Feed Processing Market Report

Published Date: 02 February 2026 | Report Code: feed-processing

Feed Processing Market Size, Share, Industry Trends and Forecast to 2033

This report delivers a comprehensive analysis of the Feed Processing market from 2023 to 2033, covering market size, growth rates, segmentation, regional insights, industry trends, and key players. It aims to provide stakeholders with valuable insights for strategic decision-making.

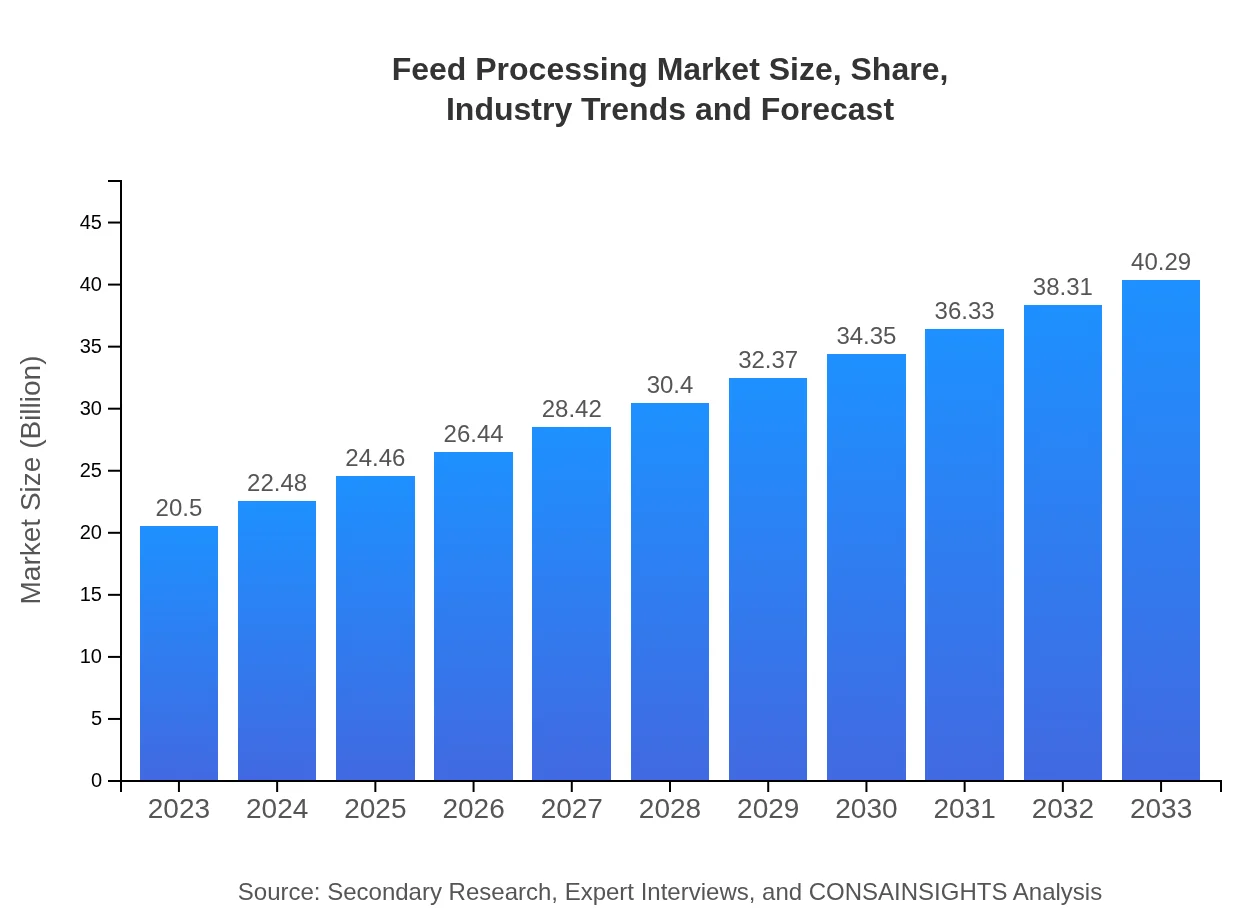

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $40.29 Billion |

| Top Companies | Cargill, Inc., Archer Daniels Midland Company (ADM), CHS Inc. |

| Last Modified Date | 02 February 2026 |

Feed Processing Market Overview

Customize Feed Processing Market Report market research report

- ✔ Get in-depth analysis of Feed Processing market size, growth, and forecasts.

- ✔ Understand Feed Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Processing

What is the Market Size & CAGR of Feed Processing market in 2023 and 2033?

Feed Processing Industry Analysis

Feed Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Processing Market Analysis Report by Region

Europe Feed Processing Market Report:

Europe's Feed Processing market is significantly promising, expected to reach $10.58 billion by 2033 from $5.39 billion in 2023. The stringent EU food safety regulations and a shift towards sustainable practices, including organic feed, are compelling producers to innovate.Asia Pacific Feed Processing Market Report:

In the Asia Pacific region, the Feed Processing market is projected to grow from $4.21 billion in 2023 to $8.28 billion by 2033. This growth is fueled by increasing livestock farming and rising demand for quality animal feed in countries like China and India. The region also witnesses a shift towards technological adoption to enhance feed quality and processing efficiency.North America Feed Processing Market Report:

Valued at $7.72 billion in 2023, the North American market is expected to double to $15.18 billion by 2033. The USA is the largest contributor, with strict regulatory frameworks necessitating high feed quality standards and promoting innovation in feed processing technologies.South America Feed Processing Market Report:

The South American Feed Processing market will grow from $1.26 billion in 2023 to $2.48 billion by 2033. With Brazil being a major player, the country's poultry and beef industry significantly influences the feed market, driving demand for processed feed solutions as farmers seek efficient production practices.Middle East & Africa Feed Processing Market Report:

The Middle East and Africa market is anticipated to grow from $1.91 billion in 2023 to $3.76 billion by 2033, fueled by increasing consumer awareness regarding animal health and a rise in poultry farming. This region is increasingly looking towards imported feed solutions due to local production challenges.Tell us your focus area and get a customized research report.

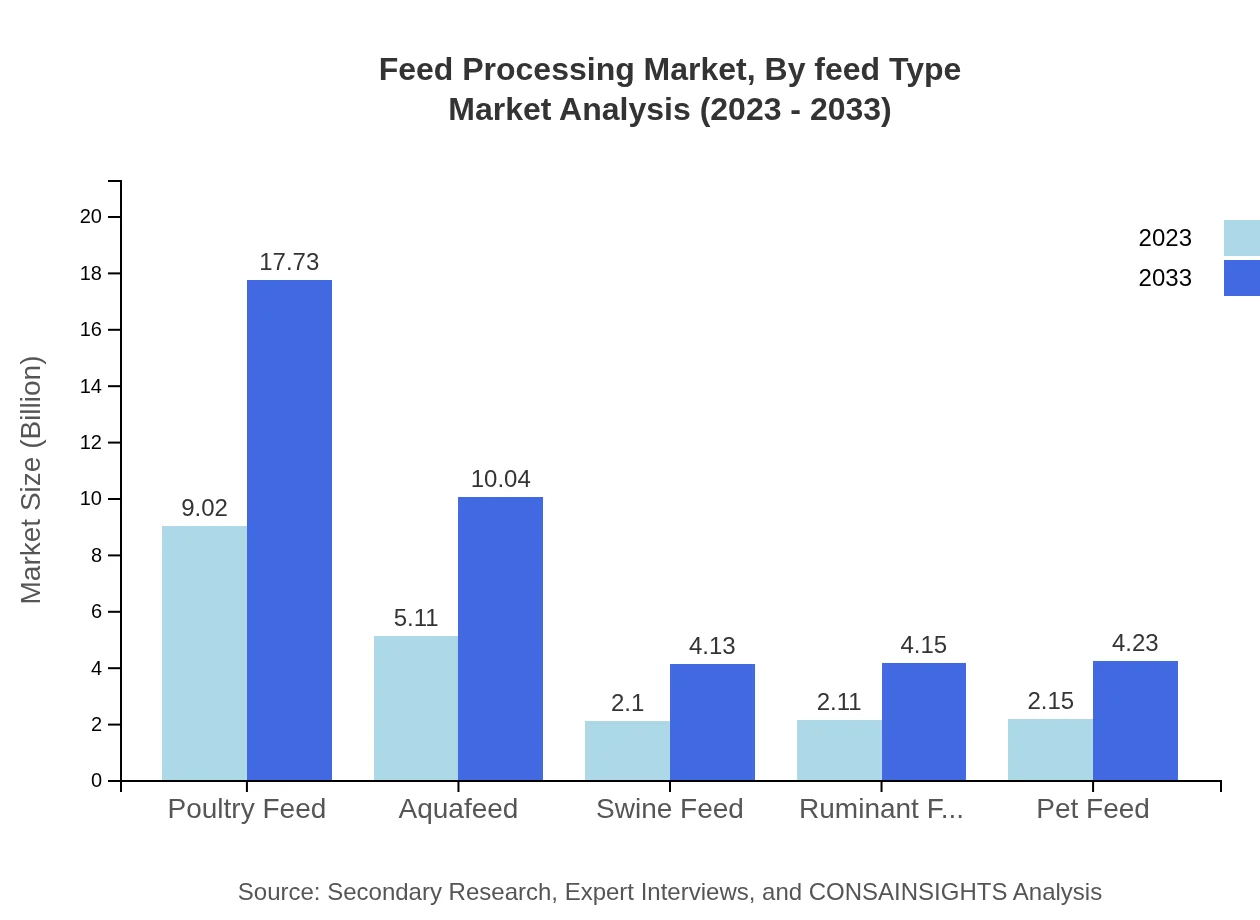

Feed Processing Market Analysis By Feed Type

The Feed Processing market, by feed type, is dominated by Poultry Feed, which constituted a revenue of $9.02 billion in 2023 and is projected to rise to $17.73 billion by 2033. Aquafeed and livestock feed are also significant, owing to the rising aquaculture industry and growing livestock demand, respectively.

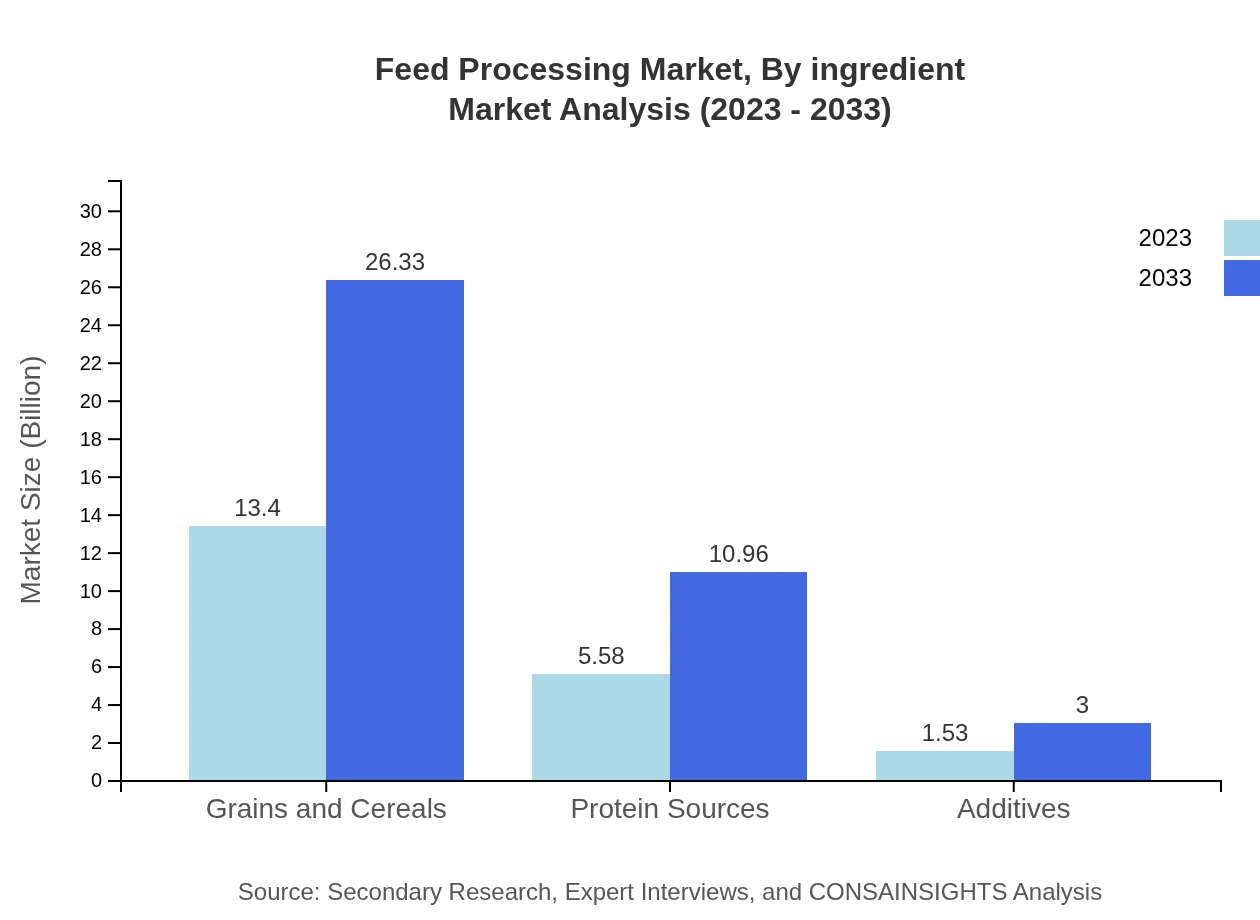

Feed Processing Market Analysis By Ingredient

Segmentation by ingredient reveals Grains and Cereals leading the market, expected to grow from $13.40 billion in 2023 to $26.33 billion in 2033. This high demand is complemented by rising prices and shortages prompting the use of protein sources and additives as alternate feed components.

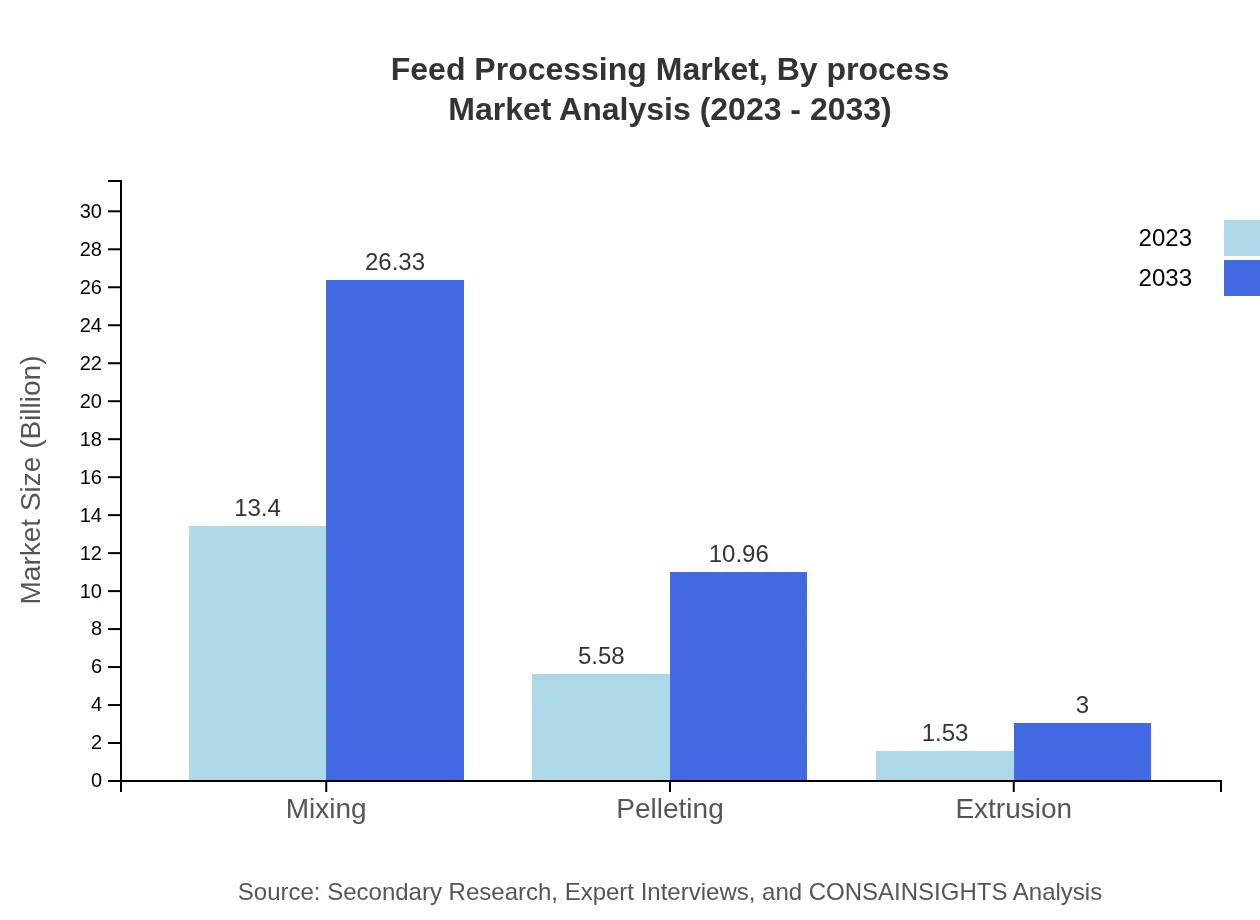

Feed Processing Market Analysis By Process

In terms of process, Mixing leads the segment, with a market size of $13.40 billion in 2023 and expected to grow to $26.33 billion by 2033, followed by Pelleting and Extrusion, which are crucial for shaping feed into specific forms that enhance digestibility and nutrient absorption.

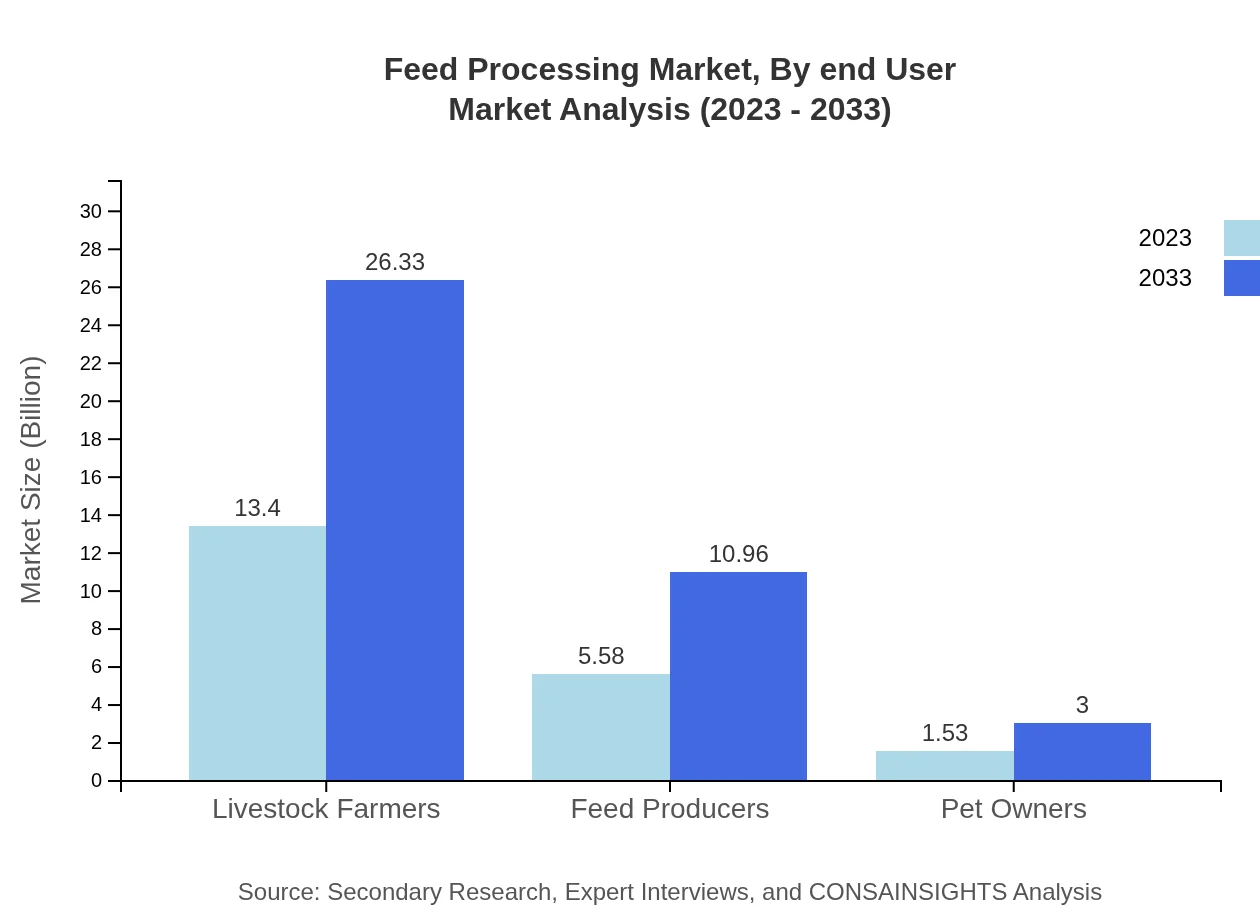

Feed Processing Market Analysis By End User

By end user, the Livestock Farmers segment leads with a market size of $13.40 billion in 2023. This growth is attributed to the increasing number of livestock operations and the demand for high-quality feed to enhance meat, dairy, and egg production.

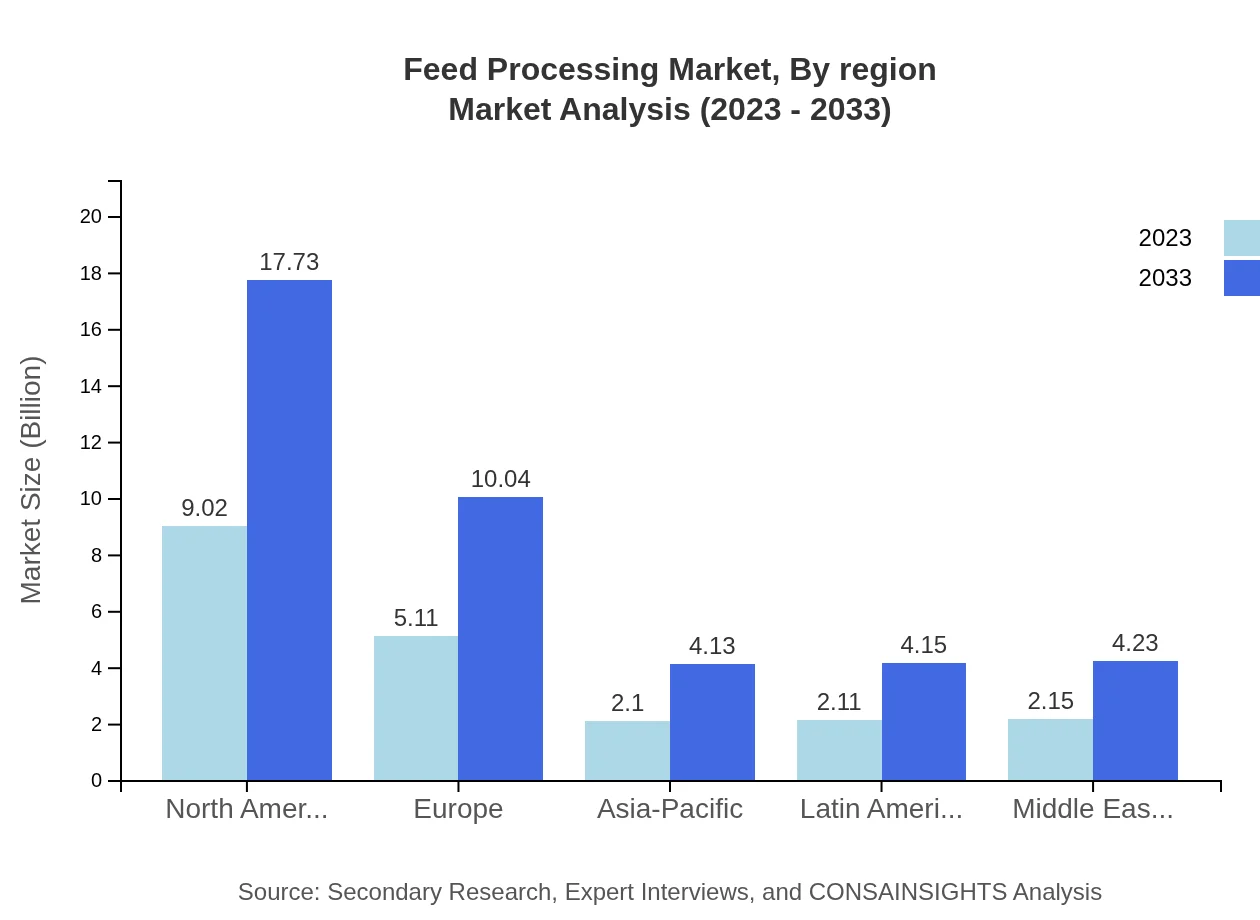

Feed Processing Market Analysis By Region

Regionally, the North American segment leads with significant contributions, followed closely by Europe and Asia-Pacific. Each region has unique demands and preferences, which influence the overall market dynamics.

Feed Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Processing Industry

Cargill, Inc.:

As one of the largest suppliers of animal feed, Cargill offers a wide range of feed solutions designed to meet the nutrition needs of livestock across various segments, leveraging extensive research and global reach.Archer Daniels Midland Company (ADM):

ADM is a global leader in nutrition and animal feed, providing innovative feed formulations using cutting-edge processing technologies to enhance animal health and productivity.CHS Inc.:

CHS specializes in various agriculture products, including feed processing solutions tailored to meet specific needs of different animal types, coupled with a strong emphasis on quality and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of feed processing?

The global feed processing market is projected to grow from $20.5 billion in 2023 to approximately $40.4 billion by 2033, reflecting a robust CAGR of 6.8%. This growth indicates escalating demand for processed animal feed.

What are the key market players or companies in the feed processing industry?

Key players in the feed processing industry include Cargill, Archer Daniels Midland Company, and Alltech, among others. These firms lead in innovation, sustainability, and production, promoting efficiency and meeting regional demands in feed processing.

What are the primary factors driving the growth in the feed processing industry?

Factors driving growth include the rising global population leading to increased meat consumption, advancements in feed processing technologies, and enhanced understanding of animal nutrition. Additionally, the demand for sustainable practices further bolsters market dynamics.

Which region is the fastest Growing in the feed processing?

The North America region stands out as the fastest-growing market for feed processing, projected to expand from $7.72 billion in 2023 to $15.18 billion by 2033, alongside significant growth also seen in Asia-Pacific and Europe.

Does ConsaInsights provide customized market report data for the feed processing industry?

Yes, ConsaInsights offers tailored market report data specific to the feed processing industry, accommodating individual client needs regarding market dynamics, regional trends, competitive analysis, and segment performance for informed decision-making.

What deliverables can I expect from this feed processing market research project?

Expect comprehensive deliverables including detailed market insight reports, regional analysis, competitive landscape, projection data, strategic recommendations, and actionable insights tailored to your business needs in the feed processing industry.

What are the market trends of feed processing?

Current trends in the feed processing market include a shift towards plant-based feed ingredients, increased automation in processing, and an emphasis on sustainability, which are shaping innovations and practices within the industry.