Finance Cloud Market Report

Published Date: 31 January 2026 | Report Code: finance-cloud

Finance Cloud Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Finance Cloud market, covering key insights, current trends, and future forecasts from 2023 to 2033, including market size, industry analysis, and regional breakdowns.

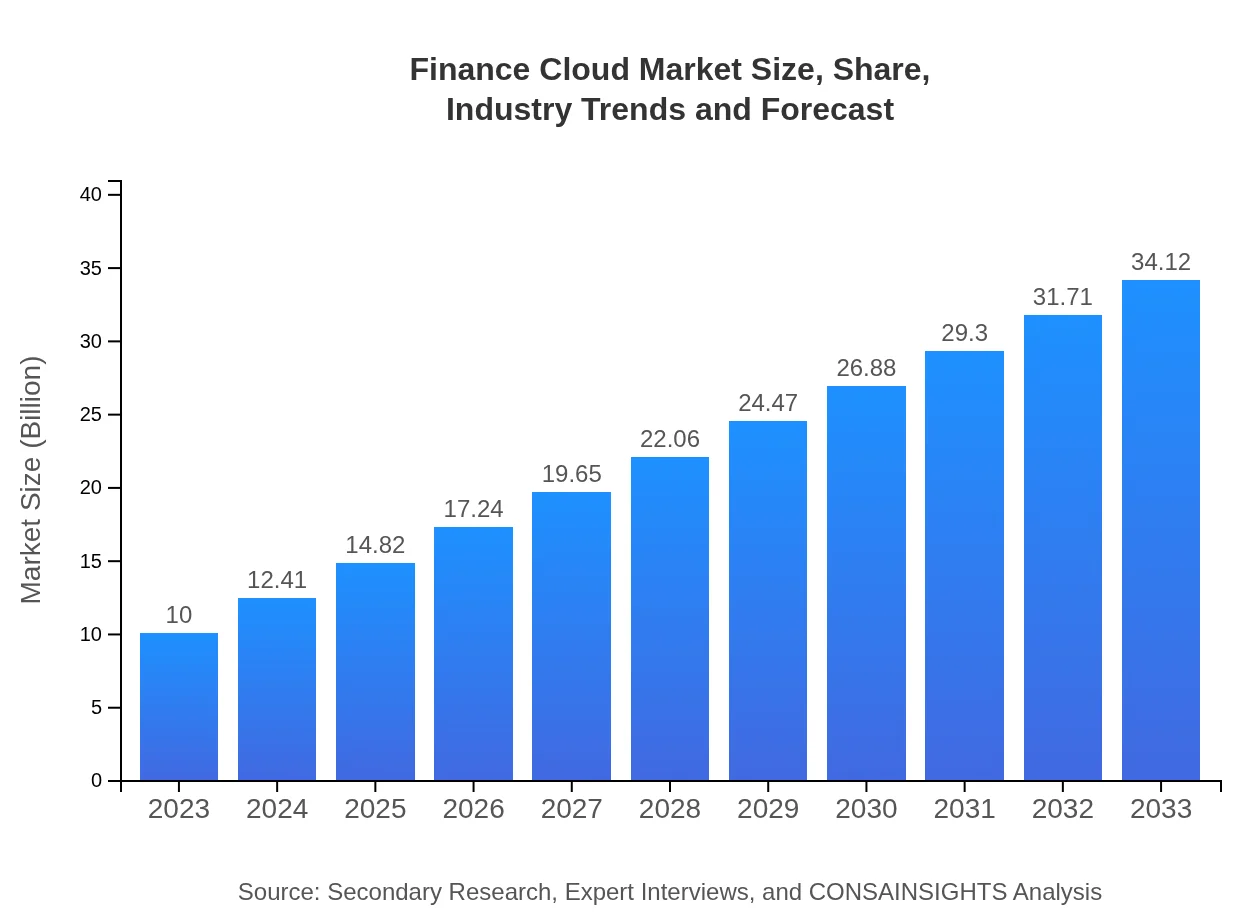

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $34.12 Billion |

| Top Companies | Microsoft, Salesforce, SAP, IBM, Oracle |

| Last Modified Date | 31 January 2026 |

Finance Cloud Market Overview

Customize Finance Cloud Market Report market research report

- ✔ Get in-depth analysis of Finance Cloud market size, growth, and forecasts.

- ✔ Understand Finance Cloud's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Finance Cloud

What is the Market Size & CAGR of Finance Cloud market in 2023?

Finance Cloud Industry Analysis

Finance Cloud Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Finance Cloud Market Analysis Report by Region

Europe Finance Cloud Market Report:

Europe's Finance Cloud market is projected to grow from $2.63 billion in 2023 to $8.97 billion by 2033. The strong regulatory landscape and financial institutions' commitment to enhancing customer experience through digital channels are major drivers of this growth.Asia Pacific Finance Cloud Market Report:

In 2023, the Finance Cloud market in Asia Pacific is valued at $2.12 billion, projected to reach $7.23 billion by 2033. The region is experiencing rapid digital transformation, with increasing investments in cloud infrastructure signaling potential for exponential growth as businesses seek innovative financial solutions.North America Finance Cloud Market Report:

North America leads the Finance Cloud market, valued at $3.63 billion in 2023 and expected to expand to $12.38 billion by 2033. The mature financial sector and high adoption rates of cloud solutions are key factors fueling growth, along with a strong emphasis on digital innovation.South America Finance Cloud Market Report:

The South American Finance Cloud market was valued at $0.89 billion in 2023 and is anticipated to grow to $3.04 billion by 2033. The adoption of cloud technology in financial services is accelerating, driven by the region's need for modernized financial systems and improved regulatory compliance.Middle East & Africa Finance Cloud Market Report:

The Finance Cloud market in the Middle East and Africa is valued at $0.73 billion in 2023 and is estimated to reach $2.50 billion by 2033. Increasing investments in fintech and regulatory changes are expected to catalyze the adoption of cloud solutions in the region.Tell us your focus area and get a customized research report.

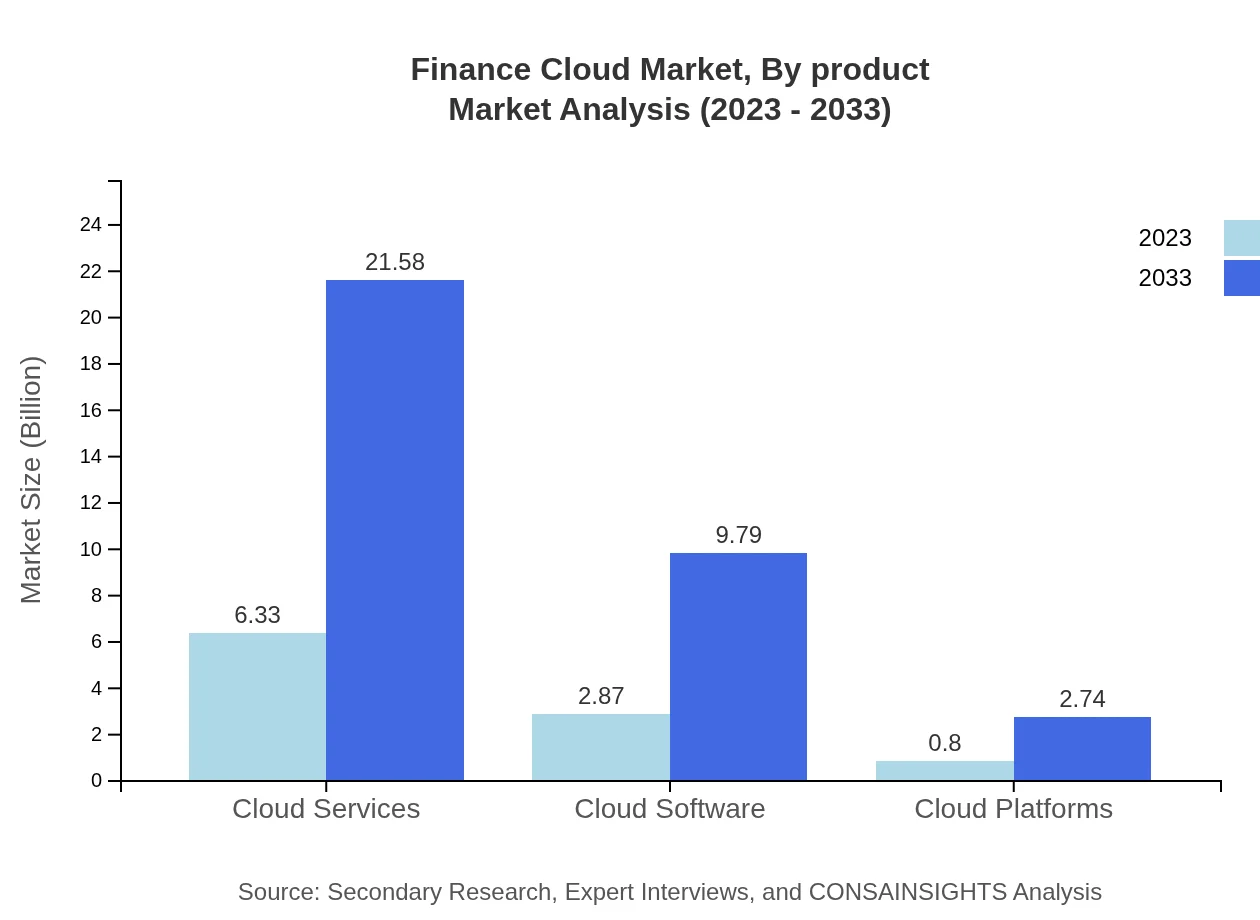

Finance Cloud Market Analysis By Product

In 2023, the Finance Cloud market for Cloud Services is valued at $6.33 billion and is expected to grow to $21.58 billion by 2033. Cloud Software is projected to increase from $2.87 billion to $9.79 billion in the same period, while Cloud Platforms will scale up from $0.80 billion to $2.74 billion.

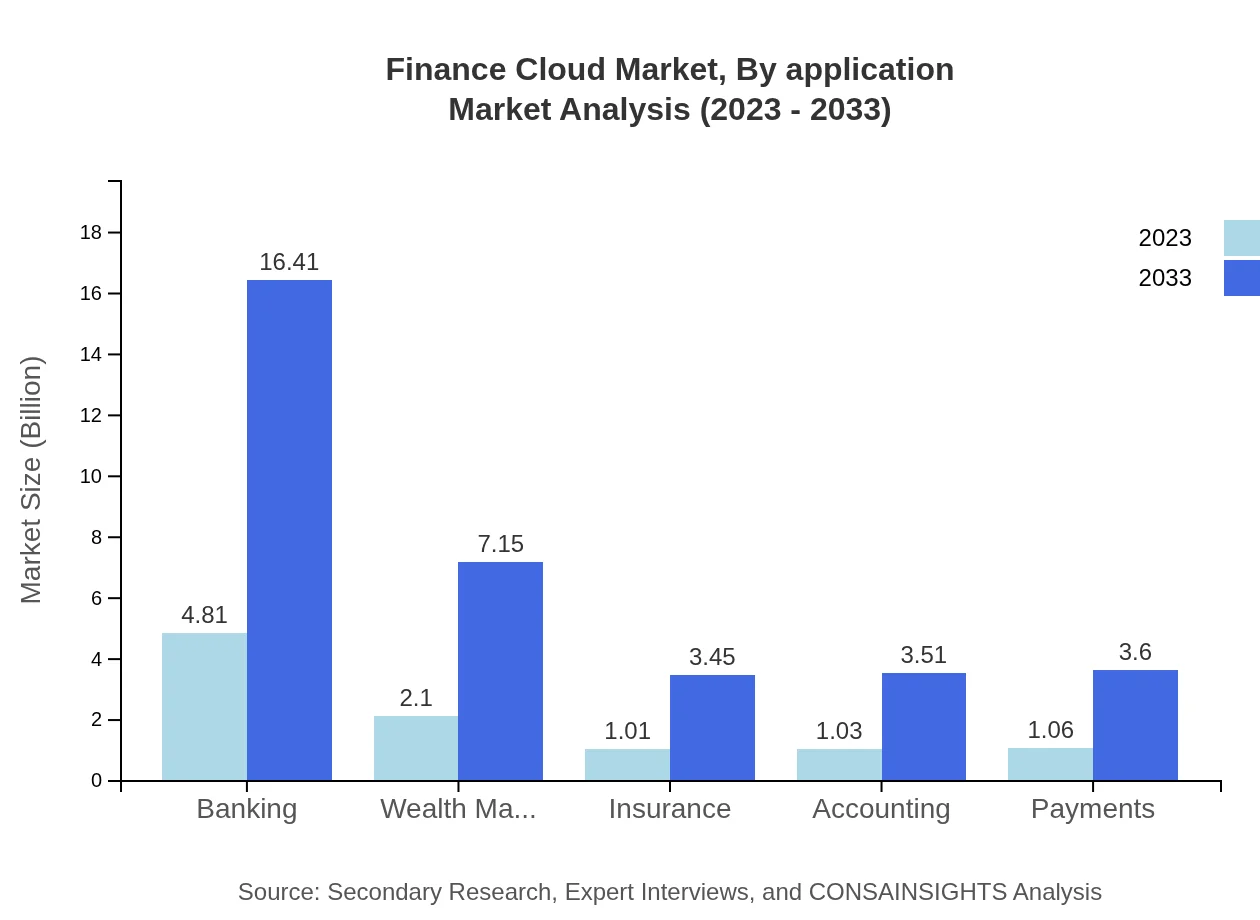

Finance Cloud Market Analysis By Application

The application segment comprises Banking, Payments, Wealth Management, Insurance, and accounting solutions, with Banking dominating the market. In 2023, the size of the Banking application is around $4.81 billion and is projected to reach $16.41 billion by 2033.

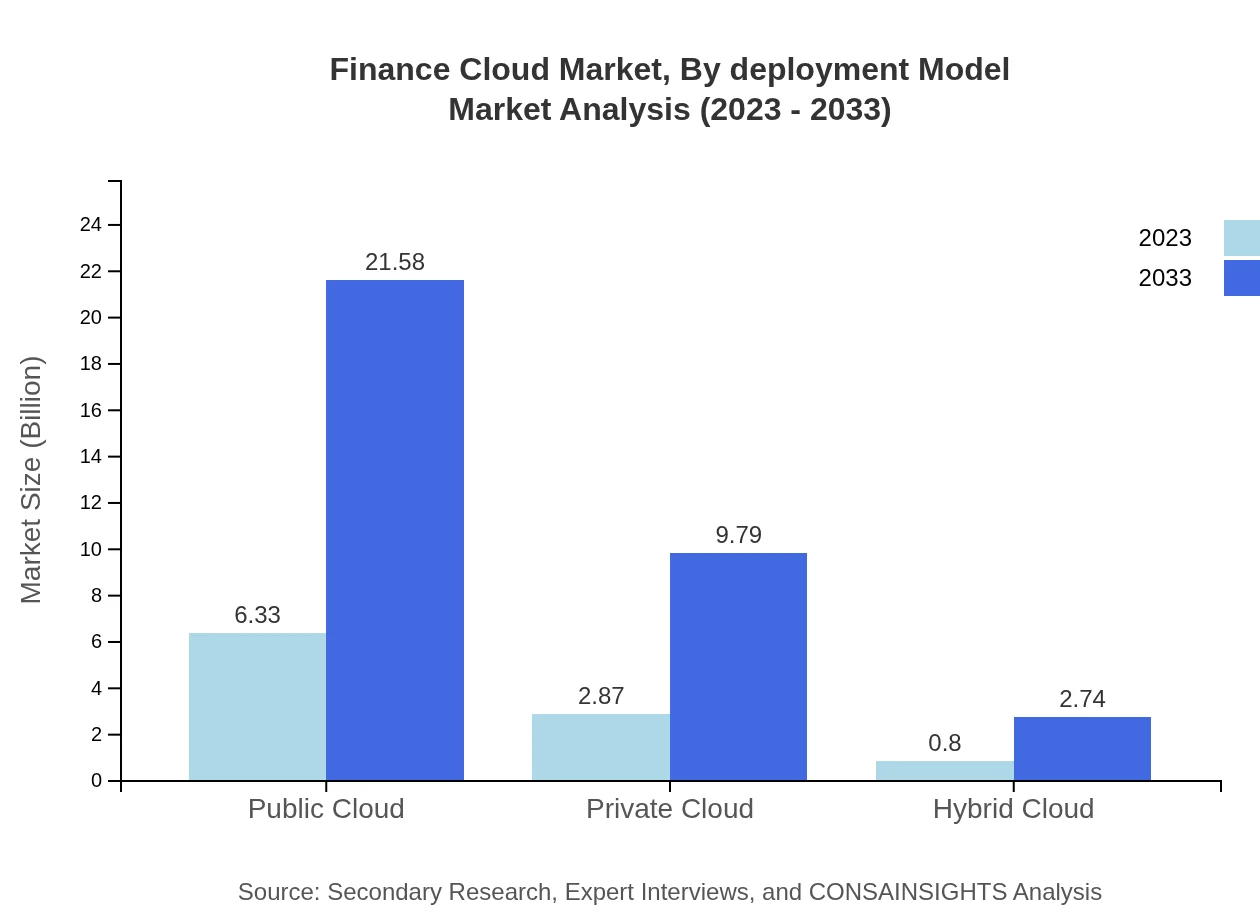

Finance Cloud Market Analysis By Deployment Model

The market is segmented into Public Cloud, Private Cloud, and Hybrid Cloud. The Public Cloud segment is leading with a size of $6.33 billion in 2023, while it is projected to grow to $21.58 billion by 2033, reflecting strong acceptance among businesses due to its scalability and cost-effectiveness.

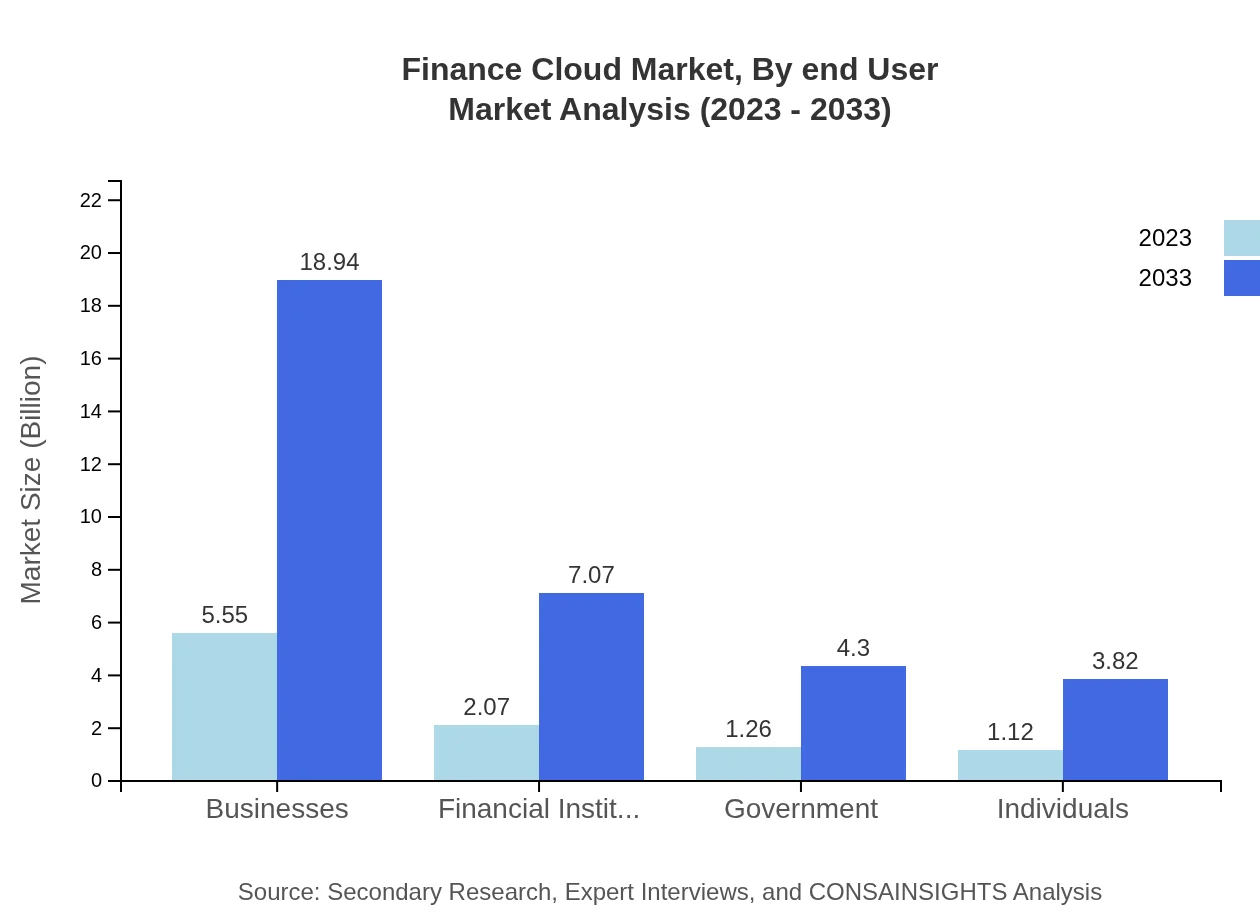

Finance Cloud Market Analysis By End User

The primary end-users include financial institutions, businesses, government agencies, and individuals. Financial institutions represent a significant share, with a market value of $2.07 billion in 2023 and expected growth to $7.07 billion by 2033.

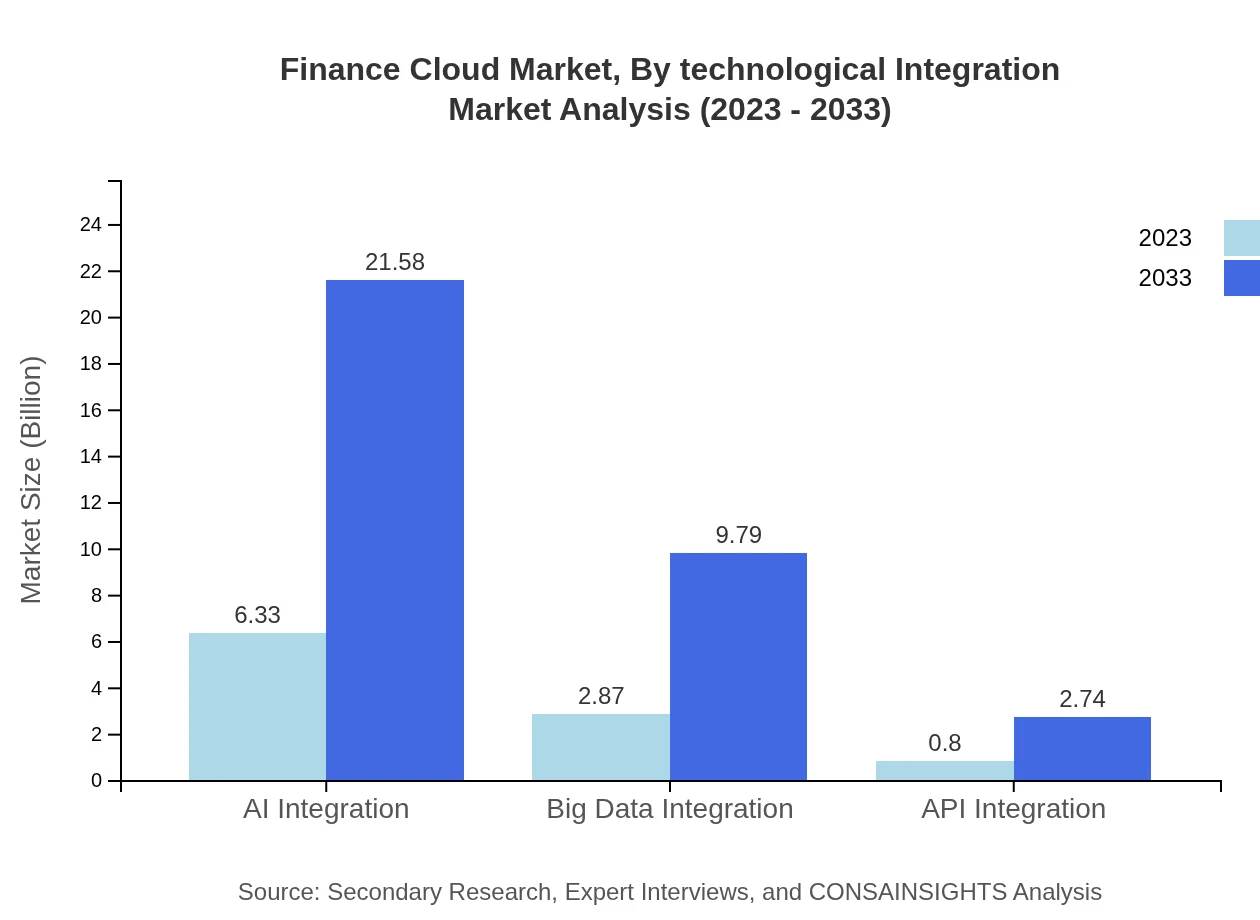

Finance Cloud Market Analysis By Technological Integration

Technological integration segments include AI Integration, Big Data Integration, and API Integration. AI Integration is expected to lead, with a size of $6.33 billion in 2023, continuing its expansion to $21.58 billion by 2033.

Finance Cloud Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Finance Cloud Industry

Microsoft:

A leader in cloud technology, Microsoft provides robust finance cloud solutions through Azure, enabling businesses to enhance financial operations and compliance.Salesforce:

Known for its CRM solutions, Salesforce also offers integrated finance cloud services that facilitate customer engagement in the financial sector.SAP:

Provides comprehensive financial cloud solutions that support enterprise-level financial operations and analytics, driving significant efficiency for organizations.IBM:

IBM's finance cloud offerings integrate advanced analytics and AI, helping organizations navigate complex financial landscapes and optimize performance.Oracle:

As a key player in financial cloud solutions, Oracle focuses on providing services that enhance enterprise financial management and reporting capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of finance Cloud?

The finance cloud market is currently valued at approximately $10 billion, with a projected compound annual growth rate (CAGR) of 12.5%, suggesting significant growth opportunities in the coming years.

What are the key market players or companies in the finance Cloud industry?

Leading companies within the finance-cloud industry include established tech giants and financial service providers that utilize cloud solutions to enhance their operations, data management, and customer engagement.

What are the primary factors driving the growth in the finance Cloud industry?

Key growth drivers for the finance-cloud industry include increasing demand for digital transformation, enhanced data analytics capabilities, and a rising emphasis on cost efficiency and flexibility in financial services.

Which region is the fastest Growing in the finance Cloud?

Among global regions, North America shows the fastest growth trajectory with projections of $12.38 billion by 2033, followed closely by Europe and Asia-Pacific. This trends reflects their robust financial technology innovations.

Does ConsaInsights provide customized market report data for the finance Cloud industry?

Yes, ConsaInsights offers customized market report data tailored to the finance-cloud sector, allowing businesses to access specific insights and detailed analytics relevant to their needs.

What deliverables can I expect from this finance Cloud market research project?

Clients can expect comprehensive deliverables, including detailed market size reports, segmented data analyses, and forecasts identifying trends and competitive landscapes specific to the finance-cloud market.

What are the market trends of finance Cloud?

Current trends in the finance-cloud market include a shift toward AI integration, an increase in public cloud usage, and a focus on security measures, which are reshaping financial services delivery.