Financial App Market Report

Published Date: 31 January 2026 | Report Code: financial-app

Financial App Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Financial App market from 2023 to 2033, covering insights into market size, growth trends, industry dynamics, segmentation, regional performance, and future forecasts.

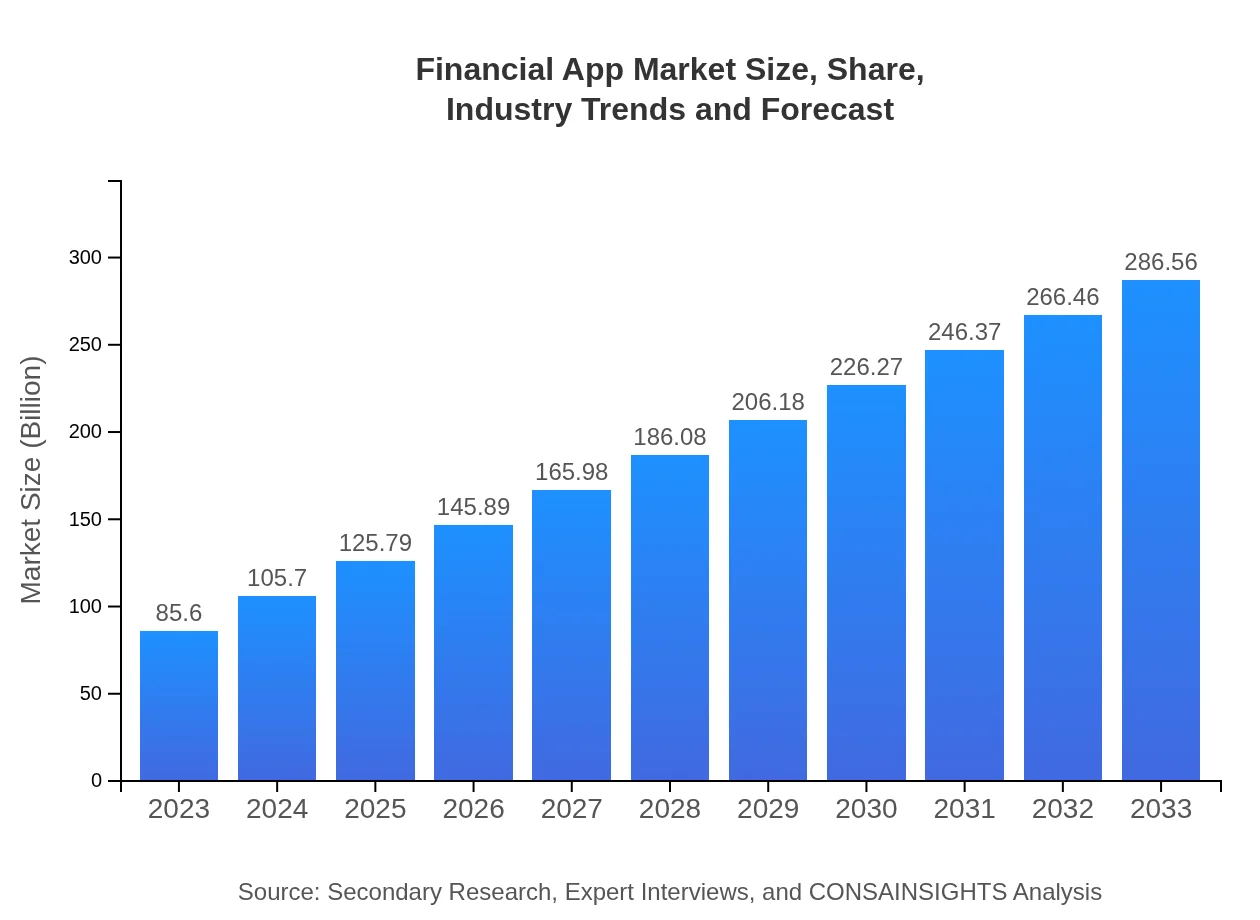

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $85.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $286.56 Billion |

| Top Companies | Intuit, PayPal, Robinhood , Square, Stripe |

| Last Modified Date | 31 January 2026 |

Financial App Market Overview

Customize Financial App Market Report market research report

- ✔ Get in-depth analysis of Financial App market size, growth, and forecasts.

- ✔ Understand Financial App's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Financial App

What is the Market Size & CAGR of Financial App market in 2023?

Financial App Industry Analysis

Financial App Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Financial App Market Analysis Report by Region

Europe Financial App Market Report:

The European financial app market is valued at $26.42 billion in 2023, expected to grow to $88.46 billion by 2033. The market benefits from a strong presence of digital banking and payment solutions driven by regulatory frameworks that encourage competition and innovation.Asia Pacific Financial App Market Report:

The Asia Pacific region accounts for a significant share of the market, valued at $17.84 billion in 2023, with an expected growth to $59.72 billion by 2033. Increasing smartphone penetration, especially in countries like India and China, coupled with a tech-savvy younger population, fuels demand for innovative financial applications. The region is witnessing a wave of financial inclusion initiatives, which further support market expansion.North America Financial App Market Report:

North America remains a crucial market for financial apps, with a size of $27.61 billion in 2023, anticipating growth to $92.44 billion by 2033. This growth can be attributed to the established presence of major fintech companies and high consumer acceptance of digital financial solutions. Regulatory support for innovation further enhances market stability.South America Financial App Market Report:

The South American market for financial apps is smaller but shows promising growth, with a market value of $2.05 billion in 2023, projected to reach $6.88 billion by 2033. Key drivers include increased internet accessibility and the rise of fintech companies aiming to cater to underbanked populations.Middle East & Africa Financial App Market Report:

In the Middle East and Africa, the financial app market, valued at $11.67 billion in 2023, is projected to rise to $39.06 billion by 2033. Growth in this region is supported by increasing smartphone adoption and initiatives to modernize financial services, particularly in countries like South Africa and Nigeria.Tell us your focus area and get a customized research report.

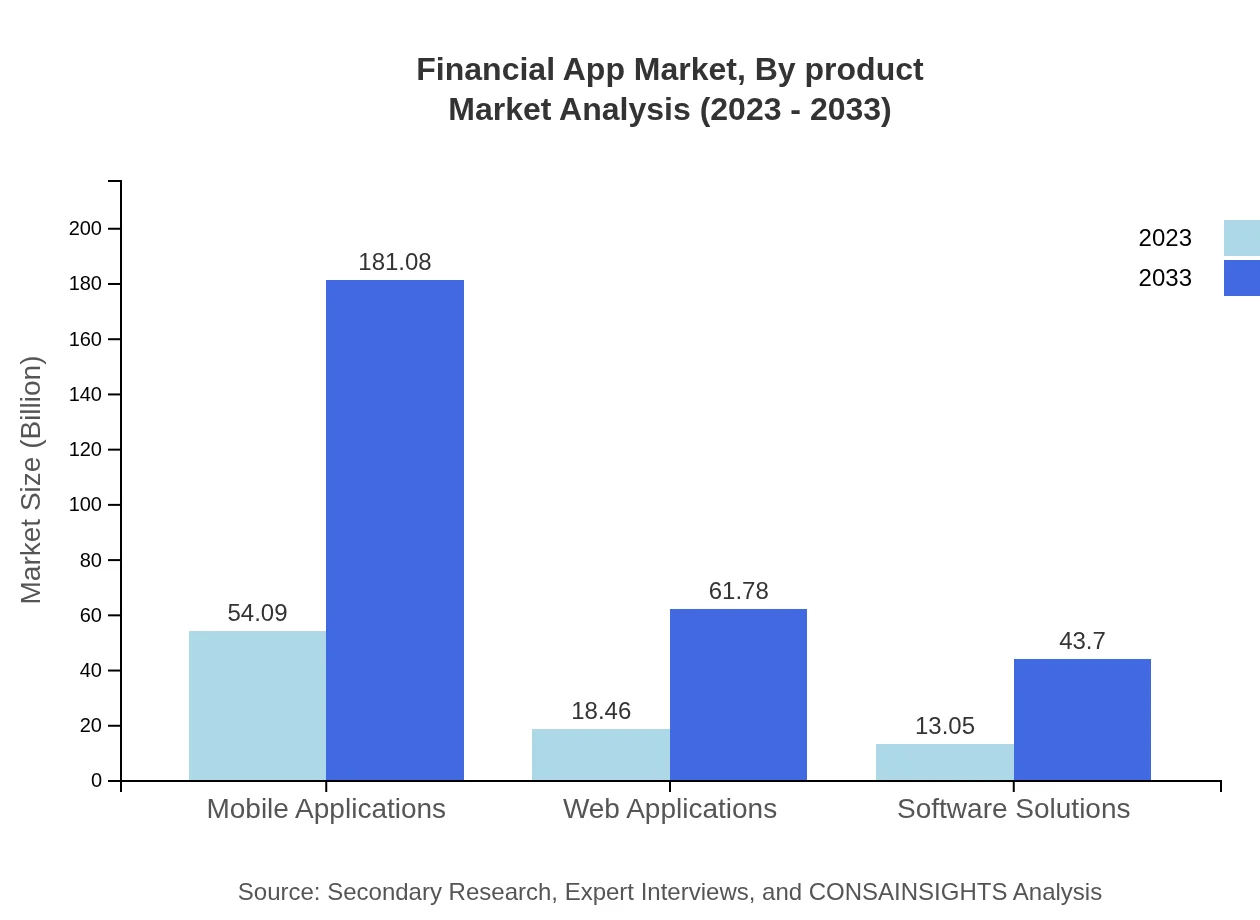

Financial App Market Analysis By Product

In 2023, mobile applications dominate the Financial App market, with a size of $54.09 billion, expected to grow to $181.08 billion by 2033. Web applications follow, starting at $18.46 billion in 2023 and projected to $61.78 billion by 2033. Software solutions hold a significant share as well, growing from $13.05 billion to $43.70 billion over the same period.

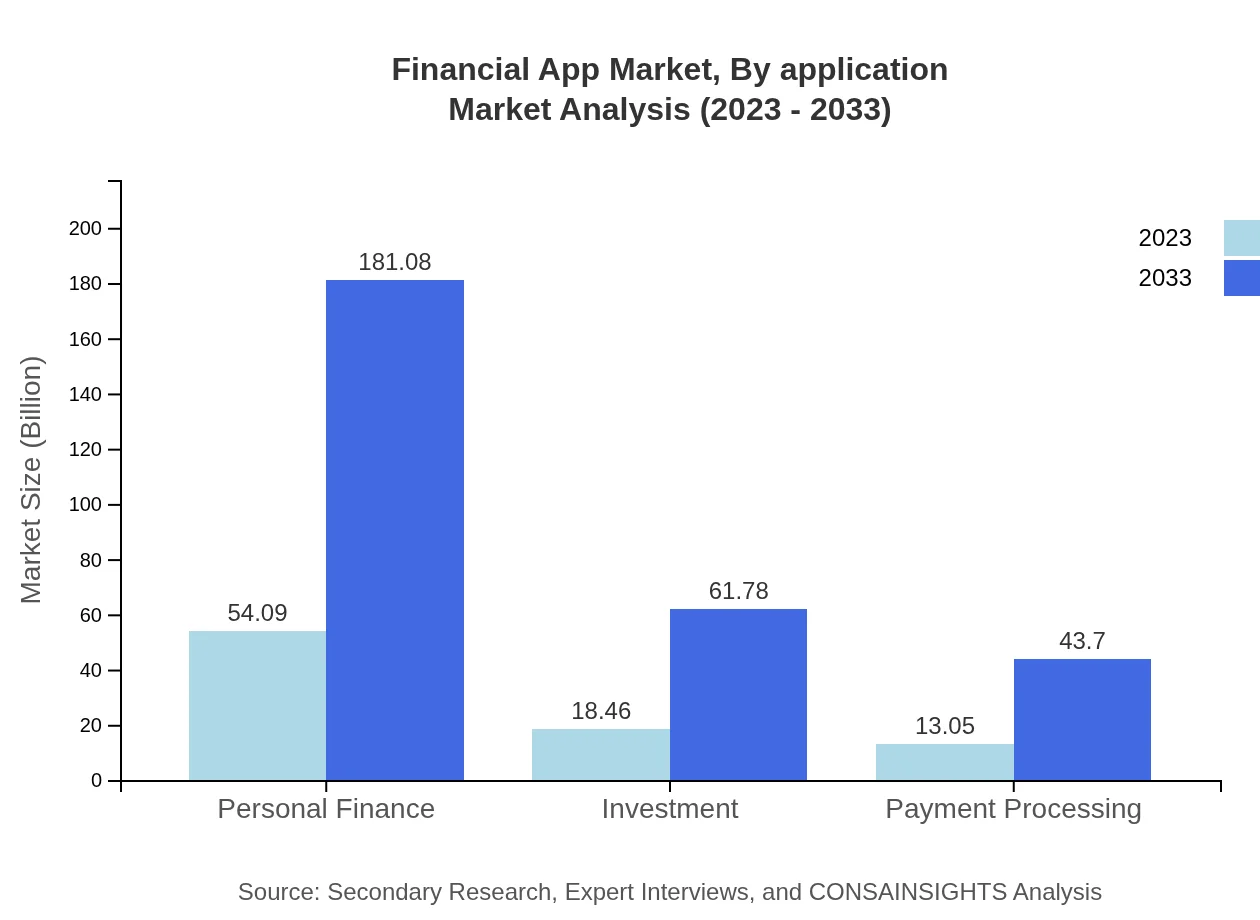

Financial App Market Analysis By Application

The applications of Financial Apps include personal finance, investment, and payment processing. Personal finance applications lead the market with a size of $54.09 billion in 2023, continuing to grow, while investment applications start at $18.46 billion and projected to reach $61.78 billion by 2033.

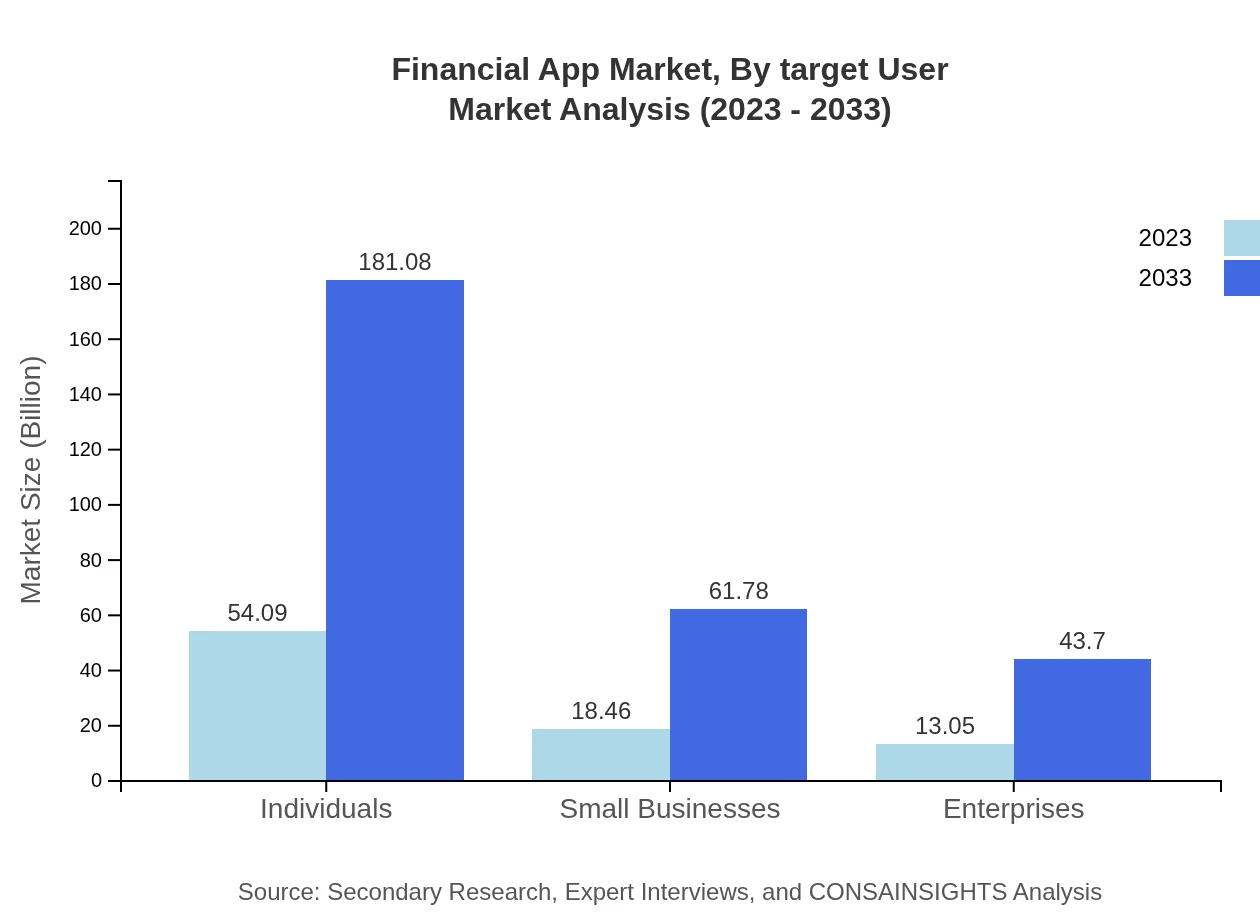

Financial App Market Analysis By Target User

Target user segmentation indicates that individuals dominate the market with a share of $54.09 billion in 2023, growing significantly. Small businesses account for $18.46 billion, indicating a rising interest in financial apps tailored for business functionalities.

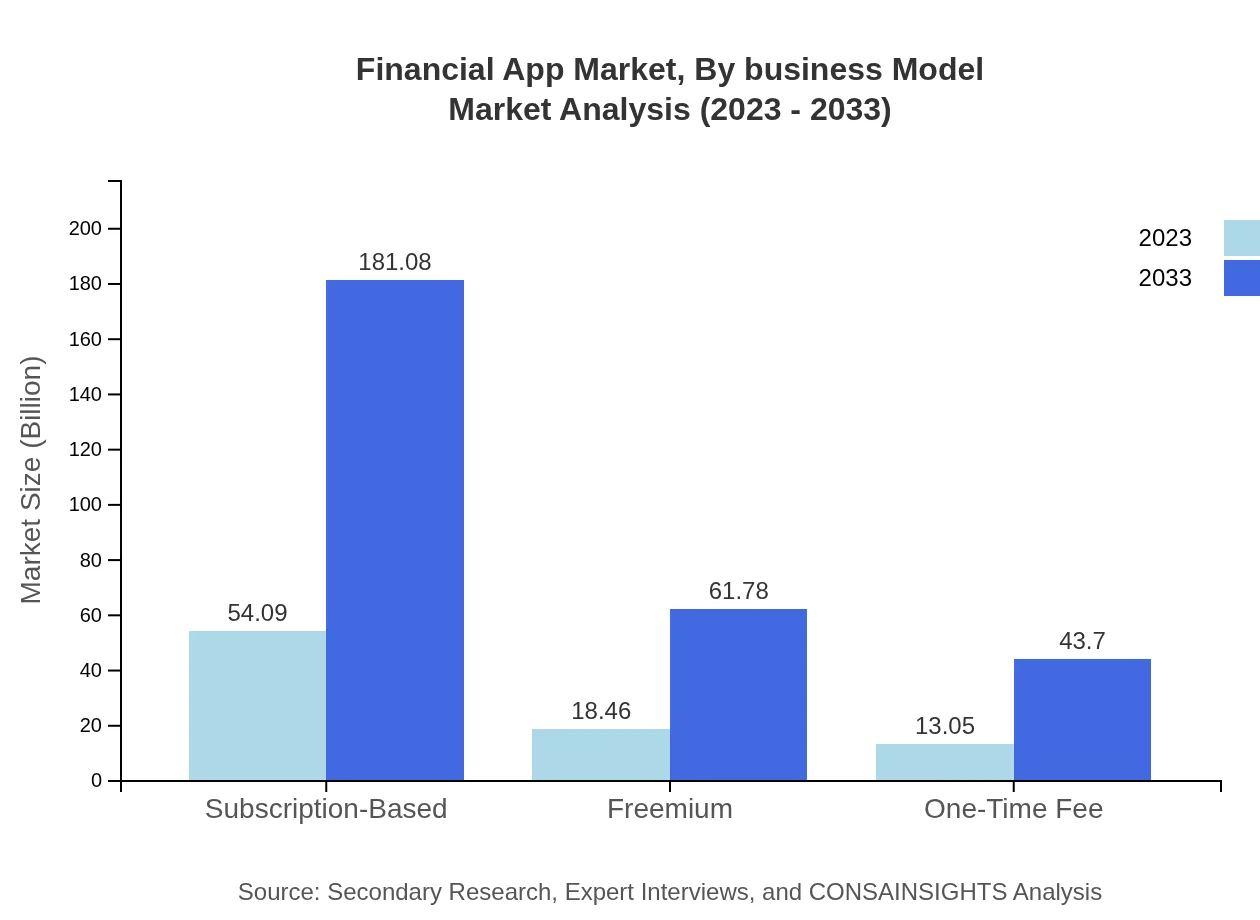

Financial App Market Analysis By Business Model

The Financial App market features various business models, including subscription-based services and freemium offerings. Subscription-based models are projected to lead the market growth from $54.09 billion in 2023 to $181.08 billion by 2033.

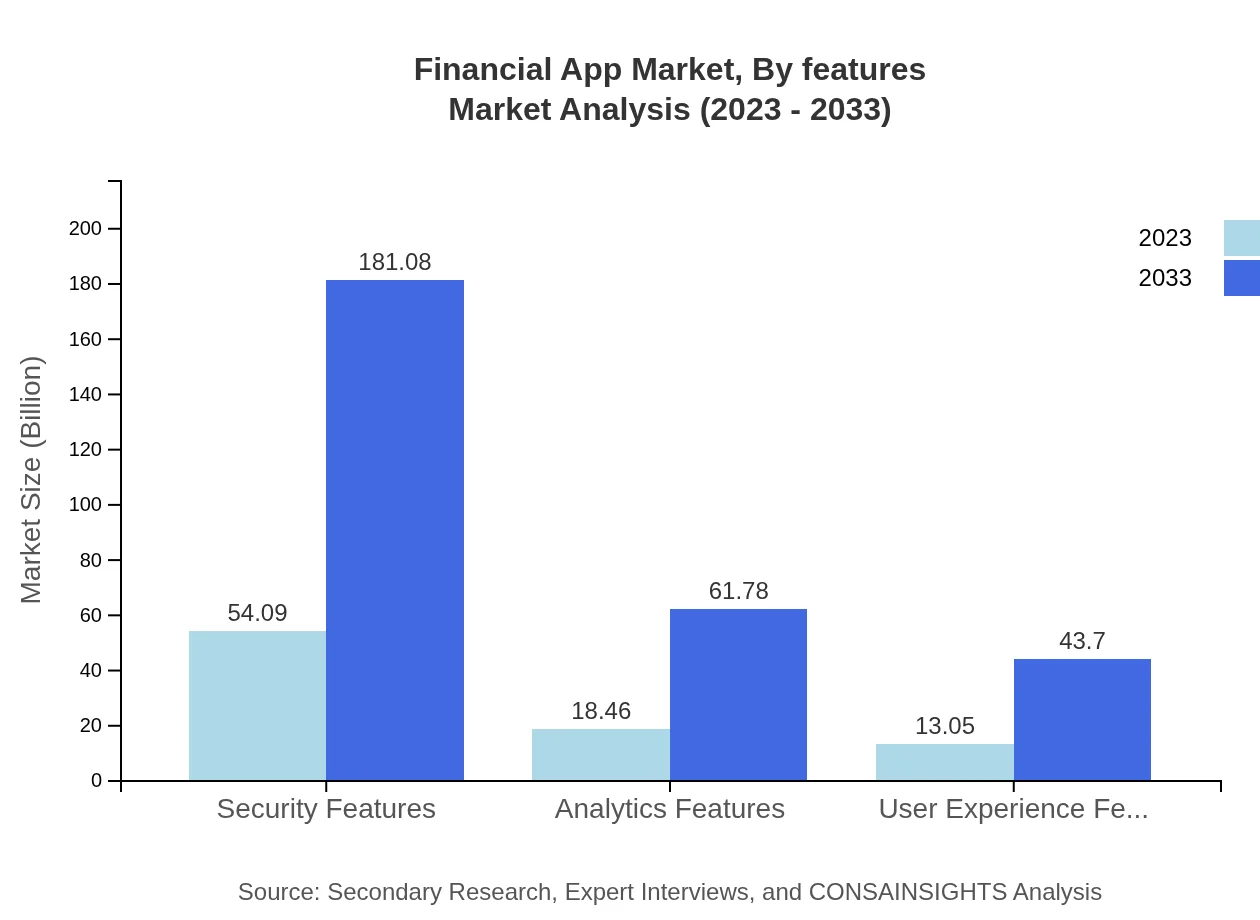

Financial App Market Analysis By Features

Key features such as security, analytics, and user experience are imperative to the performance of financial apps. Security features are projected to maintain a significant market size leading to an increasing demand for secure transactions in the evolving digital landscape.

Financial App Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Financial App Industry

Intuit:

Known for its TurboTax and QuickBooks products, Intuit leads in personal finance solutions, helping millions to manage their financial health.PayPal:

A pioneer in digital payments, PayPal provides various financial services, facilitating seamless transactions for individuals and businesses alike.Robinhood :

A popular investment app that democratizes finance by enabling commission-free trading, appealing especially to younger investors.Square:

Square offers a suite of financial services and payment solutions, making it easier for small businesses to operate and thrive in a digital economy.Stripe:

Stripe specializes in online payment processing, providing robust APIs that enable companies to easily integrate their financial services into their platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of financial App?

The financial app market is projected to reach a size of $85.6 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 12.3% from 2023. This growth reflects a robust demand for digital finance solutions.

What are the key market players or companies in this financial App industry?

Key players in the financial app industry include prominent companies like Intuit, Square, PayPal, and Mint, which lead in innovation and market share, significantly shaping the industry landscape with their advanced financial solutions.

What are the primary factors driving the growth in the financial App industry?

Growth drivers include the increasing penetration of smartphones, rising demand for convenient financial management solutions, and the growing trend of digital banking services, all contributing to a thriving ecosystem for financial apps.

Which region is the fastest Growing in the financial App?

The fastest-growing region in the financial app market is expected to be North America, which will expand significantly from $27.61 billion in 2023 to $92.44 billion by 2033, indicating a robust development in digital finance.

Does ConsaInsights provide customized market report data for the financial App industry?

Yes, ConsaInsights offers tailored market report data specific to the financial app industry, allowing clients to receive insights and analyses that align with their unique business needs and strategic goals.

What deliverables can I expect from this financial App market research project?

Expect comprehensive deliverables, including market analysis, regional insights, competitive landscape evaluations, and segmentation data, which comprehensively outline trends, growth forecasts, and opportunities within the financial app market.

What are the market trends of financial App?

Current trends in the financial app market include increasing adoption of mobile applications, enhanced security features, personalized finance solutions, and the rise of subscription-based pricing models, reflecting evolving consumer preferences.