Fiber Optic Components Market Report

Published Date: 31 January 2026 | Report Code: fiber-optic-components

Fiber Optic Components Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fiber Optic Components market, including market size, trends, segmentation, and forecasts from 2023 to 2033. It aims to offer insights into the current state of the industry and anticipated growth areas.

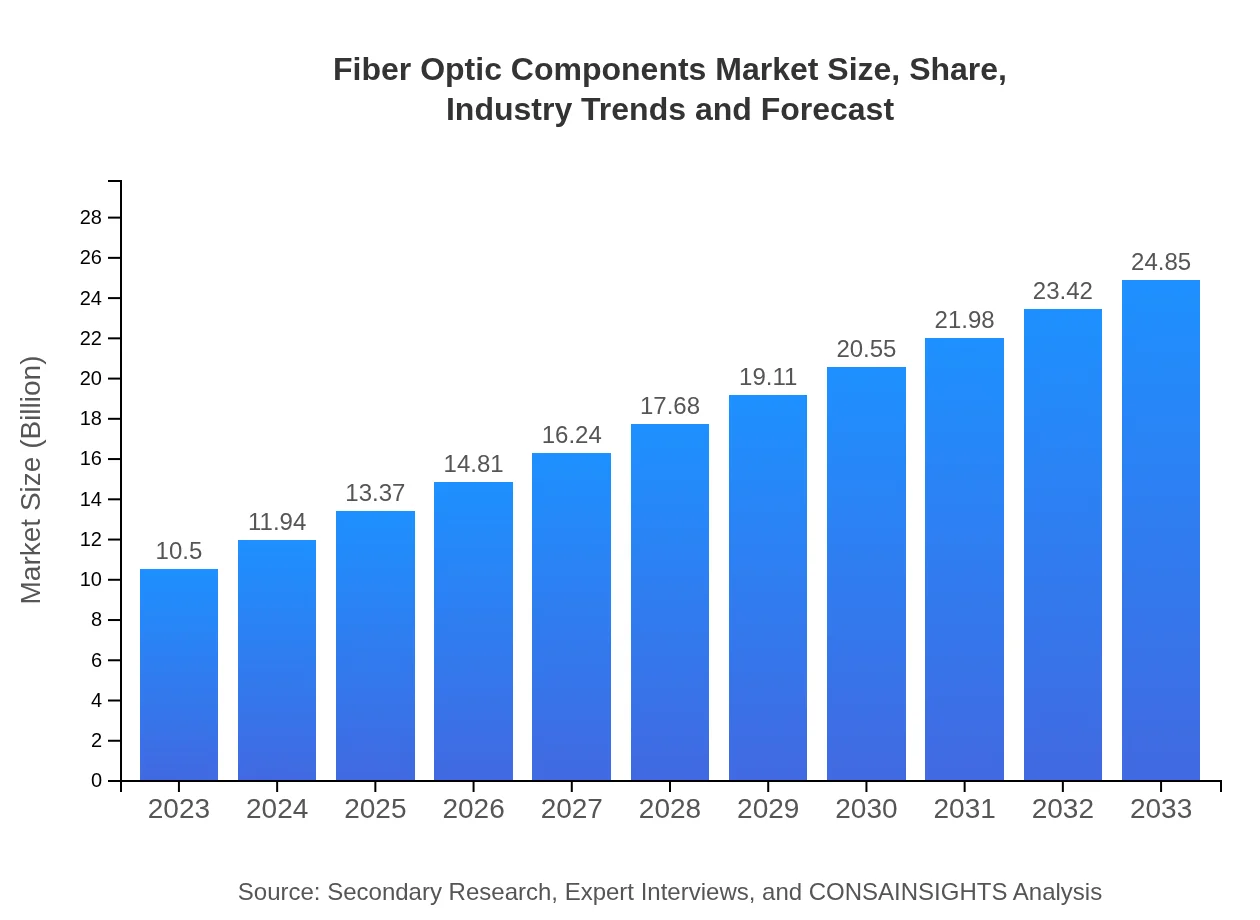

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $24.85 Billion |

| Top Companies | Corning Incorporated, Finisar Corporation, Nexans, CommScope |

| Last Modified Date | 31 January 2026 |

Fiber Optic Components Market Overview

Customize Fiber Optic Components Market Report market research report

- ✔ Get in-depth analysis of Fiber Optic Components market size, growth, and forecasts.

- ✔ Understand Fiber Optic Components's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fiber Optic Components

What is the Market Size & CAGR of Fiber Optic Components market in 2023?

Fiber Optic Components Industry Analysis

Fiber Optic Components Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fiber Optic Components Market Analysis Report by Region

Europe Fiber Optic Components Market Report:

The European market is estimated at $2.60 billion in 2023, growing to $6.16 billion by 2033. Strong government regulations promoting broadband access and investments by telecom operators in 5G networks are driving this growth.Asia Pacific Fiber Optic Components Market Report:

In Asia Pacific, the Fiber Optic Components market is poised for significant growth, projected from $2.06 billion in 2023 to approximately $4.87 billion by 2033. The increasing digitization initiatives in countries like China and India alongside government push for enhanced broadband connectivity are key drivers.North America Fiber Optic Components Market Report:

North America is leading the market with a size of $3.61 billion projected in 2023, expected to rise to $8.54 billion by 2033. The U.S. is witnessing robust growth due to the proliferation of data centers and a continuous upgrade of telecommunication networks to meet the demand for high-speed internet.South America Fiber Optic Components Market Report:

The South American market, while smaller, is anticipated to grow from $0.99 billion in 2023 to $2.34 billion by 2033. Investments in telecommunications infrastructure by governments are fostering growth in Brazil and Argentina.Middle East & Africa Fiber Optic Components Market Report:

The Middle East and Africa market, valued at $1.24 billion in 2023, is projected to reach $2.94 billion by 2033. The expansion of telecommunication networks and increased procurement of fiber technologies in regional development projects present growth opportunities.Tell us your focus area and get a customized research report.

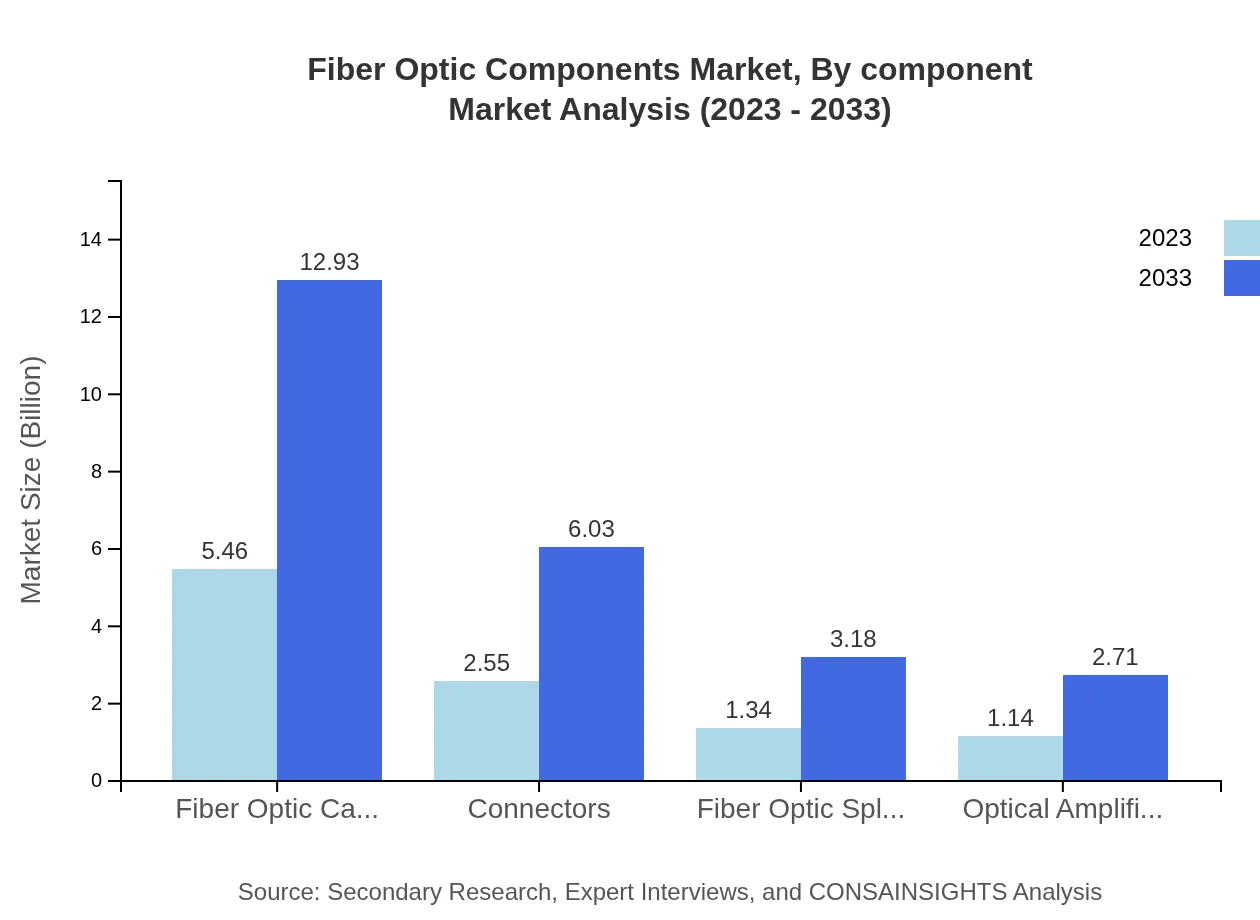

Fiber Optic Components Market Analysis By Component

The market for Fiber Optic Components by component includes major segments such as fiber optic cables, connectors, splitters, and amplifiers, which have varying growth rates and market shares. Fiber optic cables dominate, accounting for a significant market share, supported by the need for high-bandwidth communications across all sectors.

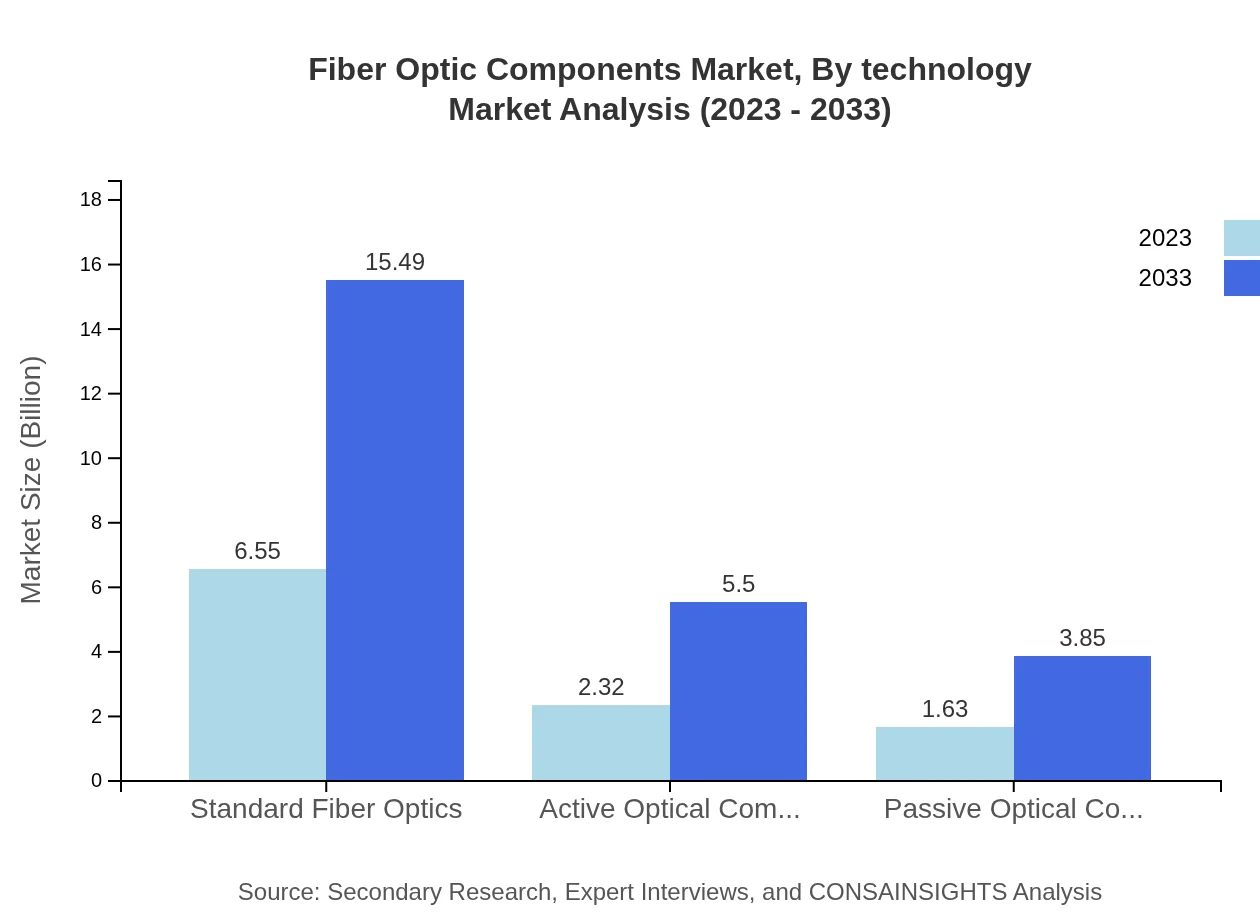

Fiber Optic Components Market Analysis By Technology

Technological advancements in fiber optics, including the development of active and passive components, are pertinent. Innovations in manufacturing techniques have further enhanced the performance and cost-effectiveness of fiber optic products, contributing to sector growth.

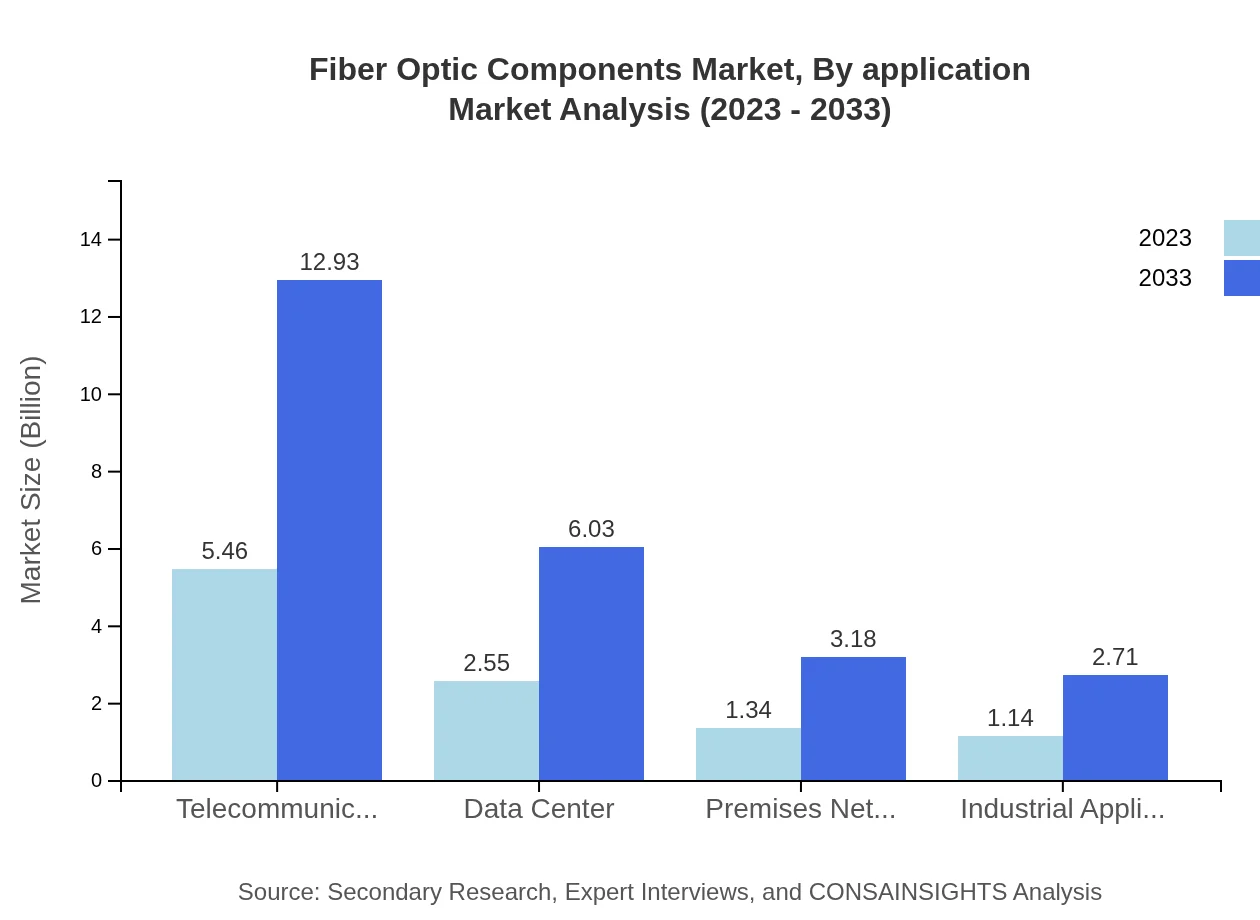

Fiber Optic Components Market Analysis By Application

Segmenting by application, the telecommunications sector is the largest domain for fiber optic components, closely followed by data centers, which require robust data transfer capabilities. Government and defense applications also represent a growing area within the market.

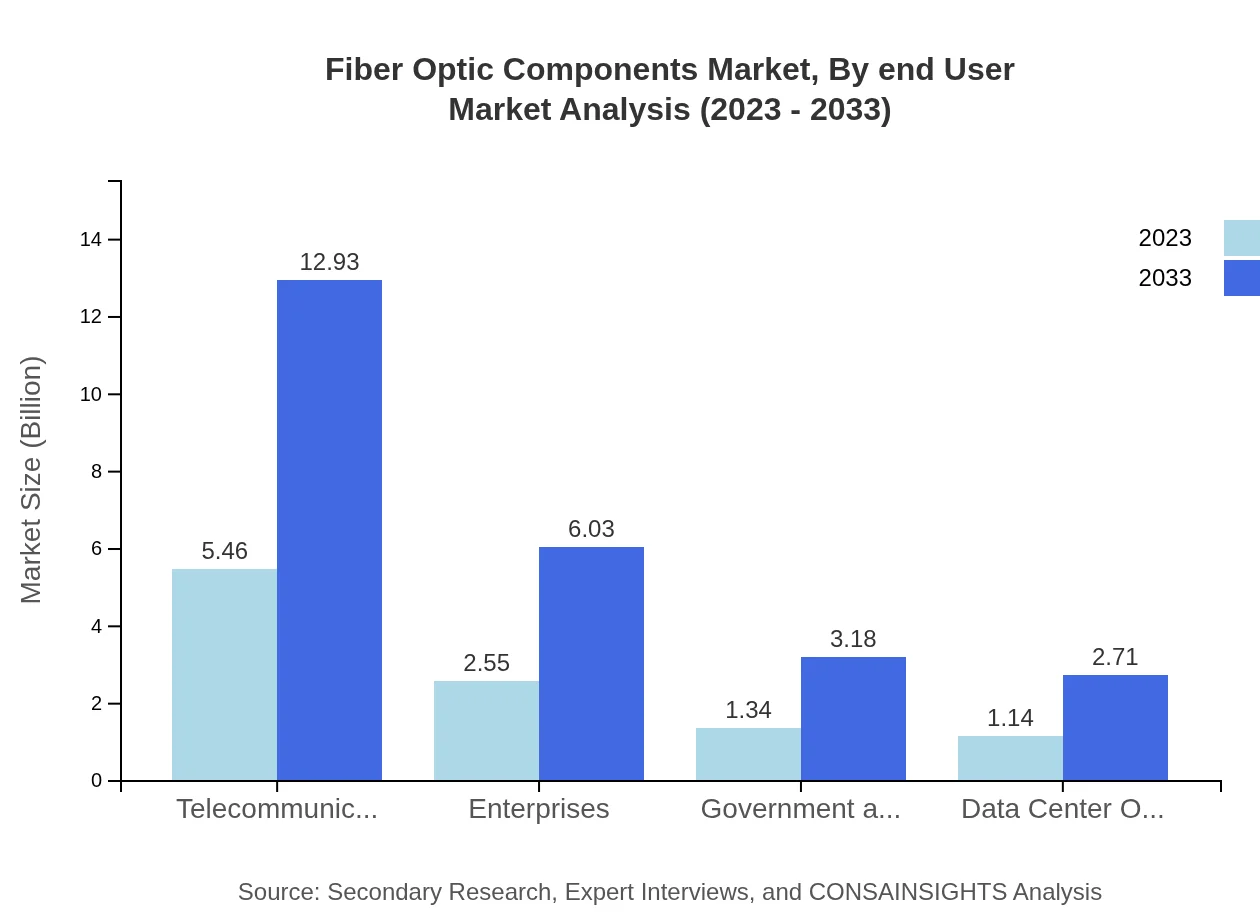

Fiber Optic Components Market Analysis By End User

End-user segmentation presents a clear view of demand from sectors including telecommunication service providers, enterprises, and government entities. Telecommunication service providers hold the largest market share due to their continuous infrastructure investments.

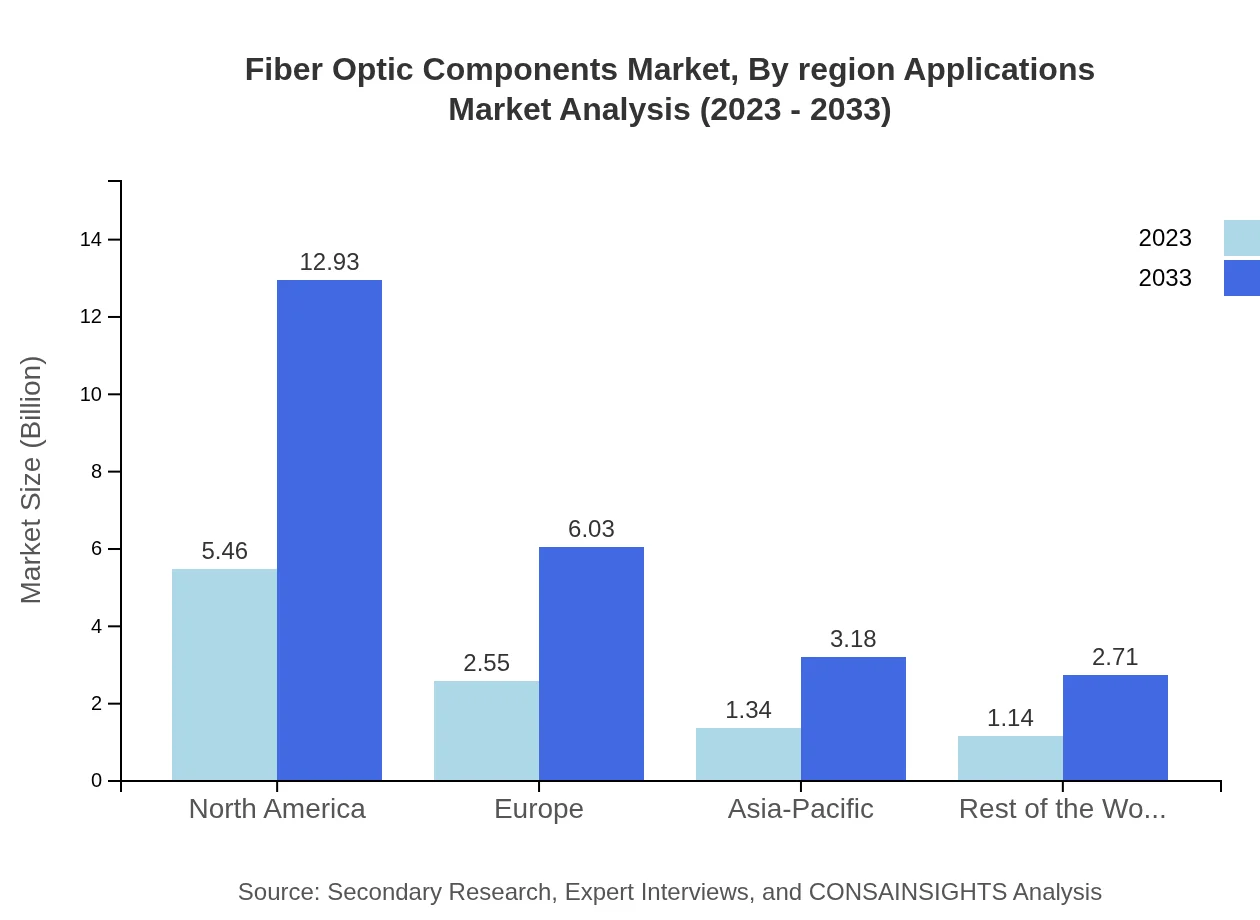

Fiber Optic Components Market Analysis By Region Applications

Regional analysis highlights specific applications across geographies, where North America and Europe lead in telecommunications, while APAC shows rapid growth in data infrastructure sectors driven by government initiatives.

Fiber Optic Components Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fiber Optic Components Industry

Corning Incorporated:

A leader in the fiber optics industry, Corning specializes in high-performance fiber optic cables and components, significantly contributing to advancements in telecommunication technologies.Finisar Corporation:

Finisar is renowned for its innovative optical components, producing high-quality transceivers and photonic products pivotal for networking and telecommunications.Nexans:

Nexans is recognized for its extensive range of fiber optic solutions, focusing on cable manufacturing that supports infrastructure development across various sectors.CommScope:

CommScope manufactures a wide array of fiber optic technologies, including connectivity products for cable systems and enterprise networks.We're grateful to work with incredible clients.

FAQs

What is the market size of fiber Optic Components?

The fiber-optic components market is currently valued at approximately $10.5 billion in 2023, with a projected CAGR of 8.7%. By 2033, the market size is expected to significantly increase, reflecting robust growth driven by technological advancements in telecommunications.

What are the key market players or companies in the fiber Optic Components industry?

Key players in the fiber-optic components market include major telecommunications manufacturers, technology providers, and component suppliers. These companies are instrumental in driving innovation and maintaining competitive advantages in this rapidly evolving market.

What are the primary factors driving the growth in the fiber Optic components industry?

The growth of the fiber-optic components industry is driven by increased data traffic, the expansion of broadband services, advancements in telecommunications infrastructure, and a growing demand for high-speed internet, particularly in urban areas.

Which region is the fastest Growing in the fiber Optic components market?

The fastest-growing region in the fiber-optic components market is North America, with its market size expected to grow from $3.61 billion in 2023 to $8.54 billion in 2033. This growth is fueled largely by technological advancements and increased investments in telecommunications.

Does ConsaInsights provide customized market report data for the fiber Optic components industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the fiber-optic components industry, ensuring that businesses receive relevant and actionable insights.

What deliverables can I expect from this fiber Optic components market research project?

Deliverables from a fiber-optic components market research project include a comprehensive report with market size, growth forecasts, competitive analysis, segmentation insights, and regional trends, providing a thorough understanding of the industry's landscape.

What are the market trends of fiber Optic components?

Current trends in the fiber-optic components market include the rise of smart city initiatives, the adoption of 5G technology, increased reliance on data centers, and a shift toward sustainable and efficient fiber-optic technologies.