Fish Farming Market Report

Published Date: 31 January 2026 | Report Code: fish-farming

Fish Farming Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Fish Farming market, highlighting key insights, trends, and forecasts from 2023 to 2033, encompassing market size, growth rates, segmentation, and regional analysis.

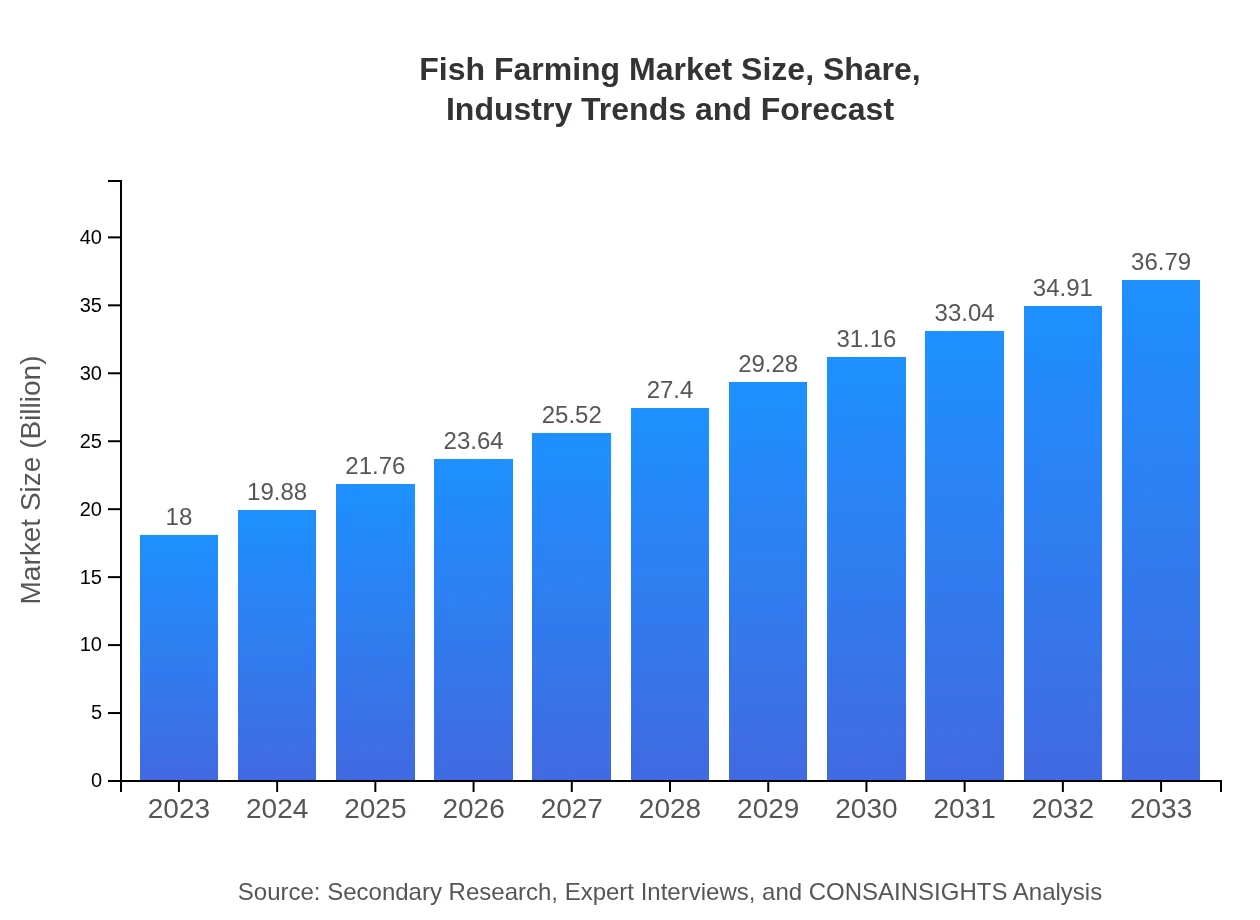

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $36.79 Billion |

| Top Companies | Mowi ASA, Thai Union Group, Skretting, Cermaq, Blue Ridge Aquaculture |

| Last Modified Date | 31 January 2026 |

Fish Farming Market Overview

Customize Fish Farming Market Report market research report

- ✔ Get in-depth analysis of Fish Farming market size, growth, and forecasts.

- ✔ Understand Fish Farming's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fish Farming

What is the Market Size & CAGR of Fish Farming market in 2023 and 2033?

Fish Farming Industry Analysis

Fish Farming Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fish Farming Market Analysis Report by Region

Europe Fish Farming Market Report:

Europe's fish farming market is experiencing significant growth, valued at $5.86 billion in 2023 and projected to reach $11.97 billion by 2033. The demand for sustainable seafood drives innovations in aquaculture practices across countries like Norway and the UK.Asia Pacific Fish Farming Market Report:

The Asia-Pacific region leads the fish farming market, with a market size of $3.18 billion in 2023 projected to grow to $6.51 billion by 2033. Key players in countries like China, India, and Japan focus on increasing aquaculture production to meet domestic demand and export opportunities.North America Fish Farming Market Report:

The North American fish farming market is currently valued at $6.52 billion in 2023 and is projected to expand to $13.32 billion by 2033. The U.S. dominates this market, driven by a growing preference for farmed fish and technological advancements.South America Fish Farming Market Report:

In South America, the fish farming market was valued at $0.97 billion in 2023, expected to reach $1.98 billion by 2033. Brazil is a prominent player, capitalizing on its vast freshwater resources for tilapia and other species.Middle East & Africa Fish Farming Market Report:

The Middle East and Africa region has a relatively smaller fish farming market, valued at $1.47 billion in 2023 and expected to grow to $3.01 billion by 2033. Countries like Egypt and South Africa are making strides in aquaculture development to bolster food security.Tell us your focus area and get a customized research report.

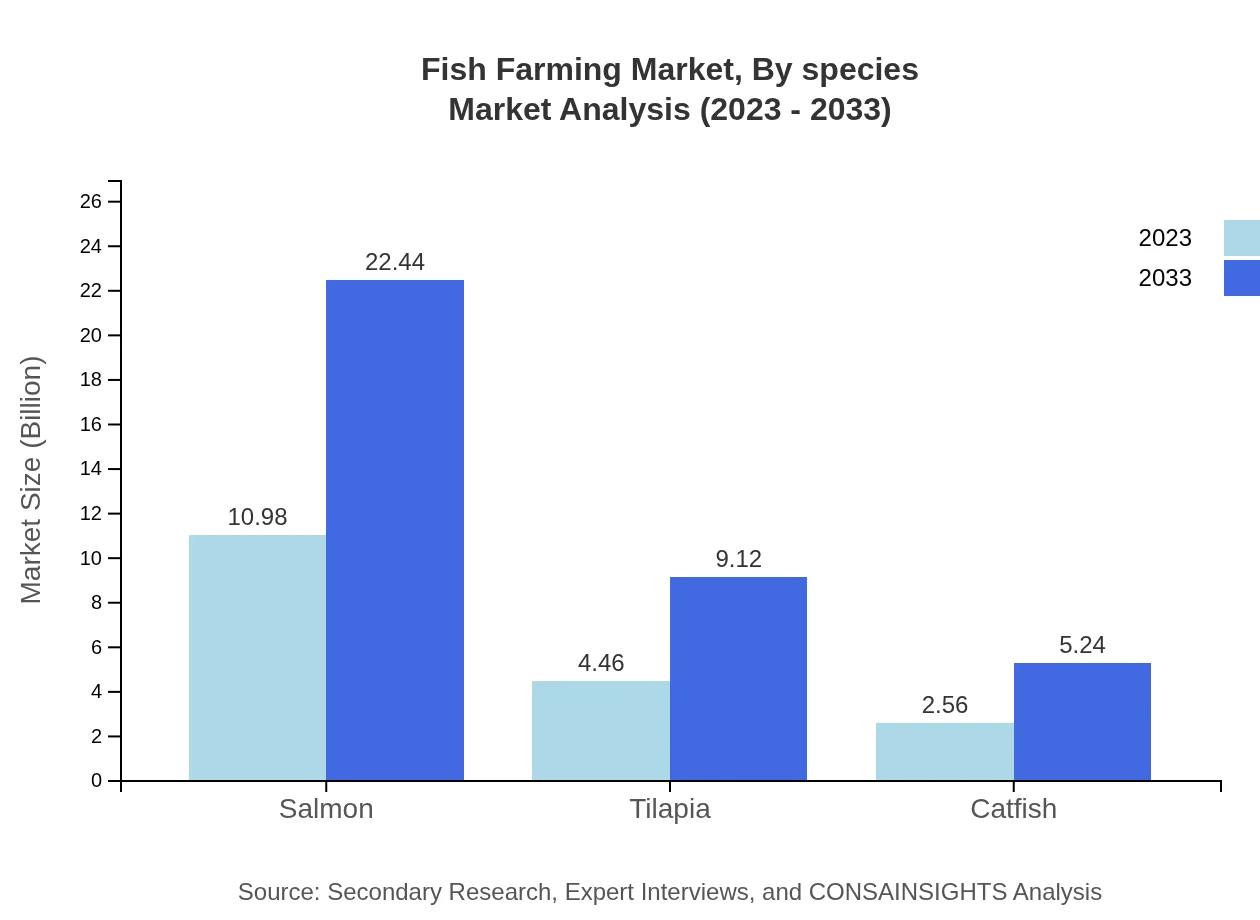

Fish Farming Market Analysis By Species

The species segment showcases different varieties cultivated in aquaculture. As of 2023, salmon leads with a market size of $10.98 billion, projected to reach $22.44 billion by 2033. Tilapia follows closely, with current market figures at $4.46 billion, expected to grow significantly in the same timeframe. Catfish holds a notable position with a size of $2.56 billion in 2023, reflecting robust growth potential.

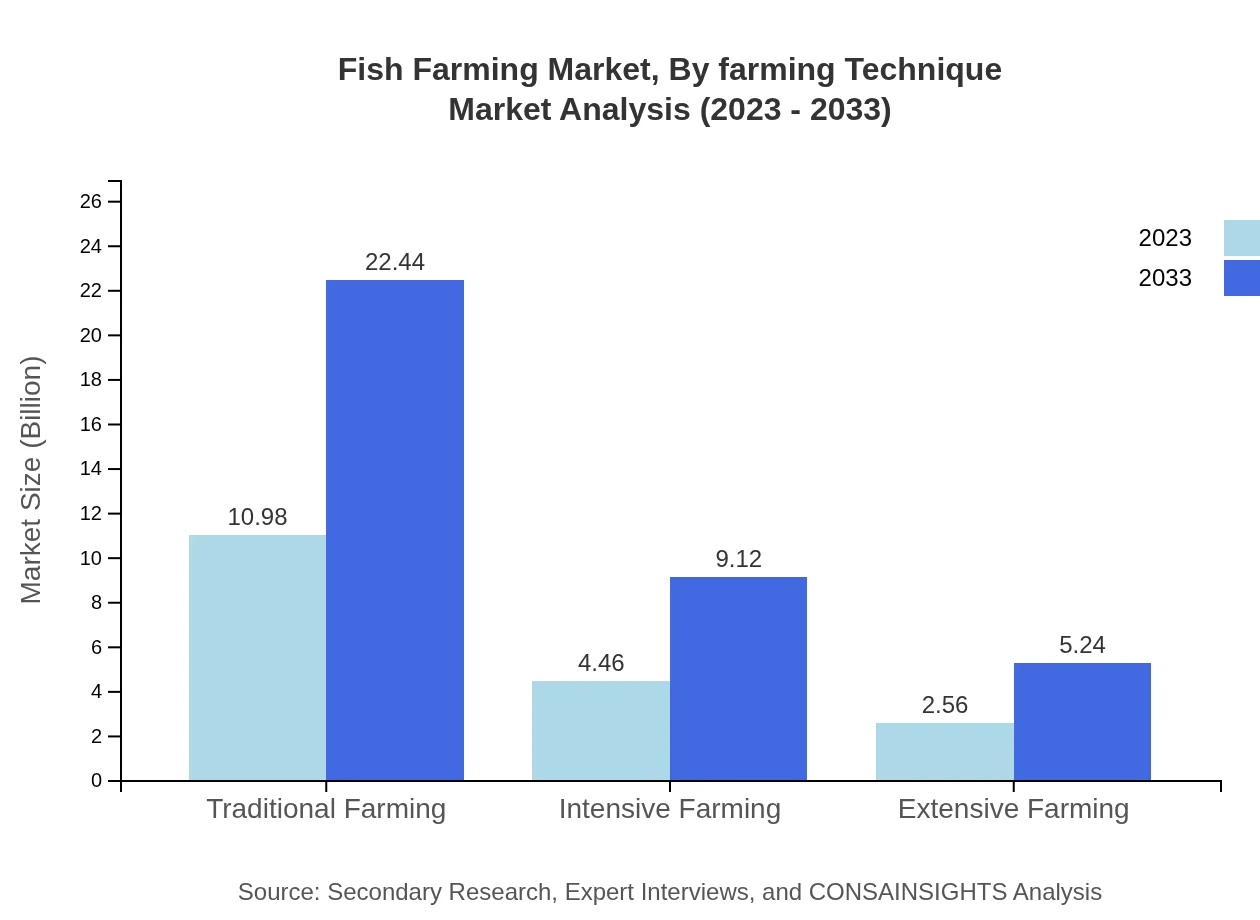

Fish Farming Market Analysis By Farming Technique

Within the farming technique segment, traditional farming holds the largest share at an estimated $10.98 billion in 2023, with a projected rise to $22.44 billion by 2033. Intensive farming, while smaller, shows promise, with current revenues at $4.46 billion. Extensive farming, although lesser in value, is gaining traction for its sustainability appeal, valued at $2.56 billion currently.

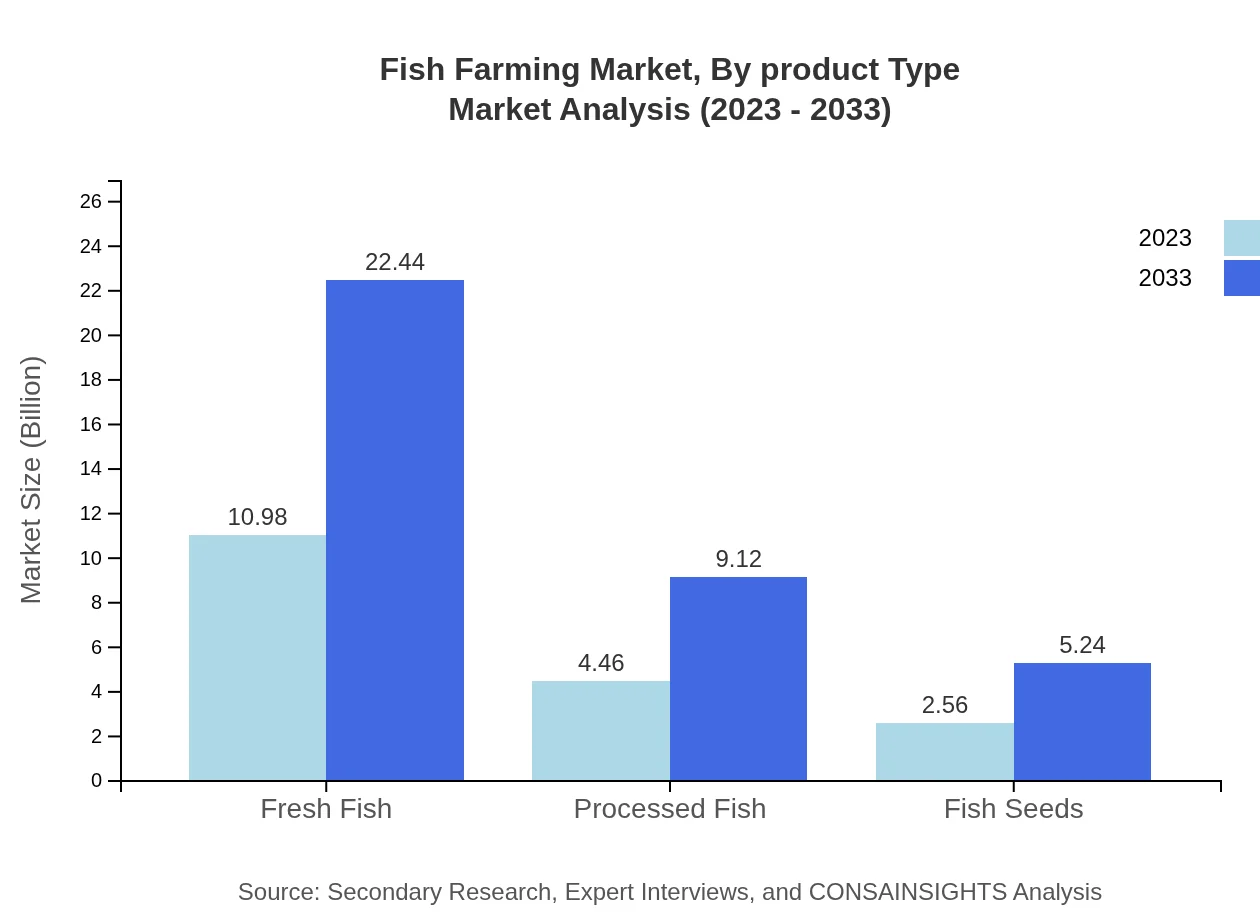

Fish Farming Market Analysis By Product Type

The product type analysis reveals that fresh fish accounts for $10.98 billion in 2023 and is set to grow to $22.44 billion by 2033. Processed fish, valued at $4.46 billion, showcases a stable growth trajectory, expected to match this growth trend. Fish seeds also play a critical role, currently valued at $2.56 billion, contributing to sustainability in aquaculture.

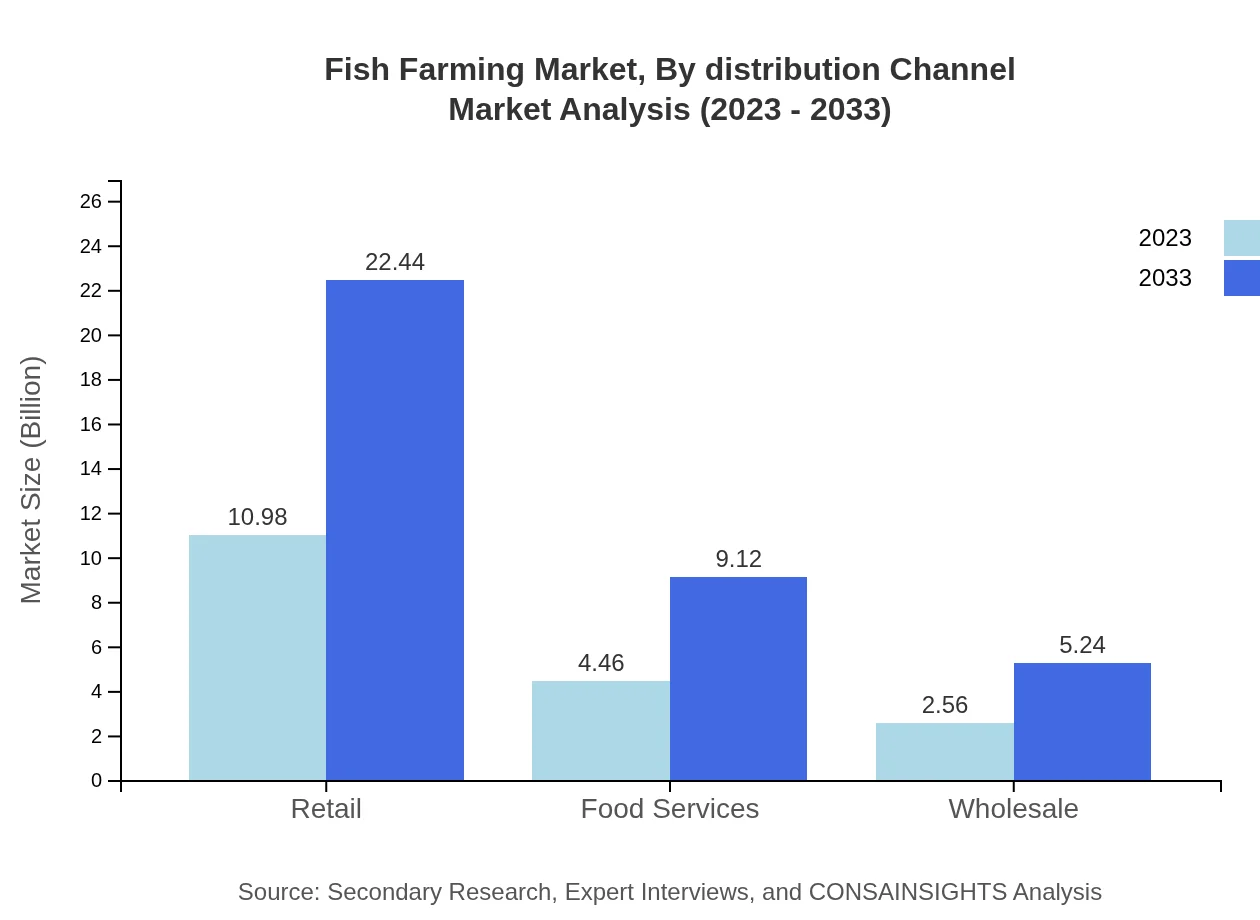

Fish Farming Market Analysis By Distribution Channel

Distribution channels are key to market reach; the retail sector leads at $10.98 billion in 2023, expected to see consistent growth. Food services and wholesale channels also play crucial roles, valued at $4.46 billion and $2.56 billion respectively. The expansion of e-commerce further supports retail growth, enhancing market accessibility.

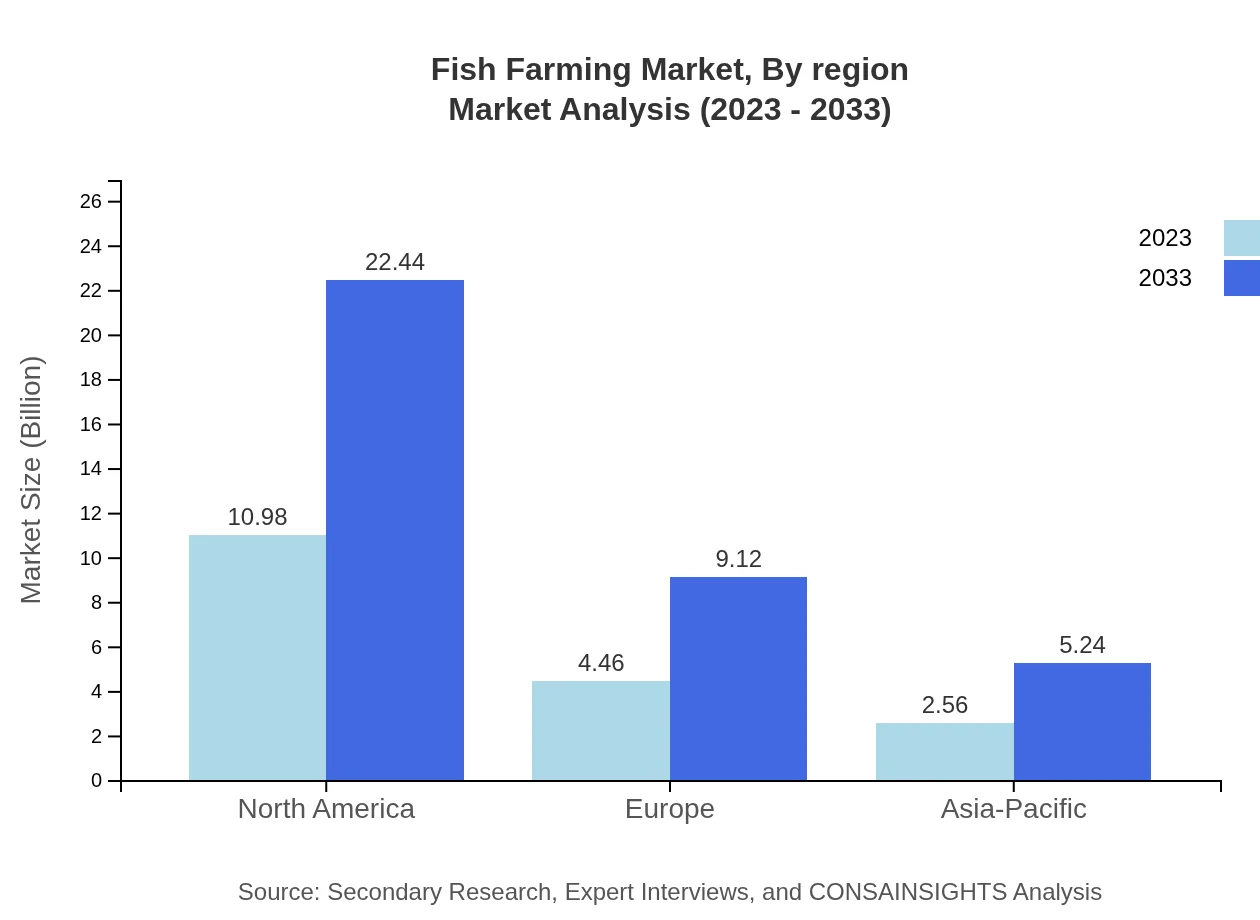

Fish Farming Market Analysis By Region

Regional analysis indicates varying trends and growth potential across the globe. North America commands the largest share, followed by Europe and Asia-Pacific, focusing on advanced aquaculture technology and sustainable practices. Emerging economies in South America and Africa present unique growth opportunities, leveraging local resources for aquaculture development.

Fish Farming Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fish Farming Industry

Mowi ASA:

A leading global seafood company based in Norway, renowned for its sustainable salmon farming practices.Thai Union Group:

One of the world’s largest seafood producers and processors, known for its innovative aquaculture practices.Skretting:

A global leader in aquaculture feed, supporting sustainable fish farming worldwide with cutting-edge feed solutions.Cermaq:

Specializes in sustainable salmon farming and has a strong global presence with operational facilities in various countries.Blue Ridge Aquaculture:

The largest tilapia aquaculture producer in the U.S., focusing on sustainable practices and local market supply.We're grateful to work with incredible clients.

FAQs

What is the market size of fish Farming?

The fish farming market is currently valued at approximately $18 billion, with a projected CAGR of 7.2%. By 2033, significant growth is expected, reflecting the increasing demand for aquaculture products globally.

What are the key market players or companies in this fish Farming industry?

Key players in the fish-farming industry include major aquaculture firms and producers from various regions, focusing on species like salmon, tilapia, and catfish. Innovation and sustainability practices are also driving collaboration among industry leaders.

What are the primary factors driving the growth in the fish farming industry?

The growth in the fish farming industry is driven by rising consumer demand for seafood, innovative farming techniques, advances in aquaculture technology, and greater emphasis on sustainable practices to address global food security.

Which region is the fastest Growing in the fish Farming market?

The fastest-growing region in the fish-farming industry is North America, which is expected to grow from $6.52 billion in 2023 to $13.32 billion by 2033, while Europe and Asia-Pacific also show significant growth potential.

Does ConsaInsights provide customized market report data for the fish Farming industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the fish farming industry, encompassing detailed analysis on market trends, regional insights, and competitive landscapes.

What deliverables can I expect from this fish Farming market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitor intelligence, trend reports, and segment-based insights, specifically targeting various aspects of the fish-farming industry.

What are the market trends of fish farming?

Current trends in fish farming include increased adoption of technology for sustainable practices, shift towards integrated aquaculture systems, and growing interest in alternative species and value-added products.