Fiber Optics Testing Market Report

Published Date: 31 January 2026 | Report Code: fiber-optics-testing

Fiber Optics Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fiber Optics Testing market, including market size, key trends, technology innovations, segmentation, and regional insights for the forecast period 2023-2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

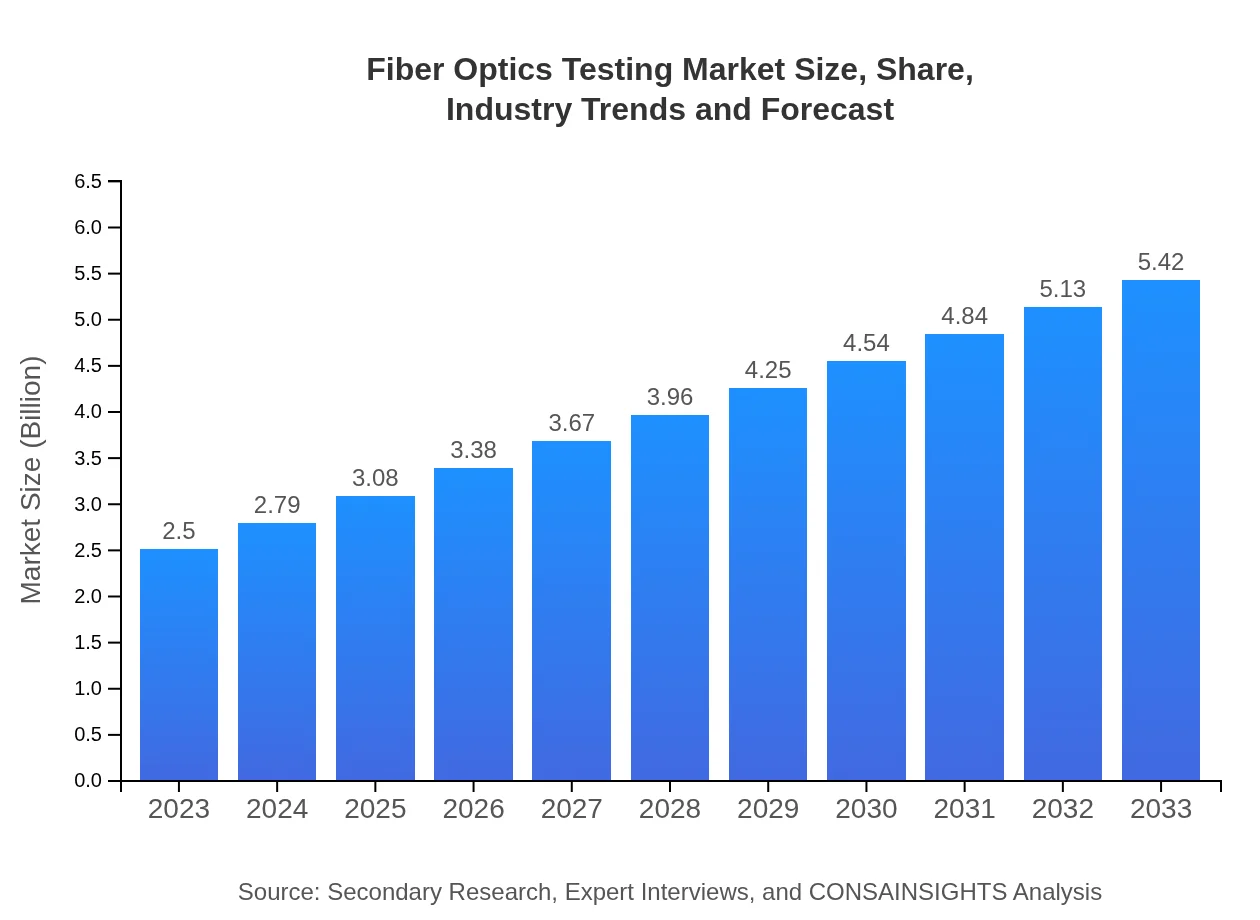

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Fluke Networks, EXFO Inc., Tektronix, Inc., Viavi Solutions, Anritsu Corporation |

| Last Modified Date | 31 January 2026 |

Fiber Optics Testing Market Overview

Customize Fiber Optics Testing Market Report market research report

- ✔ Get in-depth analysis of Fiber Optics Testing market size, growth, and forecasts.

- ✔ Understand Fiber Optics Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fiber Optics Testing

What is the Market Size & CAGR of Fiber Optics Testing market in 2033?

Fiber Optics Testing Industry Analysis

Fiber Optics Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

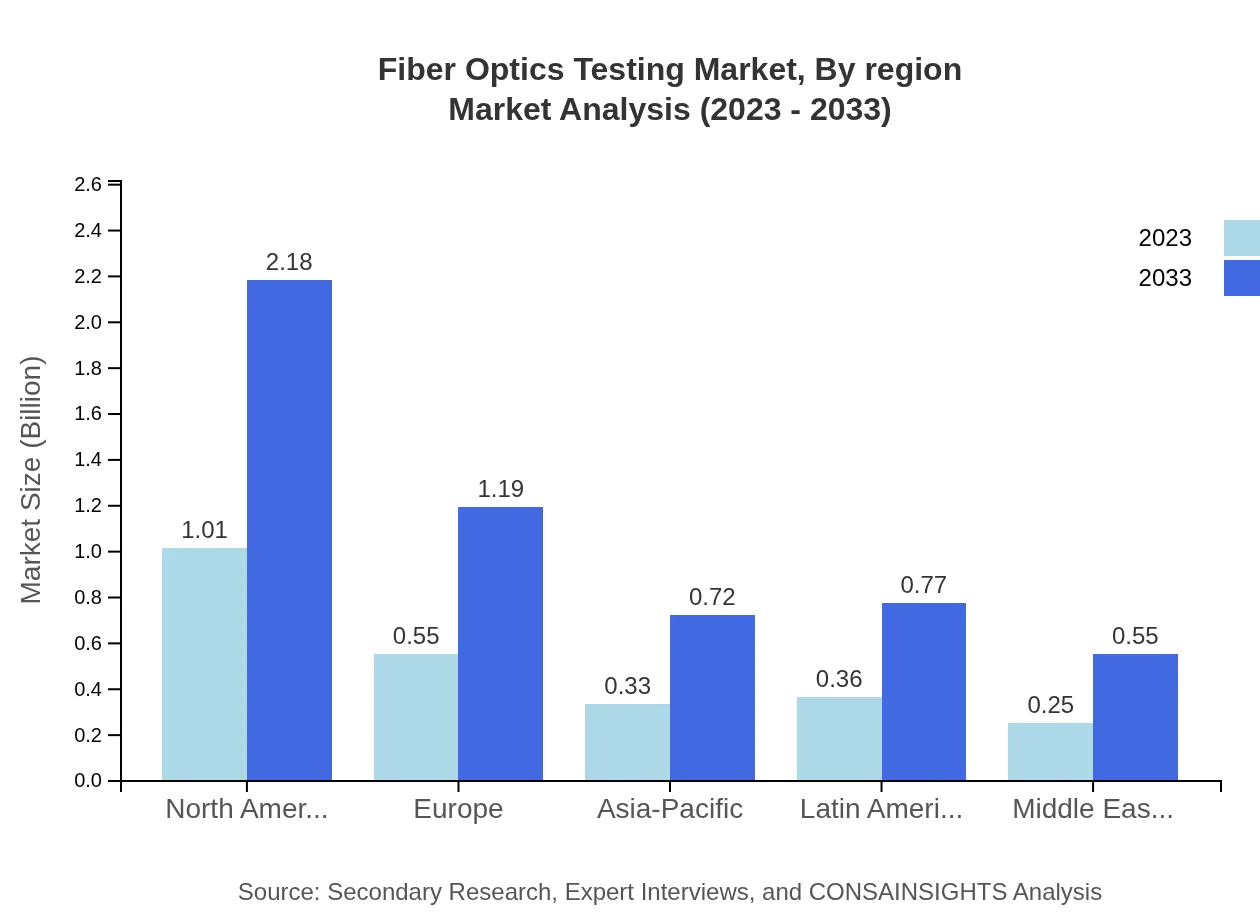

Fiber Optics Testing Market Analysis Report by Region

Europe Fiber Optics Testing Market Report:

Europe's market is anticipated to expand from $0.75 billion in 2023 to $1.63 billion by 2033, bolstered by strict regulations regarding network reliability and the push for enhanced communication infrastructure.Asia Pacific Fiber Optics Testing Market Report:

The Asia Pacific region is projected to witness significant growth from $0.49 billion in 2023 to $1.06 billion by 2033. The increasing adoption of internet services, particularly in countries like China and India, alongside substantial government investments in infrastructure, are propelling market growth.North America Fiber Optics Testing Market Report:

North America leads the market with projections of growing from $0.88 billion in 2023 to $1.90 billion by 2033. Strong communication infrastructure, the presence of key vendors, and a high rate of technology adoption contribute to this growth.South America Fiber Optics Testing Market Report:

In South America, the market size is expected to rise from $0.20 billion in 2023 to $0.43 billion in 2033. The growth is driven by the adoption of modern communication solutions and increasing demand for broadband connectivity.Middle East & Africa Fiber Optics Testing Market Report:

The Middle East and Africa market is set to grow from $0.19 billion in 2023 to $0.41 billion by 2033. Factors such as rising telecommunications investments and expansion in technology uptake are essential for market growth in this region.Tell us your focus area and get a customized research report.

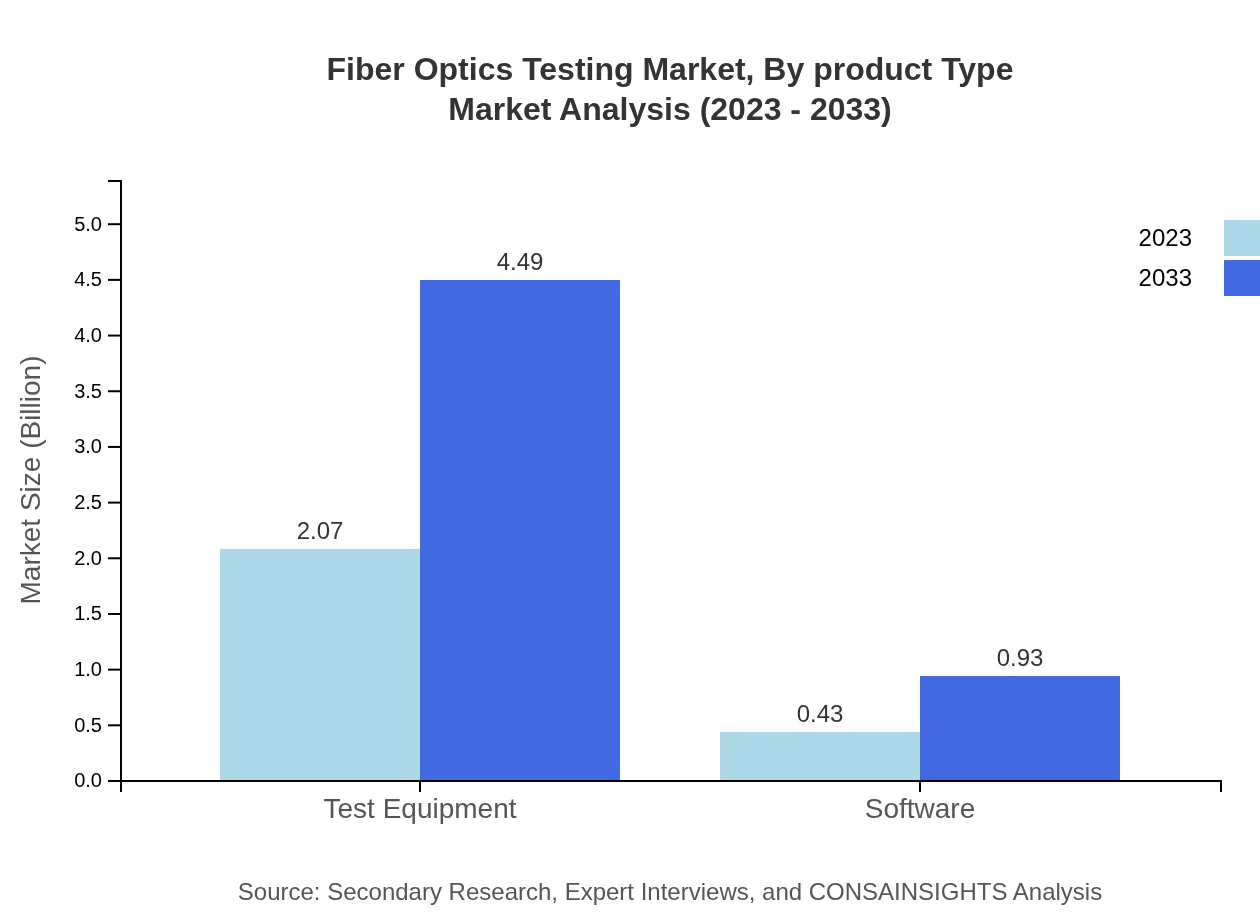

Fiber Optics Testing Market Analysis By Product Type

The Fiber Optics Testing market can be segmented into test equipment and software. Test equipment dominates the market, projected to grow from $2.07 billion in 2023 to $4.49 billion in 2033, accounting for 82.8% of the market. This segment is critical for active testing applications.

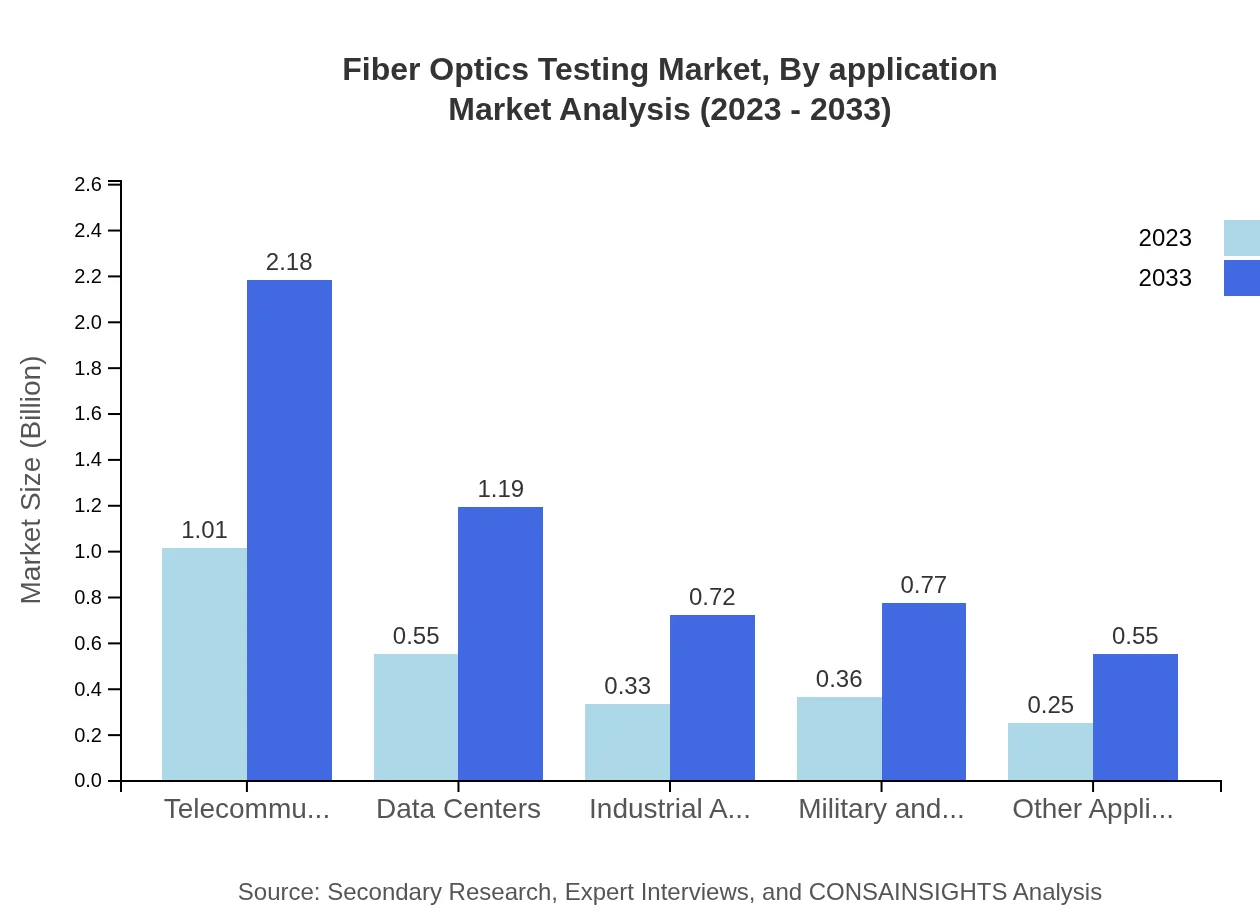

Fiber Optics Testing Market Analysis By Application

The application segment is categorized into telecommunications, data centers, industrial automation, and military and aerospace. Telecommunications accounts for 40.21% of the market in 2023, with growth driven by the rapid increase in data consumption.

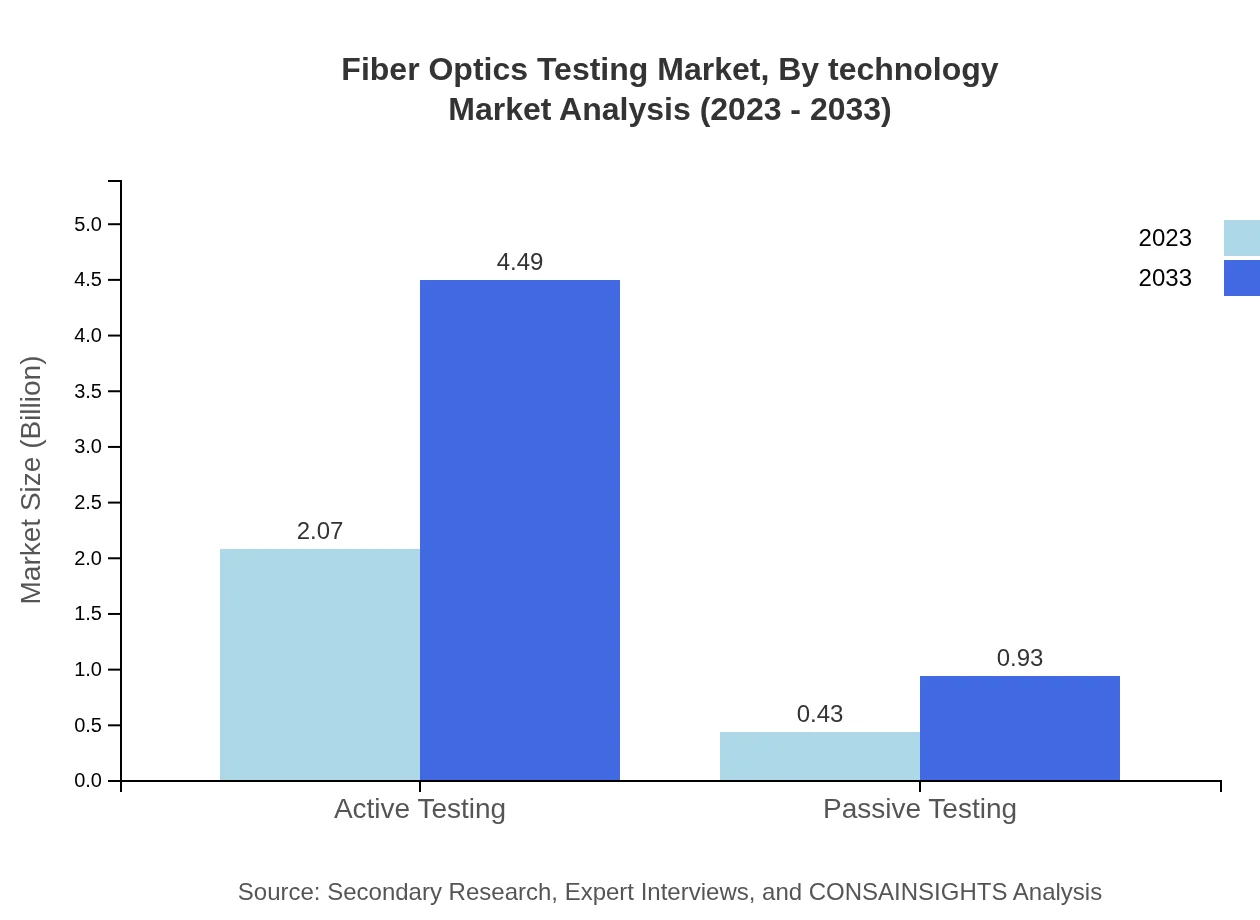

Fiber Optics Testing Market Analysis By Technology

Advancements in testing technologies such as active and passive testing methods are transforming the Fiber Optics Testing market. Active testing, in particular, is expected to dominate with a market size of $2.07 billion in 2023, which is anticipated to reach $4.49 billion by 2033.

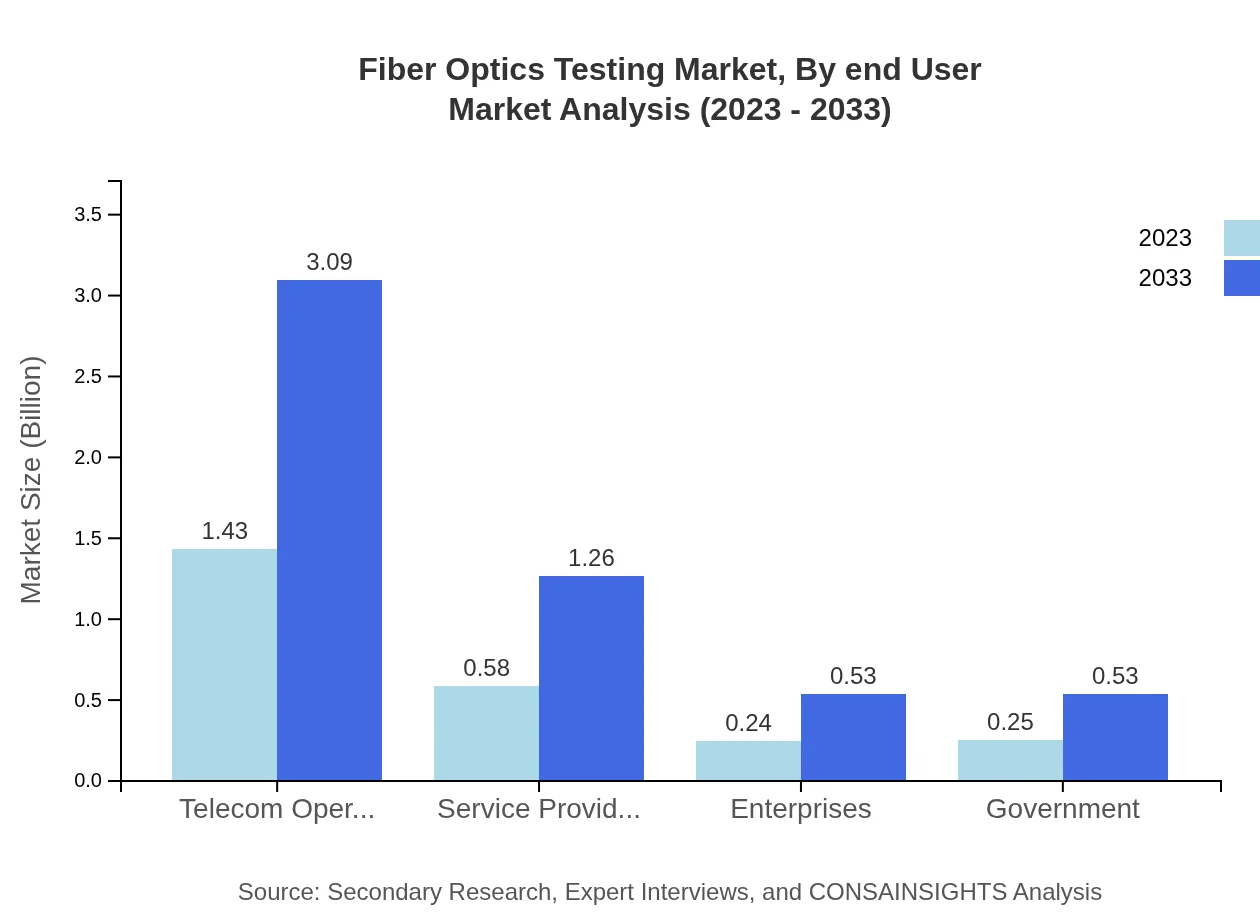

Fiber Optics Testing Market Analysis By End User

End-users include telecom operators, service providers, enterprises, and government sectors. Telecom operators hold the largest market share, contributing $1.43 billion in 2023, reflecting their crucial role in the growth of fiber optics networks.

Fiber Optics Testing Market Analysis By Region

Regional analysis provides insights into growth potential. North America and Europe are major contributors due to established telecommunication frameworks, whereas Asia Pacific shows the fastest growth due to increasing internet usage.

Fiber Optics Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fiber Optics Testing Industry

Fluke Networks:

A leading provider of innovative testing solutions that enhance network performance and reliability.EXFO Inc.:

A significant player offering advanced test and monitoring solutions for fiber optic networks.Tektronix, Inc.:

Known for high-performance test and measurement equipment utilized in fiber optics applications.Viavi Solutions:

Specializes in network testing solutions, particularly for telecom and data center infrastructure.Anritsu Corporation:

Provides a wide range of testing solutions to ensure fiber network performance and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of fiber Optics Testing?

The global fiber-optics-testing market is currently valued at approximately $2.5 billion and is projected to grow at a CAGR of 7.8% over the next decade. By 2033, the market is expected to significantly expand as demand increases.

What are the key market players or companies in this fiber Optics Testing industry?

Key players in the fiber-optics-testing market include major telecom operators, service providers, and enterprises. Companies leading this sector typically have strong technological capabilities and extensive distribution networks allowing them to capture a significant share of the market.

What are the primary factors driving the growth in the fiber Optics Testing industry?

The growth of the fiber-optics-testing industry is driven by increasing demand for high-speed internet, the expansion of data centers, and advancements in telecommunications technology. Additionally, the rise of IoT devices significantly enhances the need for robust fiber optic networks.

Which region is the fastest Growing in the fiber Optics Testing?

The Asia-Pacific region is currently the fastest-growing market for fiber-optics testing, with the market projected to grow from $0.49 billion in 2023 to $1.06 billion by 2033, driven by rapid urbanization and technological advancements.

Does ConsaInsights provide customized market report data for the fiber Optics Testing industry?

Yes, ConsaInsights offers tailored market report data specifically for the fiber-optics-testing industry, allowing clients to access customized insights that cater to their unique business requirements or research objectives.

What deliverables can I expect from this fiber Optics Testing market research project?

Deliverables from the fiber-optics-testing market research project will include detailed market analysis reports, growth forecasts, segment breakdowns, and insightful recommendations designed to assist stakeholders in making informed strategic decisions.

What are the market trends of fiber Optics Testing?

Among the significant trends in the fiber-optics-testing market is the shift towards enhanced active testing methods, coupled with a growing focus on software solutions. The market also shows strong growth in applications across telecommunications, data centers, and industrial automation.