Feed Packaging Market Report

Published Date: 02 February 2026 | Report Code: feed-packaging

Feed Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Feed Packaging market, covering insights from 2023 to 2033. It includes market size, CAGR, regional analyses, industry trends, and competitive landscape, equipping stakeholders with essential data for strategic decision-making.

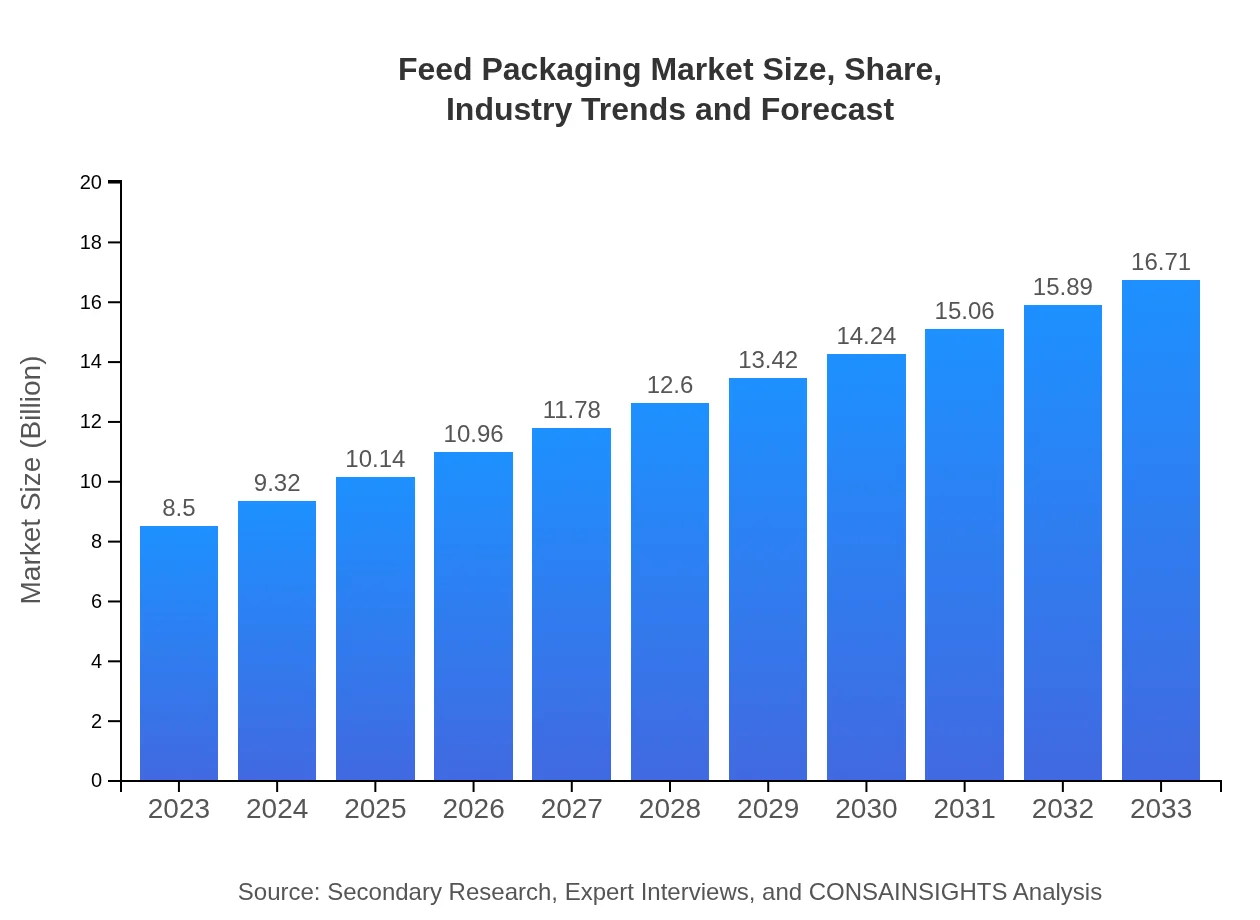

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.71 Billion |

| Top Companies | Amcor Plc, Sealed Air Corporation, Mondi Group, Berry Global, Inc., Duncan Industries |

| Last Modified Date | 02 February 2026 |

Feed Packaging Market Overview

Customize Feed Packaging Market Report market research report

- ✔ Get in-depth analysis of Feed Packaging market size, growth, and forecasts.

- ✔ Understand Feed Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Packaging

What is the Market Size & CAGR of Feed Packaging market in 2023?

Feed Packaging Industry Analysis

Feed Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Packaging Market Analysis Report by Region

Europe Feed Packaging Market Report:

The European market is expected to grow from USD 2.08 billion in 2023 to USD 4.09 billion by 2033. The European Union’s stringent regulations on food safety and packaging sustainability are driving the adoption of eco-friendly materials in the feed packaging sector.Asia Pacific Feed Packaging Market Report:

The Asia Pacific region is expected to grow from USD 1.74 billion in 2023 to USD 3.43 billion in 2033, driven by increasing livestock production and a growing middle class leading to higher meat consumption. The adoption of modern farming techniques and innovations in feed preservation are also fueling market development.North America Feed Packaging Market Report:

North America, with a market size of USD 2.75 billion in 2023, is projected to reach USD 5.40 billion in 2033. This growth is attributed to advanced agricultural practices, a significant focus on pet food packaging, and rising consumer awareness about sustainability.South America Feed Packaging Market Report:

In South America, the market for Feed Packaging is set to expand from USD 0.85 billion in 2023 to USD 1.67 billion by 2033. Factors such as increased agricultural output and investments in the livestock sector contribute to the growth in demand for high-quality, sustainable packaging solutions.Middle East & Africa Feed Packaging Market Report:

In the Middle East and Africa, the Feed Packaging market is projected to rise from USD 1.08 billion in 2023 to USD 2.12 billion by 2033. Agricultural modernization and increased livestock production are primary drivers, spurred by investments in better supply chains and packaging technologies.Tell us your focus area and get a customized research report.

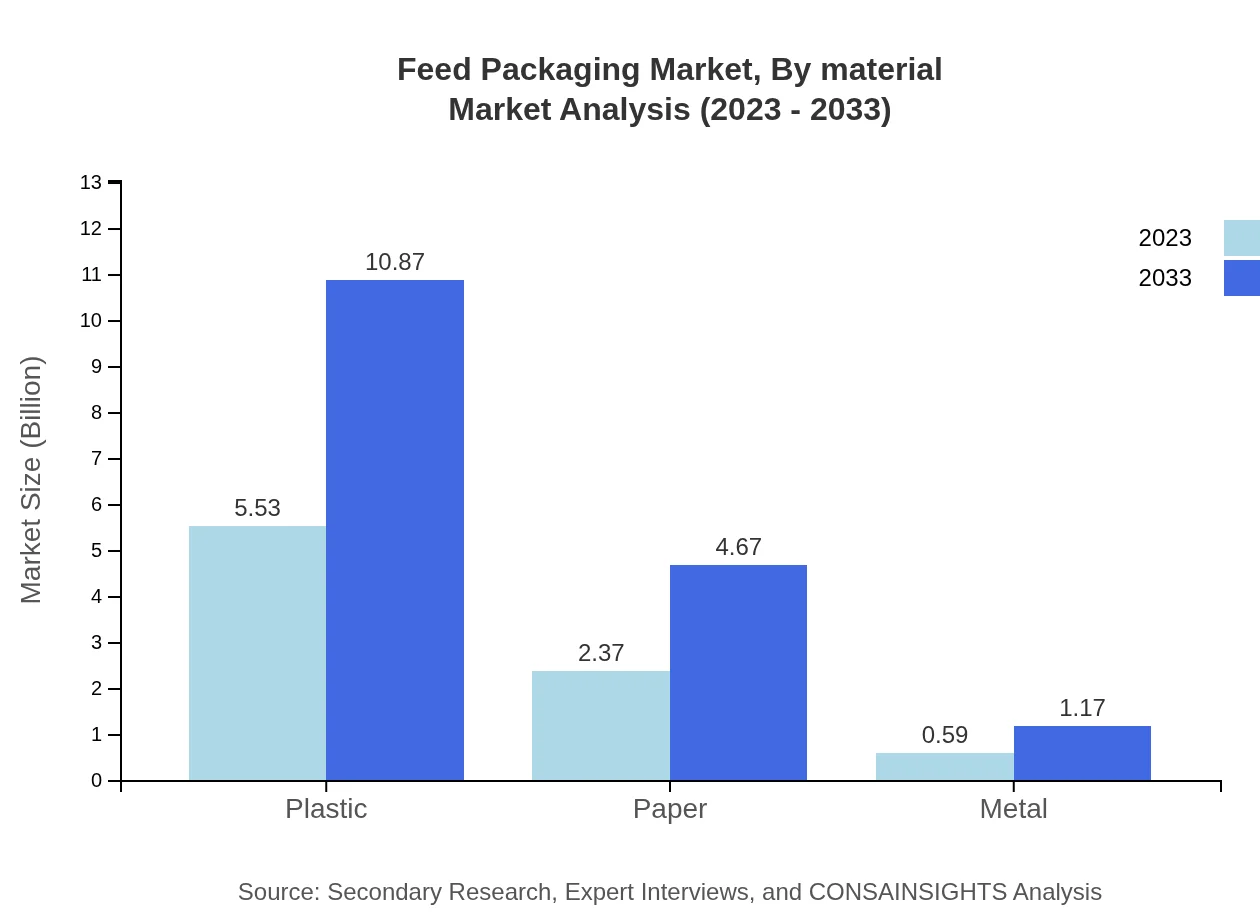

Feed Packaging Market Analysis By Material

The Feed Packaging market is dominated by plastic, which constituted a market size of USD 5.53 billion in 2023 and is projected to grow to USD 10.87 billion by 2033, holding a 65.08% market share. Paper packaging follows with USD 2.37 billion and is expected to reach USD 4.67 billion by 2033, maintaining a significant share of 27.93%. Metal packaging, although smaller, is projected to grow from USD 0.59 billion to USD 1.17 billion, with a share of 6.99%. The choice of material impacts not only the cost but also the functional properties like durability and protection against moisture, which are crucial for maintaining feed quality.

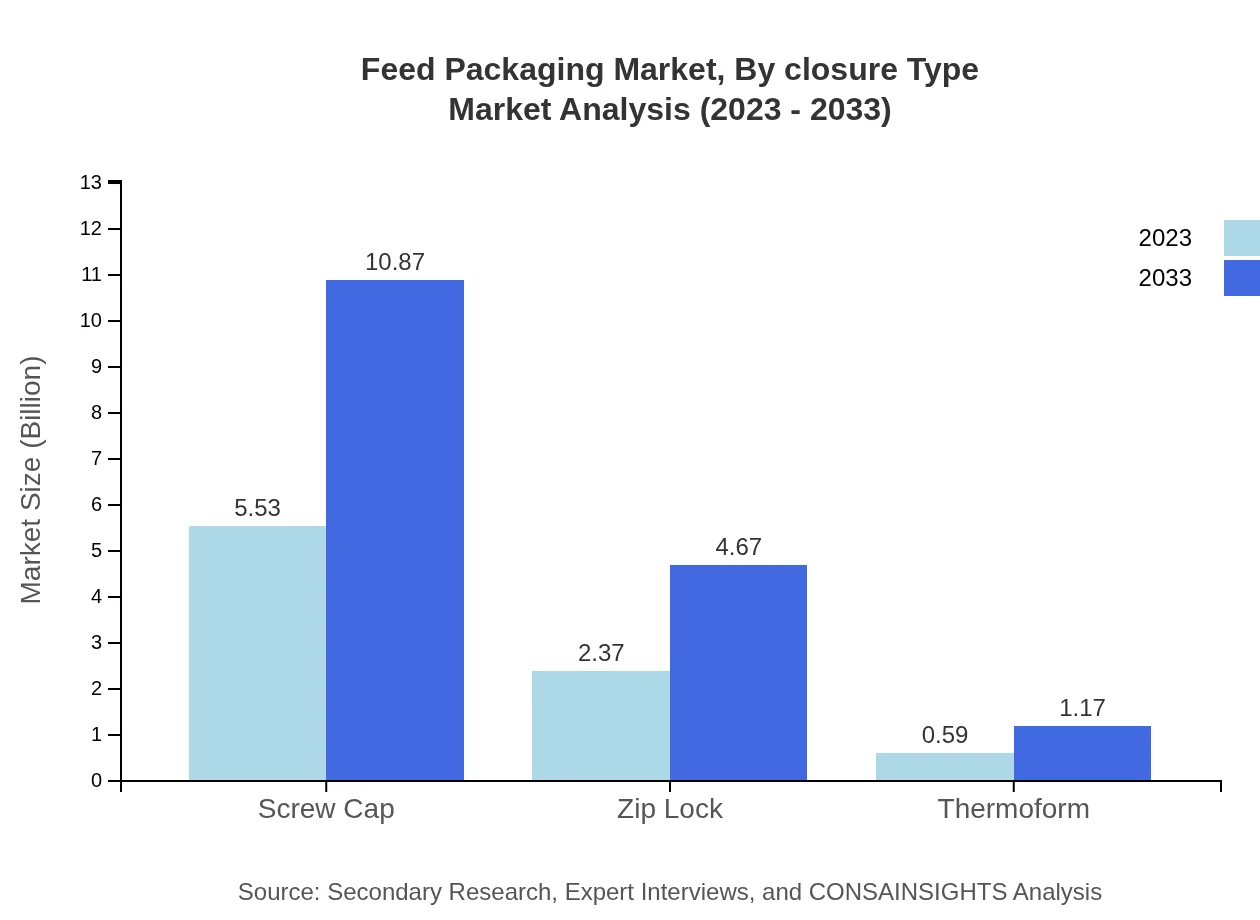

Feed Packaging Market Analysis By Closure Type

In the closure type segment, screw caps lead the market with a size of USD 5.53 billion in 2023, projected to rise to USD 10.87 billion by 2033, capturing 65.08% of the market. Zip lock closures account for USD 2.37 billion and are expected to reach USD 4.67 billion, representing a 27.93% share. Other closures, including thermoform and drums, are witnessing gradual growth, emphasizing convenience and reusability for consumers, as more packaging solutions focus on enhancing user experience.

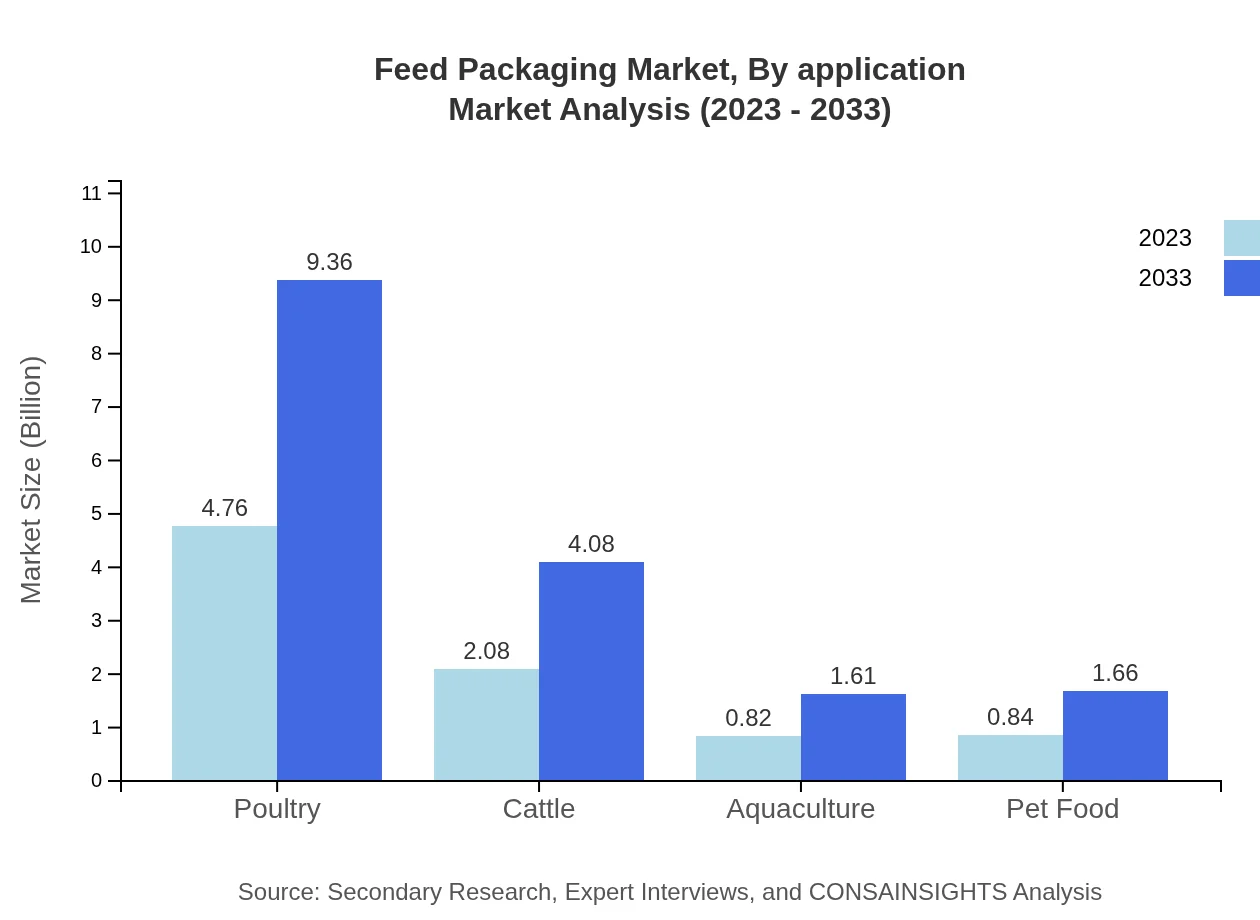

Feed Packaging Market Analysis By Application

In terms of application, the poultry sector dominates the market with a size of USD 4.76 billion in 2023, expected to increase to USD 9.36 billion by 2033, capturing a significant market share of 56.01%. The cattle and aquaculture applications follow, with market sizes of USD 2.08 billion and USD 0.82 billion respectively in 2023. Both sectors are projected to experience substantial growth, driven by rising global meat demand and advancements in aquaculture practices.

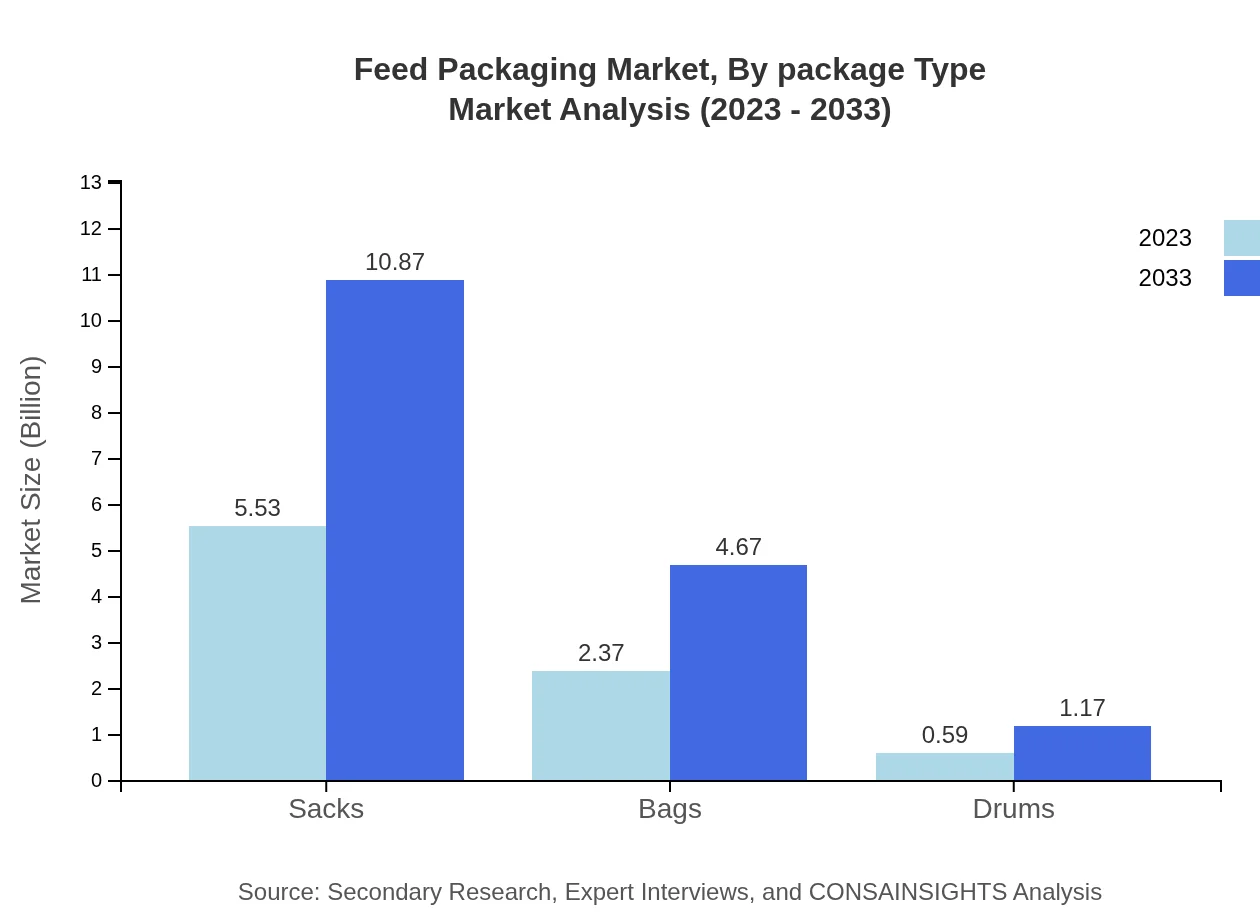

Feed Packaging Market Analysis By Package Type

The package type segment is defined mainly by sacks, contributing USD 5.53 billion to the market in 2023 and projected to reach USD 10.87 billion by 2033, maintaining a 65.08% market share. Bags and drums also play essential roles, with expected trends leaning towards more flexible and easier-to-handle options as the industry adopts new packaging technologies that emphasize accessibility and reduce waste.

Feed Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Packaging Industry

Amcor Plc:

One of the world's largest packaging companies, Amcor specializes in developing and producing responsible packaging solutions, including those tailored for feed applications.Sealed Air Corporation:

Known for its innovative packaging materials and solutions, Sealed Air plays a crucial role in providing protective and sustainable packaging for the feed industry.Mondi Group:

Mondi is a global leader in packaging and paper with extensive experience in manufacturing customized feed packaging solutions for various agriculture sectors.Berry Global, Inc.:

With a diverse portfolio in plastic packaging, Berry Global offers advanced solutions that help preserve animal feed quality and freshness.Duncan Industries:

Duncan focuses on innovative packaging solutions and customer service, providing tailored feed packaging that meets the specific needs of clients.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Packaging?

The feed-packaging market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 6.8% over the next decade. This growth indicates a robust expansion in demand for packaging solutions tailored for animal feed.

What are the key market players or companies in this feed Packaging industry?

Key players in the feed-packaging industry include prominent companies like Mondi Group, Sealed Air Corporation, Bemis Company, and Smurfit Kappa. These companies contribute significantly to innovation and sustainability in packaging solutions.

What are the primary factors driving the growth in the feed Packaging industry?

The growth in the feed-packaging industry is primarily driven by increasing demand for processed food products, a rise in livestock production, stringent food safety regulations, and innovations in packaging materials that enhance shelf stability and product freshness.

Which region is the fastest Growing in the feed Packaging?

The fastest-growing region in the feed-packaging market is North America. From a market value of $2.75 billion in 2023, it is expected to grow significantly to $5.40 billion by 2033, reflecting heightened demand for quality feed and packaging solutions.

Does ConsaInsights provide customized market report data for the feed Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the feed-packaging industry, ensuring that clients receive focused insights and analyses that can guide strategic decisions.

What deliverables can I expect from this feed Packaging market research project?

Deliverables from the feed-packaging market research project include comprehensive market analysis reports, trend forecasts, competitive landscape insights, and strategy recommendations, equipping stakeholders with valuable data for informed decision-making.

What are the market trends of feed Packaging?

Current trends in the feed-packaging market include a shift towards sustainable materials, the adoption of smart packaging technologies, increased focus on compliance with health regulations, and an upswing in demand for convenience-oriented packaging solutions.