Field Force Automation Market Report

Published Date: 31 January 2026 | Report Code: field-force-automation

Field Force Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Field Force Automation market, covering trends, growth opportunities, and forecasts for 2023 to 2033. Insights include market size, regional performance, technology advancements, and competitive landscape.

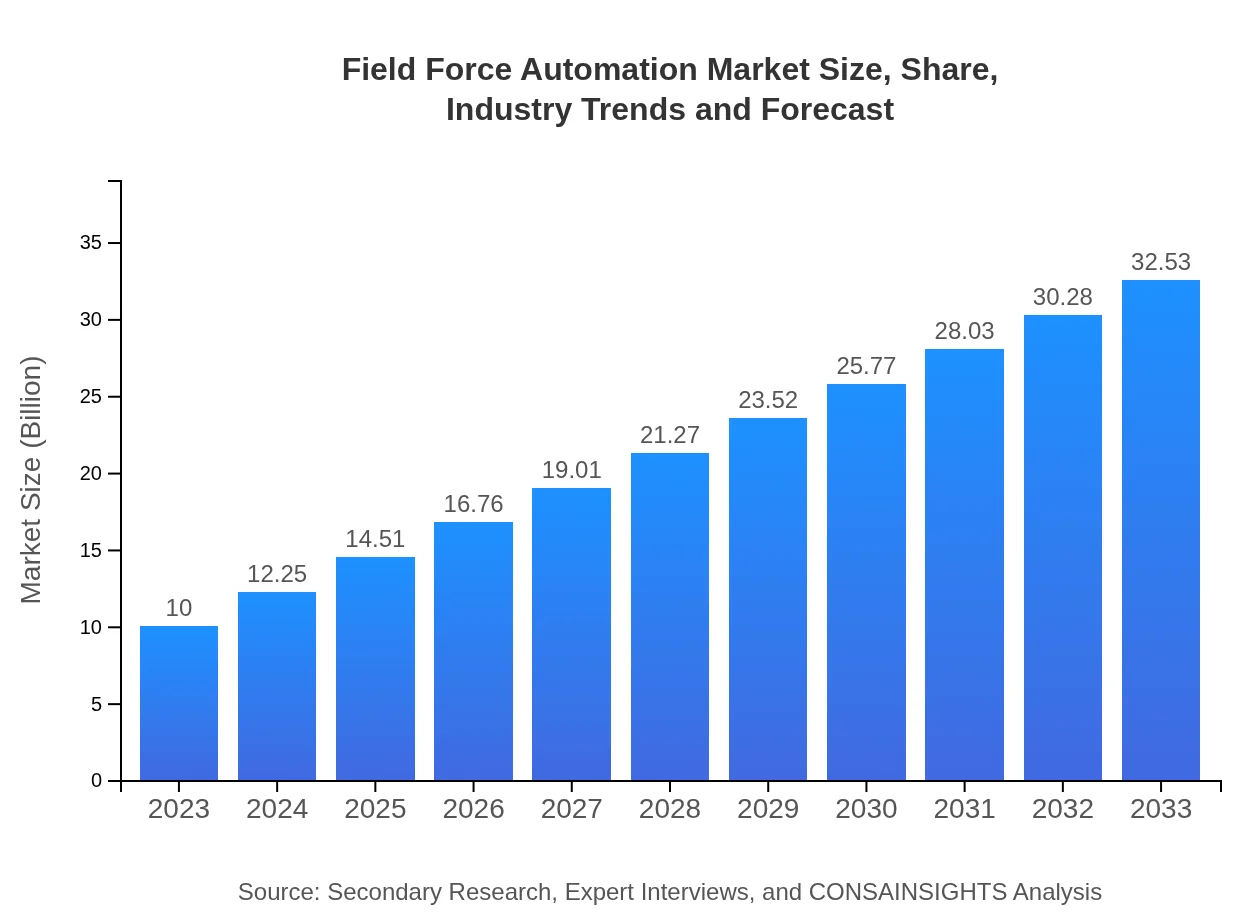

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | SalesForce, SAP, Oracle, Microsoft |

| Last Modified Date | 31 January 2026 |

Field Force Automation Market Overview

Customize Field Force Automation Market Report market research report

- ✔ Get in-depth analysis of Field Force Automation market size, growth, and forecasts.

- ✔ Understand Field Force Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Field Force Automation

What is the Market Size & CAGR of Field Force Automation market in 2023?

Field Force Automation Industry Analysis

Field Force Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Field Force Automation Market Analysis Report by Region

Europe Field Force Automation Market Report:

The European market is forecasted to expand from $2.49 billion in 2023 to approximately $8.09 billion by 2033. Growth drivers include rising demand for high-quality service delivery and increased adoption of advanced field management solutions across various sectors, including construction and healthcare.Asia Pacific Field Force Automation Market Report:

The Asia Pacific region is anticipated to see significant growth, with the market size expected to rise from $1.97 billion in 2023 to approximately $6.42 billion by 2033. Factors contributing to this growth include rapid industrialization, an increase in mobile workforce management solutions, and government initiatives to enhance digital infrastructure.North America Field Force Automation Market Report:

North America holds a leading position in the Field Force Automation market, with an expected market size increase from $3.85 billion in 2023 to $12.53 billion by 2033. The strong presence of technological innovators and high investment rates in cloud-based solutions contribute to this growth.South America Field Force Automation Market Report:

In South America, the Field Force Automation market is projected to grow from $0.84 billion in 2023 to $2.73 billion in 2033. The growth is fueled by increased focus on improving operational efficiency and service quality in industries such as utilities and telecommunications.Middle East & Africa Field Force Automation Market Report:

The Middle East and Africa market is set to progress from $0.85 billion in 2023 to $2.77 billion by 2033. The region's growing focus on improving service efficiencies and enhancing customer experiences in several sectors, such as energy and utilities, is expected to drive growth.Tell us your focus area and get a customized research report.

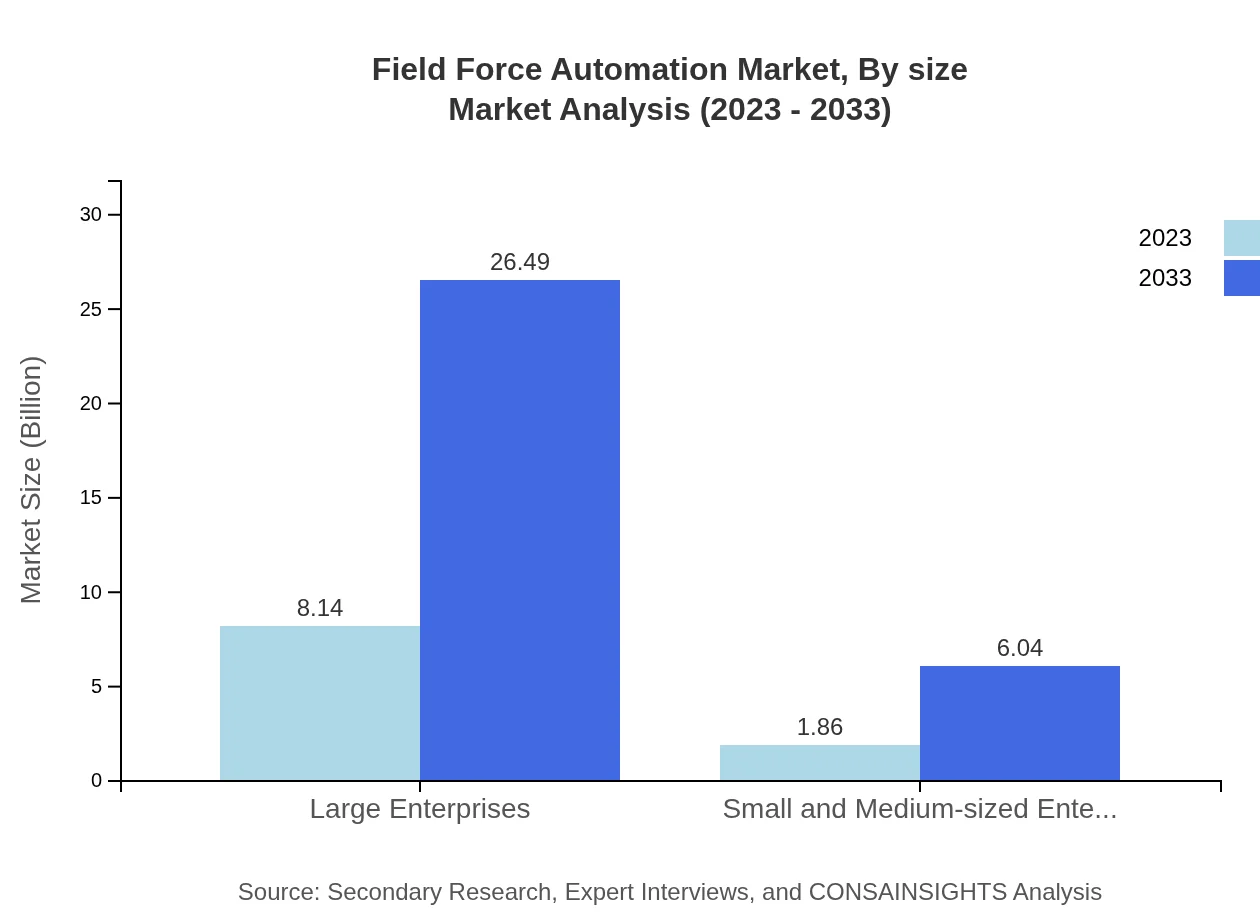

Field Force Automation Market Analysis By Size

The market is largely dominated by large enterprises, which account for a significant market share, presenting a market size of $8.14 billion in 2023 and expected to grow to $26.49 billion by 2033. In contrast, small and medium-sized enterprises (SMEs) are also growing, projected to increase from $1.86 billion in 2023 to $6.04 billion in 2033.

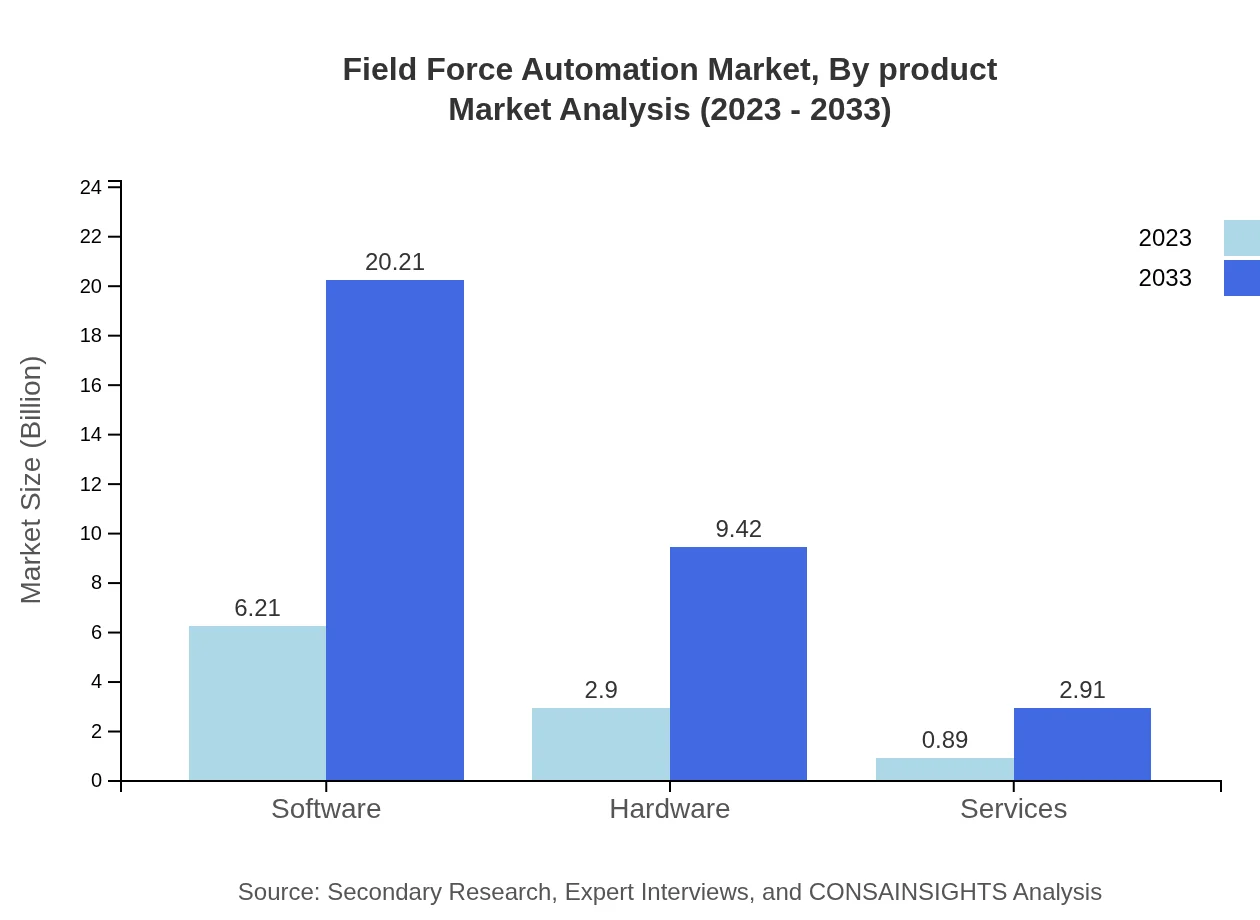

Field Force Automation Market Analysis By Product

The software segment leads the market with a substantial share, projected to grow from $6.21 billion in 2023 to about $20.21 billion by 2033, highlighting the essential role of software in driving efficiency. Hardware and services segments are also witnessing steady growth, indicating a diversified approach to field automation solutions.

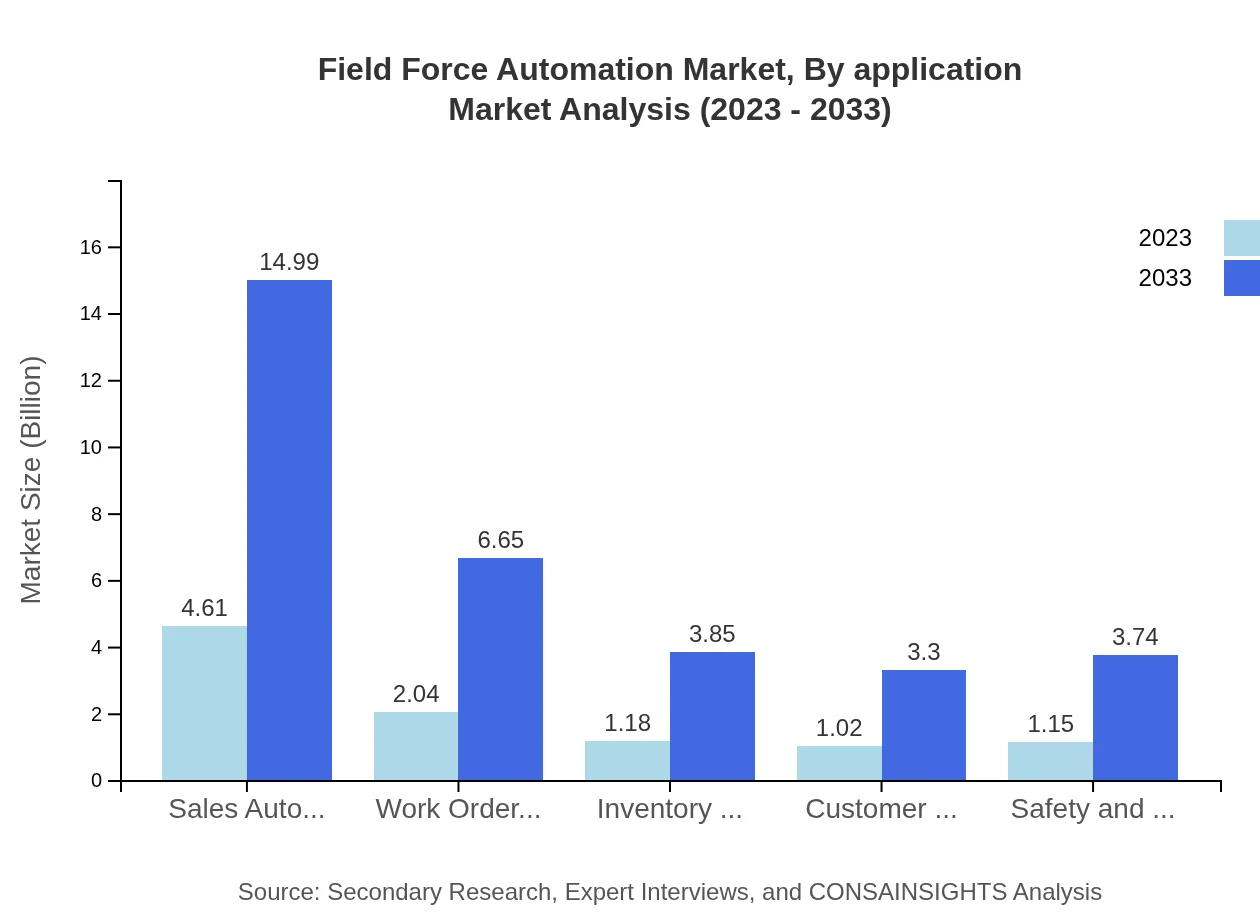

Field Force Automation Market Analysis By Application

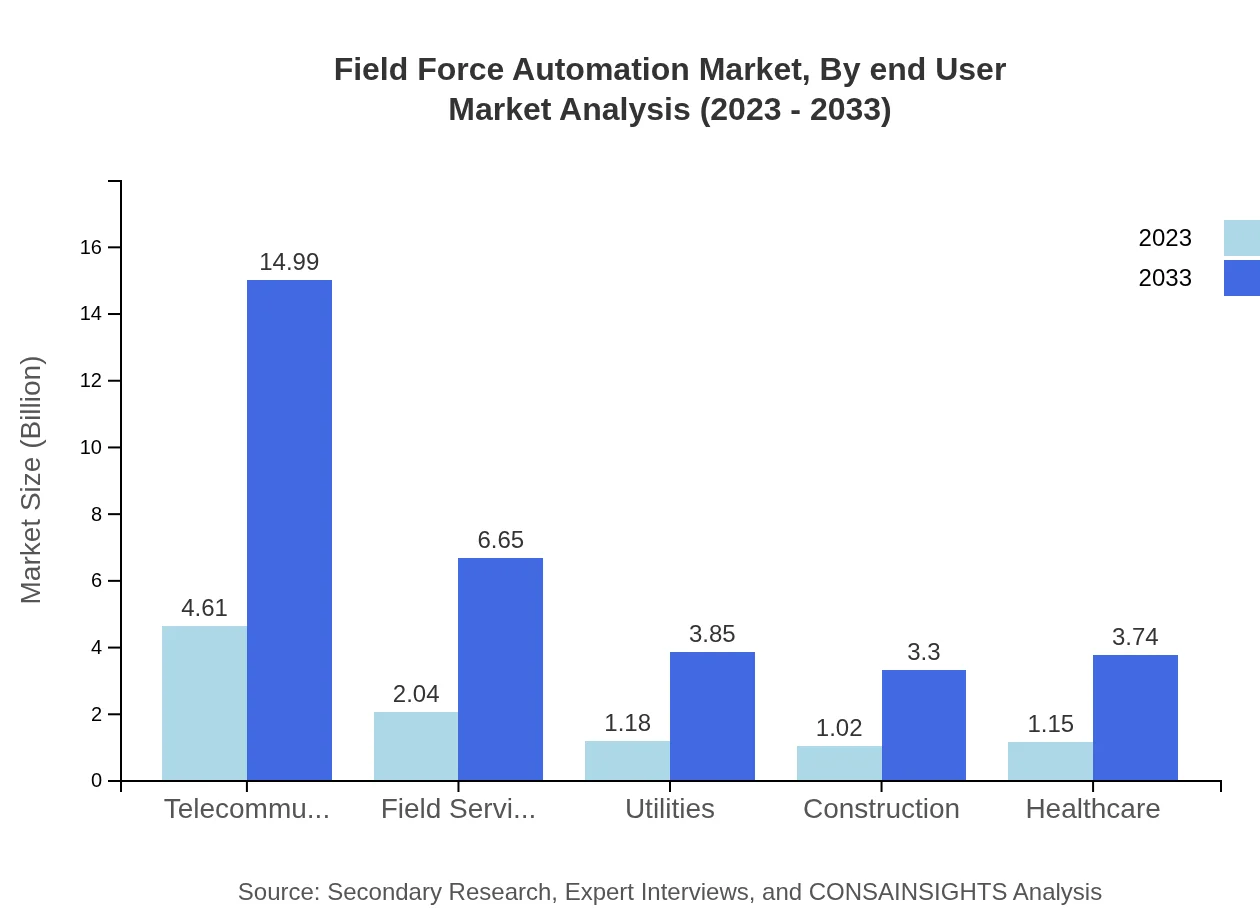

The applications of Field Force Automation encompass various sectors, primarily sales automation, which comprises a market size of $4.61 billion in 2023, projected to reach $14.99 billion by 2033. Other applications include inventory management and work order management, both essential for operational efficiency.

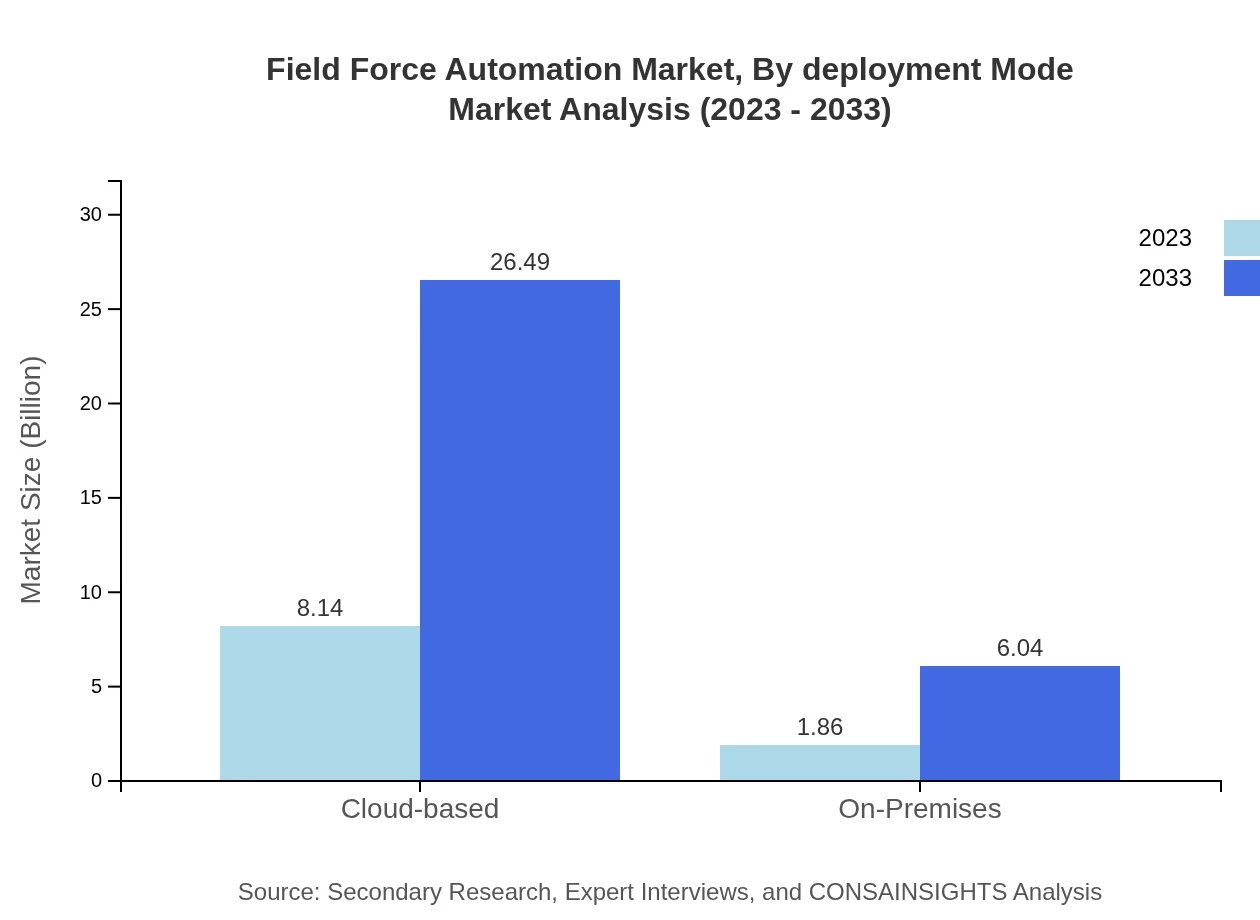

Field Force Automation Market Analysis By Deployment Mode

Cloud-based solutions dominate the deployment mode segment, accounting for a market size of $8.14 billion in 2023 and expected to grow to $26.49 billion by 2033. On-premises solutions are growing but at a slower pace due to the increasing preference for cloud offerings.

Field Force Automation Market Analysis By End User

Key end-user industries for Field Force Automation include utilities, healthcare, and telecommunications. The telecommunications sector, specifically, is expected to show remarkable growth, with substantial investments in automation to improve service delivery and customer engagement.

Field Force Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Field Force Automation Industry

SalesForce:

SalesForce is a global leader in CRM and cloud computing, providing comprehensive field service solutions that enhance productivity through automation, real-time tracking, and customer engagement.SAP:

SAP offers robust enterprise software solutions with a strong focus on field service management, enabling organizations to optimize their field operations through integrated data and analytics.Oracle:

Oracle provides innovative cloud-based applications that help businesses automate field service operations, improve service profitability, and enhance customer interactions.Microsoft:

Microsoft’s Dynamics 365 platform offers comprehensive field force automation solutions that streamline service workflows and enhance real-time collaboration for field teams.We're grateful to work with incredible clients.

FAQs

What is the market size of Field Force Automation?

The global Field Force Automation market is valued at approximately $10 billion in 2023, with a projected CAGR of 12%, indicating significant growth potential and opportunity in this sector by 2033.

What are the key market players or companies in the Field Force Automation industry?

Key players in the Field Force Automation industry include leading technology firms specializing in software and hardware solutions that enhance field operations, although specific names are not disclosed in the report.

What are the primary factors driving the growth in the Field Force Automation industry?

Growth in the Field Force Automation industry is driven by the increasing demand for efficient workforce management solutions, technological advancements, and a growing need for real-time data analytics in service sectors.

Which region is the fastest Growing in the Field Force Automation market?

The fastest-growing region in the Field Force Automation market is North America, expected to grow from $3.85 billion in 2023 to $12.53 billion by 2033, driven by widespread adoption of technology in various sectors.

Does ConsaInsights provide customized market report data for the Field Force Automation industry?

Yes, ConsaInsights offers customized market reports that cater to specific insights and detailed analyses within the Field Force Automation industry to meet unique client needs.

What deliverables can I expect from this Field Force Automation market research project?

Deliverables from the Field Force Automation market research project include comprehensive data reports, segment analyses, regional insights, and trend forecasting to assist strategic decision-making.

What are the market trends of Field Force Automation?

Current trends in the Field Force Automation market reveal an increasing shift toward cloud-based solutions, with the segment projected to grow from $8.14 billion in 2023 to $26.49 billion by 2033.