Fermented Foods And Beverages Market Report

Published Date: 31 January 2026 | Report Code: fermented-foods-and-beverages

Fermented Foods And Beverages Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Fermented Foods and Beverages market from 2023 to 2033, providing insights into current trends, market size, CAGR, regional analysis, and future forecasts.

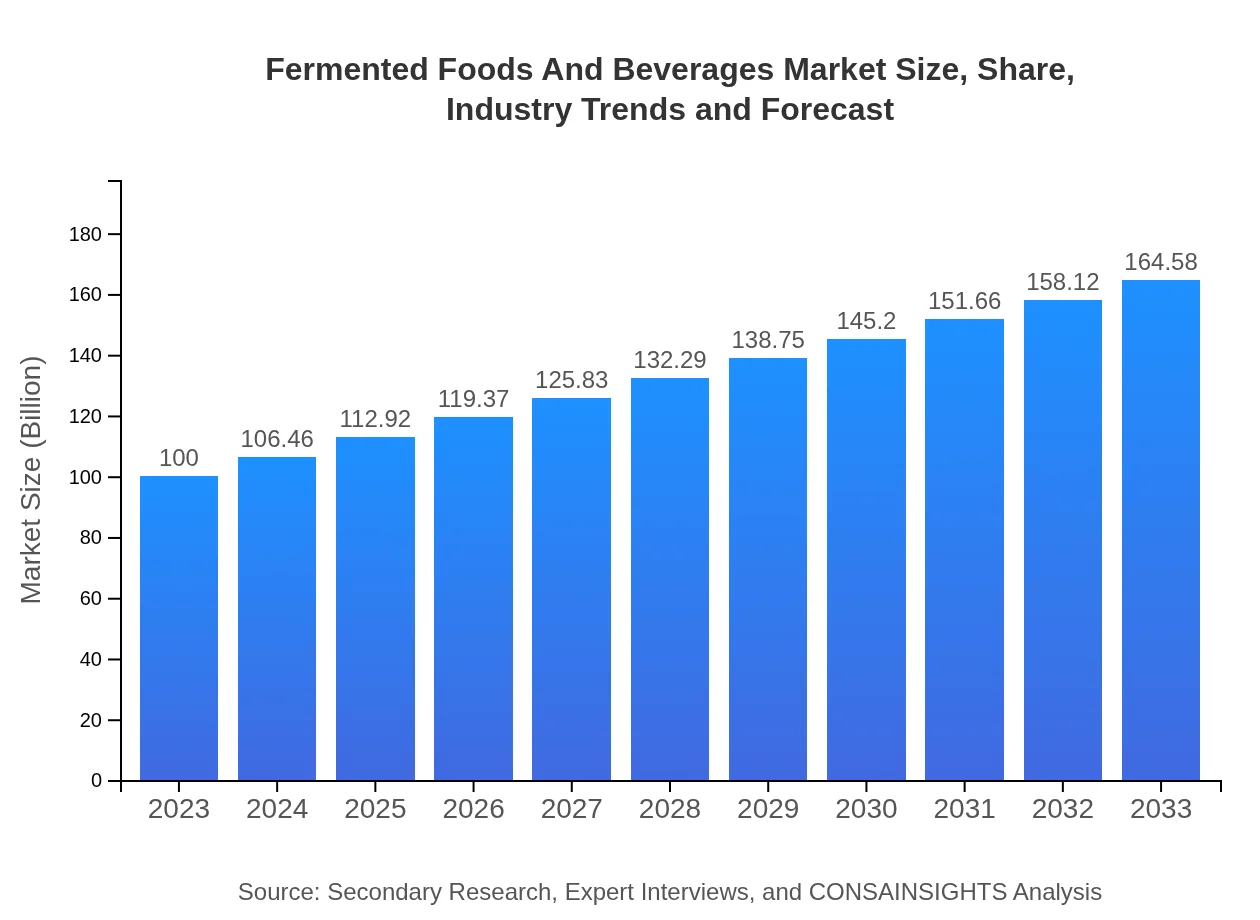

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Danone, Kraft Heinz, Yakult, Nestlé, Lifeway Foods |

| Last Modified Date | 31 January 2026 |

Fermented Foods And Beverages Market Overview

Customize Fermented Foods And Beverages Market Report market research report

- ✔ Get in-depth analysis of Fermented Foods And Beverages market size, growth, and forecasts.

- ✔ Understand Fermented Foods And Beverages's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fermented Foods And Beverages

What is the Market Size & CAGR of Fermented Foods And Beverages market in 2023?

Fermented Foods And Beverages Industry Analysis

Fermented Foods And Beverages Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fermented Foods And Beverages Market Analysis Report by Region

Europe Fermented Foods And Beverages Market Report:

Europe's market is valued at $30.63 billion in 2023 and forecasts point to $50.41 billion by 2033. The demand for organic and functional foods is particularly high in this region, spurred by stringent health regulations and a proactive consumer base. Traditional fermented products are also seeing a revival, adding diversity to the market.Asia Pacific Fermented Foods And Beverages Market Report:

In 2023, Asia Pacific holds a market value of $19.54 billion, anticipated to grow to $32.16 billion by 2033. The region's rich history with fermented products like kimchi and soy sauce, combined with a young, health-conscious population, positions it for dynamic growth. Rising disposable incomes and increasing adoption of Western dietary trends further complement this growth trajectory.North America Fermented Foods And Beverages Market Report:

North America has a market size of $33.47 billion in 2023 and is expected to reach $55.08 billion by 2033. The region is witnessing a surge in demand for probiotic-rich products, largely fueled by a strong health and wellness trend. Key brands are innovating to meet the sophisticated taste profiles of consumers, driving market expansion.South America Fermented Foods And Beverages Market Report:

South America exhibits a market size of $8.46 billion in 2023, projected to reach $13.92 billion by 2033. Growing awareness about the nutritional benefits of fermented foods, along with a cultural inclination towards traditional ferments like kefir, is driving market expansion in this region. Additionally, urbanization and changing dietary preferences support a burgeoning market.Middle East & Africa Fermented Foods And Beverages Market Report:

In the Middle East and Africa, the market size is estimated at $7.90 billion in 2023, growing to $13.00 billion by 2033. Factors such as increasing consumer awareness of the health benefits of fermented foods and the region's rich gastro-cultural heritage play a key role in this growth trajectory.Tell us your focus area and get a customized research report.

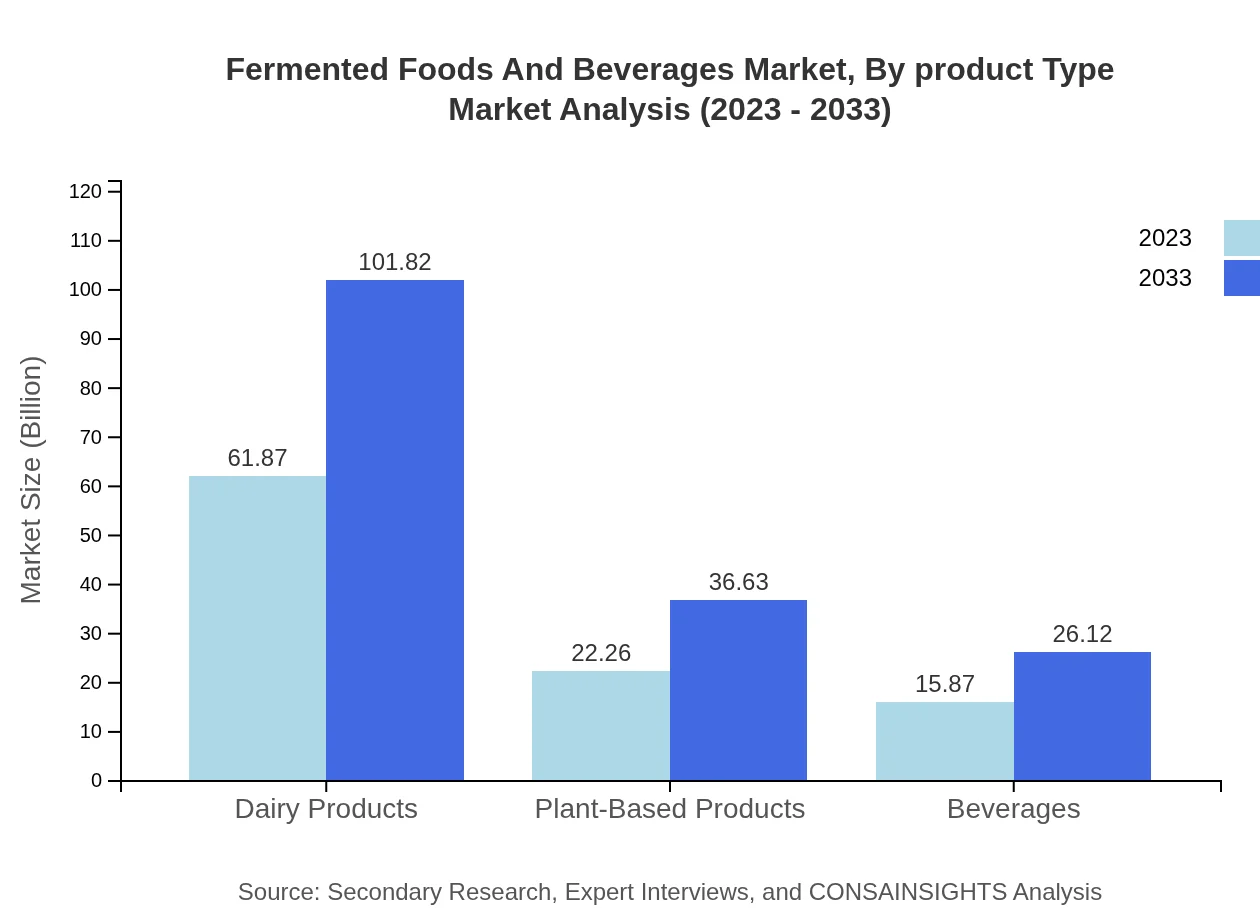

Fermented Foods And Beverages Market Analysis By Product Type

The product type analysis reveals that Dairy Products dominate the Fermented Foods and Beverages market with a size of $61.87 billion in 2023, forecasted to reach $101.82 billion by 2033. Plant-Based Products are emerging significantly, growing from $22.26 billion in 2023 to $36.63 billion by 2033, reflecting the shift towards veganism. Other segments include beverages and health food products, showcasing varied consumer preferences in this evolving market landscape.

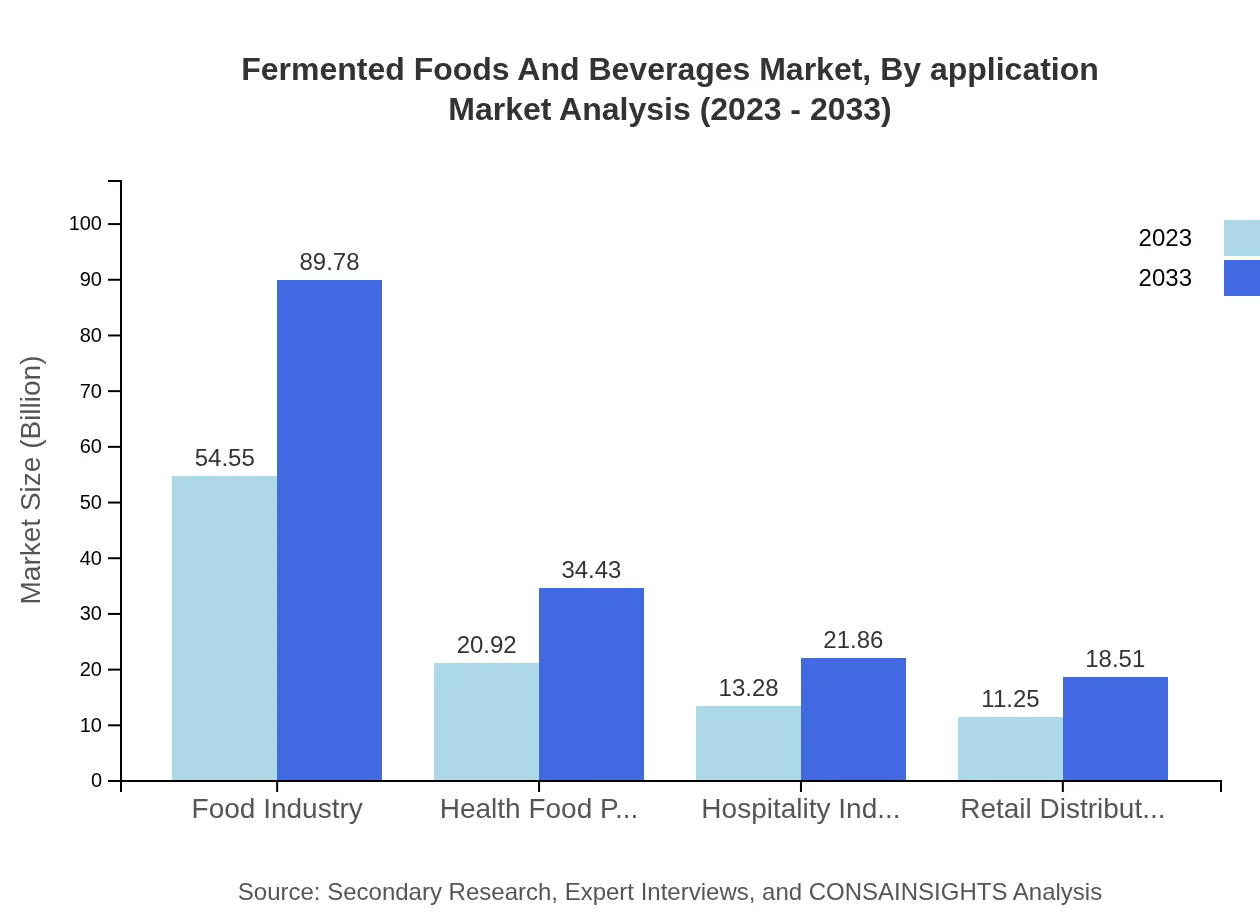

Fermented Foods And Beverages Market Analysis By Application

Applications of fermented foods span across sectors such as retail consumers, food service, and beverages. The Retail Consumer segment currently stands at $61.87 billion and is projected to grow to $101.82 billion by 2033. The food service sector, while smaller, demonstrates potential growth from $22.26 billion to $36.63 billion in the same period, driven by restaurants and cafes incorporating innovative fermented options in their menus.

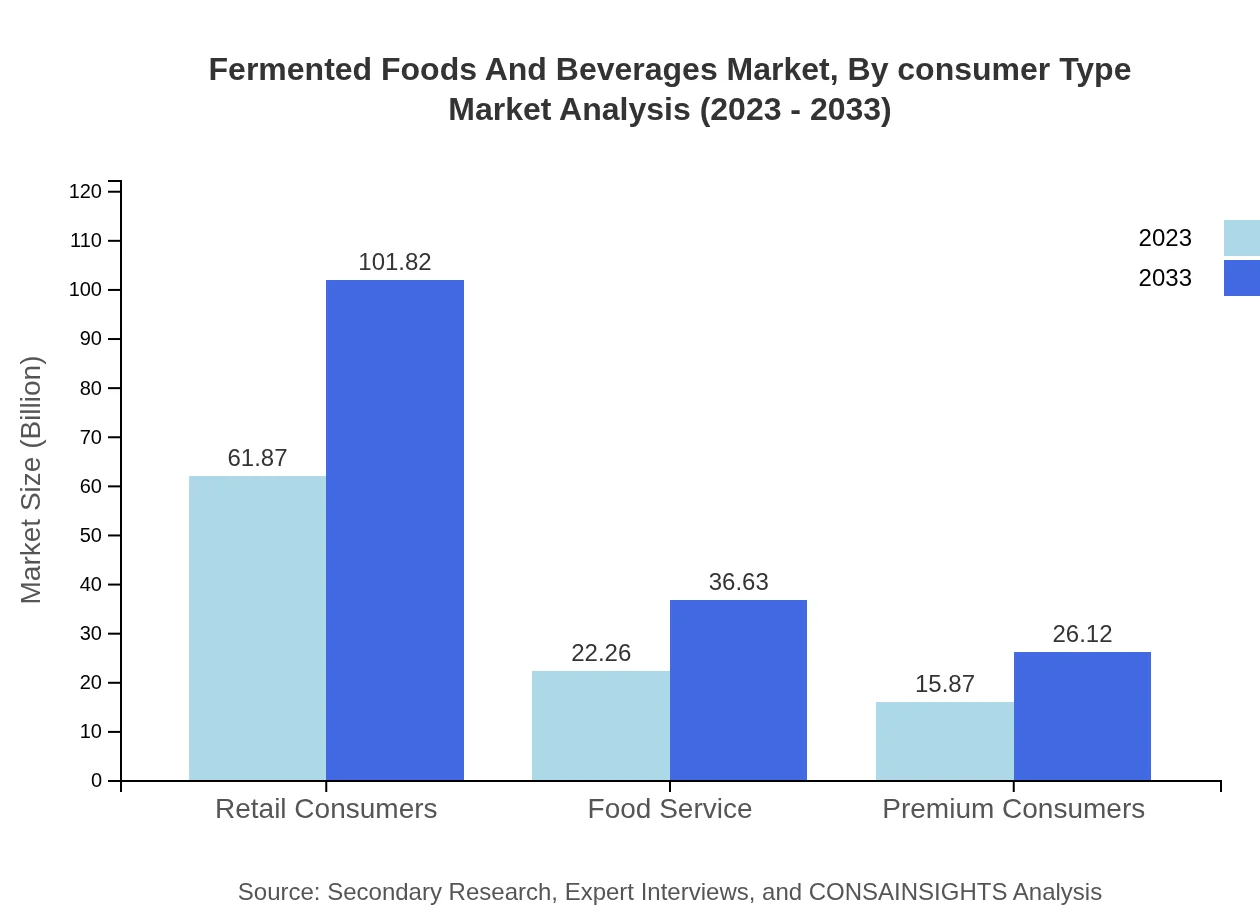

Fermented Foods And Beverages Market Analysis By Consumer Type

Consumer types are diverse, with an increasing focus on health-conscious individuals. Premium Consumers, focusing on high-quality, artisanal products, are expected to grow from $15.87 billion in 2023 to $26.12 billion by 2033. Additionally, the rise of health-related consumer preferences indicates that products promoting Digestive Health and Immunity Boosting drives significant market segments.

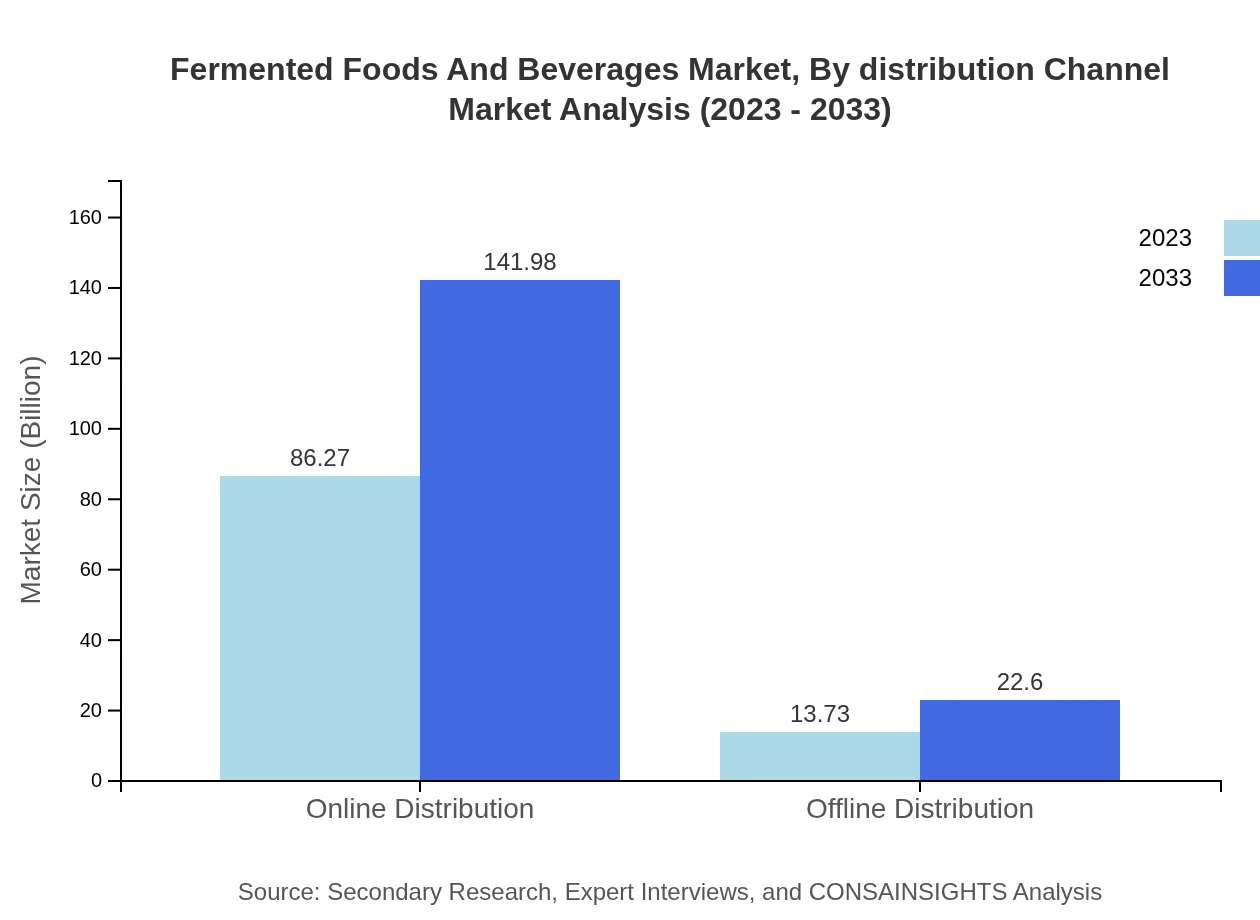

Fermented Foods And Beverages Market Analysis By Distribution Channel

The distribution landscape of Fermented Foods and Beverages includes both online and offline channels. In 2023, Online Distribution holds a significant market share of $86.27 billion, expected to expand to $141.98 billion by 2033. This growth highlights the shift towards e-commerce. Conversely, Offline Distribution, valued at $13.73 billion, demonstrates stability, appealing to traditional retail consumers.

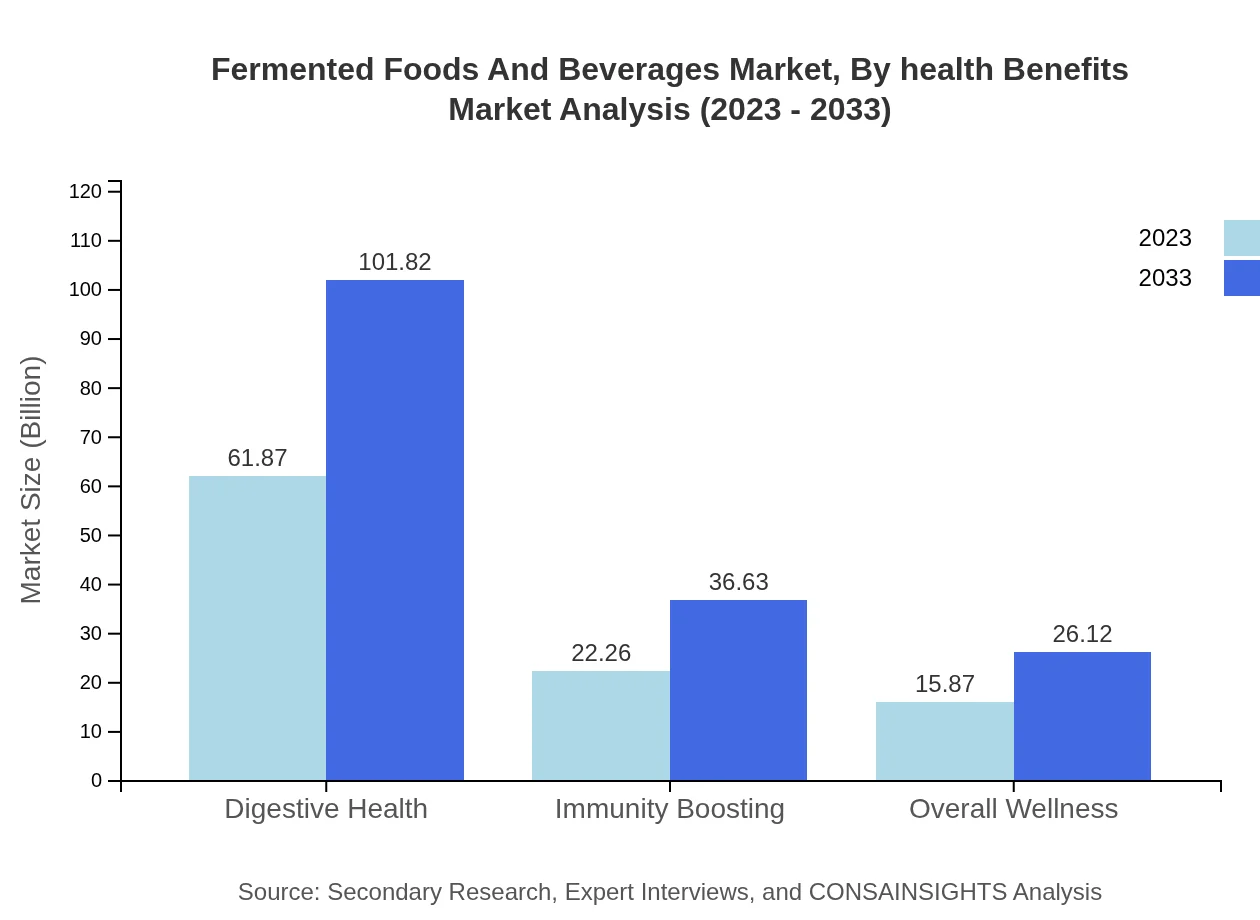

Fermented Foods And Beverages Market Analysis By Health Benefits

Health benefits are a critical focus for consumers. Digestive Health products, valued at $61.87 billion in 2023, are forecasted to reach $101.82 billion by 2033. Products aimed at Immunity Boosting also present considerable growth, increasing from $22.26 billion to $36.63 billion. This segment showcases the strong relationship between consumer health concerns and market choices.

Fermented Foods And Beverages Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fermented Foods And Beverages Industry

Danone:

A leading global producer of dairy products, Danone has made substantial investments in probiotic research, reinforcing its position in the fermented foods market.Kraft Heinz:

Known for its wide range of food products, Kraft Heinz is a prominent player in the fermented beverages segment, developing innovative flavor profiles to attract health-conscious consumers.Yakult:

Yakult specializes in probiotic beverages and has established a strong global presence, promoting health benefits through educational campaigns.Nestlé:

Nestlé covers a vast portfolio in the fermentation space, emphasizing both traditional and health-oriented fermented food products.Lifeway Foods:

A market leader in the production of kefir, Lifeway Foods has capitalized on the growing demand for probiotic-rich dairy alternatives.We're grateful to work with incredible clients.

FAQs

What is the market size of fermented Foods And Beverages?

The fermented foods and beverages market, valued at approximately $100 million in 2023, is projected to grow at a CAGR of 5%, hinting at robust expansion possibilities over the next decade.

What are the key market players or companies in this fermented Foods And Beverages industry?

Key players in the fermented foods and beverages industry include prominent brands like Danone, PepsiCo, and General Mills, well-known for their innovative and diverse product lines targeting consumer preferences.

What are the primary factors driving the growth in the fermented Foods And Beverages industry?

The rise in health-conscious consumers, demand for probiotic products, and increased awareness about gut health are driving growth in the fermented foods and beverages market globally.

Which region is the fastest Growing in the fermented Foods And Beverages?

The Asia Pacific region is witnessing significant growth, projected to increase from $19.54 million in 2023 to $32.16 million by 2033, showcasing strong demand for fermented products.

Does ConsaInsights provide customized market report data for the fermented Foods And Beverages industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements, providing in-depth insights into the fermented foods and beverages sector.

What deliverables can I expect from this fermented Foods And Beverages market research project?

Deliverables from this market research project include comprehensive reports, executive summaries, data analytics, segmented insights, and trend analysis relevant to the fermented foods and beverages industry.

What are the market trends of fermented Foods And Beverages?

Current trends in the fermented foods and beverages market include increasing demand for plant-based options, the rise of functional foods, and innovative packaging methods to meet consumer preferences.