Fingerprint Module Market Report

Published Date: 31 January 2026 | Report Code: fingerprint-module

Fingerprint Module Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fingerprint Module market, covering growth trends, market size, segmentation, and regional insights from 2023 to 2033. It aims to deliver valuable data and forecasts for stakeholders in the fingerprint module industry.

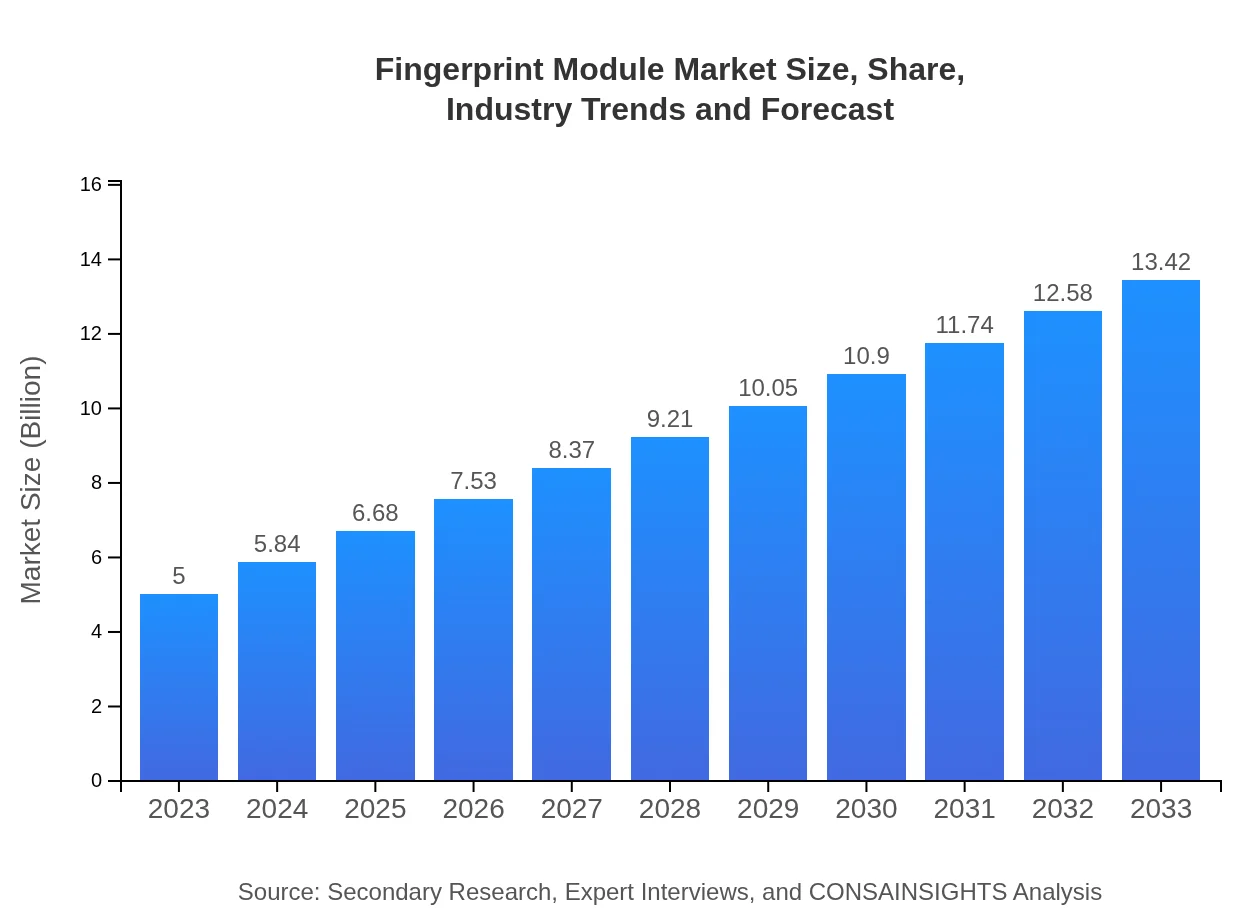

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $13.42 Billion |

| Top Companies | Synaptics, IDEX Biometrics, FPC (Fingerprint Cards AB), Qualcomm Technologies, Inc., Honeywell |

| Last Modified Date | 31 January 2026 |

Fingerprint Module Market Overview

Customize Fingerprint Module Market Report market research report

- ✔ Get in-depth analysis of Fingerprint Module market size, growth, and forecasts.

- ✔ Understand Fingerprint Module's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fingerprint Module

What is the Market Size & CAGR of Fingerprint Module market in 2023?

Fingerprint Module Industry Analysis

Fingerprint Module Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fingerprint Module Market Analysis Report by Region

Europe Fingerprint Module Market Report:

Europe is estimated to grow from $1.69 billion in 2023 to $4.53 billion by 2033, driven by increasing investments in smart city initiatives and enhanced security measures across various sectors. Countries in Europe are leading initiatives emphasizing data protection, contributing to the overall growth.Asia Pacific Fingerprint Module Market Report:

The Asia Pacific region holds a significant share in the Fingerprint Module market, with a projected market size of $2.38 billion by 2033, up from $0.89 billion in 2023. The increasing implementation of biometric solutions in law enforcement and financial institutions, along with high smartphone penetration, ensures sustained market growth.North America Fingerprint Module Market Report:

North America boasts a mature Fingerprint Module market, estimated to grow from $1.74 billion in 2023 to $4.68 billion by 2033. The region is characterized by high consumer demand for advanced security features in smartphones and electronic devices, facilitated by stringent regulatory requirements for data security.South America Fingerprint Module Market Report:

The South America Fingerprint Module market is projected to show steady growth despite current negative figures, with a slight increase expected by 2033. Market players are focusing on enhancing security measures in governmental and financial services, presenting potential growth opportunities once stability returns.Middle East & Africa Fingerprint Module Market Report:

The Middle East and Africa are expected to increase Fingerprint Module market size from $0.69 billion in 2023 to $1.86 billion by 2033. Factors like heightened adoption of biometric systems in high-security facilities and law enforcement agencies are propelling this growth.Tell us your focus area and get a customized research report.

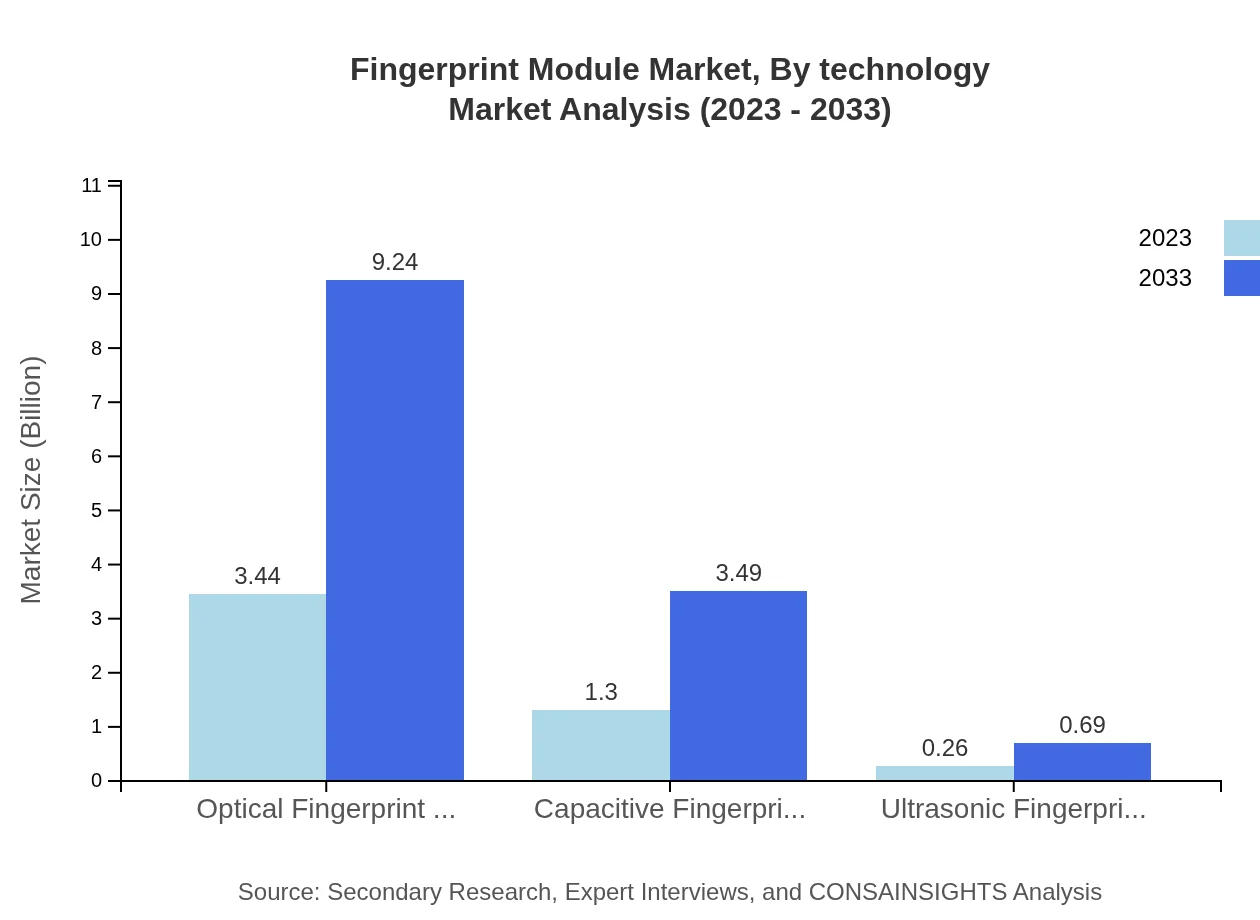

Fingerprint Module Market Analysis By Technology

Optical Fingerprint Modules dominate the market with a size of $3.44 billion in 2023, projected to grow to $9.24 billion by 2033. Capacitive modules follow, expected to reach $3.49 billion by 2033 from $1.30 billion. Ultrasonic modules, while currently smaller at $0.26 billion in 2023, show potential with growth to $0.69 billion by 2033.

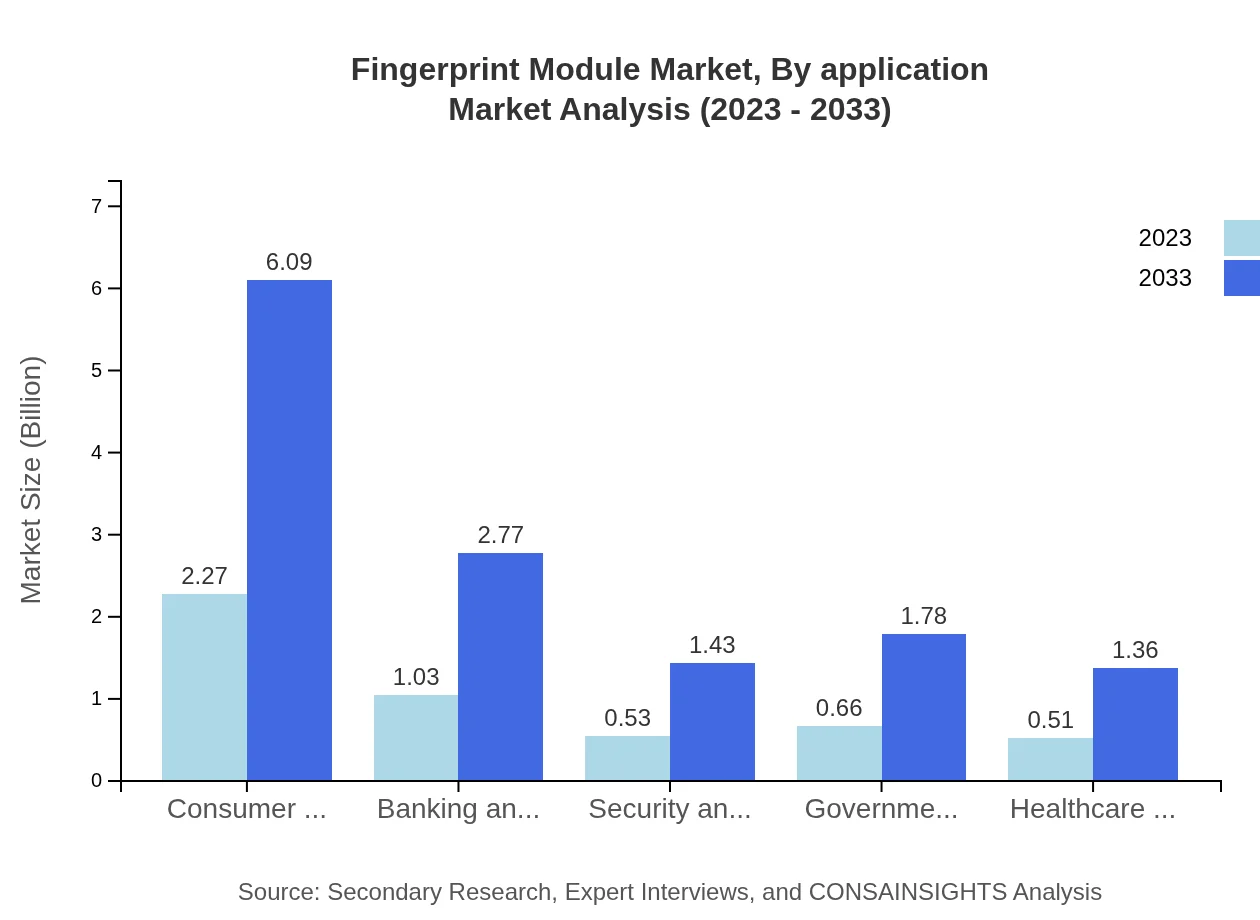

Fingerprint Module Market Analysis By Application

The Consumer Electronics segment leads with a substantial size of $2.27 billion in 2023, increasing to $6.09 billion by 2033. The Banking and Financial Services sector, starting at $1.03 billion, is anticipated to reach $2.77 billion, followed by Security and Access Control applications growing from $0.53 billion to $1.43 billion.

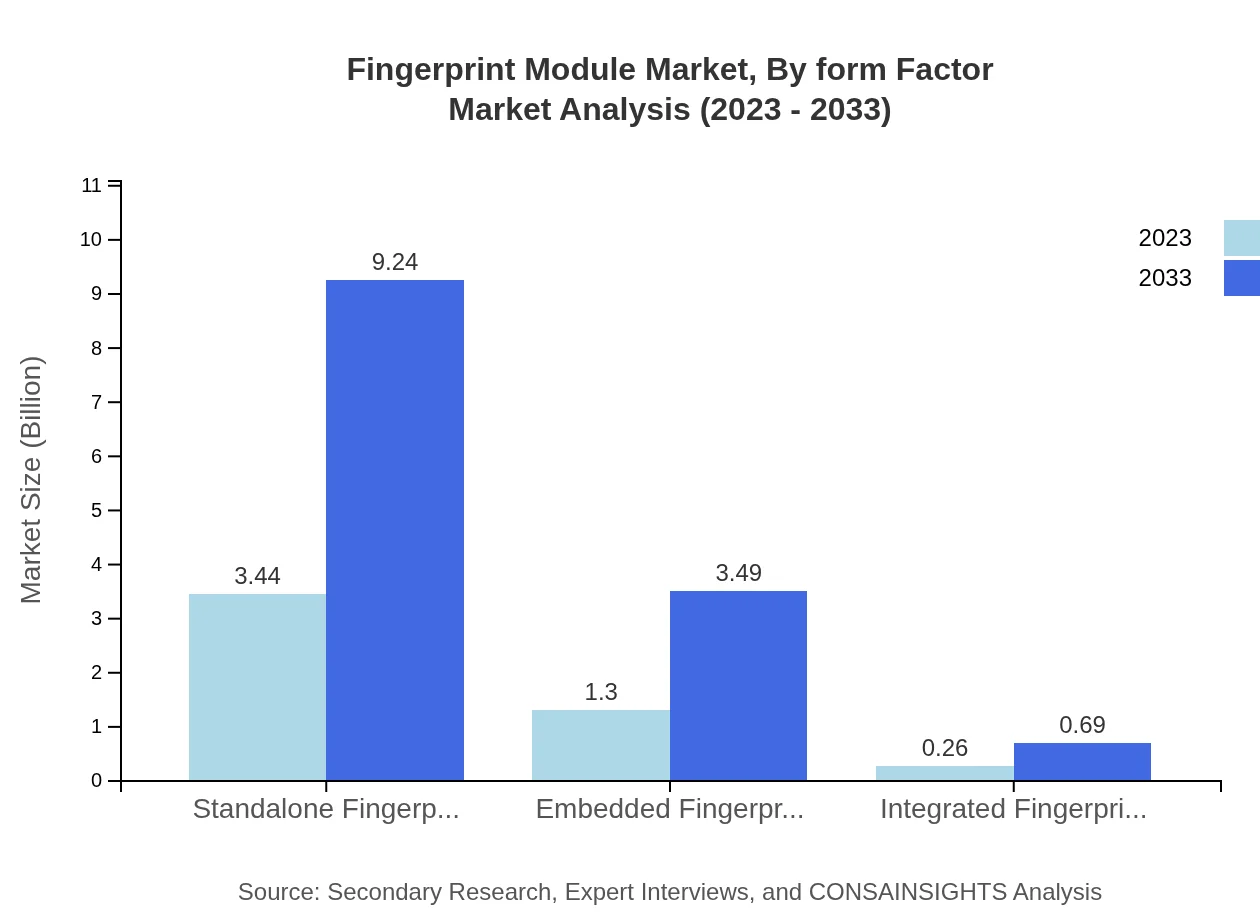

Fingerprint Module Market Analysis By Form Factor

Standalone Fingerprint Modules represent the largest market share with $3.44 billion in 2023, expected to rise significantly by 2033. Embedded Fingerprint Modules are experiencing growth as they integrate into various devices, moving from $1.30 billion to $3.49 billion.

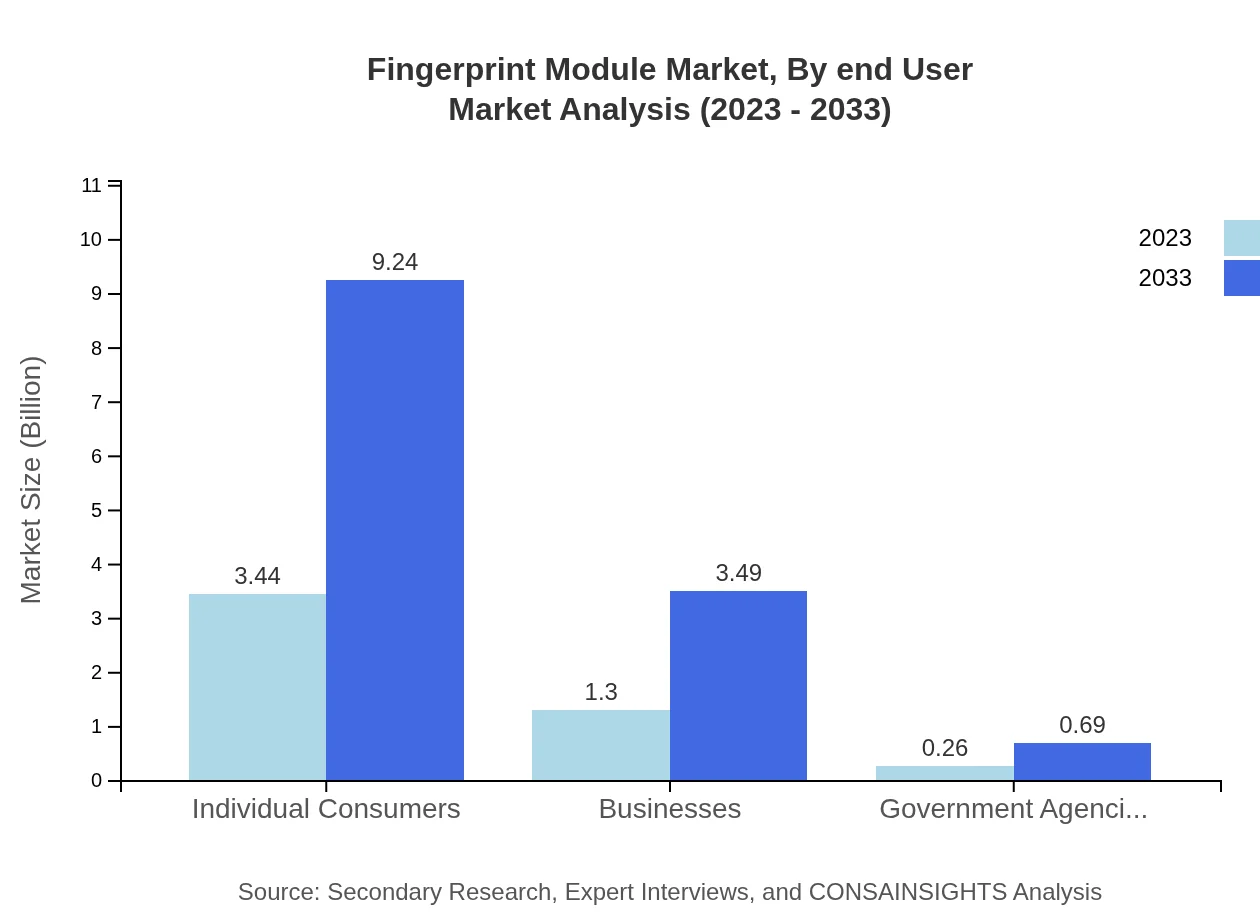

Fingerprint Module Market Analysis By End User

Individual Consumers account for the majority market share with $3.44 billion in 2023, showcasing steady growth. Businesses and Government Agencies see considerable growth in demand as regulatory requirements around security tighten.

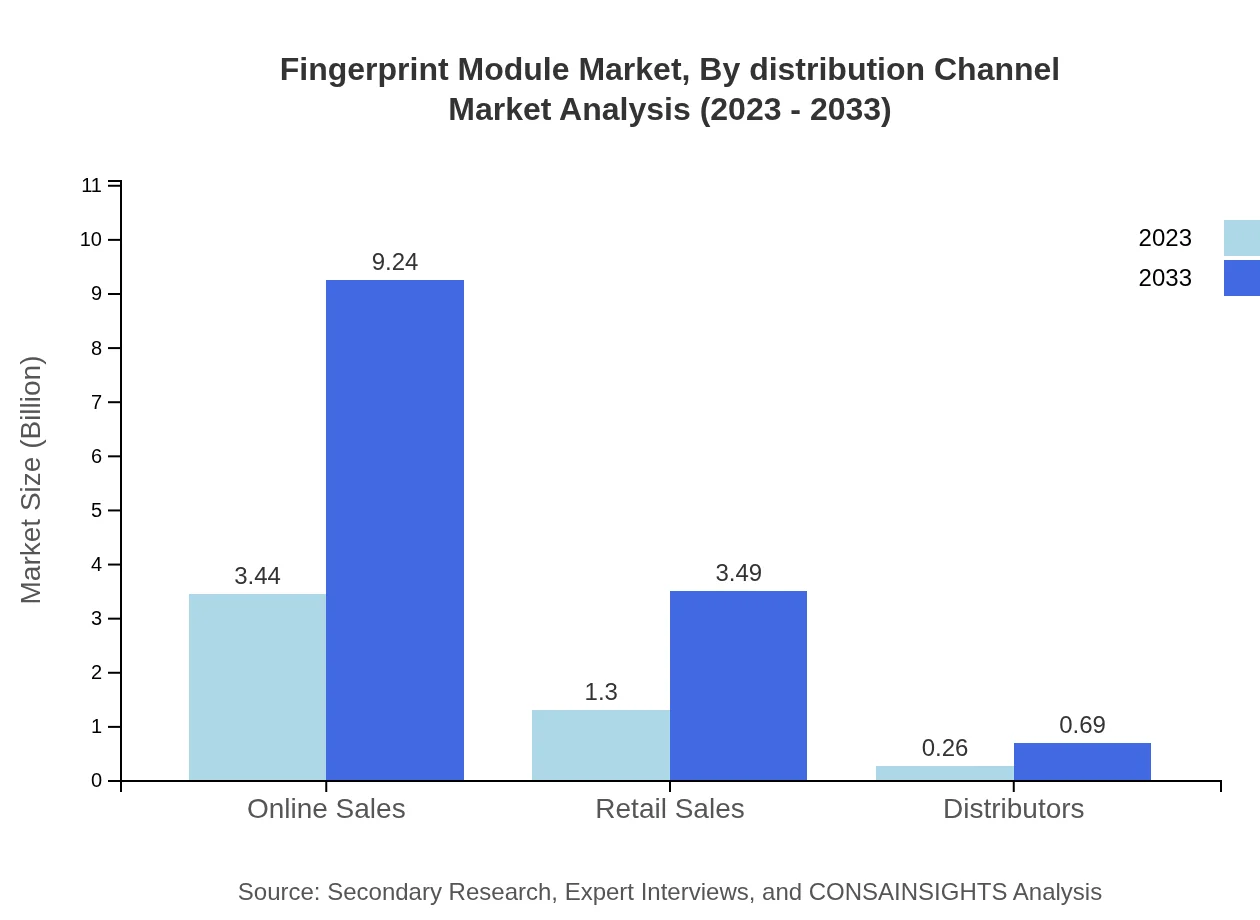

Fingerprint Module Market Analysis By Distribution Channel

Online Sales dominate at $3.44 billion in 2023, expected to soar to $9.24 billion by 2033 due to enhanced e-commerce infrastructure. Retail Sales also demonstrate healthy growth, highlighting a versatile distribution strategy.

Fingerprint Module Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fingerprint Module Industry

Synaptics:

A leading provider of human interface solutions, offering a range of fingerprint recognition modules widely used in smartphones and PCs.IDEX Biometrics:

Specializes in fingerprint recognition technology with a focus on secure access and payment solutions.FPC (Fingerprint Cards AB):

Known for its high-quality fingerprint sensors, FPC provides advanced biometric solutions for a variety of applications.Qualcomm Technologies, Inc.:

Enhances security within mobile devices using its innovative fingerprint sensor technologies.Honeywell :

Provides embedded security solutions, including fingerprint modules suitable for various commercial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of fingerprint Module?

The global fingerprint module market size is projected at $5 billion in 2023, with an expected CAGR of 10%, reaching approximately $13.1 billion by 2033, driven by increased adoption in various sectors.

What are the key market players or companies in this fingerprint Module industry?

Key players in the fingerprint module industry include major tech companies that specialize in biometric technology and hardware manufacturing, focusing on innovation and quality to maintain competitive advantages in a growing market.

What are the primary factors driving the growth in the fingerprint Module industry?

The growth in the fingerprint module industry is driven by rising security concerns, increased implementation in consumer electronics, and the demand for enhanced authentication solutions in various sectors such as banking and healthcare.

Which region is the fastest Growing in the fingerprint Module?

The Asia Pacific region is the fastest-growing market for fingerprint modules, with growth from $0.89 billion in 2023 to $2.38 billion by 2033, attributed to rapid technological advancements and rising adoption rates.

Does Consainsights provide customized market report data for the fingerprint Module industry?

Yes, Consainsights offers customized market report data tailored to specific industry needs, ensuring clients receive relevant and actionable insights to make informed business decisions in the fingerprint module sector.

What deliverables can I expect from this fingerprint Module market research project?

Deliverables from the fingerprint module market research project include detailed market analysis reports, trend identification, competitor landscape overviews, and tailored insights regarding growth opportunities in the market.

What are the market trends of fingerprint Module?

Market trends in fingerprint modules include increasing integration of biometric technologies in consumer devices, heightened investments in security infrastructure, and a growing focus on enhancing user experience through effective authentication methods.