Fixed Asset Management Software Market Report

Published Date: 31 January 2026 | Report Code: fixed-asset-management-software

Fixed Asset Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fixed Asset Management Software market from 2023 to 2033, covering market size, growth rates, trends, and insights across various segments and regions. The report aims to equip stakeholders with valuable information for strategic decision-making.

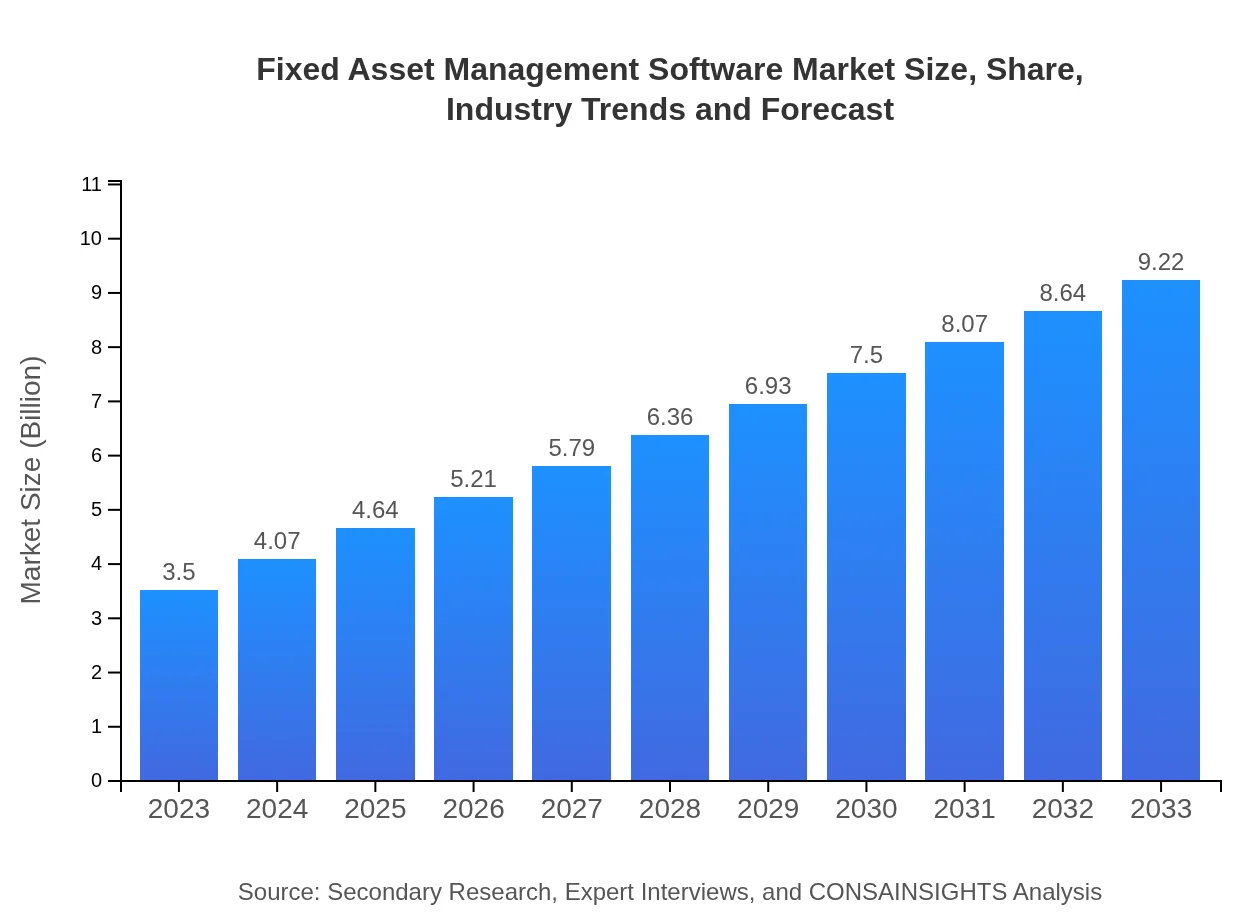

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $9.22 Billion |

| Top Companies | SAP SE, IBM Corporation, Oracle Corporation, Infor, Asset Panda |

| Last Modified Date | 31 January 2026 |

Fixed Asset Management Software Market Overview

Customize Fixed Asset Management Software Market Report market research report

- ✔ Get in-depth analysis of Fixed Asset Management Software market size, growth, and forecasts.

- ✔ Understand Fixed Asset Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fixed Asset Management Software

What is the Market Size & CAGR of Fixed Asset Management Software market in 2023?

Fixed Asset Management Software Industry Analysis

Fixed Asset Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fixed Asset Management Software Market Analysis Report by Region

Europe Fixed Asset Management Software Market Report:

In Europe, the market size for Fixed Asset Management Software was approximately $0.99 billion in 2023 and is projected to grow to $2.60 billion by 2033. The growth is predominantly due to increasing regulatory pressures on asset tracking and management. Additionally, industries such as manufacturing and healthcare are investing heavily in technology to improve their asset management capabilities.Asia Pacific Fixed Asset Management Software Market Report:

In the Asia Pacific region, the Fixed Asset Management Software market was valued at $0.66 billion in 2023 and is expected to grow to $1.75 billion by 2033. The growth is attributed to the rapid industrialization, increasing urbanization, and the expanding economy in countries like China and India. Additionally, the adoption of advanced technologies and increased investments in IT infrastructure are propelling market expansion in this region.North America Fixed Asset Management Software Market Report:

North America holds a significant share in the Fixed Asset Management Software market, valued at $1.32 billion in 2023, expected to reach $3.48 billion by 2033. The region's growth is driven by the high adoption rate of advanced technologies, a strong presence of established vendors, and stringent regulatory compliance requirements. Companies are increasingly investing in asset management solutions to enhance operational efficiency and optimize capital expenditures.South America Fixed Asset Management Software Market Report:

The South American Fixed Asset Management Software market generated $0.12 billion in 2023, with a projected value of $0.31 billion by 2033. The growth in this region is supported by a resurgence in the construction and manufacturing industries, alongside a growing awareness of the benefits of effective asset management. As companies begin to modernize their asset management processes, the demand for sophisticated software will increase.Middle East & Africa Fixed Asset Management Software Market Report:

The Fixed Asset Management Software market in the Middle East and Africa reached a valuation of $0.40 billion in 2023, with an anticipated increase to $1.07 billion by 2033. This growth can be attributed to expanding industries such as oil and gas, construction, and services, coupled with government initiatives encouraging technology adoption in business operations.Tell us your focus area and get a customized research report.

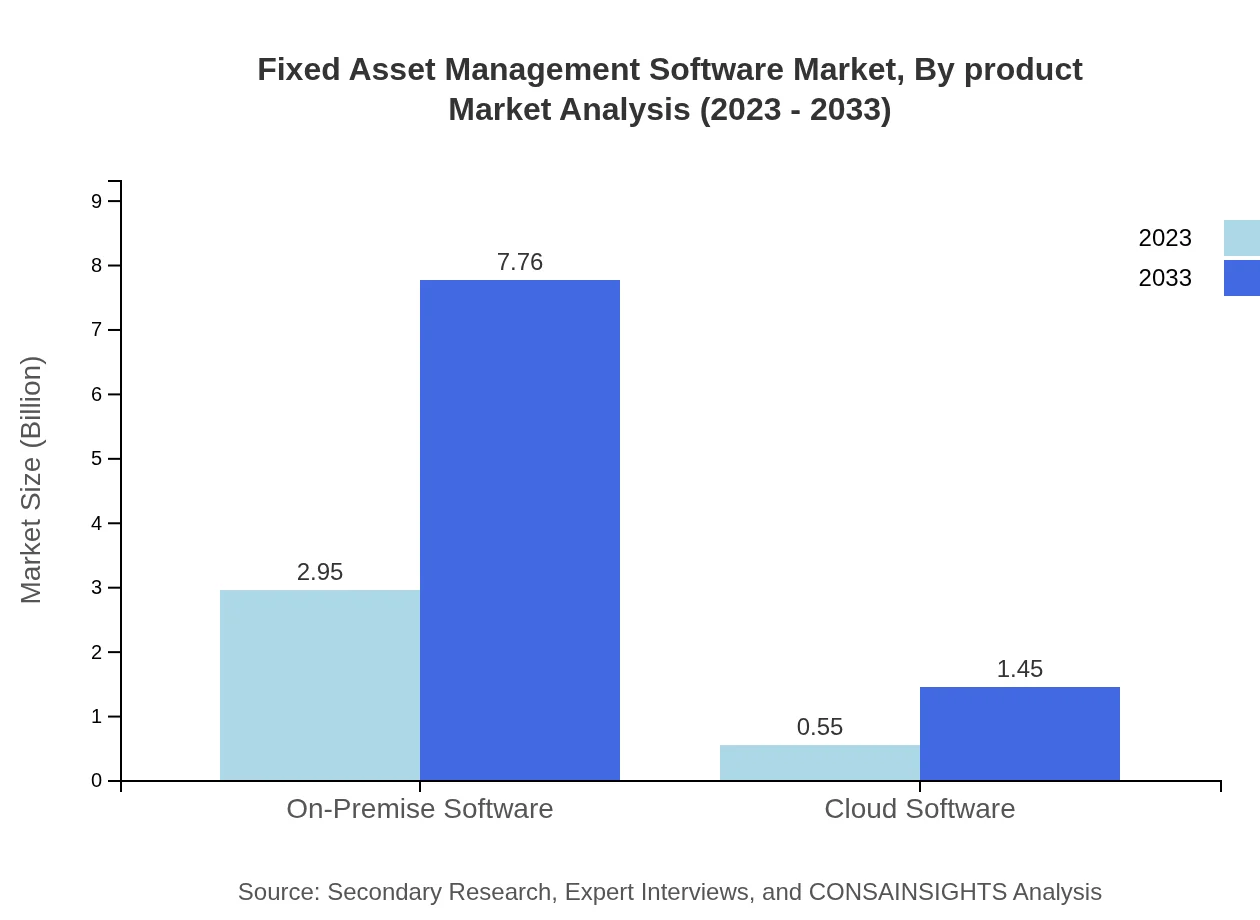

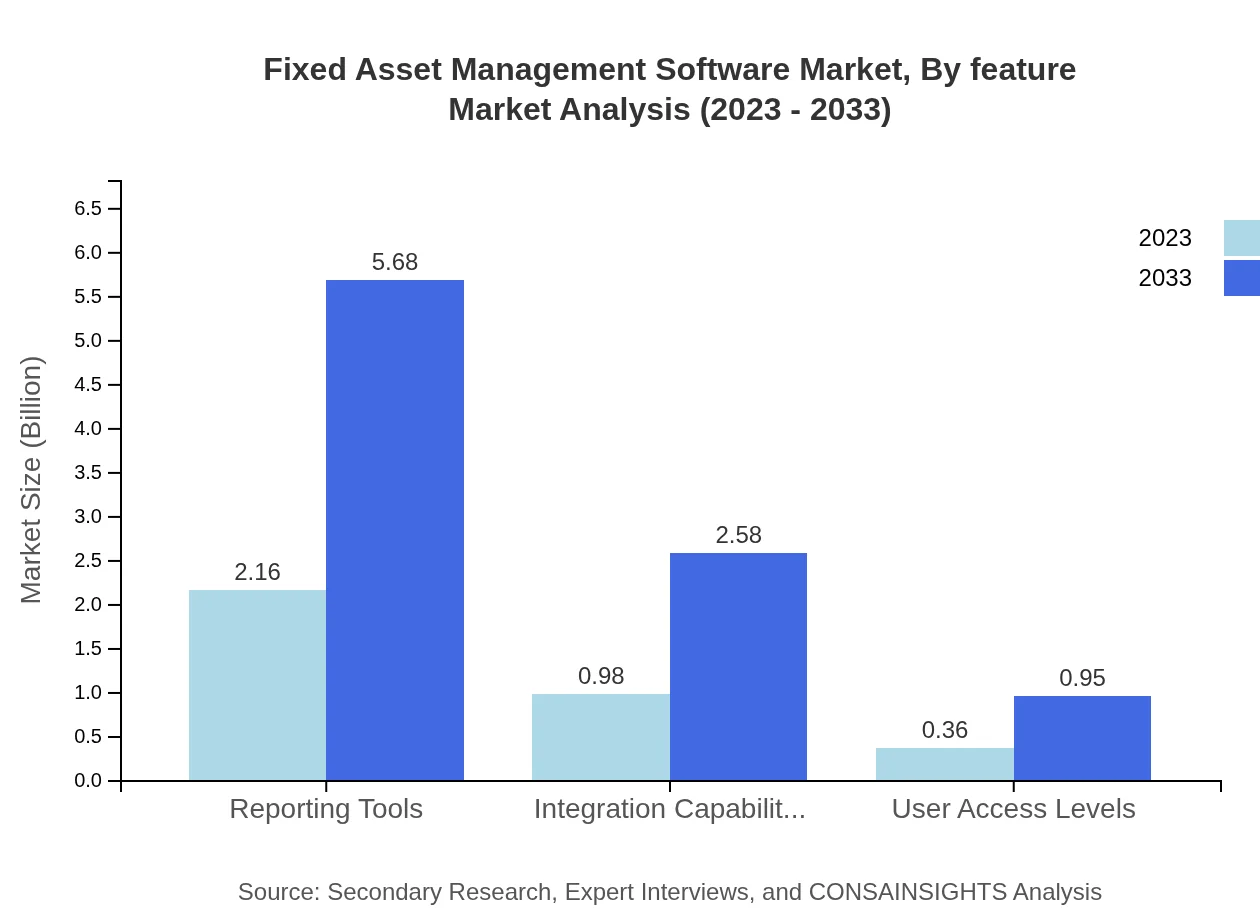

Fixed Asset Management Software Market Analysis By Product

The Reporting Tools segment captured a significant market share, valued at approximately $2.16 billion in 2023 and expected to reach $5.68 billion by 2033. This segment is critical for providing businesses with analytical insights into asset performance and financial reporting. In contrast, Integration Capabilities, valued at $0.98 billion in 2023 and projected to grow to $2.58 billion, support businesses in seamlessly connecting their fixed asset systems with existing enterprise solutions.

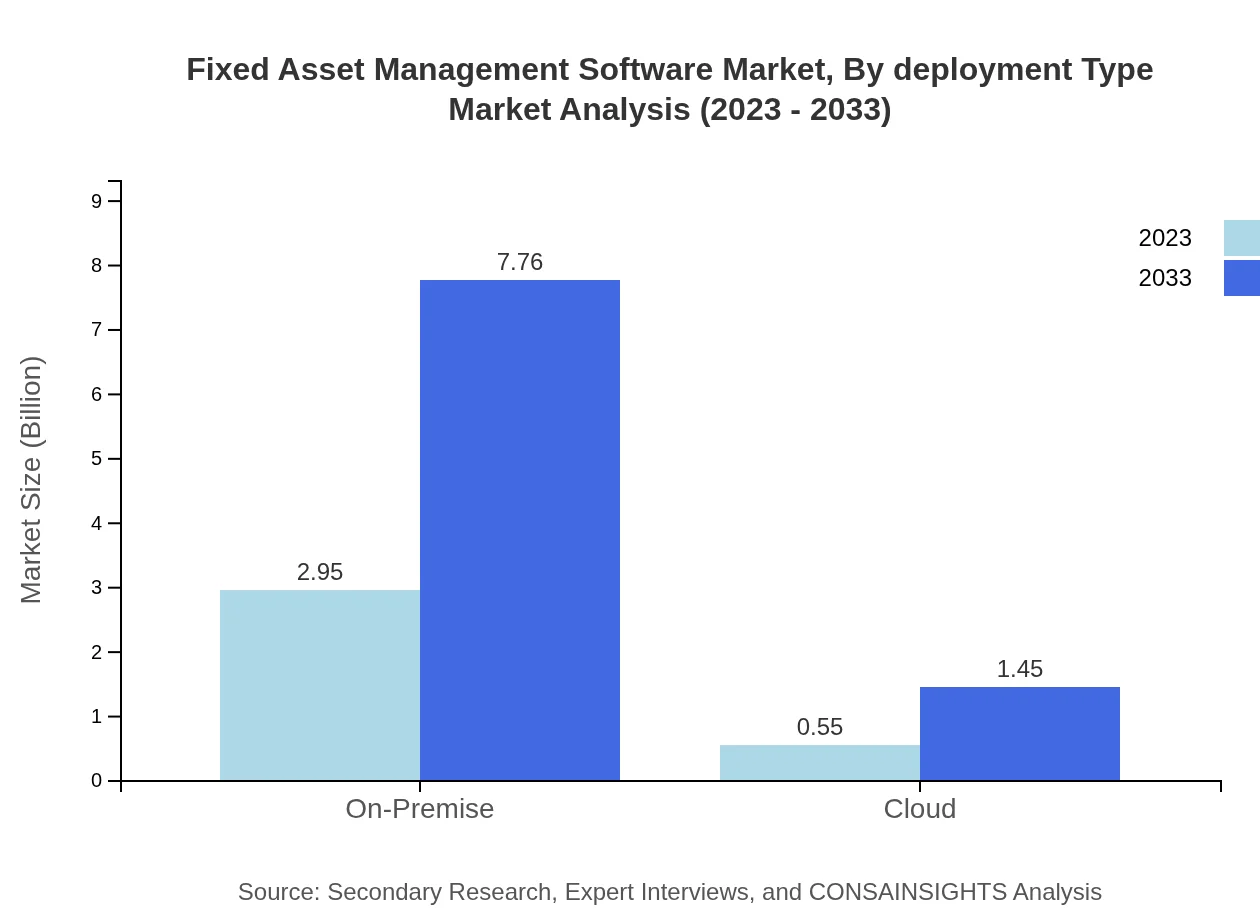

Fixed Asset Management Software Market Analysis By Deployment Type

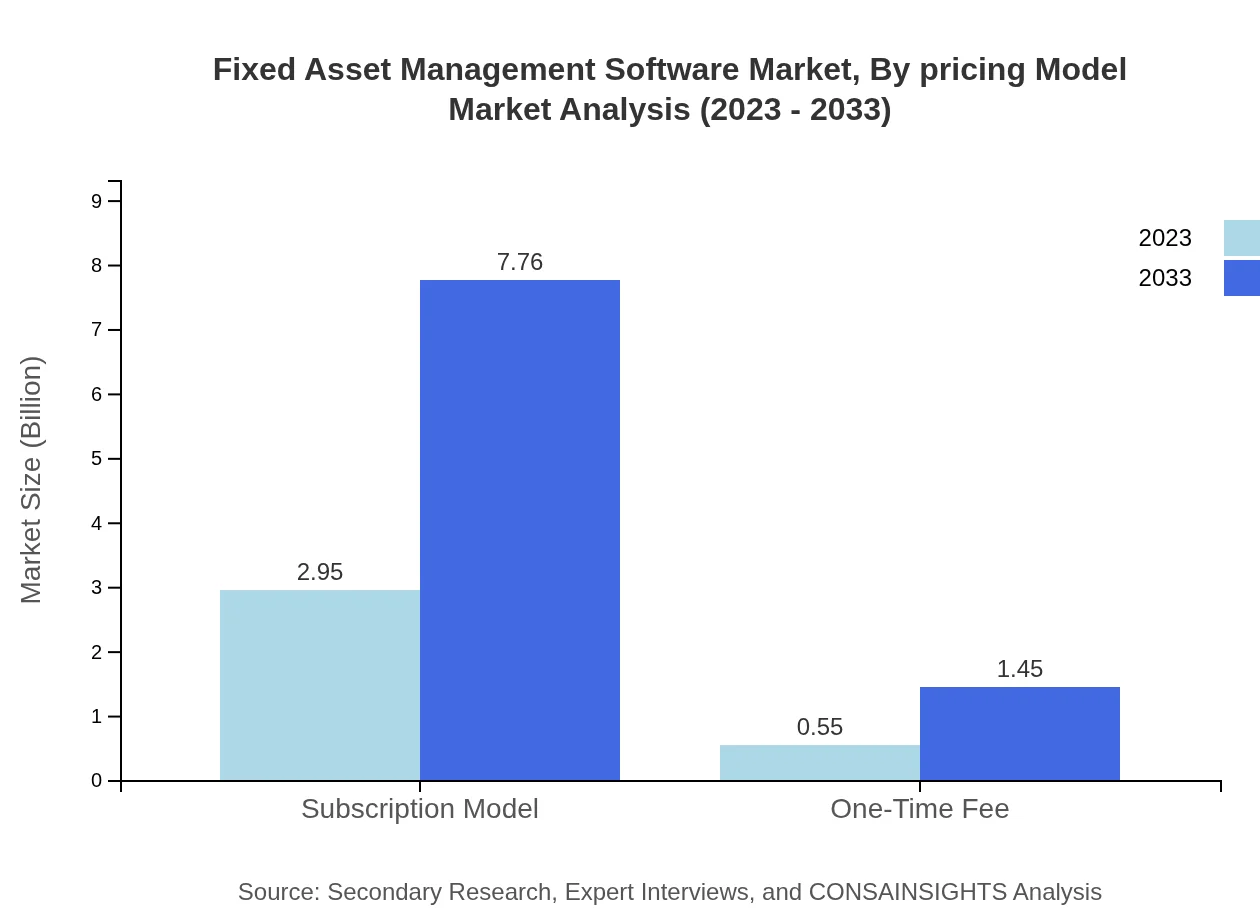

The market is also categorized by deployment types, where On-Premise Software leads with a significant valuation of $2.95 billion in 2023, growing to $7.76 billion by 2033. Conversely, Cloud Software is witnessing adoption due to its flexibility and lower upfront costs, growing from $0.55 billion to $1.45 billion during the same period.

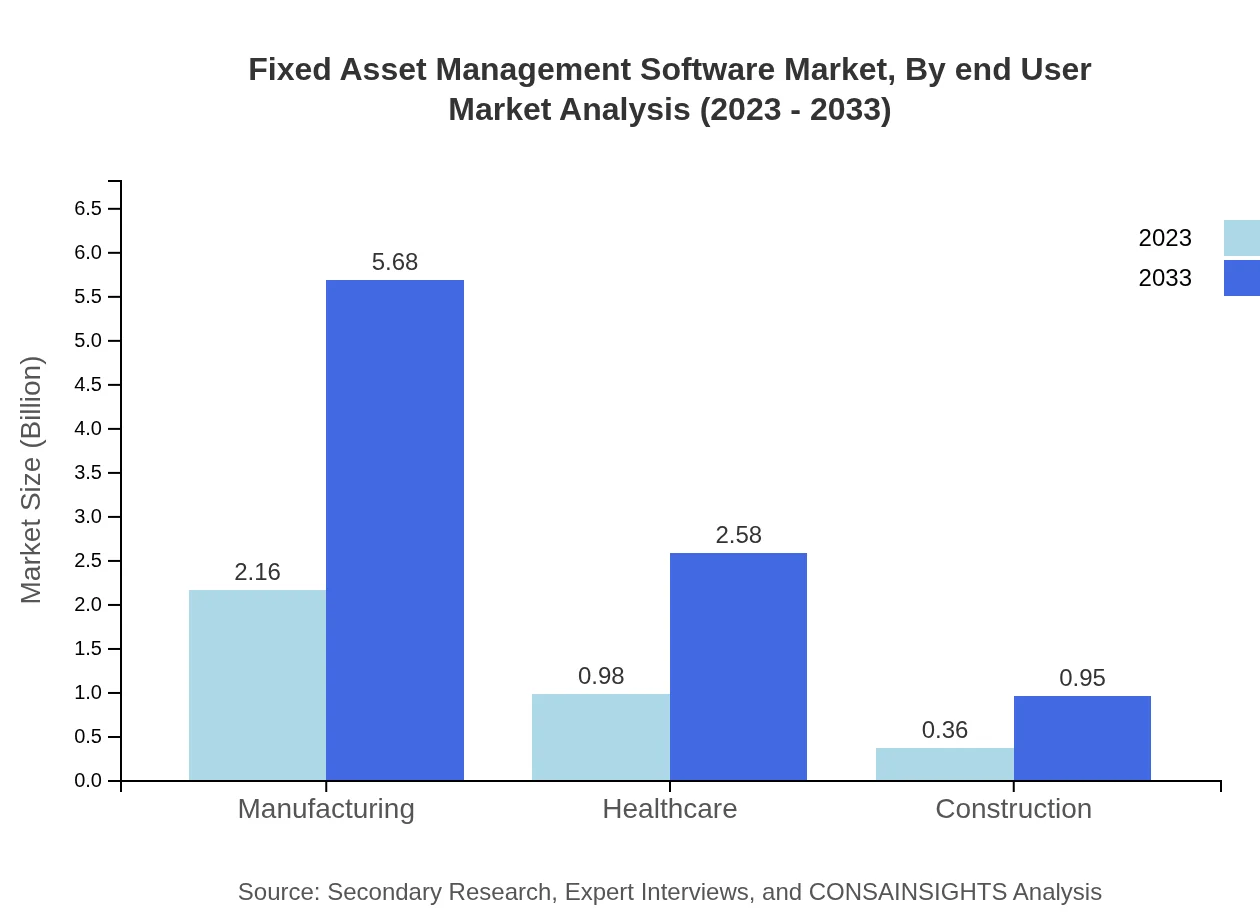

Fixed Asset Management Software Market Analysis By End User

The Manufacturing sector dominates the market, contributing around $2.16 billion in 2023 and expected to reach $5.68 billion by 2033. Healthcare follows as a significant segment, projected to grow from $0.98 billion to $2.58 billion due to increased regulatory compliance requirements. The Construction industry, while smaller, is also expected to grow as companies look for better asset management solutions.

Fixed Asset Management Software Market Analysis By Feature

Key features such as Reporting Tools and Integration Capabilities are essential for organizations to track their assets efficiently. Reporting Tools captured a market share of 61.66% in 2023, while Integration Capabilities maintained 28.03%. Their importance underscores the necessity of detailed asset reporting and seamless data integration with financial and operational systems.

Fixed Asset Management Software Market Analysis By Pricing Model

Most companies are moving towards Subscription Models, which accounted for approximately $2.95 billion in 2023, forecasted to rise to $7.76 billion by 2033, offering flexibility and scalability for users. One-time fee models, while still prevalent, are anticipated to decline in favor of more dynamic subscription structures.

Fixed Asset Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fixed Asset Management Software Industry

SAP SE:

SAP SE is a market leader in enterprise software, providing comprehensive fixed asset management solutions that integrate with its broader business suite, helping organizations streamline asset management processes.IBM Corporation:

IBM Corporation offers a range of asset management solutions with cutting-edge technologies such as AI and machine learning, aimed at enhancing operational efficiency and data-driven decision-making.Oracle Corporation:

Oracle provides robust fixed asset management capabilities as part of its cloud applications suite, allowing organizations to manage asset lifecycles and compliance obligations effectively.Infor:

Infor specializes in industry-specific solutions and offers advanced fixed asset management software tailored for industries like manufacturing and healthcare.Asset Panda:

Asset Panda is known for its user-friendly asset tracking software that leverages mobile technology, enabling businesses to manage and track assets efficiently in real-time.We're grateful to work with incredible clients.

FAQs

What is the market size of Fixed Asset Management Software?

The Fixed Asset Management Software market was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 9.8%, reaching substantial growth by 2033.

What are the key market players or companies in the Fixed Asset Management Software industry?

Key players in the Fixed Asset Management Software market include established enterprises like SAP, Oracle, IBM, and emerging tech firms innovating in asset management solutions.

What are the primary factors driving the growth in the Fixed Asset Management Software industry?

Factors such as increasing need for streamlined asset tracking and compliance, technological advancements, and enhanced reporting capabilities are driving growth in the Fixed Asset Management Software market.

Which region is the fastest Growing in the Fixed Asset Management Software?

The Fastest-growing region for Fixed Asset Management Software is North America, projected to grow from $1.32 billion in 2023 to $3.48 billion by 2033, showcasing significant market potential.

Does ConsaInsights provide customized market report data for the Fixed Asset Management Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Fixed Asset Management Software domain, ensuring clients get the most relevant insights.

What deliverables can I expect from this Fixed Asset Management Software market research project?

Deliverables typically include comprehensive market analysis, competitive landscape overview, segmented market insights, historical and forecast data, and strategic recommendations.

What are the market trends of Fixed Asset Management Software?

Current trends include increasing adoption of cloud software solutions, enhanced integration capabilities, and a shift towards subscription-based models, reflecting evolving customer preferences.