Firewall As A Service Market Report

Published Date: 31 January 2026 | Report Code: firewall-as-a-service

Firewall As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Firewall As A Service (FWaaS) market, providing insights on market dynamics, size projections, segment analysis, and industry trends from 2023 to 2033.

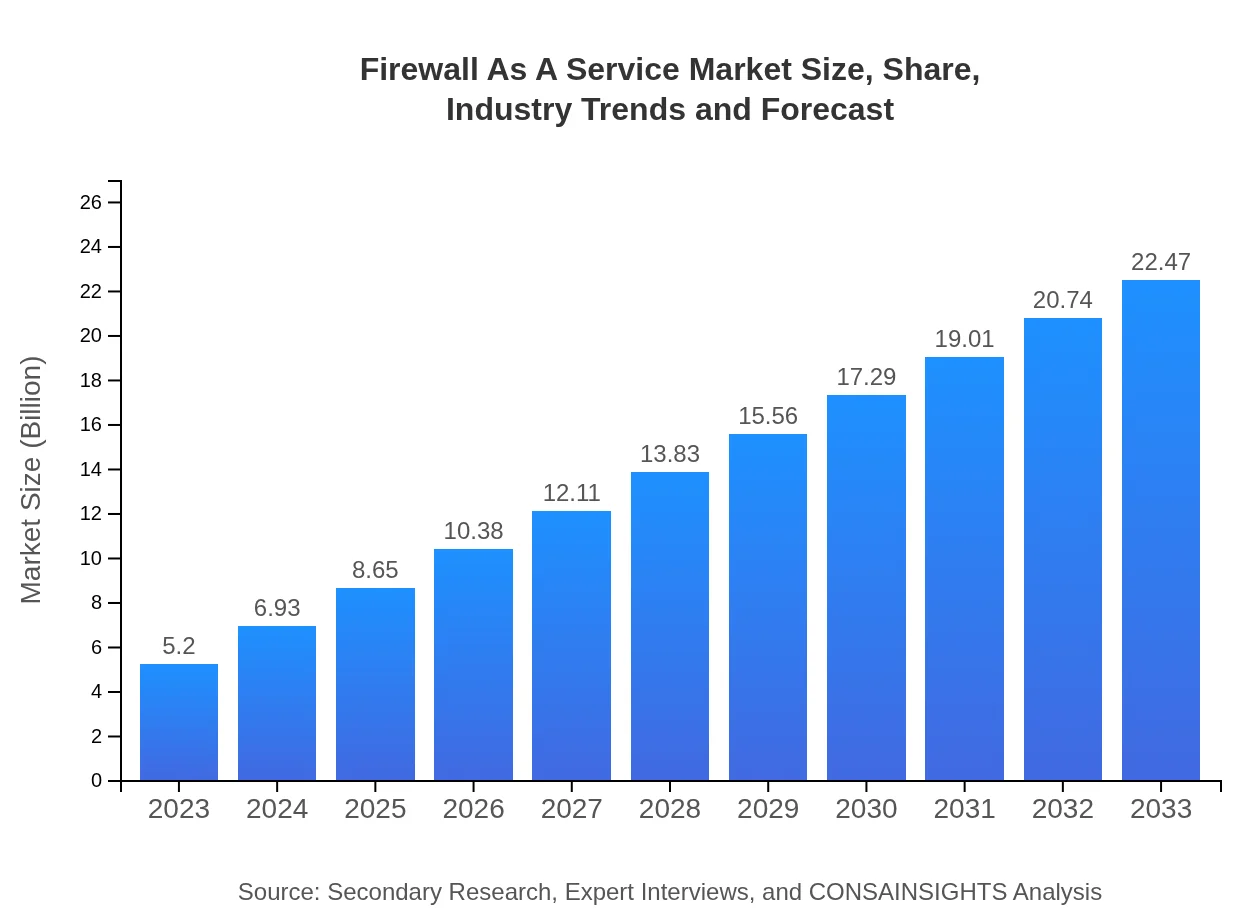

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $22.47 Billion |

| Top Companies | Palo Alto Networks, Fortinet, Cisco Systems, Check Point Software |

| Last Modified Date | 31 January 2026 |

Firewall As A Service Market Overview

Customize Firewall As A Service Market Report market research report

- ✔ Get in-depth analysis of Firewall As A Service market size, growth, and forecasts.

- ✔ Understand Firewall As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Firewall As A Service

What is the Market Size & CAGR of Firewall As A Service market in 2023?

Firewall As A Service Industry Analysis

Firewall As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Firewall As A Service Market Analysis Report by Region

Europe Firewall As A Service Market Report:

The European market for Firewall As A Service is anticipated to grow from $1.53 billion in 2023 to $6.62 billion by 2033. Growing concerns around data privacy and stringent GDPR regulations are key factors driving demand. Furthermore, the integration of advanced technologies such as AI and machine learning is set to enhance the capabilities of FWaaS solutions.Asia Pacific Firewall As A Service Market Report:

In the Asia Pacific region, the Firewall As A Service market is estimated at $1.02 billion in 2023 and is projected to grow to $4.40 billion by 2033. The increasing number of internet users and digital transactions in countries like China and India are major factors enhancing market growth. Additionally, the rising trends of cloud adoption across different sectors are expected to propel the market further.North America Firewall As A Service Market Report:

North America leads the Firewall As A Service market, with a projected size of $1.85 billion in 2023, increasing to $8.01 billion by 2033. The region's advanced technological landscape, regulatory frameworks, and a high concentration of IT firms positioned for innovation significantly contribute to market growth in this region.South America Firewall As A Service Market Report:

The South American Firewall As A Service market is expected to grow from $0.50 billion in 2023 to $2.15 billion by 2033. This growth is driven by the increasing digitalization of businesses and a growing awareness of cybersecurity among organizations. The development of IT infrastructure in countries such as Brazil and Argentina continues to support this growth.Middle East & Africa Firewall As A Service Market Report:

In the Middle East and Africa, the market is projected to rise from $0.30 billion in 2023 to $1.28 billion by 2033. The increasing incorporation of digital technologies across sectors and continuously evolving cyber threats are encouraging organizations to adopt advanced security measures. Moreover, international investments in improving telecommunication infrastructure are expected to support market growth.Tell us your focus area and get a customized research report.

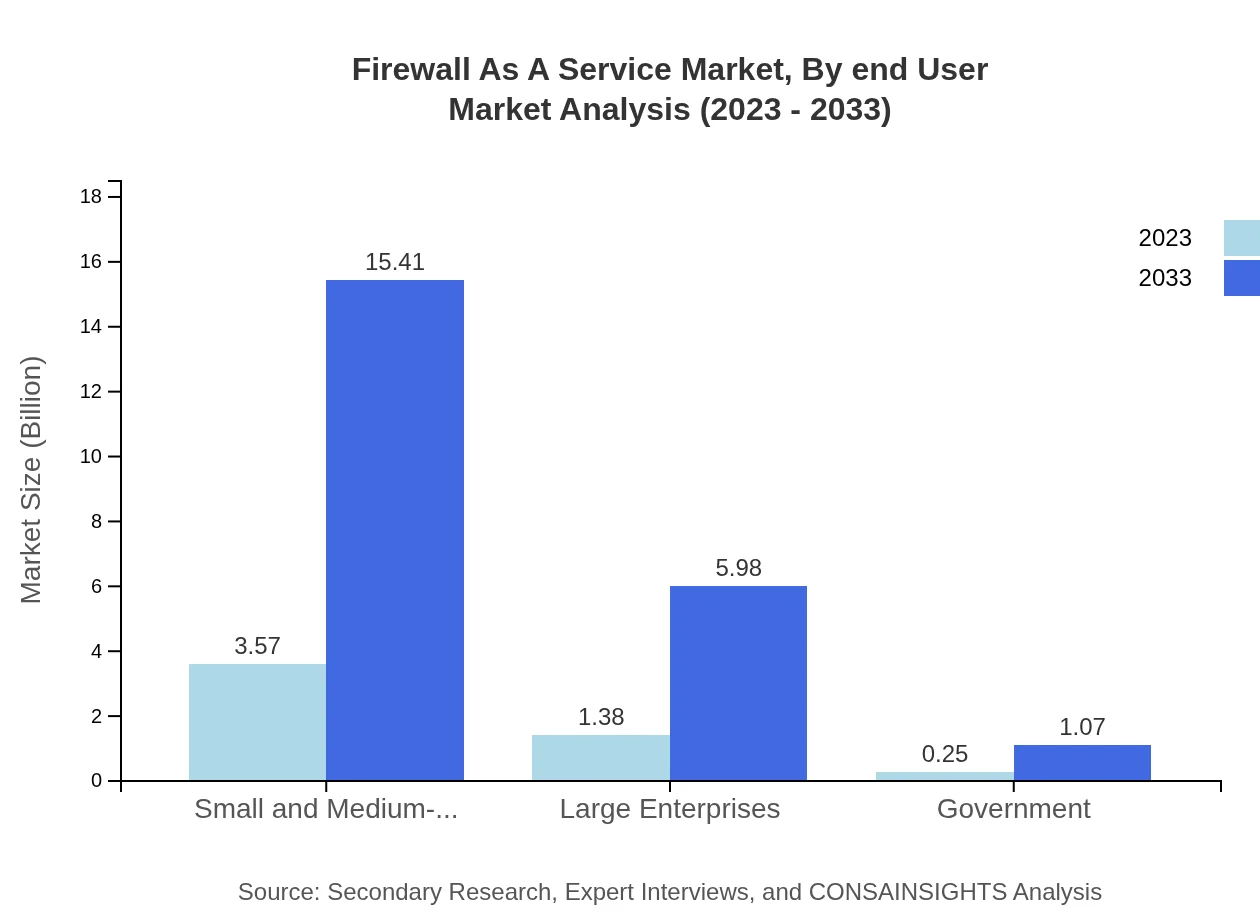

Firewall As A Service Market Analysis By End User

In terms of end-users, the Firewall As A Service market exhibits a biennial performance. Small and Medium-sized Enterprises (SMEs) represent a significant share, accounting for approximately 68.61% of the market in 2023, projected to maintain this share through 2033, expanding from a market size of $3.57 billion to $15.41 billion. Large Enterprises follow, representing 26.62% with a growth from $1.38 billion to $5.98 billion. Government entities, while smaller, are projected to grow from $0.25 billion to $1.07 billion, reflecting a consistent focus on secure digital infrastructure.

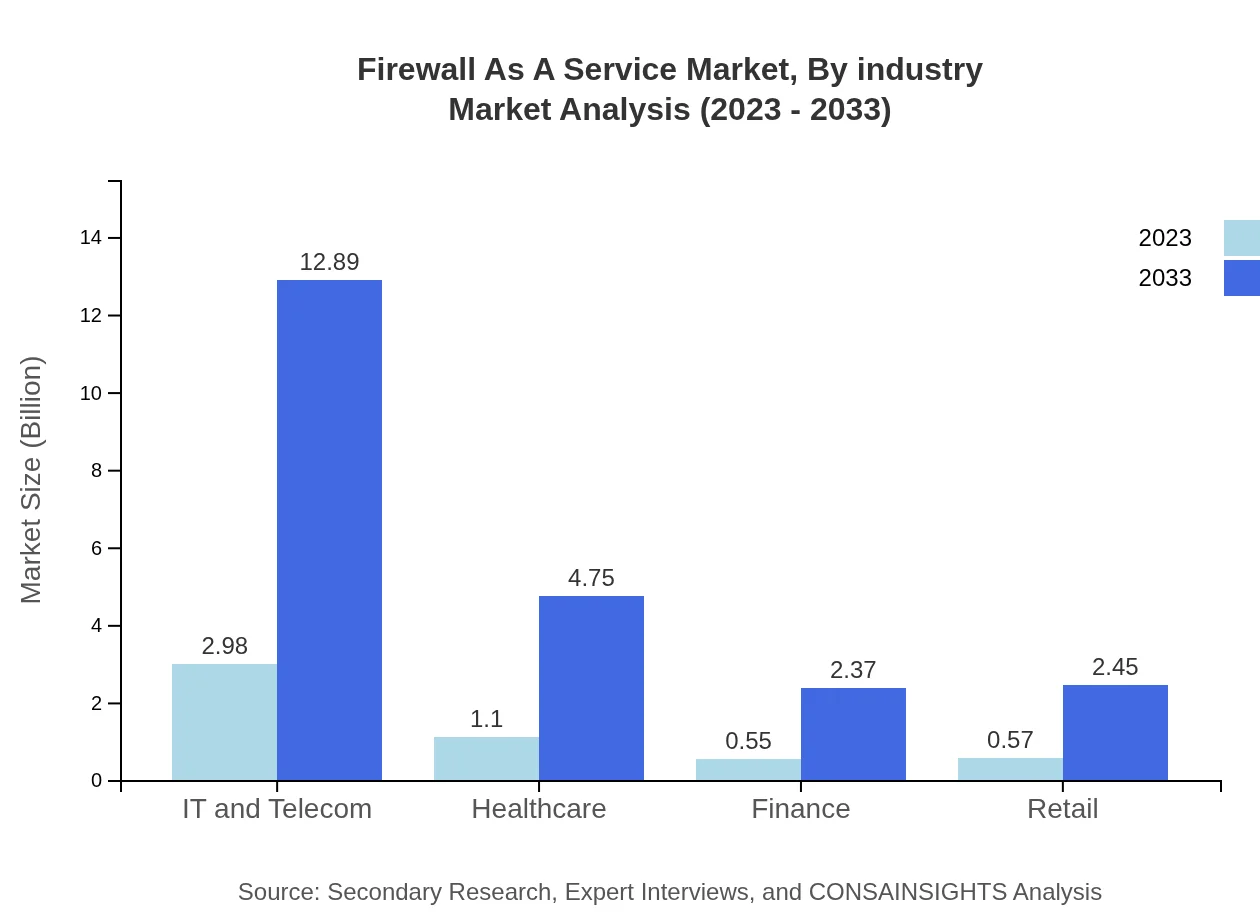

Firewall As A Service Market Analysis By Industry

Industry-wise, the IT and Telecom sector commands a large part of the Firewall As A Service market, holding a share of 57.37% in 2023, expected to expand from $2.98 billion to $12.89 billion by 2033. The Healthcare sector follows, gradually increasing from $1.10 billion to $4.75 billion. The Finance and Retail sectors, while smaller, are also projected to reflect considerable growth, rising from $0.55 billion to $2.37 billion and $0.57 billion to $2.45 billion, respectively.

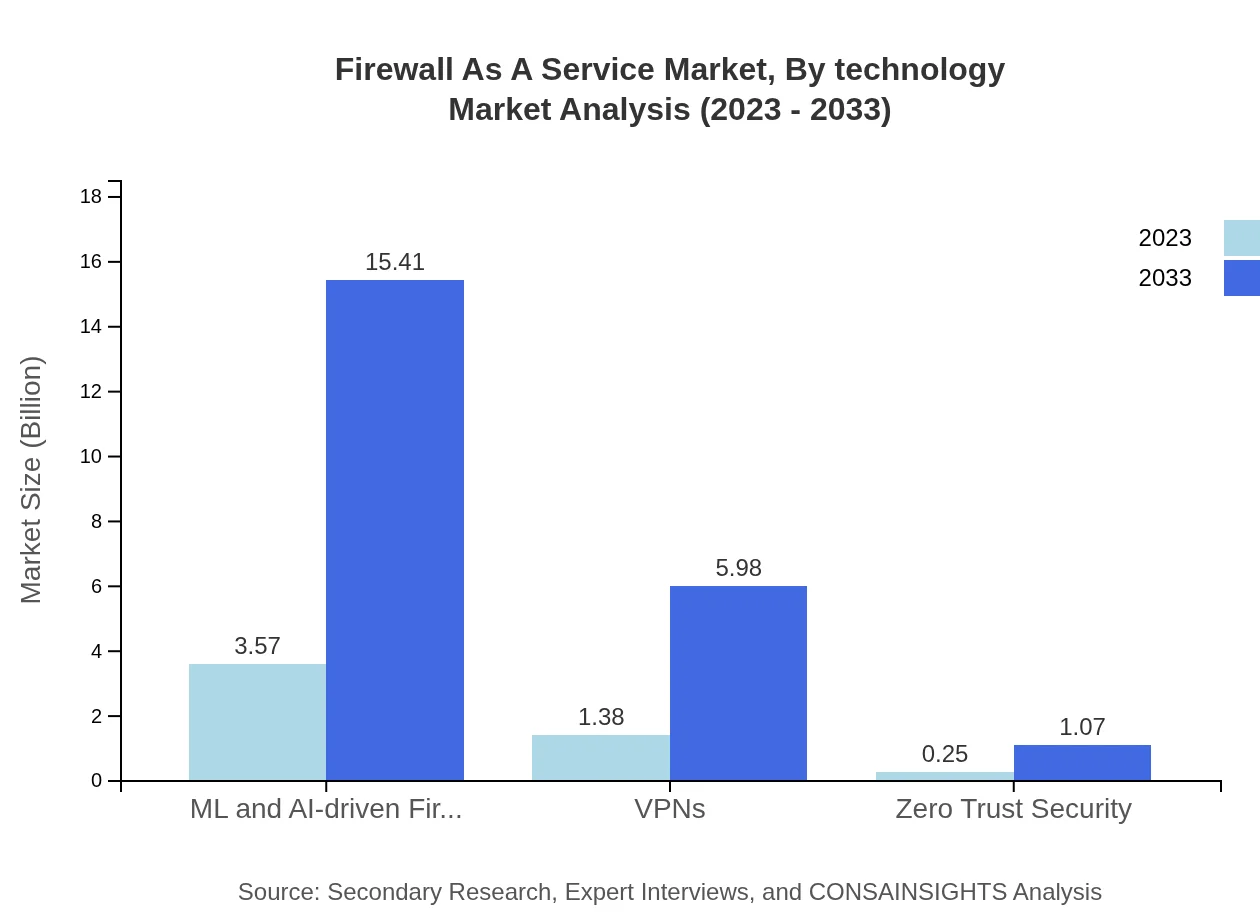

Firewall As A Service Market Analysis By Technology

In analyzing technology segments, ML and AI-driven firewalls yield the most significant growth potential, from $3.57 billion in 2023 to $15.41 billion by 2033, maintaining a share of 68.61%. VPNs also represent a critical segment, with projections showing an increase from $1.38 billion to $5.98 billion. Additionally, the Zero Trust security model, though smaller, shows promise with expected growth from $0.25 billion to $1.07 billion.

Firewall As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Firewall As A Service Industry

Palo Alto Networks:

Palo Alto Networks is a leader in enterprise security, known for its innovative firewall technology and advanced threat prevention solutions that empower organizations to secure their networks effectively.Fortinet:

Fortinet provides broad, high-performance security solutions with its FortiGate firewalls at the core, addressing the robust demands of enterprises while maintaining operational efficiency.Cisco Systems:

Cisco is a leading provider of networking and security solutions, offering a wide range of firewall services that integrate seamlessly into existing network architectures.Check Point Software:

Check Point Software specializes in cybersecurity solutions, broadly known for their effective firewall technologies that help organizations implement security best practices and create secure environments.We're grateful to work with incredible clients.

FAQs

What is the market size of firewall As A Service?

The global Firewall-as-a-Service market is projected to reach approximately $5.2 billion by 2033, reflecting a robust CAGR of 15% from 2023. This escalating market size is indicative of the increasing demand for scalable and efficient security solutions.

What are the key market players or companies in this firewall As A Service industry?

Key players in the Firewall-as-a-Service market include major industry leaders known for their innovative cybersecurity solutions. These companies typically offer a range of services including managed firewalls, cloud firewalls, and advanced security features tailored to diverse organizational needs.

What are the primary factors driving the growth in the firewall As A Service industry?

The growth of the Firewall-as-a-Service market is driven by factors including the increasing frequency of cyber-attacks, the shift towards cloud computing, and the demand for scalable security solutions among small to medium enterprises and larger organizations seeking comprehensive protection.

Which region is the fastest Growing in the firewall As A Service market?

North America emerges as the fastest-growing region in the Firewall-as-a-Service market, expected to rise from $1.85 billion in 2023 to approximately $8.01 billion by 2033. This growth is fueled by high demand for advanced security solutions and favorable regulatory environments.

Does ConsaInsights provide customized market report data for the firewall As A Service industry?

Yes, ConsaInsights offers tailored market report data to meet the specific needs of clients interested in the Firewall-as-a-Service industry. This customized approach ensures that businesses receive comprehensive insights relevant to their market conditions and strategic objectives.

What deliverables can I expect from this firewall As A Service market research project?

From the Firewall-as-a-Service market research project, you can expect detailed reports containing market size data, growth forecasts, competitor analysis, regional insights, and trends across various segments, which will aid in strategic planning and decision-making.

What are the market trends of firewall As A Service?

Current trends in the Firewall-as-a-Service market include the increasing integration of AI and machine learning for threat detection, a pivot towards subscription-based models, and a rising focus on Zero Trust architectures as organizations strive for enhanced security measures.