Fintech Market Report

Published Date: 24 January 2026 | Report Code: fintech

Fintech Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Fintech market, providing comprehensive insights from 2023 to 2033. It covers market size, segmentation, analysis by region, technology impacts, and a forecast highlighting future trends and growth potential.

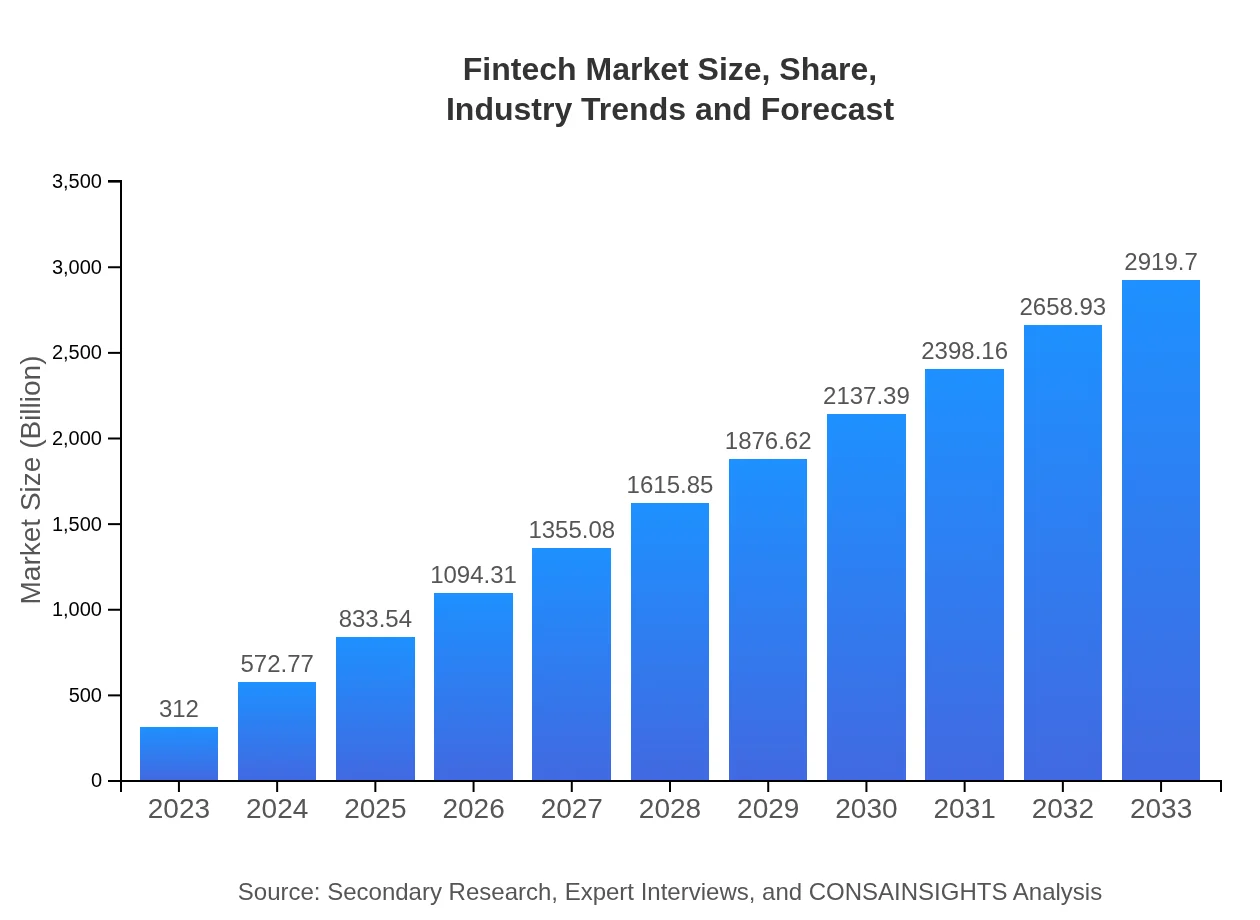

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $312.00 Billion |

| CAGR (2023-2033) | 23.5% |

| 2033 Market Size | $2919.70 Billion |

| Top Companies | PayPal, Square, Stripe, Adyen, Robinhood |

| Last Modified Date | 24 January 2026 |

Fintech Market Overview

Customize Fintech Market Report market research report

- ✔ Get in-depth analysis of Fintech market size, growth, and forecasts.

- ✔ Understand Fintech's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fintech

What is the Market Size & CAGR of Fintech market in 2023?

Fintech Industry Analysis

Fintech Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fintech Market Analysis Report by Region

Europe Fintech Market Report:

Europe’s fintech market is estimated at $105.30 billion in 2023, forecast to expand significantly to $985.40 billion by 2033. The region is characterized by strict regulations that spur innovation in compliance-focused fintech solutions. Countries like the UK, Germany, and France are at the forefront of fintech adoption, with a robust ecosystem of startups and established firms.Asia Pacific Fintech Market Report:

In 2023, the fintech market in the Asia Pacific region is valued at $57.88 billion, projected to grow to $541.60 billion by 2033. Rapid urbanization, a tech-savvy population, and an increasing number of internet users are significant factors contributing to this growth. Countries like China and India lead the charge, investing heavily in digital banking, e-wallets, and investment platforms.North America Fintech Market Report:

North America holds a substantial portion of the fintech market, projected to grow from $105.46 billion in 2023 to $986.86 billion in 2033. The region benefits from a mature financial sector and high investment in technology. Major players are innovating in areas such as AI-based financial advice and blockchain technology advancements.South America Fintech Market Report:

South America’s fintech market, valued at $23.96 billion in 2023, is set to reach $224.23 billion by 2033. The region is experiencing a surge in digital banking and mobile payment solutions, driven by increased smartphone penetration and the demand for financial inclusion, particularly in unbanked populations.Middle East & Africa Fintech Market Report:

The fintech market in the Middle East and Africa is projected to grow from $19.41 billion in 2023 to $181.61 billion by 2033. The region is witnessing rapid growth in fintech adoption, driven by government initiatives aimed at fostering innovation and enhancing financial inclusivity. Mobile payment platforms and digital banking services are gaining popularity, especially in regions with limited banking infrastructure.Tell us your focus area and get a customized research report.

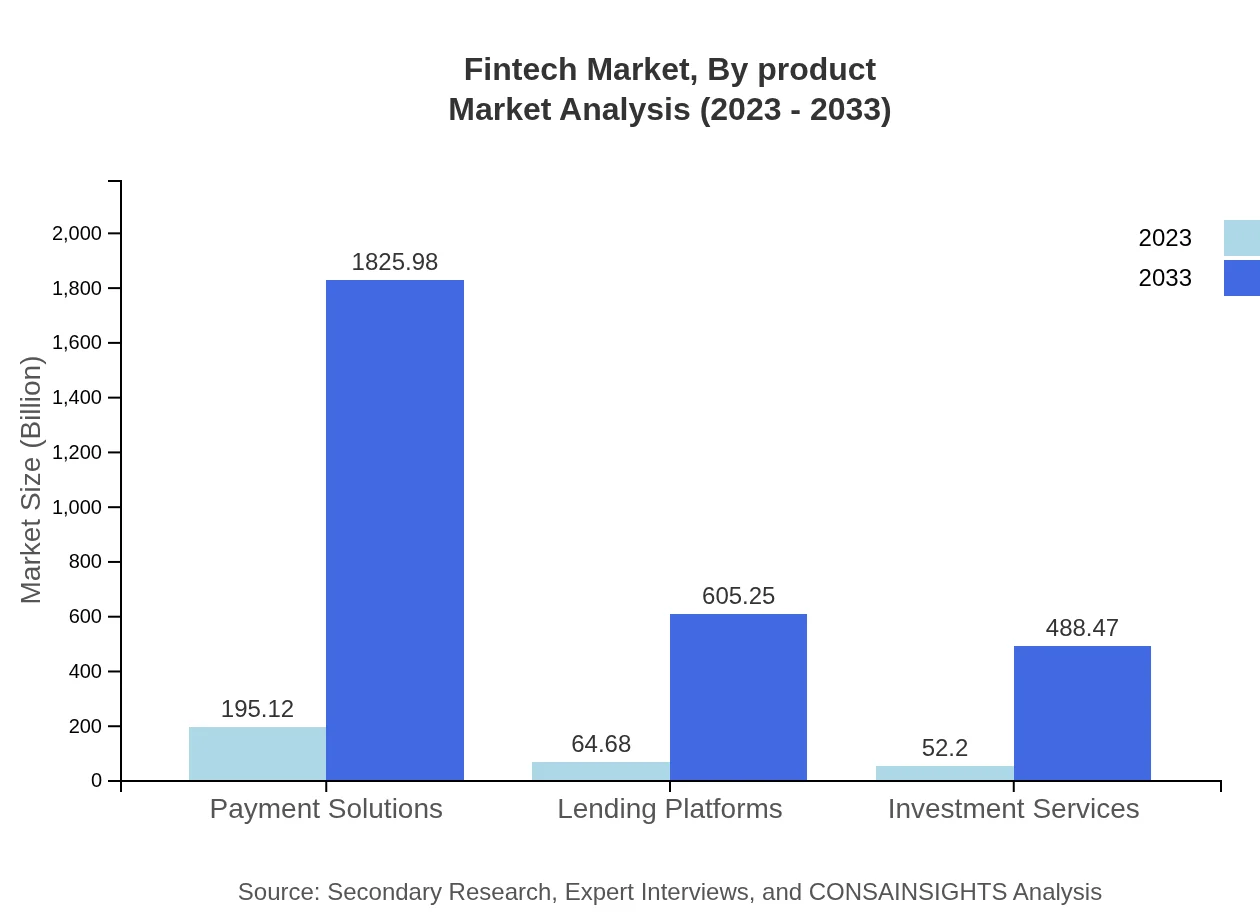

Fintech Market Analysis By Product

The payment solutions segment is currently the largest, valued at $195.12 billion in 2023, expected to balloon to $1.83 trillion by 2033. Lending platforms, valued at $64.68 billion, are forecasted to reach $605.25 billion, driven by the demand for accessible credit options. Investment services are expected to grow steadily from $52.20 billion to $488.47 billion, highlighting consumer interest in digital advice and investment management tools.

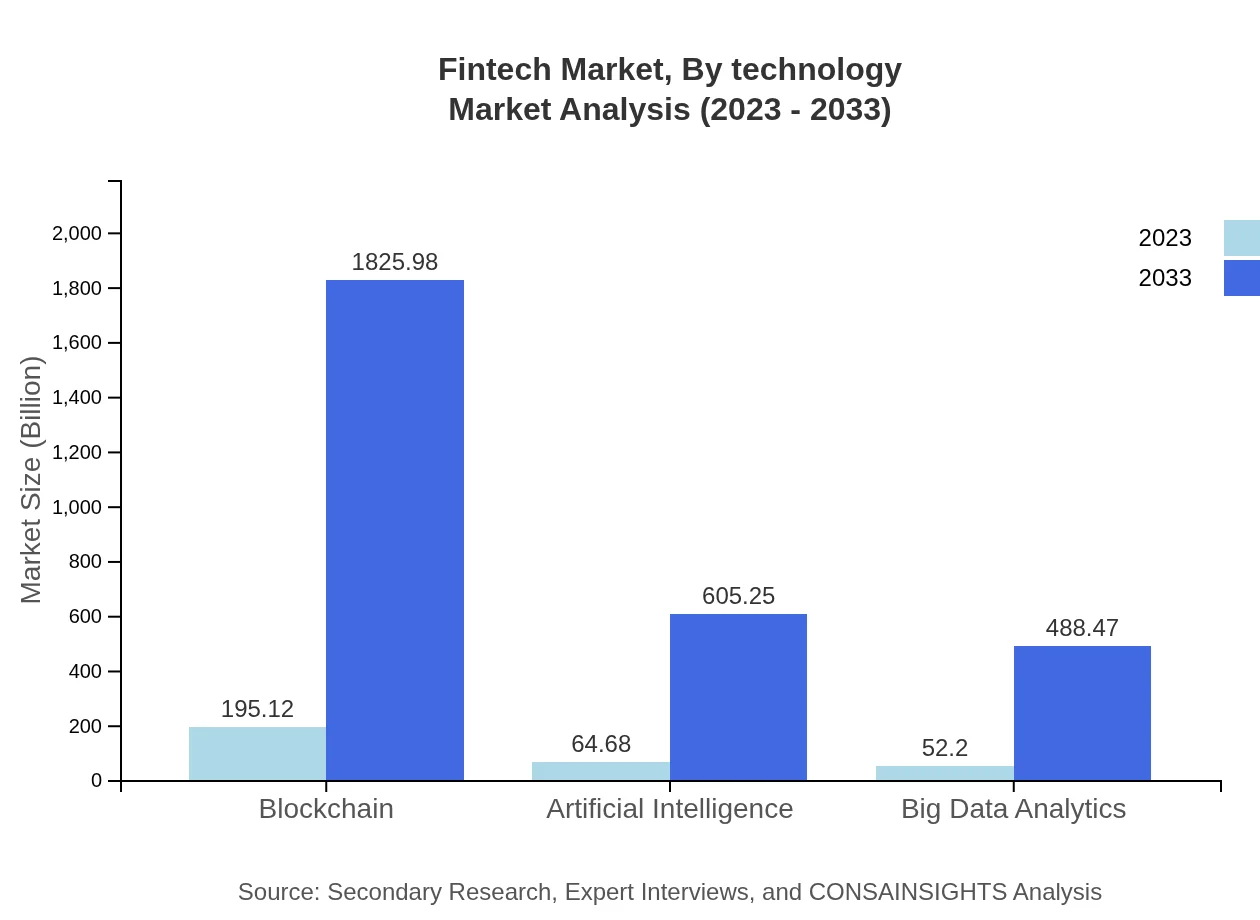

Fintech Market Analysis By Technology

Key technologies driving the fintech market include blockchain, AI, and big data analytics. Blockchain, valued at $195.12 billion in 2023, is set for explosive growth, reaching $1825.98 billion by 2033. AI technologies are also crucial, growing from $64.68 billion to $605.25 billion over the same period, enhancing the capabilities of lending platforms and investment services. Big data analytics, currently valued at $52.20 billion, is projected to increase significantly, reflecting the need for data-driven decision-making.

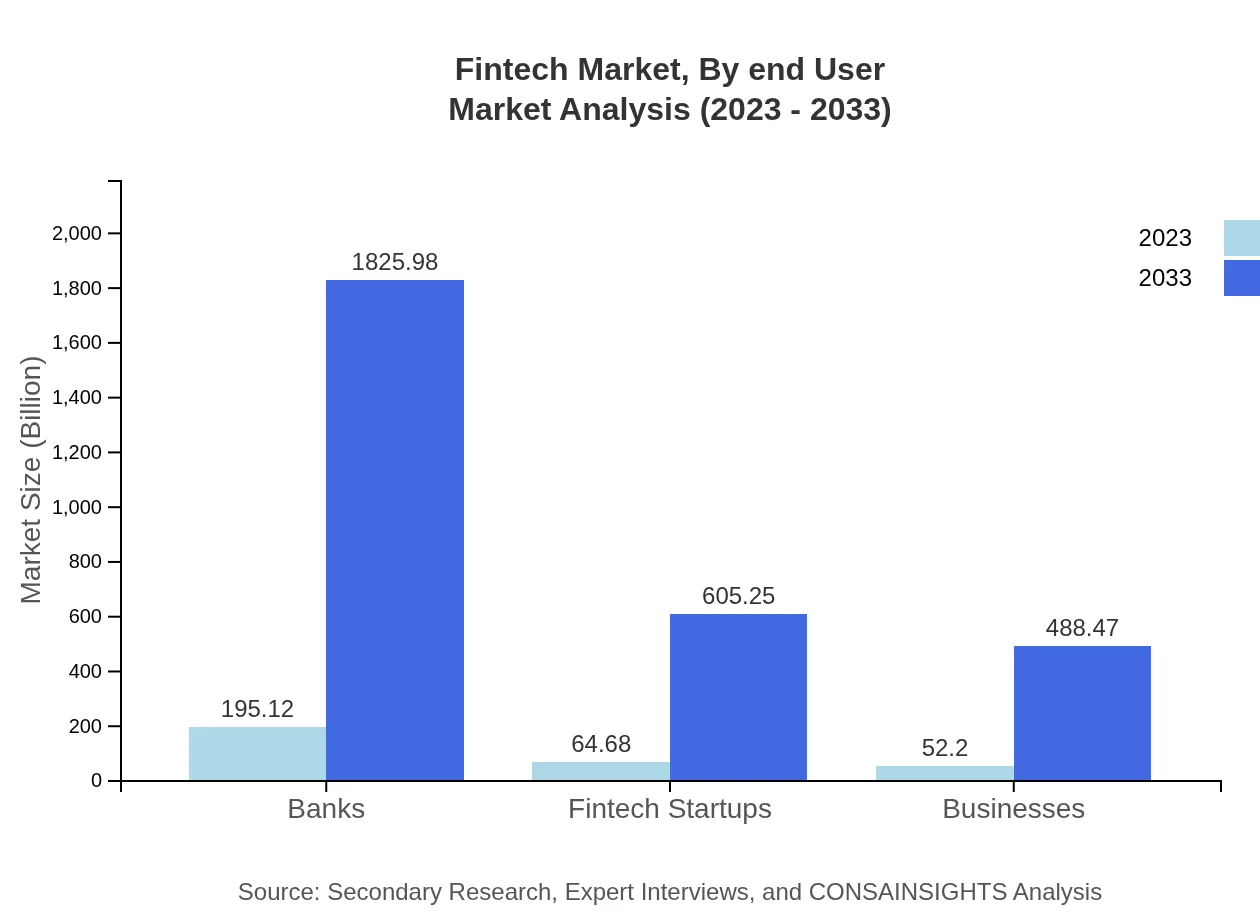

Fintech Market Analysis By End User

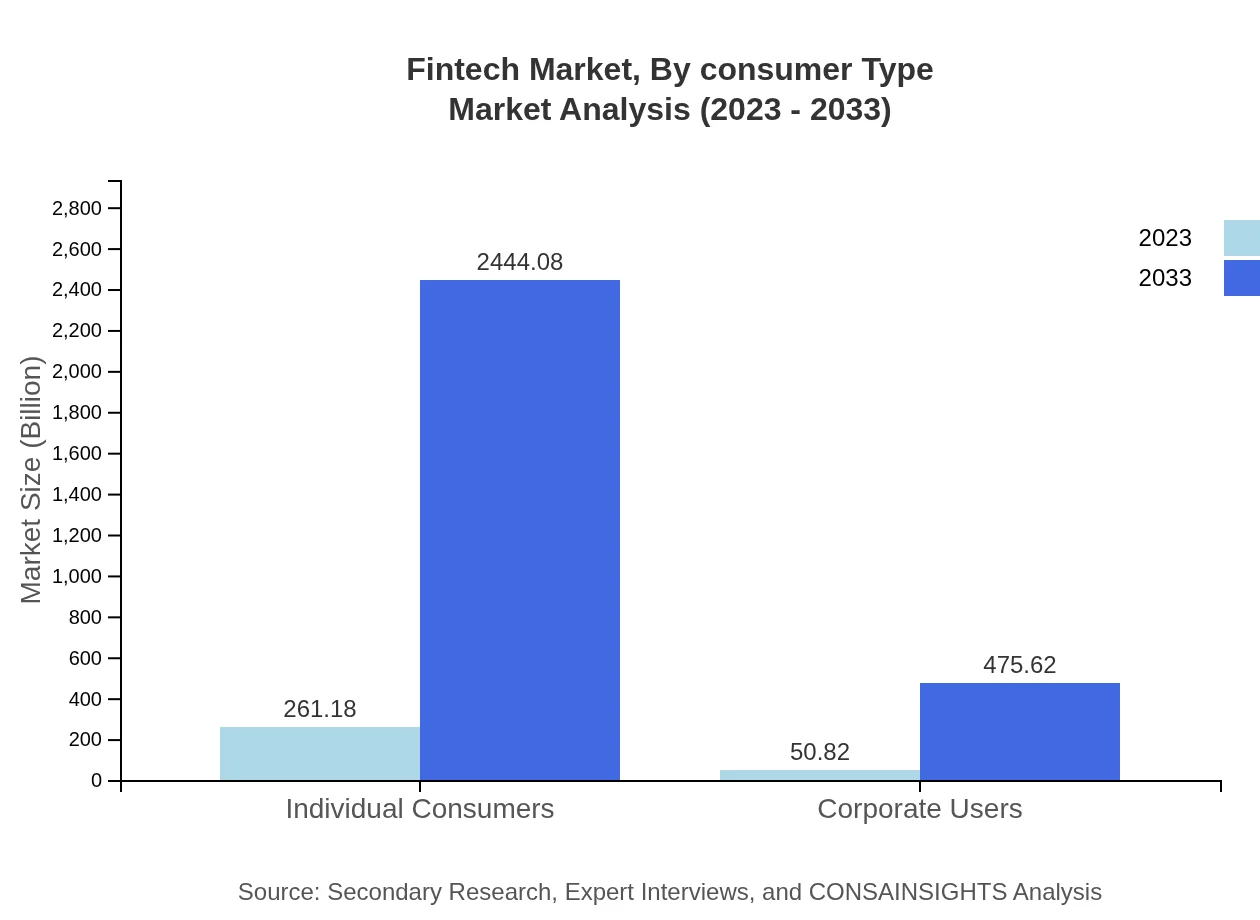

End-user segmentation includes individuals, businesses, and corporate users. The individual consumer segment, valued at $261.18 billion in 2023, is projected to grow rapidly to $2.44 trillion in 2033, driven by increasing adoption of personal finance and investment apps. Businesses are also leveraging fintech solutions, growing from $52.20 billion to $488.47 billion, as they seek innovative financial management tools.

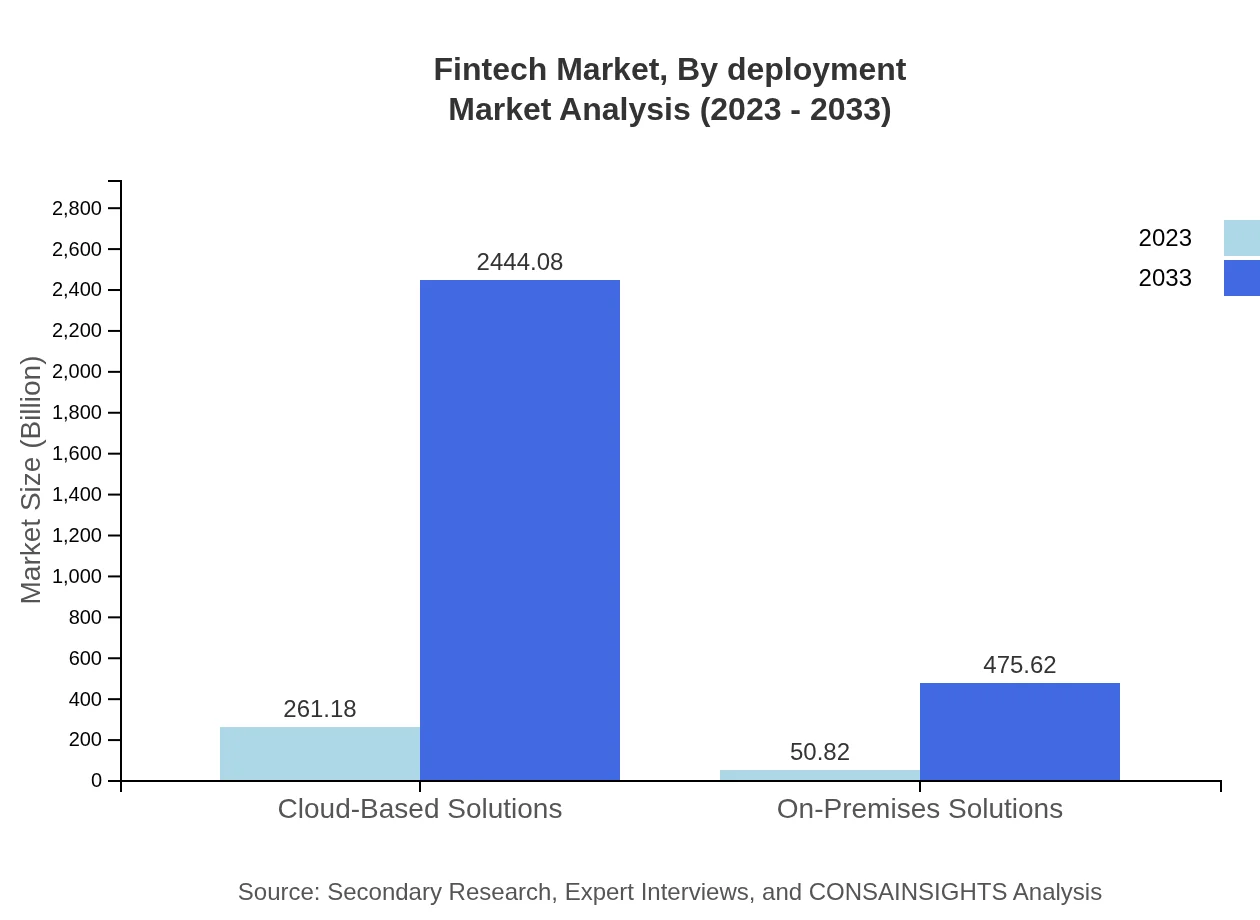

Fintech Market Analysis By Deployment

The fintech market can be divided into cloud-based and on-premises deployment. Cloud-based solutions dominate, valued at $261.18 billion in 2023, expected to reach $2.44 trillion by 2033. The shift to cloud computing is driven by the need for scalability and flexibility in fintech applications. On-premises solutions, though smaller at $50.82 billion, will still grow significantly, catering to enterprises preferring in-house data solutions.

Fintech Market Analysis By Consumer Type

The consumer type can be divided into individual and corporate users. Individual consumers are projected to lead the market, currently valued at $261.18 billion in 2023 and soaring to $2.44 trillion by 2033. Corporate users, valued at $50.82 billion, will also see growth as companies increasingly adopt digital finance solutions.

Fintech Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fintech Industry

PayPal:

A leading digital payments platform that enables users to make transactions, send and receive money, and shop online securely.Square:

A mobile payment company that allows businesses to accept card payments via a mobile device, known for its user-friendly solutions for small businesses.Stripe:

A technology company that builds economic infrastructure for the internet, offering a suite of APIs that enable businesses to implement payment processing.Adyen:

A global payment company that allows businesses to accept payments anywhere in the world and offers advanced fraud protection and data analytics.Robinhood :

An American financial services company that offers commission-free trades on stocks, ETFs, options, and cryptocurrencies.We're grateful to work with incredible clients.

FAQs

What is the market size of Fintech?

The global fintech market is currently valued at approximately $312 billion, with a projected compound annual growth rate (CAGR) of 23.5% from 2023 to 2033, highlighting robust growth in the industry.

What are the key market players or companies in the Fintech industry?

Key players in the fintech space include established banks, innovative startups, and technology companies focusing on payment solutions, lending platforms, and investment services. This diverse group drives competition and innovation across the sector.

What are the primary factors driving growth in the Fintech industry?

Growth in the fintech industry is propelled by digitalization trends, increased consumer demand for convenience, advancements in technology like AI and blockchain, regulatory changes, and evolving customer expectations towards financial services.

Which region is the fastest Growing in the Fintech market?

The Asia Pacific region is the fastest-growing in fintech, with a market size projected to surge from $57.88 billion in 2023 to $541.60 billion by 2033, significantly outpacing other regions due to its tech-savvy population.

Does ConsaInsights provide customized market report data for the Fintech industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the fintech industry, allowing for focused insights and analysis relevant to diverse business strategies.

What deliverables can I expect from this Fintech market research project?

Participants can expect comprehensive reports including market size, growth projections, segment analysis, competitive landscape, and regional insights, offering a well-rounded view of the fintech industry trends and dynamics.

What are the market trends of Fintech?

Current trends in the fintech industry include the rise of decentralized finance (DeFi), increased utilization of artificial intelligence, focus on cybersecurity, growth of neobanks, and the integration of blockchain technology in various financial services.