Fixed Wireless Access Market Report

Published Date: 31 January 2026 | Report Code: fixed-wireless-access

Fixed Wireless Access Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fixed Wireless Access market, covering market trends, segmentation, regional insights, and forecasts for the period of 2023 to 2033. It aims to offer valuable data for stakeholders to navigate the evolving landscape of this technology.

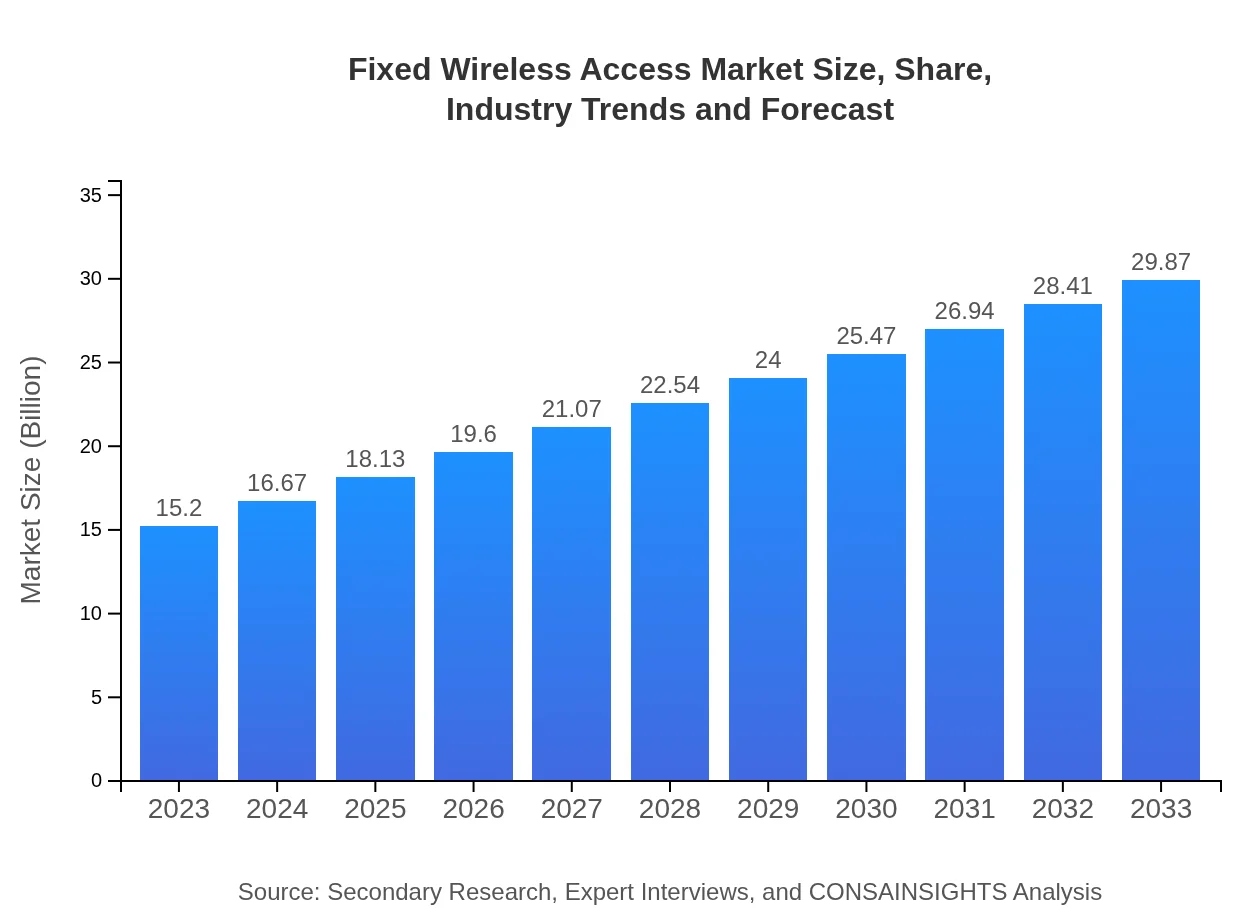

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $29.87 Billion |

| Top Companies | Cisco Systems, Ericsson , Nokia , Huawei , Verizon |

| Last Modified Date | 31 January 2026 |

Fixed Wireless Access Market Overview

Customize Fixed Wireless Access Market Report market research report

- ✔ Get in-depth analysis of Fixed Wireless Access market size, growth, and forecasts.

- ✔ Understand Fixed Wireless Access's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fixed Wireless Access

What is the Market Size & CAGR of Fixed Wireless Access market in 2023?

Fixed Wireless Access Industry Analysis

Fixed Wireless Access Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fixed Wireless Access Market Analysis Report by Region

Europe Fixed Wireless Access Market Report:

Europe's FWA market is robust, with a value of $5.00 billion in 2023 growing to $9.83 billion by 2033. The region benefits from stringent regulations promoting digital connectivity and the expansion of 5G services. European telecom companies are strategically positioning themselves to provide comprehensive FWA solutions amidst rising consumer demand for high-speed internet.Asia Pacific Fixed Wireless Access Market Report:

In the Asia Pacific region, the FWA market was valued at approximately $2.91 billion in 2023 and is expected to grow to $5.72 billion by 2033. The region is witnessing rapid urbanization and a growing demand for connectivity, positioning FWA as an ideal solution. Countries such as India and China are at the forefront, with major telecom operators expanding their FWA services to cater to the large population and underserved areas.North America Fixed Wireless Access Market Report:

North America represents a significant segment of the FWA market, valued at $4.96 billion in 2023 and projected to grow to $9.76 billion by 2033. The presence of advanced telecommunications infrastructure and the increasing adoption of 5G technology are key drivers. Major telecommunications companies are investing in FWA solutions to enhance broadband access and reduce service stagnation in rural regions.South America Fixed Wireless Access Market Report:

The South American FWA market is smaller, with a value of $0.89 billion in 2023 expected to reach $1.75 billion by 2033. However, the region is experiencing a gradual uptake of FWA services, driven by increasing smartphone penetration and demand for internet access in both urban and rural areas. Governments in South America are also implementing policies to encourage broadband expansion.Middle East & Africa Fixed Wireless Access Market Report:

In the Middle East and Africa, the FWA market was valued at $1.44 billion in 2023, expected to double to $2.83 billion by 2033. The region's diverse population and varying levels of existing infrastructure present both challenges and opportunities for FWA implementation. Key players in this region are focusing on partnerships and strategic investments to improve network availability, particularly in remote areas.Tell us your focus area and get a customized research report.

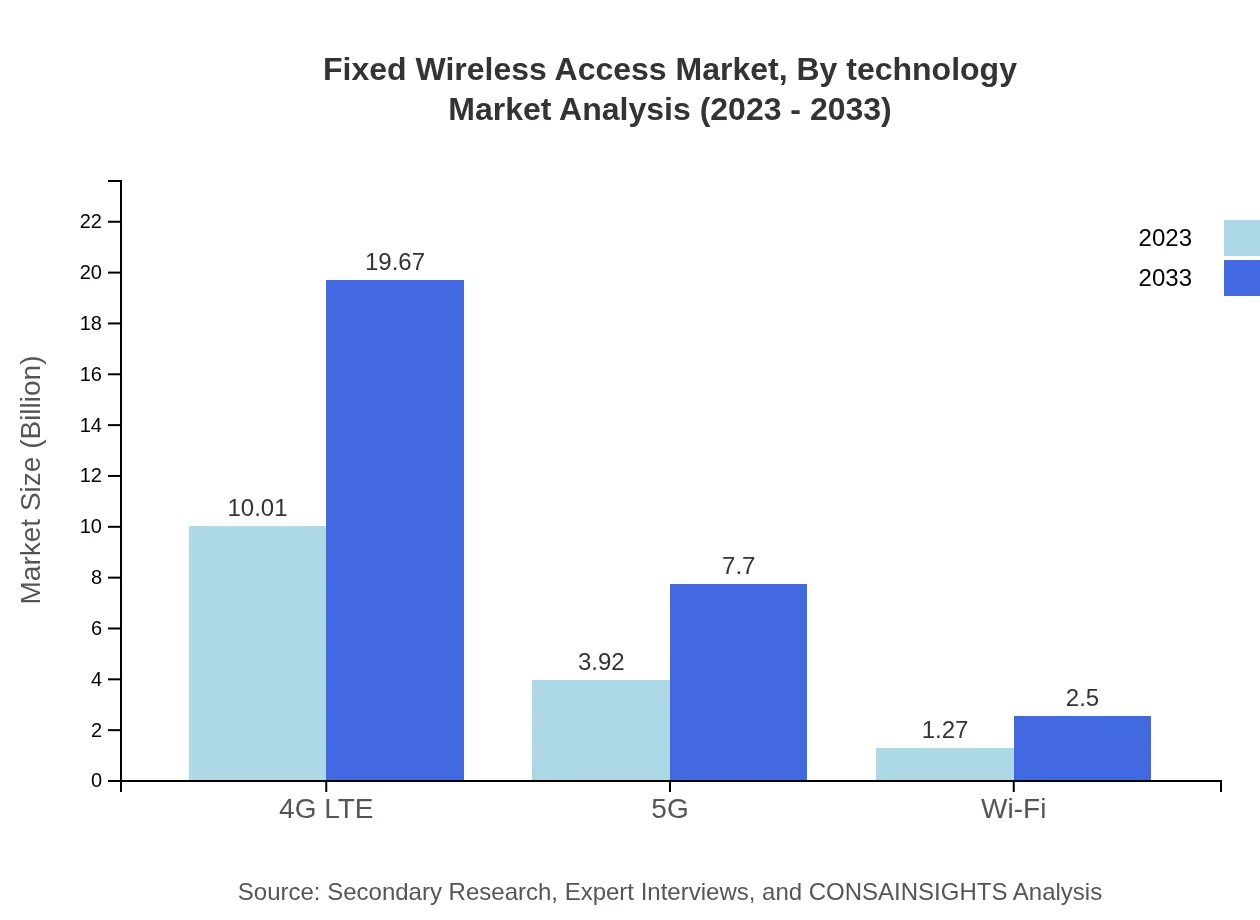

Fixed Wireless Access Market Analysis By Technology

The Fixed Wireless Access market, segmented by technology, demonstrates varying growth rates. In 2023, the 4G LTE segment accounted for a substantial market size of $10.01 billion, projected to reach $19.67 billion by 2033. The 5G technology segment started with a market size of $3.92 billion in 2023, anticipated to expand to $7.70 billion by 2033. Wi-Fi technology also plays a critical role but is smaller in scale, starting at $1.27 billion in 2023 and progressing to $2.50 billion by 2033.

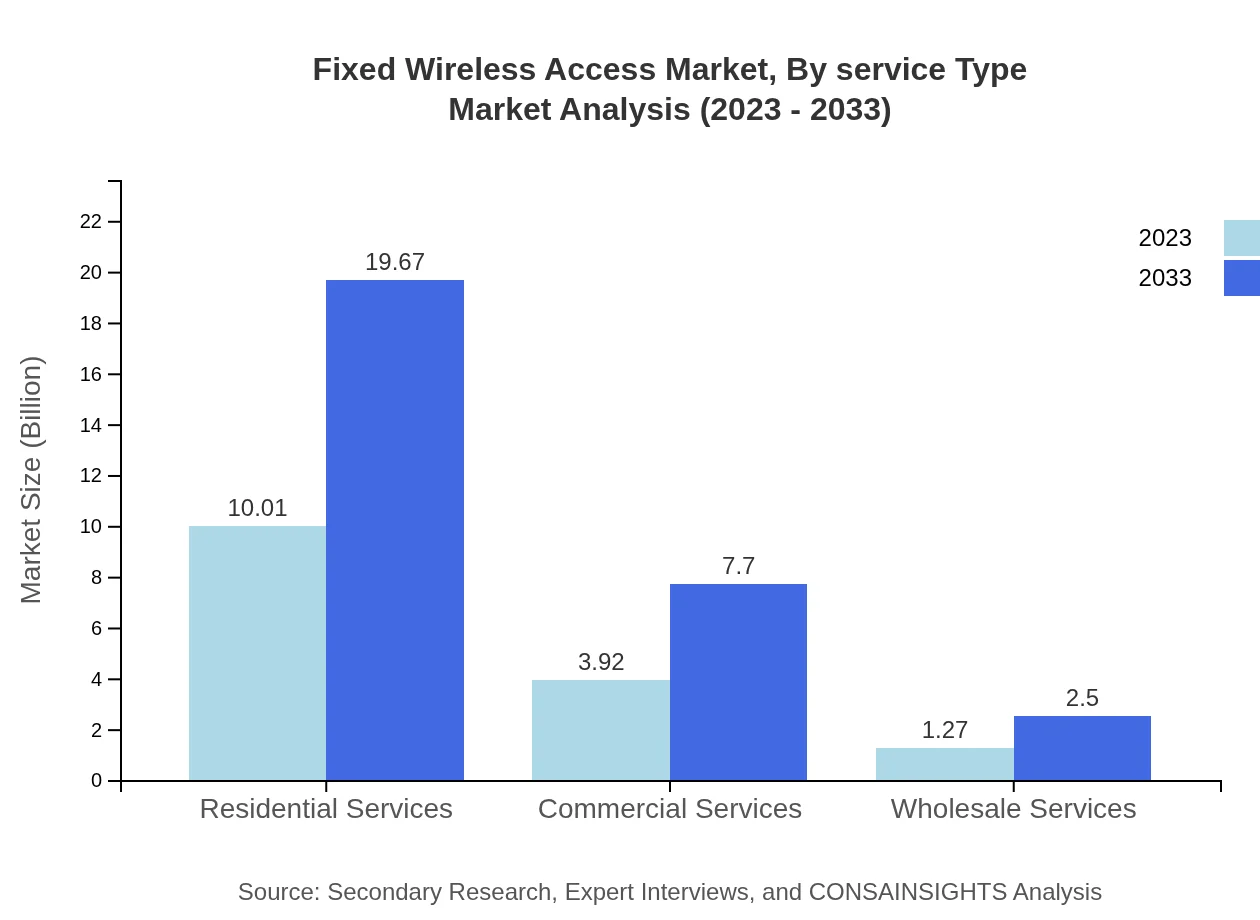

Fixed Wireless Access Market Analysis By Service Type

In terms of service offerings, the residential services sector is a dominant player in the Fixed Wireless Access market, valued at $10.01 billion in 2023 and expected to grow to $19.67 billion by 2033. Commercial services represent an important segment with a projected increase from $3.92 billion to $7.70 billion within the same period. Wholesale services, while smaller, are witnessing growth as small ISPs look to leverage existing networks, increasing from $1.27 billion to $2.50 billion.

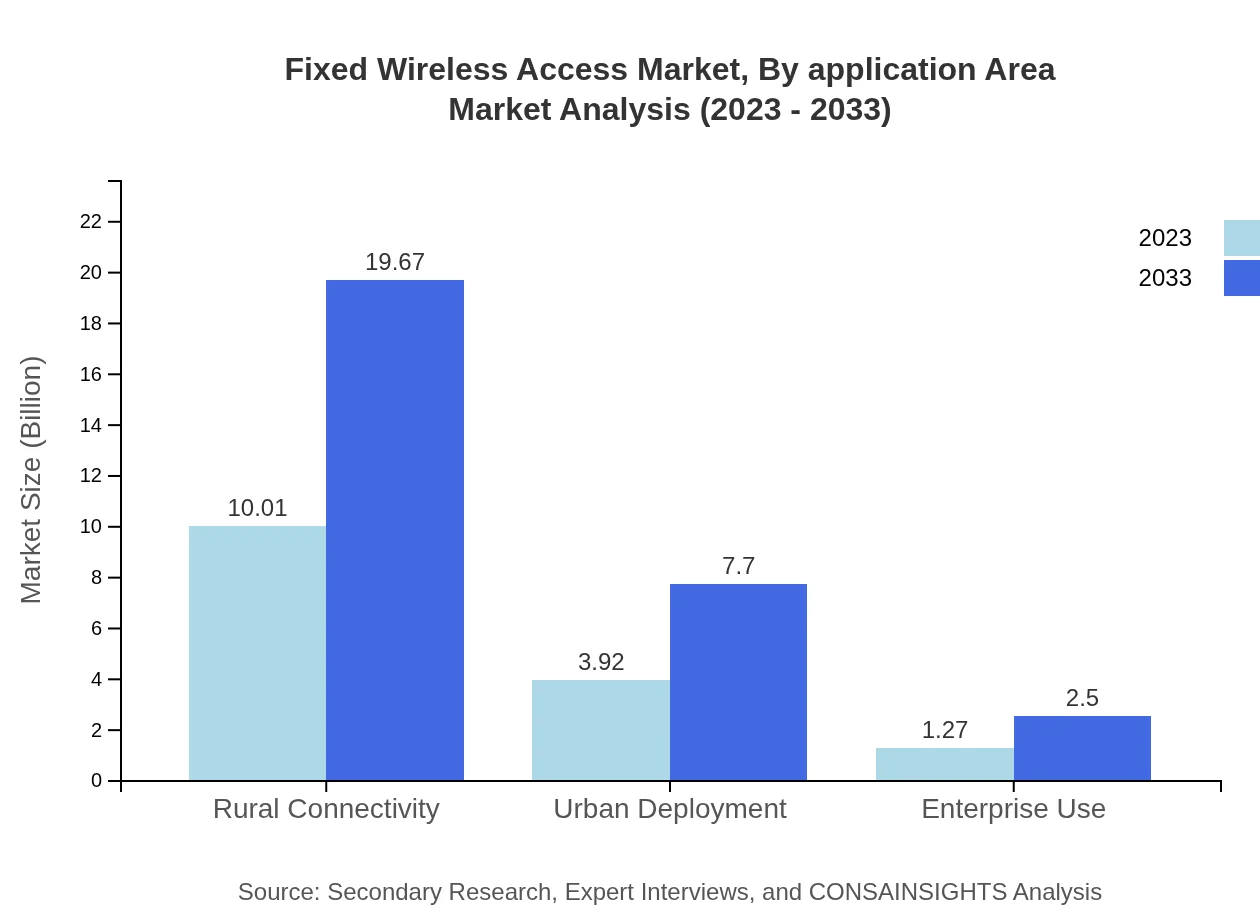

Fixed Wireless Access Market Analysis By Application Area

The Fixed Wireless Access market is also segmented by application areas, including rural connectivity, urban deployment, and enterprise use. Rural connectivity continues to be a significant segment, starting at $10.01 billion in 2023 and moving to $19.67 billion by 2033, driven by infrastructure deficits in rural areas. Urban deployment is projected to grow from $3.92 billion to $7.70 billion, while enterprise use, although smaller, is expected to grow from $1.27 billion to $2.50 billion, reflecting the growing need of businesses for reliable internet access.

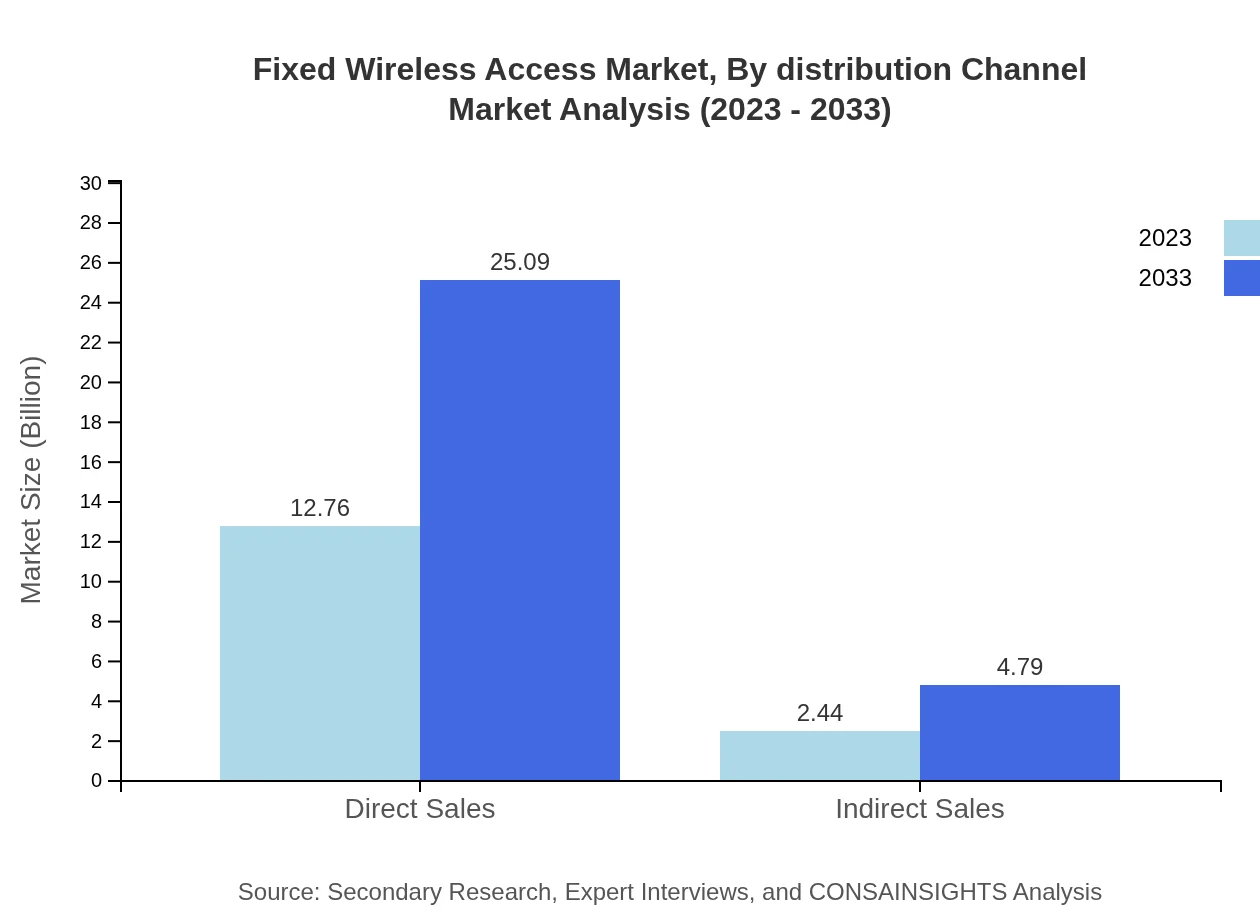

Fixed Wireless Access Market Analysis By Distribution Channel

Distribution channels for Fixed Wireless Access include both direct and indirect sales. Direct sales dominate the market, comprising $12.76 billion in 2023 and projected to climb to $25.09 billion by 2033. This sales model facilitates better control over service quality and customer relationships. Indirect sales, while less significant, are expected to grow from $2.44 billion to $4.79 billion, as partnerships with third-party vendors become increasingly common.

Fixed Wireless Access Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fixed Wireless Access Industry

Cisco Systems:

Cisco is a leader in networking technology, providing innovative FWA solutions that include routers and wireless technology to enhance connectivity in various environments.Ericsson :

Ericsson offers cutting-edge technologies for 5G and FWA, leading advancements in mobile and broadband communications across the globe.Nokia :

Nokia is known for its comprehensive FWA solutions, focusing on creating high-capacity networks that deliver reliable internet access in both urban and rural settings.Huawei :

Huawei provides advanced FWA products, utilizing both 4G and 5G technologies to support digital transformation and improve connectivity for underserved areas.Verizon:

Verizon is a dominant telecom provider in the U.S. focusing on FWA services, leveraging its vast network infrastructure to offer high-speed internet connectivity to residential areas.We're grateful to work with incredible clients.

FAQs

What is the market size of Fixed Wireless Access?

The Fixed Wireless Access market is valued at approximately $15.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% until 2033, indicating robust growth in demand for wireless connectivity solutions.

What are the key market players or companies in the Fixed Wireless Access industry?

Key players in the Fixed Wireless Access industry include major telecommunications providers, technology companies focused on broadband and wireless solutions, and equipment manufacturers. They are continuously innovating to enhance service delivery and expand market reach.

What are the primary factors driving the growth in the Fixed Wireless Access industry?

Driving factors for growth include rising internet demand, increased mobile data consumption, and the need for faster rural connectivity solutions. Innovations in 5G technology and the expansion of smart device usage are also pivotal.

Which region is the fastest Growing in the Fixed Wireless Access market?

The fastest-growing region in the Fixed Wireless Access market is North America, projected to grow from $4.96 billion in 2023 to $9.76 billion in 2033, alongside significant growth in Europe and Asia Pacific.

Does ConsInsights provide customized market report data for the Fixed Wireless Access industry?

Yes, ConsInsights offers customized market report data tailored to specific needs in the Fixed Wireless Access industry, assisting businesses in making informed decisions with data-driven insights.

What deliverables can I expect from this Fixed Wireless Access market research project?

Deliverables typically include a comprehensive market report, segmentation analysis, growth forecasts, competitive analysis, and insights into market trends, tailored to the Fixed Wireless Access industry.

What are the market trends of Fixed Wireless Access?

Current trends include the rising adoption of 5G technology, increased investments in rural connectivity, and a shift towards service models focusing on digital transformation and enhanced user experience.