Financial Analytics Market Report

Published Date: 24 January 2026 | Report Code: financial-analytics

Financial Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the financial analytics market, including market trends, size, forecasts from 2023 to 2033, and insights into regional growth patterns, segmentation, and competitive landscape.

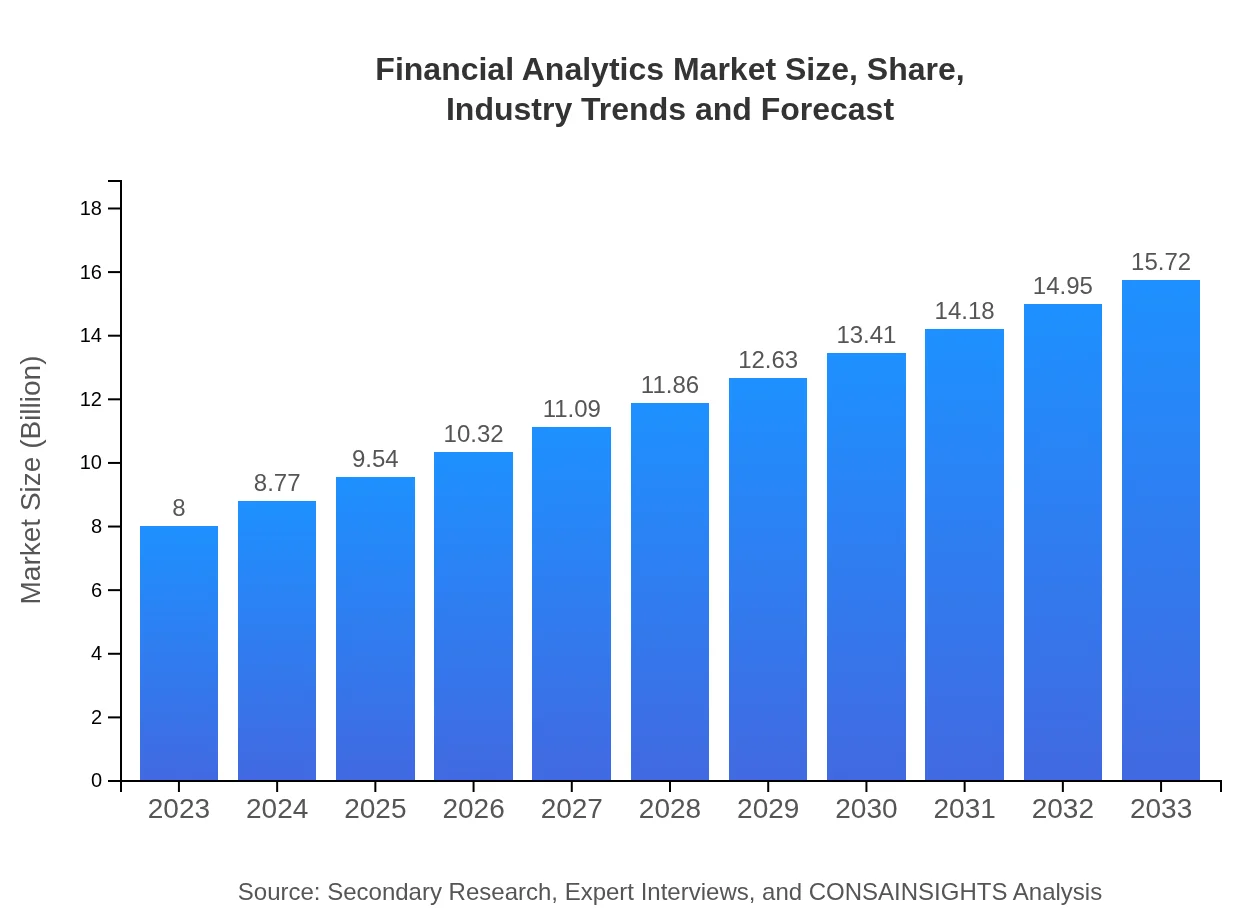

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $15.72 Billion |

| Top Companies | Oracle Corporation, SAP SE, IBM Corporation, Tableau Software, SAS Institute |

| Last Modified Date | 24 January 2026 |

Financial Analytics Market Overview

Customize Financial Analytics Market Report market research report

- ✔ Get in-depth analysis of Financial Analytics market size, growth, and forecasts.

- ✔ Understand Financial Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Financial Analytics

What is the Market Size & CAGR of Financial Analytics market in 2023 - 2033?

Financial Analytics Industry Analysis

Financial Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Financial Analytics Market Analysis Report by Region

Europe Financial Analytics Market Report:

The European financial analytics market is anticipated to grow from $2.06 billion in 2023 to $4.06 billion by 2033. Market growth is fueled by stringent regulations and the need for enhanced risk management through analytics. Countries like the U.K., Germany, and France lead the way as they integrate technological advancements in financial decision-making processes.Asia Pacific Financial Analytics Market Report:

In the Asia Pacific region, the financial analytics market is forecasted to grow from $1.65 billion in 2023 to $3.24 billion by 2033, reflecting a strong adoption of analytics among emerging economies. Countries like China and India are fostering significant investments in fintech, enhancing the financial analytics landscape. The push for digital transformation in financial services, driven by government initiatives and increased consumer expectations for better service delivery, is propelling market growth in this region.North America Financial Analytics Market Report:

North America remains the largest market for financial analytics, expected to grow from $2.81 billion in 2023 to $5.53 billion by 2033. The U.S. is a key player, with a robust technology infrastructure and high adoption rates of advanced analytics solutions among financial institutions. The region's regulatory landscape also mandates increased transparency, pushing companies to invest in analytics technologies.South America Financial Analytics Market Report:

The South American market is projected to expand from $0.78 billion in 2023 to $1.52 billion by 2033. The region is experiencing a gradual shift toward digital financial services, especially in Brazil and Argentina, which are increasingly leveraging analytics to enhance operational performance and customer experience. The demand for improved regulatory compliance and agile financial management further drives this growth.Middle East & Africa Financial Analytics Market Report:

The Middle East and Africa (MEA) market is expected to rise from $0.70 billion in 2023 to $1.37 billion by 2033. As financial institutions in this region recognize the value of data analytics for decision-making and risk mitigation, investments in financial analytics solutions are increasing. The growing digital payment ecosystem and a shift toward cloud-based solutions are also contributing to market growth.Tell us your focus area and get a customized research report.

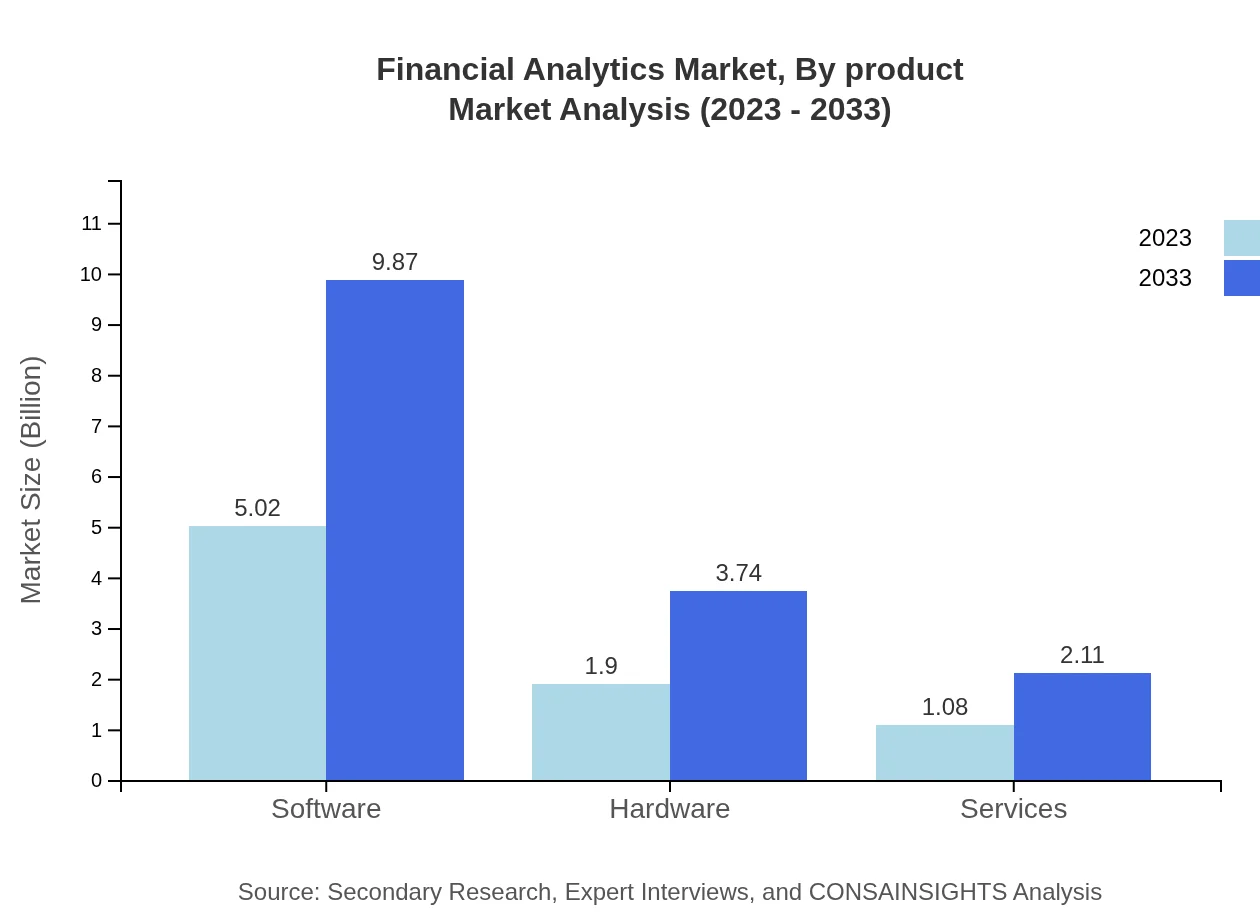

Financial Analytics Market Analysis By Product

The market segmentation by product indicates that software remains the largest segment, projected to grow from $5.02 billion in 2023 to $9.87 billion by 2033. Hardware and services segments are also significant, with hardware growing from $1.90 billion to $3.74 billion and services from $1.08 billion to $2.11 billion during the same period. This indicates a balanced demand across different facets of financial analytics, with software solutions dominating the landscape due to their ability to process and analyze massive volumes of data quickly.

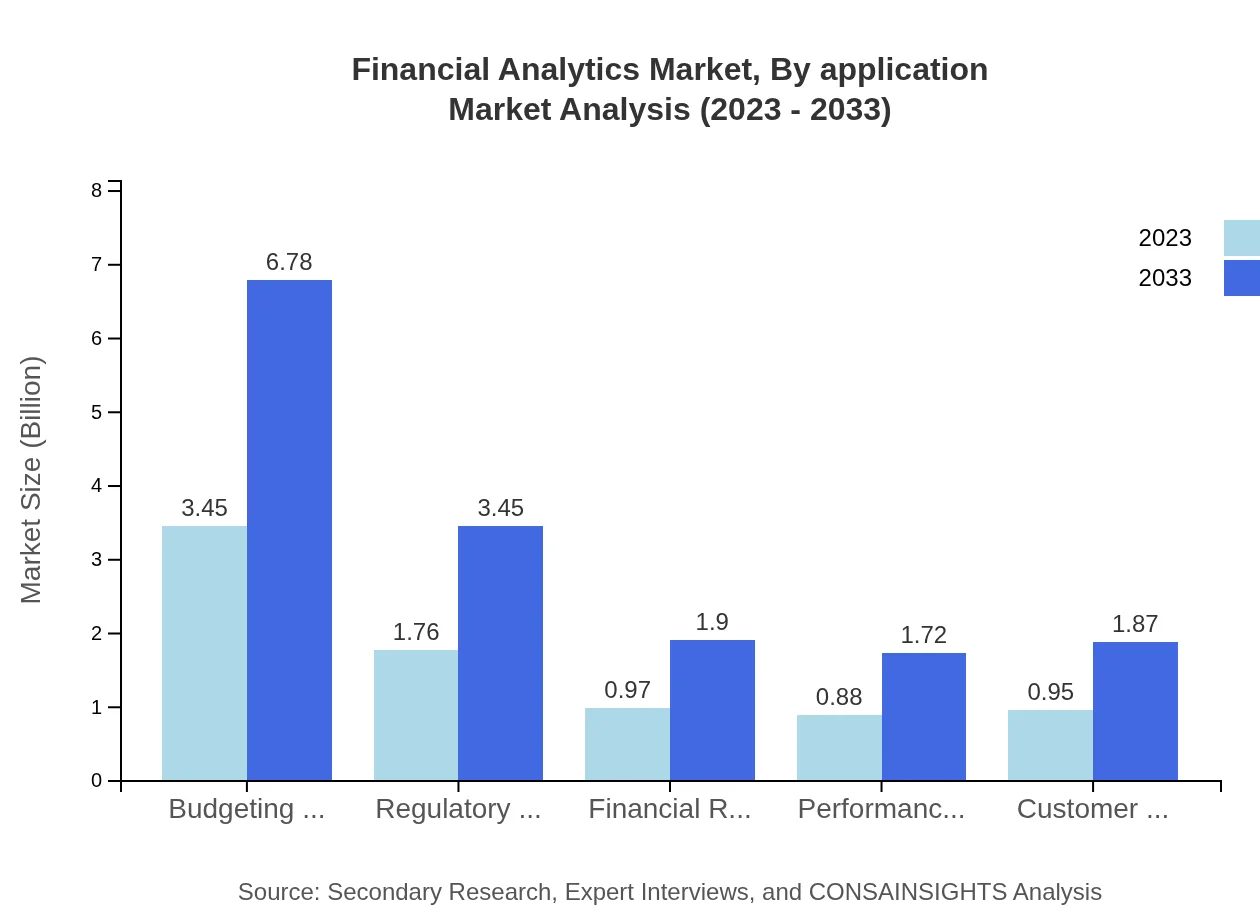

Financial Analytics Market Analysis By Application

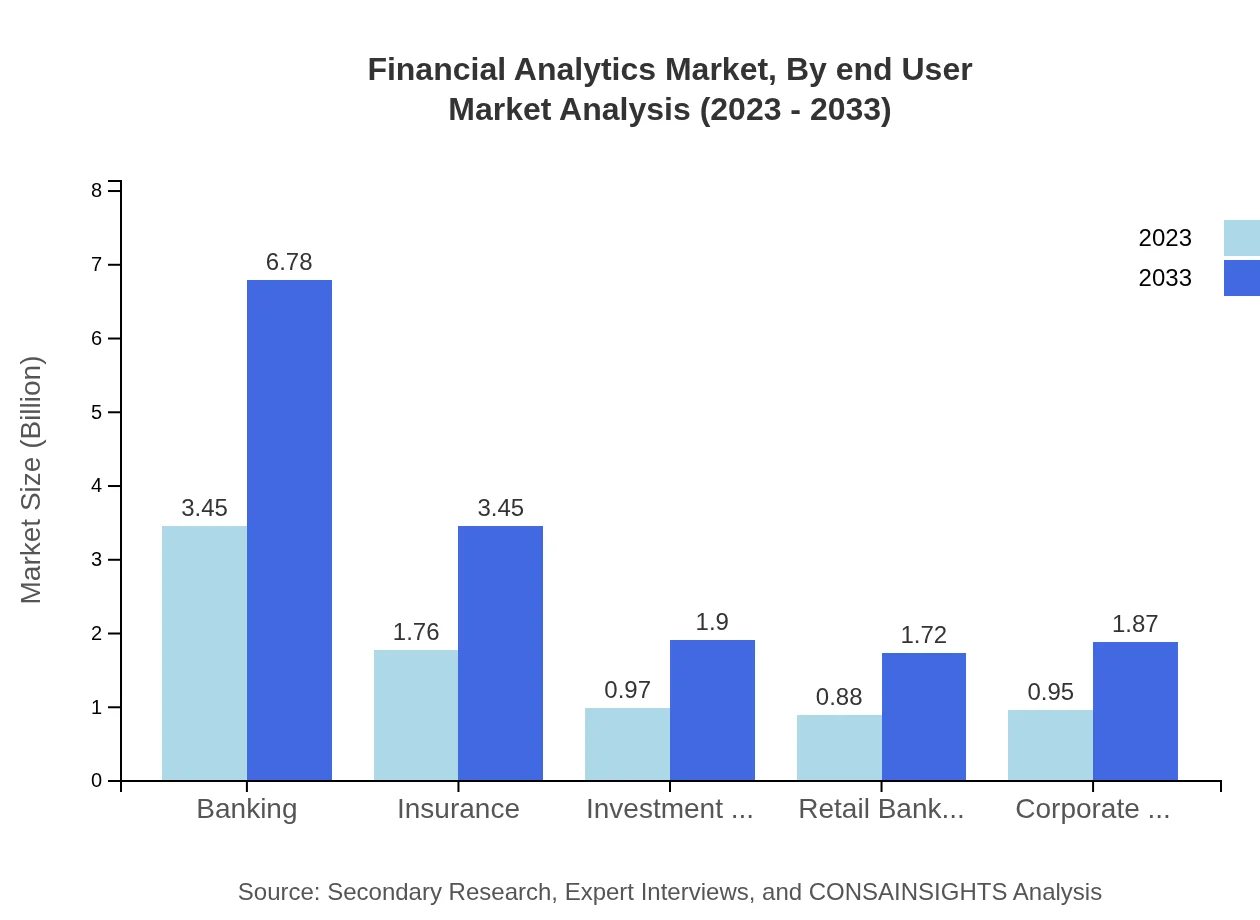

Market segments by application highlight banking as the leading sector, with a robust growth forecast from $3.45 billion in 2023 to $6.78 billion by 2033. Insurance follows closely, expanding from $1.76 billion to $3.45 billion. Other applications, including investment firms and corporate finance, are also anticipated to grow, reflecting the extensive applicability of financial analytics across various financial domains.

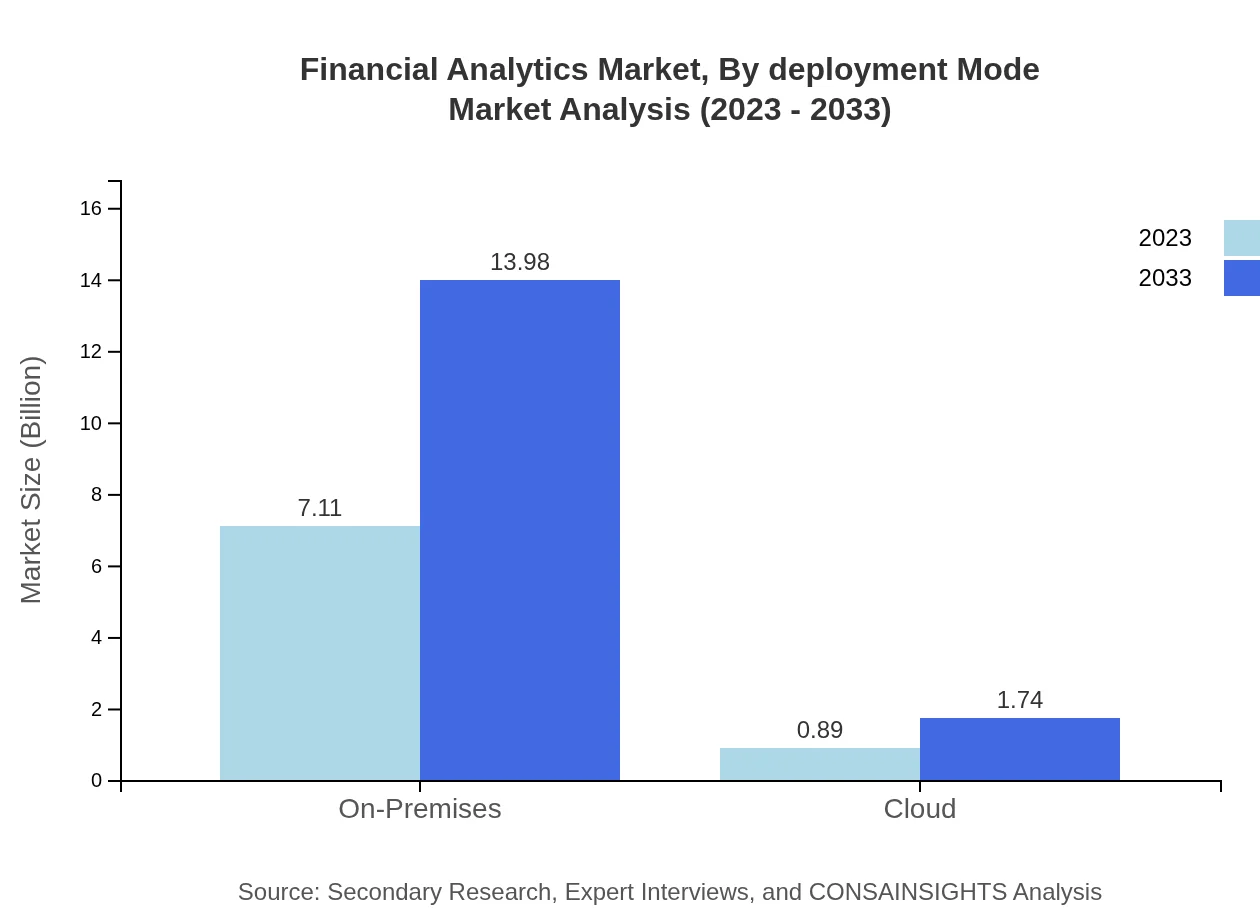

Financial Analytics Market Analysis By Deployment Mode

On-premises deployment continues to be the dominant mode in the financial analytics market, growing from $7.11 billion in 2023 to $13.98 billion by 2033. However, cloud deployment is gaining traction, with an increase from $0.89 billion to $1.74 billion, as businesses seek more flexible and scalable solutions to support their financial analytics processes.

Financial Analytics Market Analysis By End User

End-user segments signify strong engagement from banking and insurance sectors, accounting for significant shares in the financial analytics market. Retail banking is expected to see substantial growth from $0.88 billion to $1.72 billion as digital banking adoption increases. The corporate finance segment also shows promising results with growth from $0.95 billion to $1.87 billion, highlighting the varied applications across industries.

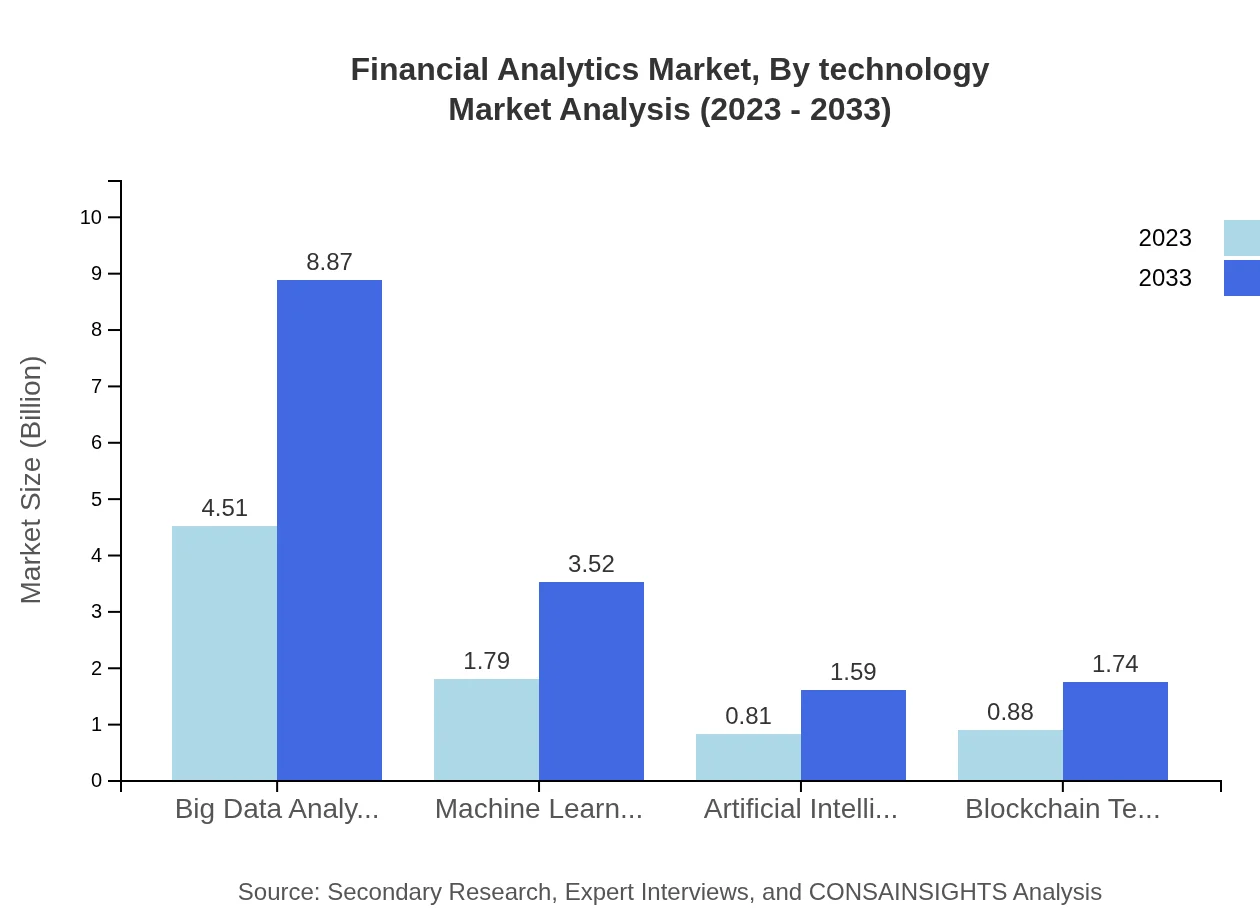

Financial Analytics Market Analysis By Technology

In terms of technology, big data analytics holds a significant share, expected to grow from $4.51 billion in 2023 to $8.87 billion by 2033, reflecting the rising importance of big data technologies in financial analytics processes. Machine learning and AI are also gaining prominence, enhancing the predictive capabilities of financial analysis tools and equipping organizations to make data-informed decisions.

Financial Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Financial Analytics Industry

Oracle Corporation:

A leading software and hardware systems provider, Oracle offers various financial management solutions and analytics tools aimed at improving financial decision-making processes for organizations.SAP SE:

SAP is well-known for its enterprise resource planning software which integrates financial analytics capabilities to enhance operational efficiency across various industries.IBM Corporation:

IBM offers a suite of financial analytics solutions that leverage AI and machine learning to provide real-time insights and improve financial performance.Tableau Software:

Recognized for its data visualization products, Tableau strengthens financial analytics by enabling organizations to visualize complexities in their financial data effectively.SAS Institute:

SAS is known for analytics software and solutions, providing comprehensive tools for data management and complex analytical processes in financial sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of financial Analytics?

The global financial analytics market is valued at approximately $8 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating robust growth and increased investment in analytics technologies.

What are the key market players or companies in the financial Analytics industry?

Leading companies in the financial analytics industry include IBM, Oracle, SAP, SAS Institute, and Tableau, which dominate through innovative software solutions and extensive client portfolios, influencing market trends and technological advancements.

What are the primary factors driving the growth in the financial Analytics industry?

Key drivers include the rising demand for data-driven insights, regulatory compliance pressures, advancements in AI and ML technologies, and increased adoption of cloud-based solutions that enhance financial decision-making processes.

Which region is the fastest Growing in the financial Analytics?

Asia Pacific is the fastest-growing region, projected to expand from $1.65 billion in 2023 to $3.24 billion by 2033, driven by increasing digital transformations and a burgeoning demand for analytics solutions in emerging markets.

Does ConsaInsights provide customized market report data for the financial Analytics industry?

Yes, ConsaInsights offers tailored market reports, allowing clients to obtain specific data and insights based on their unique requirements, ensuring relevance and applicability in strategic decision-making.

What deliverables can I expect from this financial Analytics market research project?

Deliverables include detailed market analysis reports, segmentation insights, competitive landscape evaluations, actionable trends and forecasts, tailored recommendations for strategic initiatives, and comprehensive regional data.

What are the market trends of financial Analytics?

Current trends include increased incorporation of big data analytics, growth in AI and ML applications, demand for real-time data processing, and a shift towards cloud-based financial analytics solutions, enhancing operational agility.