Feed Testing Market Report

Published Date: 31 January 2026 | Report Code: feed-testing

Feed Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Feed Testing market from 2023 to 2033, covering market size, growth trends, regional insights, and leading companies. It aims to equip stakeholders with data-driven insights for strategic decision-making.

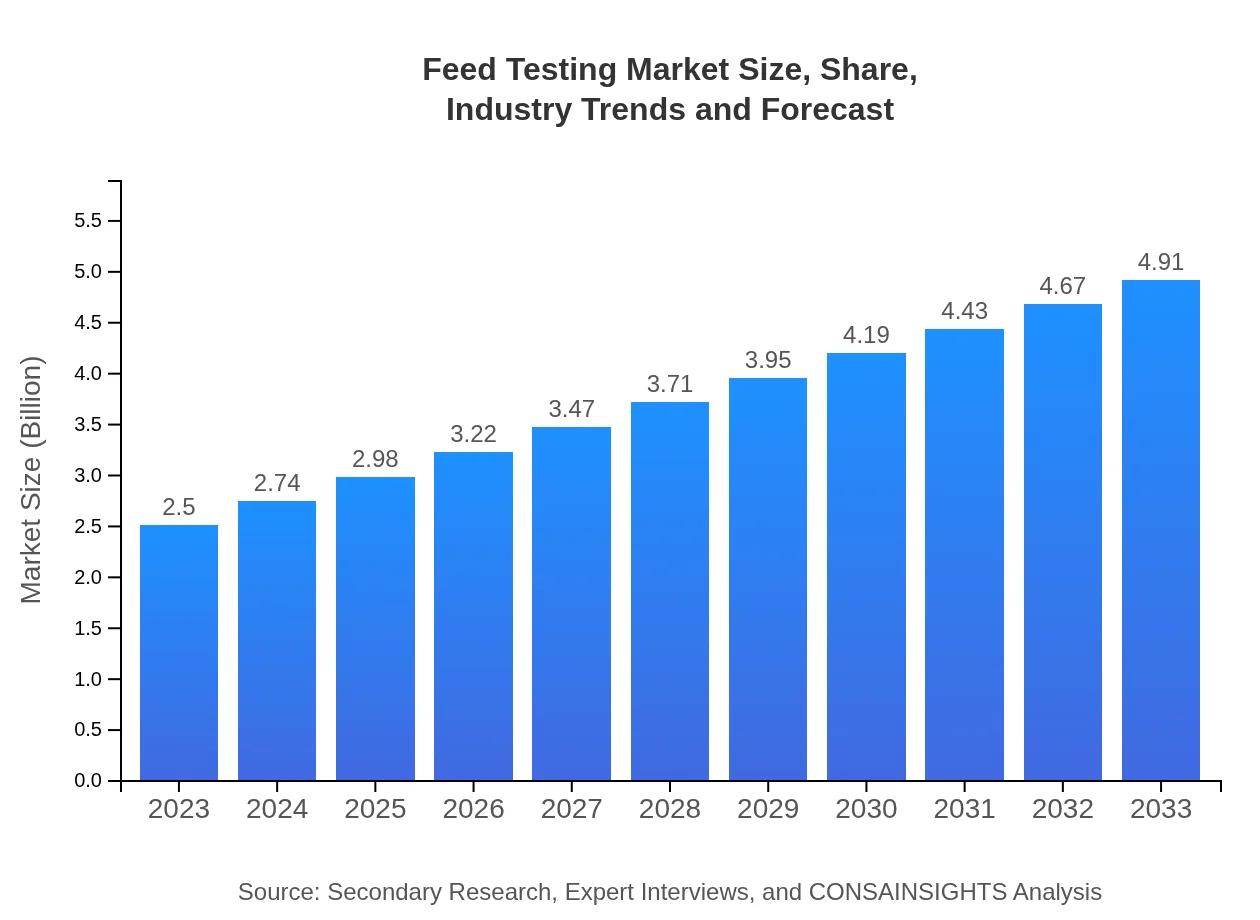

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Eurofins Scientific, SGS S.A., Intertek Group plc |

| Last Modified Date | 31 January 2026 |

Feed Testing Market Overview

Customize Feed Testing Market Report market research report

- ✔ Get in-depth analysis of Feed Testing market size, growth, and forecasts.

- ✔ Understand Feed Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Testing

What is the Market Size & CAGR of Feed Testing market in 2023?

Feed Testing Industry Analysis

Feed Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Testing Market Analysis Report by Region

Europe Feed Testing Market Report:

Europe's Feed Testing market is anticipated to grow from USD 0.64 billion in 2023 to USD 1.26 billion by 2033. The demand is driven by increasing consumer awareness around food safety and the growing trend of sustainable farming practices.Asia Pacific Feed Testing Market Report:

The Asia-Pacific region is witnessing remarkable growth in the Feed Testing market, projected to expand from USD 0.52 billion in 2023 to USD 1.03 billion by 2033. This growth is driven by the increasing demand for animal protein, rising livestock populations, and awareness about feed safety standards.North America Feed Testing Market Report:

North America is forecast to see growth from USD 0.91 billion in 2023 to USD 1.78 billion by 2033. The region's stringent regulations regarding feed safety and the strong emphasis on research and development within the feed industry contribute significantly to market expansion.South America Feed Testing Market Report:

In South America, the Feed Testing market is expected to grow from USD 0.09 billion in 2023 to USD 0.18 billion by 2033. The region benefits from a robust livestock sector, particularly beef and poultry, leading to heightened testing needs to ensure feed safety and compliance.Middle East & Africa Feed Testing Market Report:

In the Middle East and Africa, the market is projected to grow from USD 0.34 billion in 2023 to USD 0.66 billion by 2033. A rising population and growing emphasis on meat consumption are fueling the demand for reliable feed testing services.Tell us your focus area and get a customized research report.

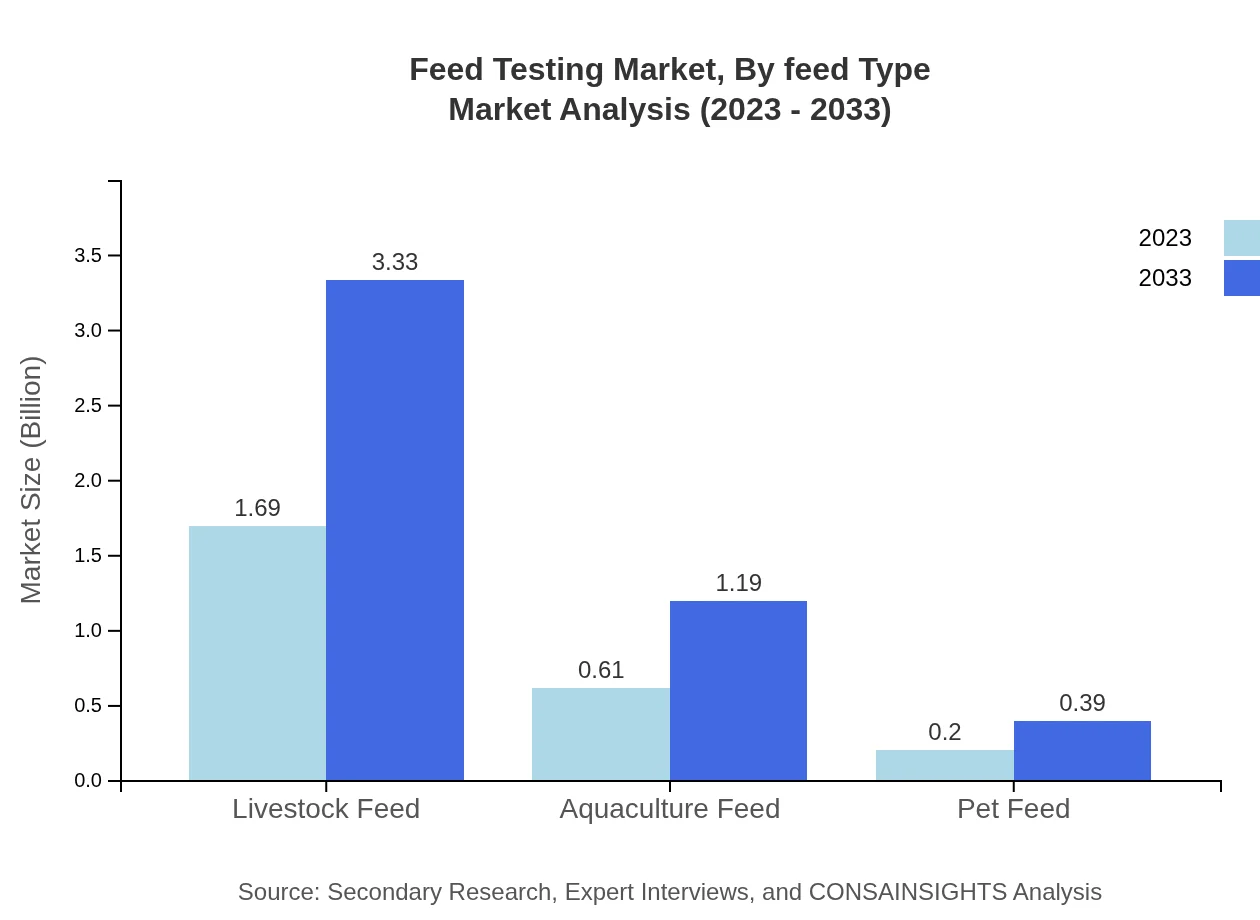

Feed Testing Market Analysis By Feed Type

The feed testing market by feed type reveals significant insights: The livestock feed segment leads the market, with a size of USD 1.69 billion in 2023 and projected growth to USD 3.33 billion by 2033. Aquaculture feed is also substantial, growing from USD 0.61 billion in 2023 to USD 1.19 billion by 2033, indicating the increasing importance of fish farming. Pet feed is smaller but projected to grow as more consumers invest in pet care.

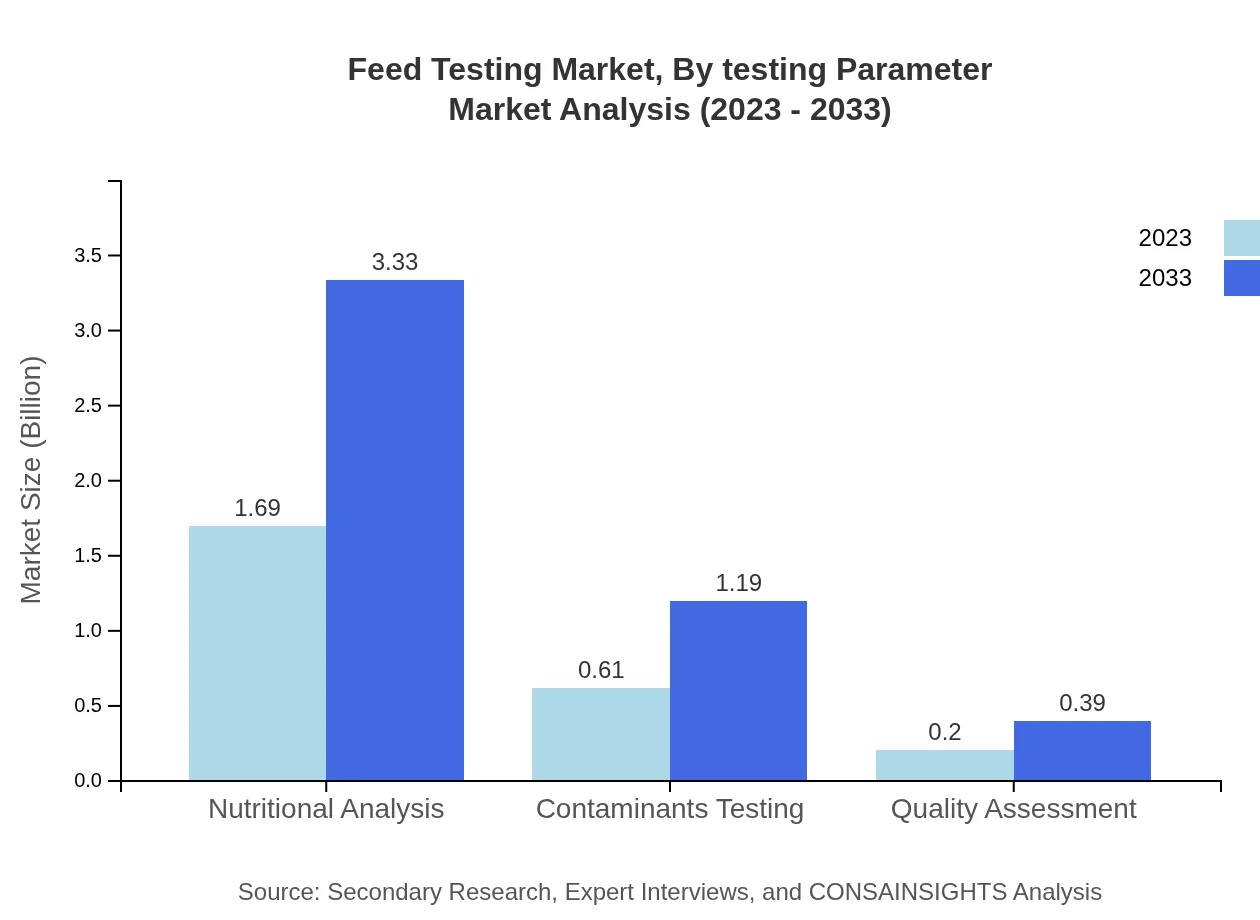

Feed Testing Market Analysis By Testing Parameter

Testing parameters play a crucial role, with nutritional analysis dominating the market at USD 1.69 billion in 2023, growing to USD 3.33 billion by 2033. It reflects an industry focus on optimizing feed for better animal health. Contaminants testing is also vital, expected to grow from USD 0.61 billion to USD 1.19 billion during the same period.

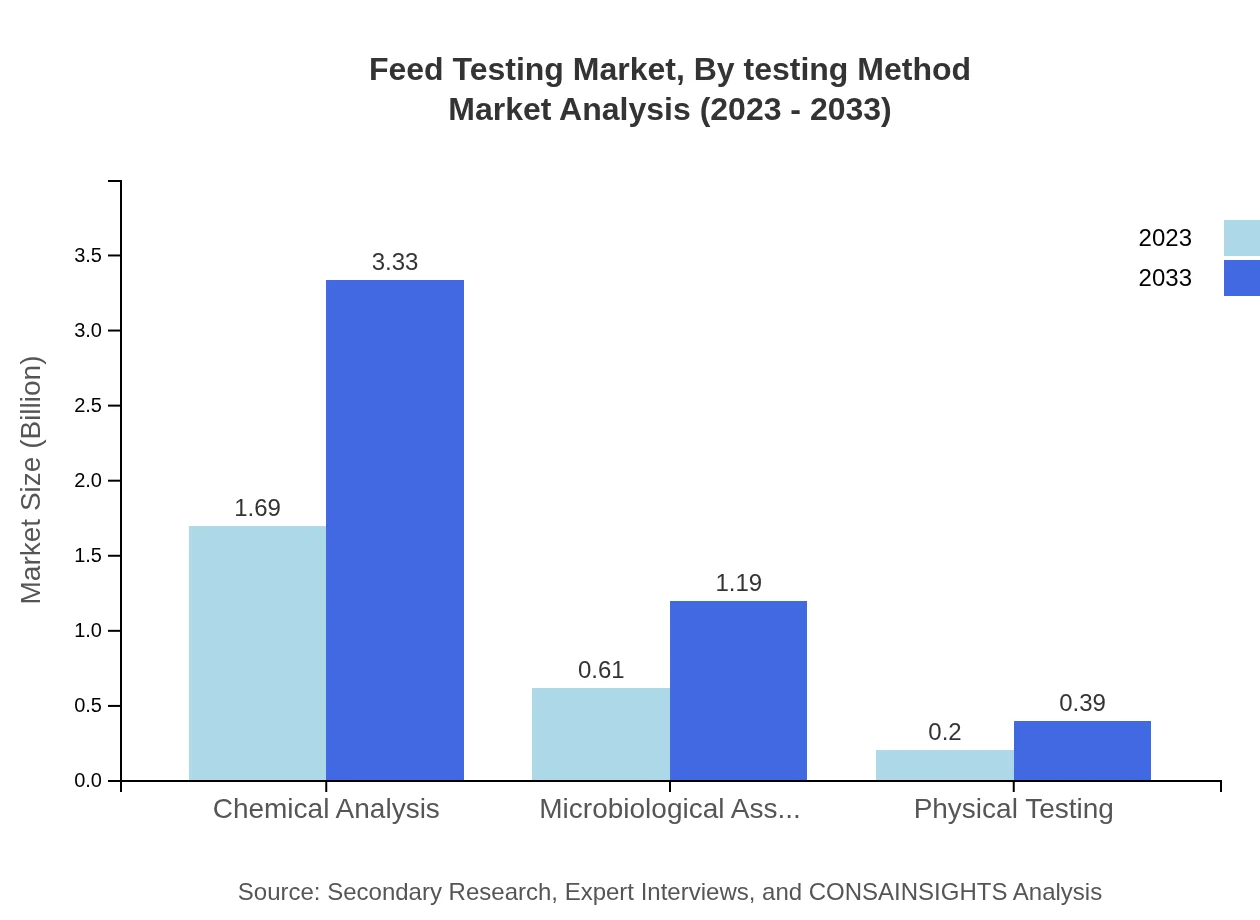

Feed Testing Market Analysis By Testing Method

Various testing methods like chemical analysis, microbiological assessment, and physical testing represent crucial parts of the market. Chemical analysis, being significant for its role in ensuring safety, is seen to dominate, while microbiological assessments are increasingly important due to rising safety standards.

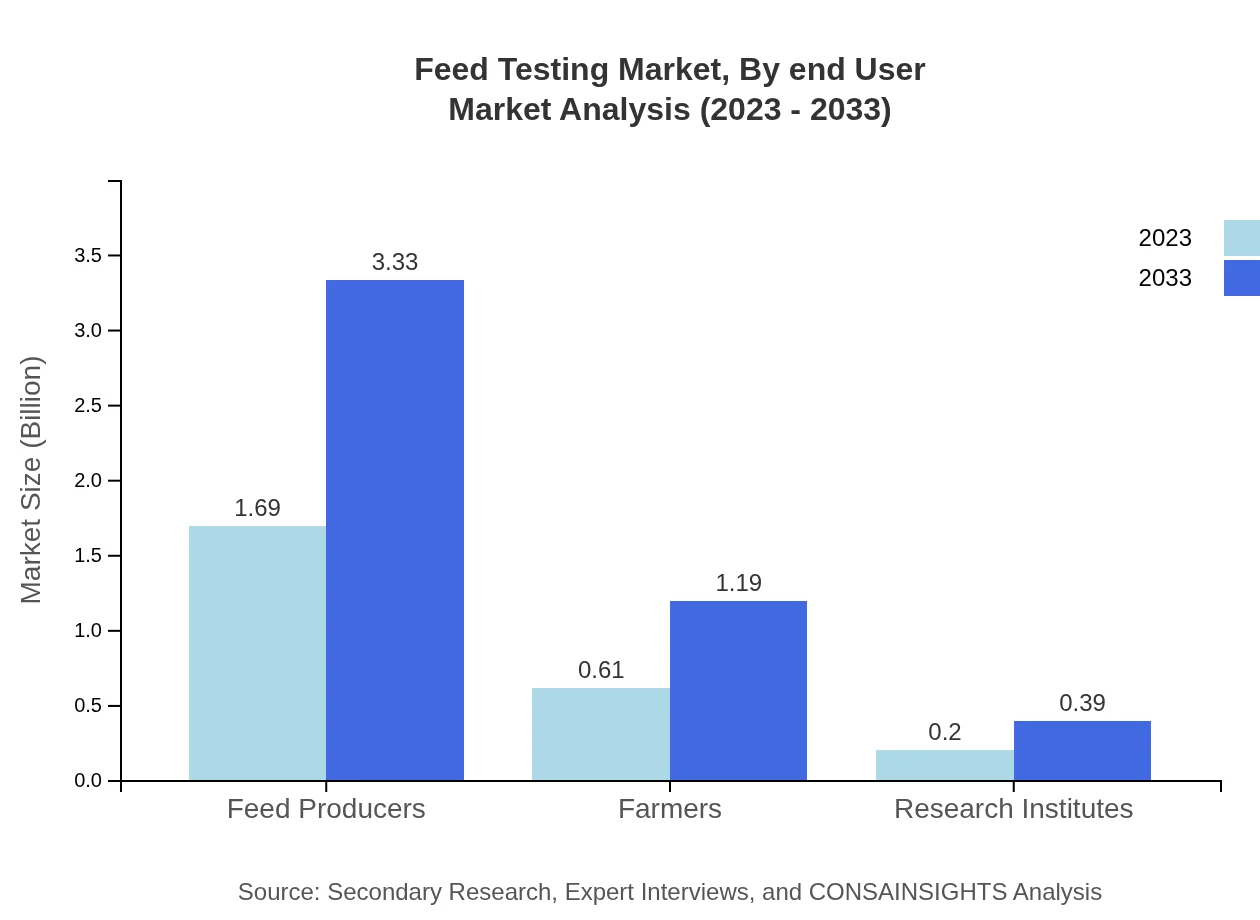

Feed Testing Market Analysis By End User

End-users in the feed testing market mainly comprise feed producers, farmers, and research institutes. Roughly 67.68% of the market share in 2023 belongs to feed producers, reflecting their reliance on accurate feed testing to maintain quality in production. Farmers account for around 24.32%, emphasizing the necessity for testing in livestock operations.

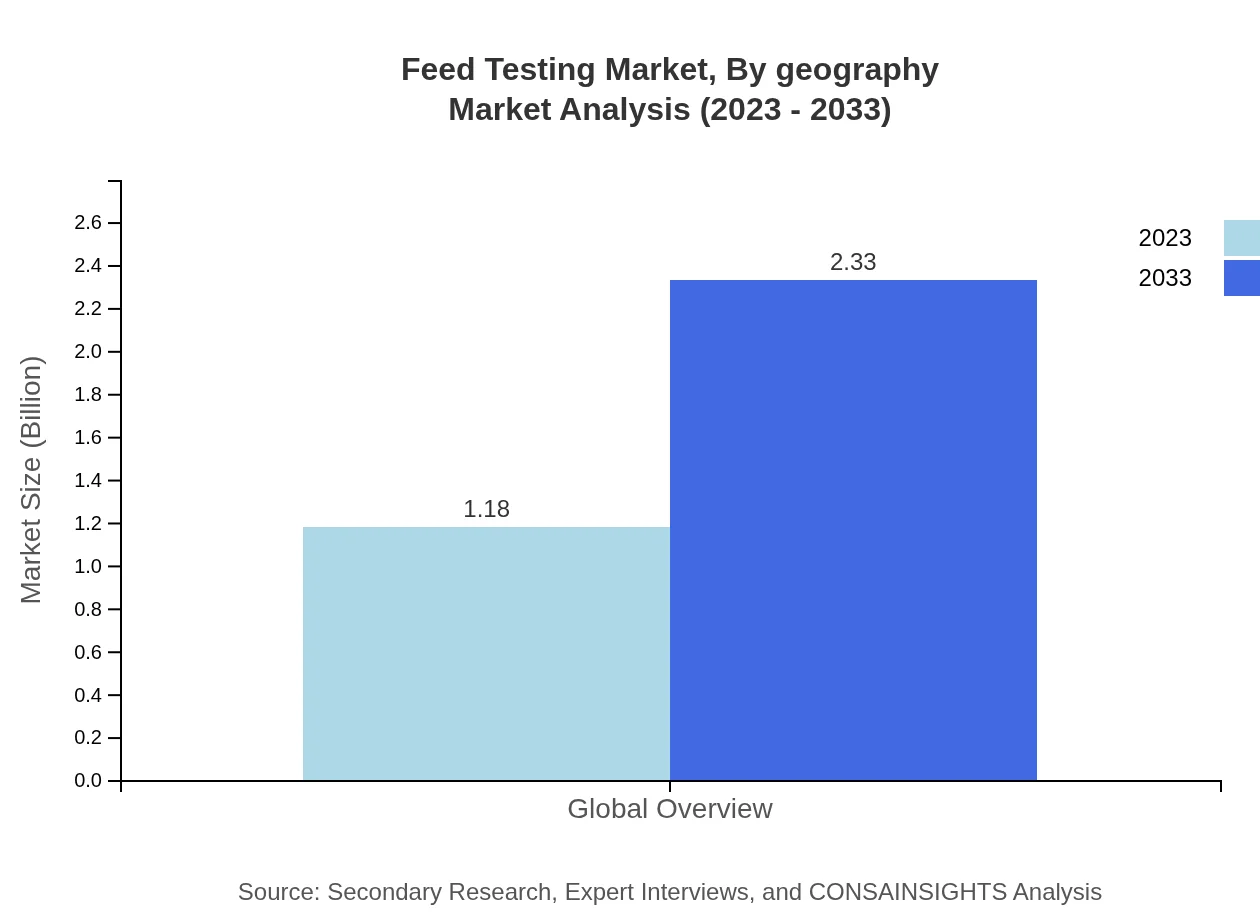

Feed Testing Market Analysis By Geography

Geographic segmentation of the feed testing market shows diverse growth patterns. While North America and Europe are significant markets due to strong regulations and industry standards, rapid growth in the Asia-Pacific region indicates a shifting focus towards improving animal husbandry through better feed safety practices.

Feed Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Testing Industry

Eurofins Scientific:

Eurofins is a global leader in laboratory services, offering comprehensive testing solutions in food, feed, and environmental sectors, ensuring safety and quality.SGS S.A.:

SGS is recognized worldwide for its inspection, verification, testing, and certification services across multiple sectors, including feed testing.Intertek Group plc:

Intertek provides quality and safety solutions to a wide range of industries, offering innovative testing methodologies and comprehensive feed analysis.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Testing?

The feed-testing market is currently valued at approximately $2.5 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.8% over the next decade. It is projected to show consistent growth leading up to 2033.

What are the key market players or companies in this feed Testing industry?

Some notable companies leading the feed-testing market include Eurofins Scientific, Intertek Group, and SGS SA. These industry giants play critical roles in providing comprehensive and reliable feed-testing solutions globally.

What are the primary factors driving the growth in the feed Testing industry?

Factors such as rising livestock production, increasing concerns over feed quality, and stringent government regulations on animal feed safety are significantly driving the growth of the feed-testing market worldwide.

Which region is the fastest Growing in the feed Testing?

The Asia Pacific region is set to be the fastest-growing market, increasing from $0.52 billion in 2023 to $1.03 billion by 2033, reflecting a strong demand for feed testing amidst growing agricultural activities.

Does ConsaInsights provide customized market report data for the feed Testing industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the feed-testing industry, allowing clients to obtain insights that cater to their unique business needs and market challenges.

What deliverables can I expect from this feed Testing market research project?

Deliverables from the feed-testing market research project will include comprehensive market analysis reports, growth forecasts, competitive landscape assessments, and segment-specific insights detailing current market trends.

What are the market trends of feed Testing?

Current trends in the feed-testing market include an increased focus on nutritional analysis and contaminants testing, driven by consumer demand for quality assurance and safety in animal feed products.