Fipronil Market Report

Published Date: 31 January 2026 | Report Code: fipronil

Fipronil Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fipronil market from 2023 to 2033, highlighting key trends, market size, growth opportunities, and competitive dynamics among leading players in the industry.

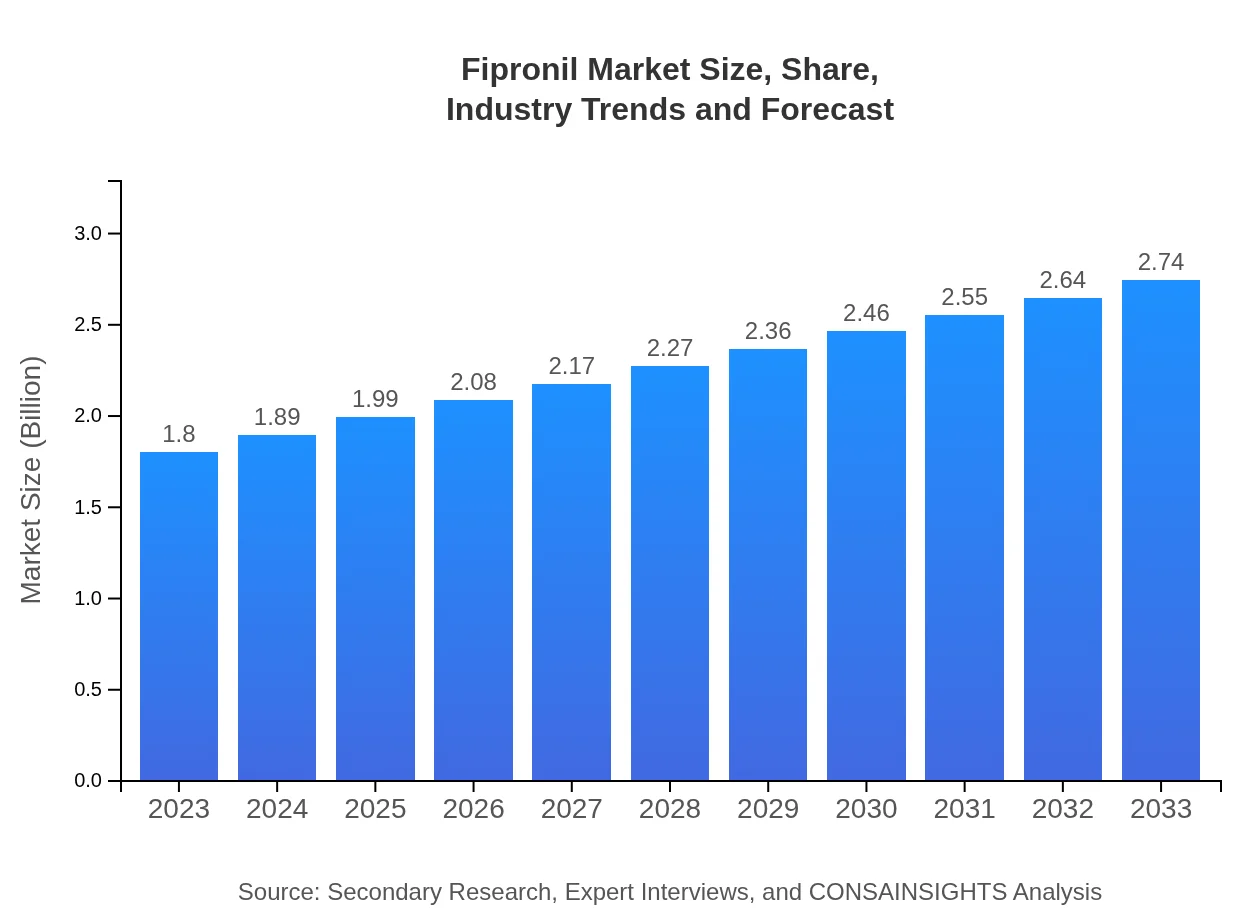

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $2.74 Billion |

| Top Companies | BASF SE, FMC Corporation, Syngenta AG, Nufarm Limited |

| Last Modified Date | 31 January 2026 |

Fipronil Market Overview

Customize Fipronil Market Report market research report

- ✔ Get in-depth analysis of Fipronil market size, growth, and forecasts.

- ✔ Understand Fipronil's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fipronil

What is the Market Size & CAGR of Fipronil market in 2023 and 2033?

Fipronil Industry Analysis

Fipronil Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fipronil Market Analysis Report by Region

Europe Fipronil Market Report:

The European market for Fipronil is anticipated to grow from $0.49 billion in 2023 to $0.75 billion by 2033. Factors such as sustainability initiatives and increasing awareness of pest control impacts drive the adoption of Fipronil products.Asia Pacific Fipronil Market Report:

The Asia Pacific region is witnessing strong growth in the Fipronil market, expected to grow from $0.37 billion in 2023 to $0.56 billion by 2033. Increased agricultural output and pest pressures in countries like India and China are driving demand for effective pest control solutions.North America Fipronil Market Report:

North America, the largest market for Fipronil, is set to grow from $0.67 billion in 2023 to $1.01 billion by 2033. The strong emphasis on veterinary applications and stringent pest control regulations drive the demand for Fipronil in this region.South America Fipronil Market Report:

In South America, the Fipronil market is projected to expand from $0.06 billion in 2023 to $0.09 billion by 2033, benefitting from rising agricultural practices and the need for robust pest management solutions amidst increasing crop production.Middle East & Africa Fipronil Market Report:

In the Middle East and Africa, the market grows from $0.22 billion in 2023 to $0.33 billion by 2033. The need for effective pest control solutions in both agricultural and domestic settings fuels this growth.Tell us your focus area and get a customized research report.

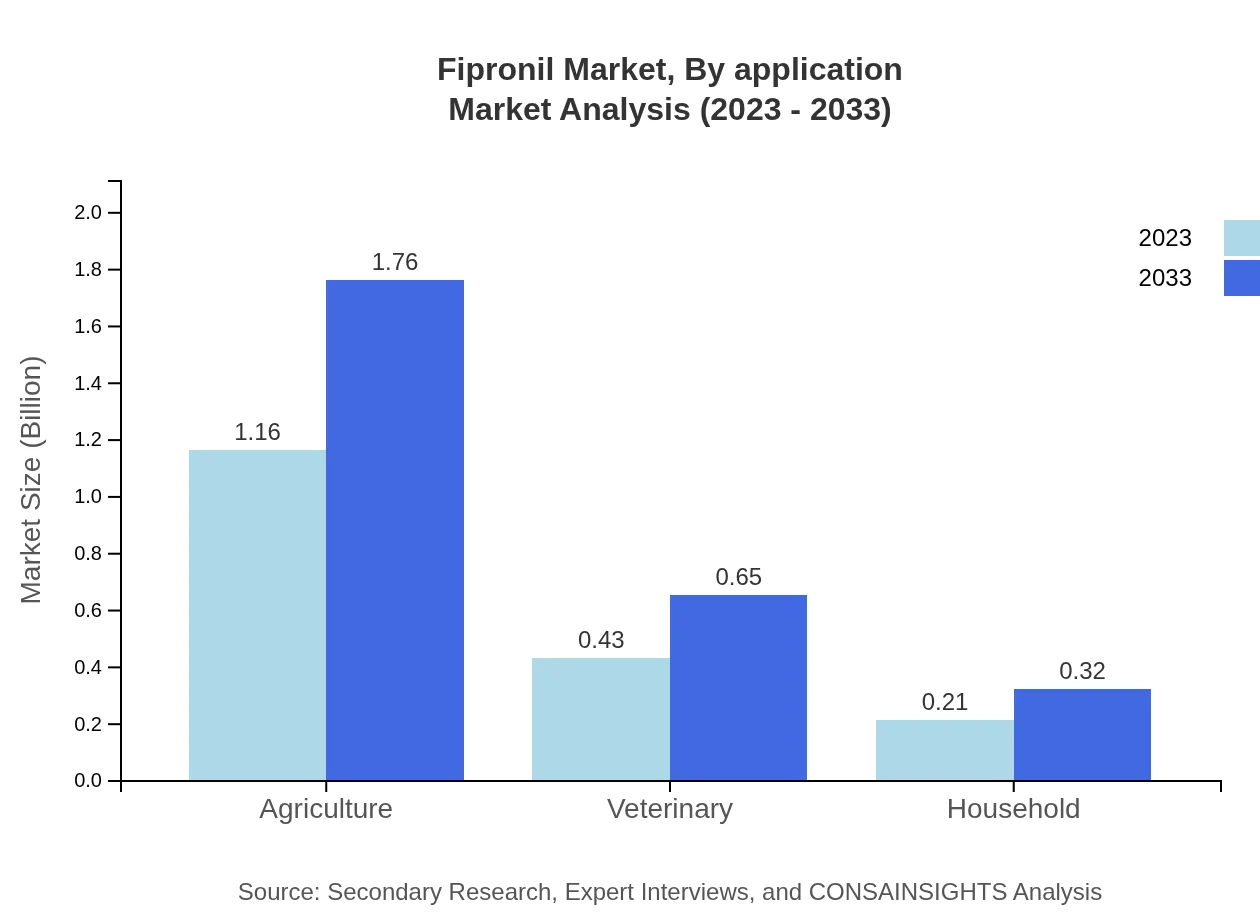

Fipronil Market Analysis By Application

The primary applications of Fipronil are in agriculture and veterinary practices. The agricultural producers segment dominates the market with a size of $1.16 billion in 2023, expected to grow to $1.76 billion by 2033, accounting for 64.21% market share. The veterinary practitioners segment is also significant, with revenues projected to increase from $0.43 billion to $0.65 billion, encompassing a 23.92% share.

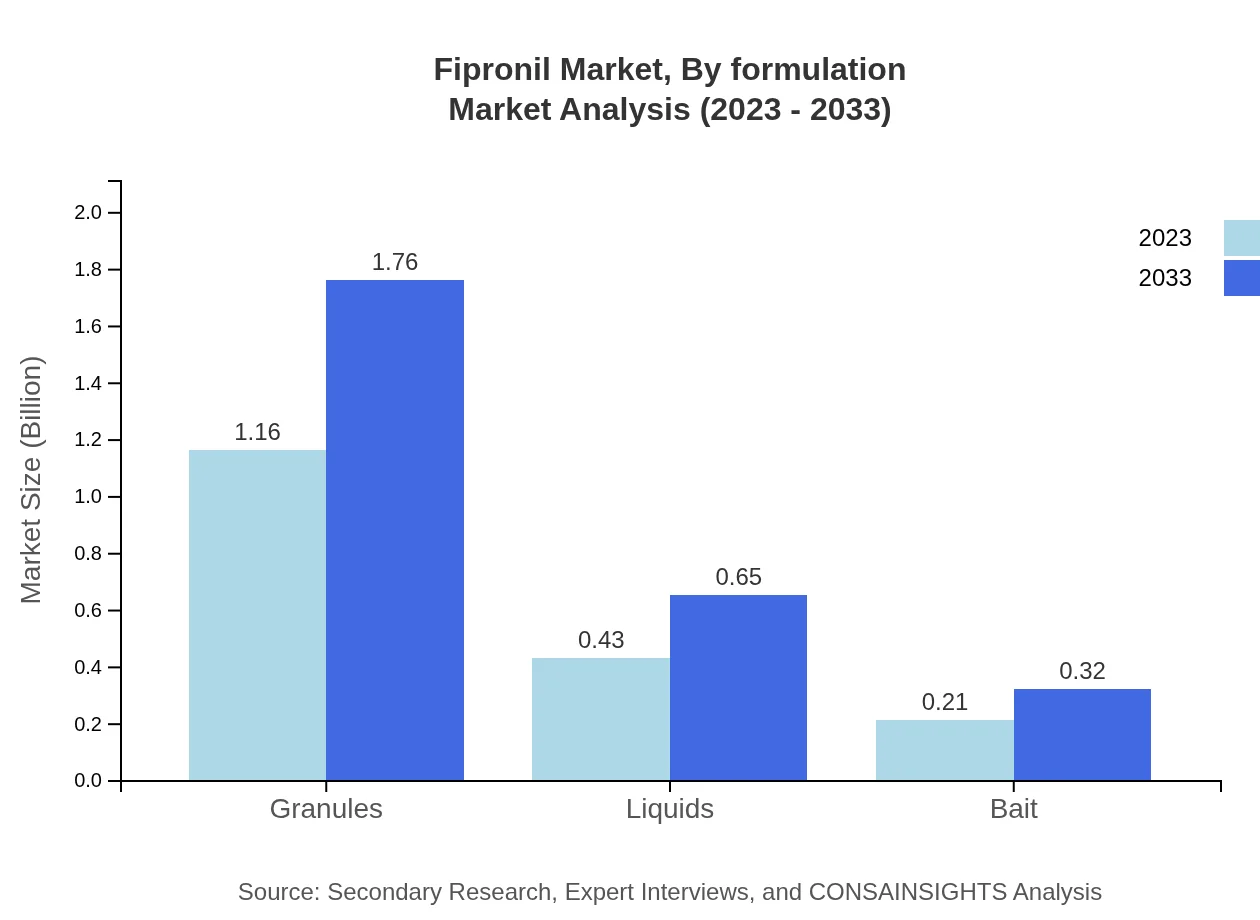

Fipronil Market Analysis By Formulation

Fipronil is available in various formulations such as granules, liquids, and baits. Granules represent the largest share at $1.16 billion in 2023, projected to rise to $1.76 billion by 2033, capturing 64.21% of the market. Liquid formulations and baits hold smaller yet essential positions, with sizes of $0.43 billion and $0.21 billion in 2023, forecasted to reach $0.65 billion and $0.32 billion by 2033, respectively.

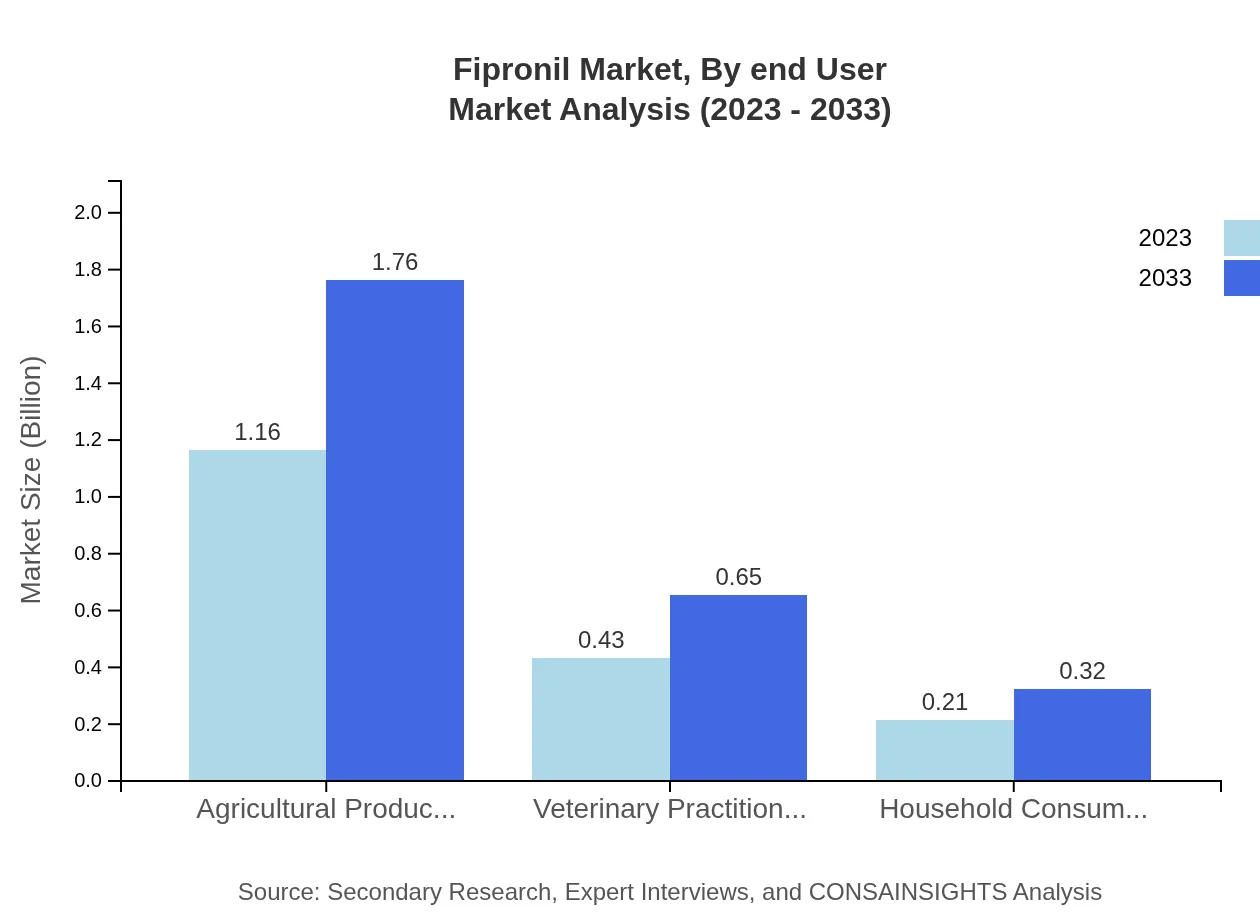

Fipronil Market Analysis By End User

End-user segmentation indicates that agricultural users command the market, demonstrating the highest demand for Fipronil products. Following agricultural producers, veterinary professionals and household consumers are critical segments, with respective sizes of $0.43 billion and $0.21 billion in 2023, highlighting the diverse applications of Fipronil.

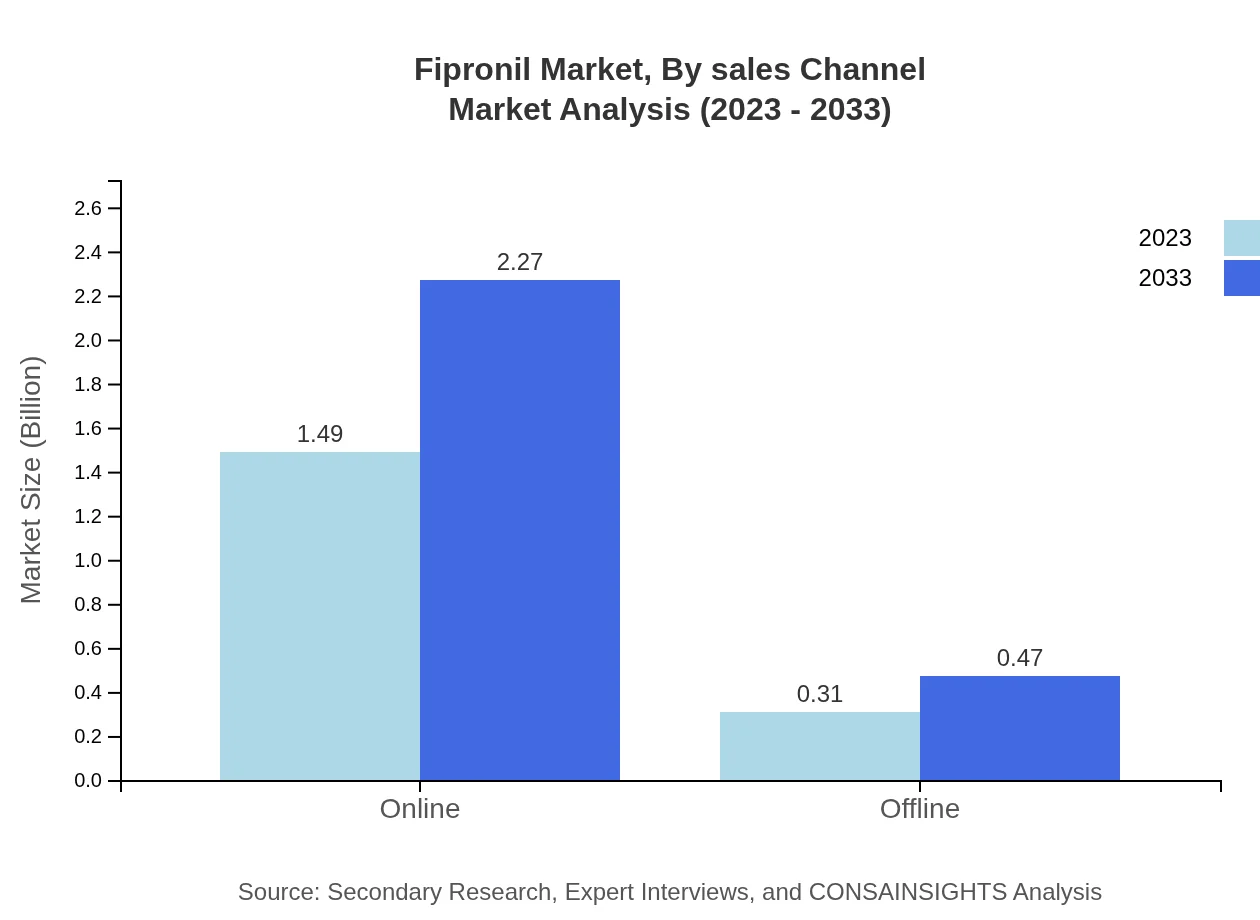

Fipronil Market Analysis By Sales Channel

The Fipronil market is divided into online and offline sales channels. Online sales dominate with approximately $1.49 billion in 2023, projected to reach $2.27 billion by 2033, accounting for 82.84% of the total market. The offline channel is expected to grow gradually, from $0.31 billion to $0.47 billion, capturing a 17.16% market share.

Fipronil Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fipronil Industry

BASF SE:

One of the leading chemical manufacturers in the world, BASF offers a comprehensive range of agricultural solutions, including Fipronil formulations, contributing significantly to pest management innovations.FMC Corporation:

FMC Corporation is a global specialty company known for its innovative crop protection solutions, including Fipronil, focusing on sustainable agriculture and effective pest control strategies.Syngenta AG:

Syngenta is a top-tier agricultural company dedicated to sustainable farming practices, providing advanced Fipronil products that enhance crop yields while managing pest threats.Nufarm Limited:

Nufarm is a global crop protection company providing a diverse portfolio of Fipronil products tailored for various agricultural needs, supporting farmers in pest management.We're grateful to work with incredible clients.

FAQs

What is the market size of fipronil?

The global Fipronil market is valued at approximately $1.8 billion in 2023, with a projected CAGR of 4.2% from 2023 to 2033, indicating steady growth in demand over the decade.

What are the key market players or companies in the fipronil industry?

Key players in the Fipronil industry include leading agrochemical companies and veterinary firms focusing on pest control and veterinary solutions, contributing significantly to market expansions and product innovations.

What are the primary factors driving the growth in the fipronil industry?

Growth factors for the Fipronil market include increasing agricultural production, heightened pest management needs, and rising demand for veterinary products, alongside regulatory support for chemical pesticides.

Which region is the fastest Growing in the fipronil?

The North American region is emerging as the fastest-growing market for Fipronil, with the market size expected to grow from $0.67 billion in 2023 to $1.01 billion by 2033.

Does ConsaInsights provide customized market report data for the fipronil industry?

Yes, ConsaInsights offers customized market report data for the Fipronil industry, allowing clients to tailor research according to specific needs and market conditions.

What deliverables can I expect from this fipronil market research project?

Deliverables from the Fipronil market research project typically include comprehensive market analysis, regional breakdowns, competitive landscape insights, and growth forecasts.

What are the market trends of fipronil?

Current trends in the Fipronil market include rising utilization in agriculture, growing veterinary applications, and an increasing shift towards online distribution methods, enhancing product accessibility.