Fingerprint Biometrics Market Report

Published Date: 31 January 2026 | Report Code: fingerprint-biometrics

Fingerprint Biometrics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fingerprint Biometrics market, covering market size, trends, and forecasts from 2023 to 2033, along with significant regional insights and competitive landscape data.

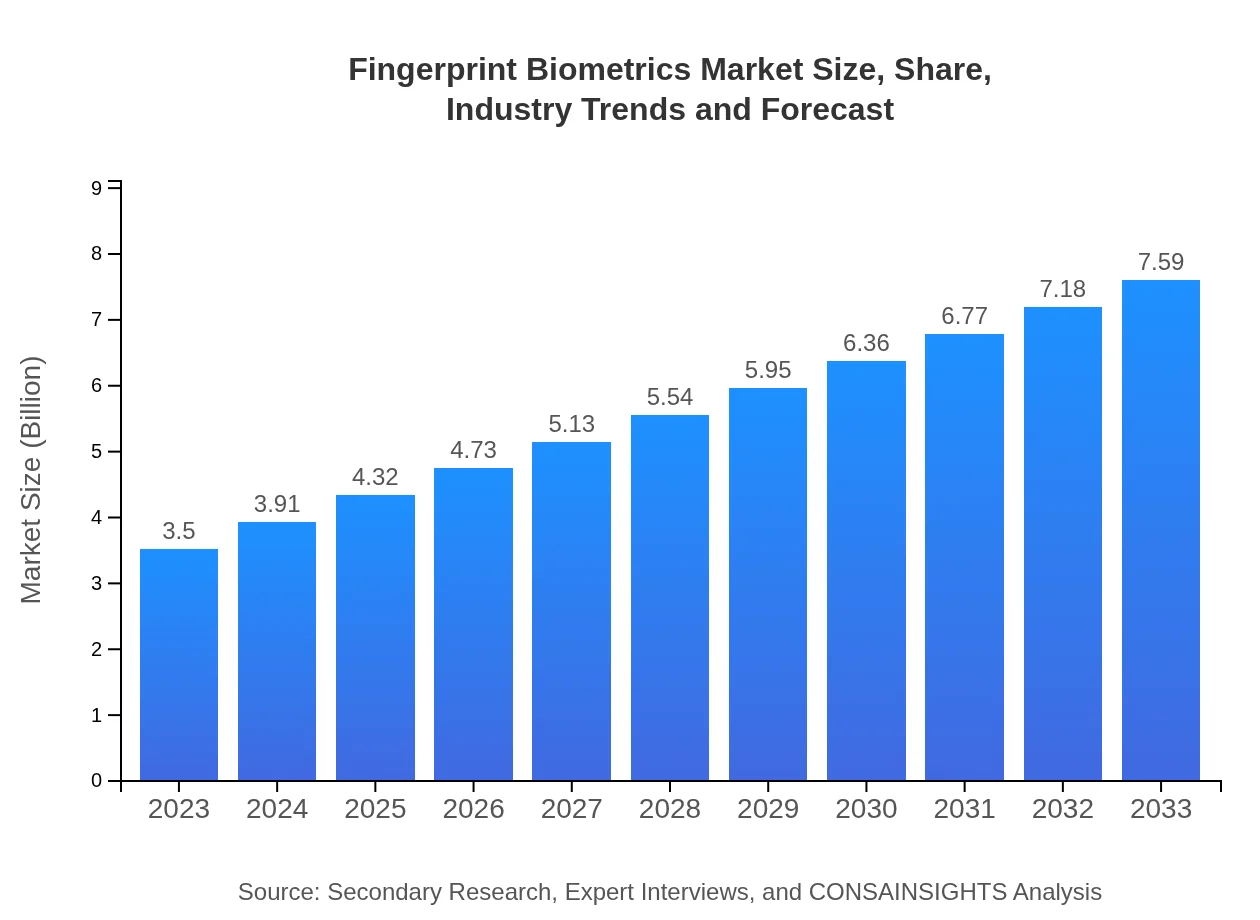

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.59 Billion |

| Top Companies | NEC Corporation, Idemia, Gemalto (Thales Group), Innovatrics, Futronic Technology Company |

| Last Modified Date | 31 January 2026 |

Fingerprint Biometrics Market Overview

Customize Fingerprint Biometrics Market Report market research report

- ✔ Get in-depth analysis of Fingerprint Biometrics market size, growth, and forecasts.

- ✔ Understand Fingerprint Biometrics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fingerprint Biometrics

What is the Market Size & CAGR of Fingerprint Biometrics market in 2023?

Fingerprint Biometrics Industry Analysis

Fingerprint Biometrics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fingerprint Biometrics Market Analysis Report by Region

Europe Fingerprint Biometrics Market Report:

Europe's market is projected to grow from $0.96 billion in 2023 to $2.07 billion by 2033. The increased focus on privacy regulations and compliance standards, such as GDPR, is propelling organizations to seek biometric solutions for secure access and identity management.Asia Pacific Fingerprint Biometrics Market Report:

The Asia Pacific region is experiencing rapid growth in the Fingerprint Biometrics market, projected to increase from $0.66 billion in 2023 to $1.43 billion by 2033. This growth is driven by the expanding adoption of biometric solutions in the banking and consumer electronics sectors, particularly in emerging economies like India and China where there is a strong demand for secure payment systems.North America Fingerprint Biometrics Market Report:

North America holds a significant share of the Fingerprint Biometrics market, estimated to reach $2.95 billion by 2033 from $1.36 billion in 2023. The region is witnessing robust investment in security technologies across various sectors, including government, finance, and healthcare, due to escalating concerns around identity theft and data breaches.South America Fingerprint Biometrics Market Report:

In South America, the Fingerprint Biometrics market is expected to grow from $0.23 billion in 2023 to $0.49 billion in 2033. The rise in digital payment solutions and government initiatives to improve security infrastructure are key drivers contributing to this growth.Middle East & Africa Fingerprint Biometrics Market Report:

In the Middle East and Africa, market size is likely to grow from $0.29 billion in 2023 to $0.64 billion by 2033, driven by an increase in investments towards smart city initiatives and enhanced security measures in airports and public facilities.Tell us your focus area and get a customized research report.

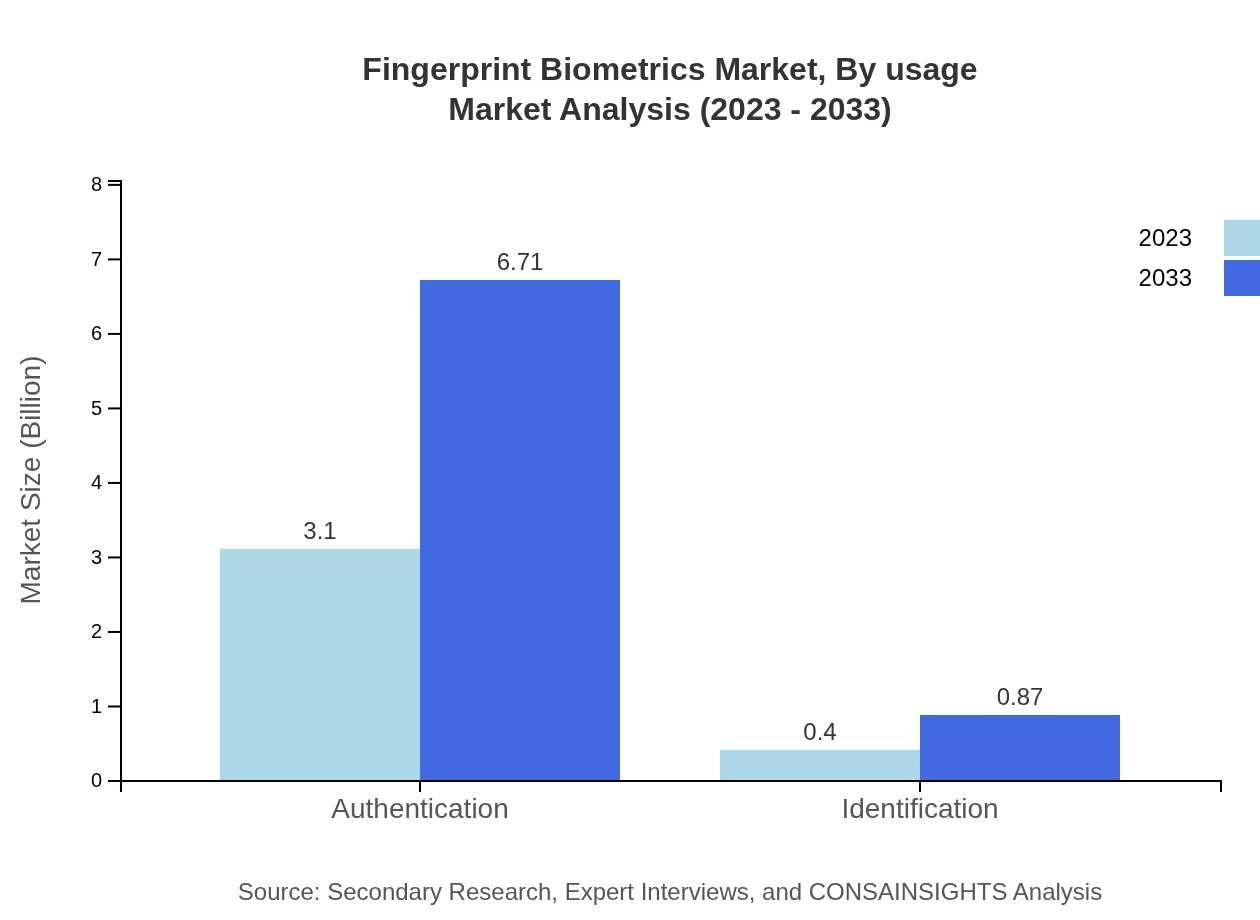

Fingerprint Biometrics Market Analysis By Application

The Fingerprint Biometrics market, by application, includes segments such as Authentication and Identification. The authentication segment is projected to dominate the market, with a size projected growth from $3.10 billion in 2023 to $6.71 billion by 2033, representing a steady share of 88.49%. Identification applications, while smaller, are also expected to see growth from $0.40 billion to $0.87 billion over the same period, indicating its profiling significance in security applications.

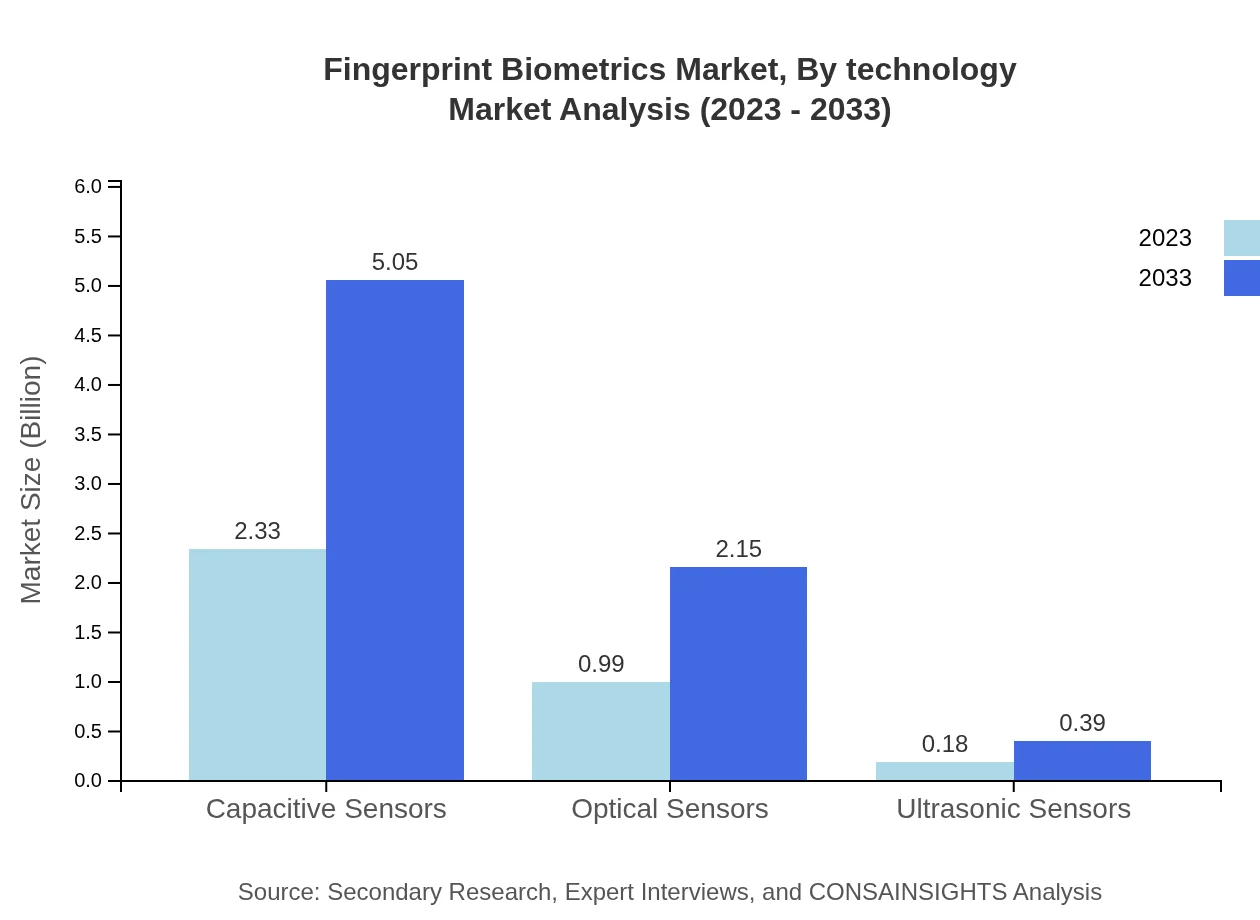

Fingerprint Biometrics Market Analysis By Technology

By technology, the Fingerprint Biometrics market encompasses various sensor types. Capacitive sensors are leading the market, with a size expected to reach $5.05 billion by 2033 from $2.33 billion in 2023. Optical sensors will follow, growing to $2.15 billion by 2033 from $0.99 billion. Ultrasonic sensors, while smaller, are also anticipated to grow from $0.18 billion to $0.39 billion, indicating a diversified technology application across the biometric landscape.

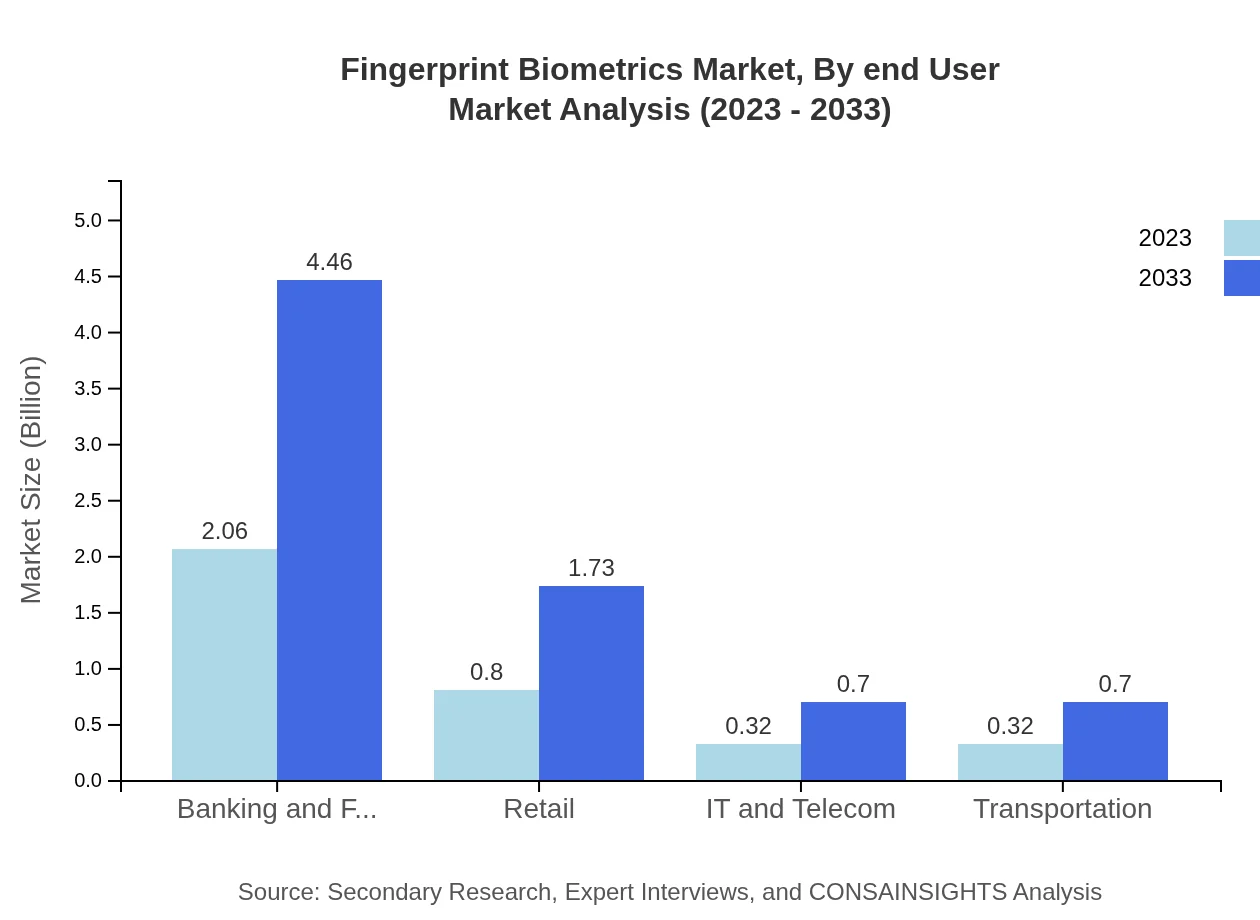

Fingerprint Biometrics Market Analysis By End User

The Fingerprint Biometrics market, by end-user, reveals critical insights across sectors like Banking and Financial Services, Retail, IT and Telecom, and Government. The Banking and Financial Services sector holds the largest share, projected to grow from $2.06 billion to $4.46 billion, capturing around 58.77% of the market share by 2033. Retail also plays a significant role, increasing from $0.80 billion to $1.73 billion, reflecting its importance in securing consumer transactions.

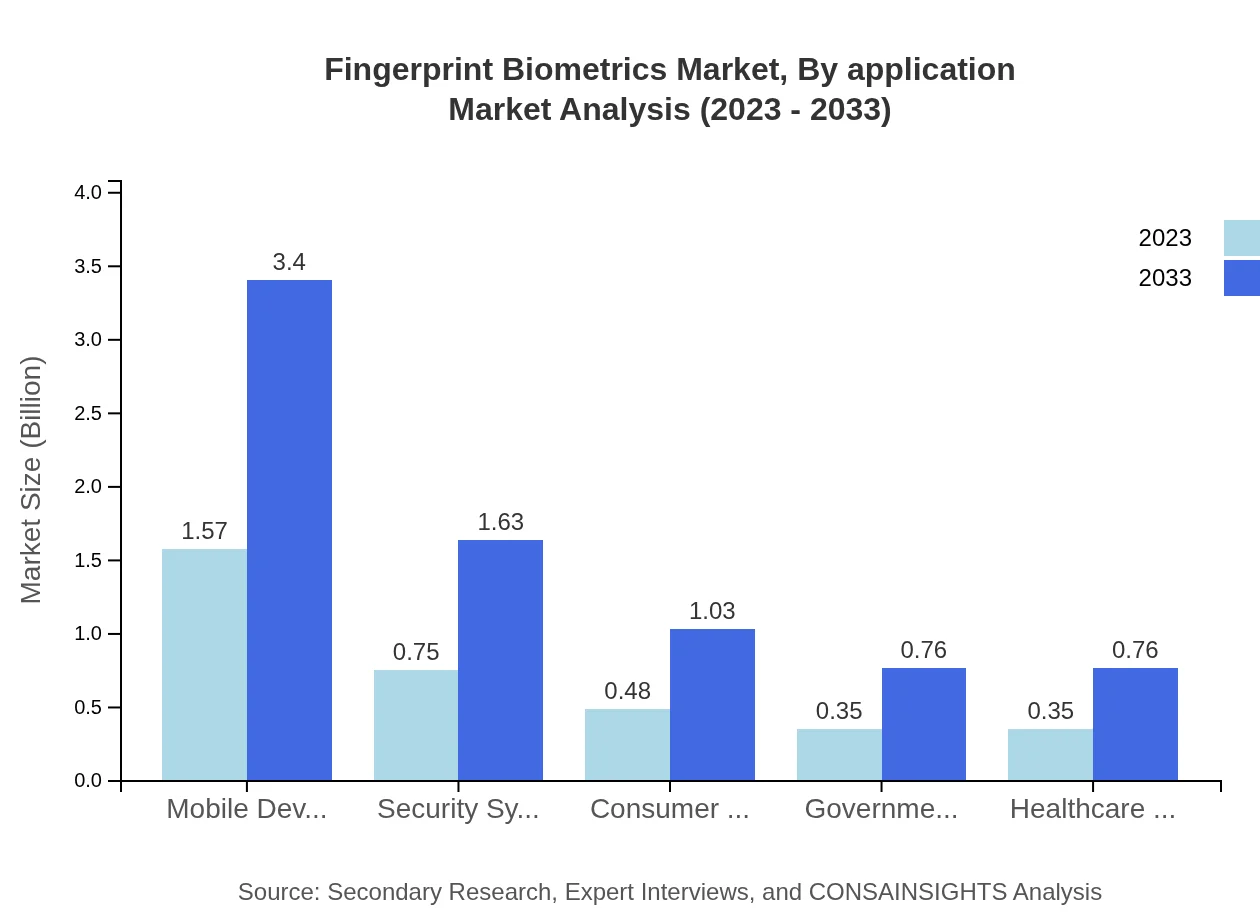

Fingerprint Biometrics Market Analysis By Usage

The usage analysis of Fingerprint Biometrics highlights essential applications in personal devices, enterprise solutions, and security systems. Mobile Devices constitute a major share, growing from $1.57 billion to $3.40 billion, indicating a significant trend towards integrating biometric solutions in everyday consumer electronics and enhancing security measures in various applications.

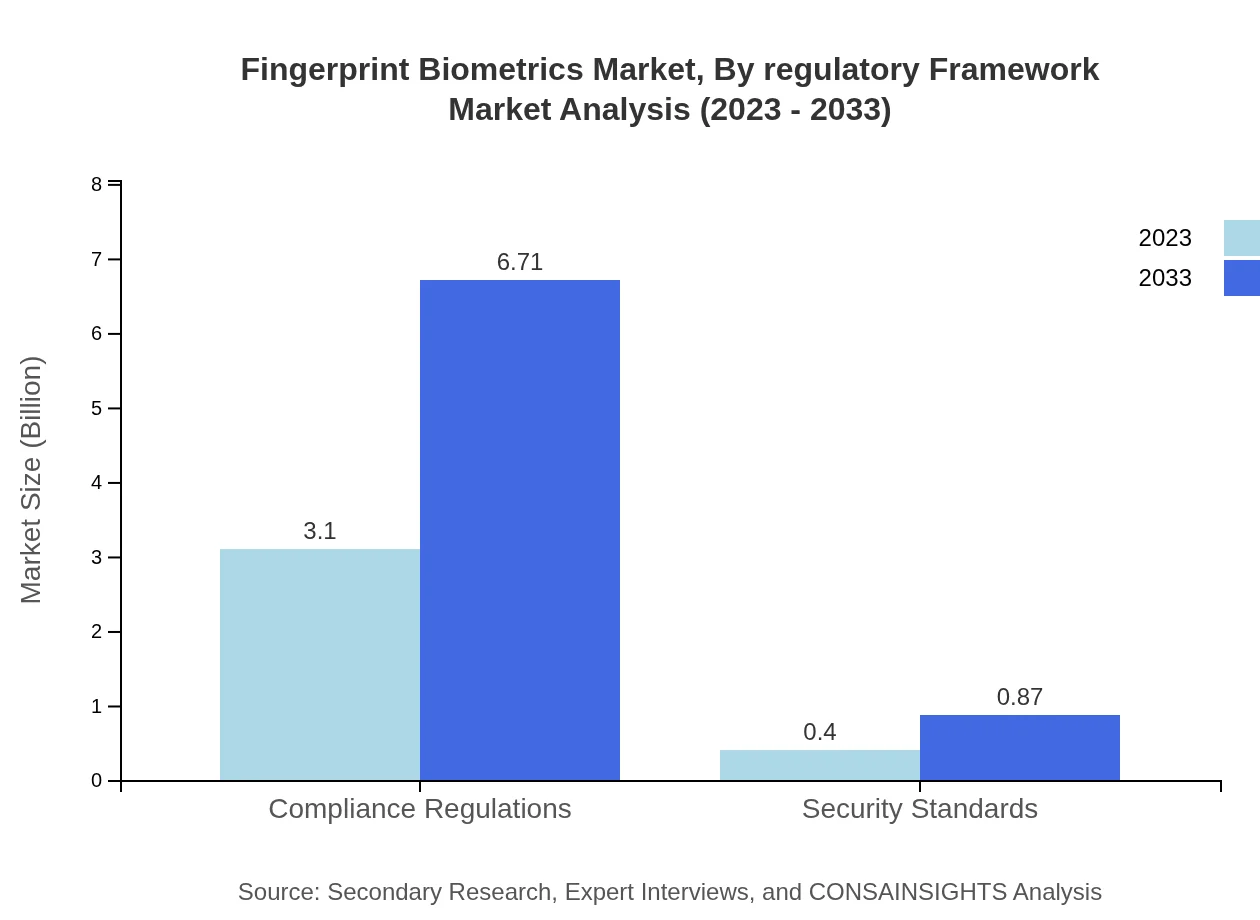

Fingerprint Biometrics Market Analysis By Regulatory Framework

Compliance regulations play a crucial role in the Fingerprint Biometrics market. The segment of security standards and regulations is anticipated to influence market dynamics significantly. As organizations seek to comply with strict data protection and privacy laws, the demand for biometric solutions that enhance identity verification and secure transactions is projected to rise.

Fingerprint Biometrics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fingerprint Biometrics Industry

NEC Corporation:

NEC Corporation provides integrated solutions for biometric authentication and is renowned for its advanced fingerprint recognition technology, catering to both governmental and commercial applications.Idemia:

Idemia specializes in identity and security solutions, delivering biometric technology for various sectors including banking, government, and telecommunications, focusing on personal identity management.Gemalto (Thales Group):

Gemalto, now part of Thales Group, focuses on digital security and provides biometric solutions that enhance identification processes, driving significant advancements in digital identity and security technologies.Innovatrics:

Innovatrics is known for its biometric software and solutions for identity management, specializing in fingerprint technology for various applications from law enforcement to civil ID systems.Futronic Technology Company:

Futronic Technology manufactures fingerprint recognition systems and mobile biometric devices, providing innovative security solutions for personal and commercial use.We're grateful to work with incredible clients.

FAQs

What is the market size of fingerprint Biometrics?

The fingerprint biometrics market is currently valued at $3.5 billion with a CAGR of 7.8%. This growth is driven by increasing adoption in various sectors, including banking and security.

What are the key market players or companies in the fingerprint Biometrics industry?

Key players in the fingerprint biometrics market include Identiv, NEC Corporation, and Crossmatch. These companies dominate with innovations in technology and strategic partnerships ensuring robust market presence.

What are the primary factors driving the growth in the fingerprint Biometrics industry?

Key Growth drivers include heightened security needs, advancements in biometric technology, and increased smartphone adoption, all fostering demand for fingerprint biometric solutions across various industries.

Which region is the fastest Growing in the fingerprint Biometrics?

Asia Pacific is the fastest-growing region in the fingerprint biometrics market, expanding from $0.66 billion in 2023 to $1.43 billion by 2033, reflecting significant investment in technology.

Does ConsaInsights provide customized market report data for the fingerprint Biometrics industry?

Yes, ConsaInsights offers customized market report data tailored to the fingerprint biometrics industry, allowing clients to gain insights specific to their needs and strategic objectives.

What deliverables can I expect from this fingerprint Biometrics market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscapes, segmentation insights, and tailored recommendations, providing actionable insights for strategic planning.

What are the market trends of fingerprint Biometrics?

Notable trends include increased adoption of fingerprint biometrics in mobile devices, significant growth in the banking and financial services sector, and advancements in sensor technology enhancing security measures.