Feed Plant Based Protein Market Report

Published Date: 02 February 2026 | Report Code: feed-plant-based-protein

Feed Plant Based Protein Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Feed Plant Based Protein market, covering market size, industry trends, segment analysis, and regional insights from 2023 to 2033.

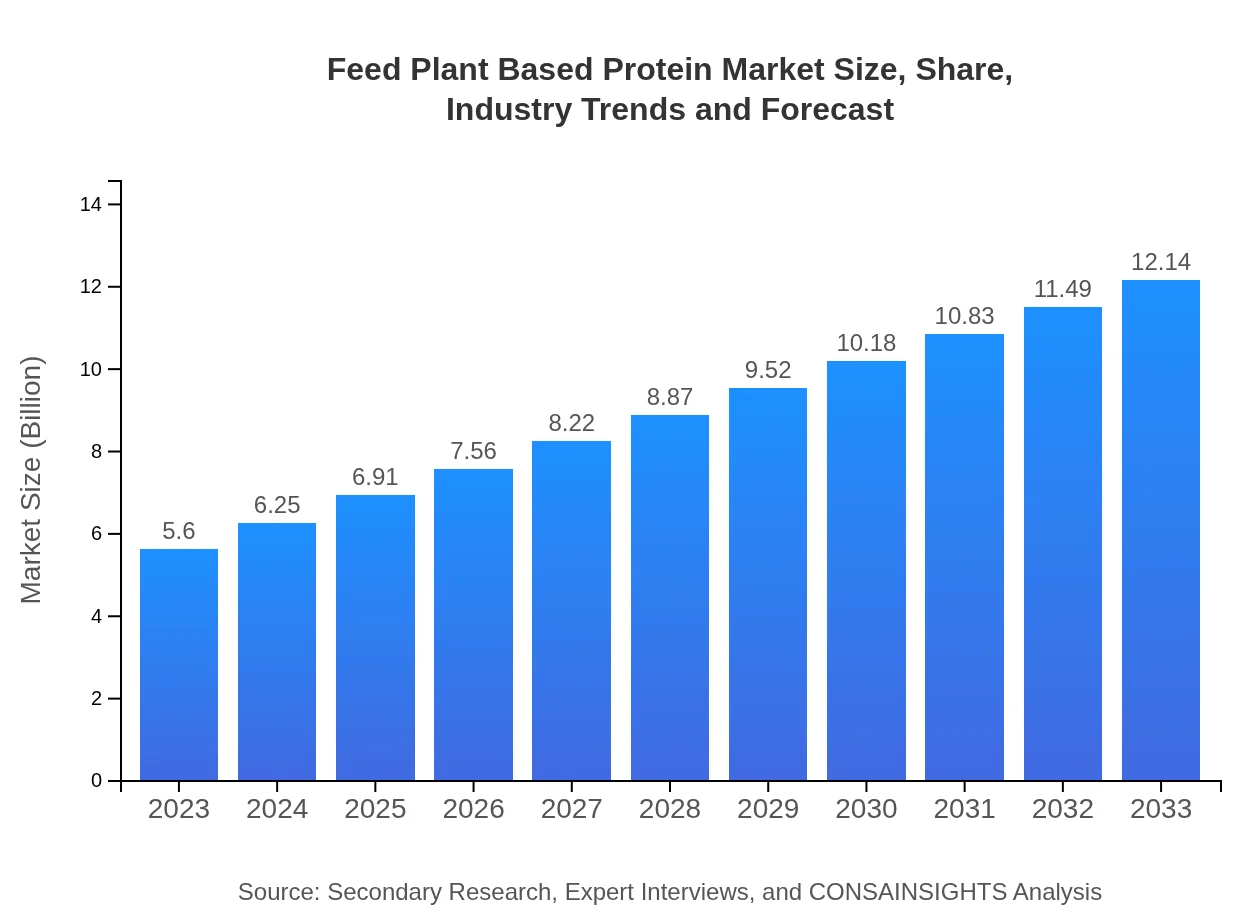

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Cargill , DuPont, Bunge Limited, ADM, Novozymes |

| Last Modified Date | 02 February 2026 |

Feed Plant Based Protein Market Overview

Customize Feed Plant Based Protein Market Report market research report

- ✔ Get in-depth analysis of Feed Plant Based Protein market size, growth, and forecasts.

- ✔ Understand Feed Plant Based Protein's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Plant Based Protein

What is the Market Size & CAGR of Feed Plant Based Protein market in 2033?

Feed Plant Based Protein Industry Analysis

Feed Plant Based Protein Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Plant Based Protein Market Analysis Report by Region

Europe Feed Plant Based Protein Market Report:

The European market for Feed Plant Based Protein stands at $1.51 billion in 2023, with projections to reach $3.28 billion by 2033. The growing trend towards organic livestock farming aligns with consumer preferences for sustainable and traceable food sources, thus increasing the appeal of plant-based proteins.Asia Pacific Feed Plant Based Protein Market Report:

In 2023, the Feed Plant Based Protein market in Asia Pacific is valued at approximately $1.10 billion, projected to grow to $2.38 billion by 2033. This growth is driven by increasing meat consumption, rapid urbanization, and the expansion of aquaculture practices in countries like China and India.North America Feed Plant Based Protein Market Report:

North America displays a robust market presence with a valuation of $2.08 billion in 2023, forecasted to nearly double with a target of $4.51 billion by 2033. Increasing awareness of the benefits of plant-based diets and stringent regulations on antibiotic use in livestock amplify market growth.South America Feed Plant Based Protein Market Report:

The South American market for Feed Plant Based Protein was valued at $0.32 billion in 2023 and is expected to reach $0.70 billion by 2033. The region benefits from rising demand for plant-based feed solutions as livestock farming evolves towards more sustainable practices.Middle East & Africa Feed Plant Based Protein Market Report:

The Middle East and Africa market is valued at $0.59 billion in 2023, anticipated to reach $1.27 billion by 2033. The region shows significant growth potential as the demand for alternative protein sources rises alongside efforts to improve food security.Tell us your focus area and get a customized research report.

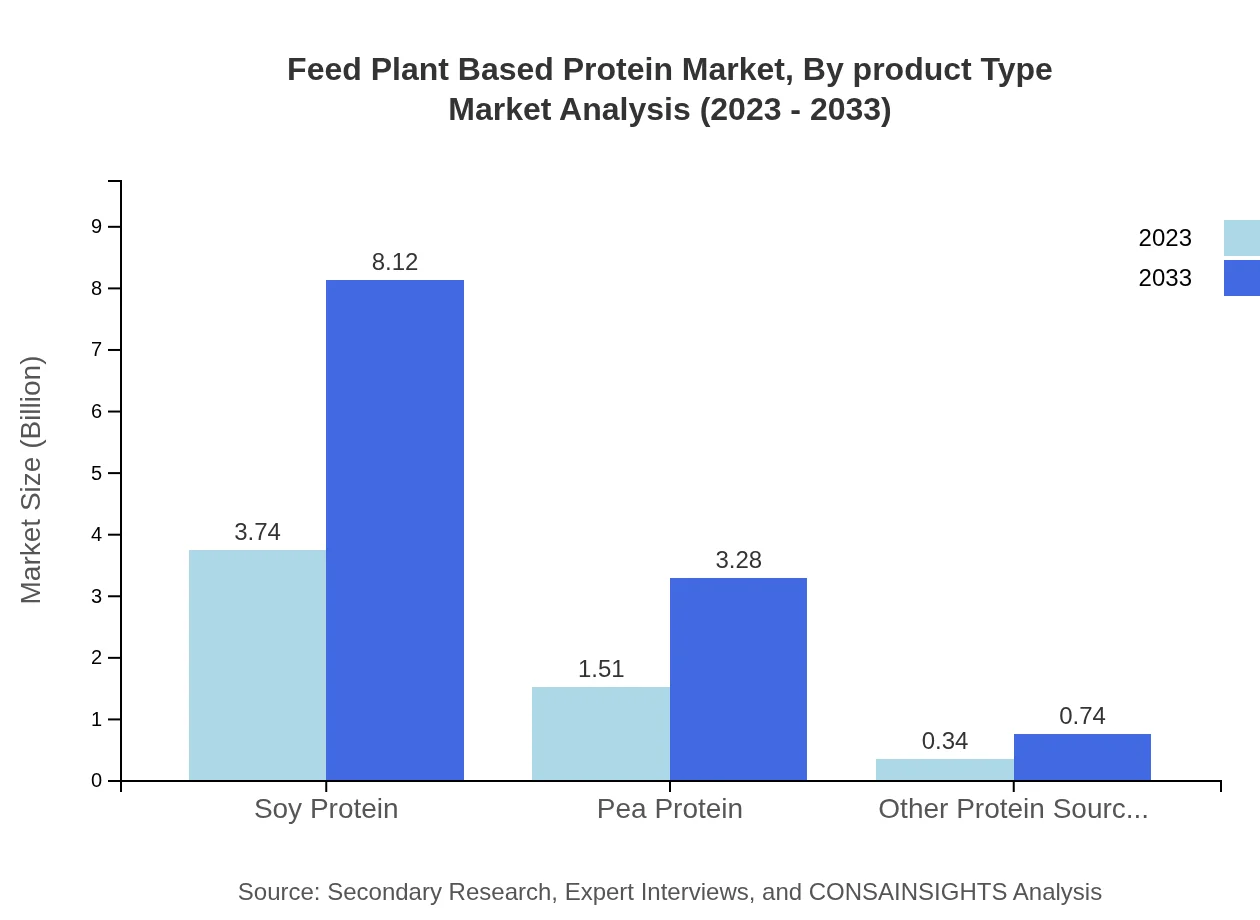

Feed Plant Based Protein Market Analysis By Product Type

The Feed Plant-Based Protein market by product type includes Soy Protein, Pea Protein, and other sources. Soy Protein dominates the market with a size of $3.74 billion (66.87% share) in 2023, growing to $8.12 billion (66.87% share) by 2033. Pea Protein follows with a size of $1.51 billion (27% share) in 2023, expanding to $3.28 billion (27% share) in 2033.

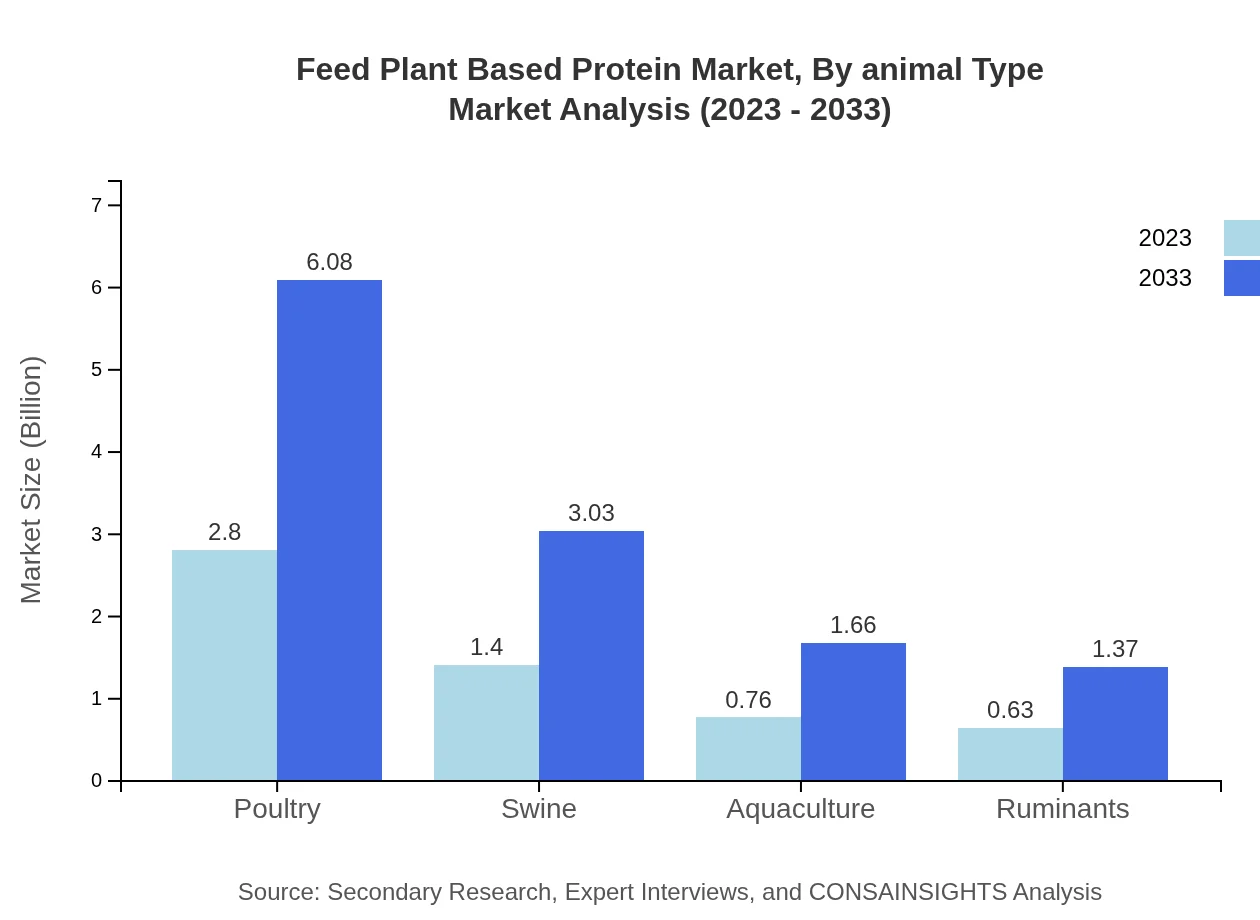

Feed Plant Based Protein Market Analysis By Animal Type

In terms of animal type, the market is largely driven by livestock, poultry, swine, aquaculture, and pets. Livestock accounts for the majority market share with a size of $3.74 billion (66.87% share) in 2023, increasing to $8.12 billion (66.87% share) by 2033. Poultry also represents a significant segment, with a projected growth from $2.80 billion (50.08% share) in 2023 to $6.08 billion (50.08% share) in 2033.

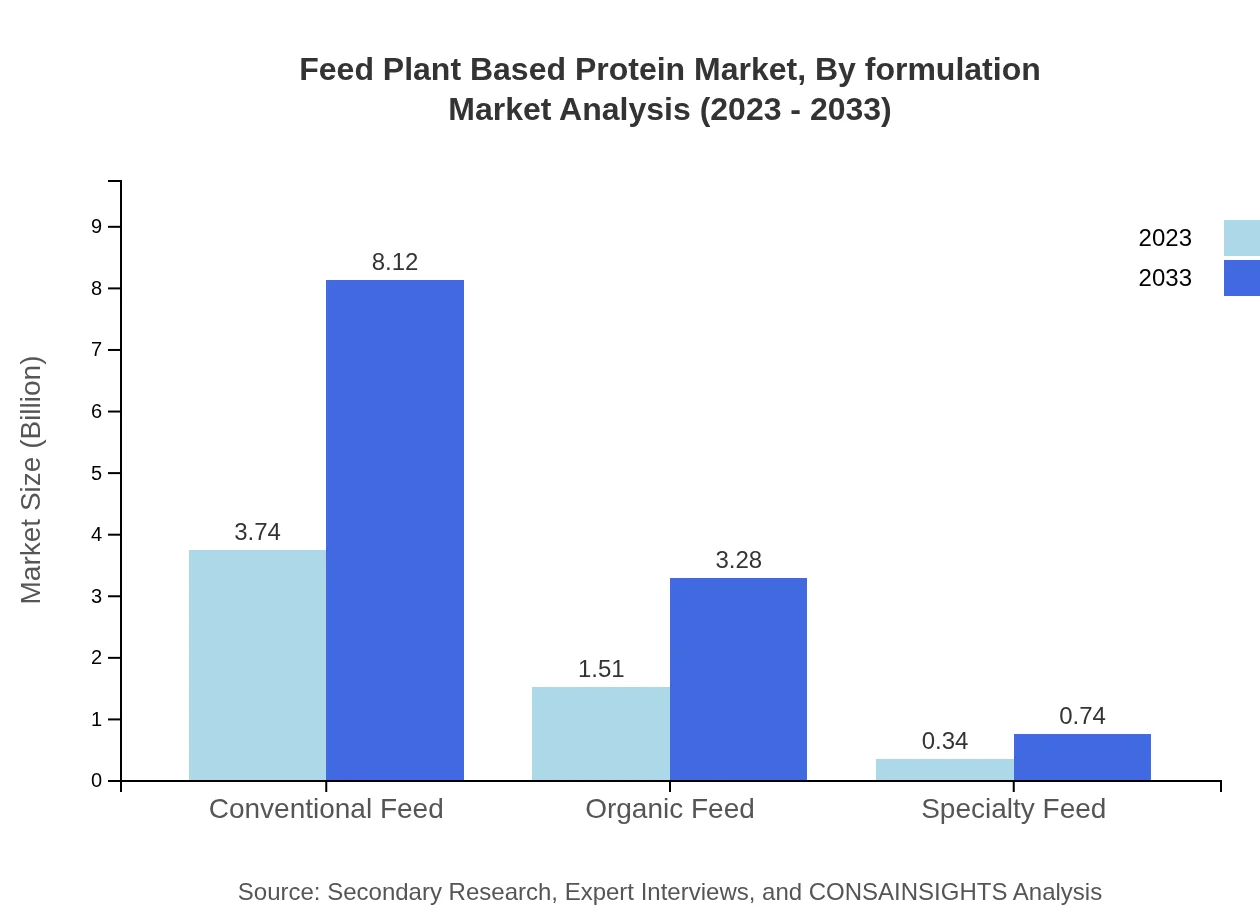

Feed Plant Based Protein Market Analysis By Formulation

The formulation segment is categorized into conventional, organic, and specialty feeds. Conventional feed represents the largest share, starting at $3.74 billion (66.87% share) in 2023 and expected to reach $8.12 billion (66.87% share) by 2033. Organic feed follows, projected to grow from $1.51 billion (27% share) in 2023 to $3.28 billion (27% share) by 2033.

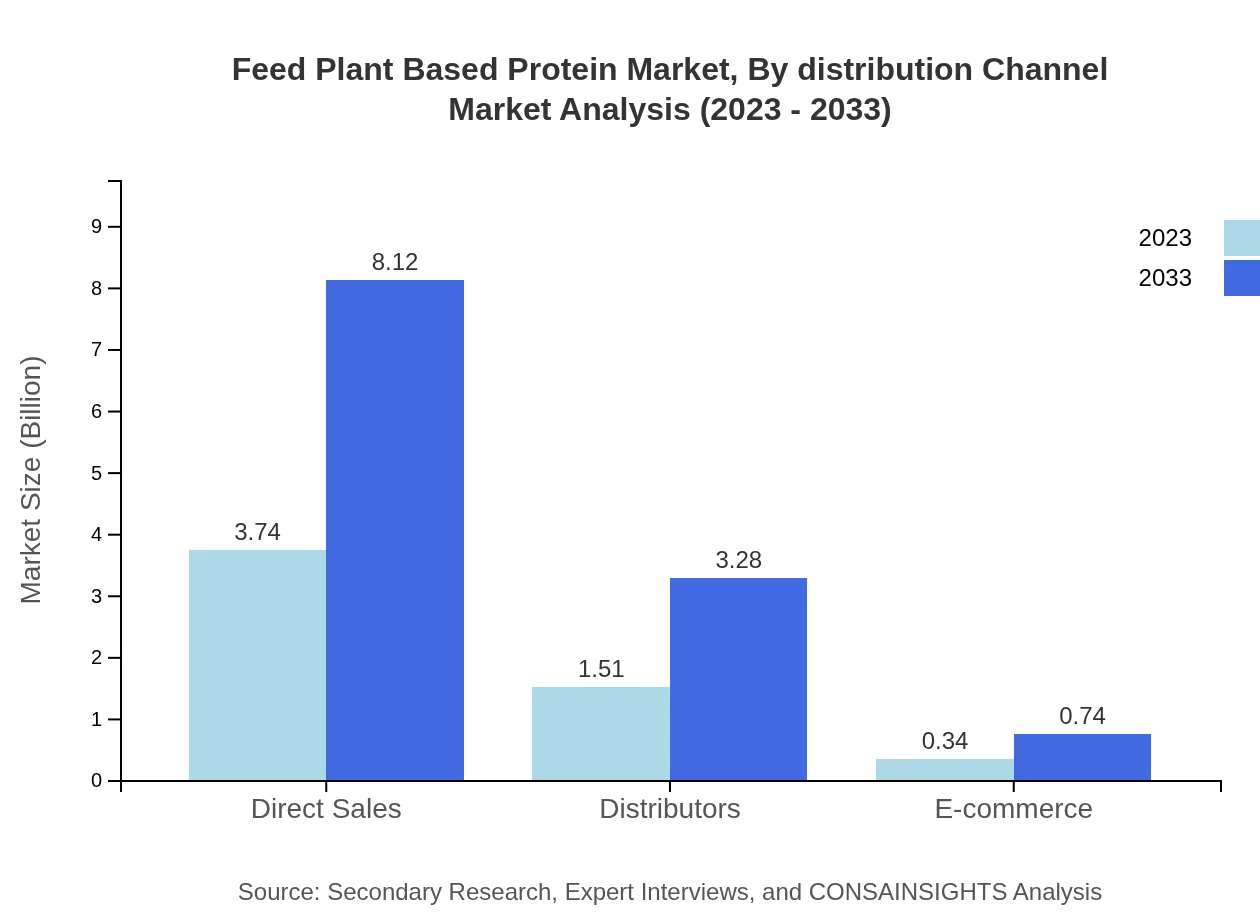

Feed Plant Based Protein Market Analysis By Distribution Channel

In terms of distribution channels, direct sales, distributors, and e-commerce are key players. Direct sales dominate with a size of $3.74 billion (66.87% share) in 2023, expected to grow to $8.12 billion (66.87% share) by 2033. Distributors hold the second-largest market share with $1.51 billion (27% share) in 2023, predicted to increase to $3.28 billion (27% share) by 2033.

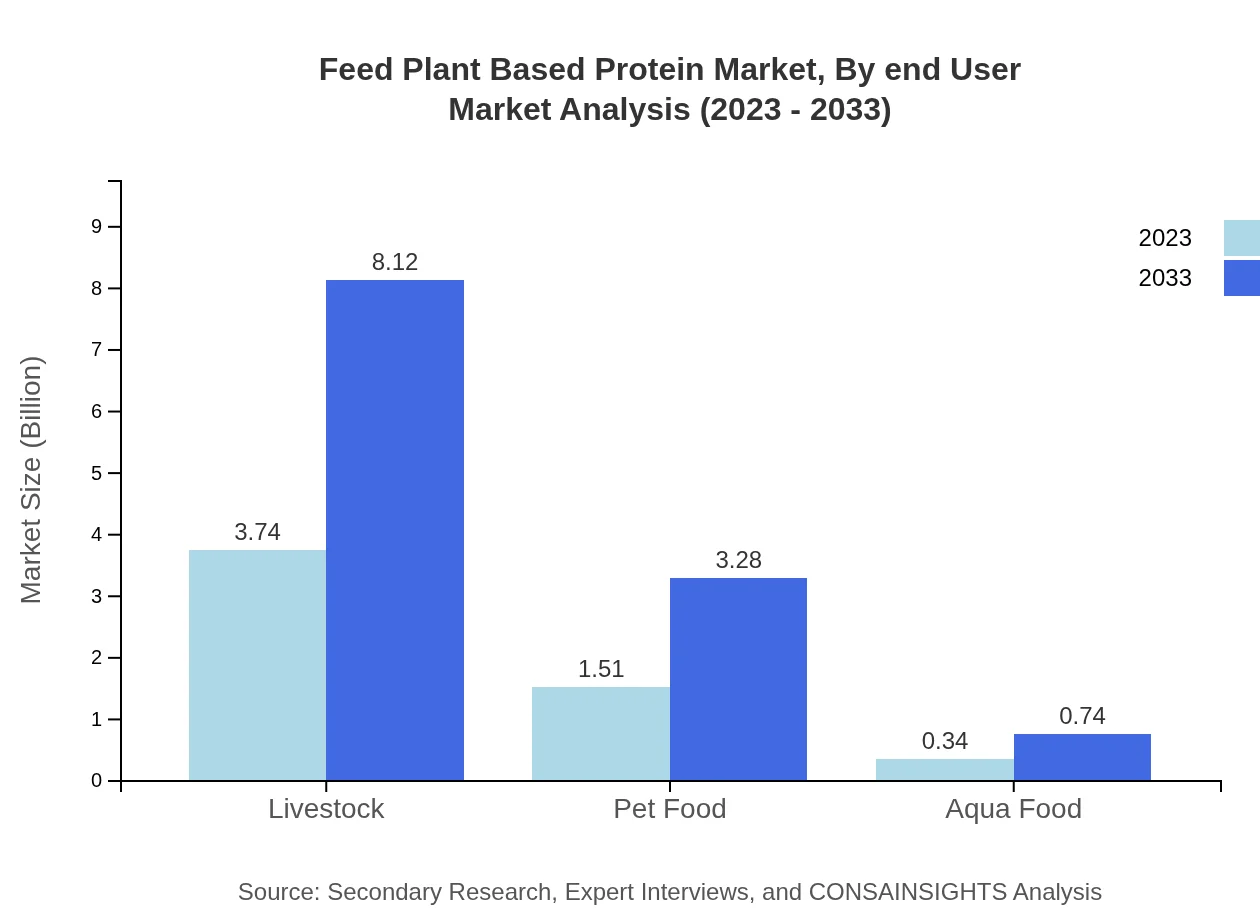

Feed Plant Based Protein Market Analysis By End User

This segment caters to livestock, aquaculture, and pet food sectors. Livestock represents the largest share, reflecting trends in sustainable agriculture and holistic animal nutrition. The segment's growth from $3.74 billion (66.87% share) in 2023 to $8.12 billion (66.87% share) by 2033 underlines the overall trend in the feed industry towards plant-based solutions.

Feed Plant Based Protein Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Plant Based Protein Industry

Cargill :

Cargill is a global leader in agriculture and food production, focusing on innovative plant protein solutions to enhance animal nutrition.DuPont:

DuPont is renowned for its expertise in biotechnology and nutrition, producing high-quality plant-based proteins for diverse feed applications.Bunge Limited:

Bunge is a major agribusiness and food production company that provides plant protein solutions to livestock and aquaculture markets.ADM:

Archer Daniels Midland Company offers a wide range of plant-based protein products, leveraging its extensive supply chain and innovative processing technologies.Novozymes:

Novozymes specializes in enzyme production that enhances the nutritional content of plant-based proteins for animal feeds.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Plant Based Protein?

The feed plant-based protein market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 7.8% over the coming years. This growth indicates a robust demand for plant-based protein sources in animal feed.

What are the key market players or companies in this feed Plant Based Protein industry?

Key players in the feed plant-based protein industry include major companies that specialize in animal nutrition and feed formulations. These companies focus on developing innovative products to meet the growing demand for sustainable protein alternatives in animal agriculture.

What are the primary factors driving the growth in the feed plant Based Protein industry?

Several factors are driving the growth of the feed plant-based protein market, including rising demand for sustainable animal feed, increased awareness of animal welfare, and the shift towards organic and non-GMO products among consumers and producers alike.

Which region is the fastest Growing in the feed plant Based Protein?

The Asia Pacific region exhibits significant growth in the feed plant-based protein market, projecting a rise from $1.10 billion in 2023 to $2.38 billion by 2033. Europe also shows substantial growth, reaching $3.28 billion in the same timeframe.

Does ConsaInsights provide customized market report data for the feed plant Based Protein industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the feed plant-based protein industry, enabling them to make informed business decisions based on detailed insights and analyses.

What deliverables can I expect from this feed plant Based Protein market research project?

Deliverables from the feed plant-based protein market research project include comprehensive reports that cover market size, growth forecasts, competitive analysis, segmentation data, and key trends within the industry, all aimed at supporting strategic decision-making.

What are the market trends of feed plant Based Protein?

Key market trends in the feed plant-based protein sector include increasing adoption of plant-based proteins in livestock diets, innovation in protein extraction methods, and a growing preference for sustainable sourcing practices, reflecting broader environmental and health concerns in agriculture.