Feed Pigments Market Report

Published Date: 31 January 2026 | Report Code: feed-pigments

Feed Pigments Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Feed Pigments market from 2023 to 2033, including market size, growth rates, trends, and regional insights. It aims to equip stakeholders with relevant data and forecasts to make informed decisions in this dynamic industry.

| Metric | Value |

|---|---|

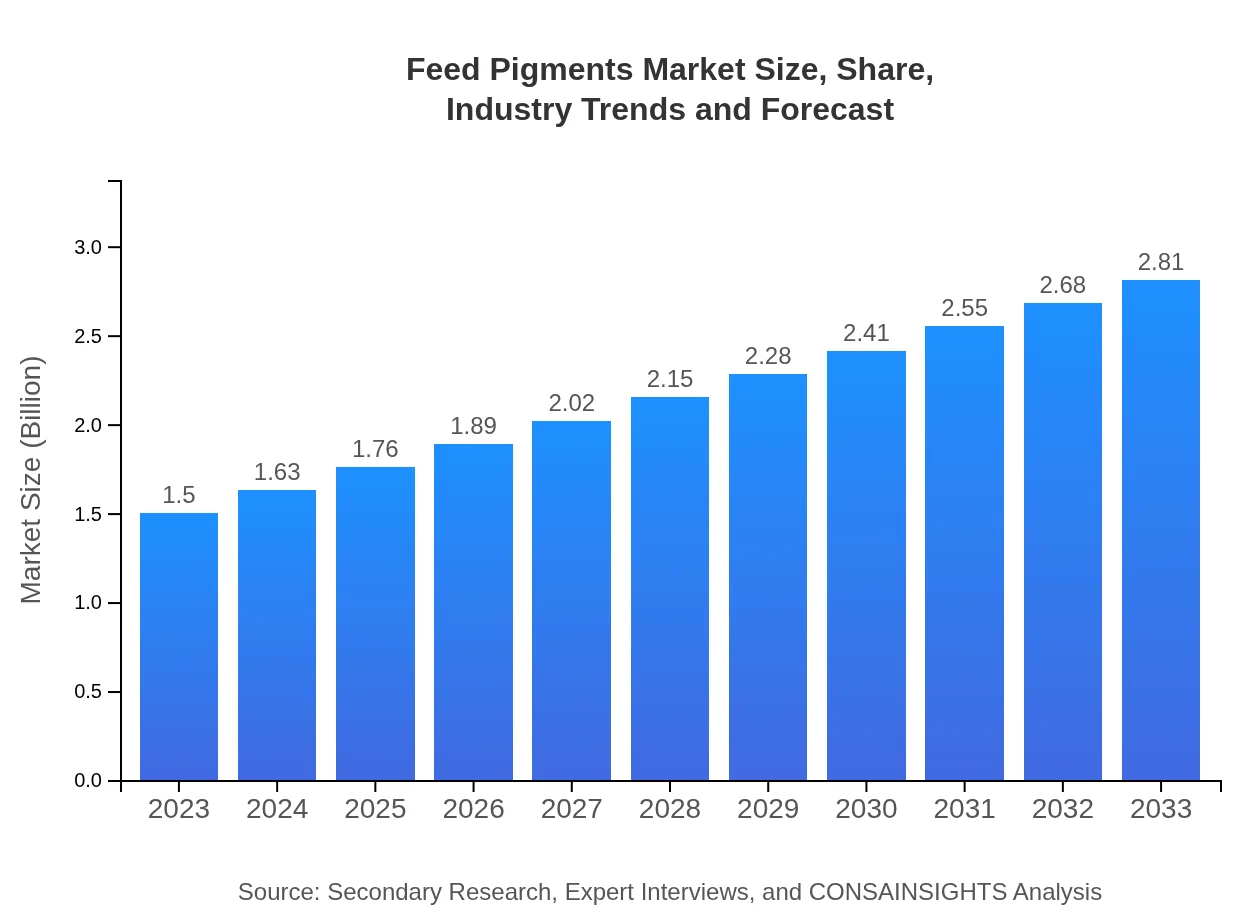

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $2.81 Billion |

| Top Companies | BASF SE, Alltech Inc., Davisco Foods International, Kemin Industries, Denk Ingredients |

| Last Modified Date | 31 January 2026 |

Feed Pigments Market Overview

Customize Feed Pigments Market Report market research report

- ✔ Get in-depth analysis of Feed Pigments market size, growth, and forecasts.

- ✔ Understand Feed Pigments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Pigments

What is the Market Size & CAGR of Feed Pigments market in 2023?

Feed Pigments Industry Analysis

Feed Pigments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Pigments Market Analysis Report by Region

Europe Feed Pigments Market Report:

The European market is anticipated to grow from 0.45 billion USD in 2023 to 0.83 billion USD in 2033, influenced by strict regulations on animal feed quality and consumer demand for natural ingredients.Asia Pacific Feed Pigments Market Report:

Asia Pacific is projected to witness significant growth, reaching an estimated market size of 0.52 billion USD by 2033, up from 0.28 billion USD in 2023. The increasing livestock population and investments in animal feed production are key drivers of this growth.North America Feed Pigments Market Report:

North America holds a substantial share of the Feed Pigments market, with an estimated market size of 1.04 billion USD by 2033, growing from 0.56 billion USD in 2023. The region's focus on high-quality animal products and advanced feed technologies supports this growth.South America Feed Pigments Market Report:

In South America, the Feed Pigments market is expected to grow from 0.09 billion USD in 2023 to 0.16 billion USD by 2033, driven by rising meat consumption and the expanding poultry industry in countries like Brazil and Argentina.Middle East & Africa Feed Pigments Market Report:

In the Middle East and Africa, the market is set to increase from 0.13 billion USD in 2023 to 0.25 billion USD by 2033. This growth is driven by improving livestock management and increased investments in the aquaculture sector.Tell us your focus area and get a customized research report.

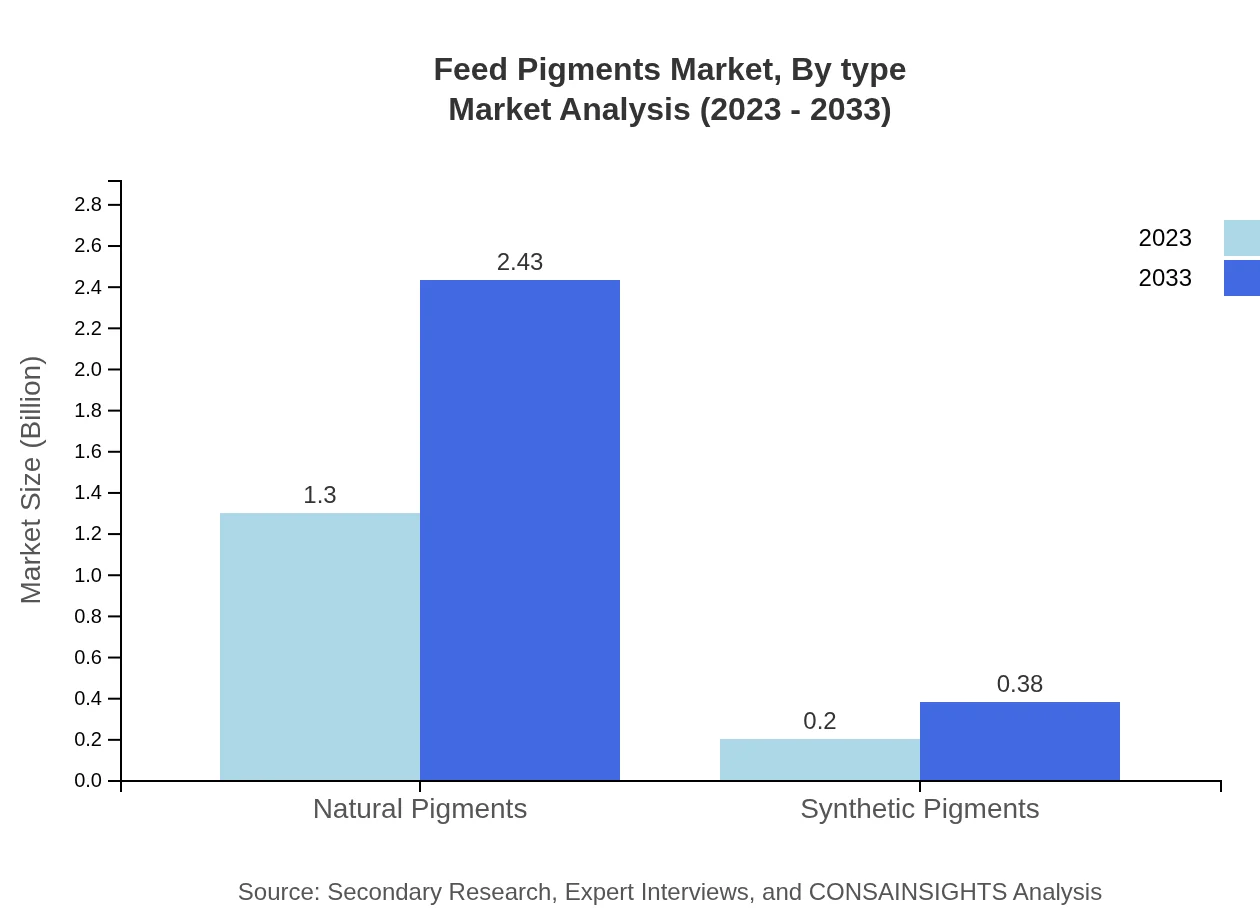

Feed Pigments Market Analysis By Type

The market is predominantly led by natural pigments, projected to grow from 1.30 billion USD in 2023 to 2.43 billion USD by 2033, maintaining a market share of approximately 86.47%. In contrast, synthetic pigments are expected to expand from 0.20 billion USD to 0.38 billion USD, comprising roughly 13.53% of the market share.

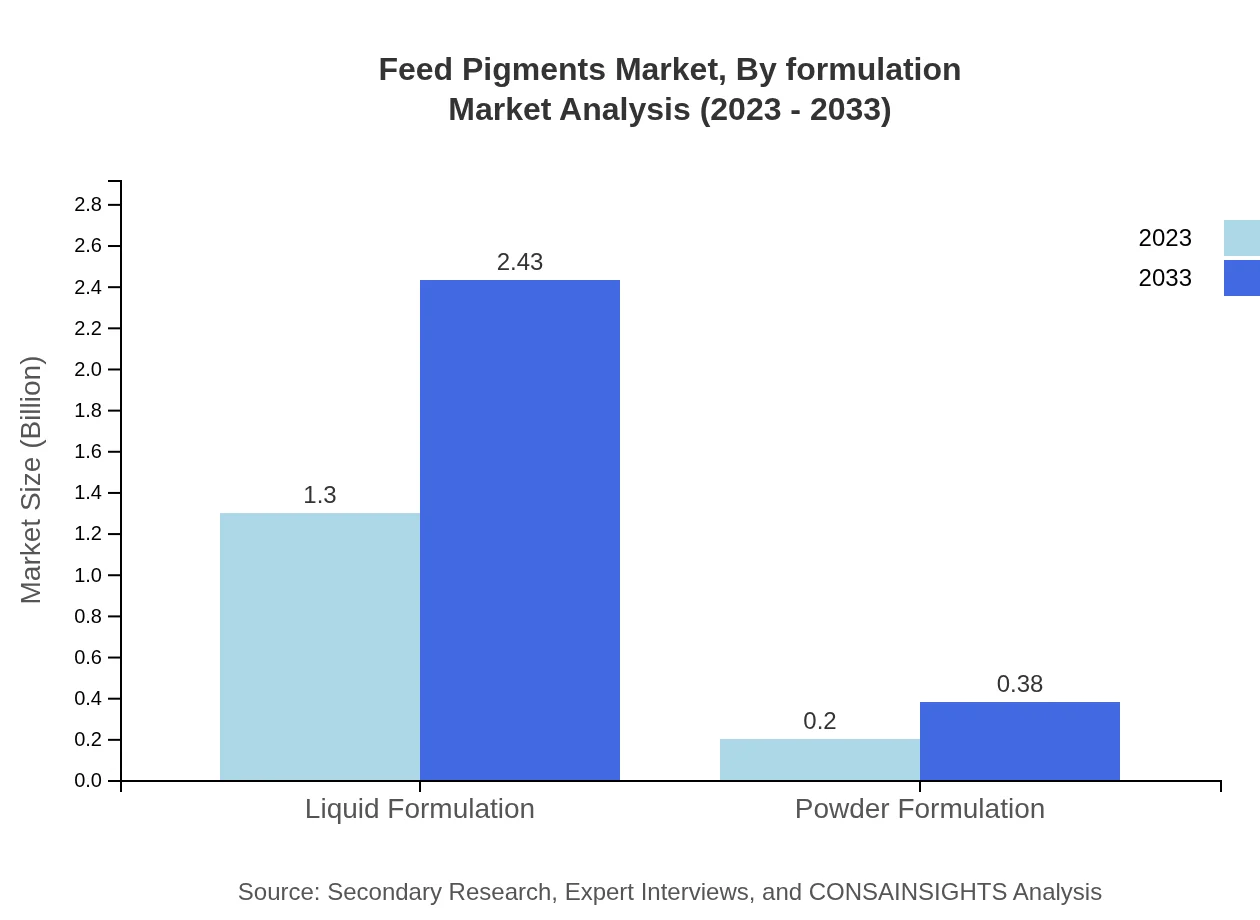

Feed Pigments Market Analysis By Formulation

Liquid formulations dominate, with a market size growing from 1.30 billion USD in 2023 to 2.43 billion USD by 2033 (86.47% market share), while powder formulations are anticipated to increase from 0.20 billion USD to 0.38 billion USD, representing a 13.53% market share.

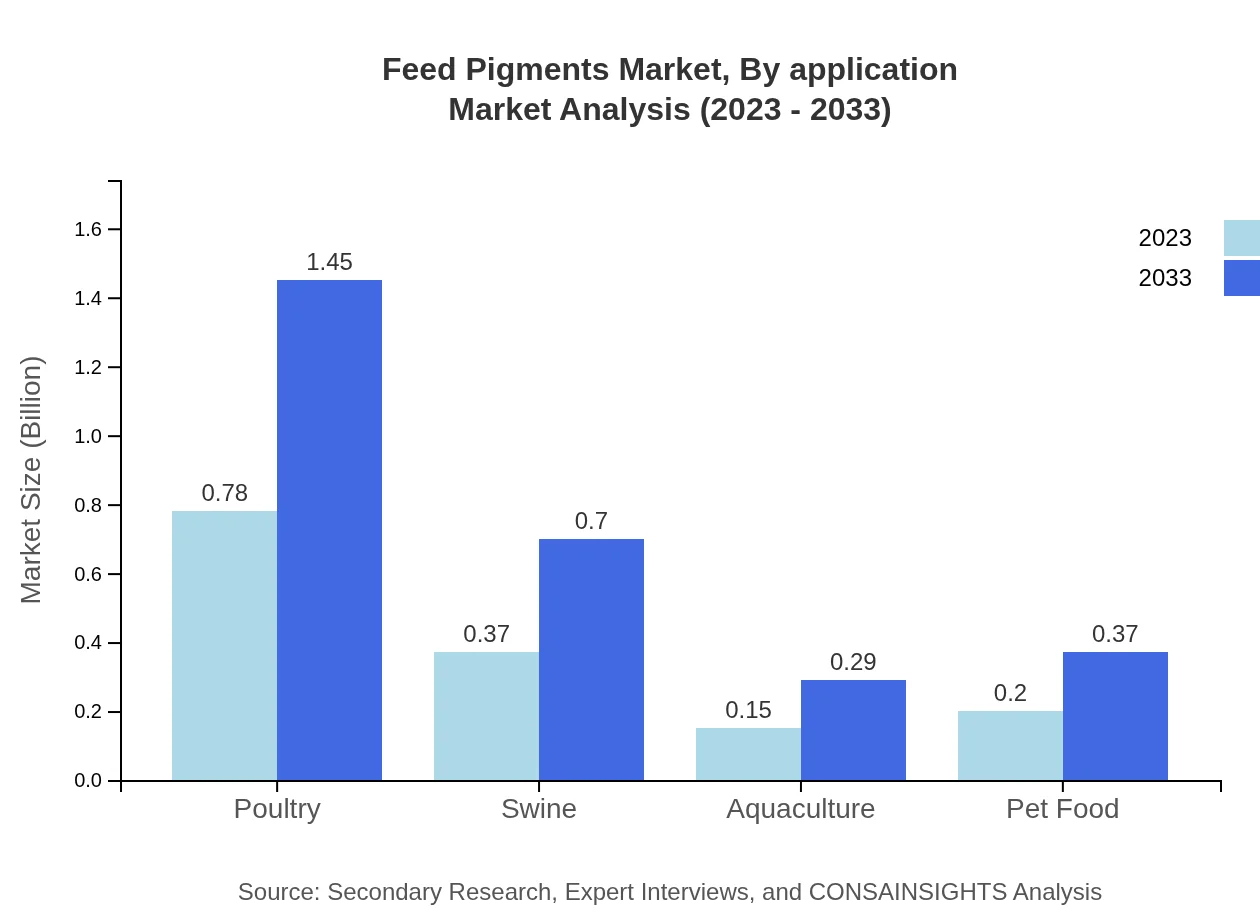

Feed Pigments Market Analysis By Application

The poultry segment commands the largest share, with anticipated growth from 0.78 billion USD in 2023 to 1.45 billion USD by 2033 (51.78% share). The swine sector is also significant, growing from 0.37 billion USD to 0.70 billion USD (24.87% share).

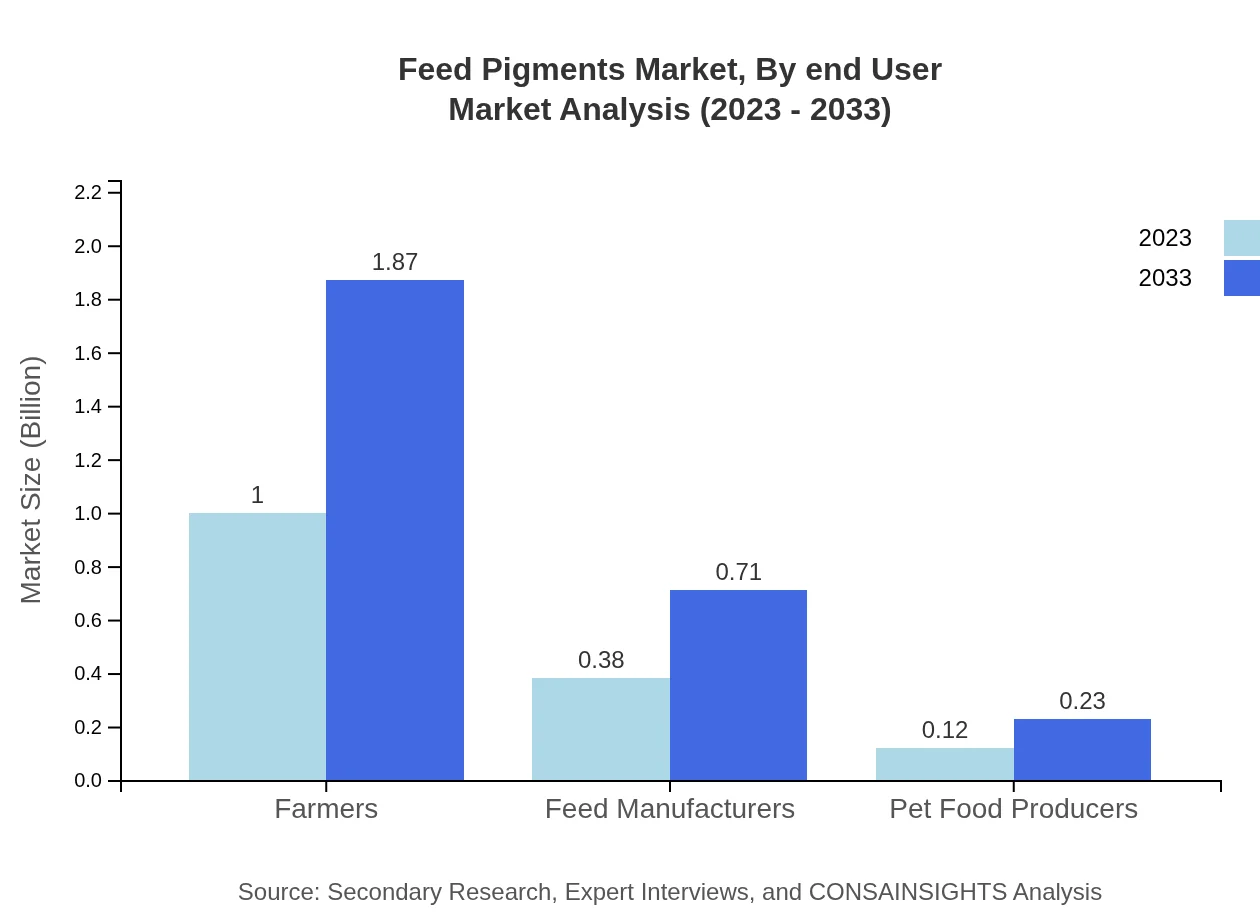

Feed Pigments Market Analysis By End User

Farmers remain the largest end-users, with an increasing market size from 1.00 billion USD in 2023 to 1.87 billion USD by 2033 (66.65% share). Feed manufacturers also play a crucial role, growing from 0.38 billion USD to 0.71 billion USD (25.3% share).

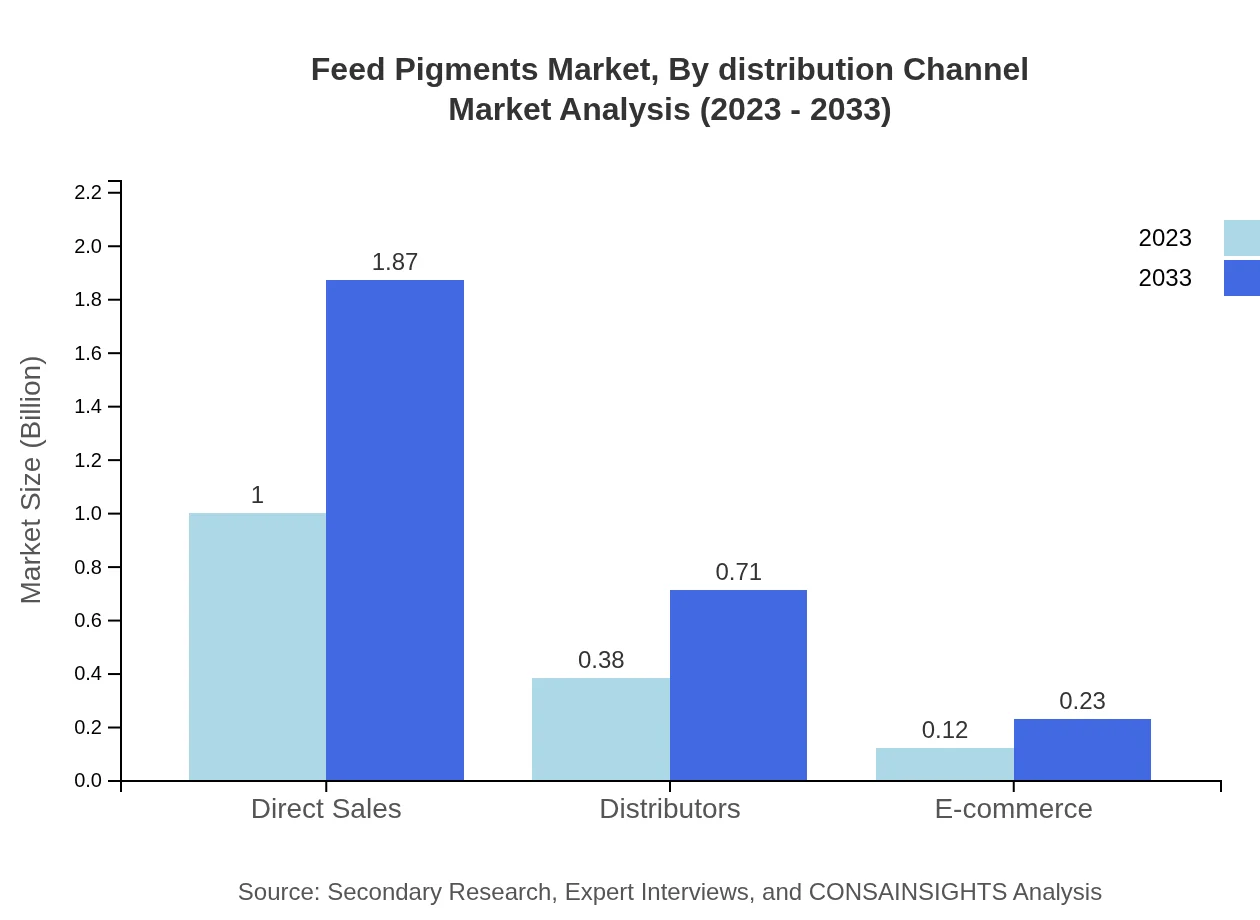

Feed Pigments Market Analysis By Distribution Channel

Direct sales are leading with a substantial market size of 1.00 billion USD in 2023, increasing to 1.87 billion USD by 2033 (66.65% share). Distributors and e-commerce channels are also noteworthy, growing from 0.38 to 0.71 billion USD and 0.12 to 0.23 billion USD, respectively.

Feed Pigments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Pigments Industry

BASF SE:

BASF is one of the largest chemical producers worldwide, offering a wide range of feed pigments known for their quality and innovation.Alltech Inc.:

Alltech is a global animal health company focusing on sustainable feed solutions, providing high-quality natural pigments.Davisco Foods International:

Davisco specializes in dairy and food ingredient production, contributing significantly through its feed pigment innovations.Kemin Industries:

Kemin applies science to agriculture, producing a variety of feed ingredients, including high-quality feed pigments.Denk Ingredients:

Denk Ingredients offers innovative and sustainable feed solutions, including a range of natural pigments for the livestock industry.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Pigments?

The global feed pigments market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.3% from 2023 to 2033, transforming it into a more substantial market by the end of the decade.

What are the key market players or companies in the feed pigment industry?

Key players in the feed pigments market include BASF, DSM Nutritional Products, Kemin Industries, and Novus International. These companies are recognized for their innovative solutions and extensive portfolios in the feed additives sector.

What are the primary factors driving the growth in the feed pigmented industry?

The growth of the feed pigments industry is driven by increasing demand for superior-quality animal feed, rising meat consumption globally, heightened awareness of animal health, and advancements in feed technology.

Which region is the fastest Growing in the feed pigments?

The Asia Pacific region is expected to witness significant growth in the feed pigments market, with market size projected to grow from $0.28 billion in 2023 to $0.52 billion in 2033, following increasing livestock production.

Does ConsaInsights provide customized market report data for the feed pigment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to access detailed and pertinent insights concerning the feed pigments market based on unique inquiries and parameters.

What deliverables can I expect from this feed pigment market research project?

Expect comprehensive reports featuring market analysis, regional insights, segmentation breakdowns by type and demand drivers, forecasts, competitive landscapes, and valuable recommendations for strategic planning.

What are the market trends of feed pigments?

Current trends in the feed pigments market include a shift towards natural pigments, increased investments in R&D, a growing emphasis on sustainable agriculture practices, and expanding e-commerce sales channels.