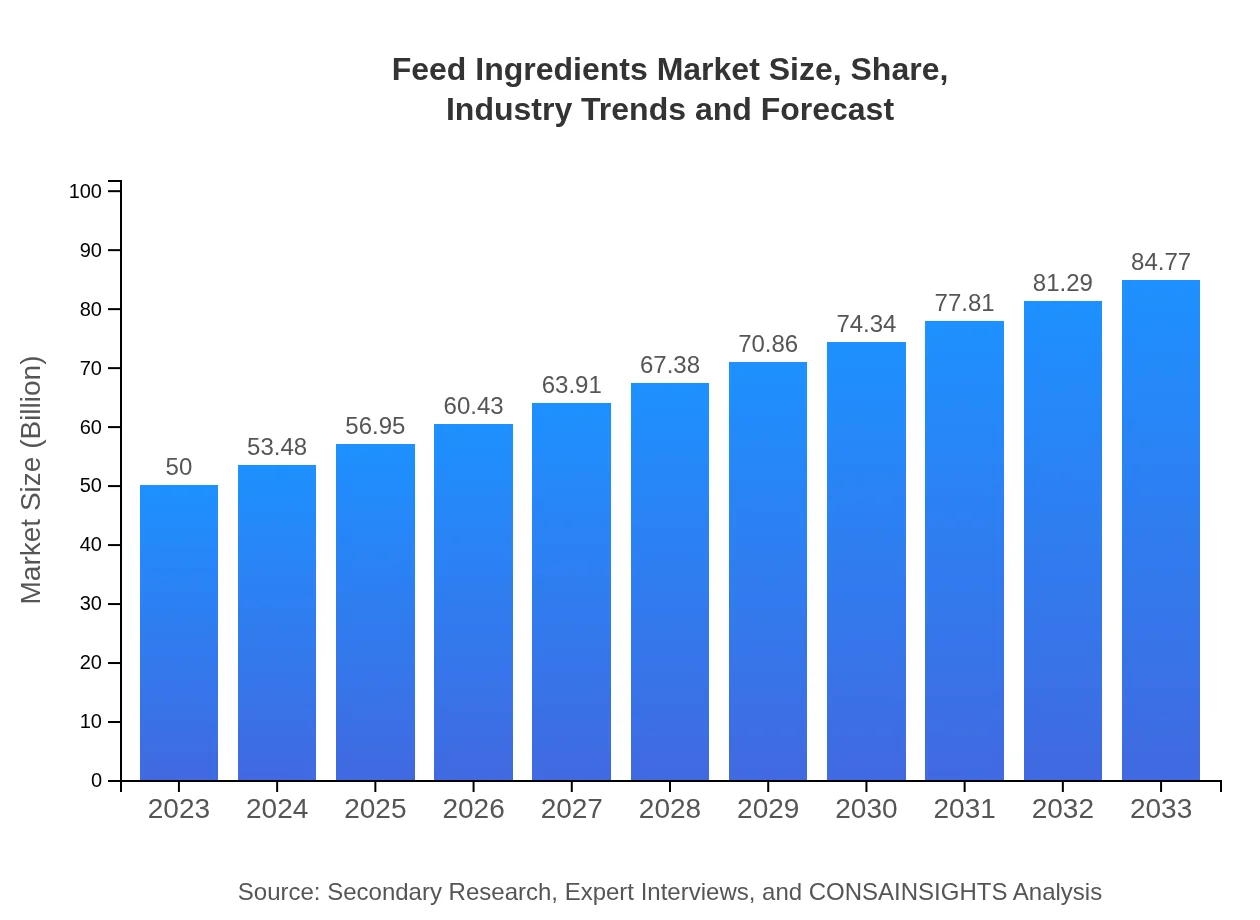

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $84.77 Billion |

| Top Companies | Cargill , ADM (Archer Daniels Midland), DuPont, Land O'Lakes, BASF |

| Last Modified Date | 02 February 2026 |

Feed Ingredients Market Overview

Customize Feed Ingredients Market Report market research report

- ✔ Get in-depth analysis of Feed Ingredients market size, growth, and forecasts.

- ✔ Understand Feed Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Ingredients

What is the Market Size & CAGR of Feed Ingredients market in 2023?

Feed Ingredients Industry Analysis

Feed Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Ingredients Market Analysis Report by Region

Europe Feed Ingredients Market Report:

The European Feed Ingredients market is poised for growth from USD 13.03 billion in 2023 to USD 22.09 billion by 2033. The region's regulatory framework emphasizes sustainability and quality, pushing manufacturers to develop innovative feed solutions, including alternatives to traditional protein sources.Asia Pacific Feed Ingredients Market Report:

In the Asia Pacific region, the Feed Ingredients market is projected to grow from USD 9.63 billion in 2023 to USD 16.33 billion by 2033. This growth is driven by factors such as the increasing demand for meat, rising disposable incomes, and advancements in aquaculture practices, making it a significant market for feed ingredients globally.North America Feed Ingredients Market Report:

North America, currently valued at USD 17.75 billion, is expected to grow to USD 30.08 billion by 2033. The region is a leader in technological innovations in animal nutrition, with trends such as organic feed and precision livestock farming significantly influencing the feed ingredients market.South America Feed Ingredients Market Report:

The South American market, valued at USD 4.54 billion in 2023, is anticipated to reach USD 7.71 billion by 2033. The region's robust agricultural sector and focus on livestock farming support the growth of feed ingredients, particularly for beef and poultry production.Middle East & Africa Feed Ingredients Market Report:

In the Middle East and Africa, the Feed Ingredients market is expected to rise from USD 5.04 billion in 2023 to USD 8.55 billion by 2033. Growing livestock populations and investments in aquaculture are key factors driving market expansion in this region.Tell us your focus area and get a customized research report.

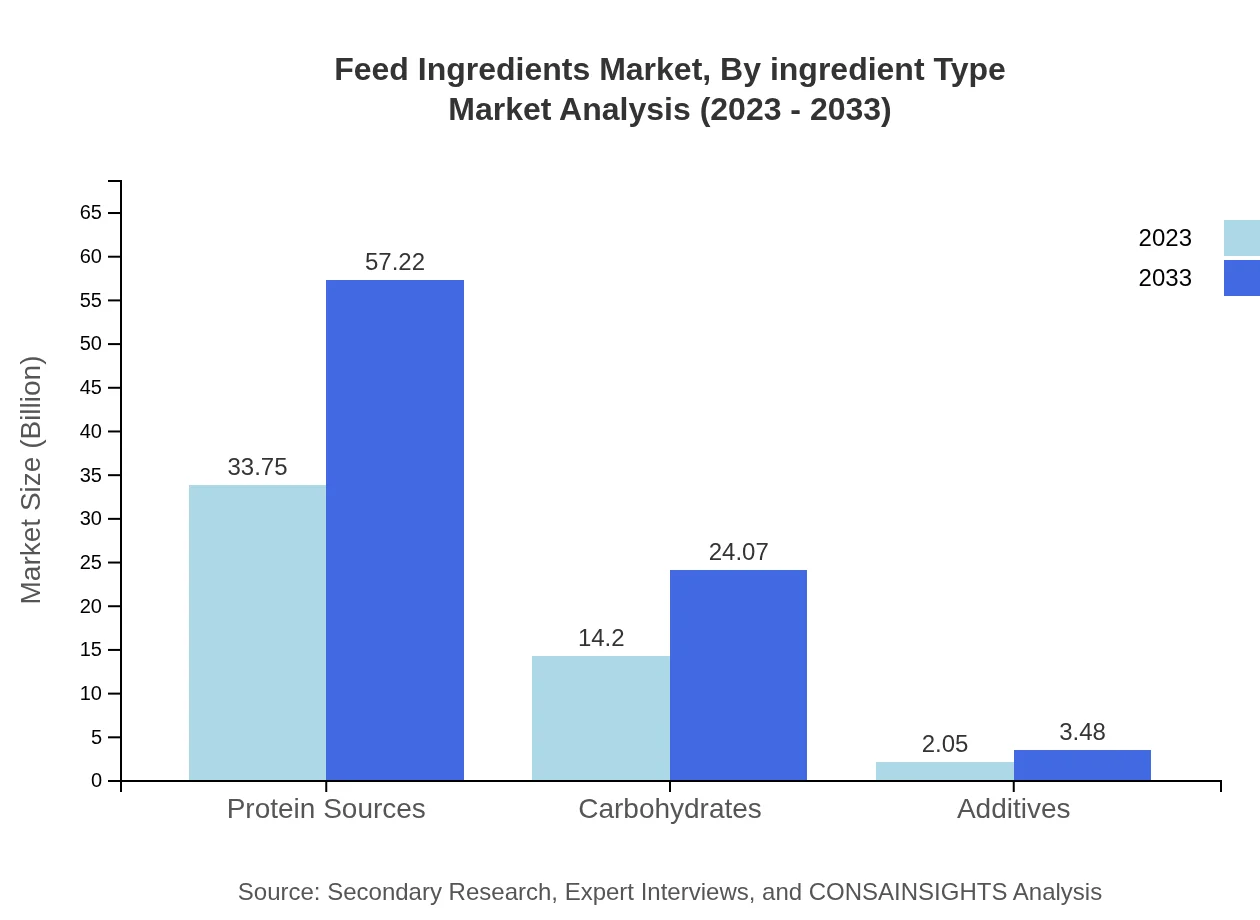

Feed Ingredients Market Analysis By Ingredient Type

The Feed Ingredients market is segmented into various ingredient types. The Protein Sources segment, including fish meal and soymeal, is forecasted to grow from USD 33.75 billion in 2023 to USD 57.22 billion by 2033, representing a dominant share of 67.5% in the market. Carbohydrates, mainly consisting of grains, are estimated to increase from USD 14.20 billion to USD 24.07 billion and hold a 28.4% market share. Different additives are also showing promise, growing from USD 2.05 billion to USD 3.48 billion, indicating an increasing focus on enhancing feed quality.

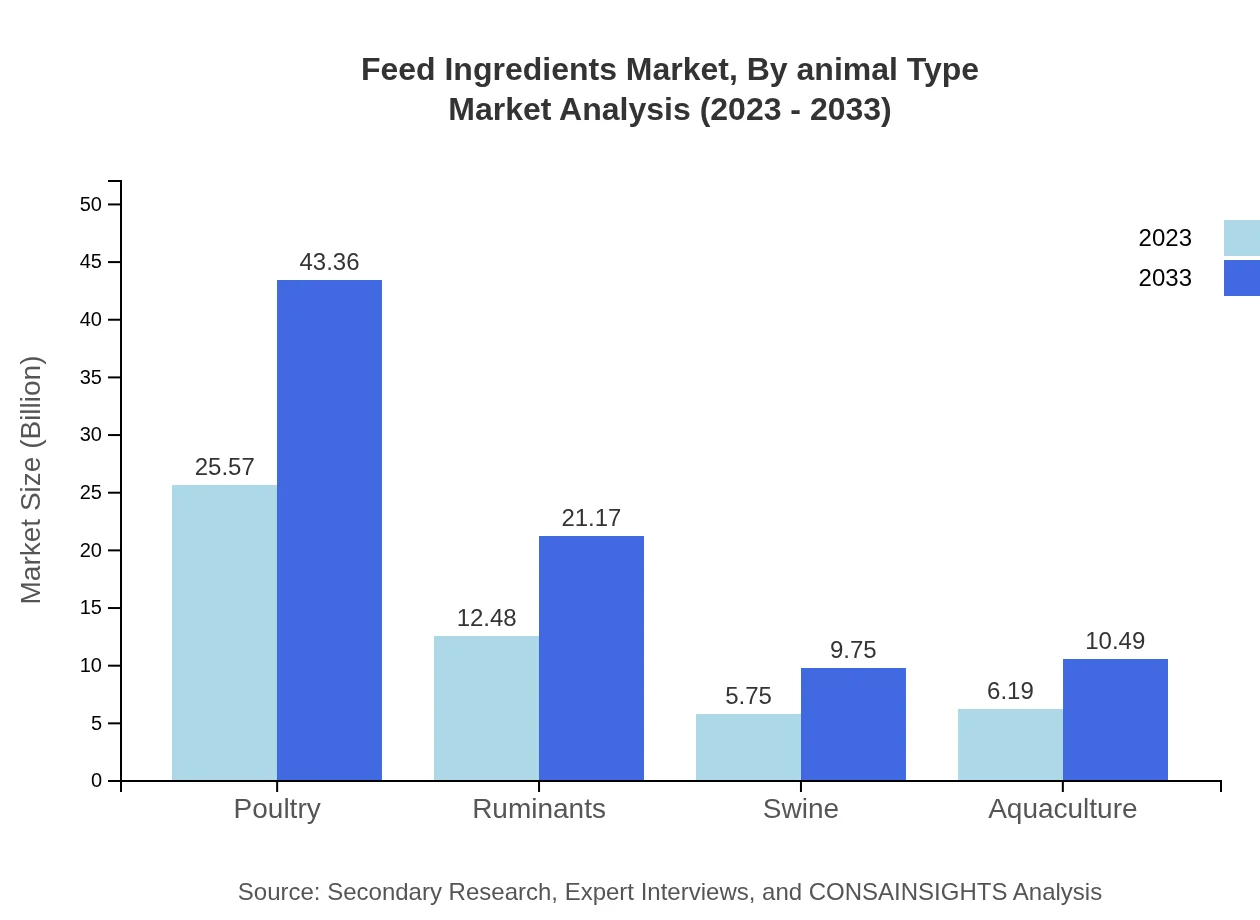

Feed Ingredients Market Analysis By Animal Type

The market is segmented by animal type, including Poultry, Ruminants, Swine, and Aquaculture. The Poultry segment commands a significant market size of USD 25.57 billion, with expectations to expand to USD 43.36 billion by 2033, maintaining a market share of 51.15%. The Ruminants segment is projected to rise from USD 12.48 billion to USD 21.17 billion, while the Swine segment is anticipated to increase from USD 5.75 billion to USD 9.75 billion. The Aquaculture segment demonstrates growth potential, increasing from USD 6.19 billion to USD 10.49 billion.

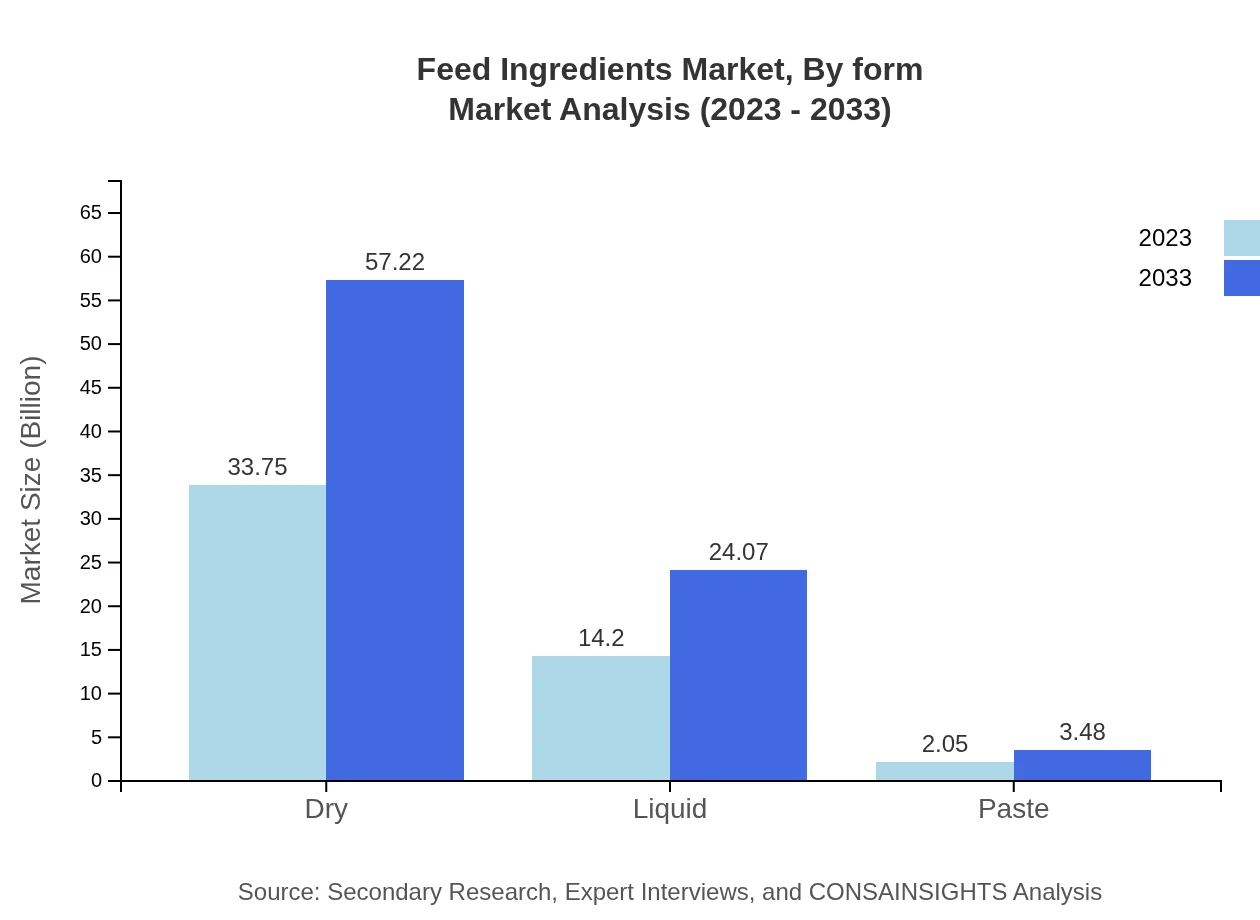

Feed Ingredients Market Analysis By Form

Feed Ingredients are categorized into Dry, Liquid, and Paste forms. The Dry segment dominates, growing from USD 33.75 billion in 2023 to USD 57.22 billion by 2033. The Liquid segment also shows strong growth, anticipated to rise from USD 14.20 billion to USD 24.07 billion. The Paste segment, albeit smaller, is expected to increase from USD 2.05 billion to USD 3.48 billion, showcasing versatile applications in animal feed formulations.

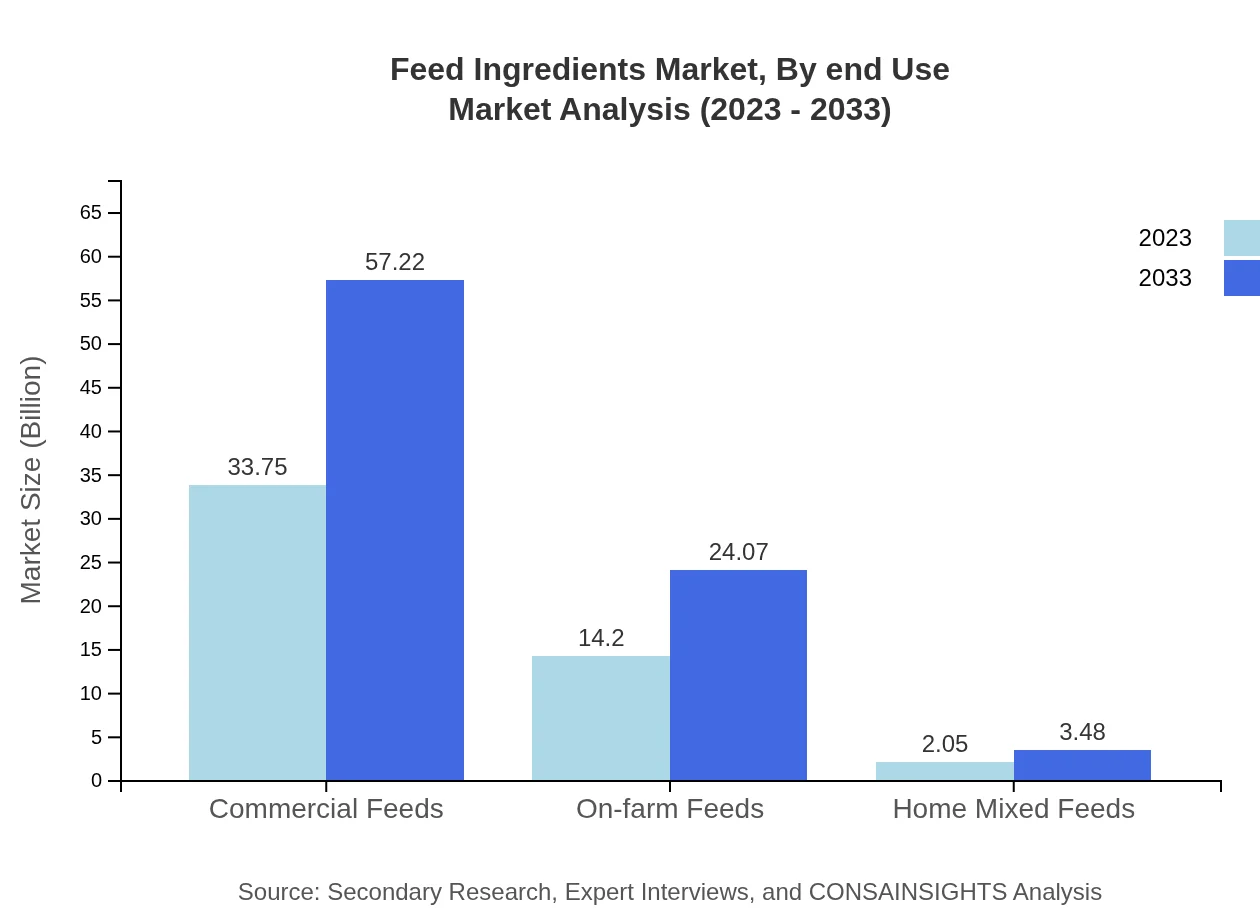

Feed Ingredients Market Analysis By End Use

Including on-farm feeds and commercial feeds, the Feed Ingredients market shows a balanced distribution. The Commercial Feeds segment is projected to grow from USD 33.75 billion to USD 57.22 billion, representing 67.5% of the market share. On-farm feeds will also grow significantly from USD 14.20 billion to USD 24.07 billion, allowing farmers flexibility in feed formulations.

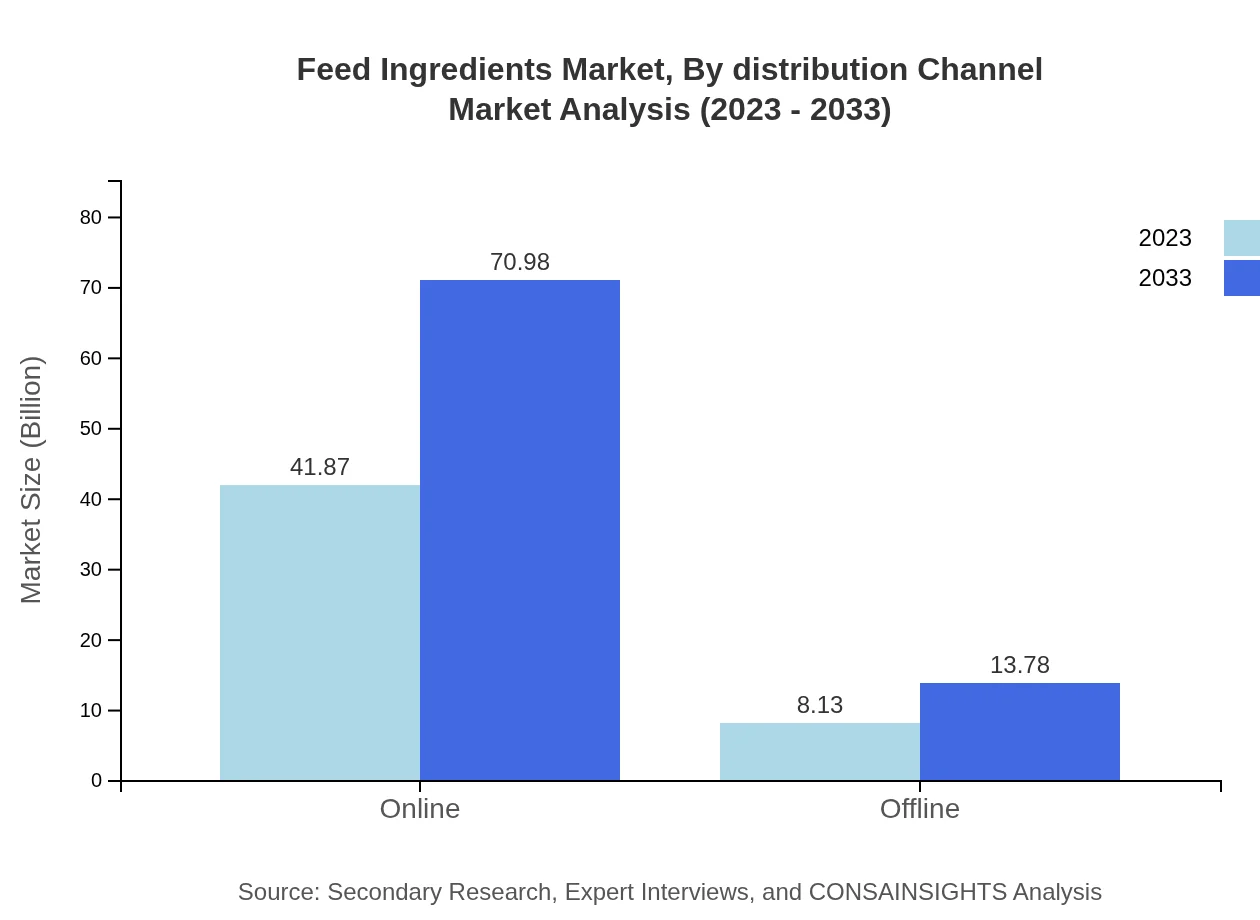

Feed Ingredients Market Analysis By Distribution Channel

In terms of distribution channels, the market is increasingly leaning towards online sales, expected to surge from USD 41.87 billion in 2023 to USD 70.98 billion by 2033, highlighting a shift in consumer buying behavior. Offline channels continue to hold a share of 16.26%, increasing from USD 8.13 billion to USD 13.78 billion, reflecting sustained demand through traditional retail channels.

Feed Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Ingredients Industry

Cargill :

Cargill is a leading player in the global feed market, offering a diverse portfolio of feed ingredients and supplements that emphasize animal health and nutrition.ADM (Archer Daniels Midland):

ADM provides a wide range of feed ingredients and has developed innovative solutions to support livestock performance and sustainability in animal agriculture.DuPont:

DuPont focuses on integrating science and technology into feed formulations, offering nutritional products that enhance livestock health and productivity.Land O'Lakes:

Land O'Lakes is committed to providing high-quality feed ingredients, with sustainability at the core of its operations in animal nutrition.BASF:

BASF is a global leader in chemical production, offering feed additives that improve feed efficiency and address livestock health, enhancing overall feed performance.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Ingredients?

The global feed ingredients market is currently valued at approximately $50 billion, with a projected growth rate of 5.3% CAGR from 2023 to 2033. This growth highlights the increasing demand for optimized nutritional solutions in animal agriculture.

What are the key market players or companies in the feed Ingredients industry?

The feed ingredients industry is characterized by numerous key players including Cargill, Archer Daniels Midland Company, and BASF SE, which dominate the market through innovative product offerings and strategic partnerships aimed at improving animal nutrition.

What are the primary factors driving the growth in the feed Ingredients industry?

Growth in the feed ingredients sector is driven by rising livestock production, increasing consumer demand for animal protein, and technological advancements in animal feed formulations, which aim to enhance feed efficiency and animal health.

Which region is the fastest Growing in the feed Ingredients?

By 2033, North America is projected to lead as the fastest-growing region in the feed ingredients market, expanding from $17.75 billion in 2023 to approximately $30.08 billion, fueled by increased livestock farming and evolving feeding practices.

Does ConsaInsights provide customized market report data for the feed Ingredients industry?

Yes, ConsaInsights offers tailored market reports for the feed ingredients industry, providing customized data and insights that suit specific business needs and market dynamics, ensuring companies can make informed strategic decisions.

What deliverables can I expect from this feed Ingredients market research project?

From the feed ingredients market research project, clients can expect comprehensive deliverables, including detailed market analysis, growth forecasts, competitive landscape insights, and segmented data on various feed types and regional performance.

What are the market trends of feed Ingredients?

Key trends in the feed ingredients market include increasing adoption of natural and organic ingredients, rising demand for sustainable practices in livestock production, and an expanding focus on precision nutrition, enhancing the efficiency and health benefits of animal feeds.