Feed Probiotics Market Report

Published Date: 31 January 2026 | Report Code: feed-probiotics

Feed Probiotics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Feed Probiotics market from 2023 to 2033. It includes insights on market trends, size, growth, segmentation, and regional performance, offering valuable data for stakeholders looking to understand the future of this industry.

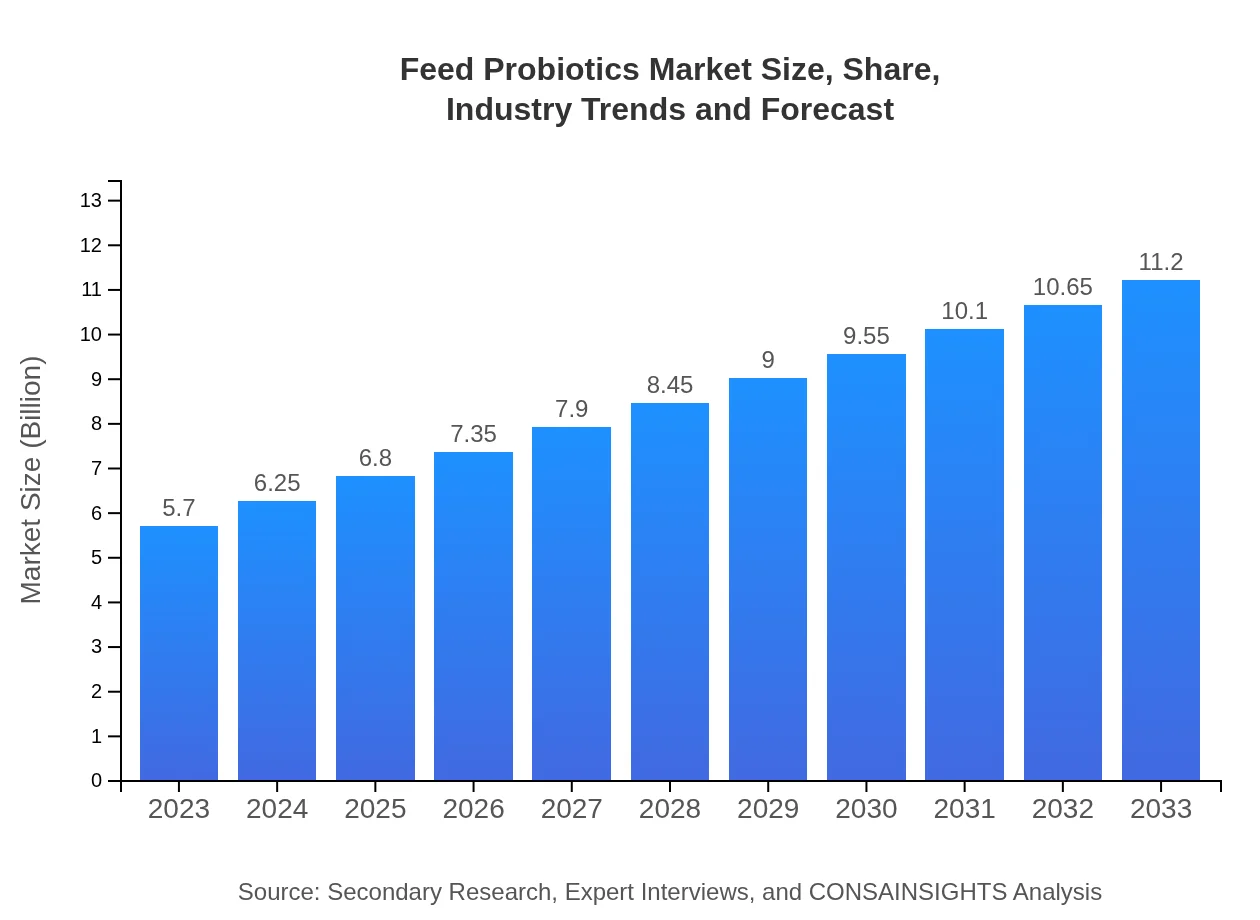

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.20 Billion |

| Top Companies | Chr. Hansen, Bifodan, ProbioFerm, Lallemand Animal Nutrition, Alltech |

| Last Modified Date | 31 January 2026 |

Feed Probiotics Market Overview

Customize Feed Probiotics Market Report market research report

- ✔ Get in-depth analysis of Feed Probiotics market size, growth, and forecasts.

- ✔ Understand Feed Probiotics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Probiotics

What is the Market Size & CAGR of Feed Probiotics market in {Year}?

Feed Probiotics Industry Analysis

Feed Probiotics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Probiotics Market Analysis Report by Region

Europe Feed Probiotics Market Report:

Europe is expected to experience substantial growth, with the market size increasing from 1.77 billion USD in 2023 to 3.48 billion USD by 2033. Stringent regulations against antibiotic use in livestock farming are accelerating the adoption of probiotics.Asia Pacific Feed Probiotics Market Report:

The Asia-Pacific region is witnessing robust growth in the Feed Probiotics market, increasing from 1.08 billion USD in 2023 to 2.12 billion USD in 2033. The rising population of livestock and enhanced focus on sustainable farming practices are driving this expansion.North America Feed Probiotics Market Report:

North America holds a significant share in the Feed Probiotics market, valued at 2.06 billion USD in 2023 and projected to reach 4.05 billion USD in 2033. The rising demand for organic and health-oriented animal feeds is fueling this growth.South America Feed Probiotics Market Report:

In South America, the market size is anticipated to grow from 0.41 billion USD in 2023 to 0.81 billion USD by 2033. The increase in meat production and a shift towards high-quality feed are key growth factors in this region.Middle East & Africa Feed Probiotics Market Report:

The Middle East and Africa market is anticipated to grow from 0.38 billion USD in 2023 to 0.75 billion USD by 2033. Growing awareness regarding animal health and rising consumption of animal products are contributing to this growth.Tell us your focus area and get a customized research report.

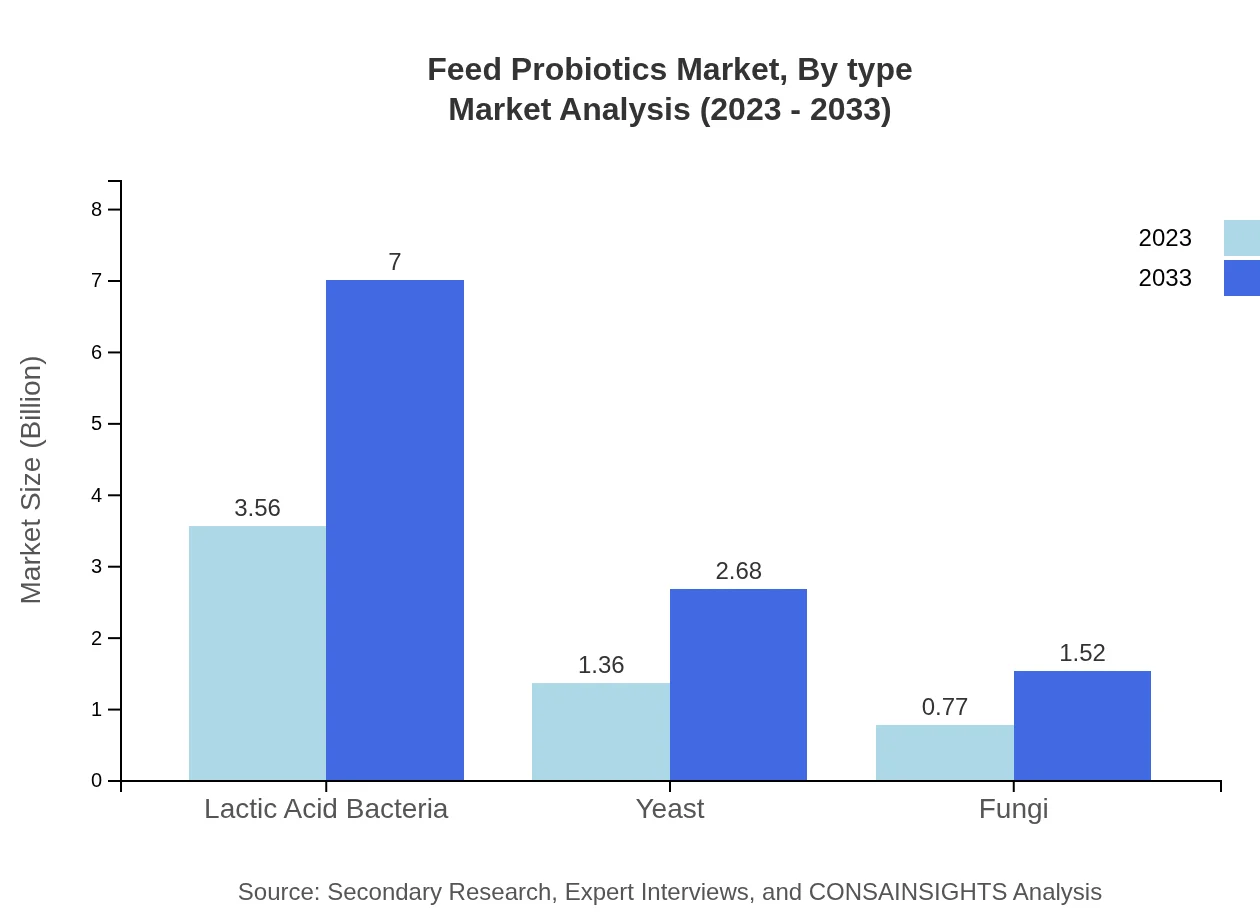

Feed Probiotics Market Analysis By Type

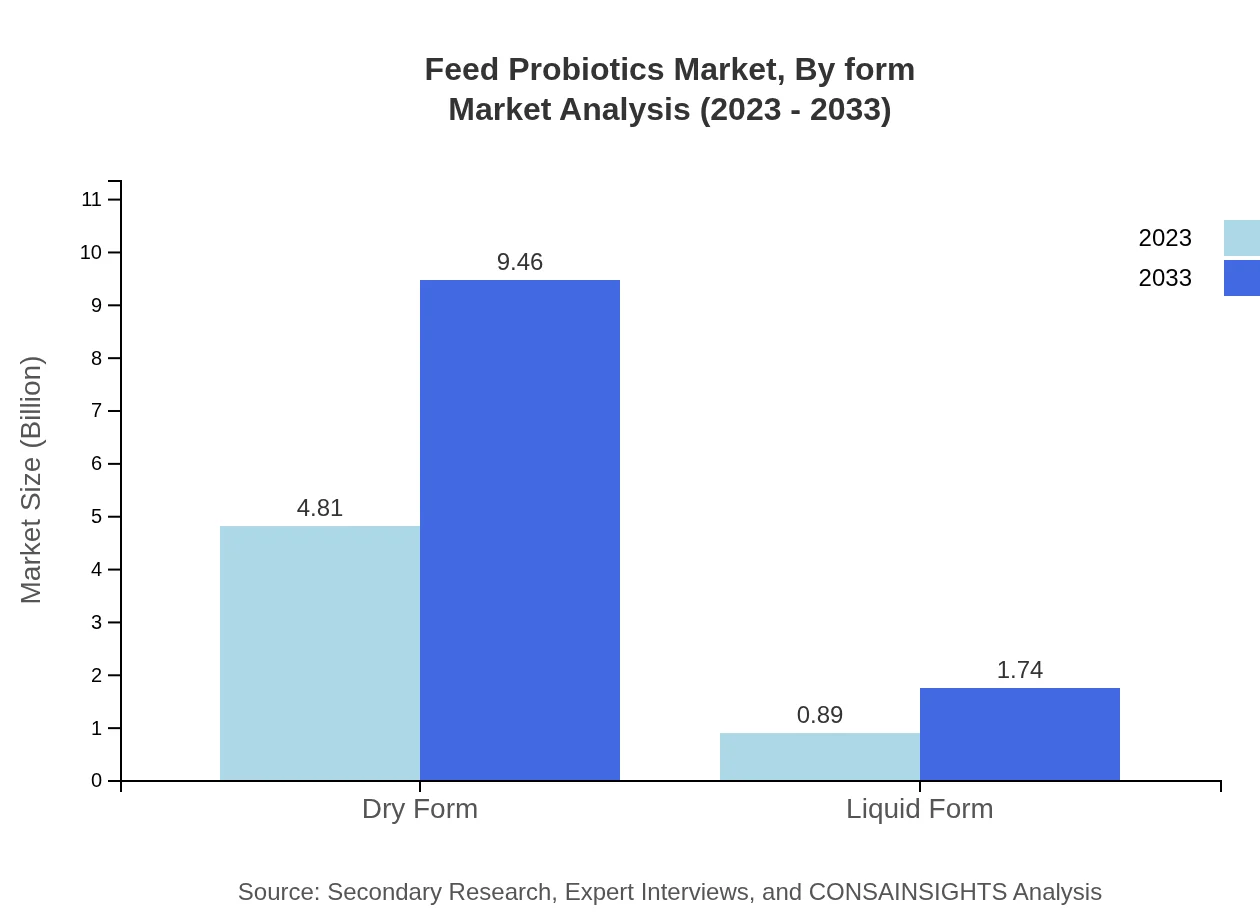

The Feed Probiotics market by type is dominated by Lactic Acid Bacteria, which accounted for 62.52% share in 2023 and is expected to maintain the same share by 2033, with an increase in market size from 3.56 billion USD to 7.00 billion USD. Dry form products are also major contributors, growing from 4.81 billion USD in 2023 to 9.46 billion USD by 2033, representing a strong hold in both size and share. Liquid forms, while smaller in market size, are also growing, reaching 1.74 billion USD by 2033.

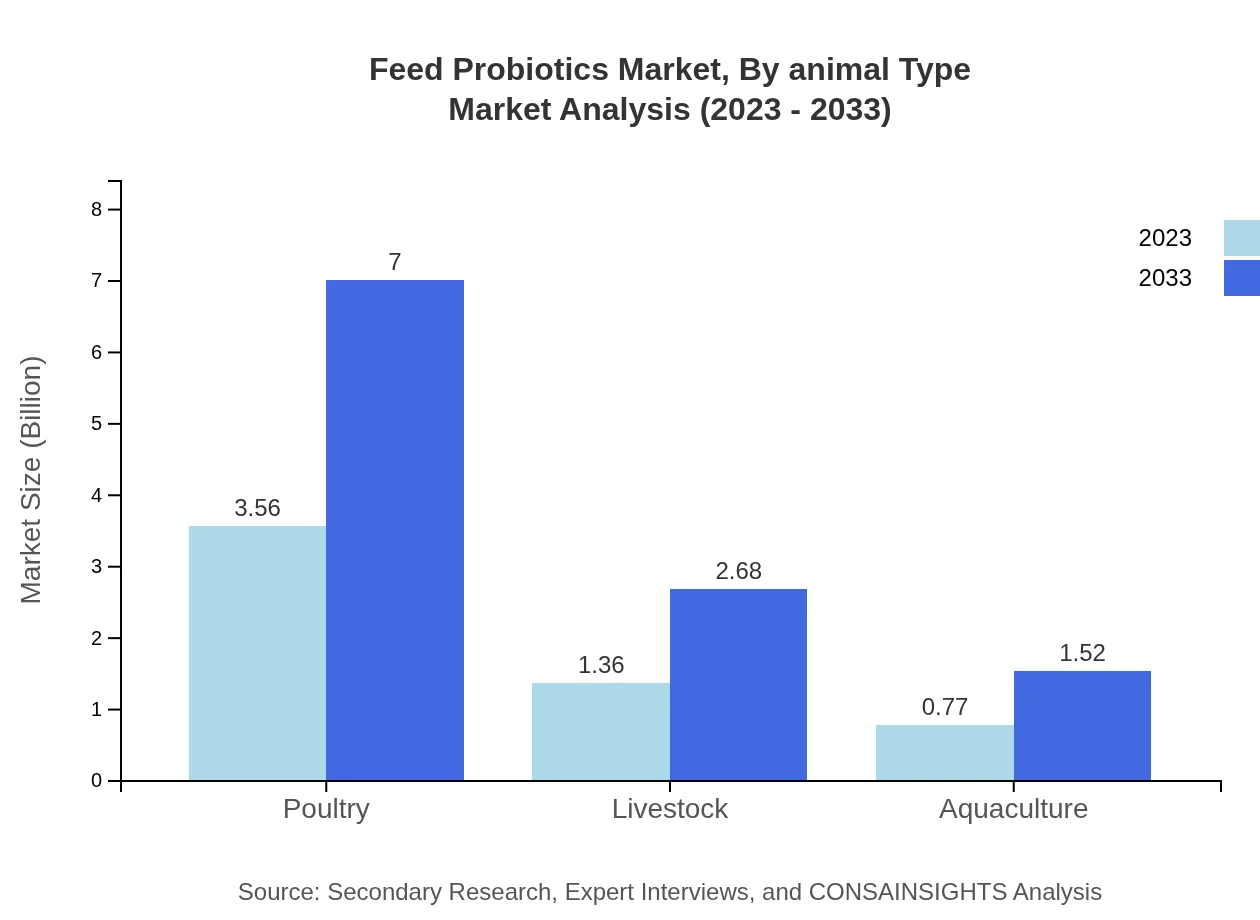

Feed Probiotics Market Analysis By Animal Type

Poultry remains the largest segment in the Feed Probiotics market, with a share of 62.52% in 2023, holding a market value of 3.56 billion USD that is expected to rise to 7.00 billion USD by 2033. Livestock and aquaculture also contribute significantly, with livestock increasing from 1.36 billion USD to 2.68 billion USD during the same period.

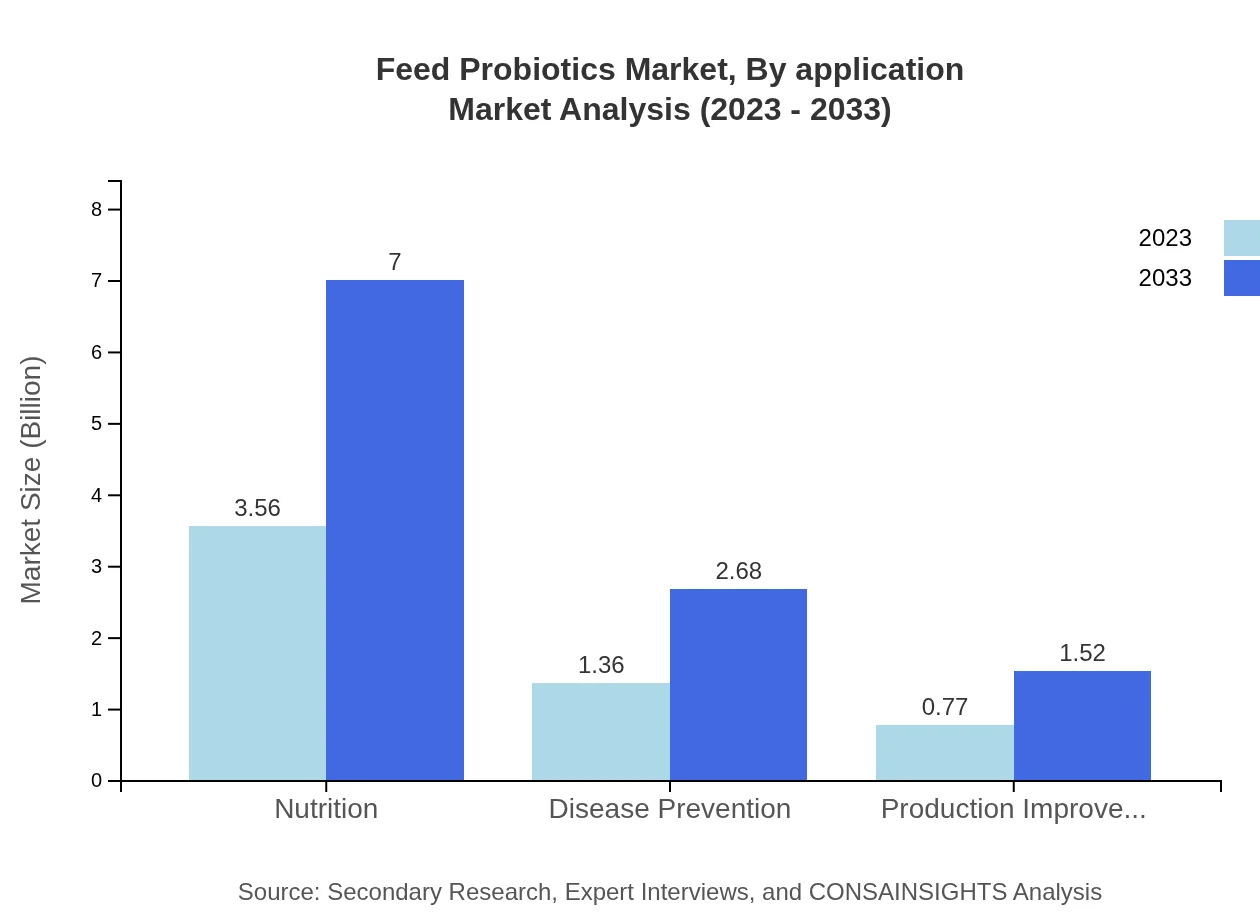

Feed Probiotics Market Analysis By Application

Nutrition plays a vital role in the Feed Probiotics market, representing a share of 62.52% in 2023, with market growth from 3.56 billion USD to 7.00 billion USD expected by 2033. Applications in disease prevention are also noteworthy, holding a similar share and increasing steadily in line with animal health awareness.

Feed Probiotics Market Analysis By Form

The Dry Form segment continues to dominate the Feed Probiotics market significantly, with a size of 4.81 billion USD in 2023 and a forecasted size of 9.46 billion USD by 2033. Liquid form, holding a 15.54% market share in 2023, is expected to grow steadily through innovations in delivery methods and applications.

Feed Probiotics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Probiotics Industry

Chr. Hansen:

A leader in bioscience, Chr. Hansen specializes in natural solutions that improve animal health, nutrition, and performance, making significant contributions to the probiotics market.Bifodan:

Bifodan focuses on probiotics for livestock and aquaculture, providing innovative products that enhance digestive health and overall animal welfare.ProbioFerm:

ProbioFerm offers a range of probiotics tailored for various animal species, emphasizing sustainable farming practices and animal health.Lallemand Animal Nutrition:

With a robust portfolio of probiotics and feed additives, Lallemand is dedicated to improving animal performance and health through fermentation technology.Alltech:

Alltech is renowned for its research-driven approach to animal nutrition, producing high-quality probiotics that support livestock health.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Probiotics?

The feed-probiotics market is valued at approximately $5.7 billion in 2023 and is expected to grow at a CAGR of 6.8% over the next decade, indicating a robust expansion in demand for probiotic solutions in animal feed.

What are the key market players or companies in this feed Probiotics industry?

Key players in the feed-probiotics industry include major companies such as DSM, BASF, and DuPont, which are leading in innovation and market share within the global market for feed and animal health solutions.

What are the primary factors driving the growth in the feed Probiotics industry?

Growth drivers for the feed-probiotics market include rising demand for animal protein, increasing awareness of animal health, stringent regulations against antibiotics, and the growing adoption of natural feed additives for livestock.

Which region is the fastest Growing in the feed Probiotics?

The fastest-growing region for feed-probiotics is North America, with the market growing from $2.06 billion in 2023 to $4.05 billion by 2033 due to increasing livestock production and consumer demand for healthier food options.

Does ConsaInsights provide customized market report data for the feed Probiotics industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications, ensuring that unique market trends, demands, and insights are adequately addressed within the feed-probiotics industry.

What deliverables can I expect from this feed Probiotics market research project?

Expected deliverables include comprehensive market analysis reports, segment-specific data, trend projections, competitive landscape assessments, and tailored insights to inform strategic decision-making for stakeholders.

What are the market trends of feed Probiotics?

Current trends in the feed-probiotics market include the rising adoption of dry form probiotics, innovations in liquid form products, a focus on lactic acid bacteria, and advancements in formulations aimed at improving livestock health and nutrition.