Female Contraceptive Market Report

Published Date: 31 January 2026 | Report Code: female-contraceptive

Female Contraceptive Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the female contraceptive market from 2023 to 2033, covering market size, industry analysis, regional insights, technology trends, and market forecasts.

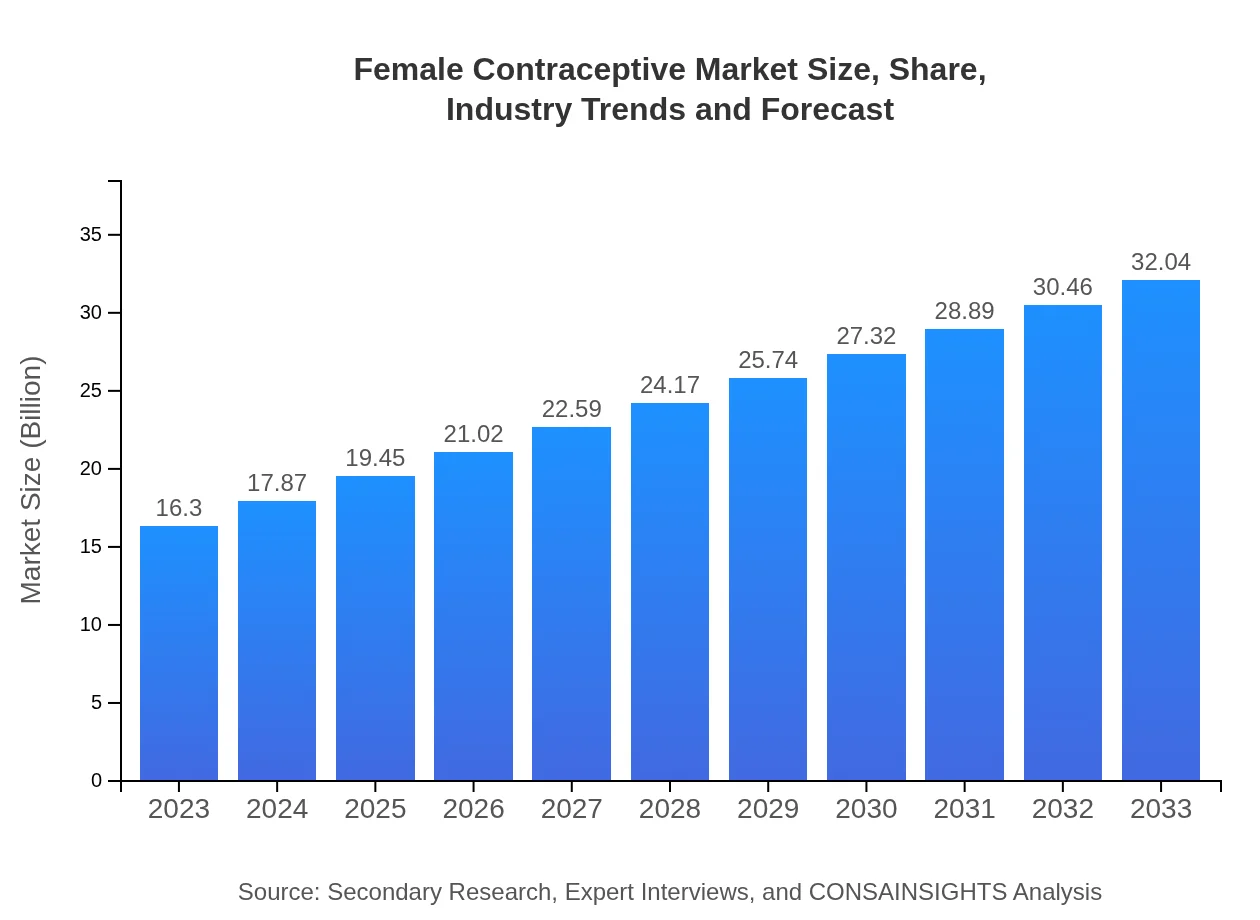

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $32.04 Billion |

| Top Companies | Bayer AG, Pfizer Inc., Merck & Co., Inc., HRA Pharma |

| Last Modified Date | 31 January 2026 |

Female Contraceptive Market Overview

Customize Female Contraceptive Market Report market research report

- ✔ Get in-depth analysis of Female Contraceptive market size, growth, and forecasts.

- ✔ Understand Female Contraceptive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Female Contraceptive

What is the Market Size & CAGR of Female Contraceptive market in 2023?

Female Contraceptive Industry Analysis

Female Contraceptive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Female Contraceptive Market Analysis Report by Region

Europe Female Contraceptive Market Report:

Europe's market for female contraceptives was valued at USD 5.08 billion in 2023 and is projected to reach USD 9.98 billion by 2033. High demand for long-term contraceptive solutions and the increasing inclination towards preventive healthcare have propelled the market. Additionally, the emphasis on women's health rights further strengthens market potential.Asia Pacific Female Contraceptive Market Report:

The Asia Pacific region has shown a robust demand for female contraceptives, with a market size of USD 2.57 billion in 2023, projected to reach USD 5.05 billion by 2033. The growing population and increasing acceptance of family planning methods have accelerated market growth, driven by both urbanization and government initiatives promoting reproductive health.North America Female Contraceptive Market Report:

The North American market is one of the largest, valued at USD 6.28 billion in 2023. By 2033, it is anticipated to nearly double to USD 12.34 billion. Factors such as strong regulatory frameworks, high awareness levels, and the presence of key market players contribute to this growth. The market's dynamics are also impacted by technological advancements in contraceptive solutions.South America Female Contraceptive Market Report:

In South America, the market for female contraceptives stood at USD 1.38 billion in 2023, expected to rise to USD 2.71 billion by 2033. Awareness programs and governmental support for contraceptive access significantly influence adoption rates, alongside cultural shifts towards smaller family norms.Middle East & Africa Female Contraceptive Market Report:

The Middle East and Africa (MEA) market was valued at USD 1.00 billion in 2023, with expectations to reach USD 1.96 billion by 2033. Although lower than other regions, growth is stimulated by rising awareness and educational outreach efforts regarding family planning, alongside initiatives by NGOs to broaden access.Tell us your focus area and get a customized research report.

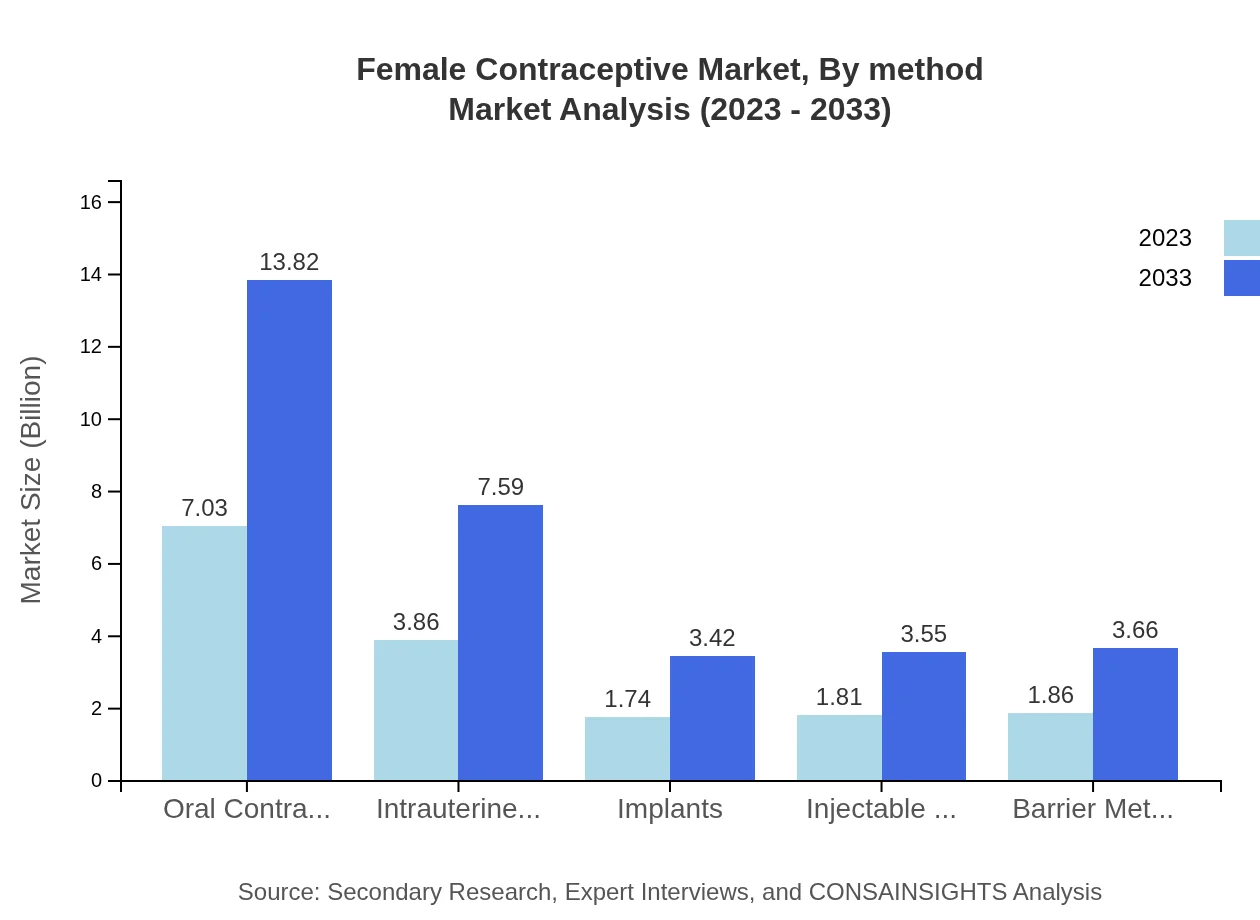

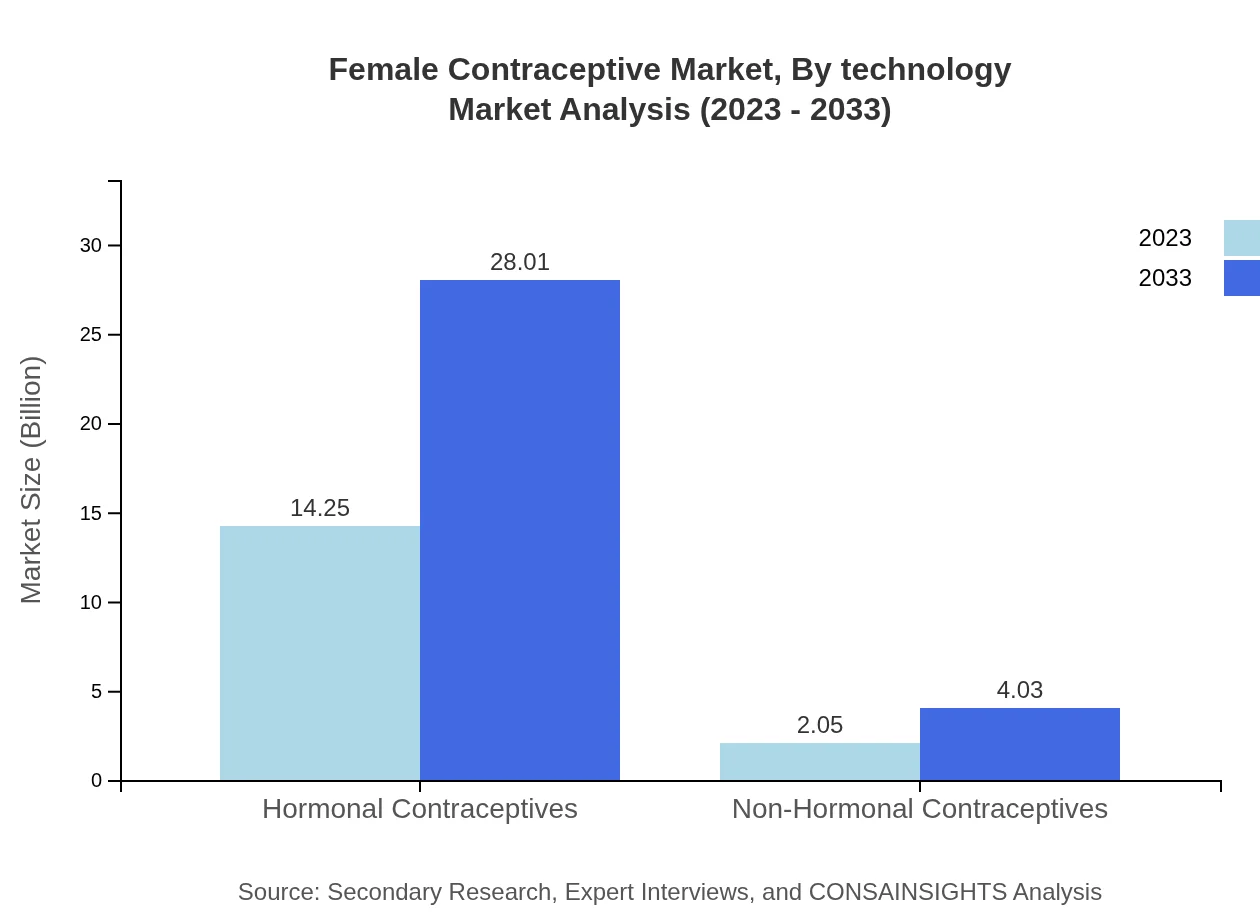

Female Contraceptive Market Analysis By Method

The Female Contraceptive Market is segmented by method into hormonal and non-hormonal contraceptives. Hormonal methods, including oral contraceptives, IUDs, and implants, dominate with a market size of USD 14.25 billion in 2023, expected to grow to USD 28.01 billion by 2033. Non-hormonal methods comprise a smaller share but are gaining traction, valued at USD 2.05 billion in 2023 and projected at USD 4.03 billion by 2033.

Female Contraceptive Market Analysis By Technology

The market includes traditional contraceptive technologies and innovative solutions, with a focus on user-friendly, effective options. Innovations in delivery systems and telehealth platforms are reshaping the market, indicating a growing trend towards personalized healthcare solutions.

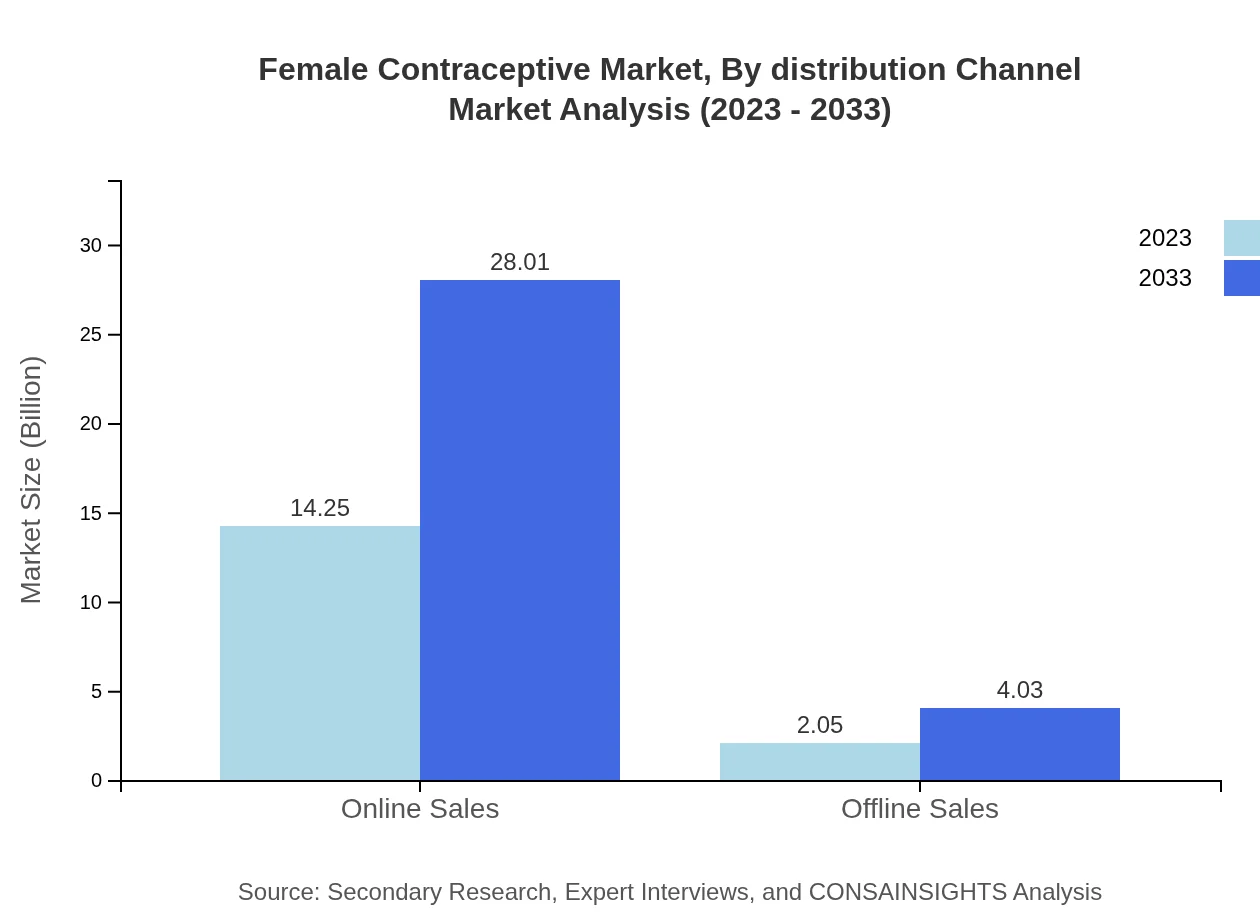

Female Contraceptive Market Analysis By Distribution Channel

Distribution channels for female contraceptives are classified into online and offline sales. Online channels are dominating with a market value of USD 14.25 billion in 2023, projected to reach USD 28.01 billion by 2033 as digital platforms ease access to various products.

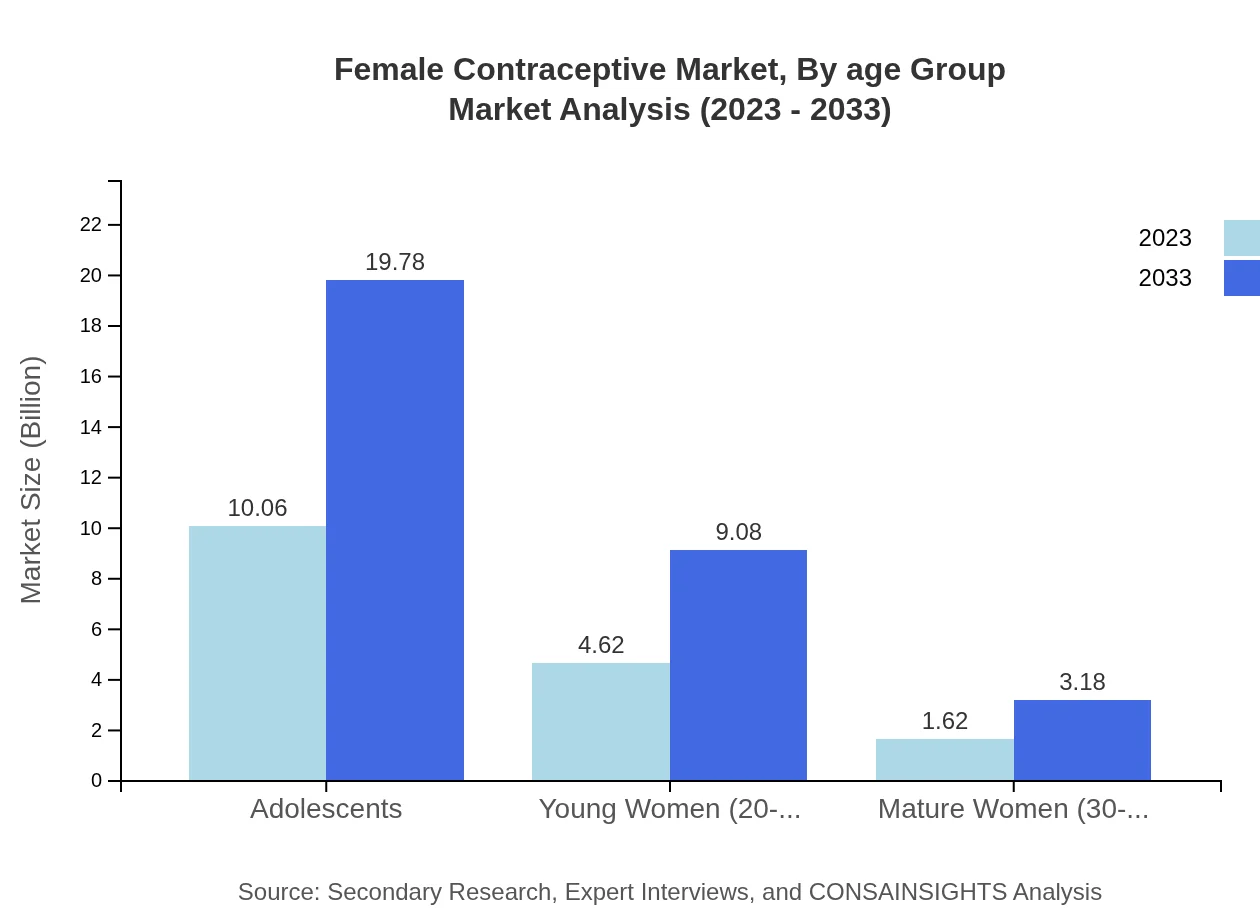

Female Contraceptive Market Analysis By Age Group

Segmenting the market by age group reveals considerable variations in preference and usage. Adolescents account for a significant share of the market with USD 10.06 billion in 2023, expected to reach USD 19.78 billion by 2033. Young women (20-29 years) and mature women (30-45 years) also represent critical demographics influencing market trends.

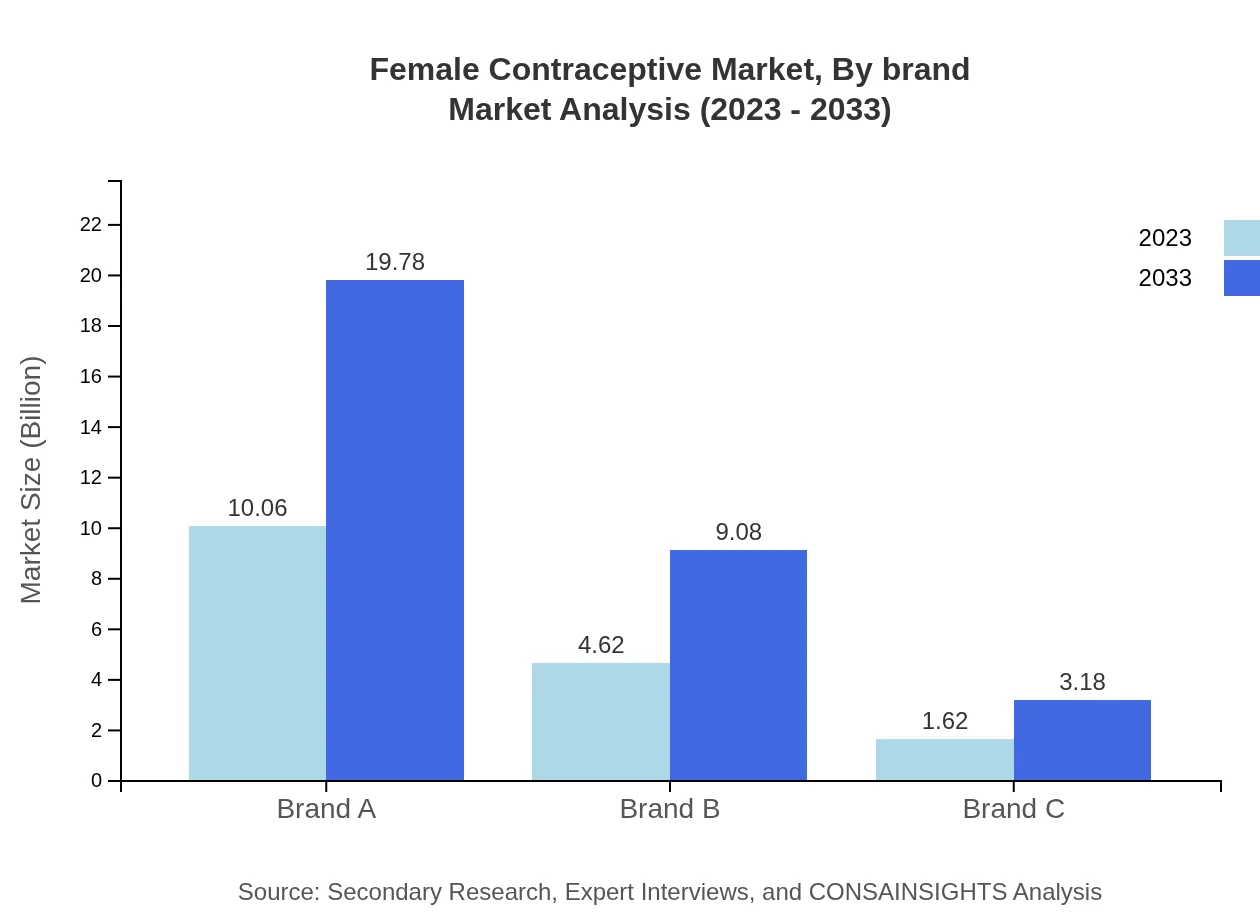

Female Contraceptive Market Analysis By Brand

Brand performance is crucial in driving market dynamics. Brand A leads the market with a size of USD 10.06 billion in 2023, maintaining a significant market share. Brand B and Brand C are also notable players, continually innovating to keep up with consumer needs.

Female Contraceptive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Female Contraceptive Industry

Bayer AG:

A prominent global player in the pharmaceutical industry, Bayer AG offers a diverse range of contraceptive products, including popular oral contraceptives and IUDs, known for their efficacy and user satisfaction.Pfizer Inc.:

Pfizer Inc. is recognized for advancing women's health with innovative contraceptives and continues to invest in research to develop new solutions, focusing on safety and effectiveness.Merck & Co., Inc.:

Merck is renowned for its commitment to improving reproductive health through a comprehensive portfolio of contraceptive products, including implants and injectables.HRA Pharma:

HRA Pharma specializes in over-the-counter contraceptive solutions, leading the way in enhancing accessibility and consumer awareness regarding contraceptive options.We're grateful to work with incredible clients.

FAQs

What is the market size of female contraceptives?

The female contraceptive market size is projected to reach $16.3 billion by 2033, growing from $10.06 billion in 2023, with a CAGR of 6.8% during the forecast period. This growth reflects increasing demand for effective contraceptive solutions.

What are the key market players or companies in the female contraceptive industry?

Key players in the female contraceptive market include major pharmaceutical companies like Bayer, Pfizer, Johnson & Johnson, Merck & Co., and Teva Pharmaceuticals, which offer a diverse range of contraceptive products and innovative solutions.

What are the primary factors driving the growth in the female contraceptive industry?

The growth in the female contraceptive market is primarily driven by increased awareness of reproductive health, greater access to contraceptive options, rising demand for family planning, and the expansion of healthcare infrastructure in developing countries.

Which region is the fastest Growing in the female contraceptive market?

North America is the fastest-growing region in the female contraceptive market, projected to expand from $6.28 billion in 2023 to $12.34 billion by 2033. This growth is fueled by a focus on women's health and increased availability of contraception.

Does ConsaInsights provide customized market report data for the female contraceptive industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the female contraceptive industry. These reports provide detailed insights, market trends, and forecasts to assist in strategic decision-making.

What deliverables can I expect from this female contraceptive market research project?

From the female contraceptive market research project, you can expect comprehensive reports including market size analysis, competitive landscape, growth forecasts, segment analysis, and regional insights to inform business strategy and market entry.

What are the market trends of female contraceptives?

Key trends in the female contraceptive market include increasing adoption of long-acting reversible contraceptives (LARCs), growth in online sales channels, a shift towards hormonal contraceptives, and innovations focusing on user experience and convenience.