Finished Steel Products Market Report

Published Date: 02 February 2026 | Report Code: finished-steel-products

Finished Steel Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Finished Steel Products market, covering key insights, market dynamics, growth drivers, and forecasts from 2023 to 2033.

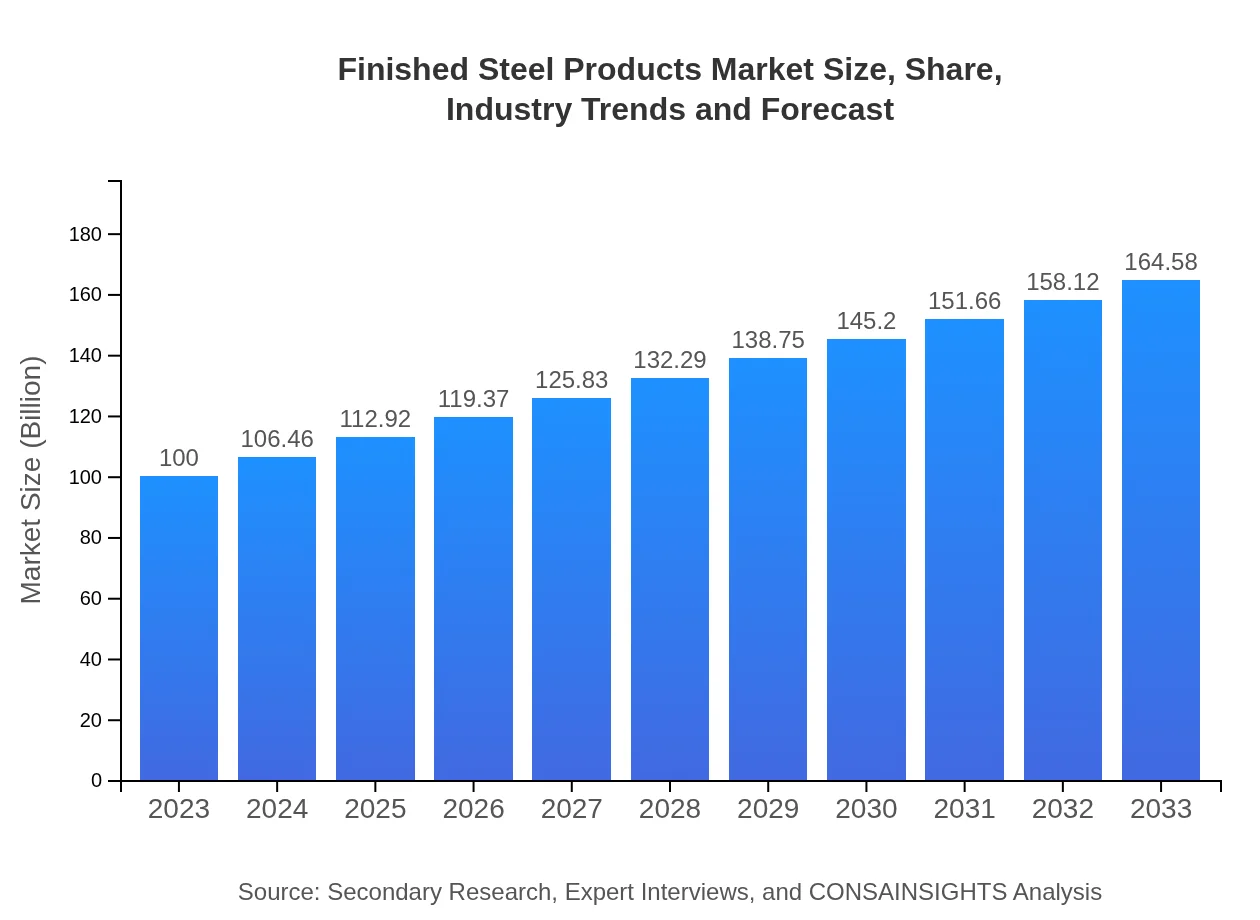

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Billion |

| Top Companies | ArcelorMittal, Nippon Steel Corporation, Tata Steel |

| Last Modified Date | 02 February 2026 |

Finished Steel Products Market Overview

Customize Finished Steel Products Market Report market research report

- ✔ Get in-depth analysis of Finished Steel Products market size, growth, and forecasts.

- ✔ Understand Finished Steel Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Finished Steel Products

What is the Market Size & CAGR of Finished Steel Products market in 2023?

Finished Steel Products Industry Analysis

Finished Steel Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Finished Steel Products Market Analysis Report by Region

Europe Finished Steel Products Market Report:

The European market for Finished Steel Products is projected to grow from $36.04 billion in 2023 to $59.31 billion by 2033, fueled by stringent construction standards and increasing investments in green building materials.Asia Pacific Finished Steel Products Market Report:

The Asia Pacific region is anticipated to exhibit substantial growth, with the market size projected to rise from $18.09 billion in 2023 to $29.77 billion in 2033. This growth is driven by rapid industrialization, urban development, and infrastructure projects in countries like China and India.North America Finished Steel Products Market Report:

North America's market is predicted to evolve from $32.32 billion in 2023 to $53.19 billion by 2033. The rise in housing developments and automotive production is driving this growth, alongside the region's focus on sustainable construction materials.South America Finished Steel Products Market Report:

In South America, the Finished Steel Products market is expected to grow from $4.87 billion in 2023 to $8.01 billion by 2033. This growth is attributed to increasing investments in construction and infrastructural projects across the region.Middle East & Africa Finished Steel Products Market Report:

The Middle East and Africa market is expected to rise from $8.68 billion in 2023 to $14.29 billion by 2033, with significant projects being undertaken in Saudi Arabia and the UAE to boost infrastructure and urban development.Tell us your focus area and get a customized research report.

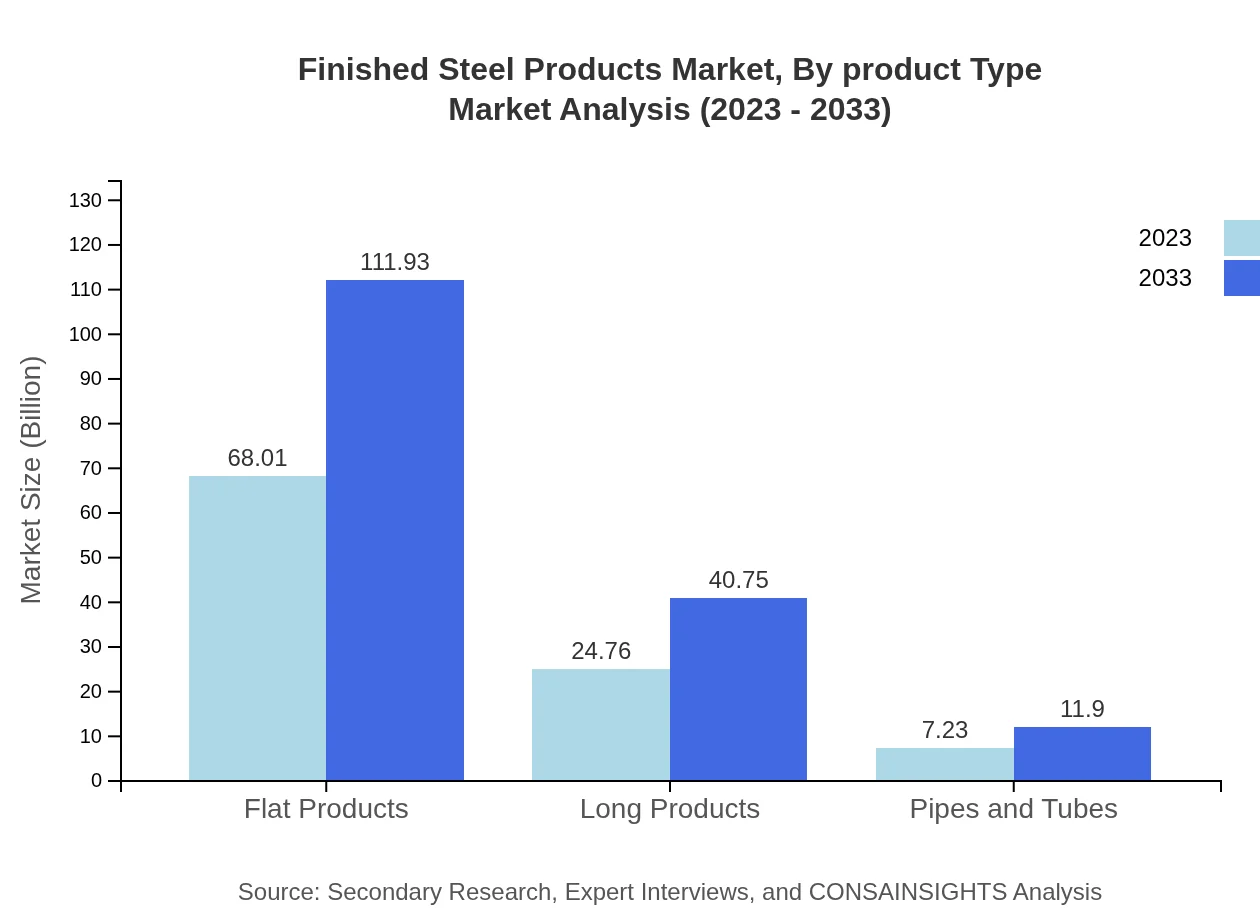

Finished Steel Products Market Analysis By Product Type

The market demonstrates a varied performance across different product types. Flat Products lead the market, growing from $68.01 billion in 2023 to $111.93 billion in 2033. Long Products follow, with market growth from $24.76 billion to $40.75 billion, while Pipes and Tubes are expected to increase from $7.23 billion to $11.90 billion during the same period.

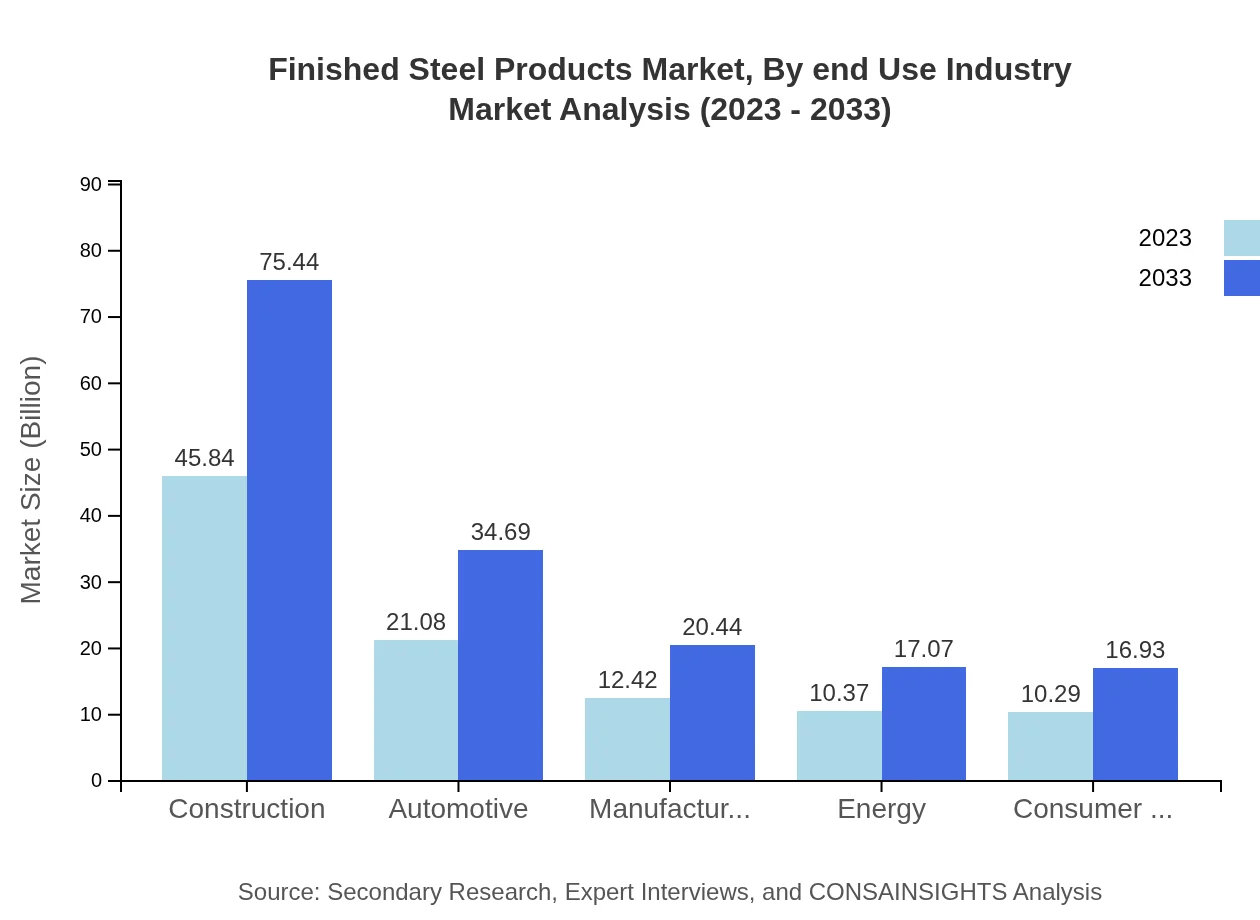

Finished Steel Products Market Analysis By End Use Industry

The construction industry is the largest end-user, growing from $45.84 billion in 2023 to $75.44 billion in 2033. The automotive sector also shows strong growth, increasing from $21.08 billion to $34.69 billion, reflecting rising vehicle production and demand for light-weight materials.

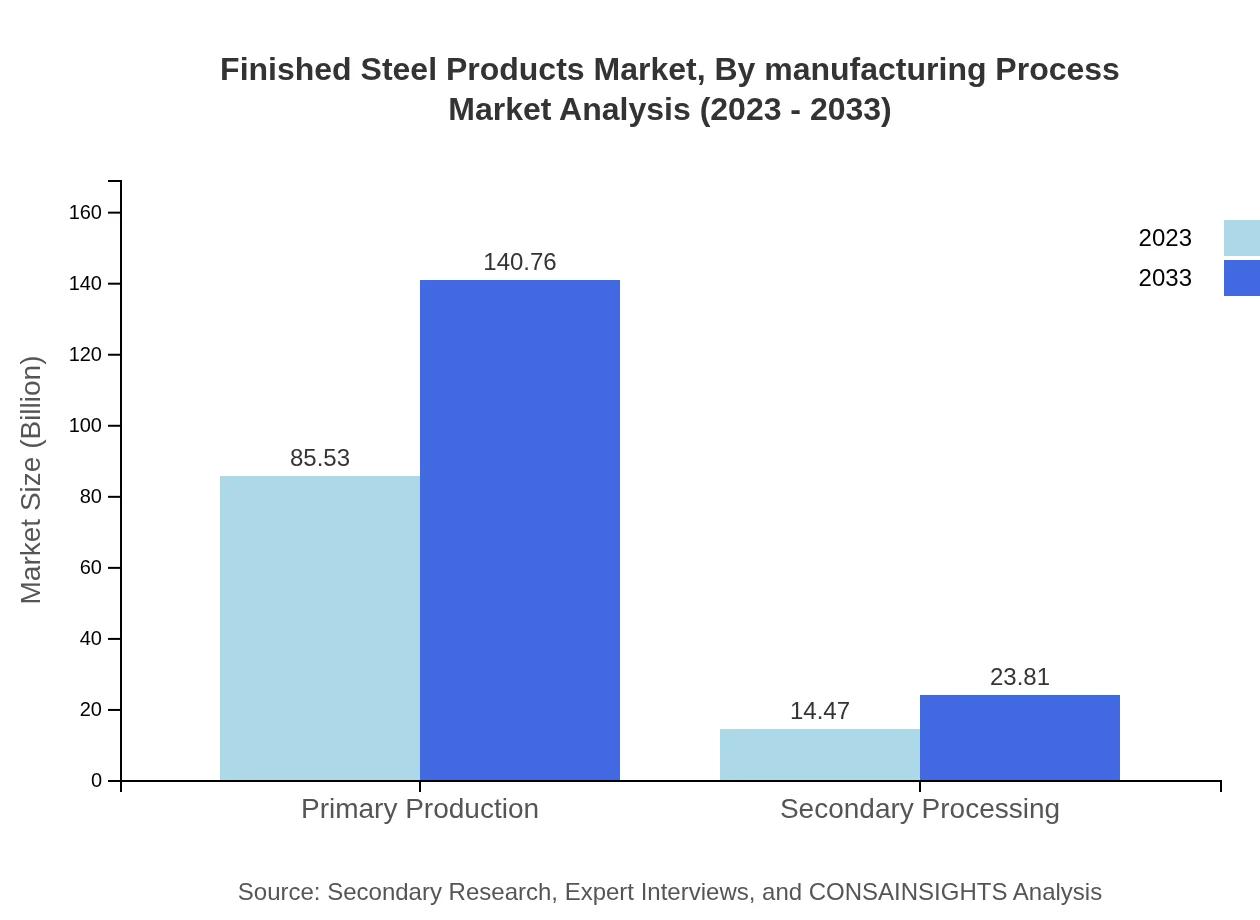

Finished Steel Products Market Analysis By Manufacturing Process

The primary production segment dominates the market, expected to grow from $85.53 billion in 2023 to $140.76 billion by 2033, driven by increased demand for primary steel products. Secondary processing is projected to rise from $14.47 billion to $23.81 billion as value-added steel products gain traction.

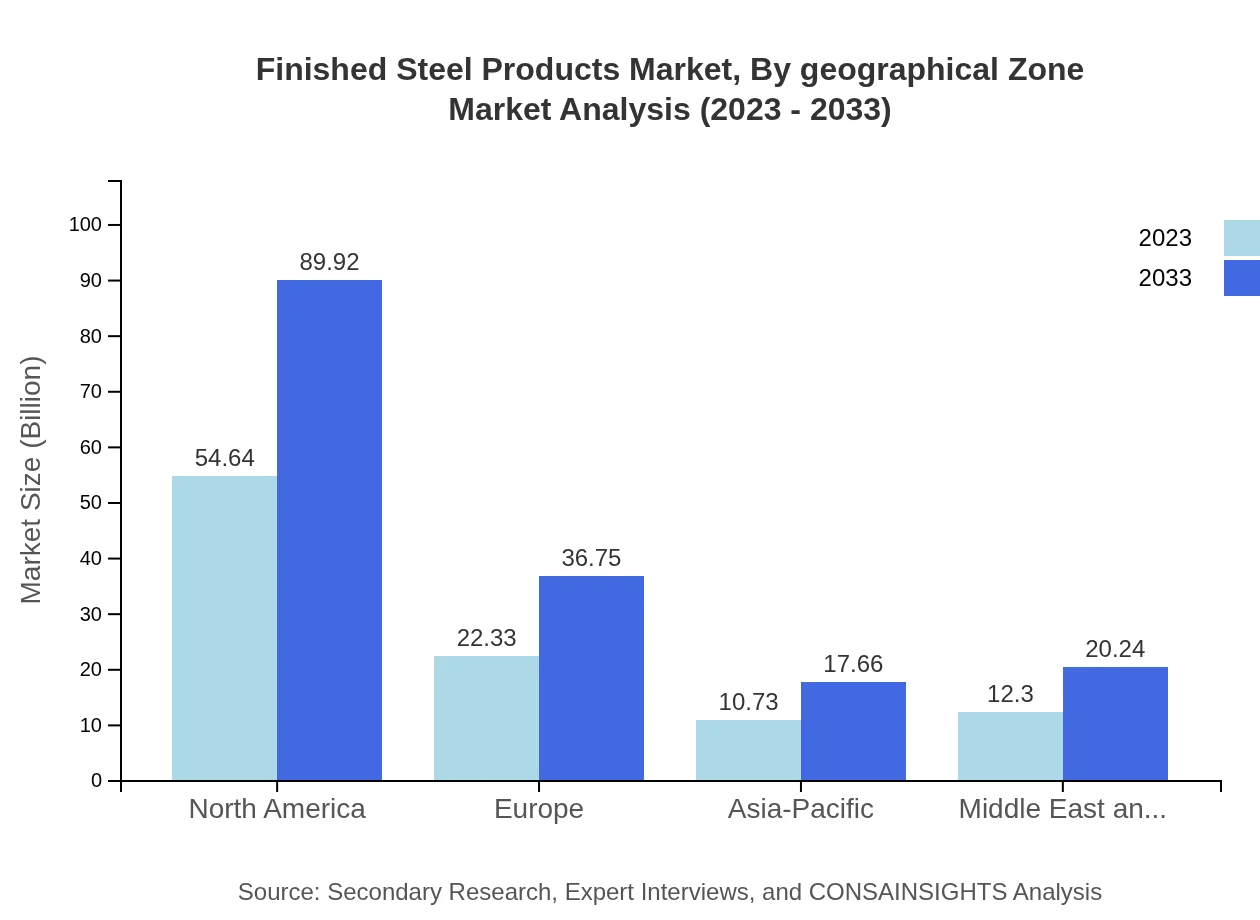

Finished Steel Products Market Analysis By Geographical Zone

The geographical segmentation of the market indicates North America as a crucial player, expected to grow significantly in the coming decade. Europe and Asia-Pacific also play substantial roles, supported by ongoing infrastructure projects and industrial activities in these regions.

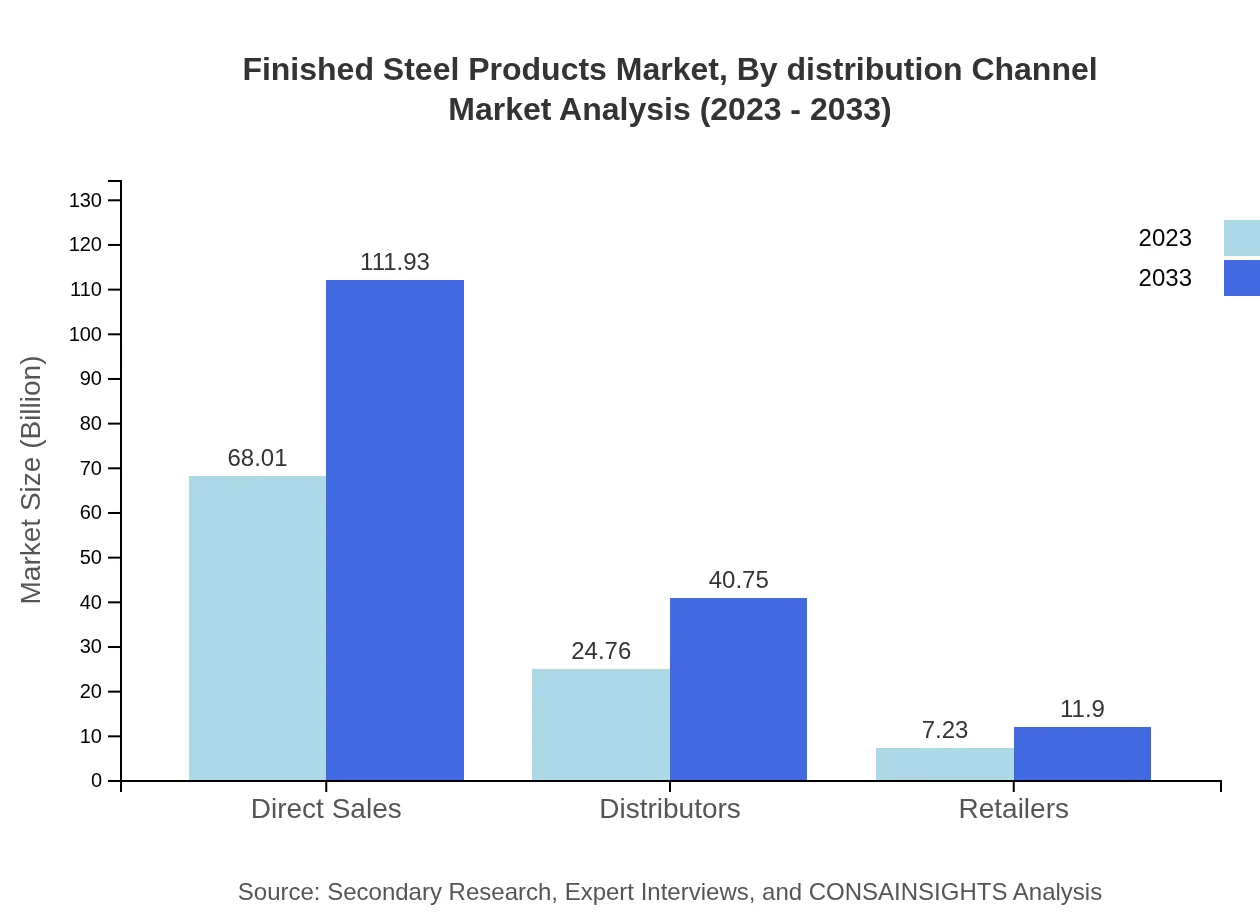

Finished Steel Products Market Analysis By Distribution Channel

Direct sales represent the largest distribution channel, forecast to grow from $68.01 billion in 2023 to $111.93 billion by 2033. Distributors and retailers follow, with significant contributions to the overall market, emphasizing the importance of varied sales channels.

Finished Steel Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Finished Steel Products Industry

ArcelorMittal:

The world's largest steel manufacturer, focusing on producing a range of steel products while maintaining a strong commitment to sustainability.Nippon Steel Corporation:

One of Japan's largest steel producers, known for high-quality steel products and innovative manufacturing techniques.Tata Steel:

A leading steel manufacturer based in India, recognized for its extensive product range and commitment to environmental sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of finished steel products?

The market size of finished steel products is projected to reach approximately $100 billion by 2033, growing at a CAGR of 5% from 2023. This growth demonstrates the industry's resilience and increasing demand across various sectors globally.

What are the key market players or companies in this industry?

Key players in the finished steel products market include major steel manufacturers and suppliers. These companies significantly influence trends, pricing, and availability of finished steel products across different segments and regions.

What are the primary factors driving the growth in the finished steel products industry?

Growth in the finished steel products industry is primarily driven by increasing construction activities, automotive production, and infrastructural developments. Additionally, innovations in manufacturing processes and rising demand from emerging economies contribute significantly to market expansion.

Which region is the fastest Growing in the finished steel products market?

The Asia Pacific region is currently the fastest-growing market for finished steel products, with expected growth from $18.09 billion in 2023 to $29.77 billion by 2033. This growth is supported by rapid industrialization and urbanization in countries like China and India.

Does ConsaInsights provide customized market report data for the finished steel products industry?

Yes, ConsaInsights offers customized market report data tailored to the finished steel products industry. Clients can request specific insights relating to market trends, competition, and forecasts to meet their unique business needs.

What deliverables can I expect from this finished steel products market research project?

Deliverables from the finished steel products market research project may include detailed market size analysis, competitive landscape assessments, trend identification, and forecasts up to 2033. Additionally, segmentation insights by region and product type will be provided.

What are the market trends of finished steel products?

Current market trends in finished steel products include a shift towards sustainable production practices, increased automation in manufacturing, and a growing focus on recycled steel. These trends reflect broader industry commitments to sustainability and efficiency.