Feed Software Market Report

Published Date: 31 January 2026 | Report Code: feed-software

Feed Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Feed Software market from 2023 to 2033, offering insights into market size, trends, key players, and regional dynamics necessary for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

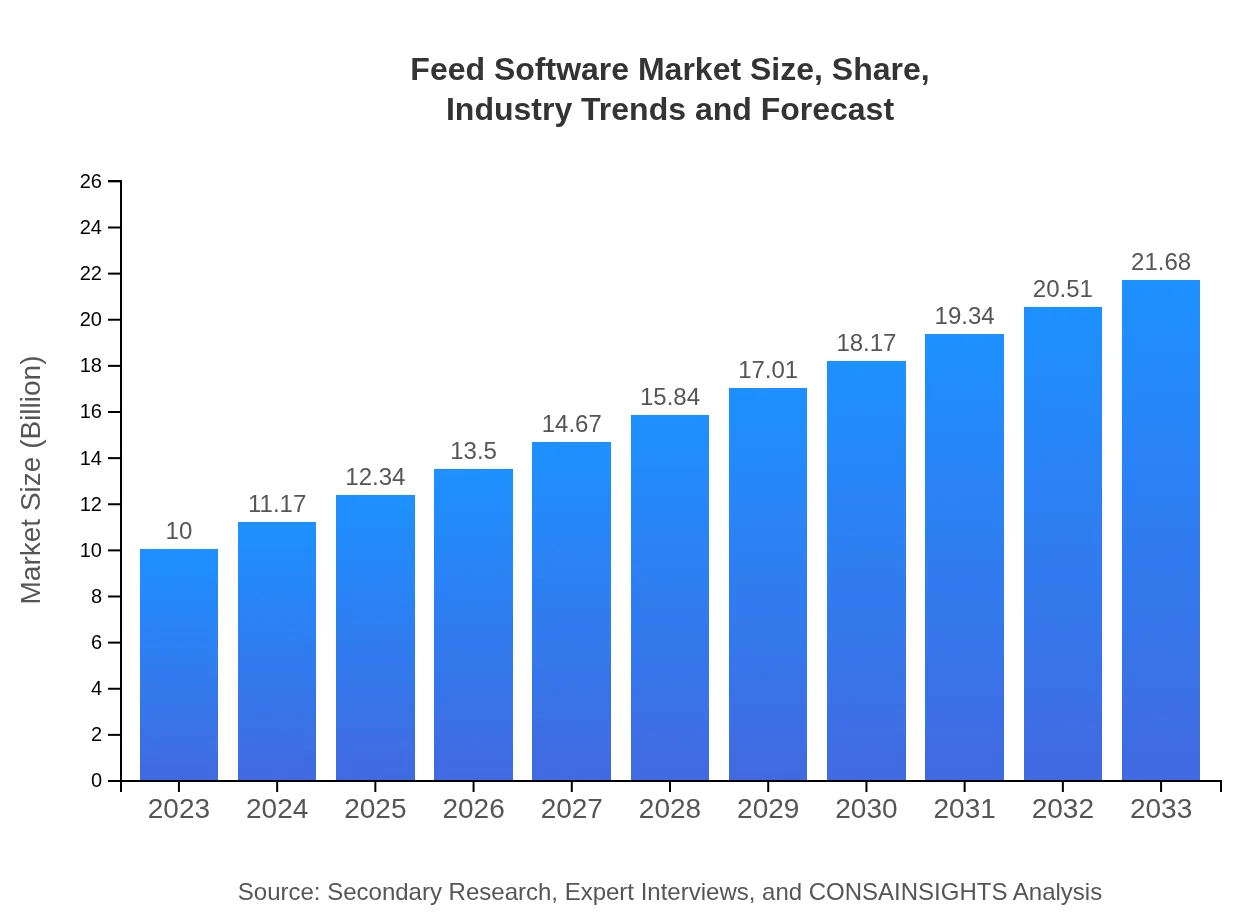

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $21.68 Billion |

| Top Companies | Cargill , Alltech, ADM Animal Nutrition, Trouw Nutrition, De Heus |

| Last Modified Date | 31 January 2026 |

Feed Software Market Overview

Customize Feed Software Market Report market research report

- ✔ Get in-depth analysis of Feed Software market size, growth, and forecasts.

- ✔ Understand Feed Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Software

What is the Market Size & CAGR of Feed Software market in 2023?

Feed Software Industry Analysis

Feed Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Software Market Analysis Report by Region

Europe Feed Software Market Report:

Europe’s Feed Software market is set to increase from $2.48 billion in 2023 to around $5.38 billion by 2033. The region's stringent regulations on animal welfare and food safety are driving investments in effective feed management solutions.Asia Pacific Feed Software Market Report:

In the Asia Pacific region, the Feed Software market is expected to grow from $2.07 billion in 2023 to $4.49 billion by 2033. This growth can be attributed to increasing livestock production, rising feed quality standards, and the adoption of advanced farming technologies in countries like China and India.North America Feed Software Market Report:

The North American market is projected to lead globally, growing from $3.89 billion in 2023 to approximately $8.44 billion by 2033. The advanced technology landscape, coupled with an increased focus on efficient feed management and sustainable practices, underpins this growth.South America Feed Software Market Report:

South America is anticipated to experience significant growth in the Feed Software market, moving from $0.67 billion in 2023 to approximately $1.46 billion by 2033. This shift is driven by the growing agribusiness sector and the rising demand for export-oriented livestock production.Middle East & Africa Feed Software Market Report:

The Middle East and Africa market is expected to witness growth from $0.88 billion in 2023 to $1.91 billion by 2033, propelled by an increased focus on food security and rising investments in agricultural technology across the region.Tell us your focus area and get a customized research report.

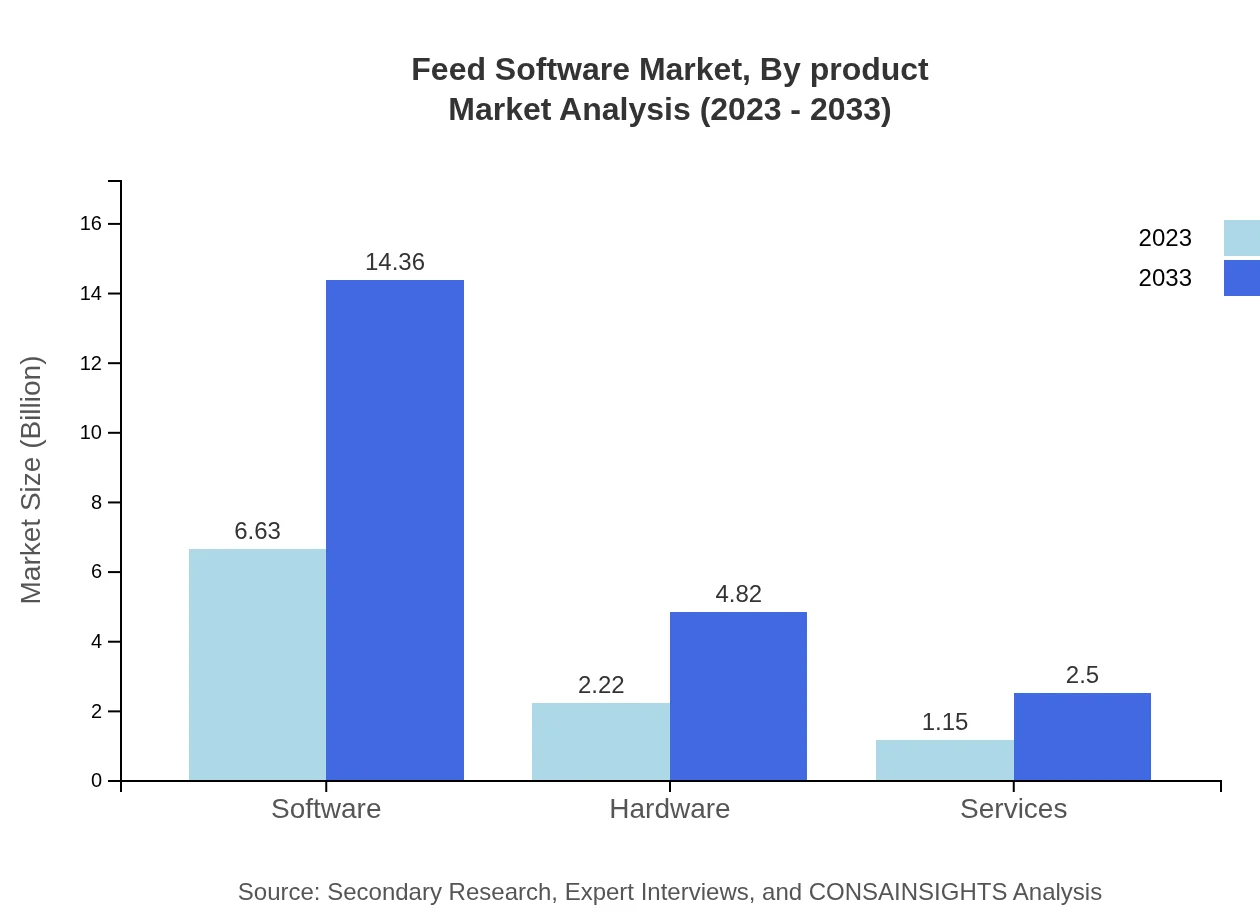

Feed Software Market Analysis By Product

The Feed Software market, categorized by product, reflects substantial growth in software solutions, expected to expand from $6.63 billion in 2023 to $14.36 billion by 2033. Software options are core elements in enhancing feed efficiency, leading to better animal health and productivity. Notably, the on-premises models hold a dominant share of around 82.19%, though cloud solutions are gaining traction due to their scalability and ease of access.

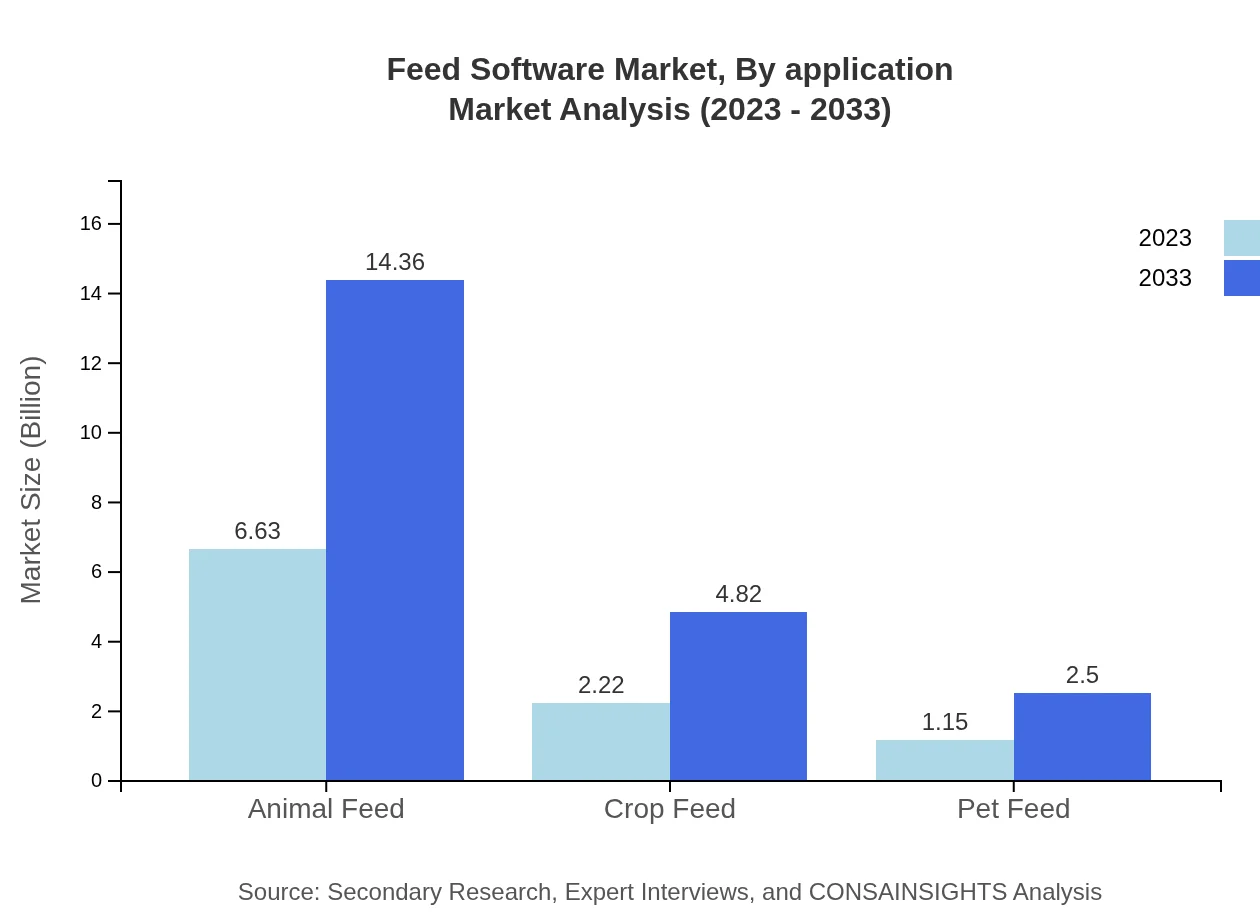

Feed Software Market Analysis By Application

In terms of application, the Feed Software market demonstrates key segments, notably animal feed, which constitutes a significant portion of the overall market share. Expectations indicate growth from $6.63 billion in 2023 to $14.36 billion by 2033, highlighting the focus on optimizing animal nutrition. Other applications include pet and crop feed, both crucial for diversification across agricultural practices.

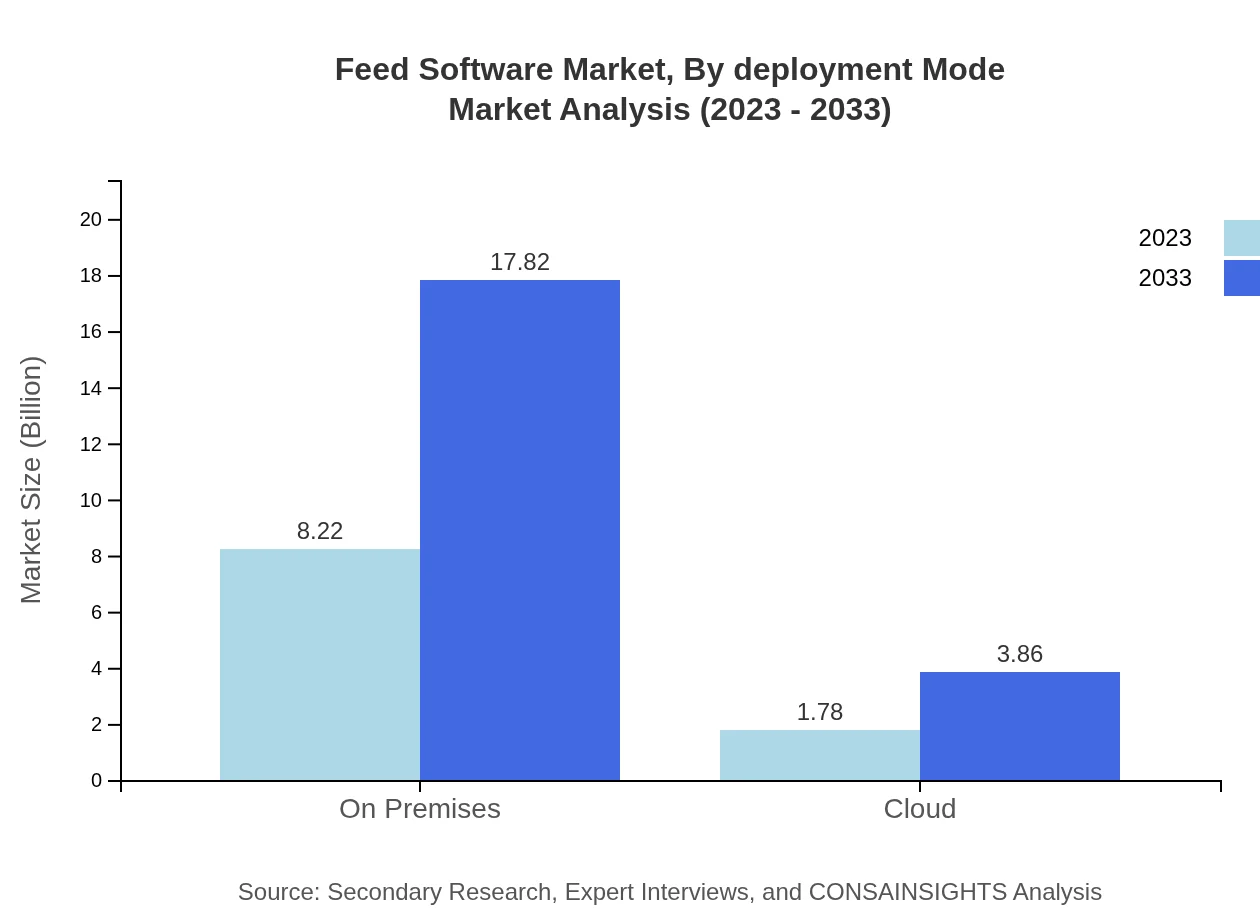

Feed Software Market Analysis By Deployment Mode

Deployment mode segments reveal strategic insights into technology adoption within the Feed Software market. On-premises solutions account for 82.19% of the market in 2023, showcasing strong demand for traditional setups, while cloud applications represent 17.81%, driven by a shift towards flexible solutions that can be remotely accessed and upgraded.

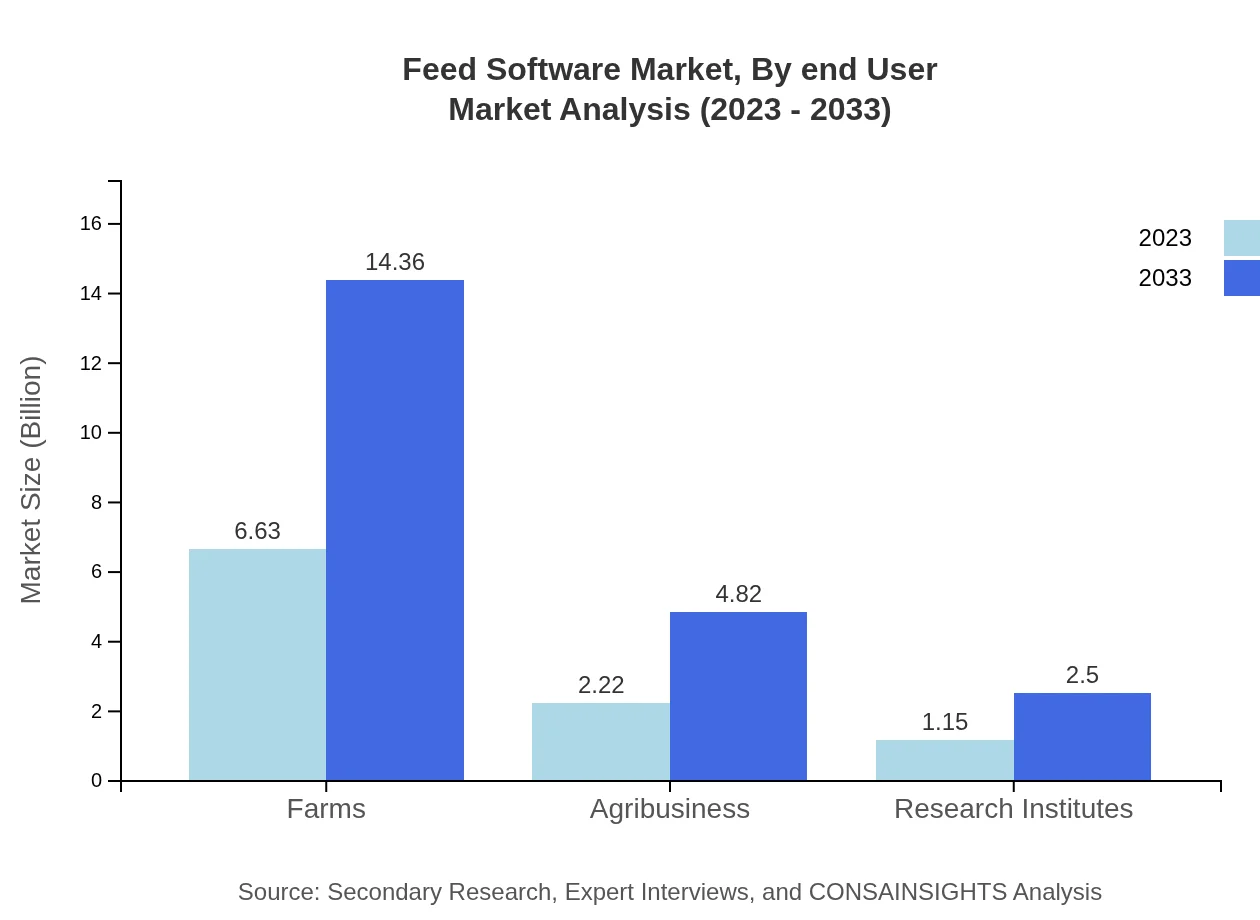

Feed Software Market Analysis By End User

End-user segments, particularly focusing on farms and agribusinesses, illustrate significant capacity in driving software adoption. The farm sector is projected to maintain dominance, primarily due to the increasing need for integrated solutions that address scaling challenges and feed management complexities.

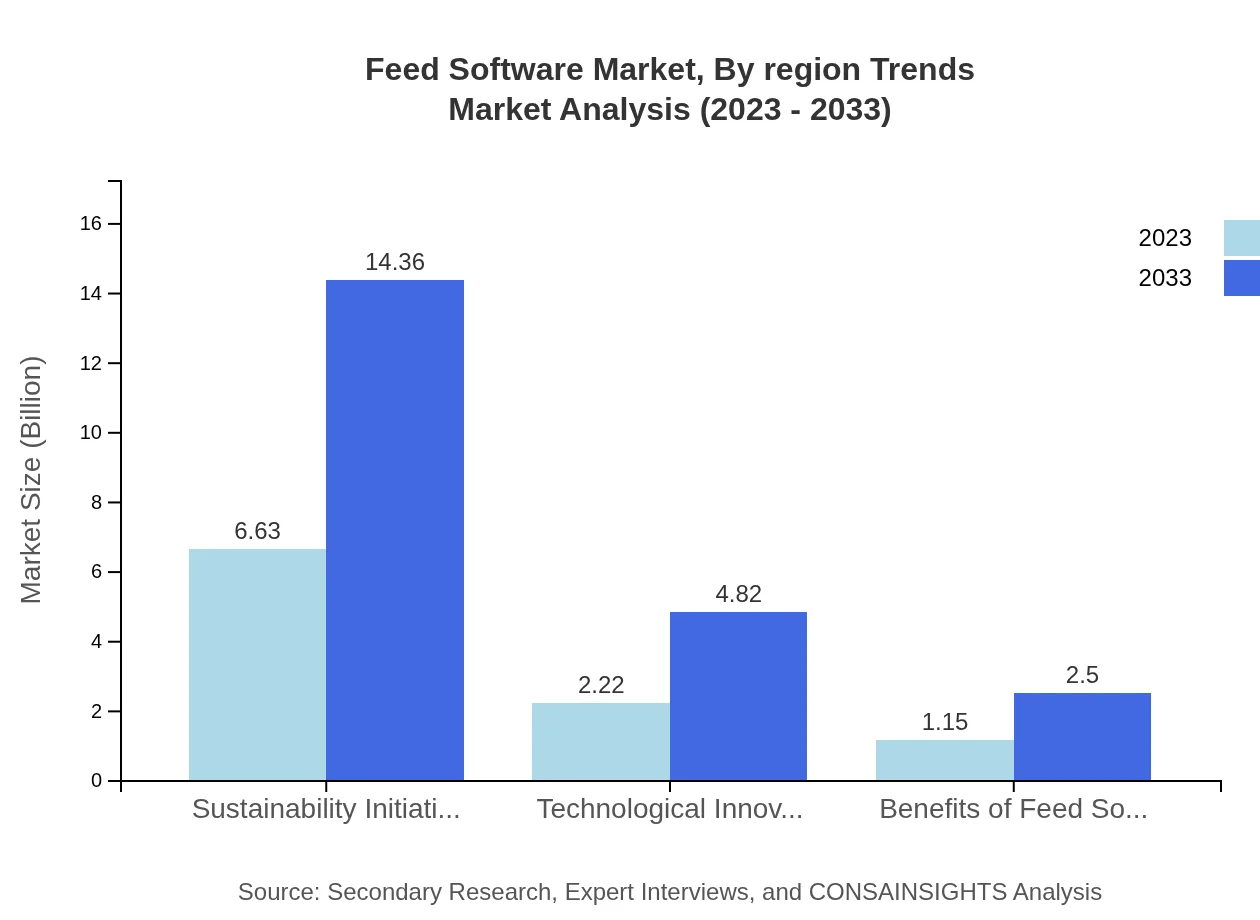

Feed Software Market Analysis By Region Trends

Current trends in the Feed Software market emphasize sustainability and technological innovations as key drivers. Solutions leveraging data analytics and IoT for real-time feed optimization are becoming essential. Furthermore, growing consumer expectations regarding animal welfare are compelling producers to adopt software solutions to maintain compliance and improve sustainability outcomes.

Feed Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Software Industry

Cargill :

Cargill is a global leader in nutrition and agricultural services, providing innovative feed solutions and software that enhance livestock management and feed optimization.Alltech:

Alltech is known for its focus on animal nutrition and health, offering advanced software solutions that integrate scientific research with practical applications to improve feed formulations.ADM Animal Nutrition:

Archer Daniels Midland (ADM) provides dietary solutions and software for the agricultural sector, emphasizing the integration of sustainable practices in feed formulation and management.Trouw Nutrition:

Trouw Nutrition specializes in animal nutrition, providing software solutions tailored to optimize feed efficiency in livestock production and improve operational productivity.De Heus:

De Heus is a major player in the animal nutrition industry, developing comprehensive software tools that support feed optimization processes across diverse agricultural formats.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Software?

The global feed software market is currently valued at approximately $10 billion, with a projected CAGR of 7.8% for the next decade. This robust growth indicates an expanding demand for innovative solutions in the agricultural and livestock sectors.

What are the key market players or companies in the feed Software industry?

Major players in the feed-software industry include companies specializing in agricultural technology, including Djuva Software, Cargill, and Alltech. These organizations consistently implement innovative software solutions and strategies to enhance productivity and efficiency in feed management.

What are the primary factors driving the growth in the feed Software industry?

Key drivers of growth in the feed-software industry include the increasing demand for efficient feed management, technological advancements in agriculture, and a rising focus on sustainable farming practices. Additionally, the integration of IoT and big data analytics continues to transform the sector.

Which region is the fastest Growing in the feed Software?

North America is currently the fastest-growing region in the feed software market, with a projected size increase from $3.89 billion in 2023 to $8.44 billion by 2033. Meanwhile, Europe and Asia Pacific also showcase significant growth in this sector.

Does ConsaInsights provide customized market report data for the feed Software industry?

Absolutely, ConsaInsights offers tailored market report data for the feed-software industry. Clients can receive customized analysis based on geographic, technological, and segment-based metrics that fit their specific needs and objectives.

What deliverables can I expect from this feed Software market research project?

From a feed-software market research project, clients can expect comprehensive reports, data analytics, market trend analysis, and segment insights. Deliverables typically include actionable insights to guide strategic planning and investment decisions.

What are the market trends of feed Software?

Current market trends in the feed-software industry include the adoption of cloud-based solutions, an emphasis on sustainability in feed production, and the integration of advanced data analytics. These trends reflect a broader shift towards precision agriculture and efficient resource management.