Fighter Aircraft Market Report

Published Date: 03 February 2026 | Report Code: fighter-aircraft

Fighter Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fighter Aircraft market, focusing on trends, statistics, and forecasts for the period from 2023 to 2033. It covers market size, growth rates, technology advancements, regional insights, and key players shaping the industry.

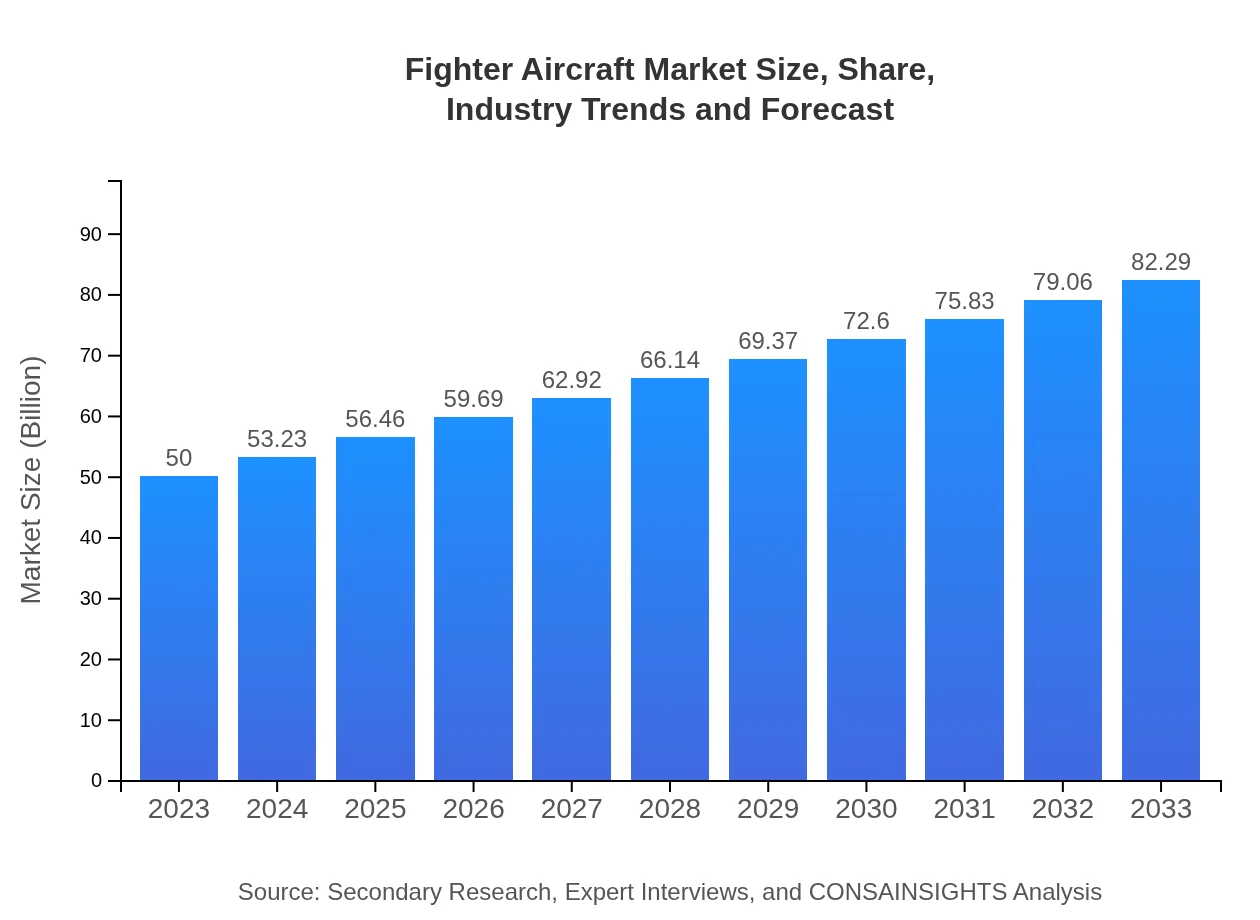

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $82.29 Billion |

| Top Companies | Lockheed Martin, Boeing , Northrop Grumman, Dassault Aviation, Eurofighter Jagdflugzeug GmbH |

| Last Modified Date | 03 February 2026 |

Fighter Aircraft Market Overview

Customize Fighter Aircraft Market Report market research report

- ✔ Get in-depth analysis of Fighter Aircraft market size, growth, and forecasts.

- ✔ Understand Fighter Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fighter Aircraft

What is the Market Size & CAGR of the Fighter Aircraft market in 2023?

Fighter Aircraft Industry Analysis

Fighter Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fighter Aircraft Market Analysis Report by Region

Europe Fighter Aircraft Market Report:

In Europe, the Fighter Aircraft market is anticipated to rise from $14.06 billion in 2023 to $23.13 billion by 2033. The rising focus on defense readiness, collaborative programs such as the Future Combat Air System (FCAS) in France and Germany, and ongoing replacements of aging fleets are factors enhancing market dynamics.Asia Pacific Fighter Aircraft Market Report:

In 2023, the Fighter Aircraft market in the Asia Pacific is valued at $9.90 billion and is forecasted to grow to $16.29 billion by 2033. The region benefits from increasing military budgets, particularly in countries like India, China, and Japan, which emphasizes modernizing air force capabilities and developing indigenous fighter programs.North America Fighter Aircraft Market Report:

North America holds the largest market share, with an expected growth from $18.43 billion in 2023 to $30.34 billion by 2033. The presence of leading manufacturers, such as Lockheed Martin and Boeing, along with significant investment in advanced technologies by U.S. defense forces, plays a key role in driving market growth.South America Fighter Aircraft Market Report:

The South American market for Fighter Aircraft is projected to grow from $4.29 billion in 2023 to $7.05 billion by 2033. Strategic collaborations and defense expenditures in Brazil and Colombia are major contributors to this growth, as governments aim to bolster their defensive capabilities amid regional instability.Middle East & Africa Fighter Aircraft Market Report:

The Middle East and Africa market is expected to move from $3.33 billion in 2023 to $5.47 billion by 2033. Political tensions in the region necessitate enhanced military capabilities, with countries like Saudi Arabia and the UAE significantly investing in modern fighter aircraft.Tell us your focus area and get a customized research report.

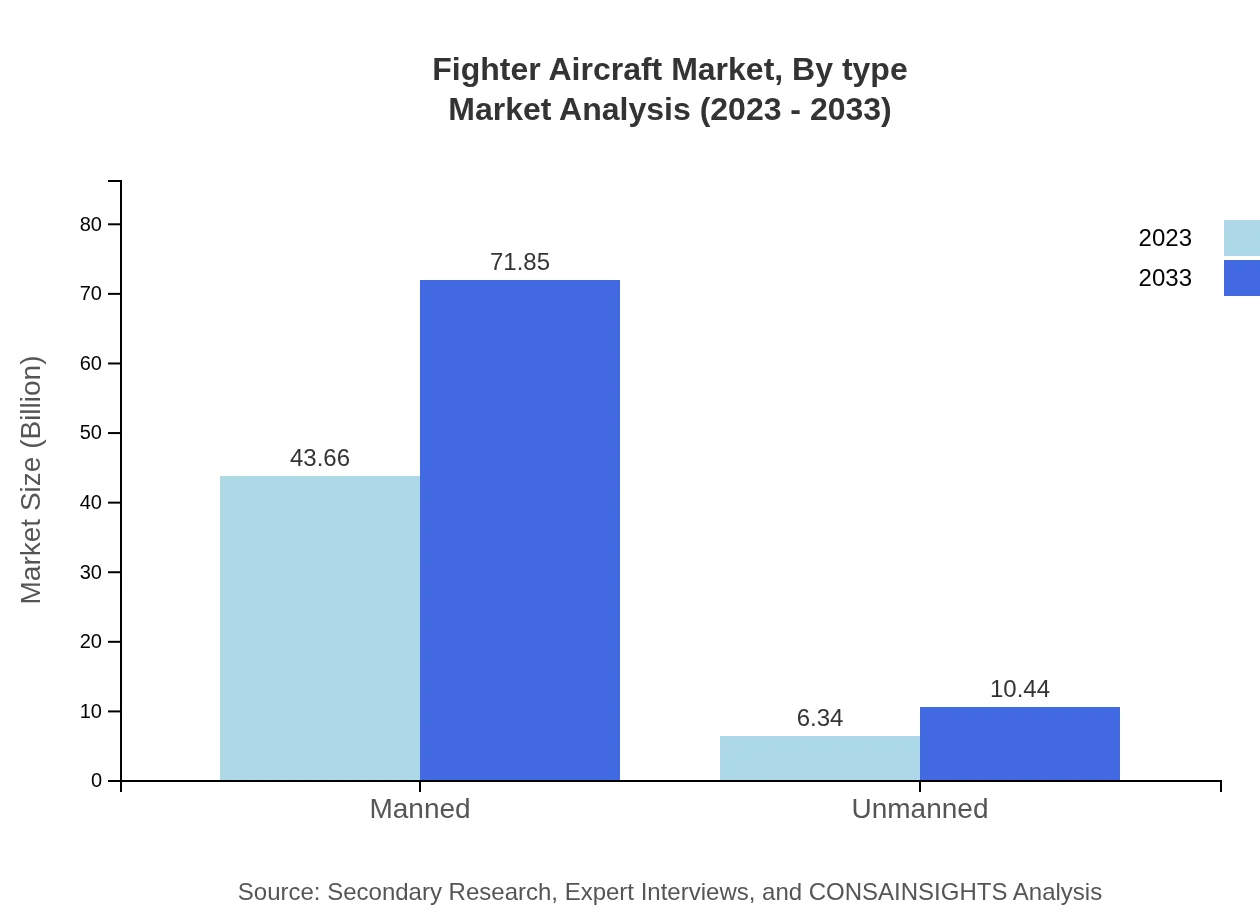

Fighter Aircraft Market Analysis By Type

The market can be categorized into Manned and Unmanned fighter aircraft. The Manned segment dominates the market, valued at $43.66 billion in 2023, growing to $71.85 billion by 2033, reflecting a robust preference for traditional piloted aircraft. The Unmanned segment, while smaller at $6.34 billion in 2023, is anticipated to expand significantly, reaching $10.44 billion by 2033 due to advancements in drone technology.

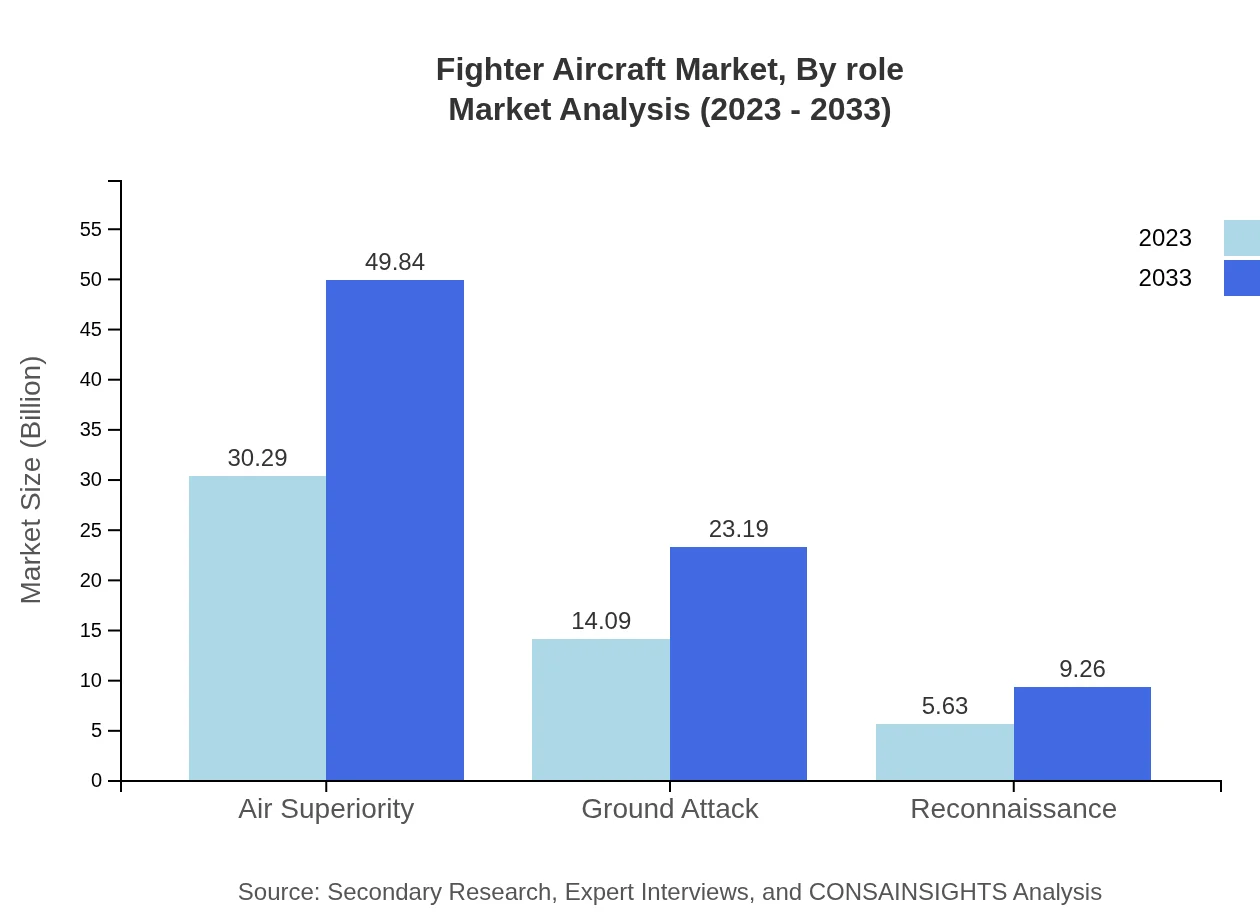

Fighter Aircraft Market Analysis By Role

The Fighter Aircraft market is segmented by role into Air Superiority, Ground Attack, and Reconnaissance. Air Superiority remains the largest segment at $30.29 billion in 2023, projected to grow to $49.84 billion by 2033, driven by the need for control of airspace. Ground Attack aircraft also show strong growth, from $14.09 billion to $23.19 billion, while Reconnaissance aircraft will grow from $5.63 billion to $9.26 billion.

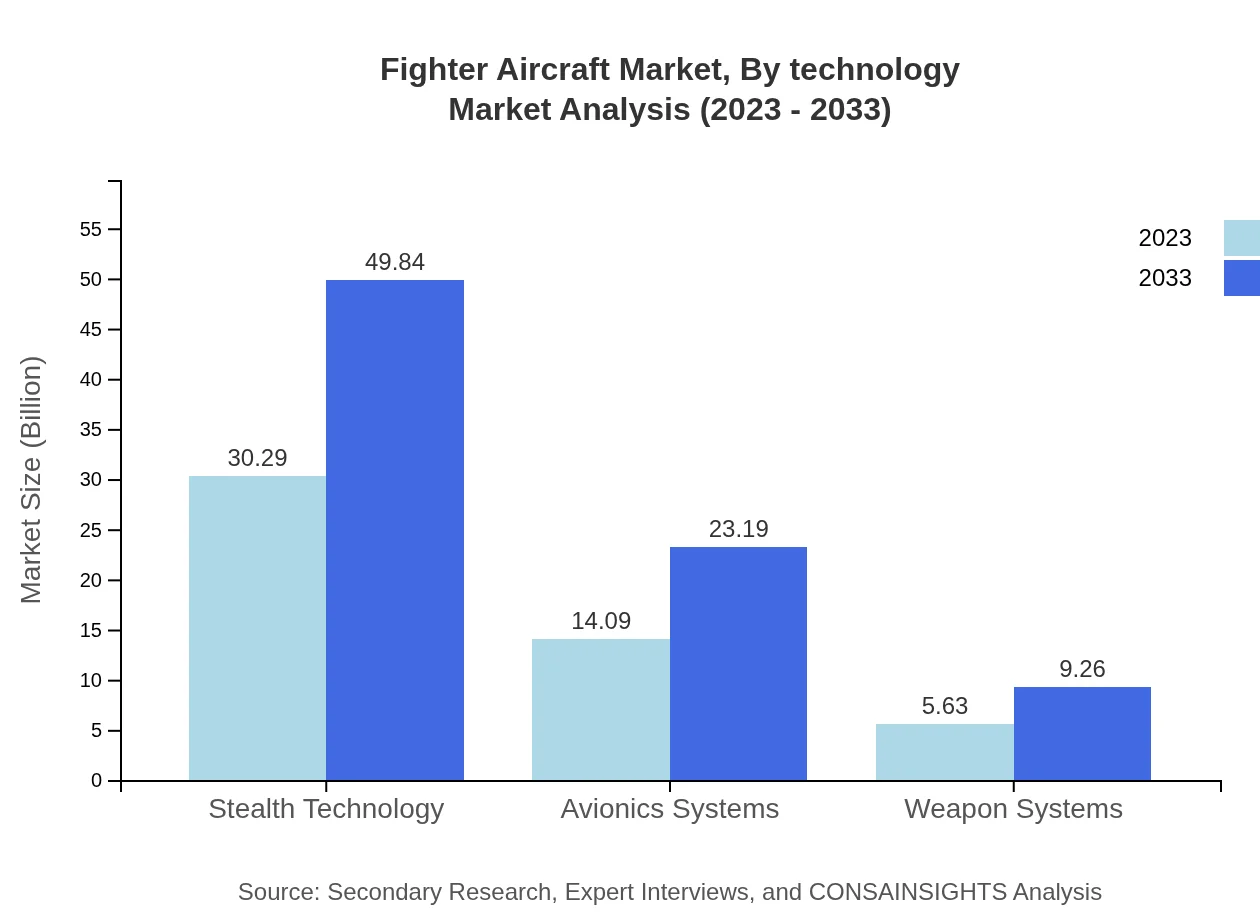

Fighter Aircraft Market Analysis By Technology

The Fighter Aircraft market sees significant segments in Stealth Technology, Avionics Systems, and Weapon Systems. Stealth Technology is estimated to represent a major share, valued at $30.29 billion and expected to reach $49.84 billion by 2033. Avionics Systems and Weapon Systems segments grow from $14.09 billion and $5.63 billion respectively in 2023 to $23.19 billion and $9.26 billion by 2033.

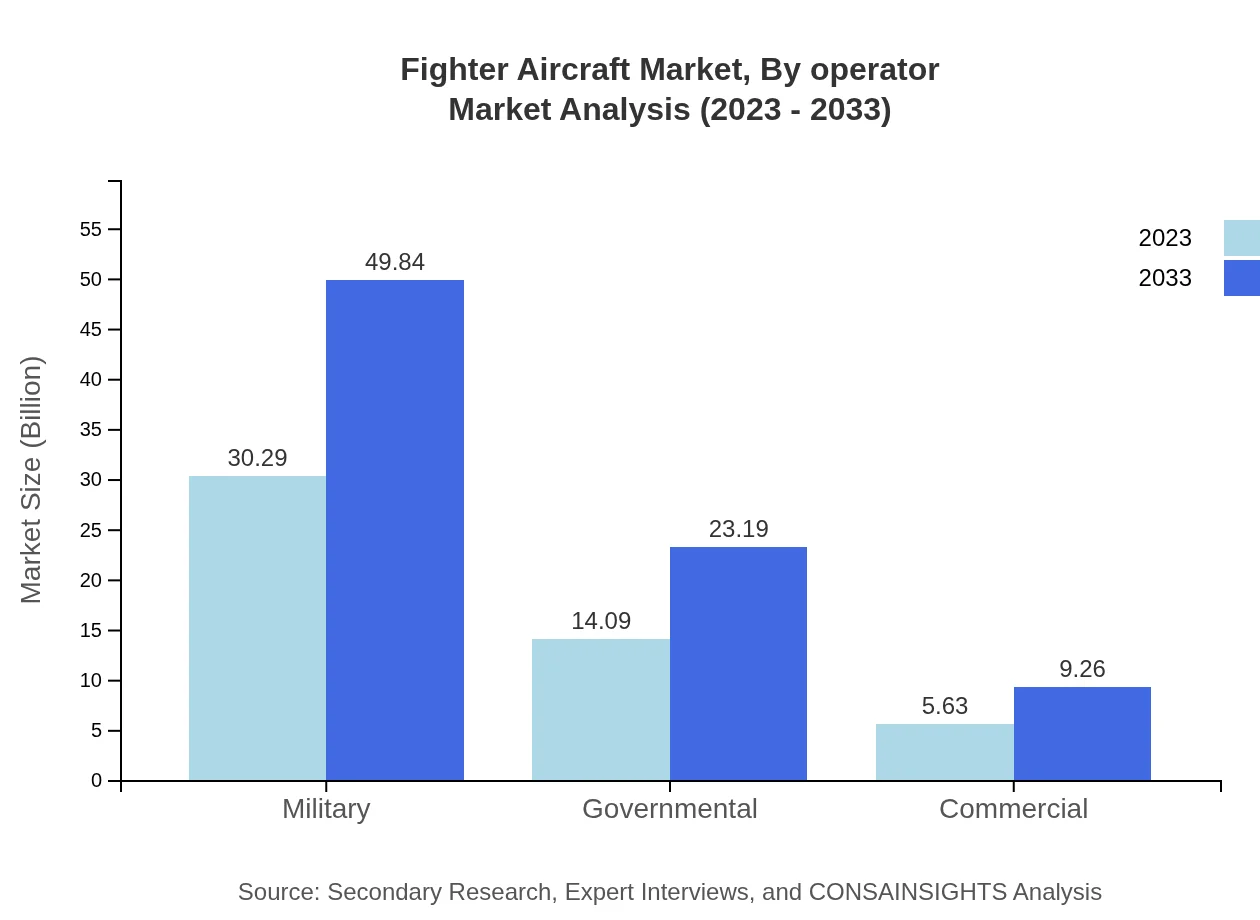

Fighter Aircraft Market Analysis By Operator

The market is categorized into Military, Governmental, and Commercial operators. Military applications dominate with a market size of $30.29 billion growing to $49.84 billion by 2033, while Governmental applications are projected to rise from $14.09 to $23.19 billion, and Commercial applications from $5.63 to $9.26 billion.

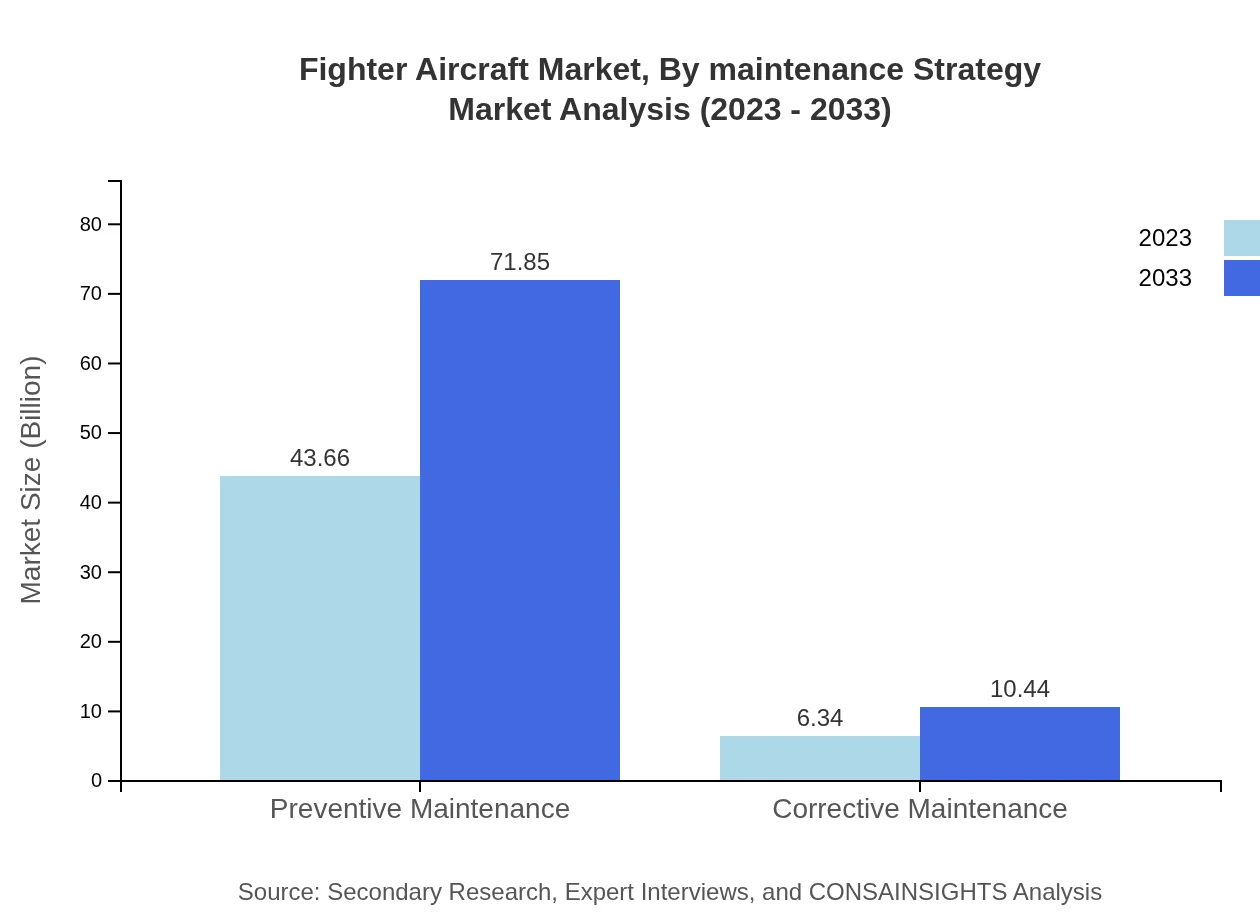

Fighter Aircraft Market Analysis By Maintenance Strategy

The Fighter Aircraft maintenance strategy can be divided into Preventive Maintenance and Corrective Maintenance. Preventive Maintenance, essential for ensuring aircraft readiness, dominates the market with a size of $43.66 billion in 2023, rising to $71.85 billion in 2033, while Corrective Maintenance grows from $6.34 billion to $10.44 billion as aircraft fleets age.

Fighter Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fighter Aircraft Industry

Lockheed Martin:

A leading aerospace and defense company, Lockheed Martin is recognized for its advanced fighter aircraft, including the F-35 Lightning II, which incorporates cutting-edge stealth and avionics technology.Boeing :

Boeing is a pivotal player in the Fighter Aircraft market, producing well-known military aircraft like the F/A-18 Super Hornet and contributing extensively to various military aviation programs.Northrop Grumman:

Northrop Grumman is known for advanced aerospace and defense technologies, including the development of innovative unmanned aircraft systems and stealth technologies.Dassault Aviation:

This French aerospace manufacturer is recognized for producing the Mirage and Rafale fighter aircraft, maintaining a strong presence in the European defense sector with advanced capabilities.Eurofighter Jagdflugzeug GmbH:

A consortium including Airbus, BAE Systems, and Leonardo, Eurofighter is known for the Typhoon fighter aircraft, characterized by versatility and performance in various military operations.We're grateful to work with incredible clients.

FAQs

What is the market size of fighter Aircraft?

The fighter aircraft market size was approximately $50 billion in 2023 and is expected to grow at a CAGR of 5% throughout the decade, reaching a projected market size by 2033 of around $80 billion.

What are the key market players or companies in this fighter aircraft industry?

Key market players in the fighter aircraft industry include Boeing, Lockheed Martin, Northrop Grumman, BAE Systems, and Dassault Aviation, which are leaders in design, manufacturing, and technological innovation.

What are the primary factors driving the growth in the fighter aircraft industry?

The growth in the fighter aircraft industry is driven by increasing military expenditures, advancements in technology such as stealth capabilities, and a growing demand for upgrades and modernization in existing aircraft fleets.

Which region is the fastest Growing in the fighter aircraft market?

North America is the fastest-growing region for the fighter aircraft market, projected to increase from $18.43 billion in 2023 to $30.34 billion by 2033, driven by robust government defense budgets and technological advancements.

Does ConsaInsights provide customized market report data for the fighter aircraft industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the fighter aircraft industry, ensuring clients receive relevant insights and data to inform their strategic decisions.

What deliverables can I expect from this fighter aircraft market research project?

Deliverables from the fighter aircraft market research project include comprehensive market analysis reports, segmentation data, competitive landscape assessments, and forecasts covering various geographical regions and market trends.

What are the market trends of fighter aircraft?

Current market trends in the fighter aircraft industry include an increasing focus on unmanned combat aerial vehicles, advancements in avionics systems, and a shift towards integrating stealth technology in new aircraft designs.