Feed Phosphate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Feed Phosphate market from 2023 to 2033, including market size, growth trends, segmentation, regional insights, and key players. Insights are designed to inform stakeholders about potential opportunities and challenges in this evolving industry.

| Metric | Value |

|---|---|

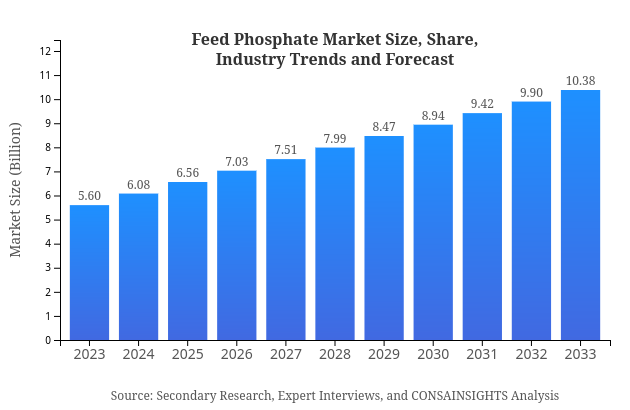

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Nutrien Ltd., Mosaic Company, Yara International, OCI Nitrogen |

| Last Modified Date | 15 November 2024 |

Feed Phosphate Market Overview

What is the Market Size & CAGR of Feed Phosphate market in 2023?

Feed Phosphate Industry Analysis

Feed Phosphate Market Segmentation and Scope

Request a custom research report for industry.

Feed Phosphate Market Analysis Report by Region

Europe Feed Phosphate Market Report:

Europe's Feed Phosphate market is set to grow from $1.52 billion in 2023 to $2.83 billion by 2033. The region focuses on sustainable agriculture, promoting the use of organic phosphates, and increasing regulatory pressures on livestock feed quality will shape market dynamics.Asia Pacific Feed Phosphate Market Report:

In the Asia-Pacific region, the Feed Phosphate market is projected to grow from $1.07 billion in 2023 to $1.99 billion by 2033. The growth is primarily driven by the increasing demand for animal protein and significant investments in the livestock sector, particularly in countries like China and India.North America Feed Phosphate Market Report:

North America holds a significant market share, projected to increase from $2.15 billion in 2023 to $3.99 billion by 2033. The region benefits from high livestock production rates and advanced animal husbandry practices, making it a leading consumer of Feed Phosphate.South America Feed Phosphate Market Report:

The South American Feed Phosphate market, valued at $0.29 billion in 2023, is expected to reach $0.54 billion by 2033. This growth can be attributed to the booming livestock and aquaculture industries in Brazil and Argentina, accompanied by rising exports of meat products.Middle East & Africa Feed Phosphate Market Report:

The Middle East and Africa market is predicted to expand from $0.56 billion in 2023 to $1.03 billion by 2033. Increasing investments in poultry and aquaculture sectors amidst rising consumer demand for protein are key growth drivers in this region.Request a custom research report for industry.

Feed Phosphate Market Analysis By Product

Global Feed Phosphate Market, By Product Market Analysis (2024 - 2033)

The product segment of the Feed Phosphate market includes Dicalcium Phosphate, Monocalcium Phosphate, and Tricalcium Phosphate. Dicalcium Phosphate dominates the market with a size of $3.51 billion in 2023, projected to reach $6.51 billion by 2033, holding a market share of 62.75%. Conversely, Monocalcium Phosphate is valued at $1.56 billion in 2023 and is expected to increase to $2.88 billion by 2033, representing a 27.79% share.

Feed Phosphate Market Analysis By Application

Global Feed Phosphate Market, By Application Market Analysis (2024 - 2033)

In terms of application, Poultry leads with a market size of $2.35 billion in 2023, anticipated to grow to $4.36 billion by 2033, corresponding to a 42.01% market share. The Swine segment follows with a size of $1.15 billion in 2023, projected to reach $2.13 billion by 2033, holding a share of 20.56%.

Feed Phosphate Market Analysis By Form

Global Feed Phosphate Market, By Form Market Analysis (2024 - 2033)

The market is segmented by form into three categories: Powder, Granules, and Liquid. Powder form is the dominant segment, valued at $3.51 billion in 2023, set to double to $6.51 billion by 2033, indicating its 62.75% market share. Granules comprise $1.56 billion in 2023, expected to grow to $2.88 billion by 2033, reflecting a 27.79% share.

Feed Phosphate Market Analysis By End User

Global Feed Phosphate Market, By End-User Market Analysis (2024 - 2033)

End-user segments include Farmers, Feed Manufacturers, and Food Companies. Farmers capture a significant portion with a market size of $3.51 billion in 2023, projected to double to $6.51 billion by 2033, maintaining a 62.75% share. Feed Manufacturers follow with $1.56 billion in 2023, growing to $2.88 billion by 2033, representing a share of 27.79%.

Feed Phosphate Market Analysis By Region

Global Feed Phosphate Market, By Region Market Analysis (2024 - 2033)

Regionally, the market experiences varied growth. Asia-Pacific’s share enhances its valuation from $1.07 billion in 2023 to $1.99 billion by 2033. Europe and North America remain competitive with market values expected to reach $2.83 billion and $3.99 billion respectively by 2033.

Feed Phosphate Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Feed Phosphate Industry

Nutrien Ltd.:

A global leader in agriculture solutions, Nutrien produces nitrogen, potash, and phosphate fertilizers, providing essential nutrients to crops and livestock.Mosaic Company:

The Mosaic Company is one of the largest producers of concentrated phosphate and potash crop nutrients, supplying essential inputs for the global agricultural market.Yara International:

Yara is a leading global fertilizer company engaged in the production and sale of nitrogen and phosphate-based fertilizers and also provides crop nutrition solutions.OCI Nitrogen:

OCI Nitrogen specializes in the production of high-quality fertilizers, including ammonium nitrate and phosphate, catering to various agricultural needs.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of feed Phosphate?

The global feed-phosphate market is projected to reach approximately $5.6 billion by 2033, growing at a robust CAGR of 6.2% from 2023 to 2033. This increase underscores the rising demand for phosphate-based nutritional supplements in animal feed.

What are the key market players or companies in this feed Phosphate industry?

Key players in the feed-phosphate industry include established companies such as Nutrien, Elmo, and Yara International. These organizations lead in production capacity and market presence, driving innovations to cater to the growing agricultural demands.

What are the primary factors driving the growth in the feed Phosphate industry?

The growth of the feed-phosphate market is primarily driven by increasing livestock production, advancements in animal nutrition, and a rising global population requiring more food. Additionally, the awareness regarding animal health and welfare boosts market demand.

Which region is the fastest Growing in the feed Phosphate market?

The Asia-Pacific region is the fastest-growing in the feed-phosphate market, with its size projected to increase from $1.07 billion in 2023 to $1.99 billion by 2033. This growth reflects strong agricultural activities and demand for animal feed.

Does ConsaInsights provide customized market report data for the feed Phosphate industry?

Yes, ConsaInsights offers tailored market report data for the feed-phosphate industry. Clients can request specific insights that align with their needs, such as regional data, market segmentation, and individual company analyses.

What deliverables can I expect from this feed Phosphate market research project?

From the feed-phosphate market research project, clients can expect detailed reports including market size, growth forecasts, competitive analysis, and insights into market trends and regional performance, specifically tailored to stakeholder needs.

What are the market trends of feed Phosphate?

Current trends in the feed-phosphate market include a shift towards organic and sustainable farming practices, innovation in phosphate production methods, and increasing investments in animal health products that drive nutrient efficiency in livestock.