Fermented Ingredients Market Report

Published Date: 31 January 2026 | Report Code: fermented-ingredients

Fermented Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Fermented Ingredients market, covering its overview, segmentation, regional performance, and growth forecast from 2023 to 2033. Key data about market size and trends are included to guide stakeholders about potential opportunities in this evolving sector.

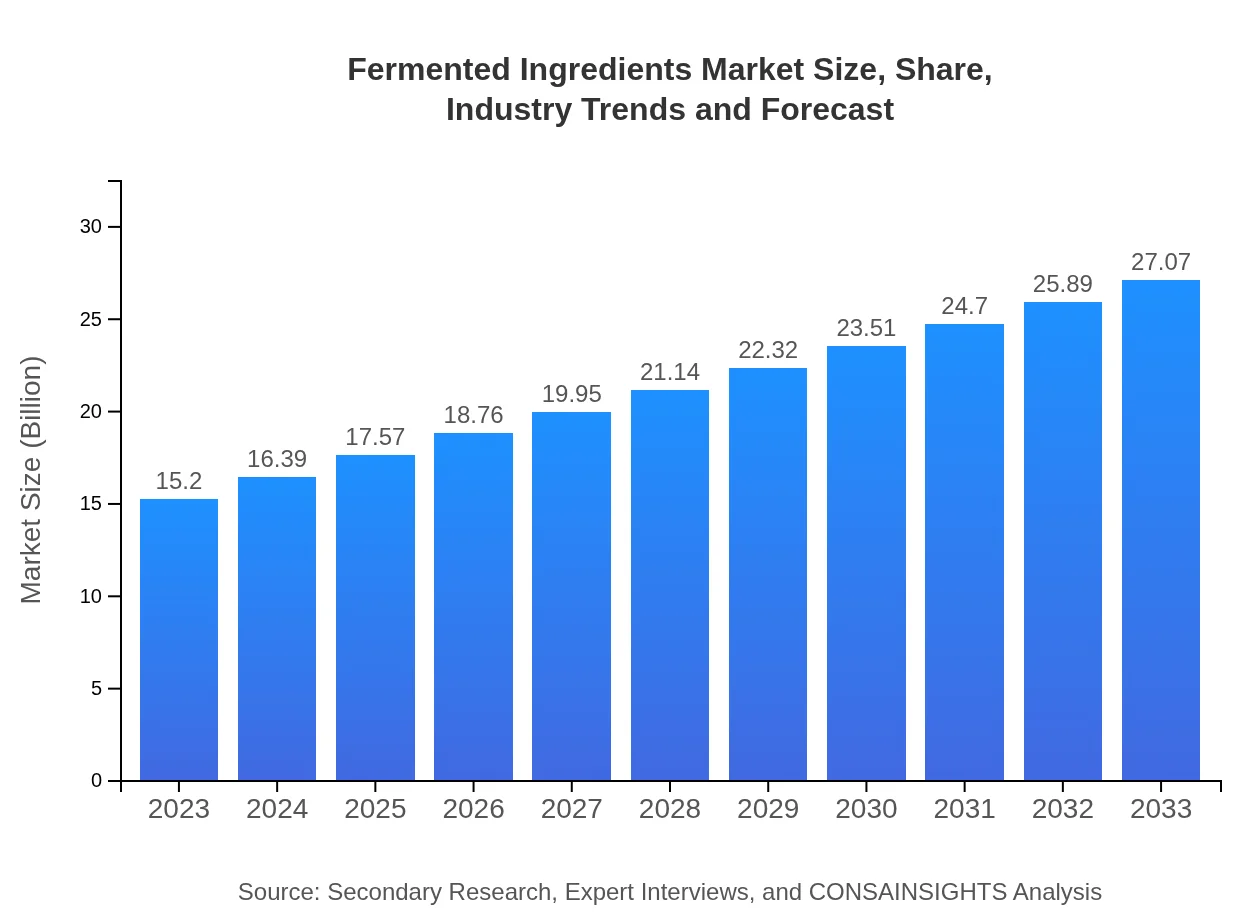

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.07 Billion |

| Top Companies | Danone, Chr. Hansen, Nestlé, Kerry Group |

| Last Modified Date | 31 January 2026 |

Fermented Ingredients Market Overview

Customize Fermented Ingredients Market Report market research report

- ✔ Get in-depth analysis of Fermented Ingredients market size, growth, and forecasts.

- ✔ Understand Fermented Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fermented Ingredients

What is the Market Size & CAGR of Fermented Ingredients market in 2023?

Fermented Ingredients Industry Analysis

Fermented Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fermented Ingredients Market Analysis Report by Region

Europe Fermented Ingredients Market Report:

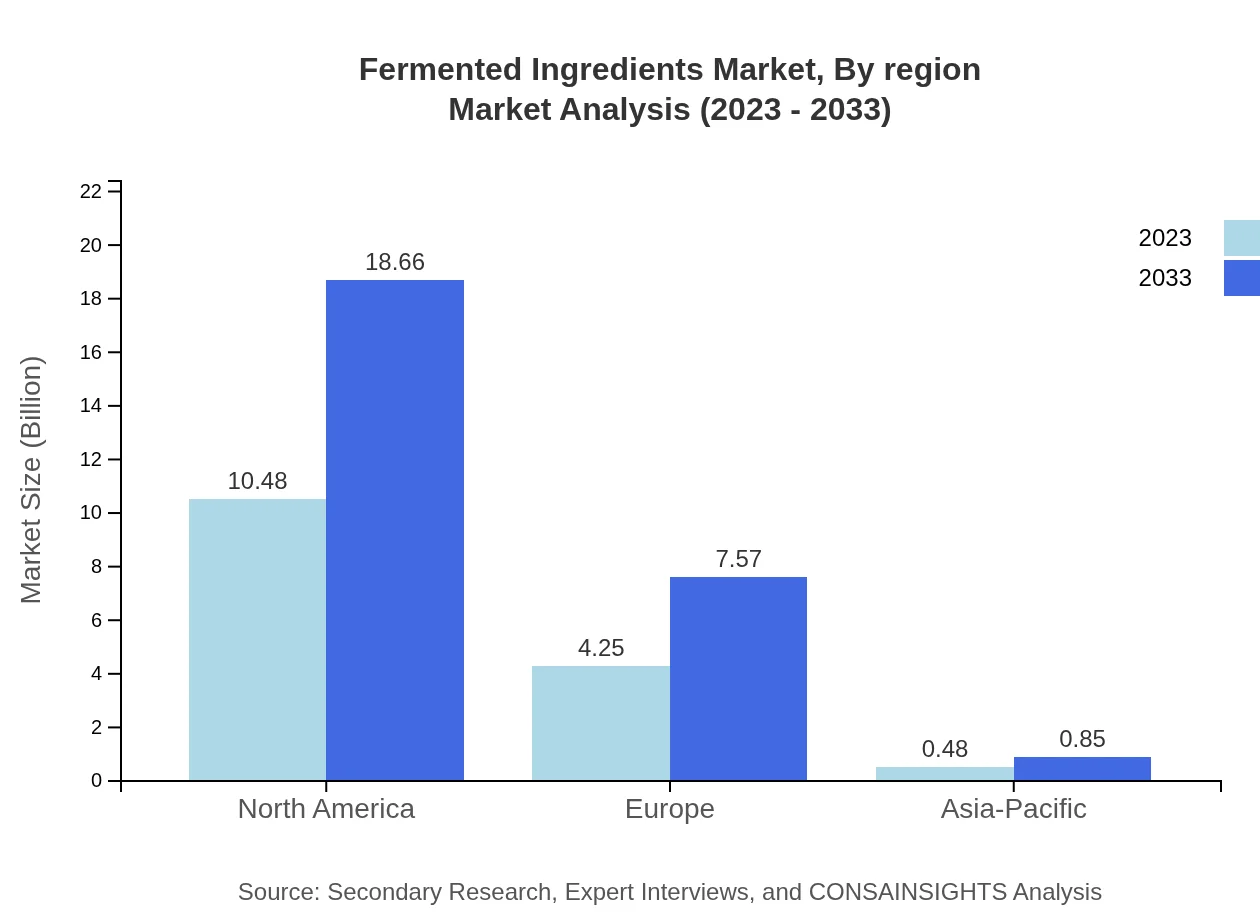

Europe's Fermented Ingredients market is poised to move from USD 4.21 billion in 2023 to USD 7.49 billion by 2033. An increasing preference for probiotic products, coupled with strict regulations that ensure quality, propels market growth. The region's cultural inclination towards fermented foods adds to its market potential.Asia Pacific Fermented Ingredients Market Report:

The Asia-Pacific region is projected to experience significant growth, with the market size expected to increase from USD 2.90 billion in 2023 to USD 5.16 billion by 2033. The region's rich tradition of fermented foods, such as kimchi and miso, alongside growing health awareness, fuels this growth. Increasing disposable incomes and urbanization are also contributing positively to market dynamics.North America Fermented Ingredients Market Report:

The North American market, with an anticipated growth from USD 5.78 billion in 2023 to USD 10.30 billion by 2033, is driven by rising health consciousness among consumers and a robust dairy industry. Innovations in plant-based fermented products are also expanding market opportunities, catering to diverse dietary preferences.South America Fermented Ingredients Market Report:

In South America, the Fermented Ingredients market is anticipated to grow from USD 0.28 billion in 2023 to USD 0.49 billion by 2033. The growing trend of healthy eating and local fermented products boosts demand. Brazilian consumers, in particular, favor traditional fermented beverages, supporting the regional growth.Middle East & Africa Fermented Ingredients Market Report:

The Middle East and Africa market is expected to rise from USD 2.04 billion in 2023 to USD 3.64 billion by 2033. The growth is influenced by various cultural practices surrounding fermented foods and increasing awareness about the health benefits of such ingredients in daily diets.Tell us your focus area and get a customized research report.

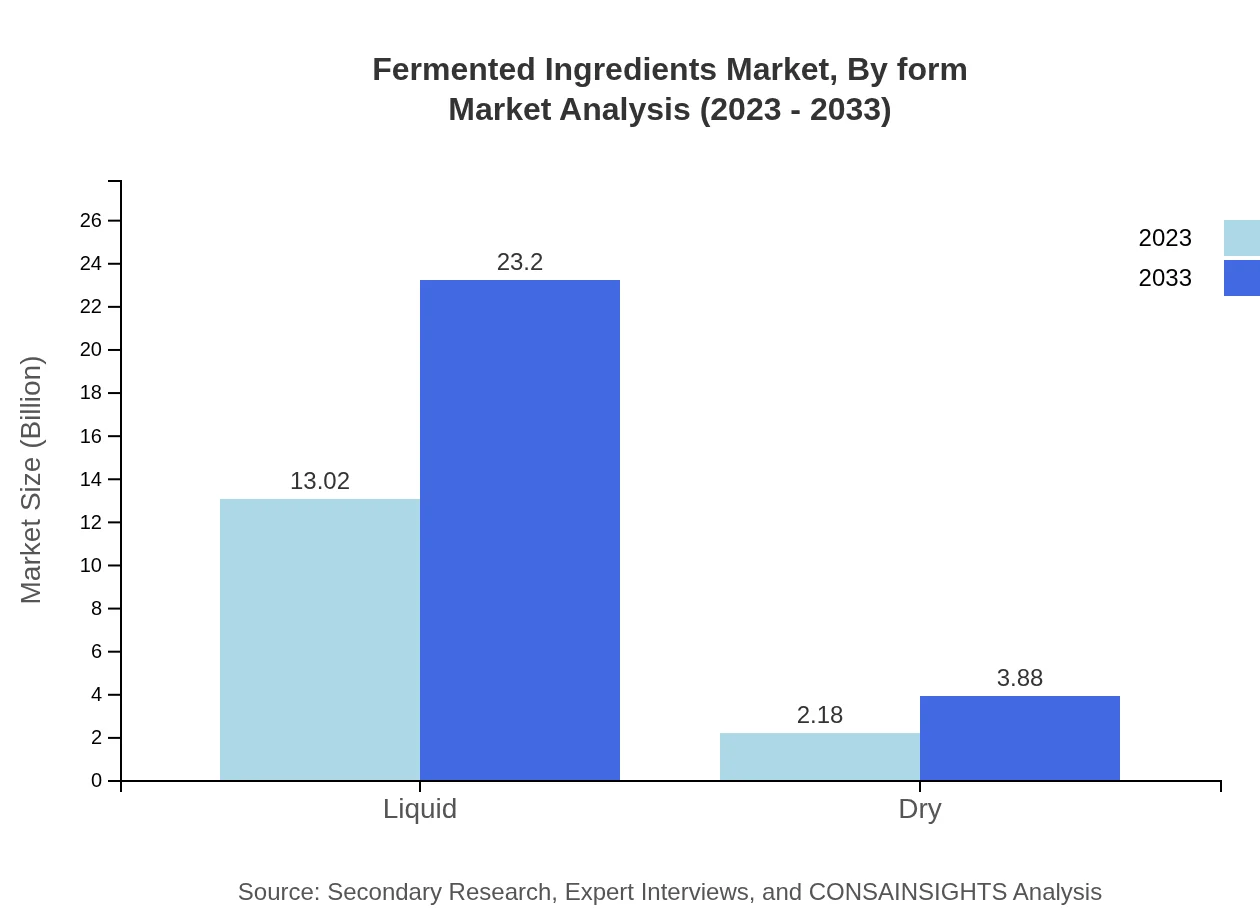

Fermented Ingredients Market Analysis By Type

The Fermented Ingredients market by type is divided into two primary categories: liquid and dry. In 2023, the liquid segment accounts for USD 13.02 billion, with a significant share of the market at 85.68%. The liquid form’s versatility leads its growth trajectory, projected to reach USD 23.20 billion by 2033. Dry fermented ingredients, while smaller in market size at USD 2.18 billion and a 14.32% share in 2023, are also expected to grow to USD 3.88 billion by 2033, indicating a favorable trend.

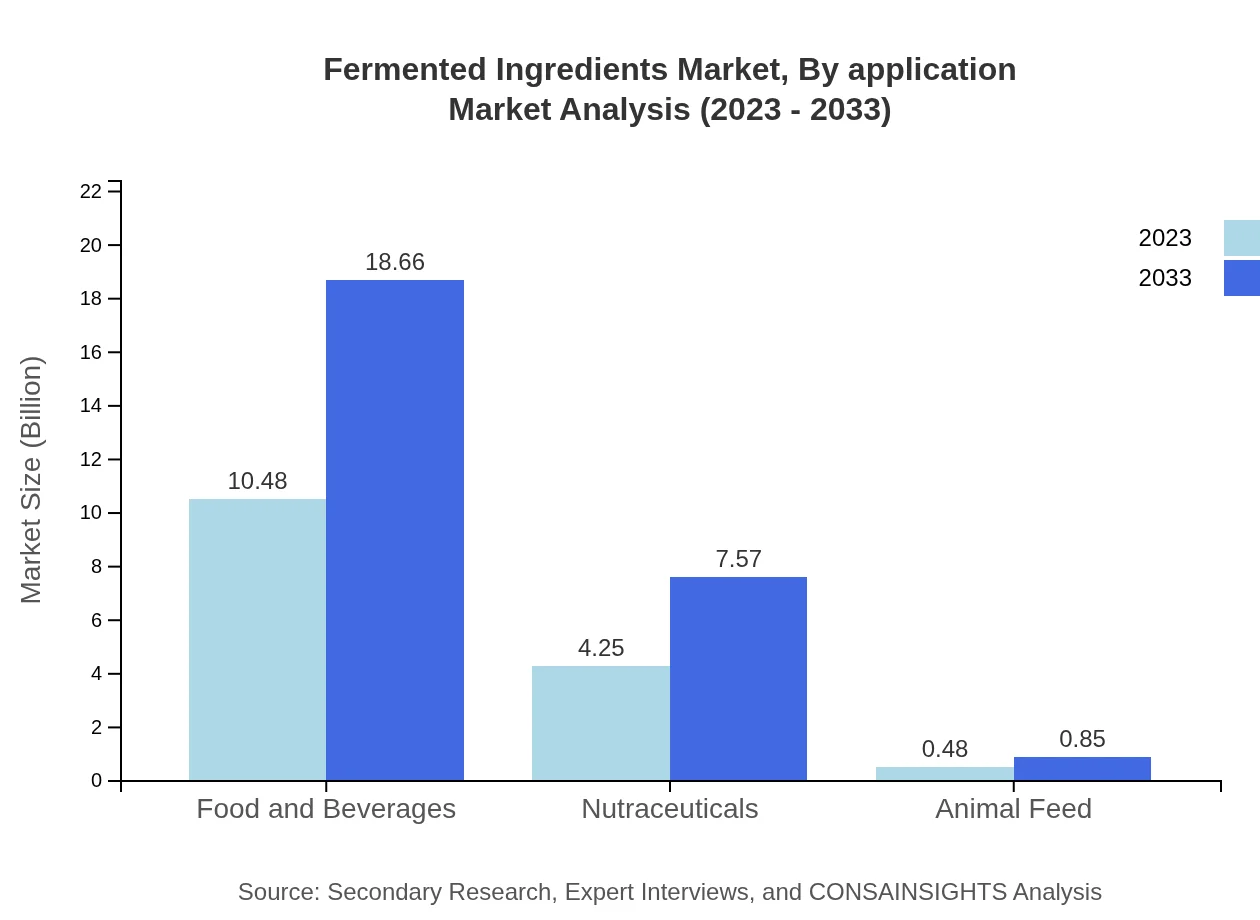

Fermented Ingredients Market Analysis By Application

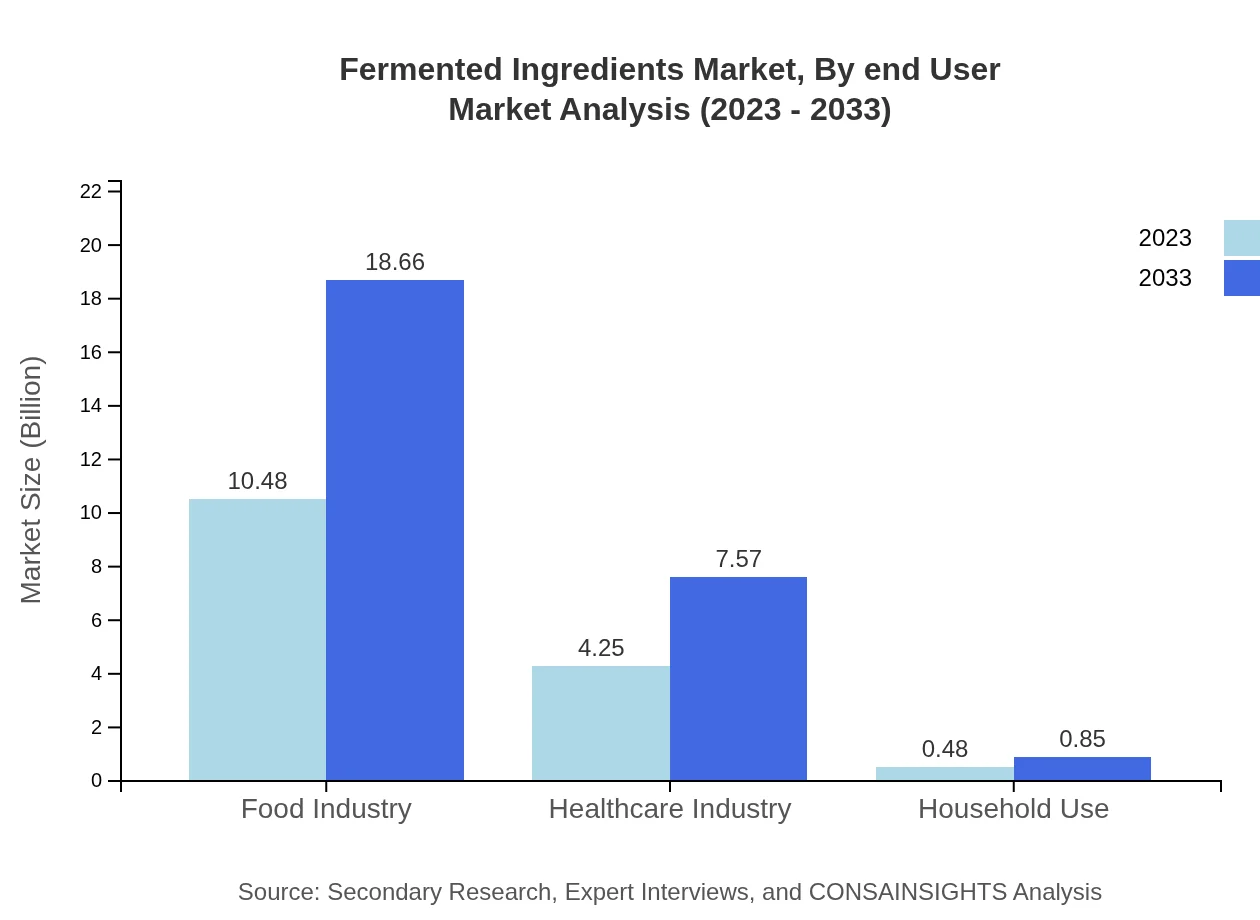

In the application segment, the food and beverages sector is dominant, representing USD 10.48 billion in 2023 and expected to rise to USD 18.66 billion by 2033, showcasing a solid 68.92% market share. The healthcare sector, significant for probiotic products, is projected to improve from USD 4.25 billion to USD 7.57 billion in the same period, equating to a 27.95% share. The household use application holds a niche market of USD 0.48 billion, anticipated to reach USD 0.85 billion by 2033, representing an increasing interest among consumers.

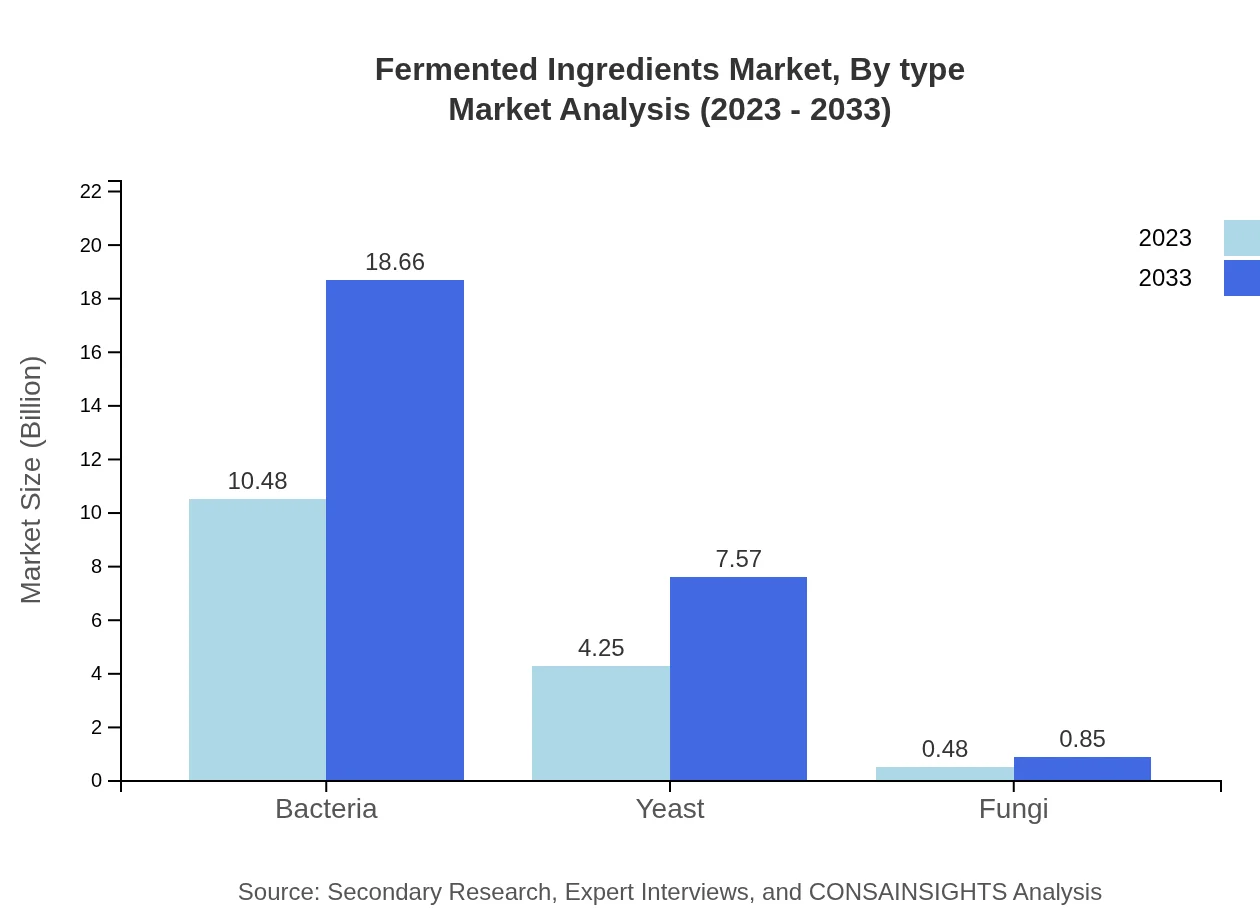

Fermented Ingredients Market Analysis By Form

The market is further segmented by form into bacteria, yeast, and fungi. Bacteria lead the market with a size of USD 10.48 billion in 2023, expected to grow to USD 18.66 billion by 2033, maintaining a strong 68.92% share. Yeast, vital in baking and brewing, is projected to rise from USD 4.25 billion to USD 7.57 billion, holding a significant 27.95% share. Fungi, while smaller in size at USD 0.48 billion, is anticipated to increase to USD 0.85 billion by 2033, attributed to rising interests in specialty products.

Fermented Ingredients Market Analysis By End User

End-user segmentation shows food industries are the primary consumers, valued at USD 10.48 billion in 2023 and expected to grow to USD 18.66 billion by 2033, indicating 68.92% of market utilization. The healthcare industry follows with an anticipated increase from USD 4.25 billion to USD 7.57 billion, reflecting 27.95%. The animal feed sector, while smaller at USD 0.48 billion, is also forecasted to see growth, paralleling consumer demand in the pet care market.

Fermented Ingredients Market Analysis By Region

Regional analysis underscores North America’s dominance in the market, with 68.92% share and a growth projection from USD 10.48 billion to USD 18.66 billion. Europe follows with 27.95%, moving from USD 4.25 billion to USD 7.57 billion by 2033, driven by cultural trends in fermented foods. The Asia-Pacific showcases potential growth with increasing demand reflected in a market of USD 0.48 billion growing to USD 0.85 billion by 2033.

Fermented Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fermented Ingredients Industry

Danone:

Danone is a leading multinational food-products corporation known for its focus on dairy products, notably yogurts, which play a significant role in the fermented ingredients market. The company invests heavily in research to innovate in the realm of probiotics.Chr. Hansen:

Chr. Hansen is well recognized for its natural ingredients and through biotechnology, it provides a wide range of cultures, enzymes, and fermented ingredients utilized across the food and beverage industries worldwide.Nestlé:

Nestlé's diverse portfolio includes many health-focused nutritional products, where fermented ingredients thrive. The company is heavily involved in promoting health through nutrition, integrating several fermented products into its offerings.Kerry Group:

Kerry Group is active in the production of taste and nutrition solutions that leverage fermented ingredients. Their innovations in flavor and functionality are perceptibly impacting market trends.We're grateful to work with incredible clients.

FAQs

What is the market size of fermented Ingredients?

The global fermented ingredients market is valued at approximately $15.2 billion in 2023, with an expected CAGR of 5.8%. By 2033, this market is projected to significantly increase, showcasing strong growth and demand in various sectors.

What are the key market players or companies in this fermented Ingredients industry?

Key players in the fermented ingredients market include multinational food companies, specialized ingredient manufacturers, and biotechnology firms. These companies are crucial for innovation and supply chain consistency in the growing market.

What are the primary factors driving the growth in the fermented ingredients industry?

The growth in the fermented ingredients sector is driven by increasing consumer awareness of health benefits, rising demand for functional foods, and advancements in fermentation technology that enhance product offerings and sustainability.

Which region is the fastest Growing in the fermented ingredients market?

North America is currently the fastest-growing region in the fermented ingredients market, with a market value expected to rise from $5.78 billion in 2023 to $10.30 billion by 2033, indicating robust growth and consumer demand.

Does ConsaInsights provide customized market report data for the fermented ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific requirements in the fermented ingredients industry. This includes in-depth analysis on various market segments, trends, and forecasts.

What deliverables can I expect from this fermented Ingredients market research project?

From the fermented ingredients market research project, clients can expect comprehensive deliverables including detailed market analysis, segmentation reports, consumer trends, and specific forecasts with actionable insights for strategic decision-making.

What are the market trends of fermented ingredients?

Emerging trends in the fermented ingredients market include increased use of probiotics in food and beverages, innovations in plant-based fermentations, and a shift towards sustainable and clean-label ingredients, reflecting changing consumer preferences.