Fixed Wing Turbine Aircraft Market Report

Published Date: 03 February 2026 | Report Code: fixed-wing-turbine-aircraft

Fixed Wing Turbine Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fixed Wing Turbine Aircraft market, covering key insights, trends, and forecasts from 2023 to 2033. It includes detailed market size information, industry analysis, and regional breakdowns to give a well-rounded perspective.

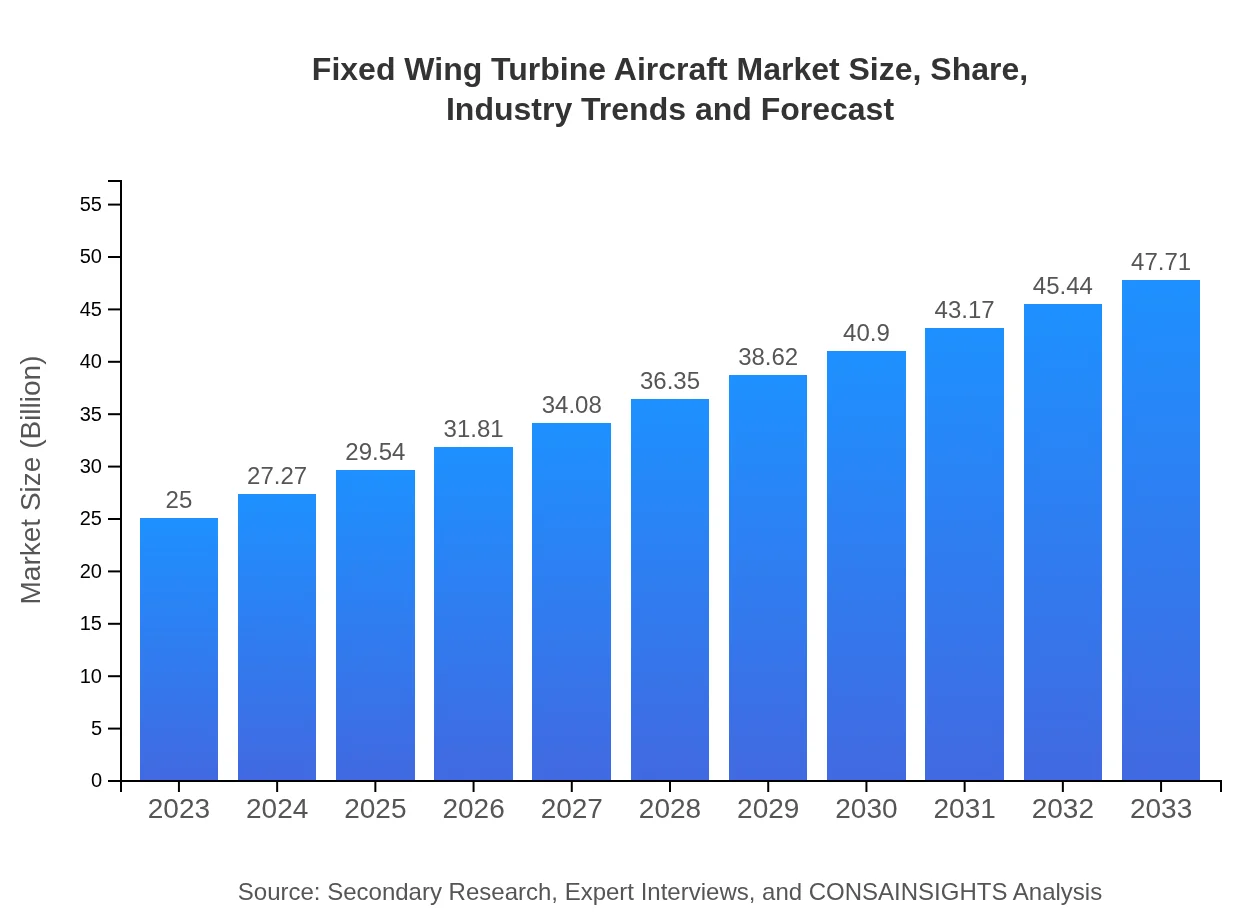

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $47.71 Billion |

| Top Companies | Boeing , Airbus, Bombardier, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Fixed Wing Turbine Aircraft Market Overview

Customize Fixed Wing Turbine Aircraft Market Report market research report

- ✔ Get in-depth analysis of Fixed Wing Turbine Aircraft market size, growth, and forecasts.

- ✔ Understand Fixed Wing Turbine Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fixed Wing Turbine Aircraft

What is the Market Size & CAGR of Fixed Wing Turbine Aircraft market in 2023?

Fixed Wing Turbine Aircraft Industry Analysis

Fixed Wing Turbine Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fixed Wing Turbine Aircraft Market Analysis Report by Region

Europe Fixed Wing Turbine Aircraft Market Report:

Europe's market is anticipated to grow from $6.18 billion in 2023 to $11.79 billion in 2033. Notable is the increasing investment in sustainable aviation technologies and net-zero goals driving aerospace innovation, particularly in turbofan engines.Asia Pacific Fixed Wing Turbine Aircraft Market Report:

The Asia Pacific region is projected to witness significant growth from $4.86 billion in 2023 to $9.27 billion in 2033, driven by increasing air travel demand and robust defense spending. Countries like China and India are expanding their aviation sectors, creating thriving markets for turbine-powered aircraft.North America Fixed Wing Turbine Aircraft Market Report:

North America will experience substantial growth from $8.08 billion in 2023 to $15.42 billion in 2033. The presence of major aircraft manufacturers and a strong market for business and commercial aviation back this robust expansion.South America Fixed Wing Turbine Aircraft Market Report:

In South America, the market is expected to grow from $2.42 billion in 2023 to $4.61 billion by 2033. The growth is attributed to rising tourism and the development of domestic freighter operations, alongside government initiatives to enhance aviation infrastructure.Middle East & Africa Fixed Wing Turbine Aircraft Market Report:

The Middle East and Africa region is set to increase from $3.47 billion in 2023 to $6.62 billion by 2033, largely due to expanding airlines and infrastructural developments in both commercial and military aviation.Tell us your focus area and get a customized research report.

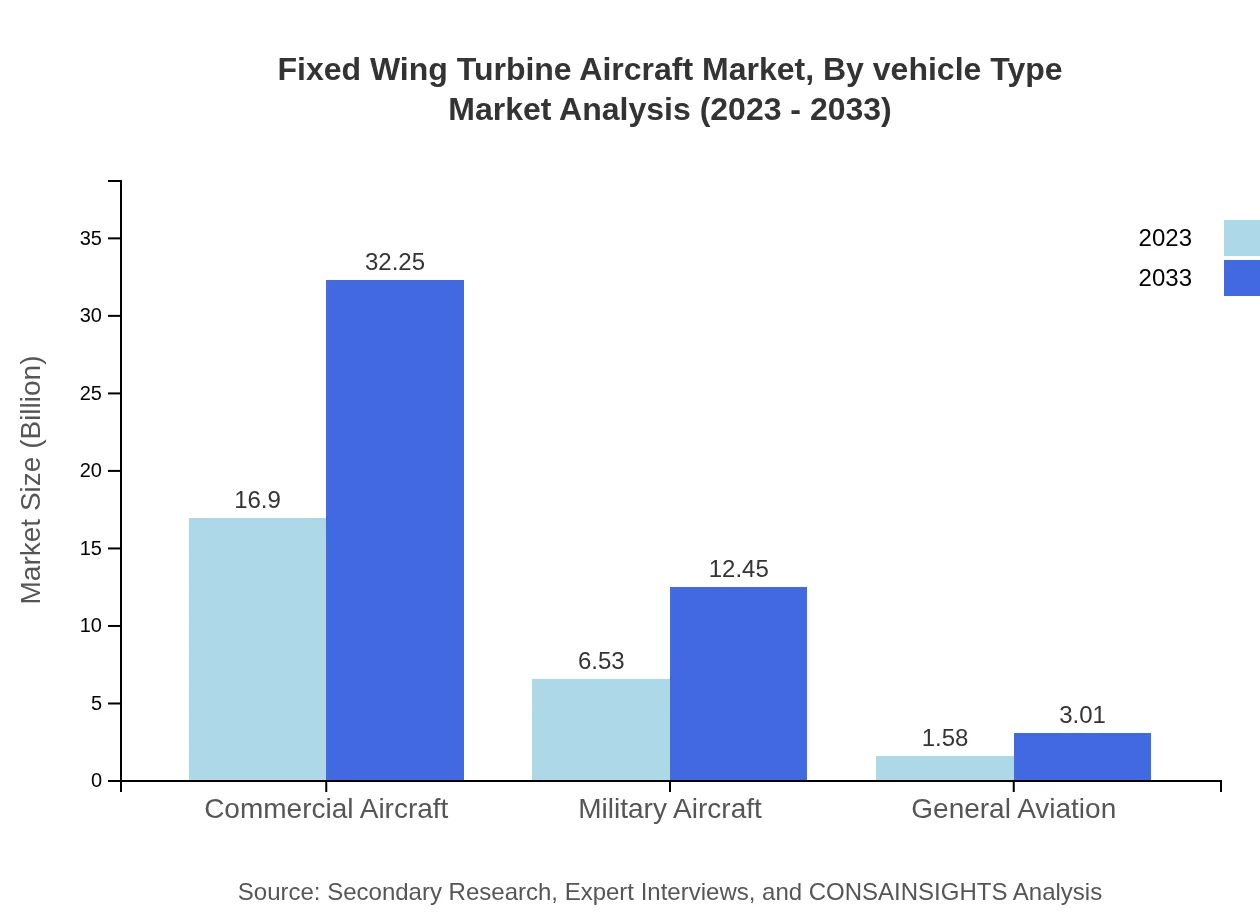

Fixed Wing Turbine Aircraft Market Analysis By Vehicle Type

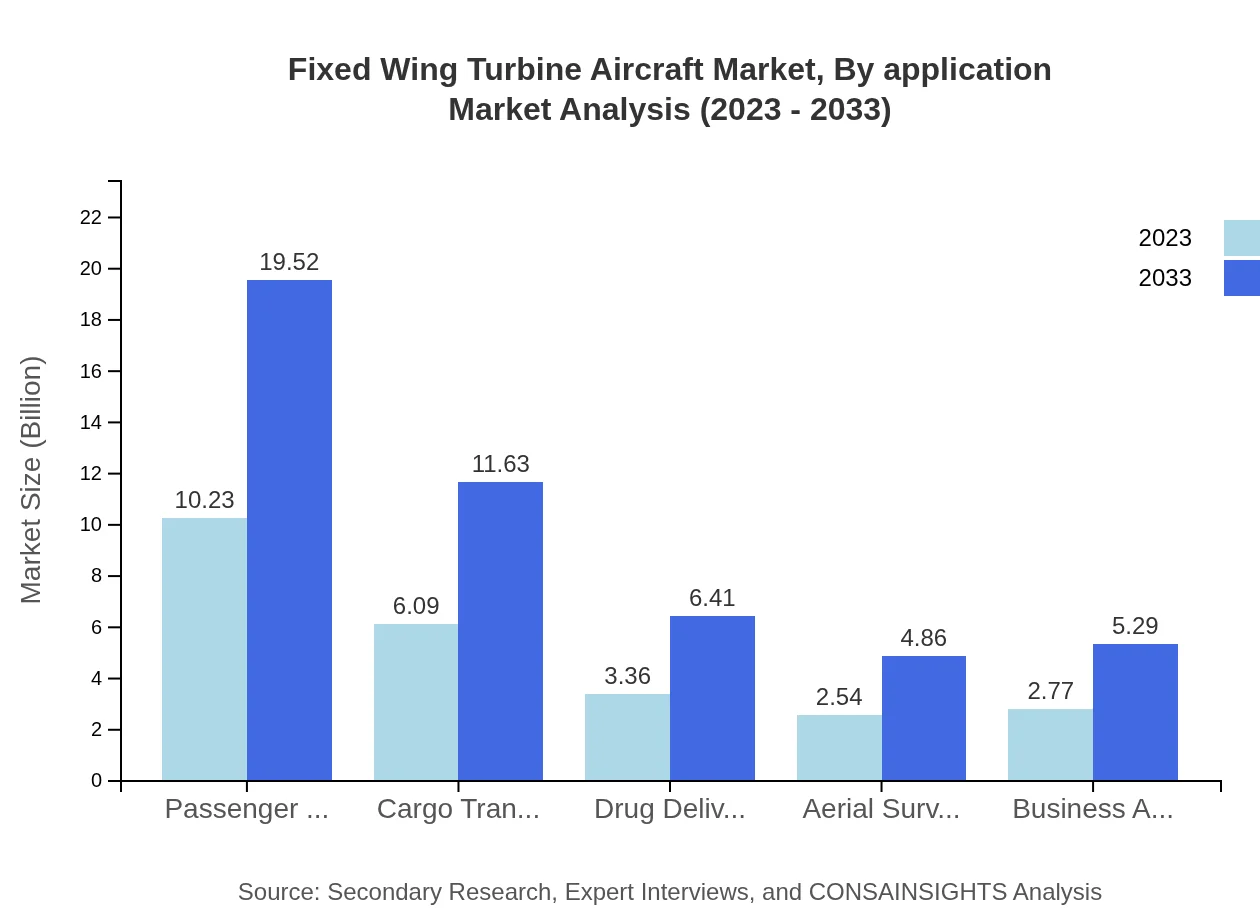

In 2023, the Passenger Transport segment dominates the fixed wing turbine market with a market size of $10.23 billion, expected to grow to $19.52 billion by 2033. In contrast, Cargo Transport will grow significantly from $6.09 billion to $11.63 billion, reflecting the growth in e-commerce and demand for express delivery services.

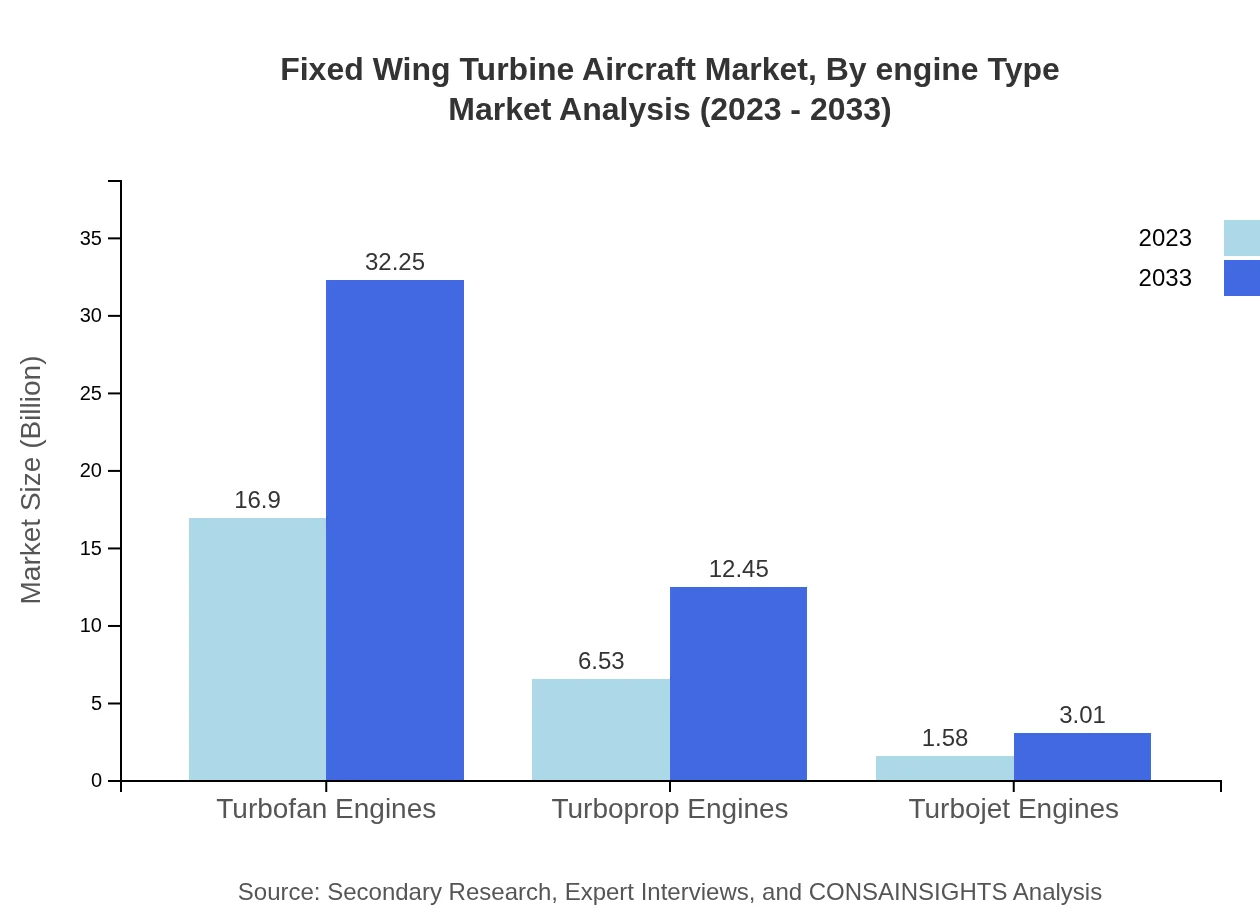

Fixed Wing Turbine Aircraft Market Analysis By Engine Type

Turbofan engines are the largest segment, with a market size of $16.90 billion in 2023, projected to reach $32.25 billion by 2033. Turboprop engines also show steady growth from $6.53 billion to $12.45 billion, indicating a continued demand for regional airliners and cargo aircraft.

Fixed Wing Turbine Aircraft Market Analysis By Application

The application segment analysis shows that commercial applications lead with a size of $16.90 billion in 2023, growing to $32.25 billion by 2033. Military applications are also noteworthy, expanding from $6.53 billion to $12.45 billion, driven by modern military requirements for advanced aviation platforms.

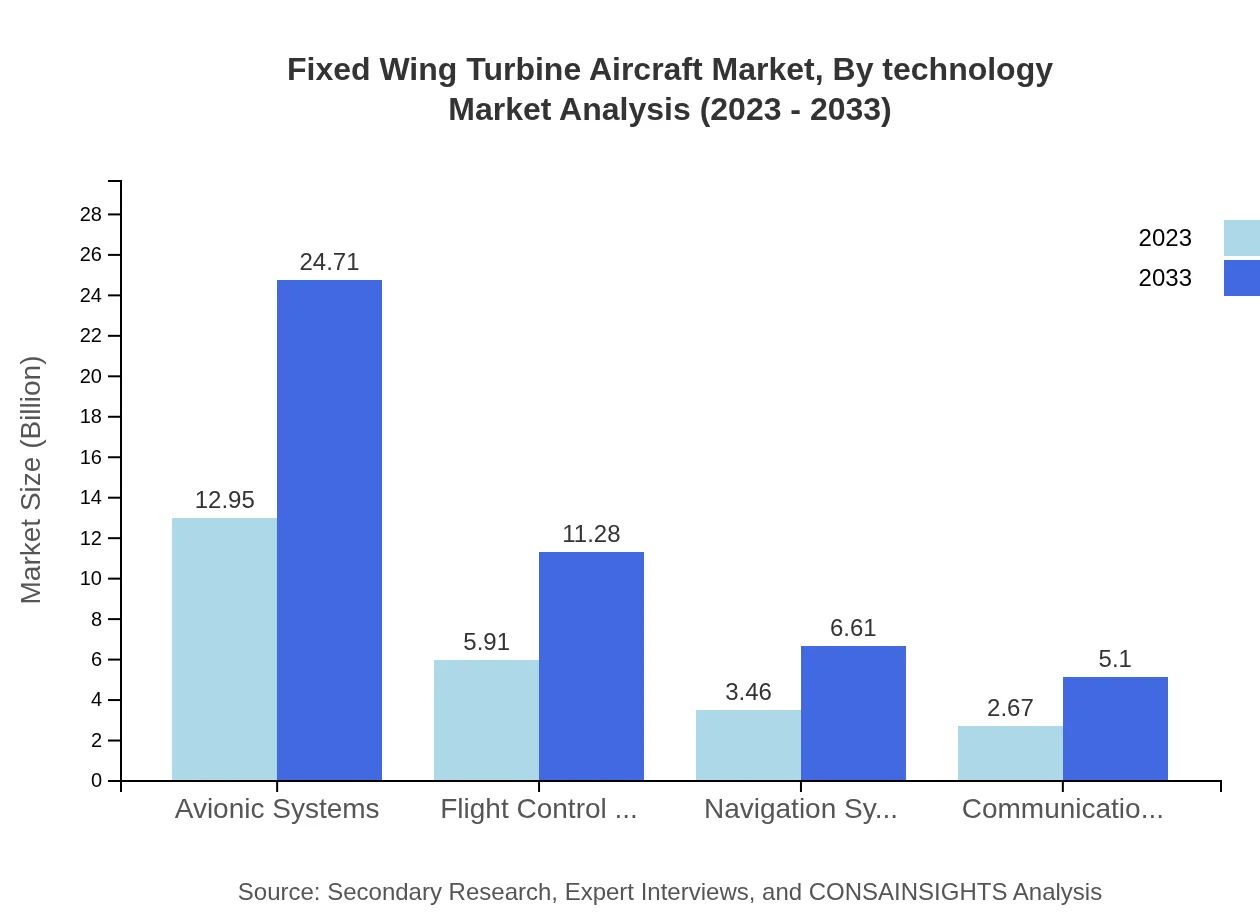

Fixed Wing Turbine Aircraft Market Analysis By Technology

Advancements in avionic systems and flight control technology are pivotal, with the avionic systems segment leading the market with a size of $12.95 billion in 2023. Its share remains stable at approximately 51.8%, showcasing its fundamental role in aircraft operation and navigation.

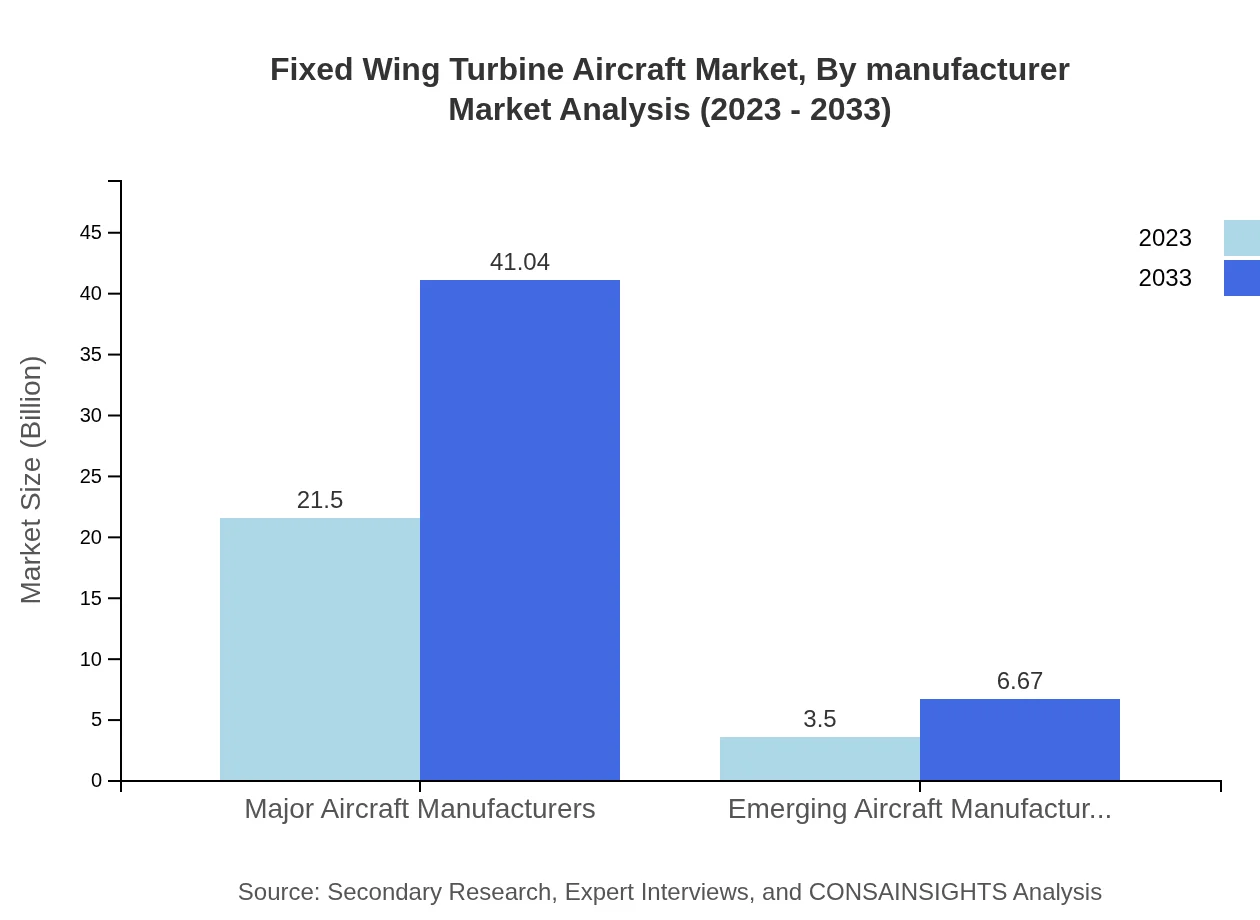

Fixed Wing Turbine Aircraft Market Analysis By Manufacturer

The major aircraft manufacturers segment is poised to maintain its dominance, valued at $21.50 billion in 2023, growing to $41.04 billion by 2033, ensuring robust competition with emerging manufacturers starting from a size of $3.50 billion and projecting to $6.67 billion.

Fixed Wing Turbine Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fixed Wing Turbine Aircraft Industry

Boeing :

Boeing is a leading manufacturer of commercial jetliners and defense, space, and security systems, contributing significantly to the global aviation industry with innovative turbine aircraft.Airbus:

Airbus is one of the world's largest commercial aircraft manufacturers known for its advanced A-series aircraft, pushing the boundaries of technology in fixed wing turbine aviation.Bombardier:

A major player in the business aviation segment, Bombardier specializes in a range of fixed wing aircraft, emphasizing comfort, performance, and advanced technology.Lockheed Martin:

A leader in military aviation, Lockheed Martin focuses on developing advanced military fixed wing aircraft, ensuring high-performance standards with its turbine engines.We're grateful to work with incredible clients.

FAQs

What is the market size of Fixed Wing Turbine Aircraft?

The fixed-wing turbine aircraft market is valued at approximately $25 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.5% through 2033, indicating robust growth as demand for efficient and advanced aircraft solutions rises.

What are the key market players or companies in the Fixed Wing Turbine Aircraft industry?

Key market players include major aircraft manufacturers like Boeing and Airbus, as well as emerging companies focused on innovative technologies. The competitive landscape is evolving with startups and established firms investing in R&D to enhance aircraft capabilities.

What are the primary factors driving the growth in the Fixed Wing Turbine Aircraft industry?

Growth drivers for the fixed-wing turbine aircraft market include increasing global air traffic, the rise of cargo logistics, advancements in aviation technology, and growing interest in sustainable aviation solutions that improve fuel efficiency and reduce emissions.

Which region is the fastest Growing in the Fixed Wing Turbine Aircraft market?

North America currently leads in market size, valued at $8.08 billion in 2023 and projected to reach $15.42 billion by 2033. However, Asia Pacific is the fastest-growing region, expanding from $4.86 billion to $9.27 billion in the same period.

Does ConsaInsights provide customized market report data for the Fixed Wing Turbine Aircraft industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the fixed-wing turbine aircraft sector. This allows stakeholders to gain unique insights and detailed analyses based on their particular interests and operational focuses.

What deliverables can I expect from this Fixed Wing Turbine Aircraft market research project?

Deliverables include comprehensive market analysis reports, regional and segment-wise data, competitive landscape assessments, trend forecasts, and actionable insights that assist in strategic decision-making for stakeholders in the fixed-wing turbine aircraft industry.

What are the market trends of Fixed Wing Turbine Aircraft?

Current market trends include a shift towards eco-friendly technologies, the integration of advanced avionics systems, increased investment in urban air mobility solutions, and a strong focus on enhancing passenger comfort and safety in fixed-wing turbine aircraft.