Fiber Food Ingredients Market Report

Published Date: 31 January 2026 | Report Code: fiber-food-ingredients

Fiber Food Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Fiber Food Ingredients market, exploring market size, trends, growth forecasts from 2023 to 2033, and regional insights. It also discusses key players and segments within the industry, offering valuable data for stakeholders to make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

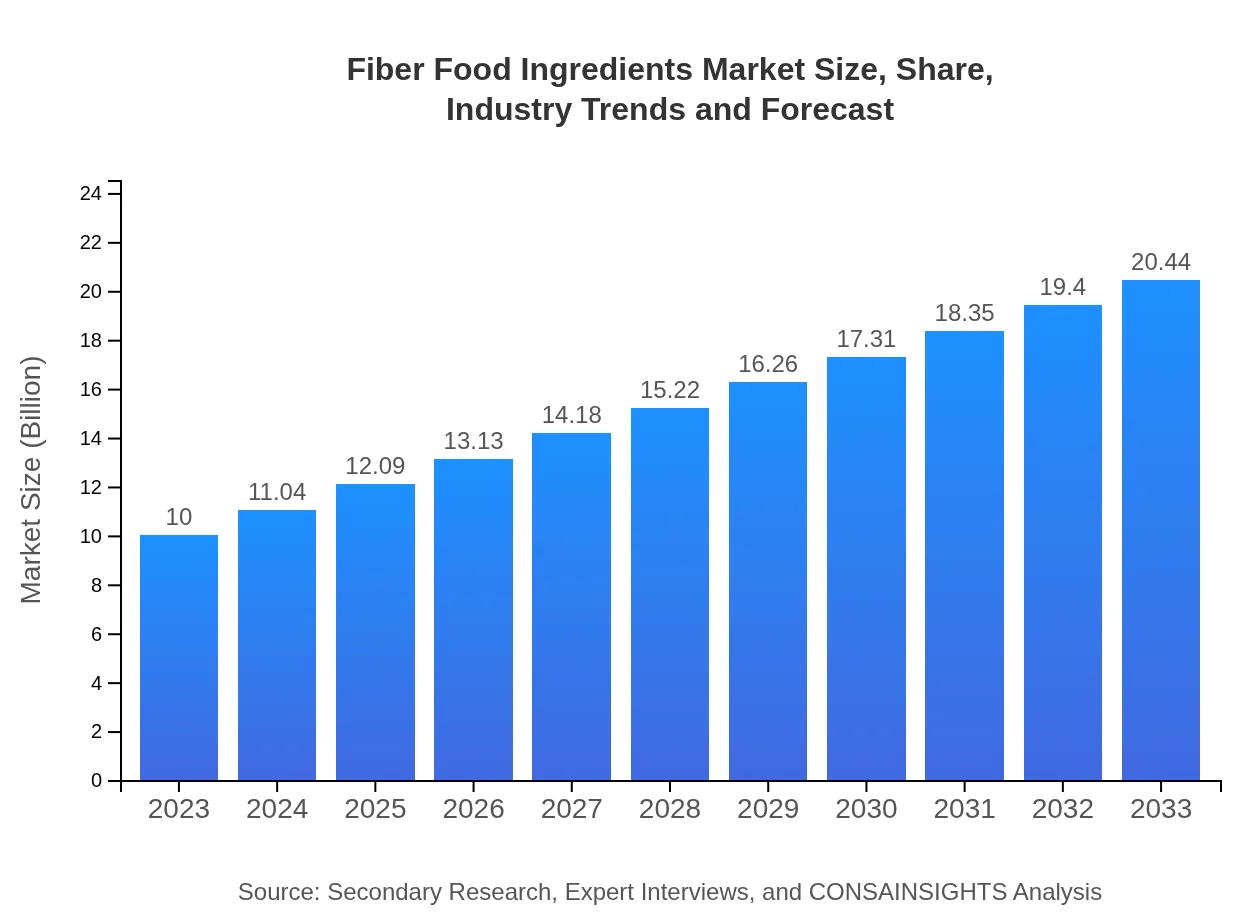

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $20.44 Billion |

| Top Companies | DuPont Nutrition & Biosciences, Cargill, Incorporated, Fibergum, MGP Ingredients, Inc. |

| Last Modified Date | 31 January 2026 |

Fiber Food Ingredients Market Overview

Customize Fiber Food Ingredients Market Report market research report

- ✔ Get in-depth analysis of Fiber Food Ingredients market size, growth, and forecasts.

- ✔ Understand Fiber Food Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fiber Food Ingredients

What is the Market Size & CAGR of Fiber Food Ingredients market in 2023?

Fiber Food Ingredients Industry Analysis

Fiber Food Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fiber Food Ingredients Market Analysis Report by Region

Europe Fiber Food Ingredients Market Report:

The European Fiber Food Ingredients market is projected to grow from $3.02 billion in 2023 to $6.17 billion by 2033. This growth is fueled by stringent regulations on food labeling and a significant shift towards plant-based diets among consumers, particularly in countries like Germany and the UK.Asia Pacific Fiber Food Ingredients Market Report:

In 2023, the market in the Asia Pacific region is valued at $1.88 billion, projected to grow to $3.84 billion by 2033, driven by rising health consciousness and growing consumer demand for functional foods. Countries like China and India are leading the market, with their expanding middle class seeking healthier lifestyle options.North America Fiber Food Ingredients Market Report:

In North America, the market size is anticipated to grow from $3.73 billion in 2023 to approximately $7.63 billion by 2033. The region’s increased focus on health and wellness, along with a rise in diseases related to poor dietary habits, is driving the demand for fiber-rich products. The United States is a key player in this growth.South America Fiber Food Ingredients Market Report:

The South American market is valued at $0.93 billion in 2023, expected to reach $1.90 billion by 2033. As consumers become more aware of nutrition and health benefits, the adoption of fiber ingredients in local diets is increasing, particularly in the beverage sector.Middle East & Africa Fiber Food Ingredients Market Report:

In the Middle East and Africa, the market is valued at $0.44 billion in 2023, increasing to $0.90 billion by 2033. Health awareness is gradually rising, though the market is still developing compared to other regions. There's a growing opportunity for manufacturers to introduce fiber-rich products tailored to local tastes.Tell us your focus area and get a customized research report.

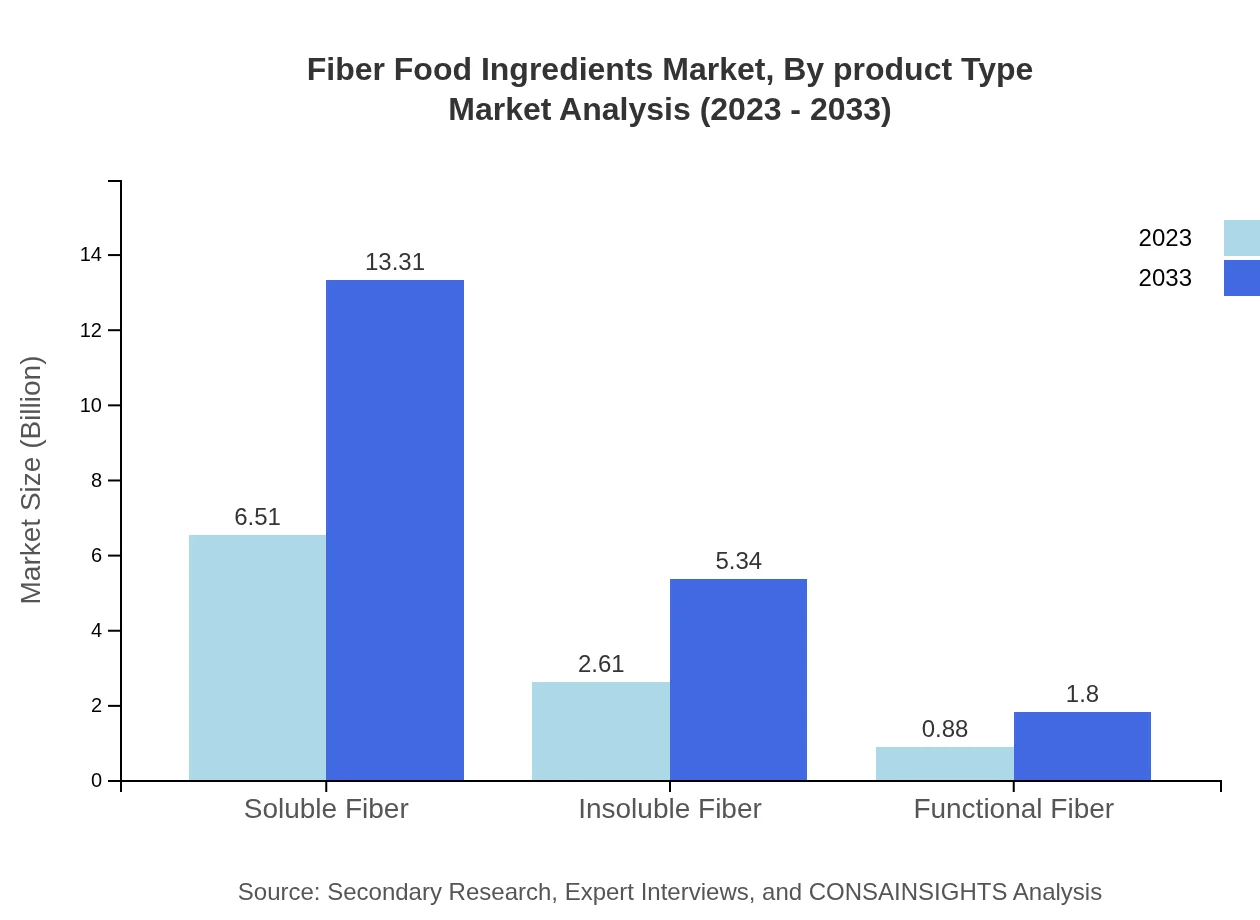

Fiber Food Ingredients Market Analysis By Product Type

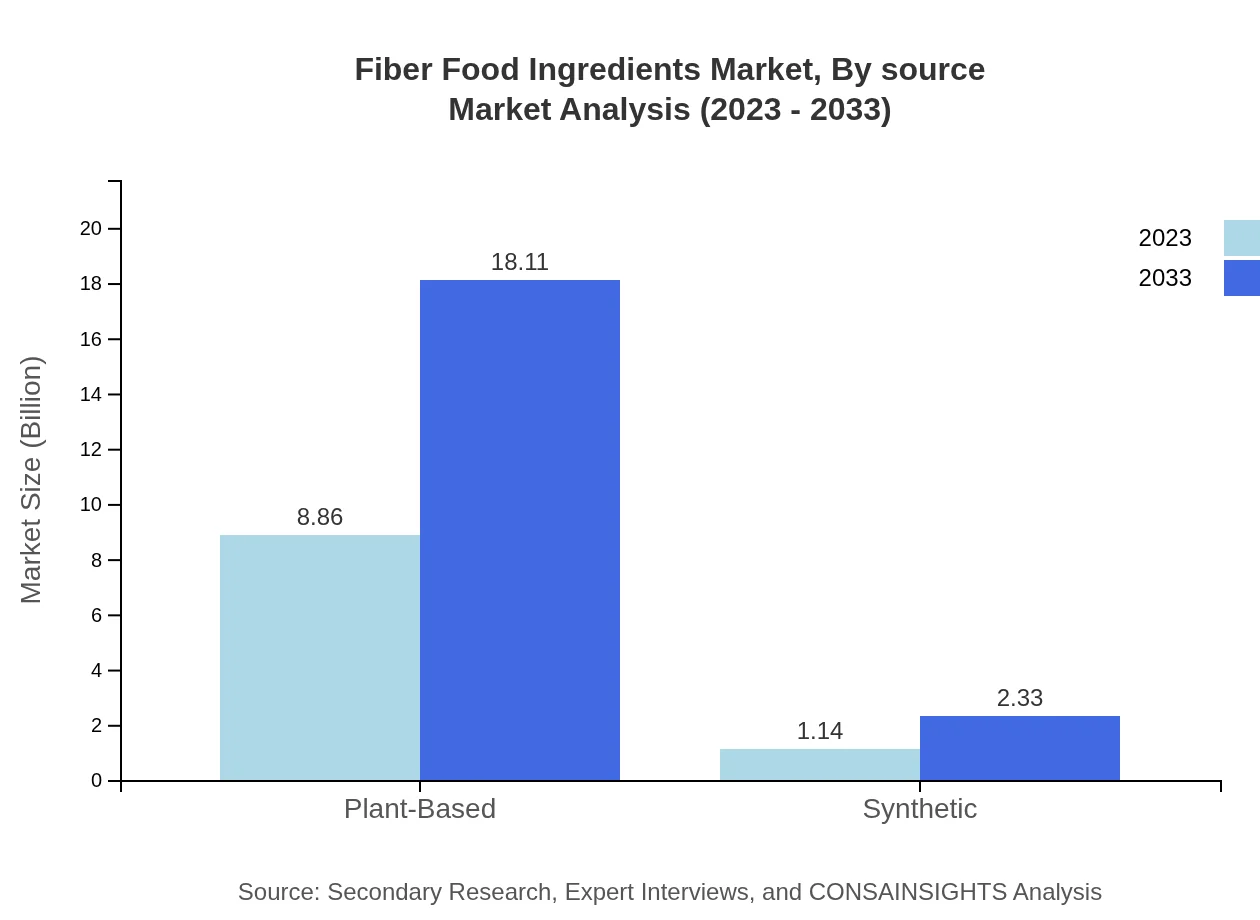

Plant-based fibers dominate the market, with an estimated size of $8.86 billion in 2023, expected to grow to $18.11 billion by 2033. The share of plant-based fiber remains robust at 88.59%. In contrast, synthetic fibers, though smaller, show growth from $1.14 billion to $2.33 billion, holding an 11.41% share.

Fiber Food Ingredients Market Analysis By Source

From a source perspective, plant-based fibers are leading, significantly contributing to the market with a growing consumer preference for natural ingredients over synthetic options. This trend is influencing product development and marketing strategies across the industry.

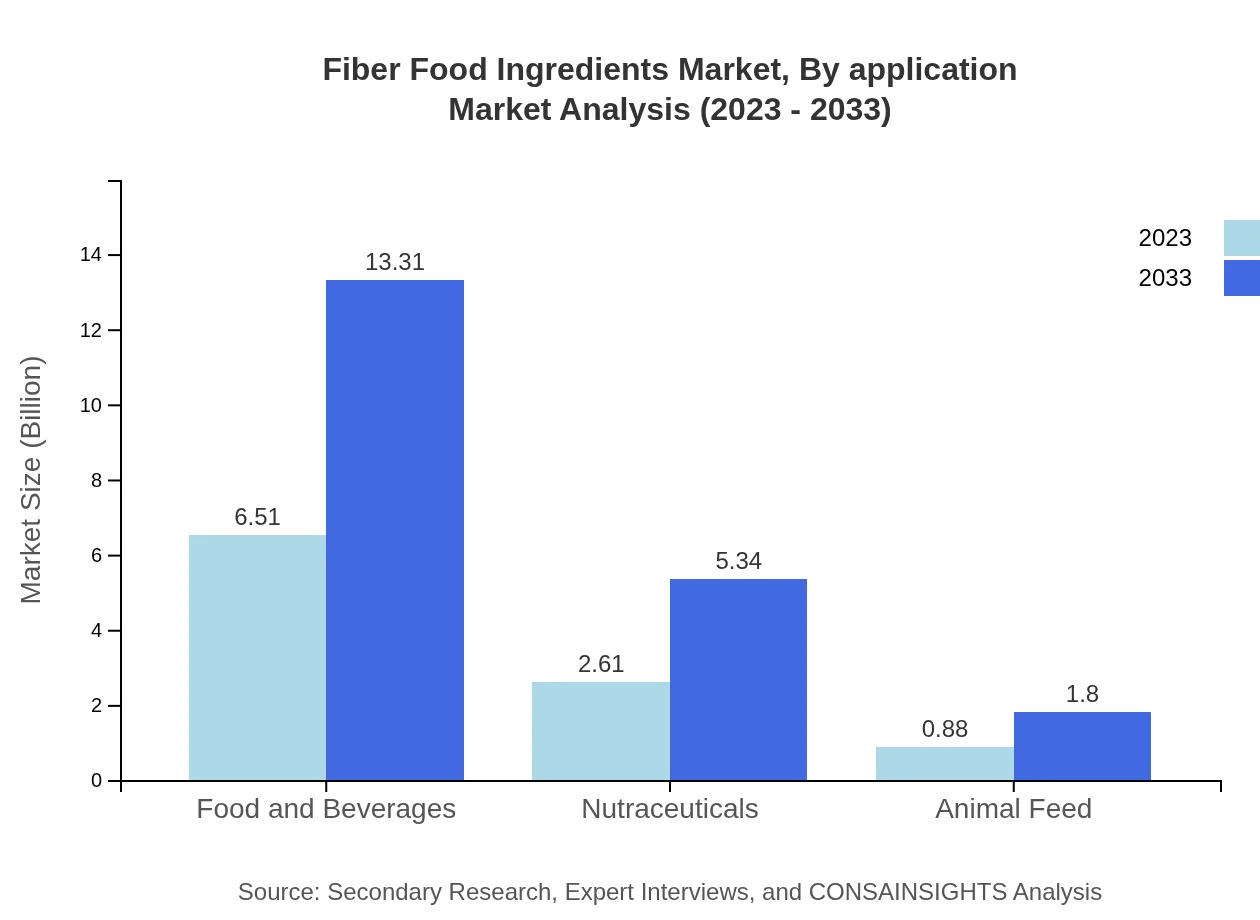

Fiber Food Ingredients Market Analysis By Application

The food and beverages segment is the largest application area, accounting for $6.51 billion in 2023 and projected to rise to $13.31 billion by 2033, representing a share of 65.09%. Nutraceuticals also show substantial growth, from $2.61 billion to $5.34 billion, driven by increasing health concerns.

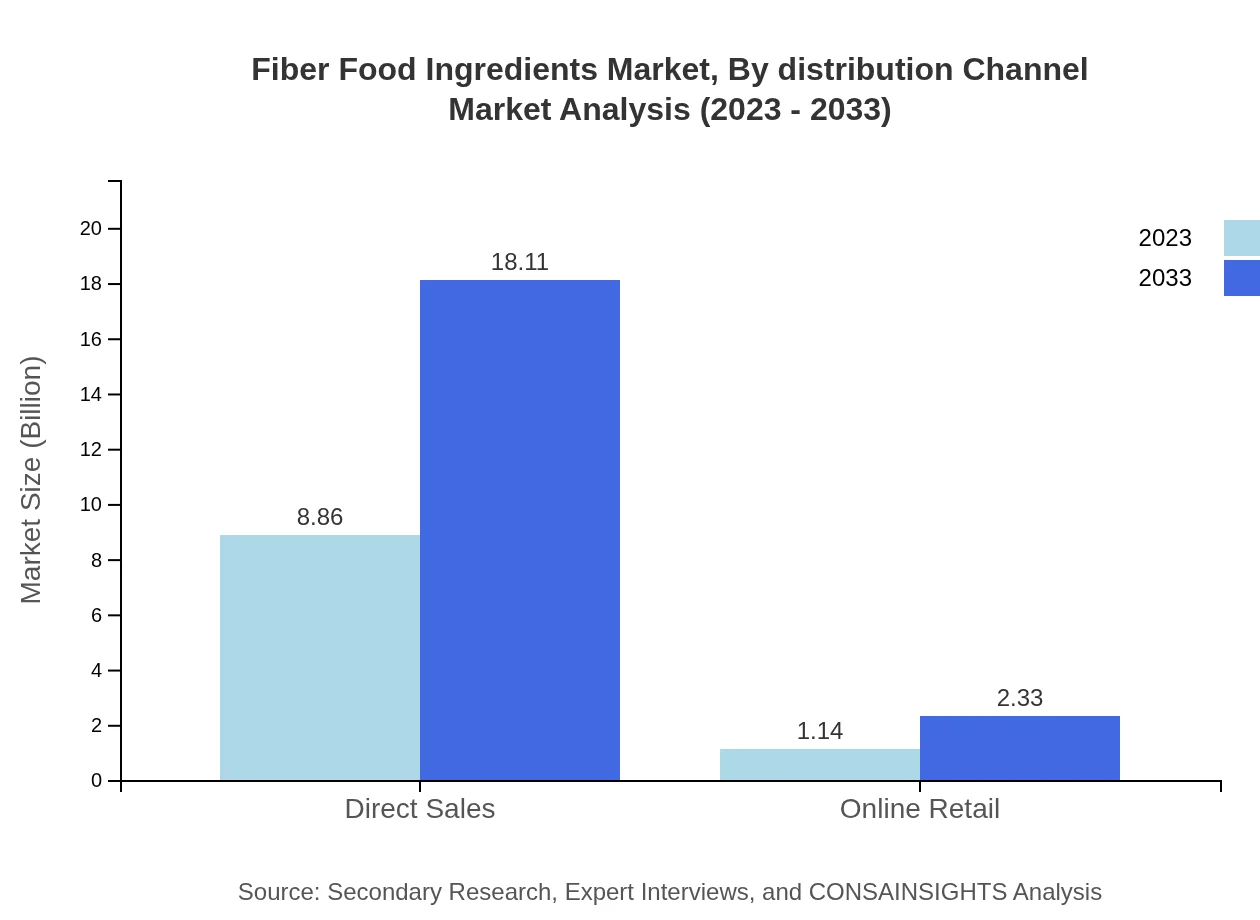

Fiber Food Ingredients Market Analysis By Distribution Channel

Direct sales dominate the distribution channel with a significant market size of $8.86 billion in 2023, growing to $18.11 billion by 2033. Online retail, holding an 11.41% market share, is also experiencing notable growth as more consumers shop for healthy products online.

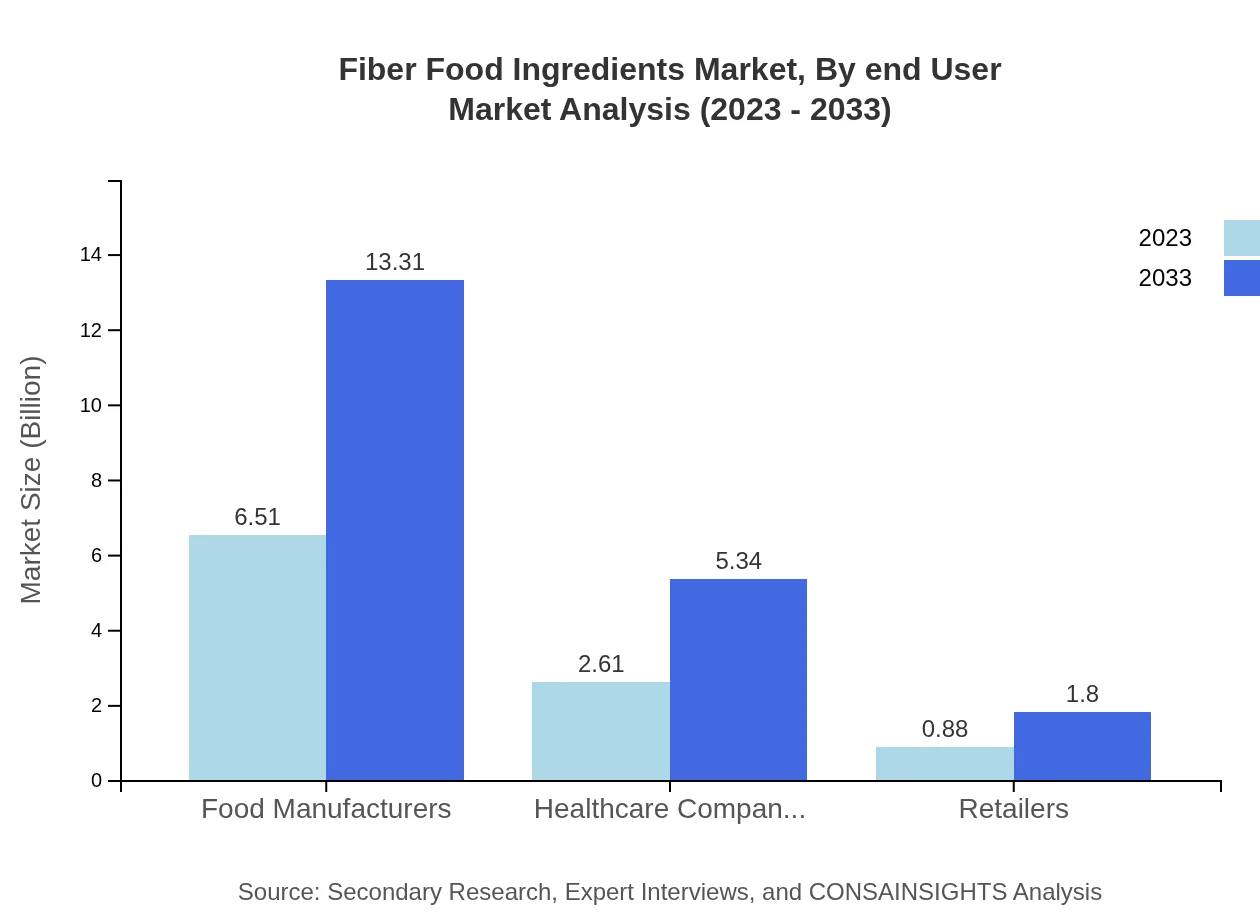

Fiber Food Ingredients Market Analysis By End User

Food manufacturers are the primary end-users, with a market size of $6.51 billion in 2023 expected to reach $13.31 billion by 2033. Healthcare companies and retailers also play essential roles, with market sizes of $2.61 billion and $0.88 billion respectively, indicating diverse applications and a healthy market outlook.

Fiber Food Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fiber Food Ingredients Industry

DuPont Nutrition & Biosciences:

A leading player offering a range of fiber additives and ingredients that enhance health benefits in food and beverage products.Cargill, Incorporated:

Cargill focuses on developing innovative food solutions, including fiber-rich ingredients that cater to health-conscious consumers.Fibergum:

Known for its exceptional quality in natural fiber ingredients, Fibergum leads in providing plant-derived fiber solutions for various applications.MGP Ingredients, Inc.:

MGP is recognized for its diverse portfolio of specialty ingredients, including fibers, that support nutritional health.We're grateful to work with incredible clients.

FAQs

What is the market size of Fiber Food Ingredients?

The global Fiber Food Ingredients market was valued at approximately $10 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2%. This growth trajectory indicates robust demand for fiber-enriched products across various sectors, supported by changing consumer preferences.

What are the key market players or companies in the Fiber Food Ingredients industry?

Key players in the Fiber Food Ingredients market include major companies such as Cargill, DuPont, and Archer Daniels Midland Company. These organizations are pivotal in driving innovation and meeting the increasing consumer demand for health-oriented products.

What are the primary factors driving the growth in the Fiber Food Ingredients industry?

Growth in the Fiber Food Ingredients sector is primarily driven by rising health consciousness among consumers, increasing demand for dietary fibers in food applications, and regulatory support for fiber enrichment initiatives, creating a favorable market landscape.

Which region is the fastest Growing in the Fiber Food Ingredients?

North America is the fastest-growing region in the Fiber Food Ingredients market, expected to expand from $3.73 billion in 2023 to $7.63 billion by 2033, indicating a surge in demand for fiber-rich diets among health-conscious consumers.

Does ConsaInsights provide customized market report data for the Fiber Food Ingredients industry?

Yes, Consainsights offers customized market report data tailored to the unique needs of clients in the Fiber Food Ingredients industry. This includes specific regional insights, market segments, and growth forecasts to support strategic decision-making.

What deliverables can I expect from this Fiber Food Ingredients market research project?

Deliverables from the Fiber Food Ingredients market research project include detailed market analysis, segmentation data, trend forecasts, competitive landscape assessments, and actionable insights, all designed to inform and guide business strategies.

What are the market trends of Fiber Food Ingredients?

Market trends in Fiber Food Ingredients show a significant shift towards plant-based fibers, with this segment projected to grow from $8.86 billion in 2023 to $18.11 billion by 2033. This highlights consumer preference for natural, healthy food options.