Feed Yeast Market Report

Published Date: 02 February 2026 | Report Code: feed-yeast

Feed Yeast Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Feed Yeast market from 2023 to 2033, covering market size, trends, regional insights, competitive landscape, and future forecasts based on key data and insights.

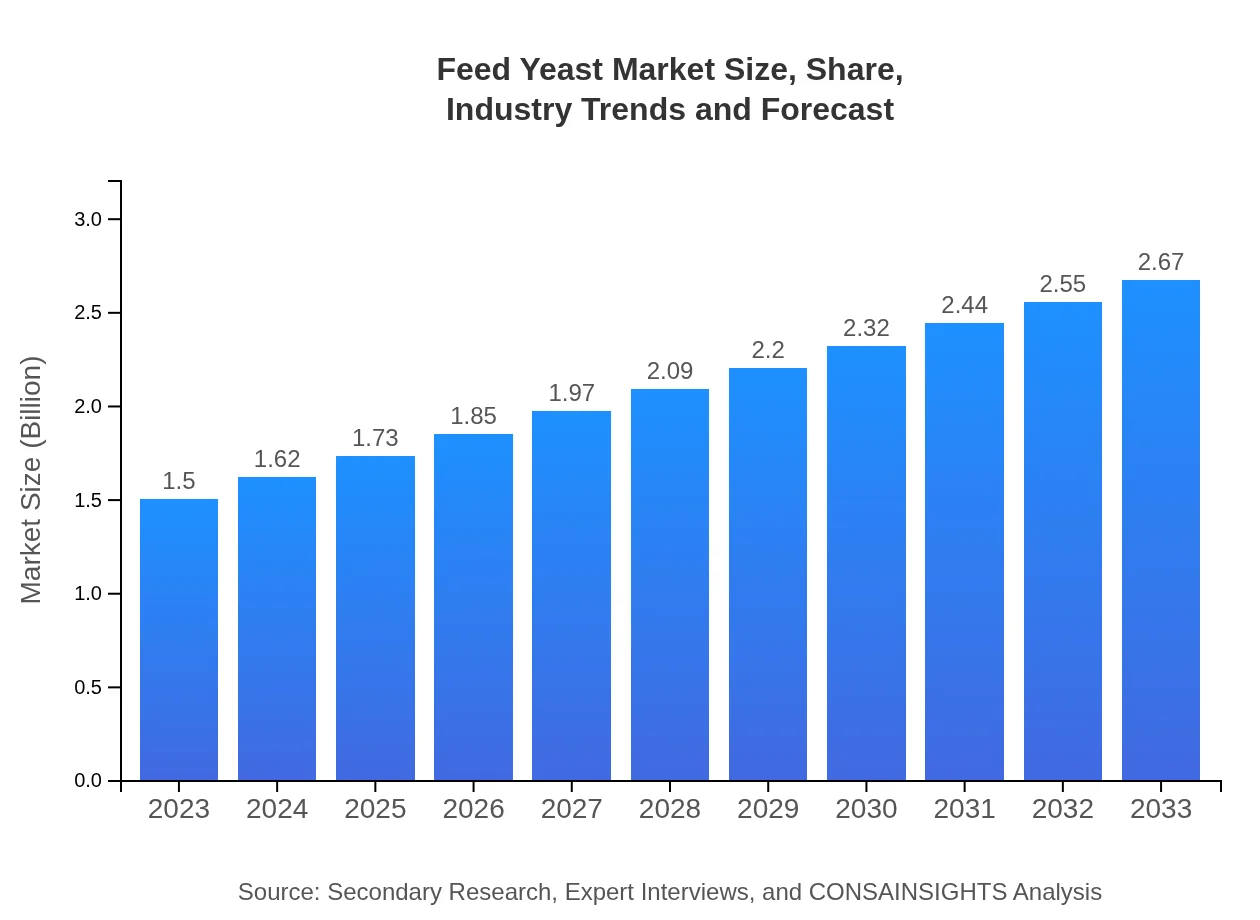

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.67 Billion |

| Top Companies | Alltech, Lesaffre, Archer Daniels Midland (ADM), Baker's yeast for Feed |

| Last Modified Date | 02 February 2026 |

Feed Yeast Market Overview

Customize Feed Yeast Market Report market research report

- ✔ Get in-depth analysis of Feed Yeast market size, growth, and forecasts.

- ✔ Understand Feed Yeast's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Yeast

What is the Market Size & CAGR of Feed Yeast market in 2023?

Feed Yeast Industry Analysis

Feed Yeast Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Yeast Market Analysis Report by Region

Europe Feed Yeast Market Report:

Europe's Feed Yeast market is expected to grow from $0.47 billion in 2023 to $0.83 billion by 2033, supported by stringent regulations on animal feed quality and a trend towards natural feed additives.Asia Pacific Feed Yeast Market Report:

In the Asia Pacific region, the Feed Yeast market was valued at $0.28 billion in 2023, expected to reach $0.50 billion by 2033. The growth is fueled by rising animal husbandry practices and increasing meat consumption in countries like China and India.North America Feed Yeast Market Report:

In North America, the market size was $0.54 billion in 2023, anticipating growth to $0.97 billion by 2033. The expanding livestock sector and strong pet food demand contribute to this growth.South America Feed Yeast Market Report:

The South American Feed Yeast market stood at $0.13 billion in 2023, with projections of $0.23 billion by 2033. The region's focus on improving livestock productivity and exports drives market growth.Middle East & Africa Feed Yeast Market Report:

In the Middle East and Africa, the market size is projected to move from $0.08 billion in 2023 to $0.14 billion by 2033, driven by an increasing investment in modernizing agriculture and livestock farming in the region.Tell us your focus area and get a customized research report.

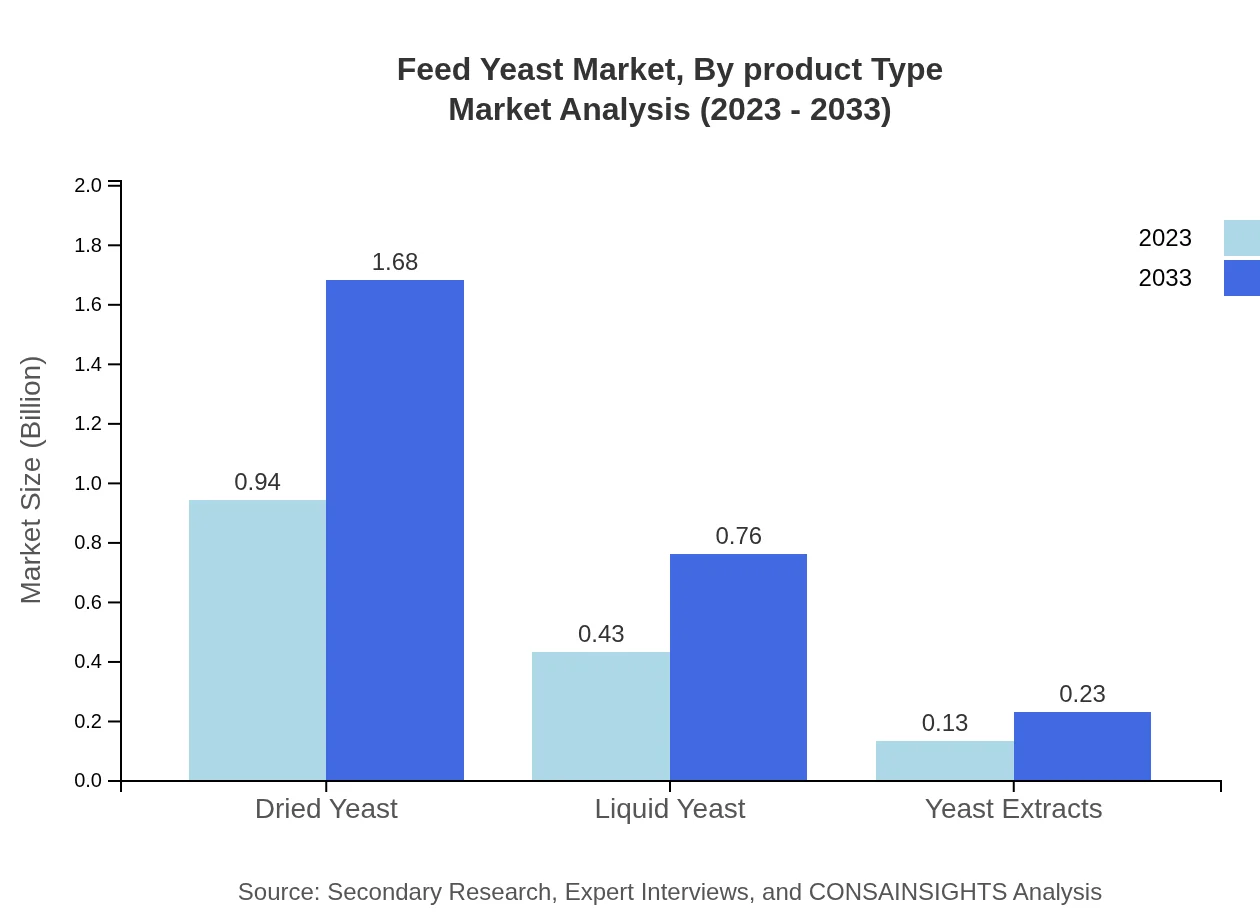

Feed Yeast Market Analysis By Product Type

Dried Yeast dominates the Feed Yeast market due to its high protein content and nutritional benefits, accounting for approximately 62.9% of the market share in 2023 and projected to maintain the same share by 2033. Liquid Yeast holds a significant position as well, with an identical market share of 28.63%, driven by its applications in various animal feeds.

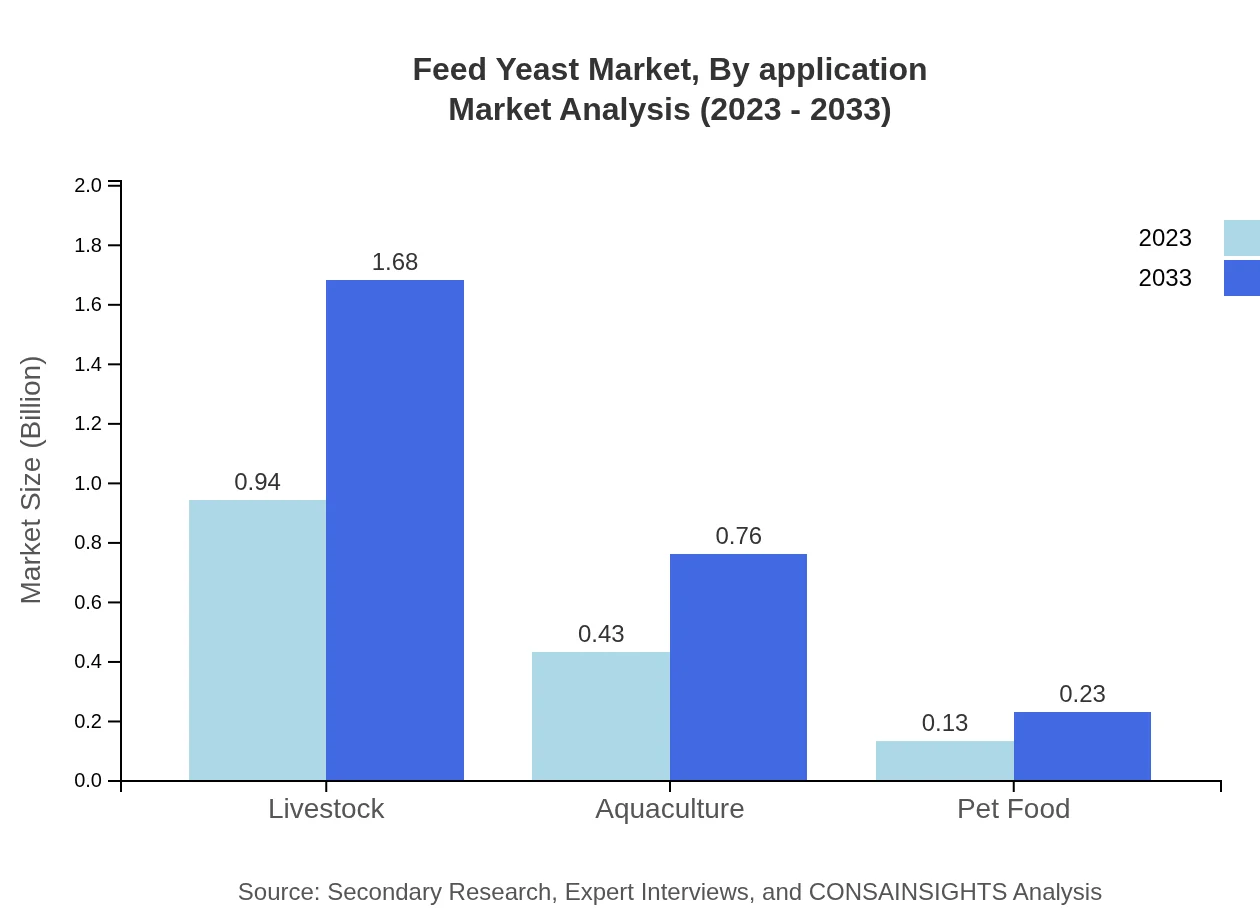

Feed Yeast Market Analysis By Application

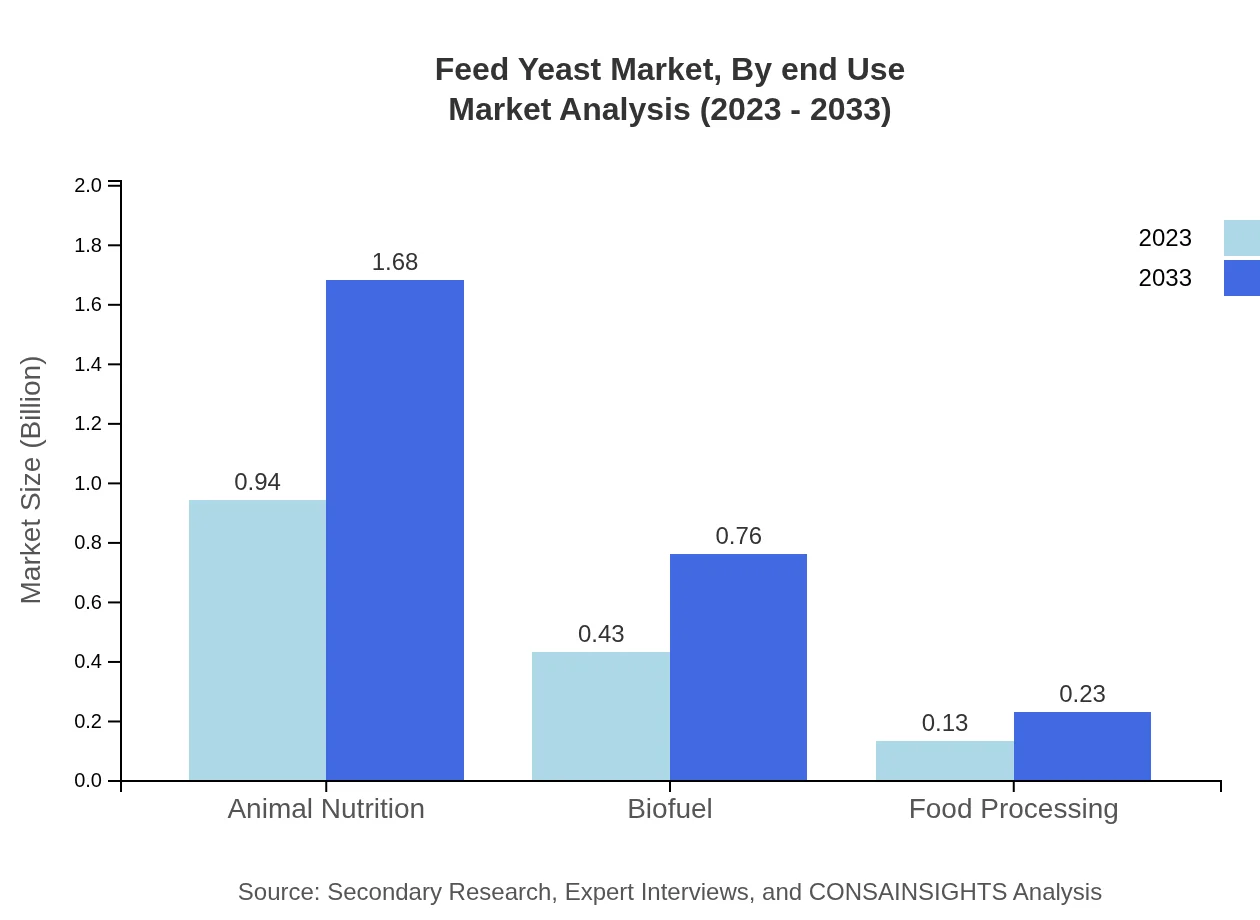

Animal Nutrition represents the largest application segment, valued at $0.94 billion in 2023, projected to grow to $1.68 billion by 2033. The Biofuel segment also plays a vital role, growing from $0.43 billion in 2023 to $0.76 billion by 2033, reflecting the trend towards renewable energy sources.

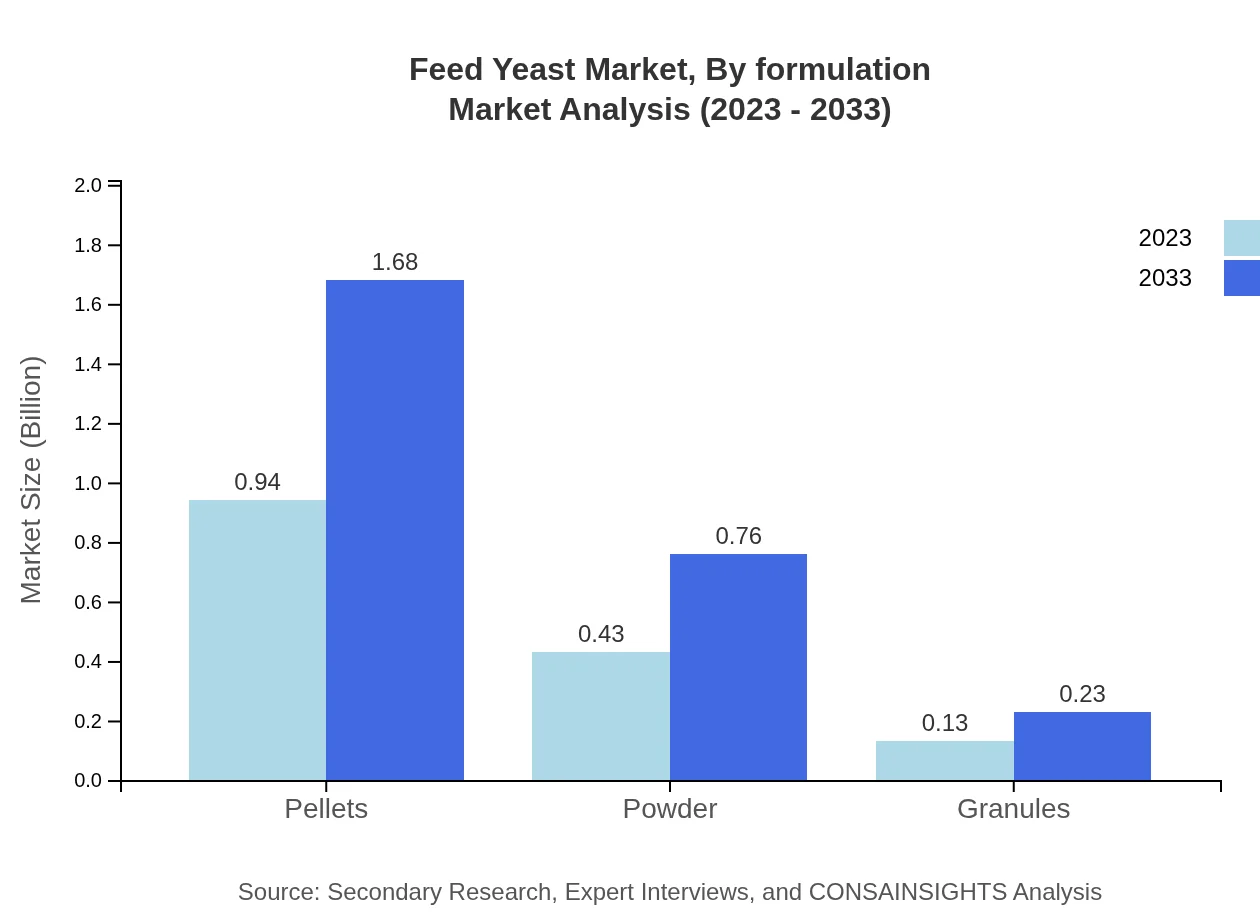

Feed Yeast Market Analysis By Formulation

The market is predominantly segmented into Pellets, Powder, and Granules. Pellets are projected to hold the largest share of approximately 62.9% of the market in 2023, boosting user convenience and storage efficiency.

Feed Yeast Market Analysis By End Use

In end-use applications, Livestock and Aquaculture dominate the sector, with Livestock holding about 62.9% of the market share in 2023. This trend is expected to continue as demand for sustainable and high-quality feed rises among livestock producers.

Feed Yeast Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Yeast Industry

Alltech:

A leader in animal nutrition products, Alltech specializes in yeast-based products that enhance animal health and performance.Lesaffre:

Known for its high-quality yeast products, Lesaffre focuses on providing sustainable feed solutions and innovative yeast applications in nutrition.Archer Daniels Midland (ADM):

ADM is a prominent player in agricultural processing and actively develops yeast-based products for animal and pet nutrition.Baker's yeast for Feed:

Specializes in producing yeasts and yeast derivatives specifically for animal feed applications.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Yeast?

The global feed-yeast market is currently valued at approximately $1.5 billion, with a projected Compound Annual Growth Rate (CAGR) of 5.8% from 2023 to 2033. This growth indicates robust expansion in demand across various applications.

What are the key market players or companies in the feed Yeast industry?

Key players in the feed-yeast market include prominent companies that specialize in animal nutrition, biofuels, and food processing. These firms are consistently innovating to optimize yeast products for diverse applications, enhancing their market position and driving competition.

What are the primary factors driving the growth in the feed Yeast industry?

Growth in the feed-yeast market is primarily driven by increasing demand for high-quality animal feed, rising awareness of animal health, and a shift towards sustainable agriculture practices. Additionally, the adoption of yeast in biofuels is contributing significantly to market expansion.

Which region is the fastest Growing in the feed Yeast?

The North America region is the fastest-growing market for feed-yeast, projected to expand from $0.54 billion in 2023 to $0.97 billion in 2033. Europe and Asia-Pacific also exhibit substantial growth, indicating a trend of increasing investment in livestock management.

Does ConsaInsights provide customized market report data for the feed Yeast industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the feed-yeast industry. This includes industry insights, competitive analysis, and bespoke reports to facilitate informed decision-making.

What deliverables can I expect from this feed Yeast market research project?

From the feed-yeast market research project, clients can expect comprehensive reports, detailed analytics on market trends, regional insights, and segmentation analysis. This will empower stakeholders to strategize effectively and capitalize on emerging opportunities.

What are the market trends of feed Yeast?

Key trends in the feed-yeast market include the growing incorporation of yeast in animal nutrition, advancements in fermentation technology, and increasing use of yeast-based products in biofuels. Sustainability and natural feed additives are also becoming pivotal in consumer preferences.