Fixed Satellite Services Market Report

Published Date: 31 January 2026 | Report Code: fixed-satellite-services

Fixed Satellite Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fixed Satellite Services market from 2023 to 2033, covering market trends, growth forecasts, regional breakdowns, and segmentation analysis to identify key opportunities and challenges in the industry.

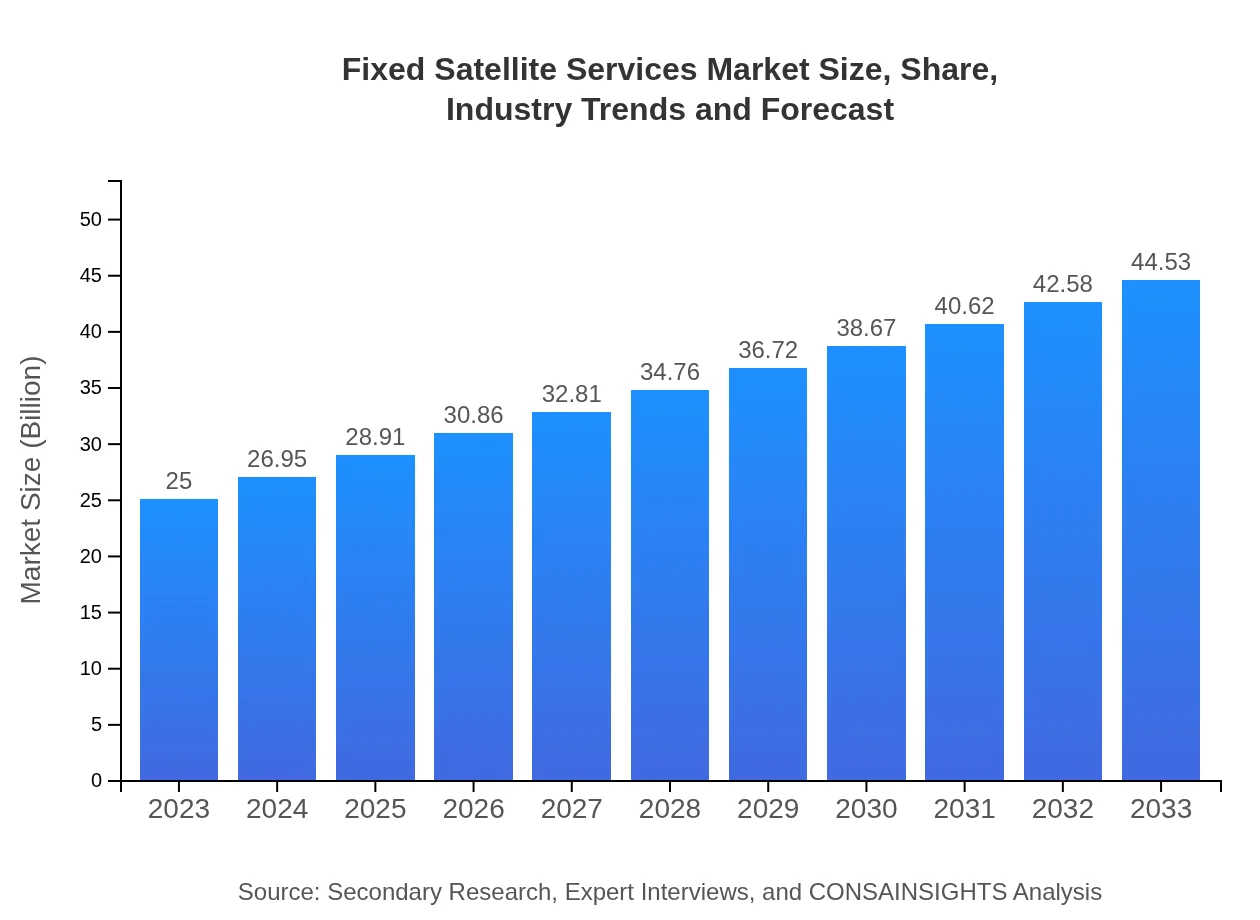

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $44.53 Billion |

| Top Companies | Intelsat, SES S.A., Eutelsat, Hughes Network Systems, Viasat, Inc. |

| Last Modified Date | 31 January 2026 |

Fixed Satellite Services Market Overview

Customize Fixed Satellite Services Market Report market research report

- ✔ Get in-depth analysis of Fixed Satellite Services market size, growth, and forecasts.

- ✔ Understand Fixed Satellite Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fixed Satellite Services

What is the Market Size & CAGR of Fixed Satellite Services market in 2023?

Fixed Satellite Services Industry Analysis

Fixed Satellite Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fixed Satellite Services Market Analysis Report by Region

Europe Fixed Satellite Services Market Report:

The European market, growing from USD 8.50 billion in 2023 to USD 15.14 billion in 2033, is supported by a mature telecommunications sector that leverages satellite technology for connectivity and broadcasting. Regulatory frameworks focused on technology innovations also contribute to this growth.Asia Pacific Fixed Satellite Services Market Report:

The Asia Pacific region is expected to witness robust growth, with the market size growing from USD 4.63 billion in 2023 to USD 8.24 billion in 2033. This growth is attributed to increased demand for broadband services and the expansion of satellite networks in countries like India and China, which are investing heavily in satellite communication infrastructure.North America Fixed Satellite Services Market Report:

North America remains a significant player, with market size expected to grow from USD 8.94 billion in 2023 to USD 15.91 billion in 2033. The region is characterized by high demand for advanced satellite communication services, stable infrastructure, and significant investments from key players.South America Fixed Satellite Services Market Report:

In South America, the market is anticipated to increase from USD 0.30 billion in 2023 to USD 0.53 billion by 2033. The region faces unique challenges, including geographical terrain, but advancements in satellite technology are helping to bridge connectivity gaps, particularly in rural and underserved areas.Middle East & Africa Fixed Satellite Services Market Report:

In the Middle East and Africa, growth projections indicate an increase from USD 2.64 billion in 2023 to USD 4.71 billion by 2033. The region shows promise due to high demand for communication services, although there are infrastructural challenges to overcome.Tell us your focus area and get a customized research report.

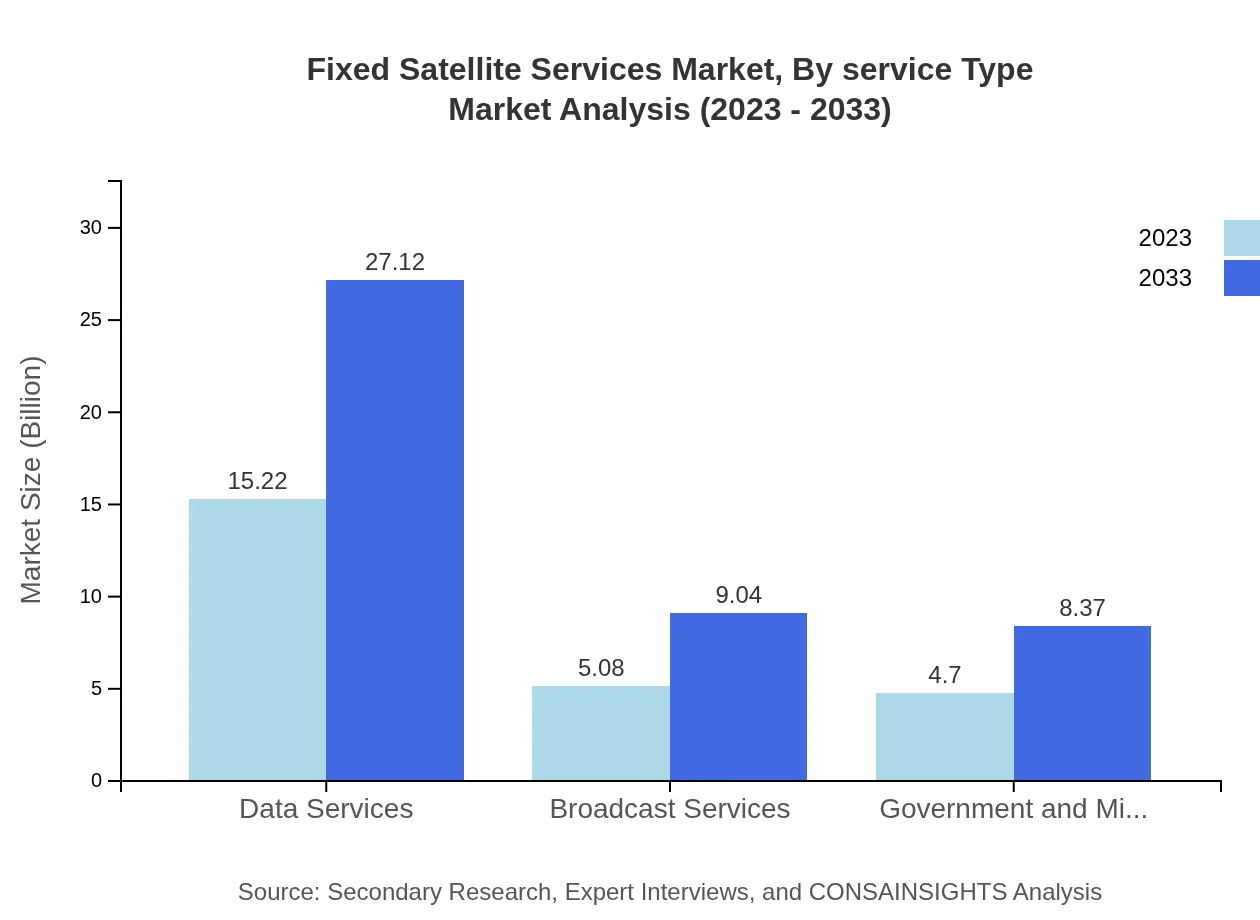

Fixed Satellite Services Market Analysis By Service Type

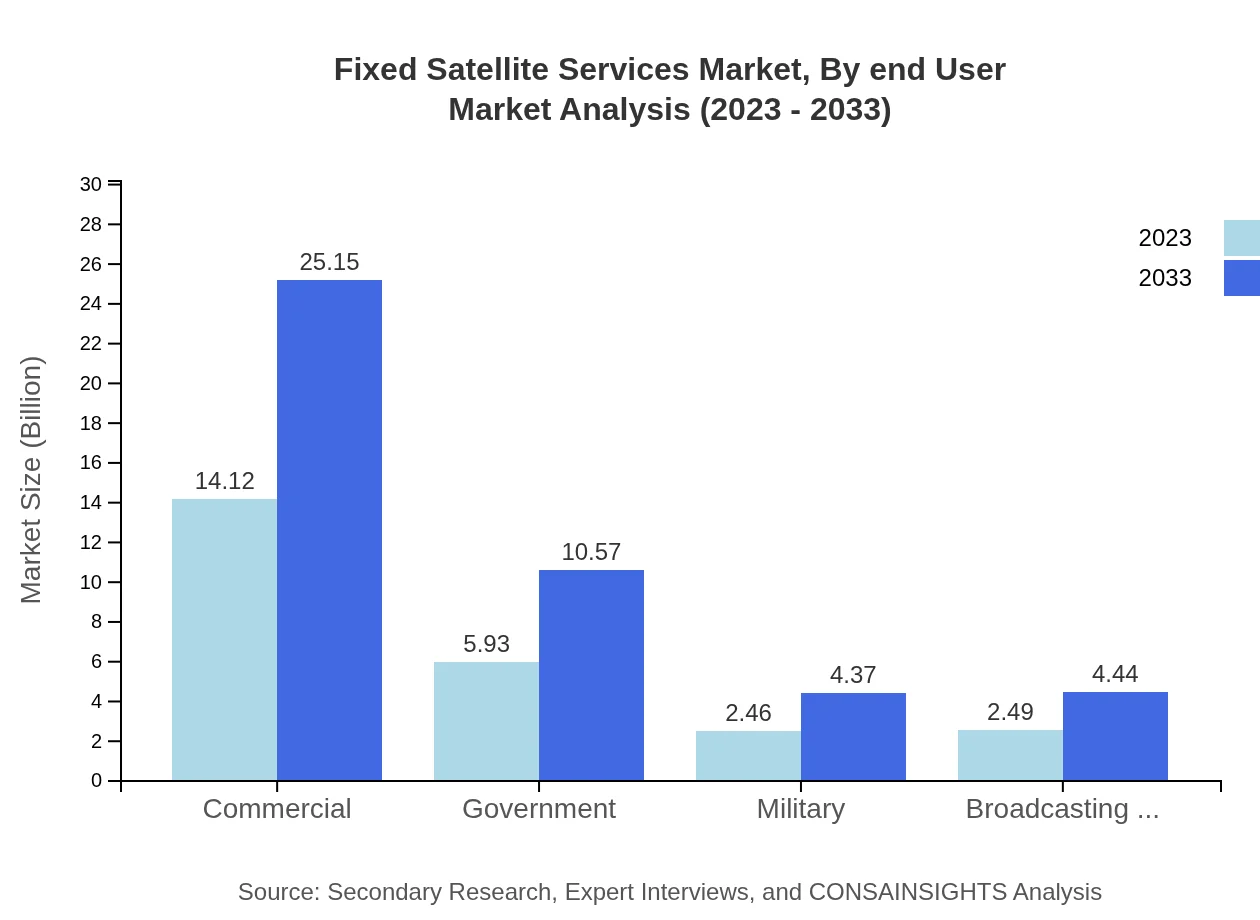

The market is segmented into Commercial, Government, and Military services. The Commercial segment dominates with a market size of USD 14.12 billion in 2023, expected to reach USD 25.15 billion by 2033, capturing 56.49% of the market share. Government services are projected to grow from USD 5.93 billion to USD 10.57 billion, maintaining a 23.73% share. Military services range from USD 2.46 billion to USD 4.37 billion during the same period, constituting 9.82% of the market share, indicating significant investment in defense capabilities.

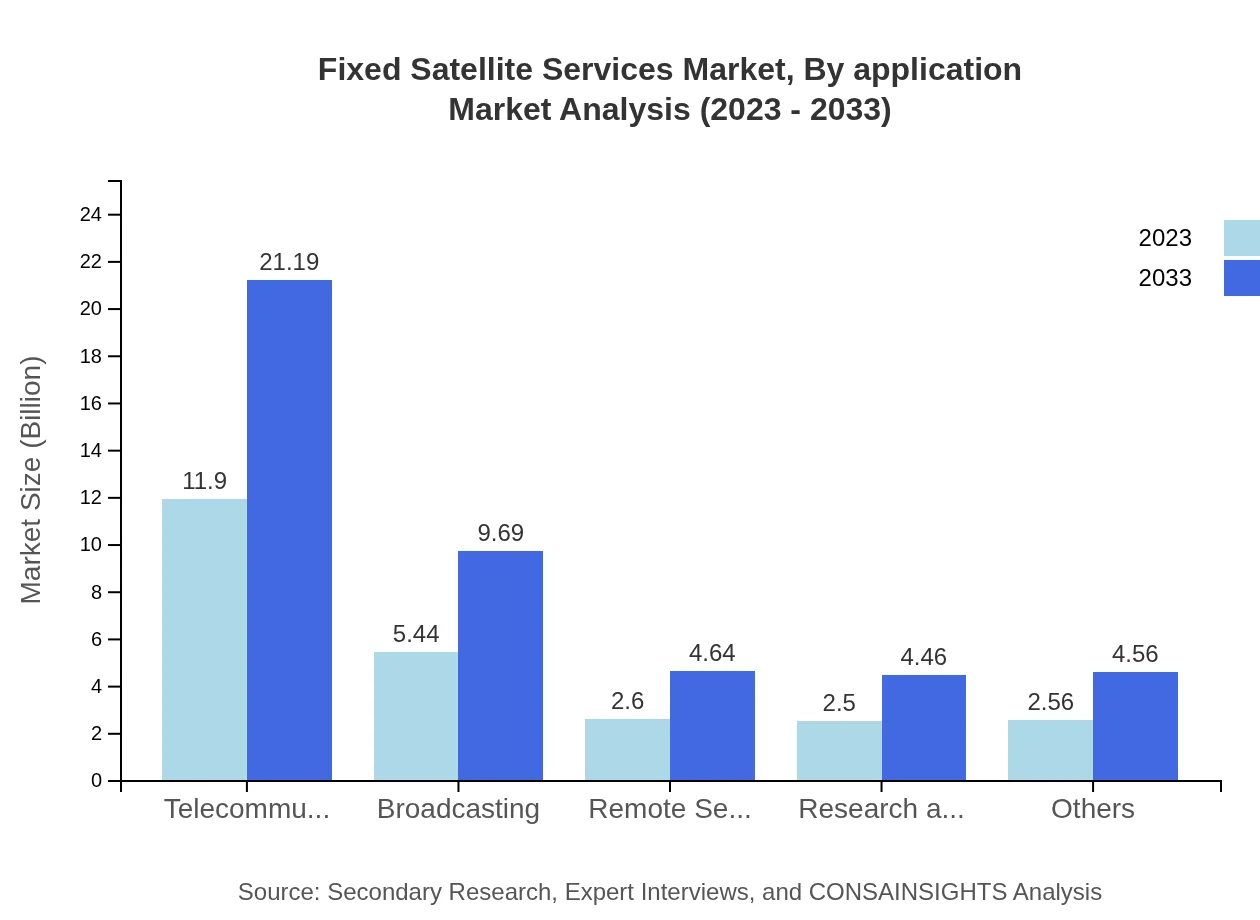

Fixed Satellite Services Market Analysis By Application

Applications in Fixed Satellite Services include Data Services, Broadcast Services, and Telecommunications. Data Services, capturing the largest share at 60.9%, will grow from USD 15.22 billion in 2023 to USD 27.12 billion by 2033. Telecommunications constitutes 47.59% of the market, increasing from USD 11.90 billion to USD 21.19 billion. Broadcasting applications show consistent growth, expanding from USD 5.44 billion to USD 9.69 billion, highlighting the evolving media landscape.

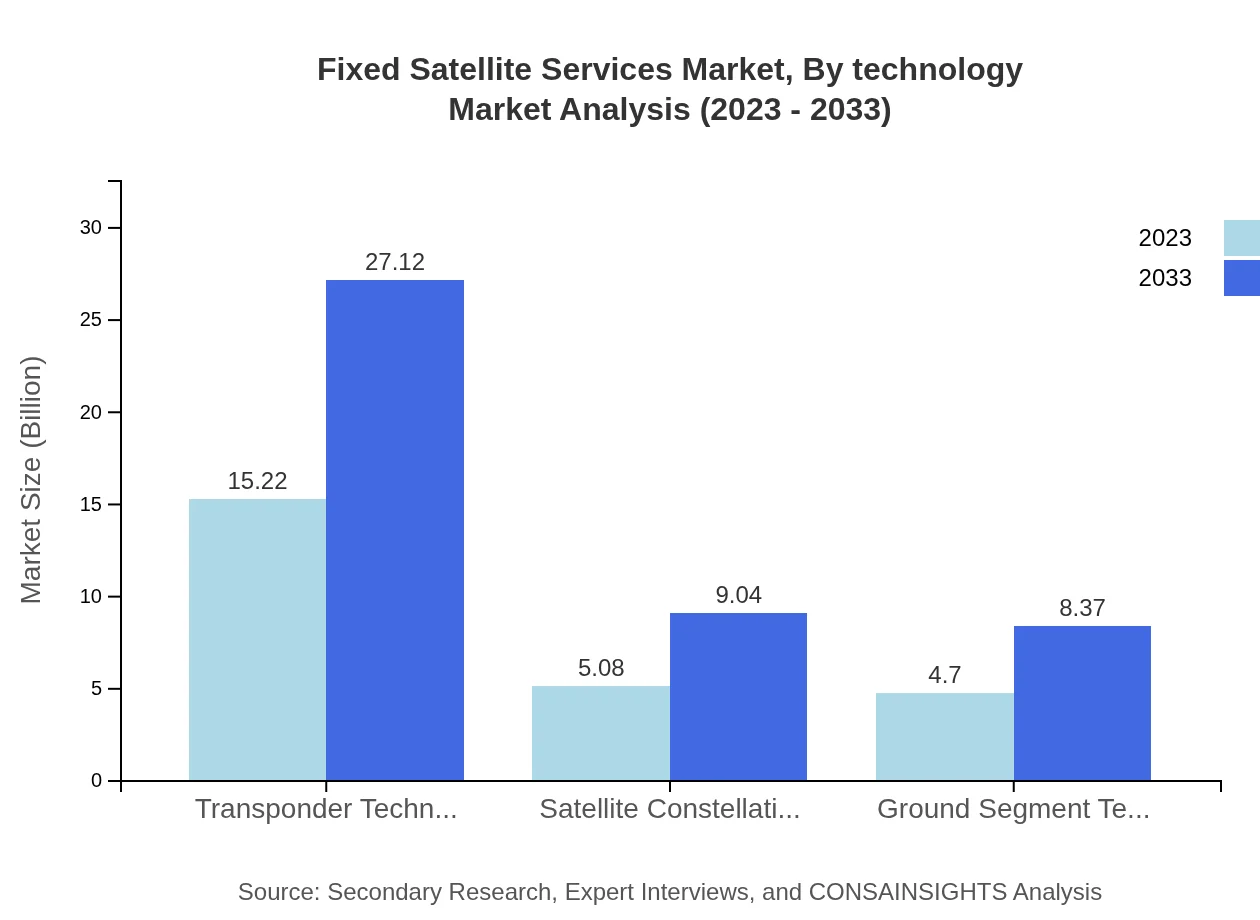

Fixed Satellite Services Market Analysis By Technology

Key technologies include Transponder Technology, Satellite Constellation Technology, and Ground Segment Technology. Transponder Technology leads the market with a size of USD 15.22 billion in 2023, forecasted to reach USD 27.12 billion by 2033, maintaining a 60.9% market share. Satellite Constellation is set to grow from USD 5.08 billion to USD 9.04 billion (20.3% share), while Ground Segment Technology will expand from USD 4.70 billion to USD 8.37 billion, representing 18.8% of the market.

Fixed Satellite Services Market Analysis By End User

End-users primarily include commercial enterprises, government agencies, and military organizations. The commercial sector dominates with a market size of USD 14.12 billion in 2023, expected to increase to USD 25.15 billion. Government and Military services are demonstrated by their growth potential, respectively moving from USD 5.93 billion to USD 10.57 billion and USD 2.46 billion to USD 4.37 billion by 2033.

Fixed Satellite Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fixed Satellite Services Industry

Intelsat:

Intelsat is a leading global satellite operator, focusing on delivering telecommunications and data services around the world with a large fleet of geostationary satellites.SES S.A.:

SES S.A. offers a range of services, including satellite uplink and downlink services, focusing on media and broadcasting sectors with a strong presence in both geostationary and medium Earth orbit satellite segments.Eutelsat:

Eutelsat is a prominent satellite operator delivering fixed satellite services across Europe, Africa, and the Middle East, supporting various applications including broadband, video, and data services.Hughes Network Systems:

Hughes Network Systems specializes in broadband satellite networking and has a significant presence in both commercial and government sectors, promoting affordable access to internet connectivity.Viasat, Inc.:

Viasat, Inc. provides high-speed satellite broadband services globally, recognized for its innovation in satellite technology and customer-centric solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of fixed Satellite Services?

The fixed satellite services market is currently valued at approximately $25 billion and is projected to grow at a CAGR of 5.8% over the next decade, reaching substantial revenues by 2033.

What are the key market players or companies in this fixed Satellite Services industry?

Key players in the fixed satellite services market include major companies like SES S.A., Intelsat S.A., Eutelsat Communications, Telesat, and Hispasat, which dominate service provision and technological advancements.

What are the primary factors driving the growth in the fixed Satellite Services industry?

The growth in fixed satellite services is primarily driven by increasing demand for broadband connectivity, expanding telecommunication infrastructure, and advancements in satellite technology, including high-throughput satellites.

Which region is the fastest Growing in the fixed Satellite Services?

The Asia Pacific region is anticipated to be the fastest-growing market for fixed satellite services, with a projected growth from $4.63 billion in 2023 to $8.24 billion by 2033, showcasing significant development.

Does ConsaInsights provide customized market report data for the fixed Satellite Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the fixed satellite services industry, ensuring comprehensive insights that meet individual business requirements.

What deliverables can I expect from this fixed Satellite Services market research project?

Deliverables may include an in-depth market analysis report, regional insights, competitive landscape data, forecasts, and customized recommendations relevant to the fixed satellite services sector.

What are the market trends of fixed Satellite Services?

Market trends in fixed satellite services include a shift towards high-throughput satellites, increasing reliance on remote communications, and expanding applications across sectors such as telecommunication, data services, and government.