Field Programmable Gate Array Market Report

Published Date: 31 January 2026 | Report Code: field-programmable-gate-array

Field Programmable Gate Array Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Field Programmable Gate Array (FPGA) market, encompassing market size, growth forecasts, industry trends, and segmentation data from 2023 to 2033.

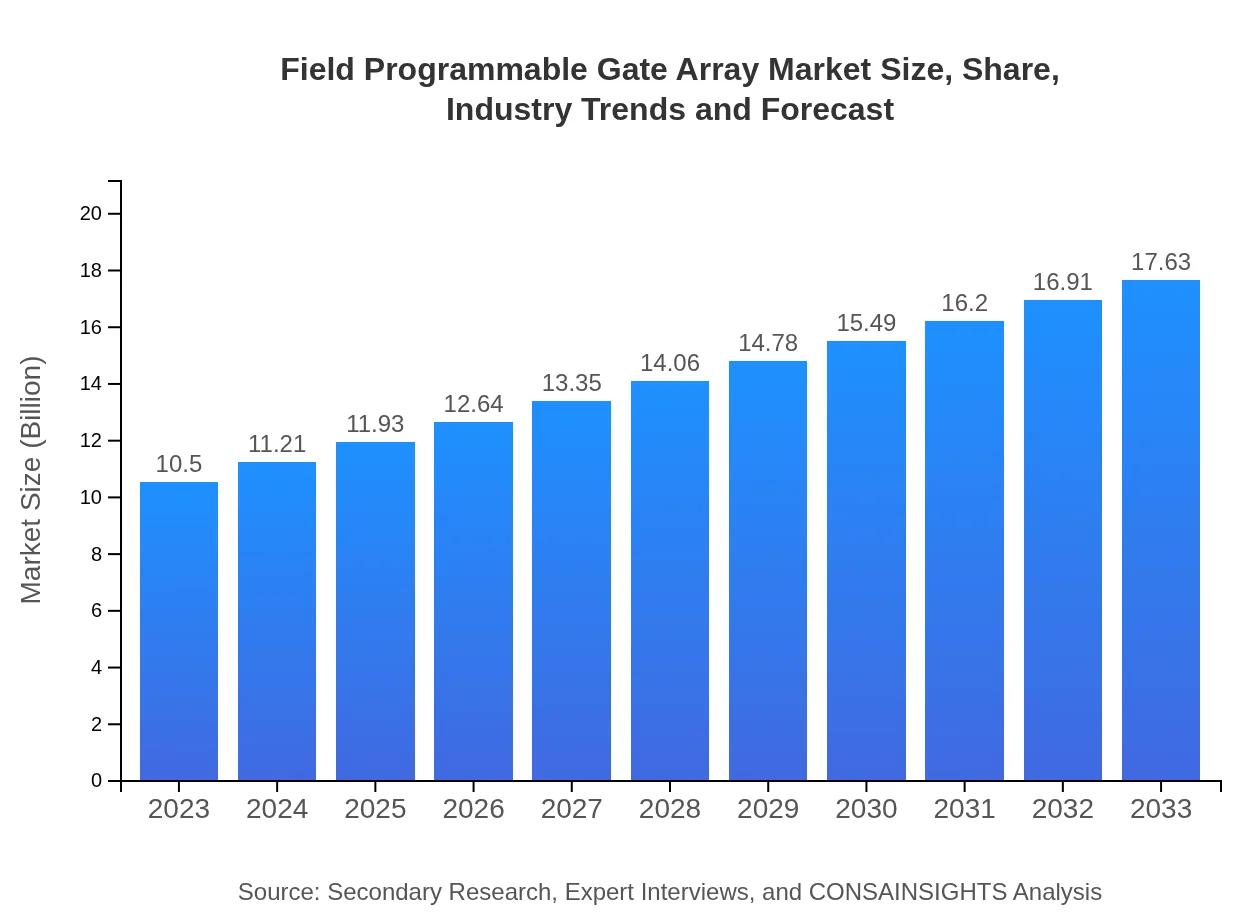

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Xilinx, Intel (Altera), Lattice Semiconductor, Microchip Technology |

| Last Modified Date | 31 January 2026 |

Field Programmable Gate Array Market Overview

Customize Field Programmable Gate Array Market Report market research report

- ✔ Get in-depth analysis of Field Programmable Gate Array market size, growth, and forecasts.

- ✔ Understand Field Programmable Gate Array's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Field Programmable Gate Array

What is the Market Size & CAGR of Field Programmable Gate Array market in 2023?

Field Programmable Gate Array Industry Analysis

Field Programmable Gate Array Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Field Programmable Gate Array Market Analysis Report by Region

Europe Field Programmable Gate Array Market Report:

Europe's FPGA market is set for steady growth from $3.57 billion in 2023 to $5.99 billion in 2033, driven by an emphasis on automotive technologies and industry automation.Asia Pacific Field Programmable Gate Array Market Report:

In the Asia Pacific region, the FPGA market is expected to grow from $1.96 billion in 2023 to $3.30 billion by 2033, driven by increasing demand for consumer electronics and telecommunications infrastructure developments.North America Field Programmable Gate Array Market Report:

North America is a leading region in the FPGA market with a size forecast to rise from $3.78 billion in 2023 to $6.34 billion by 2033, fueled by robust investments in research, development, and technology advancements across various sectors.South America Field Programmable Gate Array Market Report:

The South American FPGA market shows limited growth prospects, fluctuating between small negative values, ranging from $0.09 billion in 2023 to $0.15 billion in 2033, due to regional economic constraints and less emphasis on high-tech industries.Middle East & Africa Field Programmable Gate Array Market Report:

The Middle East and Africa showed a market value of $1.28 billion in 2023, anticipated to reach $2.15 billion by 2033. This growth is spurred by rising technological adoption in governmental and defense applications.Tell us your focus area and get a customized research report.

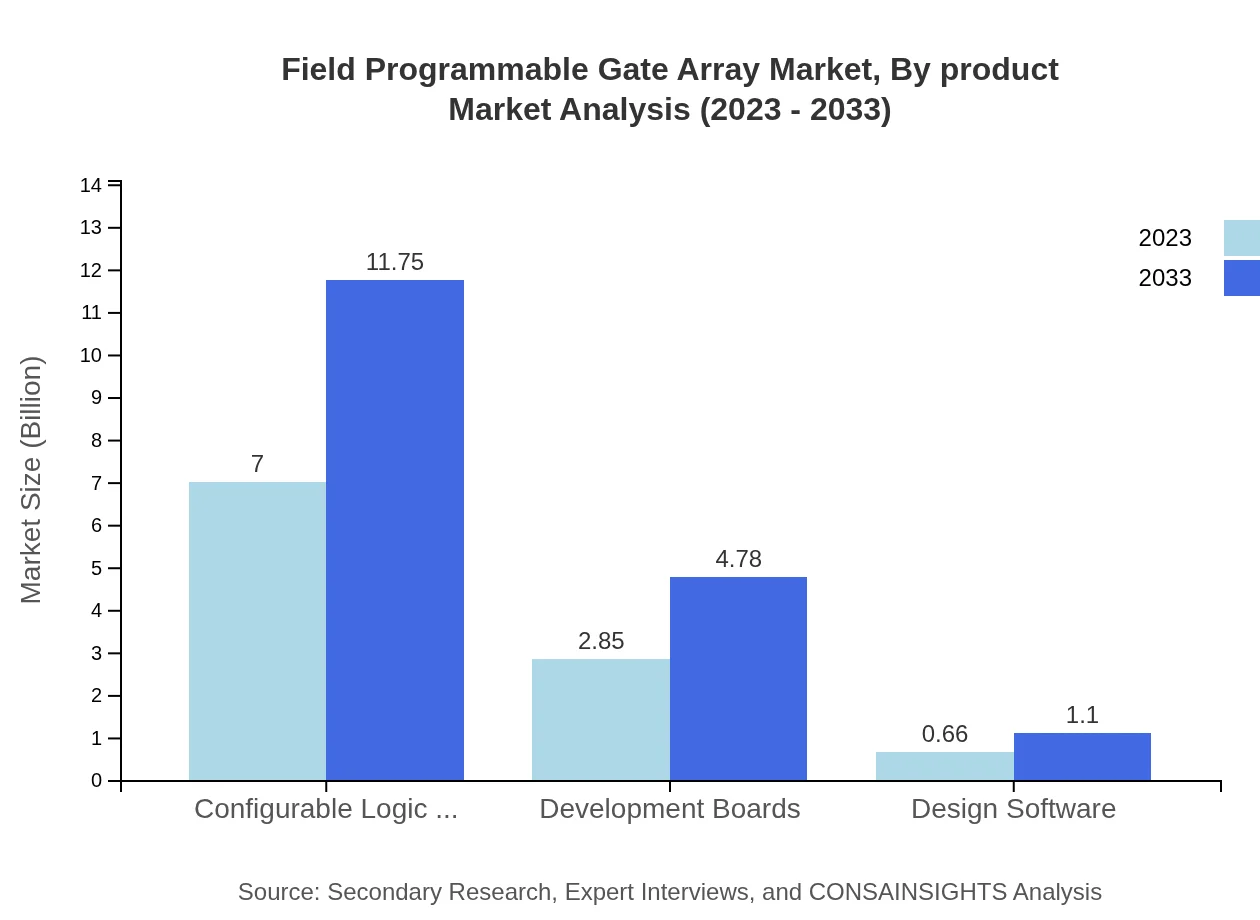

Field Programmable Gate Array Market Analysis By Product

Product types within the FPGA market include Configurable Logic Devices, Development Boards, and Design Software. Configurable Logic Devices lead the market with a notable share and are expected to grow from $7.00 billion in size in 2023 to $11.75 billion by 2033. Development Boards and Design Software represent smaller shares but are crucial for prototyping and design.

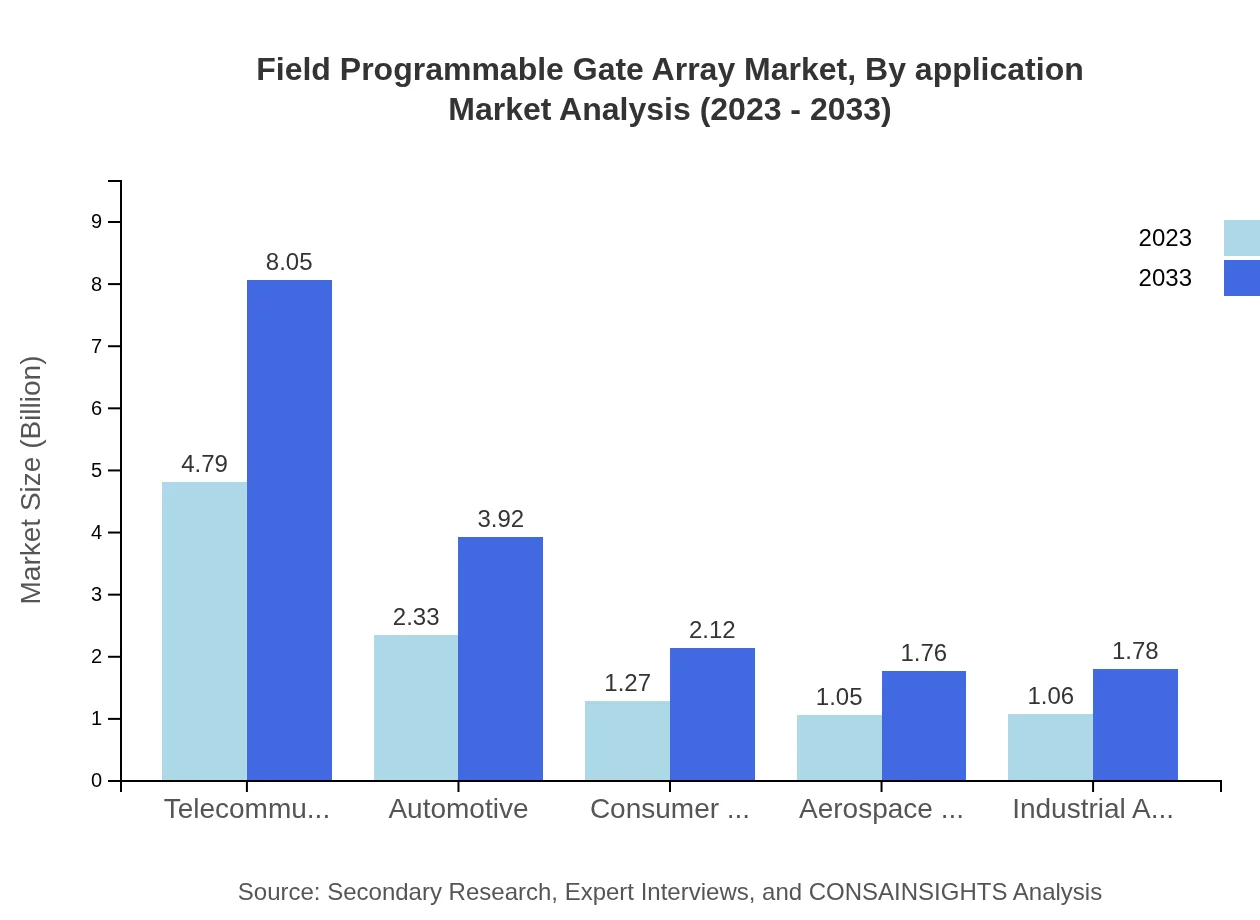

Field Programmable Gate Array Market Analysis By Application

Applications span across various sectors, including telecommunications, automotive, consumer electronics, and industrial applications. Telecommunications holds a dominant share, generating $4.79 billion in 2023 and expected to grow to $8.05 billion by 2033.

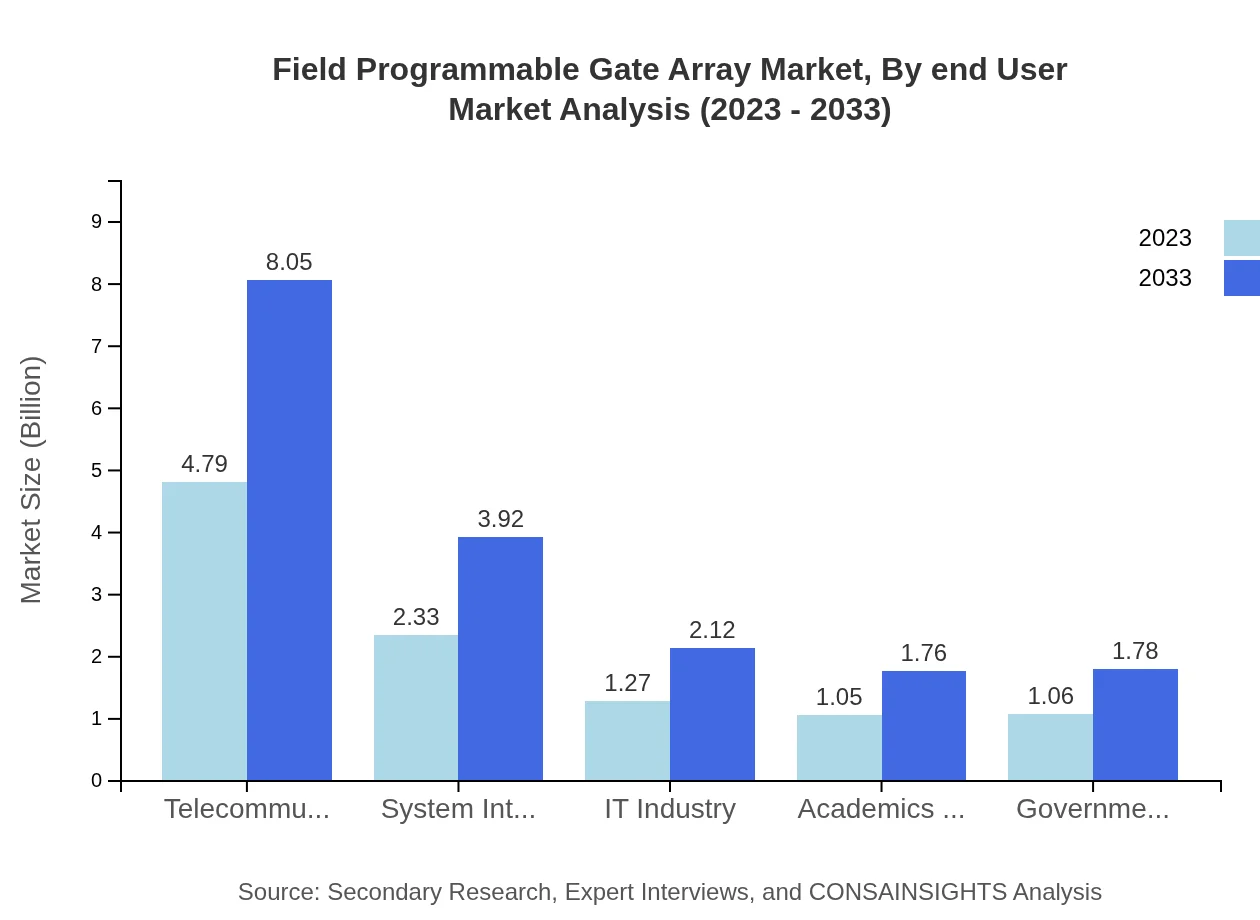

Field Programmable Gate Array Market Analysis By End User

The end-user industries comprise Government and Defense Agencies, IT Industry, and Research Institutions, amongst others. Notably, Government and Defense Agencies are forecasted to grow from $1.06 billion in 2023 to $1.78 billion by 2033.

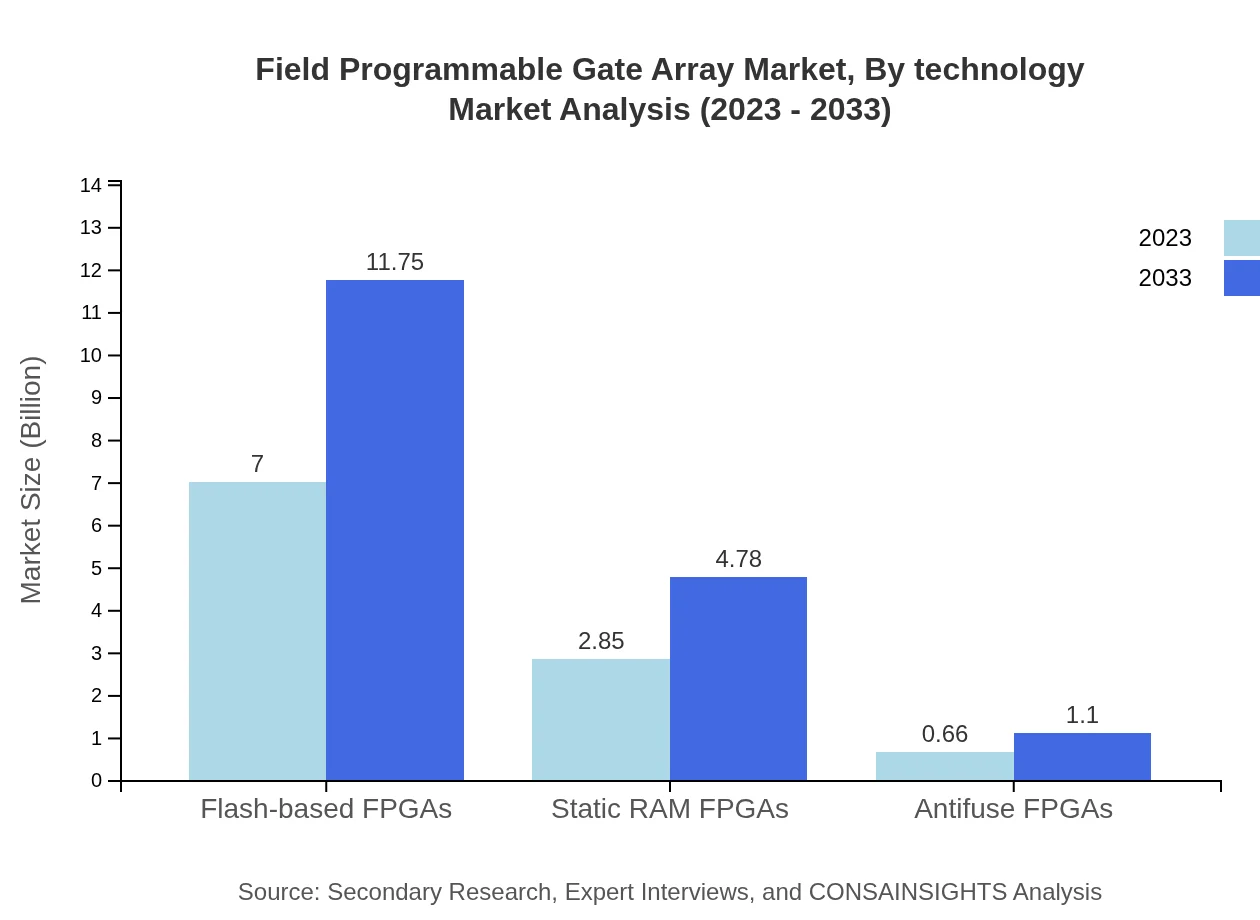

Field Programmable Gate Array Market Analysis By Technology

Technological advancements are essential in the FPGA segment with diverse technology formats such as Flash-based FPGAs and Static RAM FPGAs. Flash-based FPGAs currently predominate, with a projection from $7 billion to $11.75 billion.

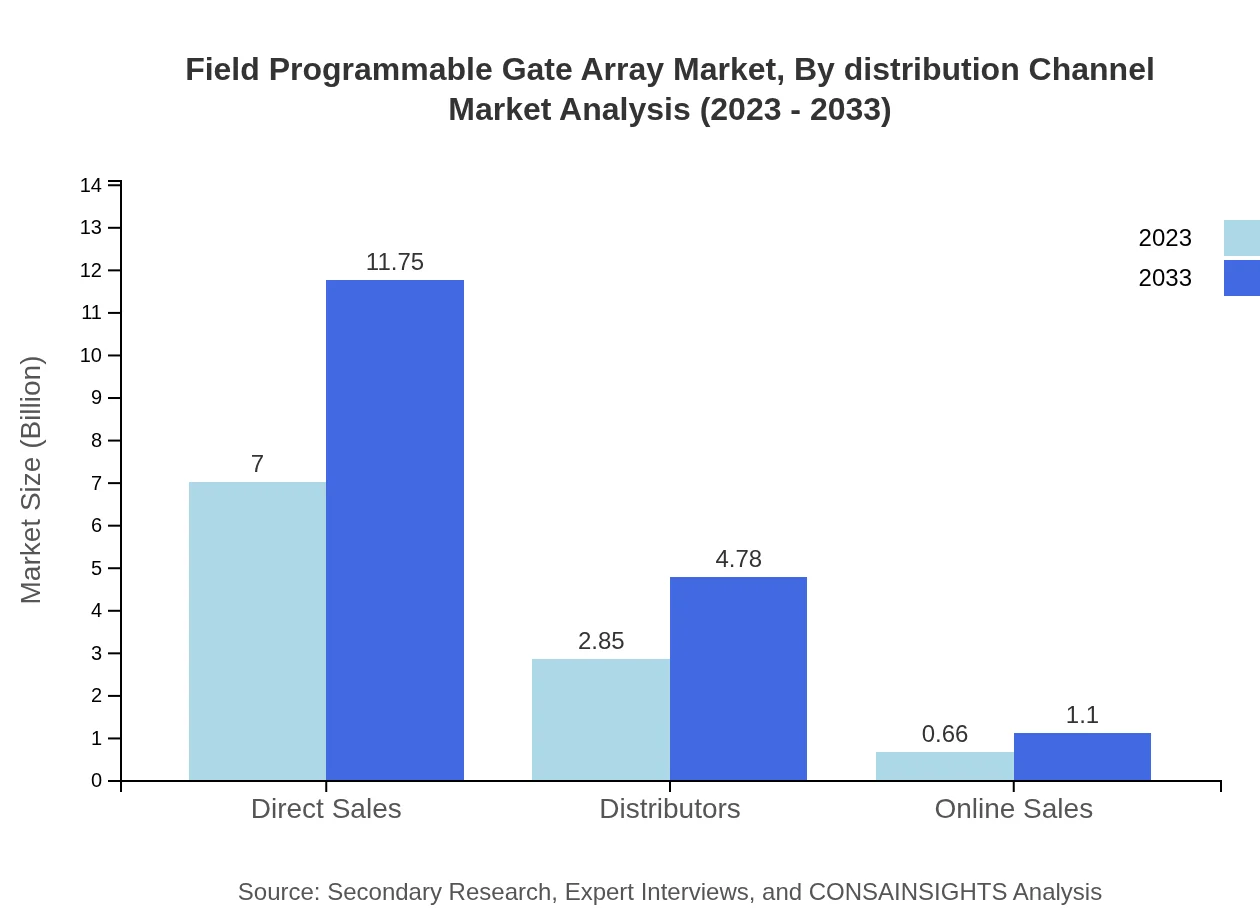

Field Programmable Gate Array Market Analysis By Distribution Channel

Distribution channels include Direct Sales, Distributors, and Online Sales. Direct Sales dominate, with a market value projecting growth from $7 billion in 2023 to $11.75 billion by 2033.

Field Programmable Gate Array Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Field Programmable Gate Array Industry

Xilinx:

Xilinx is a leader in programmable logic devices and technologies, renowned for its innovations that uphold high performance and extensive application versatility.Intel (Altera):

Intel's Altera division offers FPGA solutions that enhance computing capabilities across various industries, focusing on architectures integral to high-performance computing.Lattice Semiconductor:

Lattice Semiconductor specializes in low-power FPGAs, catering to markets including industrial automation, automotive, and mobile devices.Microchip Technology:

Microchip Technology provides a wide array of FPGA products that integrate flexibility and performance with enhanced user experience across segments.We're grateful to work with incredible clients.

FAQs

What is the market size of field Programmable Gate Array?

The global market size for Field Programmable Gate Arrays (FPGAs) is projected at approximately $10.5 billion in 2023, with a compound annual growth rate (CAGR) of 5.2% anticipated through 2033.

What are the key market players or companies in the field Programmable Gate Array industry?

Key players in the FPGA market include companies like Xilinx, Altera (Intel), Lattice Semiconductor, and Microsemi, among others. These companies lead the industry in innovation, manufacturing, and supplying FPGA technology to various sectors.

What are the primary factors driving the growth in the field Programmable Gate Array industry?

The growth in the FPGA market is primarily driven by the increasing demand for low-latency processing, the expansion of 5G technology applications, and the rise in automation across industries including automotive and aerospace.

Which region is the fastest Growing in the field Programmable Gate Array?

The North American region is the fastest-growing in the FPGA market, expected to rise from $3.78 billion in 2023 to $6.34 billion by 2033, driven by advanced technology adoption and increased investments in digital infrastructure.

Does ConsaInsights provide customized market report data for the field Programmable Gate Array industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, including detailed analysis of market segments, trends, and competitive landscape within the field-programmable-gate-array industry.

What deliverables can I expect from this field Programmable Gate Array market research project?

From this market research project, clients can expect deliverables such as detailed market analysis, segmentation insights, growth forecasts, competitive landscape reports, and strategic recommendations tailored to the FPGA sector.

What are the market trends of field Programmable Gate Array?

Current trends in the FPGA market include a shift towards enhanced integration with AI and machine learning technologies, increased use in telecommunications, and a focus on energy-efficient designs to meet evolving consumer and industrial demands.